Recording Manual Payments

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_OFFCYCLE_M_SEC |

Enter all manual payment details. |

A manual payment is a payment that is prepared outside of the Global Payroll system. You might have a remote office with no access to Global Payroll that occasionally needs to write a manual payment to process a last-minute payroll adjustment. Or you might correct errors in system-produced paychecks by producing manual payments.

Because manual payments are created outside of the system, you must record them manually into Global Payroll to updating your employees' earnings, deductions, garnishments, and tax balances.

For example, employee 8101 was hired in a remote office on January 1. The clerk did not notify the central office of the new hire. So when the payroll was produced for the January run, the new employee did not receive a check. The payroll clerk therefore calculated and produced a manual payment to be processed in an off cycle run. He then forwarded the check information to the central office to be entered into the system.

Manual payments are processed in off cycle payroll runs.

Use the Manual Payment Detail page (GP_OFFCYCLE_M_SEC) to enter all manual payment details.

Navigation

Click the Payment Details icon in the Manual Payments section of the Off Cycle Request page.

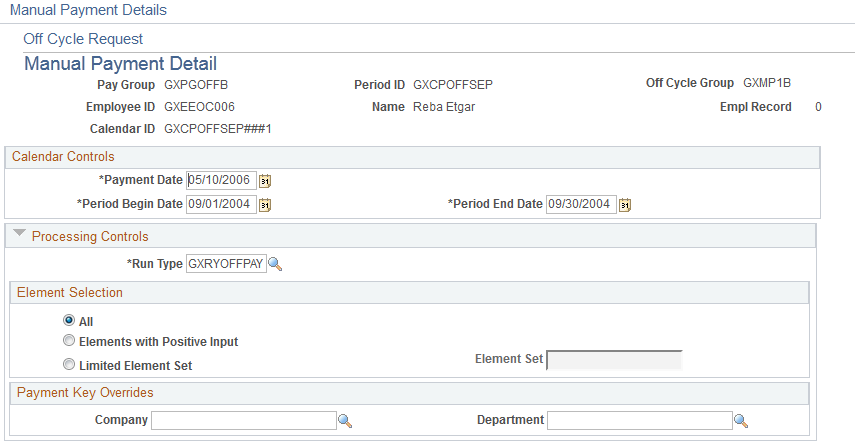

Image: Manual Payment Detail page (1 of 2)

This example illustrates the fields and controls on the Manual Payment Detail page (1 of 2).

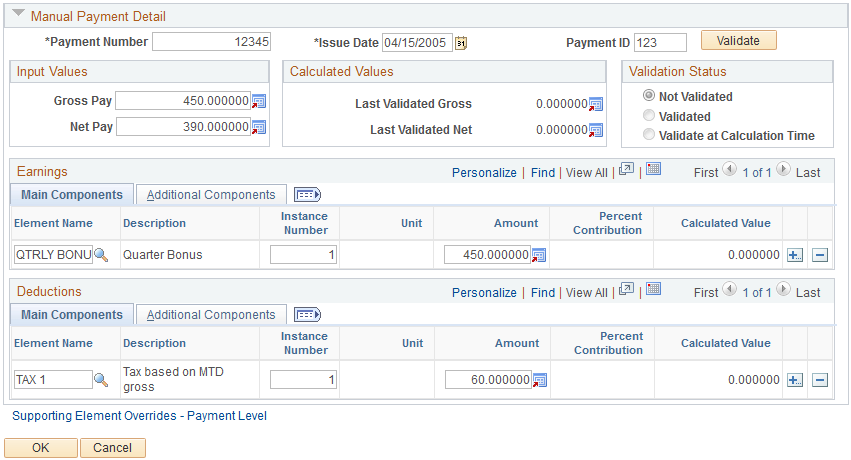

Image: Manual Payment Detail page (2 of 2)

This example illustrates the fields and controls on the Manual Payment Detail page (2 of 2).

Note: The fields that are available for entry on this page depend on the configuration settings that were created for this type of off cycle transaction.

This page shot displays the page as it will be presented when no configuration exists.

See Understanding Off Cycle Configurations.

|

Field or Control |

Definition |

|---|---|

| Payment Date |

The default value comes from the Off Cycle Request page if a value was entered on that page. This date drives the selection of date-effective rules and the allocation of results to the appropriate time period (month-to-date, quarter-to-date and year-to-date balances). Note: Payment date, as noted previously, can be used to determine what period balances to update. It may be different from the issue date of the original payment. |

| Period Begin Date and Period End Date |

Supplied from the target period ID. Dates the system use to determine:

Manual payments, corrections, and additional payments inherit these dates from the target calendar; you can override the default dates. Advance payments inherit these dates from the source calendar, the calendar that is being advanced; you cannot override these dates for advances. |

| Run Type |

Enter a run type for the calendar, unless you are using reason codes and the reason selected configures the run type for you. |

Element Selection

The fields in this section indicate the elements to process with the off cycle transaction. Select the desired option. For a manual payment the most logical choice is Elements with Positive Input.

Payment Key Overrides

The fields in this section display the payment keys that have been selected at the pay entity level. It will be visible only if payment keys are set up. The user can override the payment keys. If no payment keys are overridden, the system uses the payment keys values retrieved from the payees job information as of the period end date.

Note: If you override one payment key, you must override them all.

Manual Payment Detail

|

Field or Control |

Definition |

|---|---|

| Payment Number |

Enter the number that is associated with the payment number, cash receipt, check, or bank transfer for this manual payment. |

| Issue Date |

Enter the date that the payment was issued and payable to the payee. |

| Payment ID |

To include this payment in the payment reconciliation, add the payment ID that is applicable to the manual payment. |

| Gross Pay |

Enter the gross pay of the manual payment. |

| Net Pay |

Enter the net pay of the manual payment. |

| Calculated Values |

The Last Validated Gross and Last Validated Net values are derived based on how the earnings or deductions, which are entered on the positive input details, are defined to contribute to the gross and net accumulators. Since an earning or deduction can accumulate less than 100 percent to an accumulator, the calculated gross and net may be different from the input values of Gross Pay and Net Pay. |

| Validate |

After you enter all data for the page, click to validate the entries for the manual payment. The validation process verifies that the input gross and net amounts are equal to the calculated gross and net accumulator amounts to ensure that the amounts are entered correctly. If the values are not equal, the manual payment detail can be saved but not processed. The input gross and net pay must equal the calculated gross and net accumulators before a manual payment can be validated and then processed. The only exception is when you have a status of validate at calculation time. |

| Validation Status |

When the validation process is run, the Validation Status is automatically updated. Not Validated: Indicates that the calculated gross and net accumulators do not match the entered gross and net, or that the payment was saved and not validated. Validated: Indicates that the calculated gross and net accumulators match the entered gross and net. Validate at Calculation Time: Indicates that the earnings or deductions contributed to the accumulator based on another element. Because the element needs to be resolved during calculation, the system is not be able to validate until the calculation. |

Note: By entering all the earnings and deductions and then clicking the Validate button, you can use the page as a calculator to determine the gross and net for you, (and as such it can serve as a calculator when you issue the manual payment itself).

Earnings and Deductions Details

|

Field or Control |

Definition |

|---|---|

| Element Name |

Enter all the earning and deduction elements that are used in this manual payment. |

|

Field or Control |

Definition |

|---|---|

| Unit, Rate, Amount, Base, Percent, and Currency Code |

Enter values in the applicable fields for each element of the manual payment. |

| Percent Contribution |

Based on the element's definition, this displays the percent to add or subtract from the gross pay and net pay accumulators for this element. Note: If the element contributes based on another element, the element name appears. If the element contributes differently to gross and net, then ##### appears in this field. The system displays a message when the element contributes differently to gross and net, which reads # - Percent Contributions are different for Gross and Net. |

| Calculated Value |

Displays the value this element contributes to the gross and / or net accumulator, after the validation process is run. |

|

Field or Control |

Definition |

|---|---|

| Supporting Element Overrides |

Click to access the Supporting Element Overrides page, where you can override values of supporting elements for a specific earning or deduction. If override details are entered, the Details check box will be selected. |

| Supporting Element Overrides - Payment Level |

Click to access the Payee Calendar SOVR page, where you can override values of supporting elements for this manual payment. This override applies to all supporting elements processed. |