Generating Payday Reporting (PDR) File

This section discusses how to run the create PDR file process to generate employment file for submission.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_PDR_RC_EMFILE |

To generate the employment file prepared for PDR submission. |

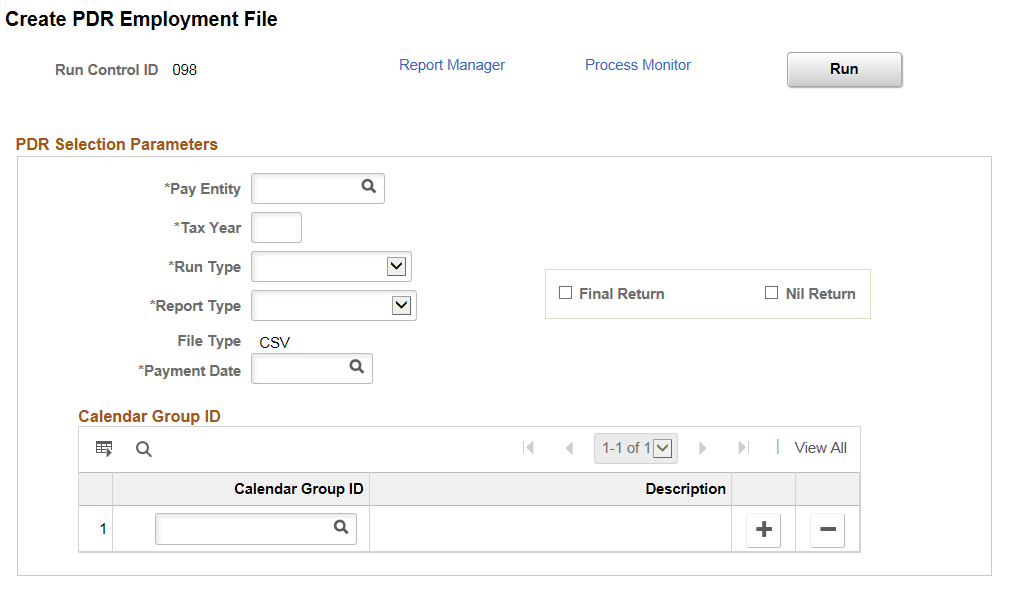

Use the Create PDR Employment File page (GPNZ_PDR_RC_EMFILE) to generate the employment file for PDR submission. Employment File needs to be submitted to Inland Revenue each time the employer makes a payment to an employee. It must contain data related to the payments processed for the relevant pay period.

Navigation

Image: Create PDR Employment File Page

This example illustrates the Create PDR Employment File Page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Pay Entity |

Select the Pay Entity for which payroll data is reported. |

| Tax Year |

Enter the tax year for which the PDR file needs to be created. 1 April to 31 March is considered as a tax year. For example, if the reporting month is May 2017 then the tax year should be selected as 2018. |

| Run Type |

Select the Run Type. Available options are:

|

| Report Type |

Select the report type. Available options are:

|

| Final Return |

Select this check box to indicate whether the report is the employer’s final payroll reporting before pay entity ceases operation. This will update the header details of the file to indicate Employer’s final return. |

| Nil Return |

Select this check box to indicate if the file is generated with Nil values. This will update the file header that the file has Nil values. |

| File Type |

Displays the file type. By Default the value will be CSV. |

| Payment Date |

Select the payment date for which the file is generated. |

| Calendar Group ID |

Select the Calendar Group ID for the corresponding payment date that you want to report Pay Event. |

Note: A log file will be generated along with employment file generation to identify any missing mandatory fields and data format errors.