Reviewing Payday Reporting (PDR) Data

Before submitting the employment file to Payday Reporting, you can review the prepared data based on selected parameters. This section discusses how to review employer and employee data prepared for Payday Reporting.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_PDR_ER_RVW |

To review the employer PDR data prepared for file submission. |

|

|

GPNZ_PDR_EE_RVW |

To review the employee PDR data prepared for file submission. |

Use the Review Employer PDR Data page (GPNZ_PDR_ER_RVW) to review the employer PDR data prepared for file submission. Employer data are the details that form part of header in the employment file. The data consist of the sum of the employee line details.

Navigation

Note: You can search for an existing employer PDR data record based on Pay Entity, Tax Year or Payment Date.

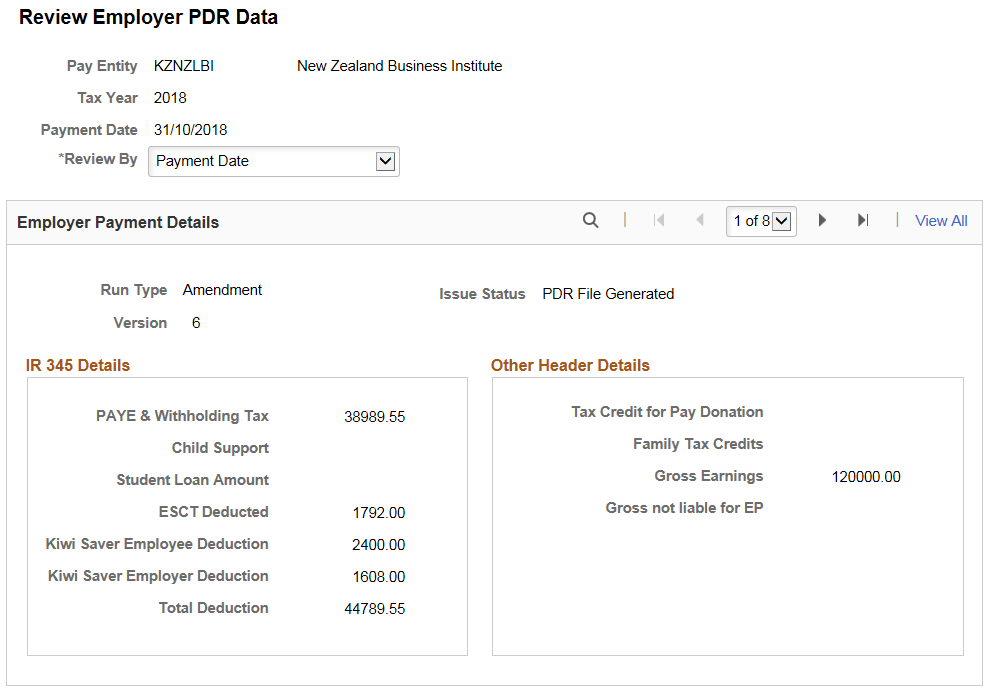

Image: Review Employer PDR Data page

This example illustrates the fields and controls on the Review Employer PDR Data page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Pay Entity |

The Pay Entity for which data is extracted. |

| Tax Year |

The tax year for which the PDR data needs to be processed. |

| Payment Date |

The date on which the payment is made. |

| Review By |

Select the parameter based on which Employer Payment details needs to be displayed. Valid options are:

|

Employer Payment Details

|

Field or Control |

Definition |

|---|---|

| Run Type |

Indicates the nature of the run type. For the payroll generated results, run type will be marked as “Original”. If any override/amendment is performed then the Run type will be “Override” or Amendment respectively. |

| Issue Status |

Indicates the status. Available options are:

Note: You can change the status from PDR File Generated to PDR Ready. This is to recreate PDR data due to addition of an off-cycle calendar in case if the file is generated in production mode. |

| Version |

Indicates the version. Original will always be represented as version “1” whereas for Overrides or Amendments version increases. |

| IR 345 Details |

For the selected parameter, the IR345 details that forms part of the employment file header is displayed which can be reviewed with internal records for the same parameter. If the payment date has multiple calendar groups then the details of each of the calendar group is displayed for review against each of the calendar details. |

Use the Review Employee PDR Data page (GPNZ_PDR_EE_RVW) to review the employee PDR data prepared for submission.

Navigation

Note: You can search for an existing employee PDR data record based on Pay Entity, Tax Year, Employee ID or Name.

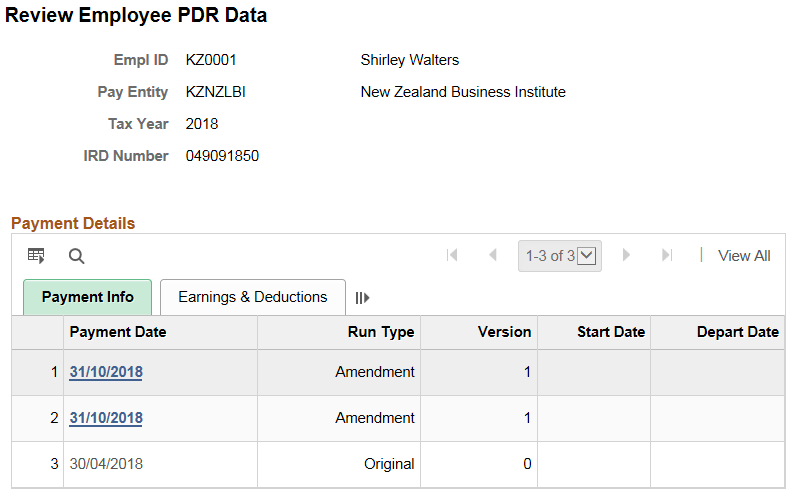

Image: Review Employee PDR Data Page

This example illustrates the Review Employee PDR Data Page.

Information that corresponds to each of the payment dates for the selected tax year is displayed for review.

Payment Info

This tab provides information about the Payment Date and Run type along with version, Start date and Termination date of employee hired during the current period. Payment date appears as hyper link if the payment date has multiple calendars.

Earnings & Deductions

This tab provides earnings and deduction details of employee prepared for Payday Reporting.