(USA) Setting Up the Company Local Tax Table

To set up the company local tax table, use the Company Local Tax Table component (COMP_LOCAL_TAX_TBL).

This topic discusses how to set up company local tax table entries.

Note: You must complete the Company Local Tax table before local tax data for employees is entered because the locality field on the Local Tax Data page is edited against this table.

Note: The tax tables discussed in these topics are required for both the Payroll for North America and Payroll Interface applications. The documentation for each of these applications discusses additional tax data setup that is specific to the application.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

COMP_LOCAL_TAX_TBL |

Set up an entry in the Company Local Tax Table page for each locality where the organization withholds or pays taxes. |

|

|

Company Local Tax Report Page |

PRCSRUNCNTRL |

Run TAX705 to print information from the Company Local Tax Table, which identifies the localities for which your organization collects and pays taxes. |

Use the Company Local Tax Table page (COMP_LOCAL_TAX_TBL) to set up an entry in the Company Local Tax Table page for each locality where the organization withholds or pays taxes.

Navigation

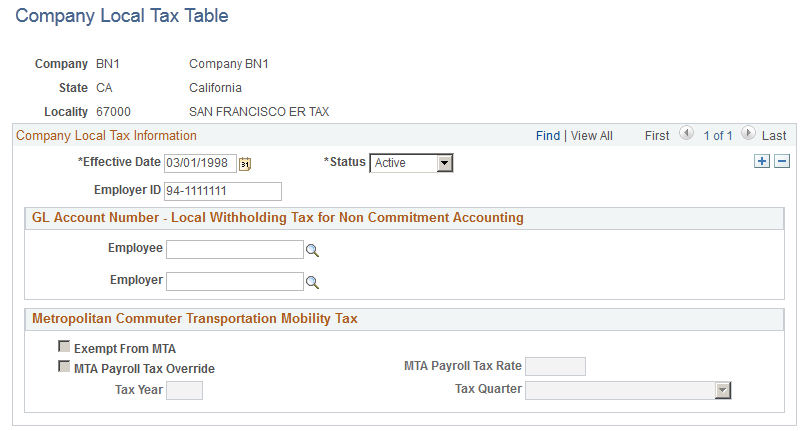

Image: Company Local Tax Table page

This example illustrates the fields and controls on the Company Local Tax Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Employer ID |

This field is used for local withholding tax for this locality. It is set by default to the Employer ID for state withholding taxes on the Company State Tax table. |

GL Account Number - Local Withholding Tax for Non Commitment Accounting

These accounts are General Ledger accounts for use with local withholding tax; they are only used by the PayGL01 process. Only GL information not subject to Commitment Accounting would use these accounts.

|

Field or Control |

Definition |

|---|---|

| Employee and Employer |

If you have general ledger account numbers to which you post liability for local withholding tax for this locality, enter the employee and employer account numbers here. |

Metropolitan Commuter Transportation Mobility Tax

(New York) This group box appears for all state and locality entries, but it applies only to the state of New York. Fields within the group box are accessible for data entry only when State = NY and Locality = P0023.

Note: Before entering data in this group box, you must determine the company’s MTA tax status, the maximum MTA tax rate, and the minimum quarterly threshold. Refer to New York State Department of Taxation & Finance and New York Metropolitan Commuter Transportation Mobility Tax (MTA Payroll Tax). See http://www.tax.ny.gov/bus/mctmt/emp.htm.

|

Field or Control |

Definition |

|---|---|

| Exempt from MTA (exempt from Metropolitan Commuter Transportation Mobility Tax) |

Select this check box if the company is an employer type that is exempt from paying MTA tax. When this check box is selected, taxable wages will not be accumulated and tax will not be calculated, therefore the MTA Payroll Tax Override check box becomes unavailable and the MTA Payroll Tax Rate hidden. Some examples of employers that are exempt from paying the tax include: an agency or instrumentality of the United States; the United Nations; an interstate agency or public corporation created under an agreement or compact with another state or Canada; any eligible educational institution. |

| MTA Payroll Tax Override |

Select this check box if the company is subject to MTA tax, but whose payroll expense for the quarter qualifies it for a lower tax rate than the maximum MTA tax rate that is delivered as the tax rate in the Local Tax Table entry for Locality NY P0023. |

| MTA Payroll Tax Rate |

Enter the tax rate that applies to the company. Enter 0.00000 if the company’s payroll expense for all covered employees for the calendar quarter falls below the minimum threshold that requires payment of the tax. |

| Tax Year and Tax Quarter |

Enter the year and quarter for which the lower tax rate or exempt status applies. |