Maintaining Interest Rate Tables

This topic provides an overview of interest rate tables and discusses how to view the tables.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_PBGC_RATES |

View PBGC interest rates. |

|

|

PA_TL_30YR_TBILL |

View 30-year T-bond rates. |

|

|

PA_TL_120AFR |

View Federal midterm rates. |

|

|

PA_SEGMENT_RATES |

View segment rates for lump sum calculations. |

Several components of pension calculations use interest rates.

Table Lookups for Interest Rates

When you need an interest rate, you have the option to find it using a table lookup.

You can use the Interest Method pages to create interest rules that you reference in the cash balance accounts and employee accounts functions. When you define an interest method, a table lookup is one of the options for the rate source.

You also use an interest rate lookup when you set up an employee-paid benefit definition. This function uses the interest rate to project the value of an employee account and determine what portion of the employee's total benefit is attributable to employee contributions.

Actuarial assumption sets can also use interest rate lookups to determine the interest basis for actuarial calculations.

Pension Administration provides three interest rate tables that you can use with the Table Lookup utility: PBGC rates, published by the Pension Benefit Guaranty Corporation, 30-year treasury bond rates, and federal midterm rates. Although PeopleSoft does not provide you with table lookup aliases for any of the delivered interest rate tables, table lookup aliases can be used with any of the tables except the segment rates. You need to create table lookup aliases for the interest rate tables that you actually use.

Segment Rates

Pension Administration provides one additional interest rate table, segment rates, that you reference directly rather than through the Table Lookup utility. Segment rates differ from the other interest rate tables because there are separate rates to use over different time periods.

You reference segment rates only from the Interest Basis page in the Actuarial Assumptions component. Only one segment rates table exists, so all you need to do is indicate that the assumption set uses segment rates, and the system automatically uses the correct table.

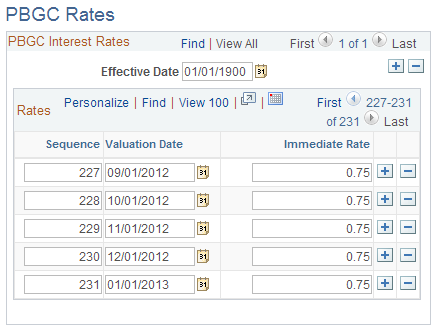

Use the PBGC Rates page (PA_PBGC_RATES) to view PBGC interest rates.

Navigation

Image: PBGC Rates page

This example illustrates the fields and controls on the PBGC Rates page.

Each row contains the PBGC immediate rate for a particular valuation date. The immediate rate is the basis for the PBGC grading structure, which uses a set formula to derive three additional rates from the immediate rate. An additional rate is applied over the period of time between the valuation date and the deferral date, the date when payments actually commence.

When you set up the plan rules, two pages offer the option to use PBGC grading: Actuarial Assumptions (ACTUARIAL_FACTORS) - Interest Basis and Components (PA_EEBENEFIT_P1) - Employee Pd Benefit 2 of 2. Although you can apply the grading to any rate, you normally use published PBGC rates any time that you grade the rates.

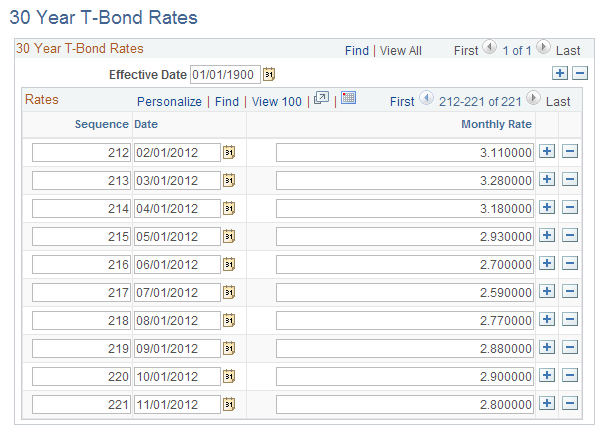

Use the 30 Year T-Bond Rates page (PA_TL_30YR_TBILL) to view 30-year T-bond rates.

Navigation

Image: 30 Year T-Bond Rates page

This example illustrates the fields and controls on the 30 Year T-Bond Rates page.

Note: The Internal Revenue Service publishes 30-year treasury bond rates. These are the average yields on 30-year treasury constant maturities for a given month. These rates are used to determine the present lump sum value of a participant's benefit under a qualified defined benefit plan.

Each effective-dated row contains a date and the 30-year Treasury bond monthly rate that was published on that date.

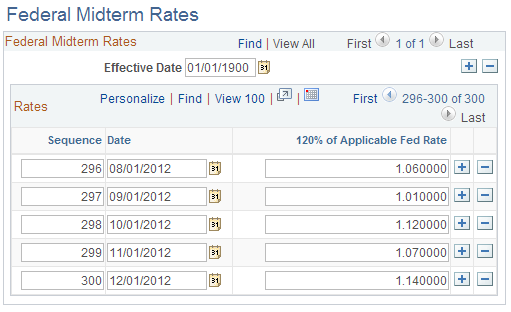

Use the Federal Midterm Rates page (PA_TL_120AFR) to view Federal midterm rates.

Navigation

Image: Federal Midterm Rates page

This example illustrates the fields and controls on the Federal Midterm Rates page.

Defined benefit plans that require employee contributions must credit interest to those contributions using the applicable federal rates (AFR), commonly called the federal midterm rates. The rate used is 120 percent of the annual AFR for the month in which the plan year commences.

Each effective-dated row contains a date and the rate that is 120 percent of the applicable federal rate for that date. This is an annualized rate.

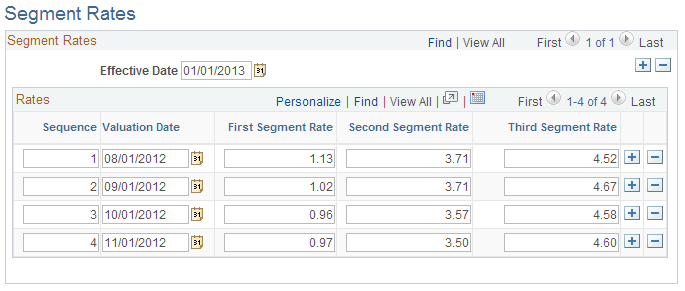

Use the Segment Rates page (PA_SEGMENT_RATES) to view segment rates for lump sum calculations.

Navigation

Image: Segment Rates page

This example illustrates the fields and controls on the Segment Rates page.

The Pension Protection Act of 2006 contains provisions for using certain interests rates in the actuarial assumptions that you use to calculate the minimum value of a lump sum distribution and to calculate the lump sum equivalent of a straight life annuity for purposes of Section 415(b).

These interest rates are called segment rates. The Treasury department publishes these segment rates monthly.

|

Field or Control |

Definition |

|---|---|

| Effective Date |

Sets of segment rates are effective dated. An actuarial assumption set that uses segment rates can include an effective date alias that the system uses to determine which set of rates to apply. If the actuarial assumption set does not specify an effective date alias, the system uses the calculation as-of date as the effective date. |

Rates

|

Field or Control |

Definition |

|---|---|

| Valuation Date |

The calculation process uses the valuation date to determine which rates to use. An actuarial assumption set that uses segment rates can include a valuation date alias for this purpose. If the actuarial assumption set does not specify a valuation date alias, the system uses the calculation as-of date as the valuation rate date. |

| First, Second, and Third Segment Rate |

Segment rates consist of three separate rates. Each segment rate applies to a specific time period:

|