Understanding Pay Groups

This topic discusses:

Purpose and function of pay groups.

Default pay group for the company.

Checklist for identifying pay groups.

How the Pay Group table affects paysheets.

When you implement Payroll for North America, a major decision you have to make is which pay groups to define. A pay group is a logical grouping of employees based on shared characteristics that facilitate payroll processing because of common requirements such as employee type, pay frequency, same country location, and so on. A pay group consolidates a set of employees within a company for payroll processing. When you run the Create Paysheet COBOL SQL process (PSPPYBLD), the system processes one pay group at a time. At this point, the system verifies that the company and pay group assigned on the employee job data match the company and pay group specified for the payroll run.

Other reasons for defining multiple pay groups are:

If you print checks or advices on more than one print stock, you must create a separate pay group for each print stock that you use.

If the organization has both U.S. and Canadian employees, you must set up a separate pay group for each.

If paysheets and checks are printed in different sort sequences, you need a separate pay group for each sequence.

When you first add a pay group, you're prompted for a company ID and pay group ID. The company ID is a key field on the pay group table, implying that all employees in a pay group are also in the same company. For the pay group ID, use any three-character alphanumeric ID that conforms to your payroll standards.

There is no limit to the number of pay groups that you can define for a company. You might need only one, or more likely, several pay groups to accommodate the different payroll schedules that you have.

After you define all the valid pay groups for a company, you must return to the Company Table - Default Settings page, to assign a pay group default. Typically, that default should be the most common pay group for the company. Employees assigned to that company in their Job data are set by default to the pay group established for that company and the employee type established for that pay group.

As you define pay groups, use this checklist to verify that the employees you're grouping together should be in the same pay group. All employees:

Belong to the same company.

Are paid at the same pay frequency.

Use the same check form or direct deposit advice form.

Have the same check date.

Share the same pay period begin and end dates.

Work in the same country.

Are paid by the same bank.

Are assigned the same work schedule for proration.

Are assigned the same minimum net pay.

(USA) Are similarly affected by the Fair Labor Standards Act (FLSA) (FLSA either applies or does not apply to all employees).

If FLSA applies, all FLSA rules (FLSA Calendar ID and FLSA Salaried Hrs Use—for example) must be the same for all employees.

Are assigned to the same earnings program, the same retro pay program, and the same retro pay trigger program.

When processing payrolls, group multiple pay groups together only if they can be scheduled and completed concurrently.

Pay Group Setup Example

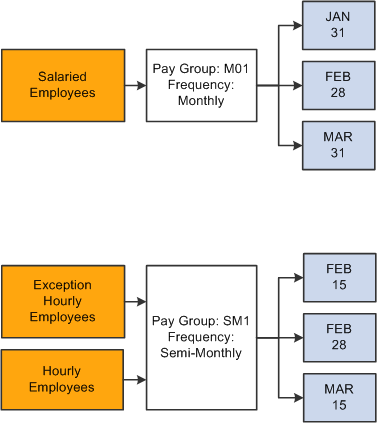

Here is an example of setting up pay groups for a company:

|

Pay Group |

Description |

|---|---|

|

MO1–Monthly |

Employees who are paid monthly and share the same pay period, which ends on the last day of the month, can belong to the same pay group. Salaried employees at CCB are paid monthly. |

|

SM1–Semimonthly |

Employees who are paid semimonthly, and share the same pay periods (ending on the 15th and last day of the month) can also belong to the same pay group. Exception hourly and hourly employees at CCB are paid semimonthly. |

This diagram shows an example of pay group setup for salaried, exception hourly, and hourly employees:

Image: Example of pay group setup for salaried, exception hourly, and hourly employees

This diagram shows an example of pay group setup for salaried, exception hourly, and hourly employees.

When you enter regular hours, overtime hours, or regular earnings on paysheets, the system refers back to the Pay Group table to determine the earnings code for regular hours, overtime hours, and regular earnings. Under other earnings, the system automatically generates entries for any holiday pay using the holiday earnings code specified on the Pay Group table.