Understanding Payroll Data

The Employee Pay Data menu contains the Payroll for North America pages that you use to maintain payroll-specific data, such as tax information, additional pay, general deductions, direct deposit, and garnishments information.

These pages work in conjunction with the information that you enter on the Workforce Administration pages and the benefit deduction data maintained in Benefits pages.

In addition to the payroll data information that is required for payroll processing, PeopleSoft also provides optional payroll data pages, where you can maintain and override information concerning check distribution and payroll deductions.

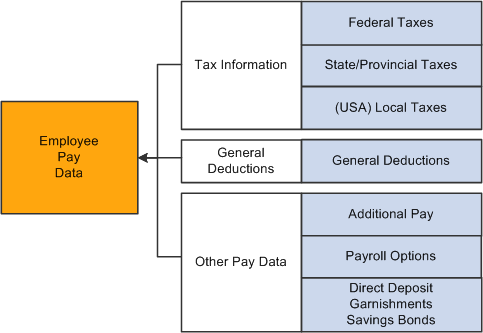

This diagram shows the types of payroll data information that you can maintain for employees, including tax information, general deductions, and other pay data:

Image: Maintaining employee payroll data including tax information, general deductions, and other pay data

This diagram shows the types of payroll data information that you can maintain for employees, including tax information, general deductions, and other pay data.

Searching by National ID

The Employee Pay Data menu also offers the Search by National ID page, part of the Administer Workforce business process in PeopleSoft HR. You can search for employees and their dependents/beneficiaries using their national ID.

(USA) Verifying Social Security Numbers

Payroll for North America provides the SSN Verification (social security number verification report) SQR Report process (TAX109) that you can use to electronically submit employee name and SSN information to the Social Security Administration (SSA) for verification. The SSA verification service is available to all employees and third-party submitters to verify current or former employees for wage reporting (Form W-2) purposes.

You can verify up to 10 names and SSNs per screen online, and receive immediate results. Consider using this method for verifying small numbers of new hires.

You can also upload overnight files of up to 250,000 names and SSNs, and receive results within the next 1–2 government business days. Consider using this method to verify an entire payroll database or if you hire a large number of workers at a time.

Note: You must obtain an Access and Activation Code from the SSA before running the TAX109 process. It's a good idea to submit this file periodically throughout the year to identify and correct SSN errors before beginning year-end processing.