Understanding Paysheets and Paylines

This topic discusses:

Paysheets.

Differences between paylines and paysheets.

Paysheet page messages.

Before you run payroll calculations, you must create paysheets. Paysheets contain the data required to calculate employee pay for each pay period.

To create a paysheet automatically, use the Create Paysheet COBOL SQL process (PSPPYBLD). This process gathers information about the employees for whom to process payroll from system tables and generates the pay earnings information for each payline.

To create a paysheet manually, create a blank paysheet with only the pay begin and end dates specified.

Use the paysheets in the Payroll Processing menu to enter time and any additional payroll-related information for the current pay period (such as earnings, frequency, one-time deductions, one-time garnishments, one-time taxes, accounting data, and tax periods) before you run the Pay Calculation process.

Use the rapid entry paysheet functionality to quickly input basic payroll data entry information based on hours worked, amounts, or a combination of both.

After you create paysheets, you can print them for review.

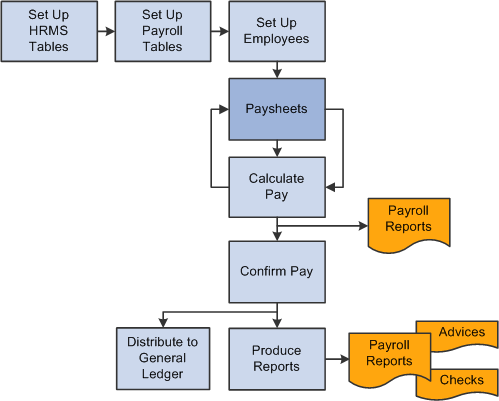

This diagram illustrates how paysheets fit into the payroll process, from setting up PeopleSoft HR tables to producing payroll reports and sending data to general ledger:

Image: Illustration showing how paysheets fit into the payroll process from setting up PeopleSoft HR tables to producing payroll reports and sending data to general ledger

This diagram illustrates how paysheets fit into the payroll process, from setting up PeopleSoft HR tables to producing payroll reports and sending data to general ledger.

See Payroll Processes.

Before automated data processing, payroll departments used sheets of ruled paper to compile the information required to calculate pay and produce paychecks for the employees scheduled to be paid in a pay period. These were called paysheets, and each horizontal row of data on the paysheet, typically representing one employee, was called a line or payline. Payroll for North America uses an online version of the pencil-and-paper paysheets and paylines.

Before running the Pay Calculation process, you can make pay-related adjustments for the current pay period. Paysheet and Payline pages display the same content, but you access them differently. The Paysheet page includes many paylines. You can view only one payline at a time on the Payline page.

Use the Paysheet pages to scroll through paylines for a paysheet run, entering any required data. After the initial calculation run, use the Payline pages to enter corrections and last-minute adjustments for employees, because you can access the employee much faster through the individual payline.

If you use paysheet reports to enter payroll information, use one of the Paysheet pages. However, to review pay earnings entries for an employee or group of employees, use one of the Payline pages.

Paysheets

The By Paysheet - Paysheet page brings together information from many different sources in the system. The default information appears as a payline for each employee when you access the page. Paysheets are arranged by pages and lines. A paysheet contains many lines. Each employee appears on a separate line that contains standard pay information, such as the amount of regular pay, number of regular hours, and job data.

When you view a printed paysheet report, several paylines appear on the same page. When you view paysheets online, you only see one payline per page on the By Paysheet - Paysheet page. Specify the number of paylines to appear on a paysheet in the Company table. Specify the sort sequence for paysheets in the Pay Group table.

During the Create Paysheet process, the system creates one payline for each employee to be paid:

Active employees.

Employees who are on leave with pay.

Employees who were terminated or on unpaid leave for only part of the pay period.

For terminated employees or new hires who did not appear on the paysheet, create a new By Paysheet - Paysheet page to include last-minute pay data for the terminated employee, or to indicate how much to pay a new hire who you hired after creating the paysheets. If you select the Automatic Paysheet Update check box on the Pay Group Table - Paysheets page, the system creates paysheets for new hires and updates paysheets with employee job, deduction, and other changes during the Pay Calculation process.

In some cases, depending on the data provided, the system automatically creates multiple pay earnings. Otherwise, enter additional records manually before running the calculation. The system automatically creates the following:

Multiple paylines, if the employee has multiple Job records and additional Employment records.

Multiple Pay Earnings records, if the following criteria are valid:

The pay is charged to different departments and account codes as specified in the Job Data record in the Workforce Administration menu.

The employee has different rates of pay due to a pay rate change during the pay period.

The employee worked in multiple departments, states, or locations during the pay period, resulting from a Job record or location change.

Other Earnings records, if the employee has additional pay entries.

Paylines

A payline consists of:

Line number.

Employee ID.

Employment record number (used for multiple jobs).

Benefit record number.

Employee name.

Manual check indicator.

A payline is associated with one or more Pay Earnings records. Each Pay Earnings record that is associated with a payline contains the following information:

Amount of regular pay.

Number of regular hours.

Additional pay.

Other earnings.

Tax information.

Job data, such as department and job code.

Note: Each employee who you scheduled to pay during a pay period must have at least one payline and one Pay Earnings record. Otherwise, the system has no information with which to calculate earnings, taxes, and deductions.

Paysheet pages display messages that might appear for each pay earnings on the paysheet. The messages indicate either the status of the pay earnings, or what the pay earnings represent.

Normal Payroll Processing Messages

The following table lists typical payroll processing messages:

|

Message |

Explanation |

|---|---|

|

No Message |

The standard message indicates that nothing unusual has happened. |

|

Partial Period |

Indicates that the employee was not active for the entire pay period, or that the employee's Job record was updated with an effective date that falls between the pay period begin and end dates. |

|

Pay Data Change |

Indicates that one or more of the employee's records was updated since the last time you ran the Pay Calculation process. If you haven't already recalculated the employee's pay, the system recalculates it the next time you run the Pay Calculation process. To select all employees whose pay data changed and requires recalculating, select the Calculation Required value in the Job Pay Data Change field on the Payline Update/Display page. Entering Y in the same field selects all employees whose pay was recalculated due to a change in one of their pay-related records. |

|

Pay Data Change - Partial Period |

Indicates, for employees who received a Pay Data Change message, that a change was made to their Job records with an effective date falling between the pay period begin and end dates, and they have already been recalculated. |

Reversal Message

This reversal message appears in the Payline record when you run the Reversal Processing COBOL SQL process (PSPPYREV) for a check reversal:

|

Message |

Explanation |

|---|---|

|

Reversal |

Indicates that the check is a reversal check. |

Reversal and Adjustment Messages

The following messages might appear when you run the Reversal batch process for a check adjustment:

|

Message |

Explanation |

|---|---|

|

Reversing Adjustment |

Indicates that a Pay Earnings record was adjusted. It appears in the original Pay Earnings record. |

|

Adjustment |

Indicates that the Reversal Processing process created a Pay Earnings record. It appears in the Pay Earnings record that you use to recalculate an employee's pay. |

|

Adjustment - Partial Period |

Indicates that the employees with the adjusted Pay Earnings record had changes to their Job records, with an effective date that falls between the pay period begin and end dates prior to running the Reversal/Adjustment process. |

|

Adjustment - Pay Data Change |

Indicates that at least one of the employee's adjusted records was updated since the last time you ran the Pay Calculation process. The system recalculates this employee during the next Pay Calculation process if it hasn't already. To select all employees whose pay data changed and requires recalculating, enter R in the Job Pay Data Change field on the Payline Update/Display page. Entering Y in the same field selects all employees whose pay was recalculated due to a change in one of their pay-related records. (See the previous example). |

|

Adj - PayChg - Partl Period (adjustment - pay change - partial period) |

Indicates, for an employee who received an Adjustment - Pay Data Change message, that a change was made to that Job record, with an effective date falling between the pay period begin and end dates, and has already been recalculated. |

Manual Check Message

The following table lists the manual check message:

|

Message |

Explanation |

|---|---|

|

Manual Check |

This message appears when you selected the Manual Check option. |