Accumulating and Adjusting Fiscal Data

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_FGPY006 |

(USF) Run the IRR Fiscal Data Accum report (FGPY006) to transfer all of the fiscal data recorded on an employee's IRR and stored in the payroll system to the fiscal data portion of the IRR. |

|

|

Adjust Empl Fiscal Yr History Page(adjust employee fiscal year history) |

GVT_ADJ_FISCAL_YR |

(USF) Adjust an employee's yearly retirement deduction totals. |

Create an IRR Fiscal Data Accum report at the end of the tax year to accumulate and store fiscal information from the IRRs for all employees.

The IRR Fiscal Data Accumulation process uses payroll earnings and deductions for the current year and accumulated fiscal data for all prior years. You do not need to run this process for an employee whose separation occurs mid-year. All IRR pages and reports automatically select and summarize payroll detail earnings and deductions.

This report accumulates all retirement deductions for employees, leave without pay hours, and basic pay that they received when they were not covered by CSRS or FERS retirement plans. Run this process at the end of a tax year.

If you must run this process at any time other than the end of the tax year, or if you must make a correction to an employee's fiscal data, you can do so for employees whose IRRs are affected.

If run regularly at the end of the tax year, this report processes records for all employees in your agency. If run for selected employees, it processes records for those employees only.

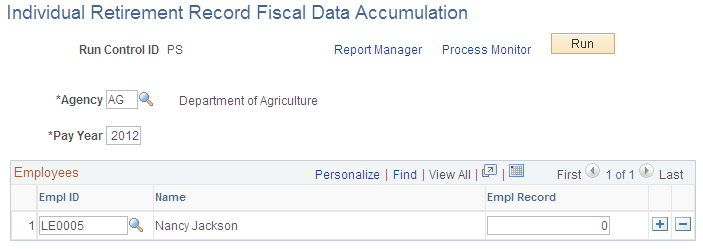

(USF) Use the Individual Retirement Record Fiscal Data Accumulation page (RUN_FGPY006) to run the IRR Fiscal Data Accum report (FGPY006) to transfer all of the fiscal data recorded on an employee's IRR and stored in the payroll system to the fiscal data portion of the IRR.

Navigation

Image: Individual Retirement Record Fiscal Data Accumulation page

This example illustrates the fields and controls on the Individual Retirement Record Fiscal Data Accumulation page.

If an employee has a status of retired and has accumulated retirement amounts in a plan for which that employee is ineligible, you can adjust the employee's fiscal year history.

|

Field or Control |

Definition |

|---|---|

| Pay Year |

Enter the pay year for which you're running the fiscal data accumulation. Note: For every pay calendar that you establish, specify the pay year on the Year Settings page in the Pay Calendar table. This is defined automatically during the pay calendar creation, and it is generally the same as the year of the pay end date. When processing IRRs, the IRR Fiscal Data Accumulation process identifies all monies that come from the pay year. Note: If you're populating historical data, you must populate pay calendars from prior years. |

Employees

|

Field or Control |

Definition |

|---|---|

| Empl ID (employee ID) and Empl Record (employee record number) |

Enter the employee ID and record number for employees to include in the IRR Fiscal Data Accumulation process. If you do not enter any employees, this process runs for your agency's employee population. |

(USF) Use the Adjust Empl Fiscal Yr History (adjust employee fiscal year history) page (GVT_ADJ_FISCAL_YR) to adjust an employee's yearly retirement deduction totals.

Navigation

|

Field or Control |

Definition |

|---|---|

| Year |

Displays the year. |

| Amount |

Displays the current amount balance. |

| Adjusted Amount |

Enter the adjusted amount balance. |

| Empl Contrib % (employee contribution percentage) |

Displays the current value of the employee's contribution percentage. |

| Adjusted Empl Contrib % (adjusted employee contribution percentage) |

Enter the adjusted value of the employee's contribution percentage. |

| LWOP Hrs (leave without pay hours) |

Displays the employee's current balance of leave without pay hours. |

| Adjusted LWOP Hrs (adjusted leave without pay hours) |

Enter the adjusted balance of leave without pay hours. |

| Reason for Adjustment |

Enter a reason. |