(CAN) Defining Canadian WCB Assessment Reporting

To define Canadian WCB assessment reporting, use the WCB Classifications Component (CAN_WCB_CU_RATES). Use the CAN_WCB_CU_RATES component interface to load data into the tables for this component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAXFORM_DEFN_TBL |

Define WCB assessable earnings. |

|

|

CAN_WCB_CU_RATES |

Define WCB classifications, rate groups, and assessment rates. |

PeopleSoft Payroll for North America enables employers registered with the Workers' Compensation Boards (WCB) in Canada to report and pay assessments based on the total assessable earnings of their workers. The system accommodates the assessment reporting structures of all provinces. This functionality enables the reporting of assessments by rate groups and classification units.

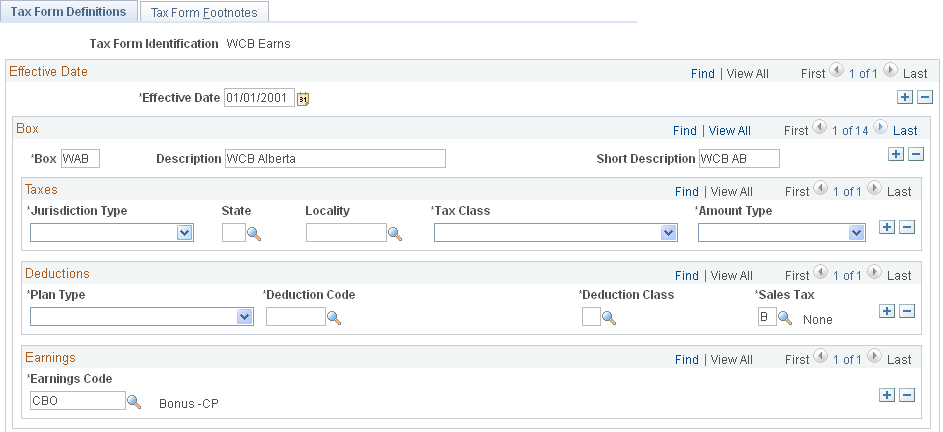

Use the Tax Form Definitions page (TAXFORM_DEFN_TBL) to define WCB assessable earnings.

Navigation

Image: Tax Form Definitions page

This example illustrates the fields and controls on the Tax Form Definitions page.

To define WCB assessable earnings:

Establish a new Tax Form ID—WCB Assessable Earnings—and the associated tax form Boxes for each province on the Tax Form Definition page.

The Boxes reflect the two-letter province code, preceded by a W.

Define and associate the assessable Earnings and Deduction Codes for each province with the WCB Assessable Earnings Tax Form ID.

Select the applicable provinces and define the assessable earnings.

The Earnings Codes defined as Regular Hours and Overtime Hours on the Pay Group table are automatically accumulated by the system as assessable earnings without defining them on the Tax Form Definitions page.

Associate the WCB Assessable Earnings tax form ID with the appropriate Plan Type, Deduction Code, Deduction Class, Sales Tax, and Earnings Code.

Note: The earnings codes defined as Regular Hours and Overtime Hours on the Pay Group table are automatically accumulated by the system as assessable earnings without defining them on the Tax Form Definitions page.

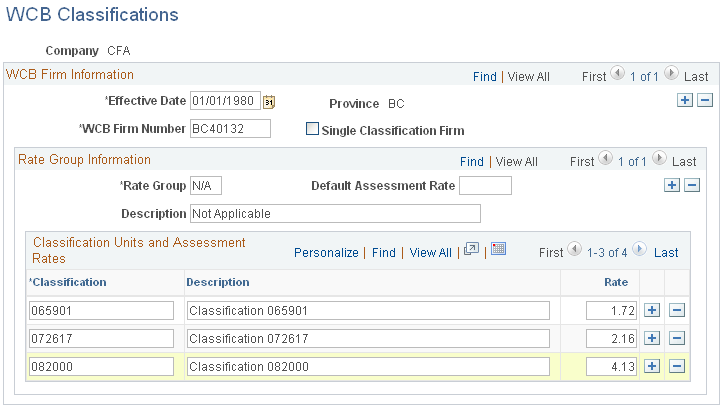

Use the WCB Classifications page (CAN_WCB_CU_RATES) to define WCB classifications, rate groups, and assessment rates.

Navigation

Image: WCB Classifications page

This example illustrates the fields and controls on the WCB Classifications page.

This page can accommodate both a single classification assigned to a single province and multiple Rate Groups associated with multiple classifications (or CUs) for a single province.

|

Field or Control |

Definition |

|---|---|

| WCB Firm Number |

Enter the WCB firm number. If a single rate group and/or classification and assessment rate applies to all covered employees in the province, select Single Classification Firm. |

| Single Classification Firm |

If this check box is selected, the Workers Compensation report (PAY102CN) uses the entry on this page as the source for reporting assessment information for all covered employees in the province. If this check box is deselected, the information defined on the Job Code table (WCB Classifications page) 4 is used as the source for reporting. |

| Rate Group |

When adding the original entry for a province, this is set by default to N/A . If rate groups are applicable to the specified province, override the default by entering the rate group. |

| Default Assessment Rate |

If you enter a default assessment rate, that rate populates into the Assessment Rate for each Classification assigned to the Rate Group. |

| Description (for Rate Group) |

Enter the rate group description, if applicable. Similar to the Rate Group field, the description is set by default to Not Applicable when adding the original entry for a province. |

| Classification |

Define a classification or classification unit (CU). |

| Assessment Rate |

Enter the assessment rate applicable to the classification. |