(CAN) Setting Up Wage Loss Plans

To set up wage loss plans, use the Wage Loss Plan (WAGELS_PLN_TBL) component

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WAGELS_PLN_TBL1 |

Define a wage loss plan for your company. |

|

|

Wage Loss Plan Report Page |

PRCSRUNCNTL |

Generate a report that lists information from the Wage Loss Plan Table for Canadian employers. |

The Canadian Wage Loss Plan table identifies valid Canadian wage loss replacement plans. The Wage Loss Replacement Plan field in the Canadian Income Tax Data table at the employee level is edited against this table. You must create entries on this table before you enter any Canadian tax data for your employees.

You must set up at least one entry on the Wage Loss Plan table for each company. Typically, you create this entry using the default EI Employer Rate and corresponding Quebec EI Employer Rate. You must define additional entries for each wage loss plan your company has registered with CRA.

Use the Wage Loss Plan Table page (WAGELS_PLN_TBL1) to define a wage loss plan for your company.

Navigation

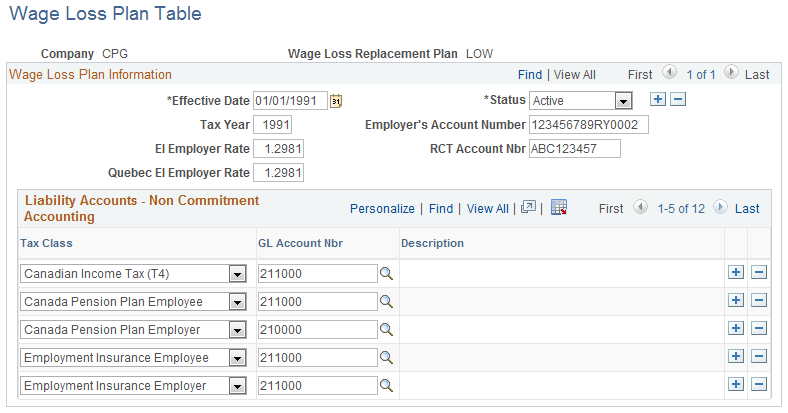

Image: Wage Loss Plan Table page

This example illustrates the fields and controls on the Wage Loss Plan Table page.

Wage Loss Plan Information

|

Field or Control |

Definition |

|---|---|

| Employer’s Account Number |

For each plan you set up, enter your company's unique CRA Taxation account number in this field. Because a company can have more than one wage loss replacement plan, you can set up any number of plans on this table. |

| EI Employer Rate |

This is the rate of your contribution to Employment Insurance. The default rate (which comes from the Employer EI Premium Rate on the Canadian Tax table) may be overridden with your specific plan rate. |

| RCT Account Number |

This field is hidden on the page for all entries with an Effective Date of 01/01/1997 or later. The field will be displayed and is available for use for all entries dated prior to 01/01/1997 for historical purposes only. |

| Quebec EI Employer Rate |

This is the rate of your contribution to Employment Insurance. You can override the default rate (which comes from the Quebec Employer EI Premium Rate on the Canadian Tax table) by entering your specific plan rate. |