(CAN) Viewing Canadian Tax Tables

To view Canadian tax tables, use the Canadian Tax Table component (CAN_TAX_TABLE).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CPP/QPP and EI Page |

CAN_TAX_TABLE1 |

View the constant values required for calculation of contributions to Canada and Quebec Pension Plans and premiums for Employment Insurance, as well as premiums for Quebec Employment Insurance, and the Quebec Parental Insurance Plan. PeopleSoft maintains this table for you. |

|

CAN_TAX_TABLE4 |

View the wage threshold and rates for calculating Canadian federal surtax. PeopleSoft maintains this page for you. |

|

|

CAN_TAX_TABLE2 |

View rates, thresholds, and constants needed to determine withholding of Canadian provincial taxes, including withholding, health insurance, and sales taxes. PeopleSoft maintains this page for you. |

|

|

Provincial Tax Thresholds Page |

CAN_TAX_TABLE3 |

View by province the net claim amount threshold and tax reduction amount. Note that this page does not affect all provinces. PeopleSoft maintains this table for you. |

The Canadian Tax tables are used during payroll calculation to compute all federal, provincial, and Quebec taxes. Because these tables are maintained largely by PeopleSoft and updated based on the standards outlined in the Canada Revenue Agency (CRA) publication Payroll Deductions Formulas for Computer Programs and the Revenu Quebec publication Guide for Employers: Source Deductions and Contributions, you shouldn't need to modify them. However, you can make changes using the Canadian Tax Table pages if you have the appropriate security authorization.

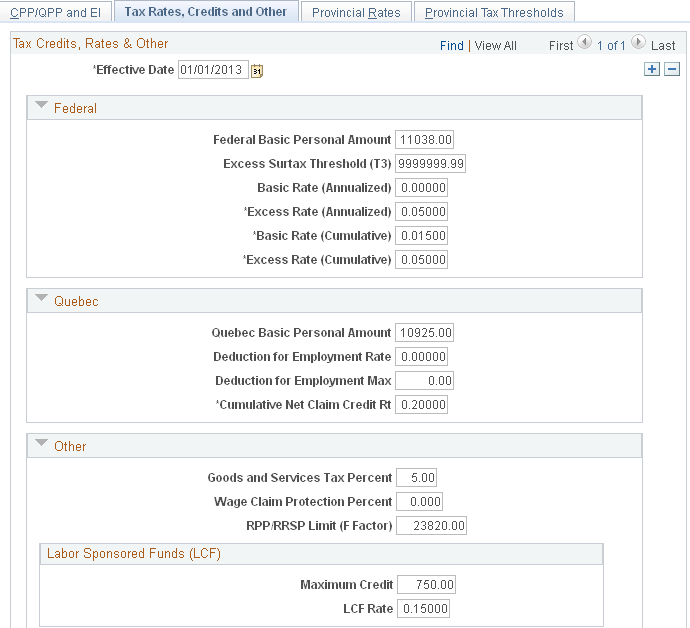

Use the Tax Rates, Credits, and Other page (CAN_TAX_TABLE4) to view the wage threshold and rates for calculating Canadian federal surtax.

Navigation

Image: Tax Rates, Credits and Other page (1 of 2)

This example illustrates the fields and controls on the Tax Rates, Credits and Other page, 1 of 2.

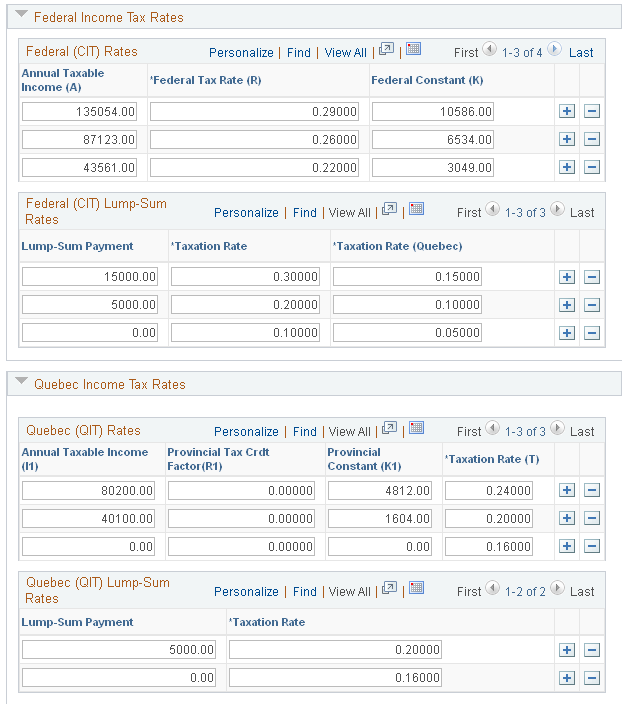

Image: Tax Rates, Credits and Other page (2 of 2)

This example illustrates the fields and controls on the Tax Rates, Credits and Other page 2 of 2.

PeopleSoft maintains this page for you.

Other

|

Field or Control |

Definition |

|---|---|

| RRP/RRSP Limit (F factor) |

This field is used during the calculation of Canadian income taxes subject to the commission tax method. |

Labor Sponsored Funds (LCF)

|

Field or Control |

Definition |

|---|---|

| Maximum Credit |

This field displays the monetary amount to be applied to employee purchases of shares in Labour Sponsored Venture Capital Corporations (LSVCC). The federal tax credit is limited to the lesser of the maximum credit and the LCF Rate. The system applies this credit to each participating employee, according to the LCF Amount you enter on the employee's Canadian Income Tax Data page. |

| LCF Rate |

This field displays the percentage to be applied to employee purchases of shares in Labour Sponsored Venture Capital Corporations (LSVCC). The federal tax credit is limited to the lesser of the maximum credit and the LCF rate. The system applies this credit to each participating employee according to the LCF Amount you enter on the employee's Canadian Income Tax Data page. |

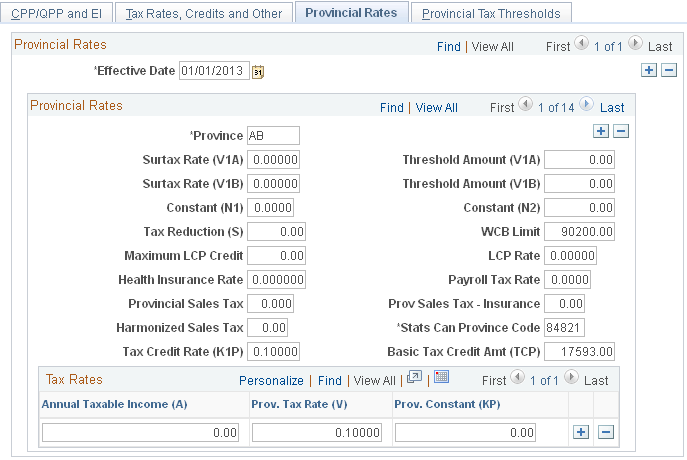

Use the Provincial Rates page (CAN_TAX_TABLE2) to view rates, thresholds, and constants needed to determine withholding of Canadian provincial taxes, including withholding, health insurance, and sales taxes.

Navigation

Image: Provincial Rates page

This example illustrates the fields and controls on the Provincial Rates page.

PeopleSoft maintains this page for you.

|

Field or Control |

Definition |

|---|---|

| Maximum LCP Credit |

For provinces where provincial labor-sponsored venture tax credits are available, you maintain the maximum LCP credit amount to be applied for that province on this table. This applies to employee purchases of shares in Labour Sponsored Venture Capital Corporations (LSVCC). |

| LCP Rate |

For provinces where provincial labor-sponsored venture tax credits are available, you maintain the LCP rate to be applied for that province on this table. This applies to employee purchases of shares in Labour Sponsored Venture Capital Corporations (LSVCC). |

| Health Insurance Rate |

You override the default health insurance rate on the Canadian Company Tax table. |