Establishing Pay Plans

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_PAYPLAN_TBL |

(USF) Enter a pay plan ID to become a setID selection for the Salary Plan table. Specify classification authority and eligibility. |

|

|

GVT_PAYPLAN_TBL2 |

(USF) Establish pay caps and limits, exempt overtime rates, and conversion factors for pay plans. |

|

|

Pay Limit Reducible Earnings Page |

GVT_EARN_RE_USF |

(USF) Specify earnings codes of all earnings that are eligible for reduction if employee’s earnings exceed pay cap/limit amounts. |

|

Pay Limit Payout Page |

GVT_EARN_PO_USF |

(USF) Assign a Payout Earnings Codes to each Pay Limit Earnings Code within a pay plan to facilitate the payout of earnings during the first pay period of a calendar year, and for termination payouts. |

Pay plans establish classification authorities and eligibility for automatic, within-grade increases (WGIs), premium pay, law enforcement officer (LEO) pay, and so on. Each pay plan also specifies a set of pay limits, exempt overtime rates, and conversion factors. In the Salary Plan table in PeopleSoft HR, you can associate a pay plan with each salary plan. The IDs that you assign to pay plans become setIDs that link salary plans with pay plans that you define here.

The following table is an example of how to configure the Pay Plan Process Control page to process the Office of Personnel Management (OPM) GS maximum pay plan limits:

|

Limit Type |

Seq |

Earnings Process Type |

LEO |

Locality (LOC) |

Pay Plan |

Grade |

Step |

Mult Fact |

|---|---|---|---|---|---|---|---|---|

|

General Schedule |

1 |

Basic Pay |

EX |

0000 |

V |

100 |

||

|

General Schedule plus LOC |

2 |

Basic Pay |

X |

EX |

0000 |

IV |

100 |

|

|

General Schedule plus LEO |

3 |

Basic Pay |

X |

X |

EX |

0000 |

IV |

100 |

|

Overtime plus LOC |

4 |

Overtime |

X |

GS |

10 |

1 |

100 |

|

|

Overtime plus LEO |

5 |

Overtime |

X |

X |

GS |

10 |

1 |

100 |

|

Premium Pay |

6 |

Pay Limit |

X |

GS |

15 |

10 |

100 |

|

|

Premium Pay |

7 |

Pay Limit |

X |

X |

GS |

15 |

1 |

100 |

|

Overtime plus LEO (150% of GS Rate Step 1) |

8 |

Pay Limit |

X |

X |

GS |

15 |

1 |

150 |

|

Overtime plus LEO (Level 5 of Executive Schedule) |

9 |

Pay Limit |

X |

X |

EX |

0000 |

V |

100 |

|

Annual |

10 |

TotAnnual |

X |

EX |

0000 |

I |

100 |

|

|

General Schedule |

11 |

Danger Pay |

EX |

0000 |

V |

35 |

||

|

General Schedule plus LOC |

12 |

Danger Pay |

X |

EX |

0000 |

IV |

35 |

|

|

General Schedule plus LEO |

13 |

Danger Pay |

X |

X |

EX |

0000 |

IV |

35 |

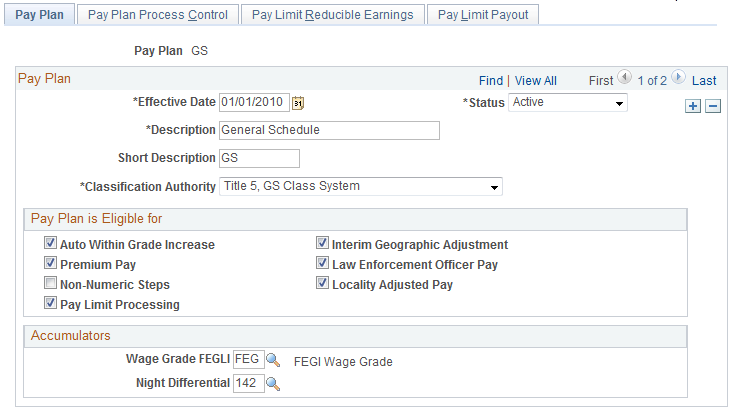

(USF) Use the Pay Plan page (GVT_PAYPLAN_TBL) to enter a pay plan ID to become a setID selection for the Salary Plan table. Specify classification authority and eligibility.

Navigation

Image: Pay Plan page

This example illustrates the fields and controls on the Pay Plan page.

Pay Plan

|

Field or Control |

Definition |

|---|---|

| Classification Authority |

Select the pay plan's classification authority from the Translate table: Equivalent to GS Class System; Equivalent to Title 5 FWS; Title 38, United States Code; Title 5, GS Class System; Title 5, Other; and Title 5, Prevailing Rate Sys. |

Pay Plan is Eligible for

|

Field or Control |

Definition |

|---|---|

| Pay Limit Processing |

When selected, the system caps employee base pay at the base pay limit for the plan. For existing pay plans, the system selects the check box by default. If you are adding a new pay plan, you must select the check box to enable pay limit processing for that plan. |

Accumulators

|

Field or Control |

Definition |

|---|---|

| Wage Grade FEGLI (Wage Grade Federal Employee Group Life Insurance) |

Select the special accumulator that is used to accumulate FEGLI. |

| Night Differential |

Select the special accumulator to associate with night differential pay for the group of employees in this pay plan. This field is information only. The system does not process it. |

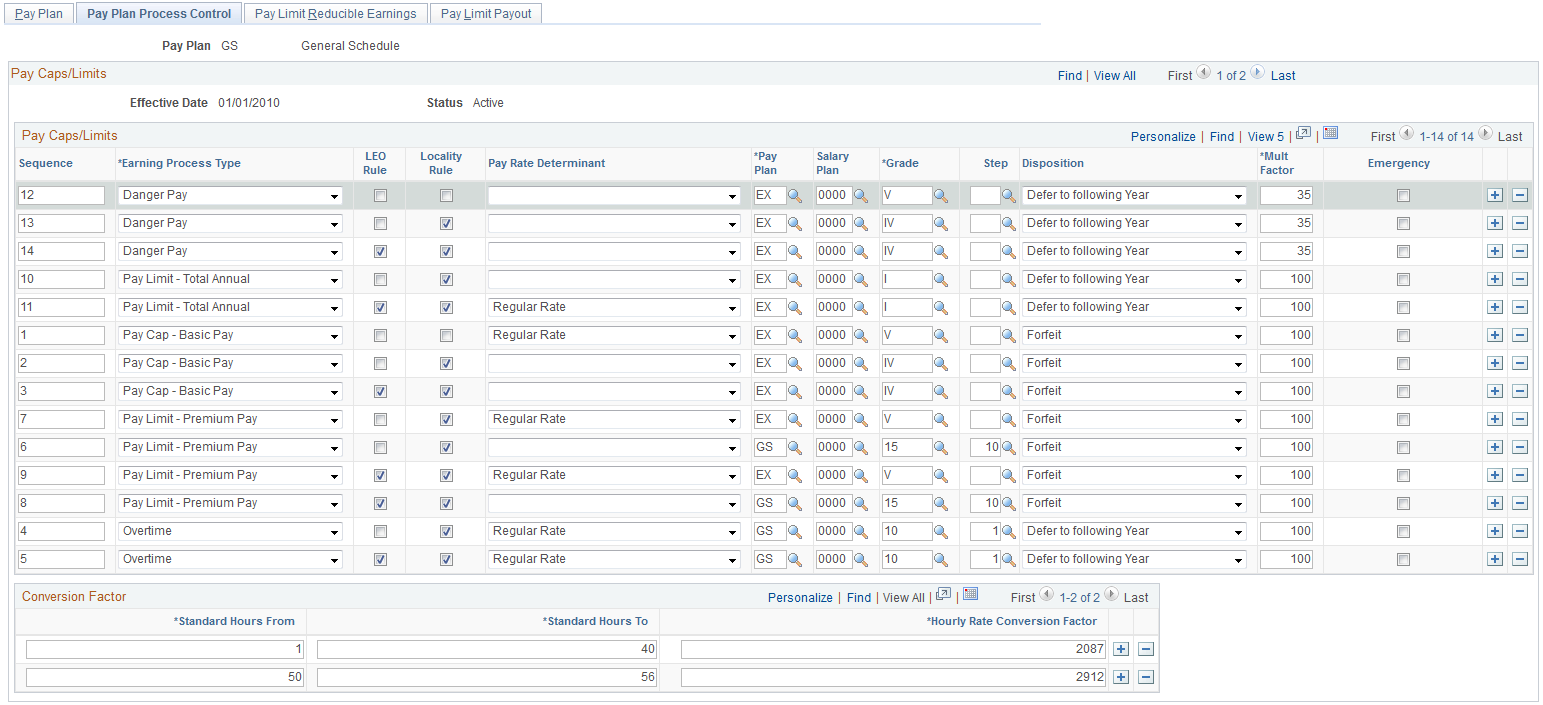

(USF) Use the Pay Plan Process Control page (GVT_PAYPLAN_TBL2) to establish pay caps and limits, exempt overtime rates, and conversion factors for pay plans.

Navigation

Image: Pay Plan Process Control page

This example illustrates the fields and controls on the Pay Plan Process Control page.

Pay Caps/Limits

Each row represents an individual pay rule.

|

Field or Control |

Definition |

|---|---|

| Sequence |

Defines the processing order of caps or limits. Each row must have a unique sequence number. If an employee qualifies for two scenarios, the system applies the cap or limit with the lower sequence number. However, the Overtime Cap calculation is done before any other caps and limits are calculated. |

| Earning Process Type |

Each Earning Process Type row represents an individual pay rule. If there are two limits, create two rows with the same Earnings Process Type and LEO / LOC Rule. Select the type of pay caps or limits that apply to this pay plan. Danger Pay: Earnings are capped to a defined percentage of Basic Pay per period. Overtime: Base pay plus overtime is subject to a pay period limit. Overtime hourly rate is subject to an hourly rate limit. Pay Cap - Basic Pay: The sum of base pay, law enforcement officer pay, and locality pay is subject to a defined limit. Pay Limit - Premium Pay: Earnings are subject to a pay period limit. Pay Limit -Total Annual: Total annual earnings are subject to an annual pay limit. Note: To learn more about pay caps and limits, and about each earning process type, see Understanding Pay Caps and Limits. |

| LEO Rule (law enforcement officer rule) |

Select if the cap or limit applies to employees who receive Law Enforcement Officer (LEO) pay. Note: The system applies pay cap and limit rules defined for LEO employees only if the employee’s LEO Status from the job record is either Primary FEPCA or Secondary FEPCA. |

| Locality Rule (locality rule) |

Select if the pay cap or limit applies to employees who receive Locality pay. |

| Pay Rate Determinant |

Select the pay rate determinant to which the pay cap or limit applies. Values are defined in Title 5 of the U. S. Code and Code of Federal Regulations. |

| Pay Plan, Salary Plan, Grade, and Step |

The pay plan, salary plan, grade, and step that determines the maximum limit of the cap or limit. The Step field value cannot exceed two characters, except for the EX pay plan. |

| Disposition |

Select the action to use when the employee's compensation exceeds a limit: Defer to Following Year to the first pay period of the next calendar year or Forfeit. To pay out deferred earnings, select Defer to following Year. The deferred earning will be paid out on the first pay period of the next calendar year. The system determines the pay period and year by the settings in the pay calendar. |

| Mult. Factor (multiplication factor) |

This factor is used for all caps or limits except overtime. The overtime earnings code multiplication factor is used for overtime. |

| Emergency |

If an emergency has been declared for the pay period, select this check box for all Pay Limit - Premium Pay earning process types. To change a pay limit to the emergency limit, select the Emergency check box. You may make this change at any time. To remove the emergency limit, deselect the Emergency check box. Note: You must manually select the Emergency check box for each Pay Limit - Premium Pay process type row. If you select the Emergency check box for one Pay Limit - Premium Pay process type row, you must select it for all Pay Limit - Premium Pay process type rows. With the Emergency check boxes selected, the system applies the annual limit instead of the premium pay limit for the pay period. |

Conversion Factor

|

Field or Control |

Definition |

|---|---|

| Hourly Rate Conversion Factor (hourly rate conversion factor) |

Enter the conversion factor to use for converting standard hours to the hourly rate. |