Preparing and Posting Accounting Lines to EnterpriseOne General Ledger

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Non Commitment Accounting Information Page |

RUNCTL_PAYGL01 |

Run the GL Interface process (PAYGL01A) to create payroll accounting lines in the HR Accounting Lines table. |

|

Earnings Page |

PAY_NACHK_DIST_ERN |

View and update the distribution of payroll earnings. |

|

Net Pay Liability Page |

PAY_NACHK_NET_LIA |

View and update the distribution of net pay liability and expense. |

|

Deductions Page |

PAY_NACHK_DIST_DED |

View and update the distribution of payroll deductions. |

|

Deduction Liability Page |

PAY_NCHK_NET_LIA |

View and update the distribution of deduction liability and expense. |

|

Taxes Page |

PAY_NACHK_DIST_TAX |

(USA) View and update the distribution of payroll taxes. |

|

Taxes (CAN) Page |

PAY_NACHK_DIST_CTX |

(CAN) View and update the distribution of payroll taxes. |

|

Tax Liability Page |

PAY_NCHK_NET_LIA |

Use this page to view and update the distribution of tax liability. |

|

HPIP_NA_PST_RUN |

Run the PNA Posting for GL process to prepare the accounting lines for posting and post them to EnterpriseOne General Ledger. |

|

|

HPIP_PRCS_STAT |

View the transaction reply indicating the status of the data load into the EnterpriseOne staging table. |

|

|

Non-Commit Reset Processing Page |

PRCSRUNCNTL_NLC |

Reset the Payroll for North America GL Interface PSJob process (PAYGL01A) before rerunning the process when reposting is necessary due to errors. |

After each confirmed payroll run, you:

Calculate and confirm payroll.

Synchronize currency exchange rates if needed.

Run the GL Interface (general ledger interface) PSJob process (PAYGL01), which creates the payroll accounting lines and enters them on the HR Accounting Line table.

4. Run the PNA Posting for GL Application Engine process (HI_NA_POST) to publish the data to EnterpriseOne General Ledger.

EnterpriseOne General Ledger processes the data when it is received.

GL Interface Process Description

You can run the GL Interface Application Engine process (PAYGL01) in one step or two separate steps:

(Optional) Prepare the distribution without generating the HR accounting lines.

Review and update the distribution results in the Review Payroll Distribution component.

(Required) Generate the HR accounting lines.

You can bypass the distribution step and directly create the accounting lines.

Posting for E1 GL Process Description

When you run the PNA Posting for GL process (HI_NA_POST), the system performs the following processing steps:

Consolidates accounting lines if the Consolidate Accounting Lines option is selected as a target system default or as a run parameter override.

Determines the cost center:

Enters the cost center on the accounting line.

Assigns the default cost center to transactions that do not have the DEPTID chartfield assigned.

Checks debit and credit balances if the balancing option is selected:

If they do not match, creates a suspense entry if a suspense account is defined for the GL business unit or generates an error without posting accounts if the suspense account option is not selected or the account is not defined.

If the foreign total amount nets to zero and domestic total amount does not, it assumes currency rounding and forces the domestic amount to net to zero.

Creates and publishes the PAYROLL_ACCTG_TRANSACTION XML service operation.

Note: You must set up the pay run IDs so that GL business units that integrate with EnterpriseOne are not combined in the same pay run ID with GL business units that do not integrate with EnterpriseOne.

See Creating Pay Run IDs.

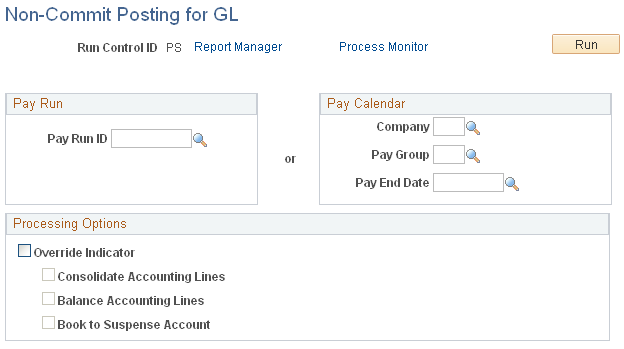

Use the Non-Commit Posting for GL page (HPIP_NA_PST_RUN) to run the PNA Posting for GL process to prepare the accounting lines for posting and post them to EnterpriseOne General Ledger.

Navigation

Image: Non-Commit Posting for GL page

This example illustrates the fields and controls on the Non-Commit Posting for GL page.

Enter the pay run ID that you want to process or specify the parameters to process an individual pay calendar.

|

Field or Control |

Definition |

|---|---|

| Pay Run ID |

You can select only from pay run IDs for which the GL Interface process has been run and the Posting for E1 GL process has not been run. If you must reprocess a pay run ID, you must first run the GL Reset Run Flag process. The pay run ID cannot contain any GL business units that do not integrate with EnterpriseOne general ledger. |

| Override Indicator |

Select to override the balance options set for the target product on the Configure Target System page. The other fields in this group box are available for entry only if Override Indicator is selected. |

| Balance Accounting Lines. |

Select this check box if you want the system to calculate whether the debits equal the credits for each general ledger business unit. |

| Book to Suspense Account |

This field is available for entry if you select Balance Accounting Lines. Select Book to Suspense Account to post unbalanced amounts to a suspense account when the credits do not equal debits. If selected, you must specify a suspense account number on the Configure GL Business Unit page. |

Note: If two instances of the same payroll posting process run in parallel, such as each company within an organization processing Payroll for North America pay groups at the same time, there can be conflicts on the staging tables. To avoid such conflicts, run the posting process in series rather than in parallel.

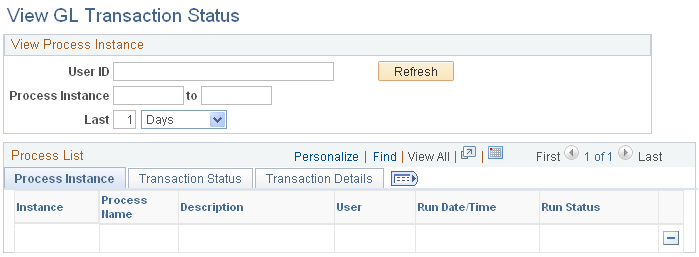

Use the View GL Transaction Status page (HPIP_PRCS_STAT) to view the transaction reply indicating the status of the data load into the EnterpriseOne staging table.

Navigation

Image: View GL Transaction Status

This example illustrates the fields and controls on the View GL Transaction Status.

|

Field or Control |

Definition |

|---|---|

| Return Code |

Possible return codes are: 0: Successful load on E1: No further action is required. 1: Account Number Mismatch: The account number of one of the lines of the payroll transaction does not match an account number previously assigned and cross-referenced during the Account initial or incremental load. No insert into the Z1 staging table was attempted. 2: Inserting Error: The insert of the lines of the payroll transaction into the Z1 staging tables failed due to some problem, such as a primary key was omitted. No lines were inserted into the Z1 staging table. |