Setting Up Garnishment Rules

To set up garnishment rules, use the Garnishment Rules Table (GARNISH_RULE_TBL) and Garnishment Rules Table CAN (GARN_RULE_TBL_CN) components.

Note: Payroll for North America provides garnishment rules for the majority of federal, state, provincial, and local garnishment requirements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GARNISH_RULE_TBL1 |

View or enter identifying and descriptive information for a garnishment rule. |

|

|

GARNISH_RULE_TBL2 |

Override the Subject to Garnishment specification on the Earnings table for selected earnings codes. |

|

|

GARNISH_RULE_TBL3 |

(USA) View or enter amounts for exemption variables to be used in the calculation formula for the rule. |

|

|

GARN_RULE_TBL3_CN |

(CAN) View or enter amounts for exemption variables to be used in the calculation formula for the rule. |

|

|

GARNISH_RULE_TBL4 |

Create step-by-step formulas for calculating garnishments or the amount available for garnishment. |

|

|

RUNCTL_GARNCLONE |

Clone an existing garnishment rule using the Rules Clone Utility Application Engine process (GARN_CLONE). Copy all data from an existing garnishment rule to create another rule identified with a different combination of law source, and rule ID. Rules created in this way are customer-maintained rules. |

|

|

Garnishment Rules Report Page |

PRCSRUNCNTL |

(USA) Generate the Garnishment Rules (U.S.) report (PAY715), which lists the contents of the Garnishment Rule table by state. (CAN) Generate the Garnishment Rules (CAN) report (PAY715CN), which lists the contents of the Garnishment Rule table by province and territory. |

Define calculation formulas on the Garnishment Rules Table - Calculation Formula page.

(CAN) Sample Calculation Formula

This example illustrates how to define the formula for a Canadian garnishment rule (BC garnishment law source and GEN/DEP rule ID):

|

Step |

Calculation Type |

Formula |

|---|---|---|

|

Step 1 |

DE for Rule (disposable earnings) |

earnings subject to garnishment − statutory deductions = result of step 1 |

|

Step 2 |

DE for Rule (disposable earnings) |

result of step one − selected deductions = result of step 2 This is the total disposable earnings. |

|

Step 3 |

Exemption |

result of step two × exempt percent = result of step 3 Note: The system performs the minimum and maximum check if appropriate to arrive at the total exemption amount. |

|

Step 4 |

Amount available for garnishment |

result of step two − result of step three = amount available for garnishment. |

(USA) Sample Calculation Formula

This example illustrates how to define the formula for a simple U.S. garnishment rule:

|

Step |

Calculation Type |

Formula |

|---|---|---|

|

Step 1 |

DE for Rule (disposable earnings) |

earnings subject to garnishment − federal taxes = result of step 1 |

|

Step 2 |

DE for Rule (disposable earnings) |

result of step one − state taxes = result of step 2 |

|

Step 3 |

DE for Rule (disposable earnings) |

result of step two − local taxes = result of step 3 |

|

Step 4 |

DE for Rule (disposable earnings) |

result of step 3 − selected employee deductions = result of step 4 This is the total disposable earnings amount. |

|

Step 5 |

Exemption |

result of step 4 × exempt percent 1 = result of step 5 |

|

Step 6 |

Amount available for garnishment |

result of step 4 – result of step 5 = amount available for garnishment |

On the Calculation Formula page, you can define a U.S. garnishment rule for a law source and rule ID by using (referencing) the same calculation formula as another law source and rule ID already defined in the system. This option is particularly useful if both rules use the same types of exemption variables but those variables do not have the same values.

To reference the calculation formula of another rule, select the Use Calculation Formula From Another Garnishment Rule option and enter the law source, rule ID, and effective date of the rule that you want to reference. The referenced rule must have a self-contained calculation formula that does not reference another rule. The system stores the identification of the referenced rule rather than the formula steps.

Note: You must ensure that the exemption variables that you define for the garnishment rule are also used in the rule that you reference. If you define any variables for the rule that are not also in the referenced rule, the system ignores the unused variables during calculation. The values of the exemption variables can differ in the two rules.

Changing a Referenced Rule

When you change a rule that is referenced by other rules, you must determine the impact on the rules that reference it.

For example, if you change rule 1 with a new effective date, you must decide whether those changes also apply to rule 2, which references rule 1.

If the changes in rule 1 do not apply to rule 2, then you can continue to reference the earlier effective dated row of rule 1 for the calculation of rule 2.

If (now or at some later time) the changes in rule 1 do apply to rule 2, then you must create a new effective-dated row for rule 2 and reference the new effective date of rule 1 on the Calculation Formulas page.

Note: The new effective date of rule 2 does not have to match the new effective date of rule 1. The system uses the effective date of rule 1 that appears on the Calculation Formula page for the rule 2 effective date being processed.

Listing Rule References

The third section of the Garnishment Rule Table U.S. SQR report (PAY715) lists each rule that is referenced in other rules along with all the rules that reference it. This topic lists the state, rule ID, description, and effective date for each referenced and referencing rule.

The first two sections of the report list the following for each rule by state:

Section 1: Rule details and exemption variables.

Section 2: Formula details.

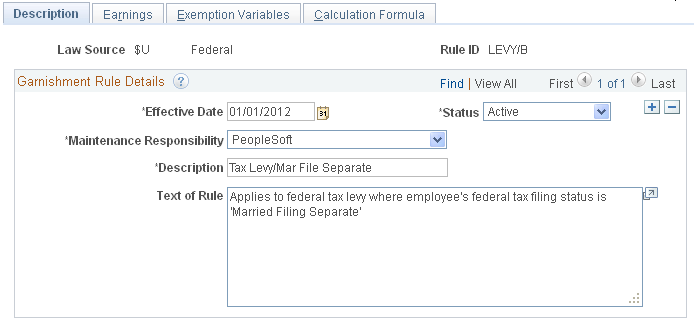

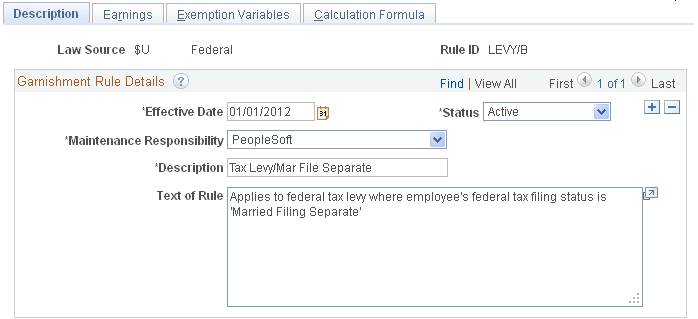

Use the Garnishment Rules Table - Description page (GARNISH_RULE_TBL1) to view or enter identifying and descriptive information for a garnishment rule.

Navigation

Image: Garnishment Rules Table - Description page

This example illustrates the fields and controls on the Garnishment Rules Table - Description page.

|

Field or Control |

Definition |

|---|---|

| Garnish Law Source |

The particular jurisdictional entity for the garnishment. |

| Rule ID |

The unique rule ID that identifies a garnishment rule. The rule ID along with the garnish law source links the garnishment rule specifications to the garnishment specification data for an individual employee. Note: (CAN) You can use any rule if it applies to a garnishment situation, regardless of the original province designation. The ZZ value identifies federally related orders. |

| Maintenance Responsibility |

In addition to the PeopleSoft-maintained garnishment rules, you can set up your own garnishment rules to handle any exceptions to the delivered rules. Customer: This value indicates that it is your responsibility to maintain rules that you have revised, cloned, or defined. |

Use the Garnishment Rules Table - Earnings page (GARNISH_RULE_TBL2) to override the Subject to Garnishment specification on the Earnings table for selected earnings codes.

Navigation

Image: Garnishment Rules Table - Earnings page

This example illustrates the fields and controls on the Garnishment Rules Table - Earnings page.

Earnings Code Inclusions/Exclusions

|

Field or Control |

Definition |

|---|---|

| Earnings Code |

Select an earnings code to override its Subject to Garnishment specification on the Earnings Table - Taxes page. |

| Include or Exclude Selection |

Select Include or Exclude to reverse the effect of the Subject to Garnishment setting on the Earnings Table - Taxes page for this earnings code and garnishment rule. |

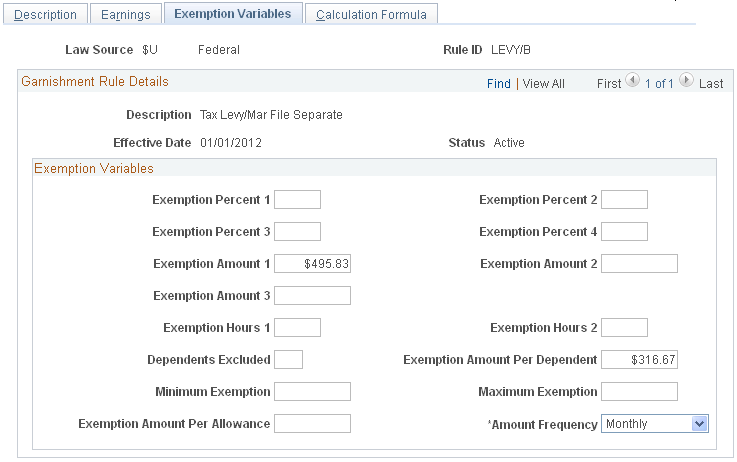

(USA) Use the Exemption Variables page (GARNISH_RULE_TBL3) to view or enter amounts for exemption variables to be used in the calculation formula for the rule.

Navigation

Image: (USA) Exemption Variables page

This example illustrates the fields and controls on the Exemption Variables page for the U.S.

Exemption Variables

View or enter values for the variables that you need in the calculation formula for this rule.

|

Field or Control |

Definition |

|---|---|

| Dependents Excluded |

Specify the number of dependents to exclude before applying the exempt amount per dependent. For example, for an exemption of 30 USD per dependent when an employee has more than two dependents, enter 2 in this field, and enter 30 in the Exempt Amount Per Dependent field. |

| Minimum Exemption and Maximum Exemption |

If you enter values for these options and specify the Min/Max Check condition for a step in the calculation formula, the system compares the calculation results for the step to the minimum and maximum exemption amounts that you enter here. If the amount is less then the minimum, the system uses the minimum. If the amount is greater than the maximum, the system uses the maximum. |

Amount Frequency

Select the frequency that applies to the exemption variable amounts for this garnishment rule. The default frequency is Monthly.

Note: If your selections on this page do not match the pay group pay frequency, the system automatically performs a conversion.

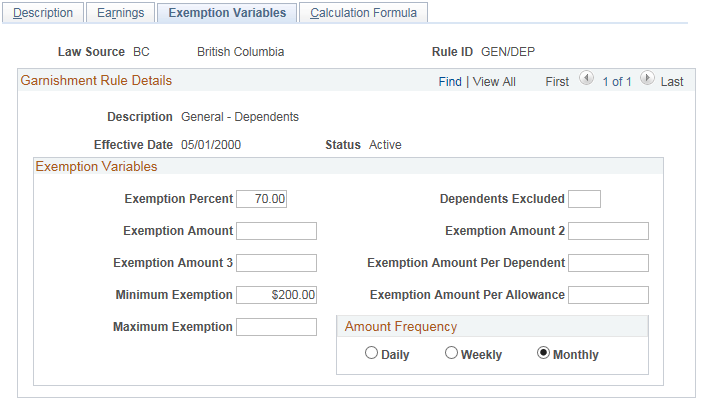

(CAN) Use the Exemption Variables page (GARN_RULE_TBL3_CN) to view or enter amounts for exemption variables to be used in the calculation formula for the rule.

Navigation

Image: (CAN) Exemption Variables page

This example illustrates the fields and controls on the Exemption Variables page for Canada.

Exemption Variables

View or enter values for the variables that you need in the calculation formula for this rule.

|

Field or Control |

Definition |

|---|---|

| Dependents Excluded |

Specify the number of dependents to exclude before applying the exempt amount per dependent. For example, for an exemption of 30 CAD per dependent when an employee has more than two dependents, enter 2 in this field, and enter 30 in the Exempt Amount Per Dependent field. |

| Exemption Amount |

Enter the exemption amount for the debtor. |

| Exemption Amount 2 |

Enter the exemption amount for the debtor’s first dependent. |

| Exemptions Amount 3 |

Enter the exemption amount for each of the debtor’s additional dependents. |

| Minimum Exemption and Maximum Exemption |

If you enter values for these options and specify the Min/Max Check condition for a step in the calculation formula, the system compares the calculation results for the step to the minimum and maximum exemption amounts that you enter here. If the amount is less then the minimum, the system uses the minimum. If the amount is greater than the maximum, the system uses the maximum. |

Amount Frequency

Select the frequency that applies to the exemption variable amounts for this garnishment rule. The default frequency is Monthly.

Note: If your selections on this page do not match the pay group pay frequency, the system automatically performs a conversion.

Use the Calculation Formula page (GARNISH_RULE_TBL4) to create step-by-step formulas for calculating garnishments or the amount available for garnishment.

Navigation

Image: Calculation Formula page

This example illustrates the fields and controls on the Calculation Formula page.

|

Field or Control |

Definition |

|---|---|

| DE Definition ID (disposable earnings definition ID) |

Select the disposable earnings definition that you want to use with this garnishment rule. It is important to select the correct DE definition ID. Note: Only two IDs are supported for Canadian garnishment processing. They are FEDERALCAN and FEDCANEXBN. |

(USA) Referencing a Calculation Formula From Another Garnishment Rule

|

Field or Control |

Definition |

|---|---|

| Use Calculation Formula From Another Garnishment Rule |

To reference the calculation formula of another rule, select this option and enter the law source, rule ID, and effective date of the rule that you want to reference. The referenced rule must have a self-contained calculation formula that does not reference another rule. The system stores the identification of the referenced rule rather than the formula steps. |

| Law Source, Rule ID, and Effective Date |

These options become visible on the page if you select Use Calculation Formula From Another Garnishment Rule. Identify the rule whose calculation formula you want to reference in this rule. |

See (USA) Understanding Calculation Formula Referencing.

Note: These fields are not visible on the page for Canada.

Calculation Formula

Use this group box to create a step-by-step formula for calculating the garnishment or the amount available for garnishment.

Note: (USA) If you select Use Calculation Formula From Another Garnishment Rule, the fields in this group box are unavailable for data entry.

|

Field or Control |

Definition |

|---|---|

| Step |

The step or sequence number in the calculation formula. |

| Calculation Type |

Select the option that identifies what the formula step is calculating. Options are: DE for Rule (disposable earnings for rule), Exemption, or Amt Available for Garnishment (amount available for garnishment). |

| Condition |

If necessary, specify how to handle the end result of a step. Options are: If negative, set to zero, Greater of Elements 1 and 2, Lesser of Elements 1 and 2, Min/Max Check (minimum and maximum check), and None. |

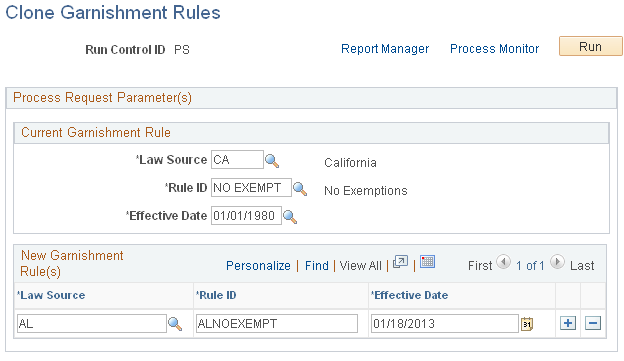

Use the Clone Garnishment Rules page (RUNCTL_GARNCLONE) to clone an existing garnishment rule using the Rules Clone Utility Application Engine process (GARN_CLONE). Copy all data from an existing garnishment rule to create another rule identified with a different combination of law source, and rule ID.

Rules created in this way are customer-maintained rules.

Navigation

Image: Clone Garnishment Rules page

This example illustrates the fields and controls on the Clone Garnishment Rules page.

Current Garnishment Rule

Select the law source, rule ID, and effective date of the rule that you want to copy.

New Garnishment Rule(s)

For each new rule that you want to create based on the current rule, enter the law source, rule ID, and effective date.

You can clone one law source and rule ID combination into multiple combinations of law source and rule ID by adding rows and entering the identifiers.

Note: You must enter an effective date for each new rule that you create. You can enter the same effective date for multiple rules as long as the law source and rule ID combination is unique.