(USA) Establishing UI Report Codes

To establish UI report codes, use the UI Report Code Table component (CO_UI_RPTCD_TBL).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CO_UI_RPTCD_TBL |

(USA) Establish UI report codes in PeopleSoft Payroll for North America for multiple work sites. |

Information you enter on the UI Report Code Table page works with the Multiple Worksite Report (TAX004) to link a tax location code to a UI report code. When you add an entry to the UI Report Code table, the system prompts you to enter the company code and the location code of the site you want to establish for reporting worksite information to the U.S. Bureau of Labor Statistics.

Exceptions for MI and MN

Most states do not require the reporting of multiple worksite data at the individual state level if the information is consolidated and reported to the U.S. Bureau of Labor Statistics. However, the states of Michigan and Minnesota do require that this data be reported individually as part of the quarterly unemployment wage reporting using these reports:

TAX810MN for commercial and E&G customers.

TAX810MI for E&G customers only.

The TAX810MN and TAX810MI reports append the employer ID extension to Employer SUT ID (from the Company State Tax table) as a unique ID for reporting purposes.

(USA) Use the UI Report Code Table page (CO_UI_RPTCD_TBL) to establish UI report codes in PeopleSoft Payroll for North America for multiple work sites.

Navigation

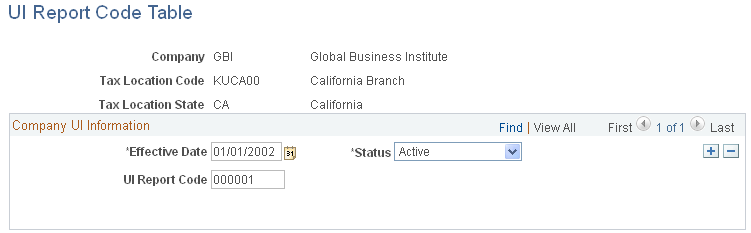

Image: UI Report Code Table page

This example illustrates the fields and controls on the UI Report Code Table page.

Company UI Information

|

Field or Control |

Definition |

|---|---|

| UI Report Code |

Enter the code you have received from the state for this site. |

| Employer ID Ext (employer ID extension) |

This field is available for data entry when the tax location state is MI or MN. Enter the employer ID extension for reporting multiple worksite data. |