Understanding Payroll Data

After the interface definitions are set up and payroll processing has commenced, Payroll Interface enables you to maintain certain payroll data, including additional pay, general deductions, employee tax withholding information, direct deposits, and information for employees with multiple jobs.

Maintenance tasks include the initial setup of the component pages followed by the additions, changes, or deletions that normally occur to payroll-related data over time. Because most of the payroll data works in conjunction with other information that you are required to set up for Payroll Interface, the maintenance tasks are discussed in this topic as well as other related setup topics in this product documentation.

Note: Depending on the requirements of the third-party payroll system, you may not need to maintain all of the data that is discussed in this topic. Or if the data is required, to simplify data entry, conversion, and maintenance issues, it may be easier to have the third-party payroll system manage the data.

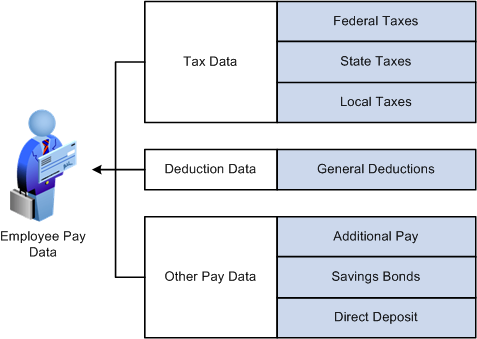

This diagram illustrates the types of payroll data that you may need to maintain:

Image: Maintaining payroll data

This diagram illustrates the types of payroll data that you may need to maintain.