(CAN) Setting Up and Maintaining Source Deductions

To set up and maintain source deductions, use the Update Source Deductions CAN (RUN_TAX103CN) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_TAX103CN |

Run the Update Source Deductions SQR Report process (TAX103CN). |

Use the Update Source Deductions SQR Report process (TAX103CN) to calculate and update federal, Quebec, and provincial basic source deductions for employees by generating a new Canadian Income Tax Data record for each employee who is active as of the effective date specified.

Set up and run this process at predefined intervals in preparation for the new year's payroll processing. The corresponding report (TAX103CN) provides a list of all records created.

Use the Update Source Deductions page (RUN_TAX103CN) to run the Update Source Deductions SQR Report process (TAX103CN).

Navigation

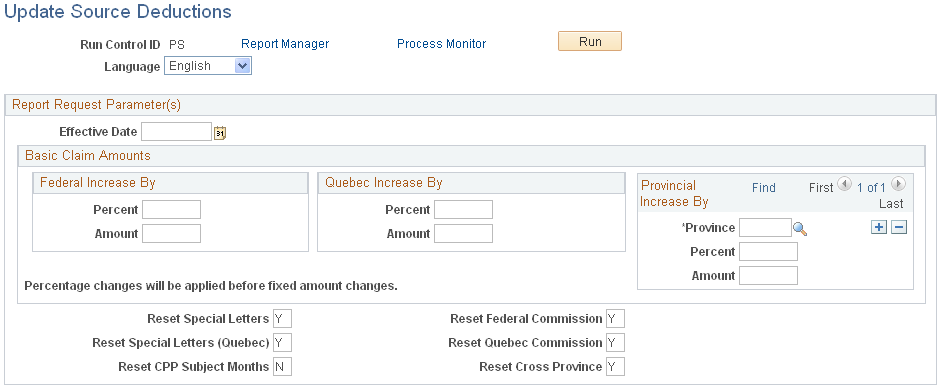

Image: Update Source Deductions page

This example illustrates the fields and controls on the Update Source Deductions page.

|

Field or Control |

Definition |

|---|---|

| Federal Increase By |

Use this group box to perform updates to employees' federal basic claim amounts. Use percent or amount only; specifying the value of the increase. |

| Quebec Increase By |

Use this group box to perform updates to employees' Quebec basic claim amounts. Use percent or amount only; specifying the value of the increase. |

| Provincial Increase By |

Use this group box to perform updates to employees' provincial basic personal amounts. Add rows to enter multiple provinces. Use percent or amount only; specifying the value of the increase. |

|

Field or Control |

Definition |

|---|---|

| Reset Special Letters |

Enter Y (yes) to reset the special letters amount to zero. |

| Reset Special Letters (Quebec) |

Enter Y to reset the Quebec special letters amount to zero. |

| Reset CPP Subject Months (reset Canada Pension Plan subject months) |

Y: Reset the employee's CPP subject months to 12. N (no): Reset the employee's CPP subject months to zero when the employee's original CPP subject months are fewer than 12 (for example, to reset CPP subject months to zero for employees who no longer contribute to CPP). If the employee's original CPP subject months are 12, they remain 12. |

| Reset Federal Commission |

Enter Y to reset the federal commission amounts to zero. |

| Reset Quebec Commission |

Enter Y to reset the Quebec commission amounts to zero. |

| Reset Cross Province |

Y: TheCross Province check box on the Canadian Income Tax Data 2 page is deselected when the new record is created. N: TheReset Cross Province check box and associated field values are copied to the newly created record. |