Data Exchanges

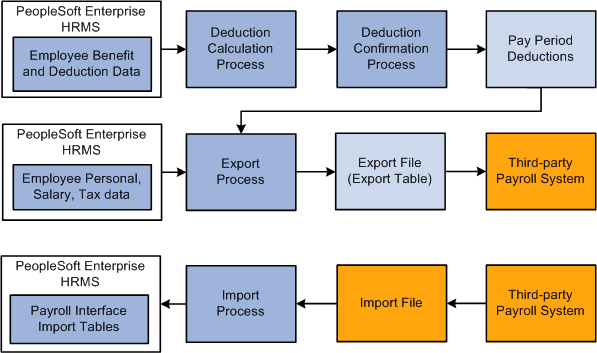

Payroll Interface enables you to maintain employee data in PeopleSoft HCM while using the third-party payroll system to perform the payroll processing functions. With Payroll Interface, data exchanges between the two systems are performed in four phases:

(optional) Run the Calculate Deductions and Deduction Confirmation processes to calculate and confirm pay period deductions.

Run the Export process to retrieve and write the pay (and deduction) data from PeopleSoft HCM to an export file or table.

Make the export file or table available to the third-party payroll vendor. The third-party vendor uses the appropriate software solution to load the data into the third-party payroll system, to perform the payroll processing functions, and to write the processed payroll results to one or more import files.

(optional) Run the Import process to read the import file and load the processed payroll data back into PeopleSoft HCM.

This diagram illustrates the Payroll Interface Deduction, Export, and Import processes:

Image: Payroll Interface Deduction, Export, and Import processes

This diagram illustrates the Payroll Interface Deduction, Export, and Import processes.

Deduction Process

You have the option of maintaining employee deduction information in PeopleSoft HCM using the PeopleSoft HR Manage Base Benefits business process. If you maintain deductions, you must run the Calculate Deductions and Deduction Confirmation processes before you run the Export process. The deduction processes calculate and confirm per pay period benefit and general deduction amounts.

Note: If you do not maintain deductions (that is, if the third-party payroll system manages all deduction information) then you do not need to run the Calculate Deductions or Deduction Confirmation processes.

Export Process

The Export process exports employee-level personal, job, salary, deduction, and tax information that the third-party payroll system needs to produce paychecks each pay period. Payroll Interface can export data from any PeopleSoft HCM table that includes the PeopleSoft EmplID field as a key field. Data is exported to either a flat file or a database table.

Payroll Interface does not perform any payroll calculations. The third-party payroll system performs the tax calculations, earnings calculations, gross-to-net calculations, and year-end processing. You use Payroll Interface to track and export changes that occur, during a pay period, to static employee payroll-related data. The data is considered static because it rarely changes, for example, a person's job code, pay rate, marital status, number of dependents, or benefit plan (which can be changed only during an open enrollment period).

Warning! Payroll Interface is designed to export changes to static employee payroll-related data; for example, job codes, benefit deductions, or wages - information that does not change that often during the course of a year. Dynamic or transactional pay data, such as monthly commission payments or time and labor calculations, must be set up and maintained by the third-party payroll system.

Import Process

You have the option of importing the payroll results produced by the third-party payroll system back into PeopleSoft HCM. The Import process loads payroll check, earnings, deduction, and tax data into seven Payroll Interface import tables. Once loaded, the data can be viewed online or by running reports. Data is imported only from ASCII files.

Note: Further processing or technical configuration may be required to check the validity of the imported data or to ensure that the data can be accessed in a secure manner.