Setting Up and Maintaining General Deductions

To set up and maintain general deductions, use the Deduction Table (DEDUCTION_TABLE) and General Deduction Table (GENL_DEDUCTION_TBL) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEDUCTION_TABLE1 |

Set up the plan type (00 — General Deduction) and deduction code. |

|

|

GENL_DEDUCTION_TBL |

Set up a general deduction and define the deduction calculation parameters. For the matching entry on the Deduction Table component, select the plan type (00 — General Deduction). |

|

|

GENL_DED_DATA |

Assign a general deduction to an employee. |

|

|

GENL_DED_OVERRIDE |

Override a general deduction that is assigned to an employee. |

General deductions are set up using Payroll Interface. To set up general deductions:

Use the Deduction Table component to select the plan type (General Deduction), enter a deduction code, and set up the deduction processing rules.

Use the General Deduction Table component to set up the general deduction and to define the deduction calculation parameters.

Use the General Deduction component to assign a general deduction to an employee.

Use the Override General Deductions component to override a general deduction assignment.

Exporting General Deductions

Payroll Interface does not calculate general deductions. However, when you run the Calculate Deductions and Deduction Confirmation processes, general deductions are automatically processed and the general deduction flat amounts are written to the export file along with the calculated benefit deduction amounts. If you do not maintain benefit deductions (do not run the Calculate Deductions process), you can set up and export general deduction amounts separately through the interface definition.

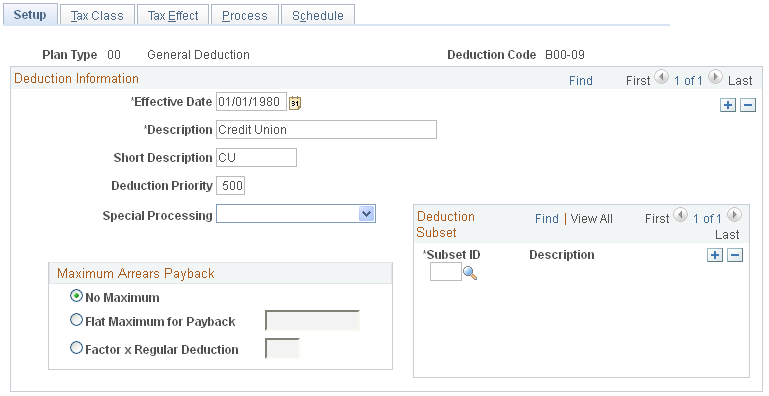

Use the Deduction Table - Setup page (DEDUCTION_TABLE1) to set up the plan type (00 — General Deduction) and deduction code.

Navigation

Image: Deduction Table - Setup page

This example illustrates the fields and controls on the Deduction Table - Setup page.

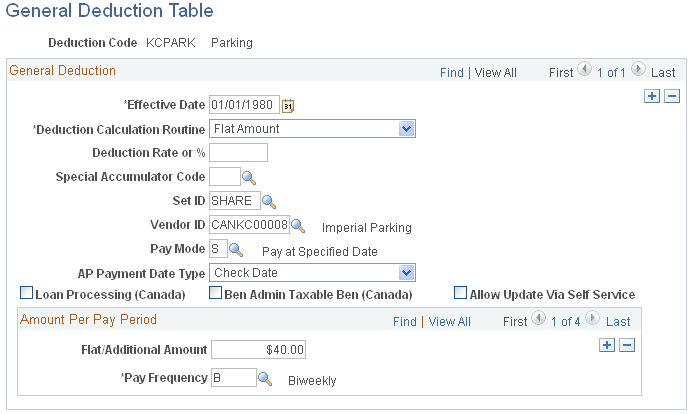

Use the General Deduction Table page (GENL_DEDUCTION_TBL) to set up a general deduction and define the deduction calculation parameters.

Navigation

Image: General Deduction Table page

This example illustrates the fields and controls on the General Deduction Table page.

|

Field or Control |

Definition |

|---|---|

| Deduction Calculation Routine |

Select to enter the deduction calculation routine. For Payroll Interface, the only valid routines are Flat Amount and Special Deduction Calculation. If you select Flat Amount, enter the amount in theFlat/Additional Amount field for each pay frequency that your company uses. If the amount varies from employee to employee, such as with United Way or other charitable contributions, leave theFlat/Additional Amount field blank. This information can be maintained at the employee level on the General Deduction page. If you use a deduction rate, you can also enter an amount to be deducted. However, you need to indicate the amount here only if it is the same for all employees within a pay frequency. If it varies from employee to employee, you enter the amounts for each employee on the General Deduction page. |

| Deduction Rate or % |

Select to enter the deduction rate or percentage. This value can be overridden at the employee level. |

| Pay Frequency |

Select to add new rows as necessary. For example, to set up a 50 USD per month parking deduction, you could create two rows: one for a semimonthly pay frequency with 25.00 USD to be taken every pay period and the other for a monthly pay frequency with 50 USD. (Note that when you select this option, the Deduction Rate box is not available.) For a deduction that varies by frequency, you must indicate the amount to be taken each pay period for each frequency. For the 50 USD per month parking deduction, you can set up the deduction for the semimonthly pay group, SM1, so that it applies only to the last pay period of the month. Rather than taking out 25 USD each pay frequency, you take the full 50 USD at the end of the month. To set this up, you need to indicate both the frequency and amount. Set the frequency as semimonthly and enter 50.00 USD. Indicate which semimonthly period to take the deduction for SM1 on the Deduction Table. |

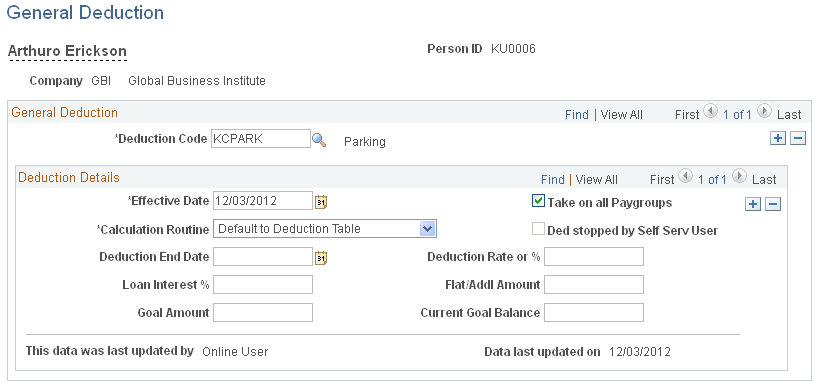

Use the General Deduction page (GENL_DED_DATA) to assign a general deduction to an employee.

Navigation

Image: General Deduction page

This example illustrates the fields and controls on the General Deduction page.

|

Field or Control |

Definition |

|---|---|

| Calculation Routine |

Select how a deduction is calculated for an employee. If you do not make a selection, the deduction is calculated according to the Deduction Table. These routines are identical to the routines on the General Deduction Table. Choose from the following: Default to Deduction Table: Uses the calculation routine that is specified on the Deduction Table. The Flat/Addl Amount field and Deduction Rate or % field on this page are not used. The system uses only values that are entered on the Deduction Table. Flat Amount: Establishes the deduction as a flat amount. Enter the amount in the Flat/Addl Amount field, which is treated as an amount per pay period. The Deduction Rate or % field is not used. |

| Ded stopped by Self Serv User (deduction stopped by self-service user) |

Select when an employee has stopped a voluntary deduction through a self-service application. |

| Deduction End Date |

Select to specify when a deduction should no longer be taken. |

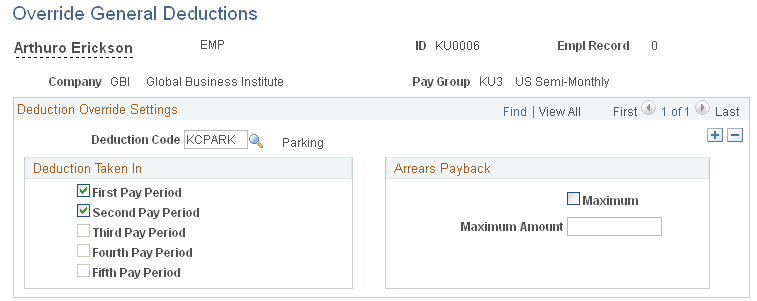

Use the Override General Deductions page (GENL_DED_OVERRIDE) to override a general deduction that is assigned to an employee.

Navigation

Image: Override General Deductions page

This example illustrates the fields and controls on the Override General Deductions page.