(USA) Setting Up and Maintaining U.S. Employee Tax Data

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_DATA1 |

Set up employee federal tax data. |

|

|

TAX_DATA3 |

Set up employee state tax data. |

|

|

TAX_DATA5 |

Set up tax data for each locality where an employee works. |

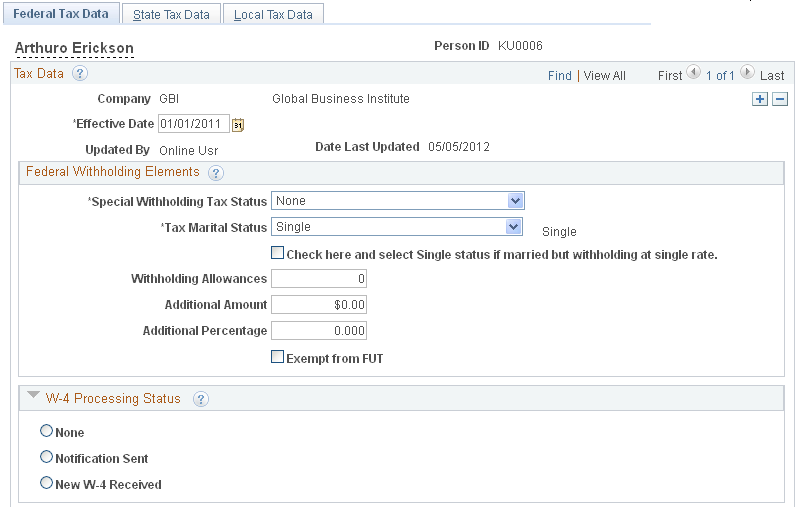

Use the Federal Tax Data page (TAX_DATA1) to set up employee federal tax data.

Navigation

Image: Federal Tax Data page (1 of 2)

This example illustrates the fields and controls on the Federal Tax Data page (1 of 2).

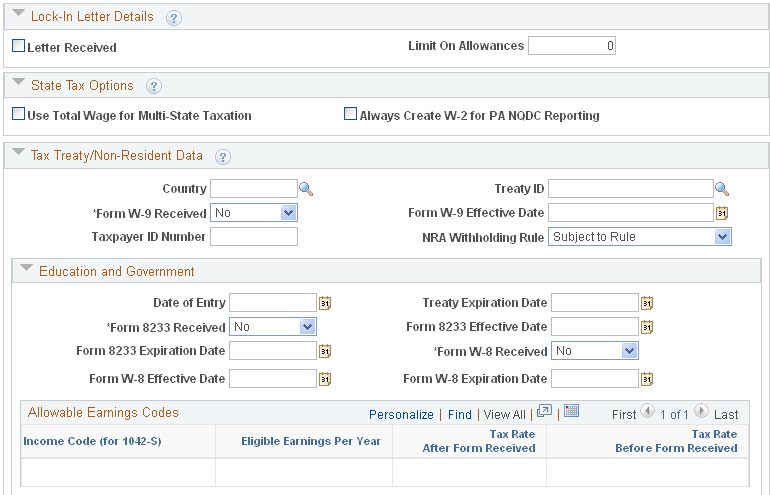

Image: Federal Tax Data page (2 of 2)

This example illustrates the fields and controls on the Federal Tax Data page (2 of 2).

Federal taxes include federal income tax, FICA, and FUT. If the employee works for multiple companies, the tax data is defined by company.

Specify employee status for FICA, FUT exemption and W-2 reporting. (E&G) Enter information for nonresident alien employees. The information in the Tax Treaty/NR Data Table assigns the employee to a tax treaty table and allows the eligible employee to be subject to a reduced tax treaty rate.

Note: Federal, state, and local taxes are implemented as a set of chained pages. To add a new effective-dated row for state or local tax data, you must insert a row on the first page in the chain, the Federal Tax Data page.

Note: For Guam (GU), Virgin Islands (VI), and American Samoa (AS): Although employees in these territories are not subject to federal withholding, they are subject to territory withholding at the same rate as federal. The system uses the tax marital status and withholding allowances information on the Federal Tax Data page to calculate the territory withholding required by each of these territories.

Federal Withholding Elements

|

Field or Control |

Definition |

|---|---|

| Special Withholding Tax Status |

Use this field to indicate whether an employee's federal withholding tax status deviates from the norm. The default is None, which means that no special status exists and that federal withholding tax should be calculated based on the employee's gross income, marital status, and withholding allowance.

|

| Tax Marital Status and Check here and select Single status if married but withholding at single rate |

Select the appropriate tax marital status for federal withholding taxes as indicated on the employee's completed Form W-4. If the employee has selected "Married but withhold at single rate" on the W-4 form, you must select both the Single option and the check box marked "Check here and select Single status if married but withholding at single rate." This setting results in the employee being reported with marital status W. Note: If you select the check box, the system automatically selects the Single option when you save. |

| Withholding Allowances |

Enter the number of allowances that the employee claims for FWT purposes. This number should match the number on the employee's W-4 form. |

| Additional Amount and Additional Percentage |

Use these fields to indicate that additional FWT taxes are to be taken. You can specify both an amount and a percentage, if appropriate, provided that your payroll system accepts this information. |

| Exempt from FUT |

Select this check box if the employee is exempt from FUT (Federal Unemployment tax). |

W-4 Processing Status

|

Field or Control |

Definition |

|---|---|

| None |

Select to indicate no change. |

| Notification Sent |

Select to indicate that the employee has been notified to submit a new Form W-4. |

| New W-4 Received |

Select to indicate that a new Form W-4 has been received. |

Note: An authorized user can manually change an employee's W-4 processing status to New W-4 Received when an employee submits an updated Form W-4. You can either do this on the current record or on a new effective-dated row. Note that the effective date of the new row must be earlier than or equal to February 15 of the new tax year. If future-dated records exist, the W-4 processing status of those records must also be set to New W-4 Received. You can change future-dated rows in Correction mode only.

Lock-In Letter Details

Use the Lock-In Letter Details group box to process lock-in letters from the IRS that limit employee withholding allowances.

|

Field or Control |

Definition |

|---|---|

| Letter Received |

Select this check box if a letter has been received from the Internal Revenue Service (IRS) specifying the allowances an employee is allowed to take. |

| Limit on Allowances |

Enter the maximum number of allowances possible. The value that you enter in the Withholding Allowances field cannot exceed the value that you enter in this field. |

State Tax Options

These fields and controls are not relevant to Payroll Interface processing.

Tax Treaty/Non-Resident Data

These fields and controls are not relevant to Payroll Interface processing.

(E&G) Education and Government

Use this group box to enter information that related to reduced tax treaty rates for eligible employees. To claim benefits of a treaty, an employee must have a visa and be a resident of one of the treaty countries. An employee can claim benefits for only one treaty at any particular time. Employees who want to claim benefits under a tax treaty must submit a written statement to their employer, along with applicable forms.

Use the Form 8233 Received and Form W8 Received options to indicate the employee's eligibility for reduced tax treaty rates.

|

Field or Control |

Definition |

|---|---|

| Treaty Expiration Date |

The treaty expiration date appears. The system calculates the date based on the date of entry and rules that are established on the Tax Treaty/NR Data table. |

| Form 8233 Received |

If the NRA employee filed a Form 8223, select Yes and enter the appropriate dates in the Form 8233 Effective Date and From 8233 Expiration Date fields. Form 8223 is required for all income codes except 12 (royalties) and 15 (scholarships and fellowships). |

| Form W8 Received |

If the NRA employee filed a Form W8 for scholarship and fellowship income or royalties, select Yes and enter the appropriate dates in the Form W8 Effective Date and Form W8 Expiration Date fields. |

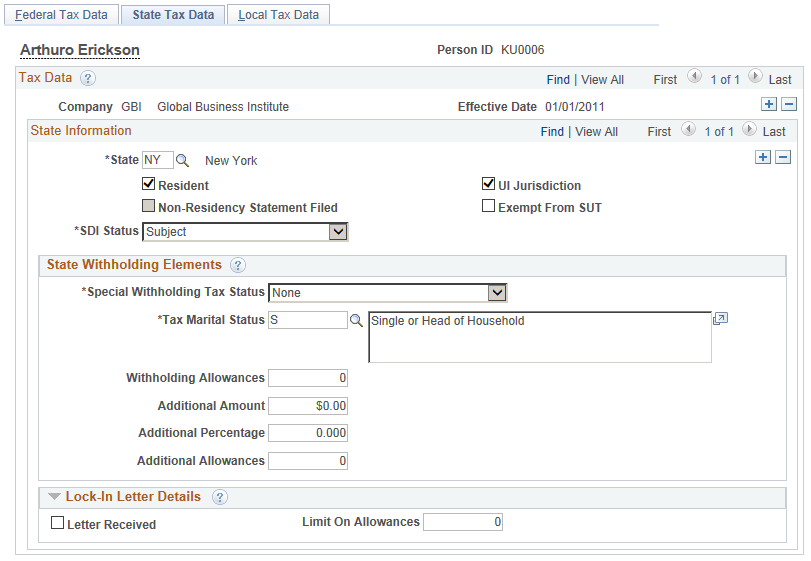

Use the State Tax Data page (TAX_DATA3) to set up employee state tax data.

Navigation

Image: State Tax Data page

This example illustrates the fields and controls on the State Tax Data page.

State Information

Use the options in the State Information group box to indicate an employee's primary work state and residency status.

|

Field or Control |

Definition |

|---|---|

| State |

Enter the employee's primary work state. The work state is derived from the employee's tax location on the Job Data Table. |

| Resident |

Select to indicate whether the employee is a resident of the primary work state. If the employee does not reside in the primary work state, create an additional state entry and select the Resident option. |

| Non-Residency Statement Filed |

Not used with Payroll Interface. |

| UI Jurisdiction (unemployment insurance jurisdiction) |

Select to indicate the state of jurisdiction. If an employee has only one state (the resident state), that state will become the state of jurisdiction by default. If an employee has two states (one resident, the other nonresident), the nonresident state will become the state of jurisdiction by default. If an employee has multiple nonresident states and no state is indicated as the state of jurisdiction, you will get a message to select UI Jurisdiction on one record. |

| Exempt from SUT (exempt from state unemployment taxes) |

Select to indicate whether the employee is exempt from SUT taxes. |

| SDI Status (state disability insurance status) |

Select the employee's SDI status. |

State Withholding Elements

Use fields in this group box to enter state-specific withholding information.

|

Field or Control |

Definition |

|---|---|

| Special Withholding Tax Status |

Specify the employee's special withholding tax status. The system calculates the withholding tax based on the value you select here and other factors.

|

| Tax Marital Status |

Select to indicate the employee's marital status. Repeat for each state where the employee pays taxes. Note: For Guam (GU), Virgin Islands (VI), and American Samoa (AS): Employees in these territories are subject to state withholding at the same rate as federal. The system uses the marital status and withholding allowances information on the Federal Tax Data page to calculate the state withholding that is required by each of these territories. If you have employees in Guam, Virgin Islands, or American Samoa, you need to enter the marital status and withholding allowances claimed on their withholding certificates on this page and on the Federal Tax Data page. |

| Withholding Allowances |

Enter the number of allowances that the employee claims for SWT purposes. This number should match the number on the employee's state withholding allowance certificate. For states that have their own withholding allowances form, the system displays informational text explaining where this information appears on the state form. |

| Additional Amount and Additional Percentage |

Use these fields to indicate an increase (or, for certain states, a decrease) in the amount of taxes to be deducted. You can specify both an amount and a percentage, if appropriate, provided that your payroll system accepts this information. |

| Additional Allowances |

If applicable, enter any additional allowances that the employee claims for SWT purposes. For states that have their own withholding allowances form, the system displays informational text explaining where this information appears on the state form. |

Arizona-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| AZ% of Federal Withholding |

Enter the percentage of federal withholding that constitutes the Arizona state withholding. |

California-Specific Page Element

The California Wage Plan Code group box appears only when the state is CA.

The California Wage Plan Code is used only by employees of the California Public Employees Retirement System (PERS)

|

Field or Control |

Definition |

|---|---|

| Disability/Unemployment Plan |

Select State/State (State Disability Plan and State Unemployment) unless instructed otherwise by your company's tax advisors. |

Connecticut-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| CT Only |

Indicate whether the withholding adjustment amount is an Increase or Decrease amount. |

Indiana-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| IN Earned Income Credit |

Select for Indiana employees who are eligible for Advance EIC payments and who have completed the Indiana Earned Income Credit Advance Payment Certificate (state WH-5 form). |

Louisiana-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| LA Only |

Indicate whether the withholding adjustment amount is an Increase or Decrease amount. |

Mississippi-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| MS Annual Exemption Amount |

Used only for Mississippi. Select to enter the annual exemption amount. |

New Jersey-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| FLI Status (family leave insurance status) |

Indicate the employee's status for the New Jersey Family Leave Insurance tax: Select Exempt if the employee's earnings are exempt from the FLI tax. Select Subject if the employee's earnings are subject to FLI tax. Select Voluntary Plan if the company has a voluntary family leave insurance plan that covers the employee. |

Puerto Rico-Specific Page Element

|

Field or Control |

Definition |

|---|---|

| PR Retirement Plan |

(E&G) This check box is visible only if Education and Government is selected on the Installation table - Products page. Select to indicate that the employee is a participant in a government pension or retirement plan of the Commonwealth of Puerto Rico. |

Lock-In Letter Details

|

Field or Control |

Definition |

|---|---|

| Letter Received |

Select this check box if a letter has been received from the state taxing authority that specifies the allowances an employee is allowed to take. |

| Limit On Allowances |

Enter the maximum number of allowances possible. The value that you enter in Withholding Allowances field cannot exceed the value that you enter in this field. |

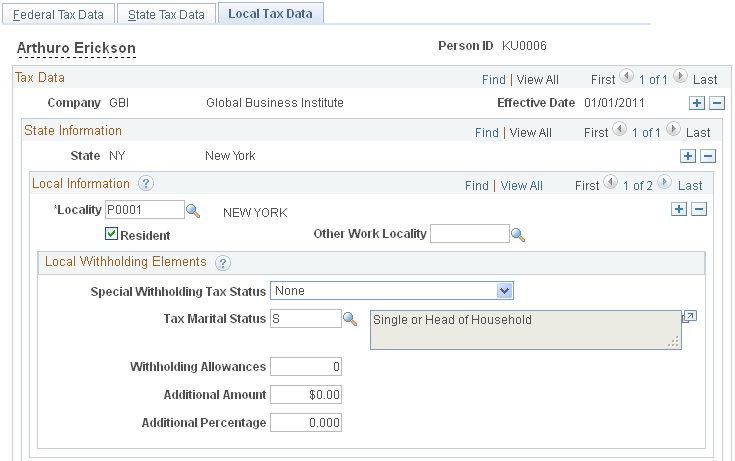

Use the Local Tax Data page (TAX_DATA5) to set up tax data for each locality where an employee works.

Navigation

Image: Local Tax Data page

This example illustrates the fields and controls on the Local Tax Data page.

Note: The Local Tax Data page has three scroll areas. The outer scroll area corresponds to the effective dates entered on the Federal Tax Data page, the middle scroll area corresponds to the states entered on the State Tax Data page, and the inner scroll area corresponds to the localities that you enter on this page.

Local Information

Use the options in the Location Information group box to identify each tax locality where an employee lives or works. Before assigning localities to employees, you must first establish localities on the Company Local Tax Table.

Note: If you are setting up local tax information for an employee who lives or works in more than one state, you must enter the appropriate local tax information for each state. An employee can also have more than one local residence. You will need multiple resident locality entries if two different taxes exist for the same locality.

Note: For Indiana Localities: In Indiana, the employee's county of residence is the first determining factor for tax withholding. If the county where an employee resides on January 1 of any year imposes a tax, you must withhold that tax. The employee is liable for the tax for the entire year, even if he or she moves to a nontaxing county. If the county of residence does not impose a tax, but the county in which the principal place of work is located does, withhold at the appropriate nonresident rate.

For employees moving from out of state into a taxing Indiana locality, withholding does not begin until January 1 of the next year, when residence determination is made.

|

Field or Control |

Definition |

|---|---|

| Resident |

Select to indicate that the locality is a resident locality. |

| Other Work Locality |

Select to link multiple local work taxes together when you have more than one work tax for a given locality. This entry links to another local work tax code, which is then entered on another Locality row. Note: When setting up Indiana localities at the employee level, you do not need to set up any localities that have an alpha suffix. |

Local Withholding Elements

|

Field or Control |

Definition |

|---|---|

| Special Withholding Tax Status |

Use the options in the Special Tax Status group box to indicate whether an employee's local withholding tax status deviates from the norm.

|

| Tax Marital Status |

Select the appropriate tax marital status for local withholding taxes. |

| Withholding Allowances |

Enter the number of allowances that the employee claims for local withholding tax purposes. |

| Additional Amount and Additional Percentage |

Use these fields to indicate that additional local taxes are to be taken. You can specify both an amount and a percentage, if appropriate, provided that your payroll system accepts this information. |