6. Processing Referrals in Oracle FLEXCUBE

Referral refers to the process of handling customer transactions, which force the accounts involved in such a transaction to exceed the overdraft limit. Examples of typical transactions, which force an account to move into overdraft, are Standing Instructions or Clearing transactions. In Oracle FLEXCUBE, if an account involved in a transaction moves into overdraft, it is sent to the Referral Queue.

This chapter contains the following sections:

6.1 Referral Queues

This section contains the following topics:

- Section 6.1.1, "Viewing Transactions in Referral Queue "

- Section 6.1.2, "Invoking the Referral Queue Screen"

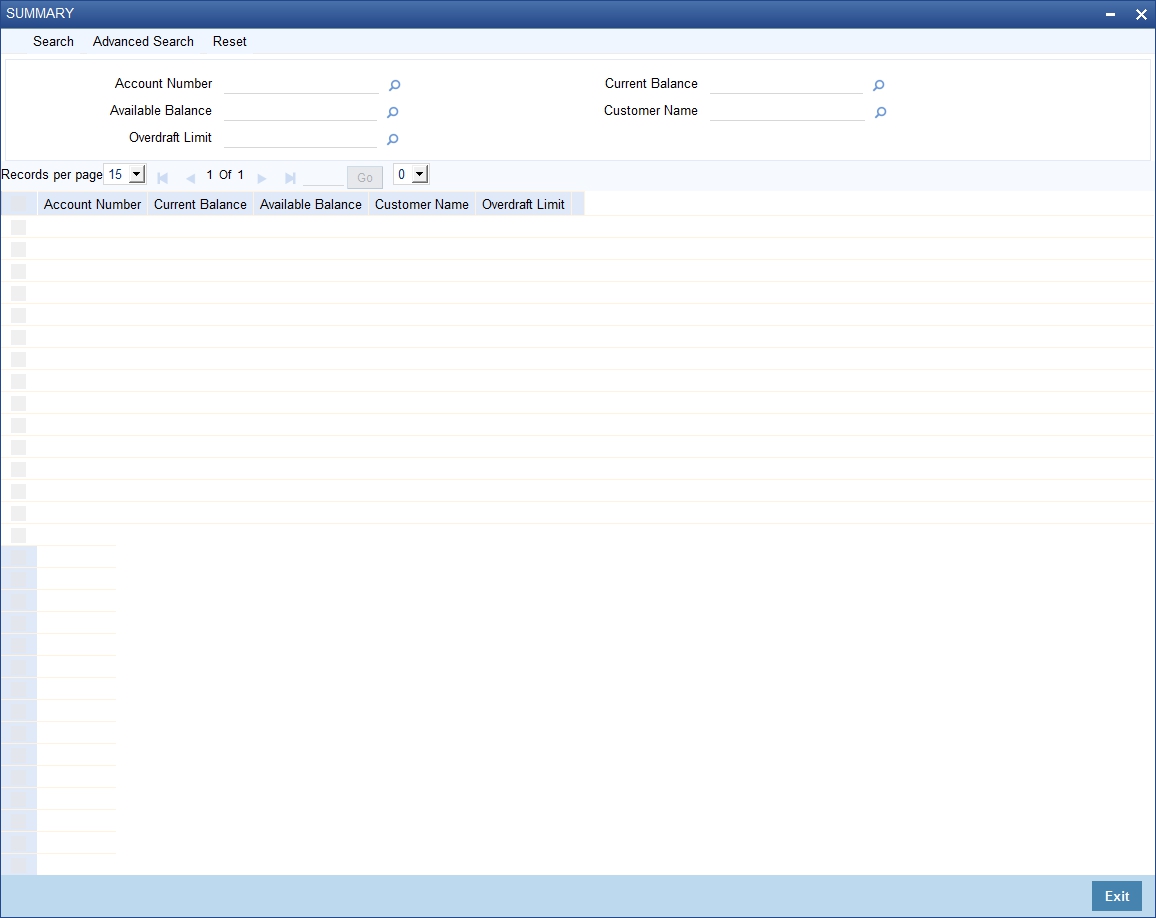

6.1.1 Viewing Transactions in Referral Queue

You can invoke this screen by typing ‘STSREFEQ’in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen the following details of the account are displayed:

- The account Branch and Branch code

- The Account Number

- The Name of the customer who holds the account

- The Current Balance in the account. This includes the aggregate of debit, credit, uncollected, unauthorized, authorized and unposted transactions

- The amount available for withdraw

- The overdraft limit of the account. This is inclusive of the sub-limit

- The Credit Rating or the credit worthiness of the account holder

Note

A charge, fee or interest debited to the customer account will not be referred to the Referral Queue

Using the Referral Queue, you can view details of all transactions processed during the day due to which the account has moved into overdraft. For example, Silas Marner’s savings account has a balance of 1000 Euro (with no O/D facility). There are five checks of 300 Euro each drawn on the account on the same day. On double clicking on Silas Marner’s account number in the Referral Queue, the details of all five checks will be displayed for your perusal in the Referral screen.

6.1.2 Invoking the Referral Queue Screen

You can invoke this screen by typing ‘’STDREFEQ’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You will be able to view the following details about the entries which have been posted and those that are not to post:

- The Posting Date

- The Contract Ref No/DD Reference Number

- A brief description about the Referral

- The amount, which is to be debited from the customer account

- Pay

- Un pay

The default option is to approve (Pay) the check/DD amount. On occasion you may want to ‘unpay’ or reject a check/DD. You will be allowed to levy charges both for approving as well as recalling/rejecting checks. There are no limits on the charges for recalling a check but you can levy approval charges for a maximum of three transactions only. The charges for each accept/reject are computed on the basis of the IC Charge Rule linked to the customer account.

Note

You will not be allowed to recall or unpay future dated transactions (typically future dated fund transfers or standing orders). The transaction will be initiated and entries posted passed only if the referral decision is to pay.

Each time you choose to reject a transaction you will have to indicate the reason for rejecting the transaction. A list of Reason Codes is available in the option list. You can select the appropriate.

A transaction is considered for charging only if the Waive Charge option has not been enabled for a particular Reject Code. You can enable the option if the charge is to be waived.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the account field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in this User Manual.

6.2 Maintenance Required for Referral Processing

For the successful processing of referrals in Oracle FLEXCUBE, you will need to maintain the following details.

This section contains the following topics:

- Section 6.2.1, "Enabling Referral Required Option"

- Section 6.2.2, "Specifying Referral Cut-off Time"

- Section 6.2.3, "Enabling Netting Required Option"

- Section 6.2.4, "Enabling Limit Maintenance Screen"

- Section 6.2.5, "Standing Instructions (SI)"

- Section 6.2.6, "Clearing (CG) Transactions"

6.2.1 Enabling Referral Required Option

You will need to enable the Referral Required option in the following maintenance screens:

- Customer Account Class Maintenance - Enabling this option would indicate whether a referral check should be performed on accounts belonging to the account class. Consequently, the system checks the available balance (not the current balance) while performing the referral checks for all transactions involving the account.

- Customer Accounts Maintenance - The Referral Required option is defaulted from the account class linked to the account. However, you can change it for a specific account. If an account is marked for referral, the details of transactions resulting in the account moving into Overdraft will be referred to the Referral Queue.

- Product Preferences screens of the Standing Instructions, Payment and Collections modules and the Product Definition screen of the Clearing module. While maintaining the details of an SI or CG product you can indicate whether transactions involving the product need to be considered for referral checks. Enabling this option indicates whether the product needs to be considered for referral. If a product is marked for referral, the details of transactions resulting in the account (involved in the transaction) moving into Overdraft will be sent to the Referral Queue.

6.2.2 Specifying Referral Cut-off Time

In branch parameter, you have to specify the referral cut-off time for accepting / rejecting transactions in the referral queue.

In case a transaction is rejected from the referral queue after the cut-off time then system displays the override message as “‘Rejected after cut off time.”

Note

Transactions are accepted into the Referral Queue even after cut-off time if account goes into overdraft.

6.2.3 Enabling Netting Required Option

If linked accounts are marked for referral you can choose to consolidate the balances in all the linked accounts before performing the referral check. To process linked accounts which are marked for referral you will need to enable the Netting Required option in the following screens:

6.2.4 Enabling Limit Maintenance Screen

Enabling this option indicates that the netting of balances is allowed for accounts linked to the credit line. To pool balances across accounts you may need to link a common Credit Line across accounts where balances are to be pooled. Therefore, you will need to indicate whether balances for the credit line and the respective accounts should be netted. As a result, while performing the limits check for accounting the system will take into consideration the collective balance across all accounts linked to the line.

If you have defined temporary overdraft limits for the accounts, and the temporary OD limit forms a part of the netting, the temporary OD limit will not be considered for netting.

Rules for Set off for principal in referrals

When customer accounts are linked for principal set-off, the Available Balance (summed for all accounts in the arrangement) plus the Overdraft Limit (for the main account) and the Sub limit (for the main account) minus the Total transactions received (on all accounts) is less than zero.

All transactions received are ‘referred’ even if a transaction is on an account, which has sufficient credit balance to pay the transaction.

If an account is set for principal, it means that it is automatically set for interest pooling too. However, if an account is marked only for interest set off the system does not perform the principal set off for referral.

Account Limits sub-screen of the Customer Account Maintenance screen

The Netting Allowed option is defaulted from the Credit Line associated with the customer account. If you change the default option the system displays an override message.

Liability Maintenance sub-screen of the Customer Information screen

The netting option is defaulted to the Liability Maintenance sub-screen of the Customer Maintenance screen. This option is defaulted from the Liability Code (which is linked to the Credit Line) that you associate with the CIF ID. If you change the default, the system displays an override message.

6.2.5 Standing Instructions (SI)

Standing instructions are sent to Queue when sufficient funds are not available in the customer’s account

Status

If accounting entries have not been passed

Resulting Action

Accept - the accounting entries are passed and the IC Charge counter is updated

Reject – No resulting action

6.2.6 Clearing (CG) Transactions

If the fund available in the customer account are insufficient, the clearing transaction is processed (i.e., the relevant accounting entries are passed) and the transaction is sent to the Referral Queue.

If the transaction is rejected, the entries are reversed. The status of the transaction is updated to ‘Dishonored’ in the clearing log. In case the transaction is accepted, no processing is required apart from updating the charge counter.

If the account goes into overdraft, all processed transactions for the day with transaction code marked for referral are moved to the Referral Queue. However, transactions which have already been accepted will not be marked for referral again.

If a transaction is to be marked for referral, the transaction details are stored in a separate table. The details in the referral screen are displayed from this table.

Note that transactions from Savings module will appear in the ‘Posted’ tab.

You can get accounting entries reversed or confirm for the overdrawn account using the ‘Intra Day Batch Start’ screen. You can invoke this screen by typing ‘BADIDBAT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following information.

Function

Specify ‘CSREFQPR’ or choose this value from the adjoining option list.

Click ‘OK’ button to run the batch.