8. Accounts for Inter-Branch Transactions

This chapter contains the following sections:

- Section 8.1, "Defining Accounts for Inter-Branch Transactions"

- Section 8.2, "Defining Accounts for Inter-Branch Fund Transactions"

- Section 8.3, "Defining Accounts for Inter-Branch Currency Transactions"

- Section 8.4, "Querying on Netting Batch"

8.1 Defining Accounts for Inter-Branch Transactions

A transaction that takes place in a branch of your bank may involve accounts that are maintained in another branch. For example, a customer has an account in the Head Office branch and approaches another branch of the bank for a cash withdrawal.

For each combination of branches that may be involved in an inter-branch transaction, you can define the currency and the respective customer accounts to which the related accounting entries will be posted.

The accounting entries for such inter-branch transactions can be routed in one of the following ways:

- Directly - where each branch will have a direct accounting relationship with all other branches

- Through a Regional Office -- where two branches involved in a transaction will interact through a common RO

- Through the Head Office -- where the two branches involved in the inter-branch transaction will interact only through the HO.

This route for all transactions is defined in the ‘Bank parameters’ screen. In the ‘Inter-branch Parameters Maintenance’ screen you define the internal accounts for pairs of branches that would be involved in any inter-branch accounting.

Invoke this screen by typing ‘ACDIBMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen appears as shown below:

In this screen you maintain the following for each combination of branches that may be involved in an inter-branch transaction:

- Branch Code of both the branches that are involved in the transaction

- For each of the branches, whether inter-branch entries must be posted in transaction currency or settlement account currency

- GL accounts of Branch 1

- Due to Branch 1

- Due from Branch 1

- GL accounts of Branch 2

- Due to Branch 2

- Due from Branch 2

8.1.1 System Features

The system generates a set of pairs of branches for which internal accounts should be maintained. The pairs generated depend upon on two factors:

- The reporting structure for the branches as created in the ‘Branch parameters’ screen and

- The route defined for inter-branch transactions in the ‘Bank-wide parameters -- Preferences’ screen,

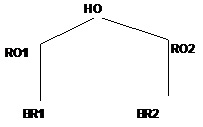

For example, the following represents the reporting structure of your bank:

If you have defined a direct inter-branch accounting route then you need to maintain an accounting relationship for each possible combination of

- Branch and branch

- Branch and RO

- RO and HO

- Branch and HO

For the above mentioned reporting structure the system will offer the following pairs of branch combinations to be maintained:

- BR1- BR2

- BR1- RO1

- BR2- RO2

- RO1- HO

- RO2- HO

- BR1 - RO2

- BR2 - RO1

- BR1 – HO

- BR2 – HO

- RO1 - RO2

If you have defined ‘through RO’ inter-branch accounting route then you need to maintain an accounting relationship for each possible combination of

- Branch and RO/HO

- RO and RO

In the branch and RO pair, the RO should be that RO to which this branch reports. For the above mentioned reporting structure the system will offer the following branch pairs to be maintained:

- BR1 - RO1

- BR2 - RO2

- RO1 – HO

- RO2 – HO

- RO1 - RO2

If you have defined ‘through HO’ inter-branch accounting route then you need to maintain an accounting relationship for each possible combination of,

- Branches and HO

- ROs and HO

For the above mentioned reporting structure the system will offer the following branch pairs to be maintained:

- HO - RO1

- HO - RO2

- HO - BR1

- HO - BR2

The system has an in-built auto escalation path for inter-branch accounting transaction which escalates from Direct to Through RO to Through HO.

For example, in the ‘Bank preferences’ screen you have defined a ‘direct’ inter-branch accounting relationship. But in the ‘Inter-branch Accounts’ maintenance screen (where all inter-branch accounts are maintained), you have not maintained an accounting relationship between two branches -- 000 and 002. Then, in case of an inter-branch accounting transaction between 000 and 002, the system will first look for a ‘direct relationship’ since that has not been maintained it will look for a relationship through RO i.e., if the two branches have a common RO; if that too does not exist then ‘through HO’ the transaction would take place.

Specifying General Ledger Details

Specify the GL accounts which are involved in the inter-branch transaction, in the respective branches

To maintain GL accounts for the branch pair specified, the following parameters should be maintained:

Inter Bank Currency

For each branch, you have the option of specifying whether the inter-branch entries must be posted in the transaction currency or the settlement account currency.

For the booking branch, if the Inter-branch Transaction Currency option specified is Transaction Currency, inter-branch entries are posted in the transaction currency only if:

- The local currency of both branches involved in the transaction is the same

- One of the accounts in the entries belongs to the booking branch

Due To Branch 2

This field identifies the GL account maintained in Branch 2 into which the credit entry is passed.

To specify the GL account, select the appropriate account from the picklist of all the accounts maintained at Branch 2.

Due From Branch 2

This field identifies the GL account maintained in Branch 2 into which a debit entry will be passed.

Due to Branch 1

This identifies the GL account maintained at Branch 1 into which a credit entry will be passed.

Due From Branch 1

This account identifies the GL account maintained at Branch 1 into which a debit entry will be passed.

System uses the GL accounts specified in this screen and determines the settlement route for a transaction between two different branches of your bank.

8.2 Defining Accounts for Inter-Branch Fund Transactions

A fund transaction that takes place in a branch of your bank may involve accounts that are maintained in another branch.

As mentioned earlier, if you have selected the option ‘Allow Corporate Access’ in the Branch Parameters screen and the branch is a fund branch, the IB Entity will be defaulted as General Ledger. The GL that will be used will be based on the maintenance in the Fund Inter Branch Accounts Maintenance screen, for the fund id.

To invoke this screen, type ‘IADIBMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.I

For a fund id, specify all the details necessary to define the Inter branch GL that will be used. The option list against the field Fund ID includes all the valid funds maintained in the system.

For an explanation on each of the other fields, refer to the previous section.

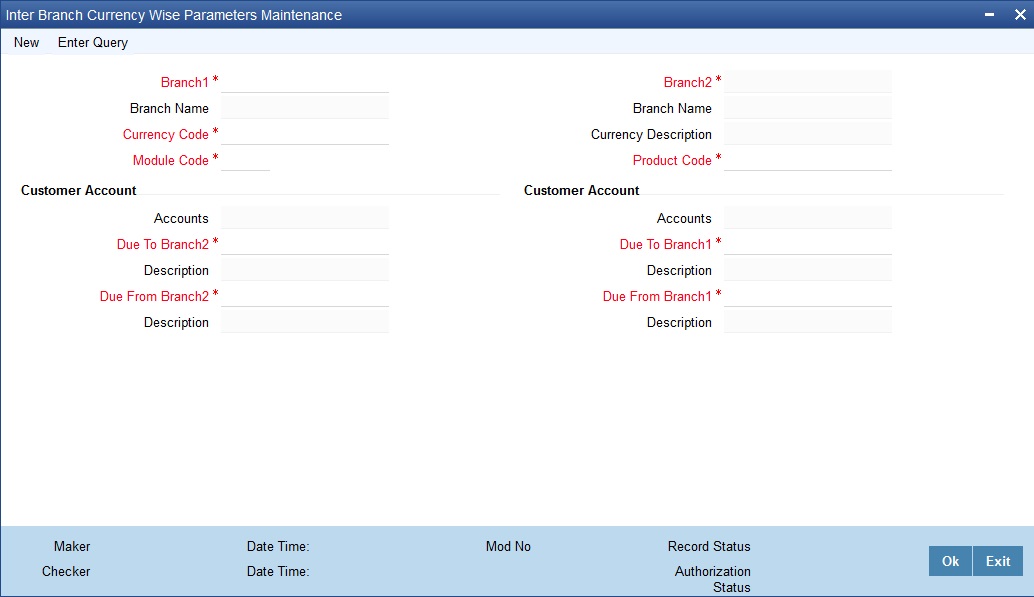

8.3 Defining Accounts for Inter-Branch Currency Transactions

Inter-Branch Currency Wise Parameter Maintenance (CADIBMNT) allows you to define the routing of accounting entries that take place between two branches when the debit and the credit entries are posted to accounts that belong to different branches.

This maintenance allows you to set up the inter-branch parameters by following Branch, Currency, Module and Product wise hierarchy. Inter-Branch accounts to be debited and credited in case of a cross-branch transaction can be defined in three different ways.

- You can have a unique inter-branch entry definition for every Product belonging to a specific Module, per Currency,

- A common definition of inter-branch entry for all Products under a Module, per Currency, or

- An inter-branch entry definition common across an entire Branch, per currency.

System passes inter-branch entries based on the currency wise inter branch parameters, The preference will be given to the following order:

- Transaction module and transaction code

- Transaction module and all products

- All modules and all products

To invoke this screen, type ‘CADIBMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.I

Specify the following details in this screen:

Branch Code1

Specify the branch 1 code. Alternatively, you can also select the valid branch code from the adjoining option list.

Branch Code2

The system displays branch 2 code based on the branch code 1 selected.

Branch Name

The system displays the branch name based on the branch code selected.

Currency Code

Specify the currency code. Alternatively, you can select the currency code from the option list. The list displays all valid codes maintained in the system.

Currency Description

The system displays the currency description based on the currency code selected.

Module Code

Specify the module for which the currency wise inter-branch parameter to be maintained. Select ‘*.*’ to maintain currency wise inter branch parameter for all modules.

Product Code

Specify the product code. Alternatively, you can select the product code form the adjoining list. Product code will fetch all the valid products for selected module. Currency wise Inter branch parameter can be maintained for all product by selecting ‘*.*’ from the list values. You can select product code as ‘*.*’, only if module code selected as ‘*.*’.

Specifying Account Details

Due To Branch 2

This field identifies the account maintained in Branch 2 into which the credit entry is passed.

To specify the account, select the appropriate account from the pick list of all the customer accounts maintained at Branch 2.

Due From Branch 2

This field identifies the account maintained in Branch 2 into which a debit entry will be passed.

Due to Branch 1

This identifies the account maintained at Branch 1 into which a credit entry will be passed.

Due From Branch 1

This identifies the account maintained at Branch 1 into which a debit entry will be passed.

System uses the accounts specified in this screen and determines the settlement route for a transaction between two different branches of your bank.

Note

When considering both ACDIBMNT and CADIBMNT screens, preference should be given to CADIBMNT screen.

8.4 Querying on Netting Batch

You can view all netted and non-netted transactions of the netting process from the ‘Netting Batch Query’ screen. You can invoke this screen by typing ‘STDNETQY’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query on the basis of one or more of the following parameters:

- Netting Group Code

- Account Number

- Date

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in this User Manual.

On searching, the system displays the following details:

- Netting Reference Number

- Date

- Branch Code

- Account

- Module

- Event

- Reference Number

- Transaction Code

- Amount Tag

- Debit/Credit Transaction

- Account Currency

- Foreign Currency Amount

- Local Currency Amount