21. Status Code Maintenance

Loans and bills, which are past their due maturity date of installment re-payment, but remain unpaid, are defaulted contracts. In the Oracle FLEXCUBE system these defaulted contracts can be assigned to different statuses, based on the number of days for which the contract is outstanding.

Each status can be assigned a code. For instance, you can define a status code PDO to represent ‘past due obligation’, and specify a period of 15 days after which an outstanding contract should be marked as ‘PDO’. If they are due for more than 60 days, you could assign a ‘doubtful’ status; ‘sub-standard’ if due for 6 months, and so on. Contracts for which no installments are due, or which are regularly paid on their due dates are assigned the status ‘Active’ by the system. According to the number of days of default defined for each status, a loan would be moved from ‘Active’ to PDO status, then to doubtful and finally to sub-standard status.

Similarly, you can define status codes for current and savings accounts also. Current and Savings accounts that have not generated any interest over a specific period or have remained inactive with interest overdue may be identified as ‘NPAs’ (Non-Performing Asset). In Oracle FLEXCUBE, you can assign these accounts different status codes and define status criteria based on which the status movement will occur.

Refer the ‘Core Entities’ user manual for details on associating status codes with a customer account class /account.

This chapter contains the following sections:

- Section 21.1, "Status Codes Maintenance"

- Section 21.2, "Maintaining Dormancy Parameter Details"

- Section 21.3, "Maintaining Central Bank Dormancy Details"

21.1 Status Codes Maintenance

This section contains the following topics:

- Section 21.1.1, "Invoking Status Maintenance Screen"

- Section 21.1.2, "Maintaining Status Codes for OD Account"

21.1.1 Invoking Status Maintenance Screen

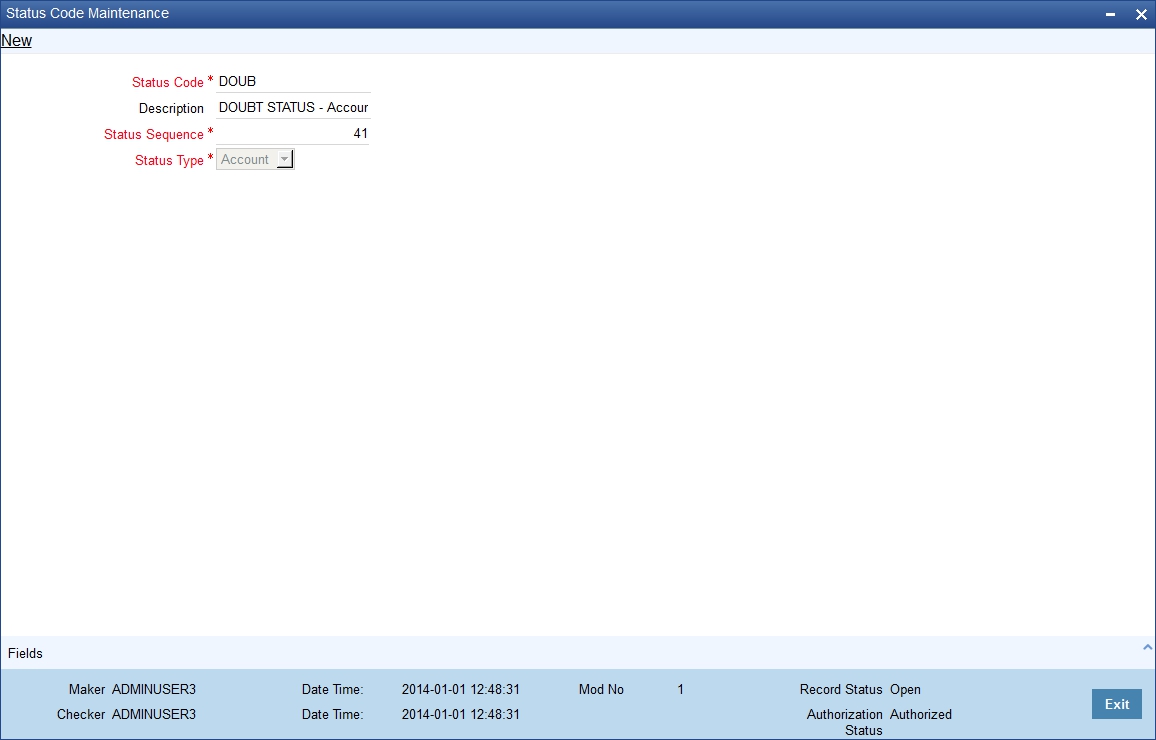

You can invoke this screen by typing ‘STDSTSCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen you can maintain the following to user defined status of a loan or bill/account status:

- A unique code for the status

- A brief description for the status

- A sequence number for the status

- The type of status – Indicate whether the status codes are maintained for an ‘Account’ or for a ‘Contract’, or for ‘Both’

The type of status you choose depends on the status processing basis for your branch, which is defined in the Branch Parameters Preferences maintenance. If status processing basis is at individual account / contract level, you can choose the applicable status types as ‘Account’ or ‘Contract’. The status codes that have been maintained of type ‘Account’ are available for association in the Account maintenance and those maintained with type ‘Contract’ can be associated with contracts.

If status processing basis is at Group / CIF level, you can only maintain status codes of type ‘Both’ (that is, applicable for both accounts and contracts). In such a case, you must associate the statuses at both the Account maintenance as well as for contracts.

Note

- It is mandatory to maintain the status code ‘NORM’ (Normal) with the sequence number as ‘0’, for all the status types. The sequence number must not be repeated for a status type.

- The sequence number associated with the status will be used for determining the hierarchy of statuses, i.e., higher the number, worst the status and this will be unique for the status codes.

Maintaining Status Codes for Contracts

The following parameters need to be maintained for defining a status code:

Status Code

This is the code, which identifies the status to which the contract belongs.

For example, assign a code using a maximum of 3 characters, alphanumeric. For example, if your contract has past its due obligation status you can input code PD1. PD representing post due obligation. The number 1 stands for stage 1 of the post due obligation status

Status Description

This is the description of the status, Enter a description using a maximum of 35 SWIFT characters.

For example, taking the above example, you can input here - Past Due Obligation 1 for Loan if you are maintaining status codes for Loans.

Link to

This represents the category of the product - asset or liability to which the contract status is applicable.

For example, if you are maintaining status codes for loans or any money market placements, click on ‘assets type of product’. If you are maintaining status codes for deposits, click on ‘liability type of products’.

Effective days from Maturity

This indicates the number of days after the due date when this status becomes applicable to the contract. You can specify any number of days from 0-999.

The effective days defined here is defaulted to the product level in the Bills and Loans modules. You have the option of redefining the number of days at the product level.

21.1.2 Maintaining Status Codes for OD Account

Oracle FLEXCUBE provides a facility to maintain status codes for Charge-off and Write-off satus of the OD account. These status codes are maintained in ‘Status Code Maintenance’ screen and the details of the same are as follows:

Status Code |

Description |

Status Sequence |

Status Type |

CROF |

Status code for Charge-off of OD accounts. |

Should be less than SUSP status sequence |

Account |

SUSP/WOFF |

Status code for suspended status of OD accounts. |

Should be greater than CROF status sequence |

Account |

21.2 Maintaining Dormancy Parameter Details

You can maintain the dormant statuses for the customer account in the ‘Dormancy Parameter Maintenance’ screen. To invoke this screen, type ‘STDSTDOR’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

Transaction Branch

Select the appropriate branch from the list of branches available in the option list. This screen will be available only for those users who has ‘Multi Branch Operational’ check box enabled at ‘User Maintenance’ Screen.

While clicking ‘Ok’ button, the system validates the access rights of the selected branch and function for the user. If you don’t have appropriate rights on the selected branch and function, the system would raise an error message. If you select a valid branch, the system updates the same as transaction branch and the transaction would be posted for this branch.

Note

The system performs the action level access rights validation only on ‘Save’ operation.

After selecting the Transaction Branch, you can enter the remaining details in the ‘Dormancy Parameter Maintenance’ screen.

You need to specify the following details:

Branch Code

Specify the branch code.

Customer A\C

Specify the customer account for which you are maintaining the dormant status. The adjoining option list displays all the customer account numbers that are maintained in the selected transaction branch. You can choose the appropriate one.

Debit

Check this box to indicate that no debits should be posted to the selected customer account.

Credit

Check this box to indicate that no credits should be posted to the selected customer account.

Frozen

Check this box to indicate that the customer account is frozen due to some unavoidable reason.

Dormant

Check this box to indicate that the account is in dormant status which means not used for along time.

Central Bank Dormant

This is checked if the account has become Central Bank Dormant. Users can update the status from here.

Dormant Param

Indicates the parameters for re-activating the dormant account. You can select one of the following options:

- Debit

- Credit

- Any

Remarks

Specify the remarks, if any.

21.3 Maintaining Central Bank Dormancy Details

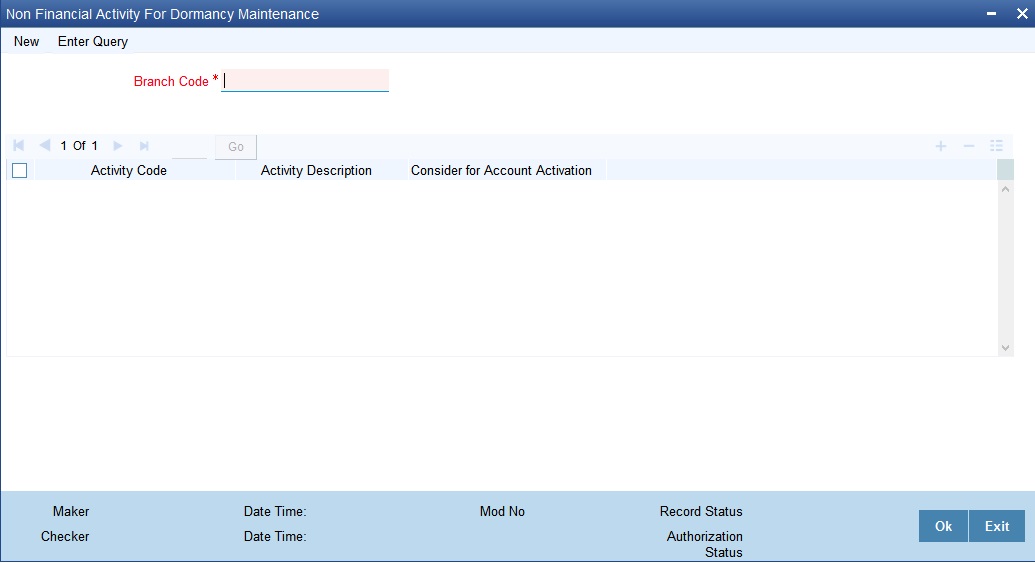

You can maintain the non financial activities for dormancy in the ‘Non Financial Activity For Dormancy Maintenance ’ screen. To invoke this screen, type ‘STDNONFA’ in the field at the top right corner of the application tool bar and click the adjoining arrow button.

Specify the following details:

Branch Code

Select or the branch code from the option list. You can also enter the branch code manually.

Activity Code

Select the activity code to be considered for activation of accounts from central bank dormancy.

Activity Description

The description of the activity. Following table shows the codes and respective description:

Activity Code |

Activity Description |

CHRQ |

Cheque book request |

PSRQ |

Passbook request |

STMT |

Ad-hoc statement request |

SWTH |

Switch Transactions |

Consider for Account Activation

Check the box if you want the activity to change the dormancy condition of the account

For dormant account, if any activity is checked then on the checked non-financial transaction, the Dormant account activates the and Dormancy Date is changed to Current Date+ Dormancy Days+1. The dormancy date is changed in the account level.

For dormant accounts if no activity is checked, but still there are the specified non-financial transactions the Dormancy Date is changed to Current Date+ Dormancy Days+1. The dormancy date is changed at the account level. But the account remains dormant.