2. Core Maintenances

2.1 Introduction

This chapter contains the following sections:

- Section 2.2, "Bank and Branch Core Parameters Maintenance"

- Section 2.3, "Maintaining Host Code"

- Section 2.4, "Local Holiday Maintenance"

- Section 2.5, "Country Code Maintenance"

- Section 2.6, "Currency Maintenance"

- Section 2.7, "Currency Holiday Maintenance"

- Section 2.8, "Floating Rates Definition"

- Section 2.9, "External Entities Maintenance"

- Section 2.10, "External Limit Entities Maintenances"

- Section 2.11, "Settlement Details Maintenance"

- Section 2.12, "MIS Details Maintenance"

- Section 2.13, "User Defined Fields Maintenance"

- Section 2.14, "Generic Interface Maintenance"

- Section 2.15, "Process Definition"

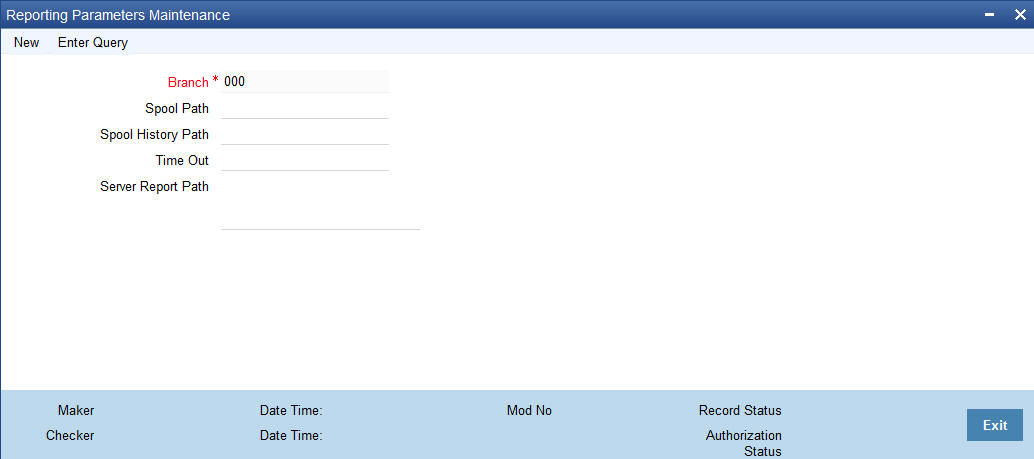

- Section 2.16, "Reporting Parameters Maintenance"

- Section 2.17, "Maintaining Amount Text"

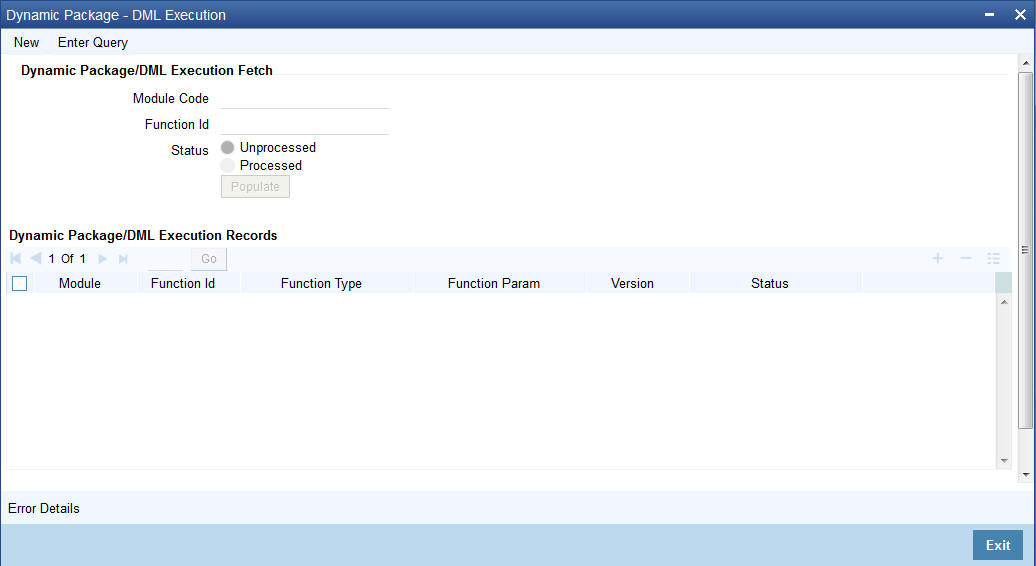

- Section 2.18, "Dynamic Package - DML Execution"

2.2 Bank and Branch Core Parameters Maintenance

This section contains the following topics:

- Section 2.2.1, "Invoking Bank Core Parameters Maintenance Screen"

- Section 2.2.2, "Invoking Branch Core Parameter Maintenance Screen"

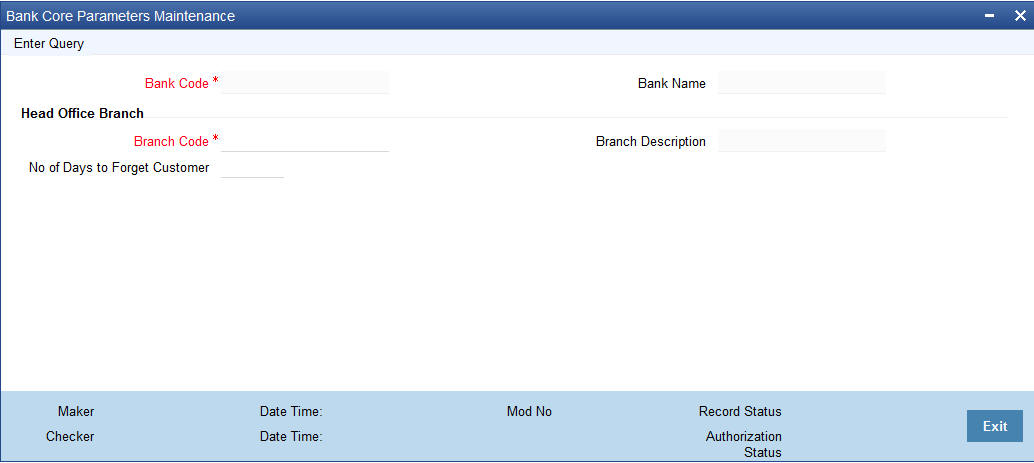

2.2.1 Invoking Bank Core Parameters Maintenance Screen

You can invoke ‘Bank Core Parameters Maintenance’ screen by typing ‘STDCRBNK’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Bank Code

Specify the bank code.

Bank Name

The name of the bank is displayed here.

Head Office Branch

Branch Code

Specify the head office branch code.

Branch Description

The description of the branch is displayed here.

No. of days to Forget Customer

Enter the number of days, after which the system will forget the customer after they close their account. Once the customer is forgotten you can’t view the details of the customer.

Click “Execute Query”. The records matching the entered query criteria is displayed.

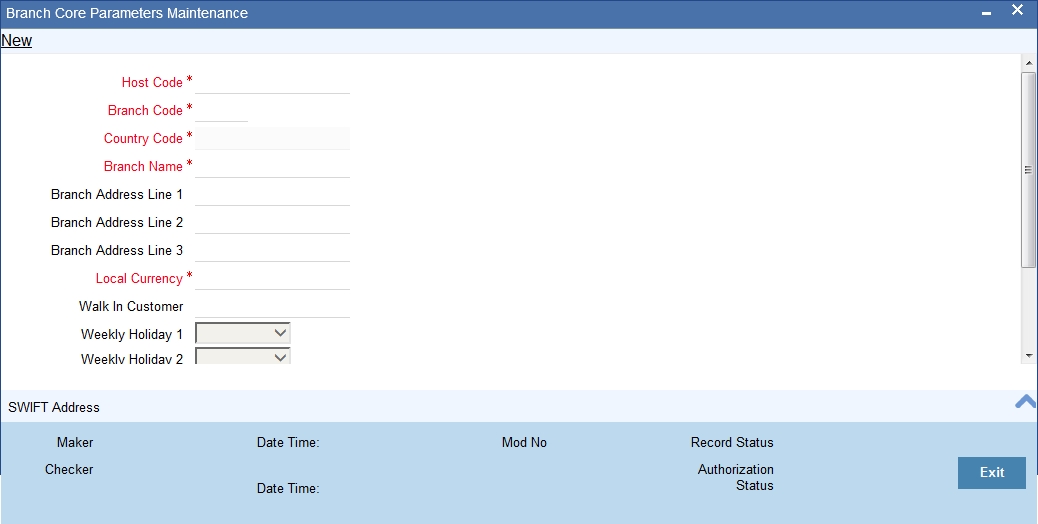

2.2.2 Invoking Branch Core Parameter Maintenance Screen

You can invoke ‘Branch Core Parameter Maintenance’ screen by typing ‘STDCRBRN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Host Code

Specify the host code here. Alternatively, you can also select the host code from the adjoining option list.

Branch Code

Specify the branch code here.

Country Code

Specify the country code here.

Branch Name

Specify the branch name here.

Branch Address

Specify the address of branch here.

Local Currency

Specify the local currency of the branch. Alternatively, you can also select the currency from the adjoining option list.

Walk in Customer

Specify the walking customer name here. Alternatively, you can also select the walk in customer name from the adjoining option list.

Weekly Holiday 1 & 2

Select the weekly holiday of the branch from the drop-down list. The list displays the following values:

- Sunday

- Monday

- Tuesday

- Wednesday

- Thursday

- Friday

- Saturday

Auto Authorization

Check this box to indicate that the branch allows auto authorization facility.

Host Name

Specifies the host name from which the customer is logged in.

Report DSN

Specify the Report DSN details.

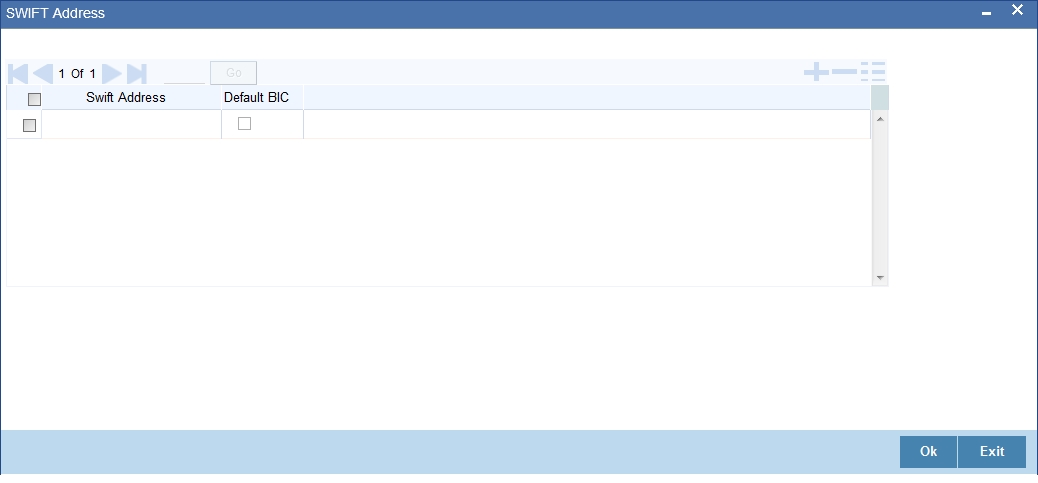

Maintaining SWIFT Address Details

You can maintain SWIFT address details for the branch in the ‘SWIFT Address’ screen. Click “Swift Address” button to invoke the screen.

SWIFT Address

Specify the required SWIFT Address. Alternatively, you can also select the SWIFT address from the adjoining option list.

Default BIC

Check this box to use the default BIC.

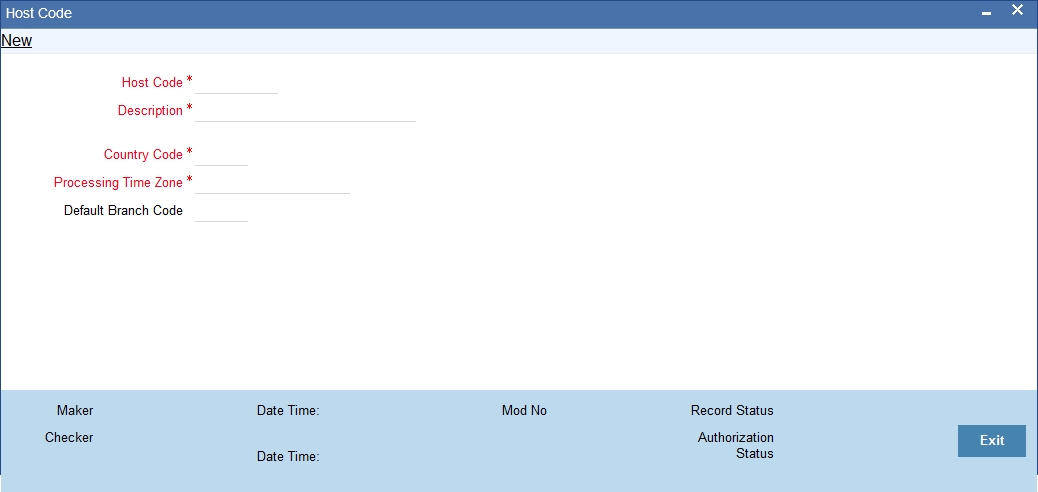

2.3 Maintaining Host Code

You can group branches in the same zone or region under a Host for specific processing. You can have multiple hosts depending on processing requirements. These hosts can be maintained in Host Code Maintenance screen.

This section contains the following topics:

- Section 2.3.1, "Invoking Host Code Maintenance Screen"

- Section 2.3.2, "Viewing Host Code Maintenance Summary"

2.3.1 Invoking Host Code Maintenance Screen

You can invoke ‘Host Code Maintenance’ screen by typing ‘STDHSTCD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Host Code

Specify the processing zone that is applicable for the requests.

Host Description

Specify the description of the host code.

Country

Specify the required country code from the list.

Processing Time Zone

Specify the time zone that is used for processing the request. All open and authorized time zones are available in the list.

Default Branch

Specify the required branch code which indicates the main branch of the group of branches linked to the same host code. All valid branches are available in the list.

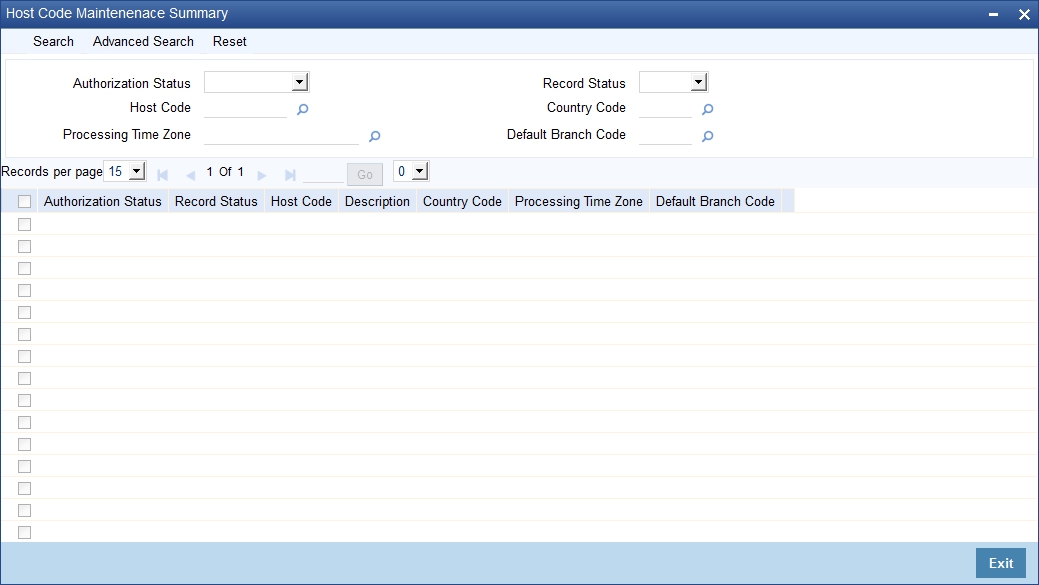

2.3.2 Viewing Host Code Maintenance Summary

You can invoke ‘Host Code Maintenance Summary’ screen by typing ‘STSHSTCD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Host Code

- Country Code

- Processing Time Zone

- Default Branch Code

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria for the following:

- Authorization Status

- Record Status

- Host Code

- Description

- Country Code

- Processing Time Zone

- Default Branch Code

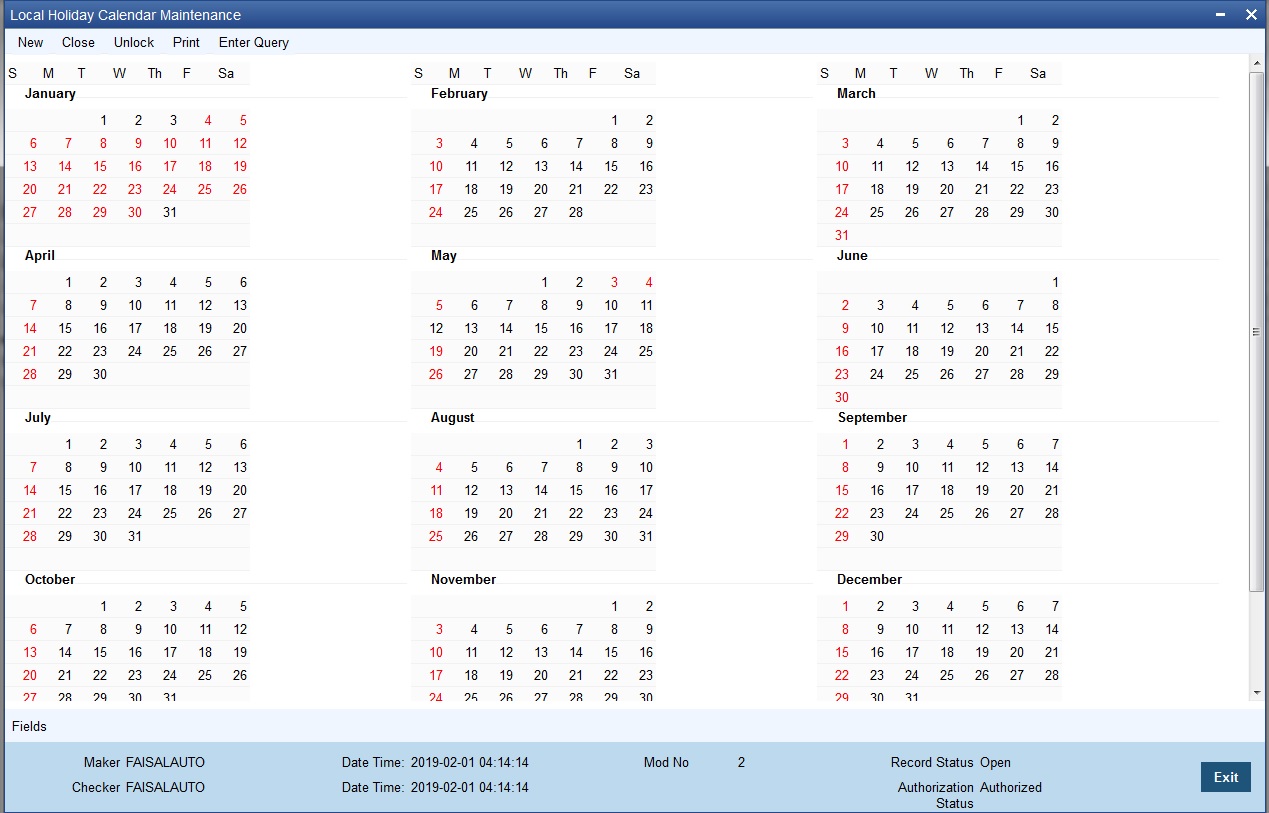

2.4 Local Holiday Maintenance

For a year, you need to define your weekly holidays and your calendar year annual holidays. This is done in the ‘Local Holiday Calendar’ screen.

The system uses the information maintained in this screen to do the following:

- To check that the ‘value date’ of no Data Entry transaction falls on a holiday

- To check that the start date / maturing date and schedule date of a loans and deposit contract does not fall on a holiday

- To effect a date change on the system -- today’s date and the next working date

For any schedule / contract maturing at a future date, say, 5 years hence, you can input a future date, only if the calendar for that year has been maintained. It is not necessary to maintain the list of all annual holidays, for future, you can merely define all regular weekly holidays.

This screen is maintained for each branch, of your bank, from the respective branches; thus making it possible to have a different set of holidays for different branches of the bank.

This section contains the following topics:

2.4.1 Maintaining Local Holiday Calendar

Invoke the ‘Local Holiday Calendar’ screen, by typing ‘STDLOCHL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Note

It is possible to maintain next working day as a holiday and next holiday as a working day.

In this screen you can specify the weekly and also the annual holidays, for your branch, for any year between 1 AD and 4000 AD.

Steps to Define Yearly Holidays

To define holidays for a year, (for instance, for 2000) you have to do the following:

Building the calendar for the year

Step 1

Select ‘New’ from the Actions menu in the Application tool bar or click new icon

Step 2

Enter the year -- 2000 or move to the year 2000 using the arrows

Step 3

To build the calendar for the year, 2000 click the ‘Refresh’ button. This button is called the ‘refresh / build up’ button because it builds the calendar for you. Please note:

- On invoking the calendar of any year, you will notice that Saturdays and Sundays are marked as weekly holidays. This is the default setting of the system

- For identification, the working days are marked in black and the holidays in red.

To define annual holidays, click on the particular date to mark the selected date as a holiday.

If you want to unmark a day specified earlier as a holiday, double click on it, once again. You will notice that the day gets marked in black.

2.4.2 Annual Holidays

These are the holidays you have defined for the year calendar on display

You will observe that all holidays are marked in red, while working days in black. (All unauthorised holiday dates appear against a blue background). To mark a date as a holiday, double click on it. In case you wish to undo a date marked off as a holiday, double click on it once again. It changes back to a working day.

With each modification you make, the Modification Number in the made by column below moves up serially.

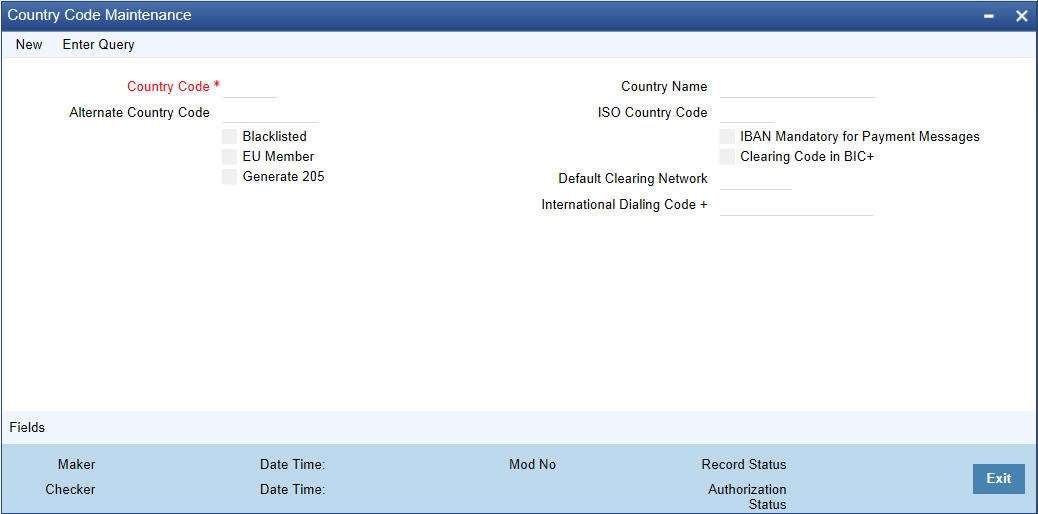

2.5 Country Code Maintenance

This section contains the following topics:

2.5.1 Maintaining Country Name Details

You can define country name through the ‘Country Code Maintenance’ screen. You can invoke this screen by typing ‘’STDCNMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here, you can capture the following details

Country Code

You can capture a unique three-character code to identify the country. For example: you can maintain USA as the country code for United States of America.

Alternate Country Code

You can also associate an alternate country code. This is for information purposes only and will not be printed on any customer correspondence.

For example you can have US as the alternate code for USA

Country Name

After you define an alphanumeric code to identify the country for which you would like to assign a name, you have to specify the name of the Country.

Blacklisted

Further, in the ‘Country Name Maintenance’ screen you can black list a country for further usage. You are not allowed to deal in countries that are blacklisted.

You can only deal with countries that are not blacklisted

IBAN Mandatory for Payment Messages

If this is checked, it indicates that for every payment message an IBAN is mandatory.

If this option is unchecked for a country, the system will not process the outgoing payments wherein the ordering customer or the beneficiary customer belongs to that country.

EU Member

This indicates whether the country is recognized by Swift as a part of the Intra European countries.

If you check this flag the instructed amount field should be mandatory in the generated 103, 103+ and 102 messages. The instructed amount field is mandatory in the incoming messages.

Clearing Code in BIC+

Check this box to indicate that the National ID in the BIC plus file is the clearing code. During upload of clearing codes from BIC plus file, the records that belong to countries against which this box is checked will be selected.

Generate 205

Check this box to indicate that the cover message 205COV or 205 need to be generated for transactions involving this country. If you do not select this option, RTGS, 202 or 202COV message will be generated.

For more details on 202COV and 205COV cover message formats, refer settlements user manual.

Default Clearing Network

Once the National ID from BIC plus directory is uploaded into clearing codes, the network will be populated as the default clearing network for that country. This is mandatory when clearing code in BIC+ is chosen as ‘Y’.

International Dialling Code

Specify the international dialing code associated with the country.

2.6 Currency Maintenance

This section contains the following topics:

- Section 2.6.1, "Maintaining Currency Definition"

- Section 2.6.2, "Maintaining Currency Position GL"

- Section 2.6.3, "Viewing Currency Summary Details"

- Section 2.6.4, "Maintaining Currency Pair"

- Section 2.6.5, "Viewing Currency Pair Summary"

- Section 2.6.6, "Maintaining Currency Rate Type"

- Section 2.6.7, "Maintaining Currency Exchange Rates"

- Section 2.6.8, "Viewing Exchange Rates"

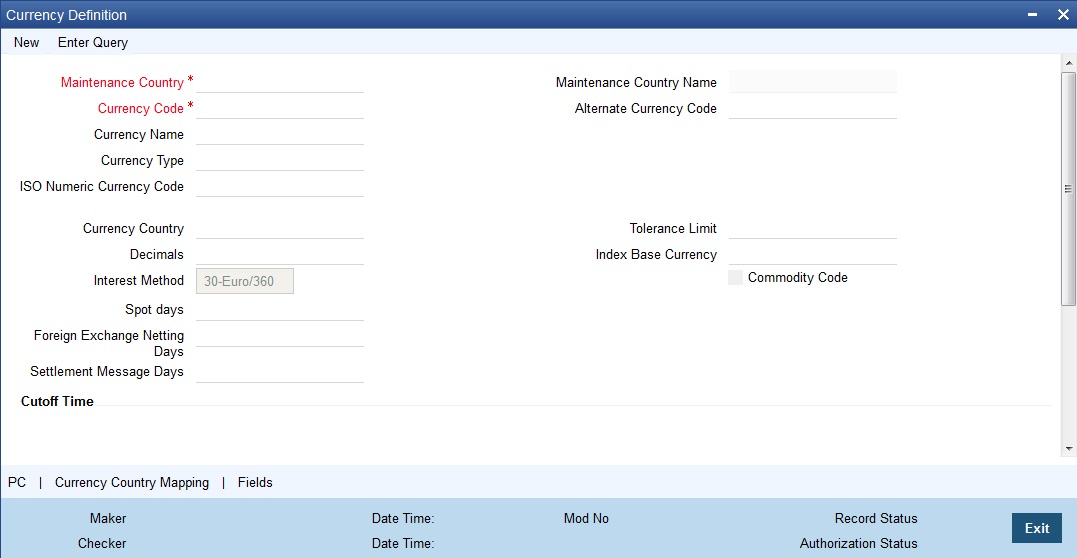

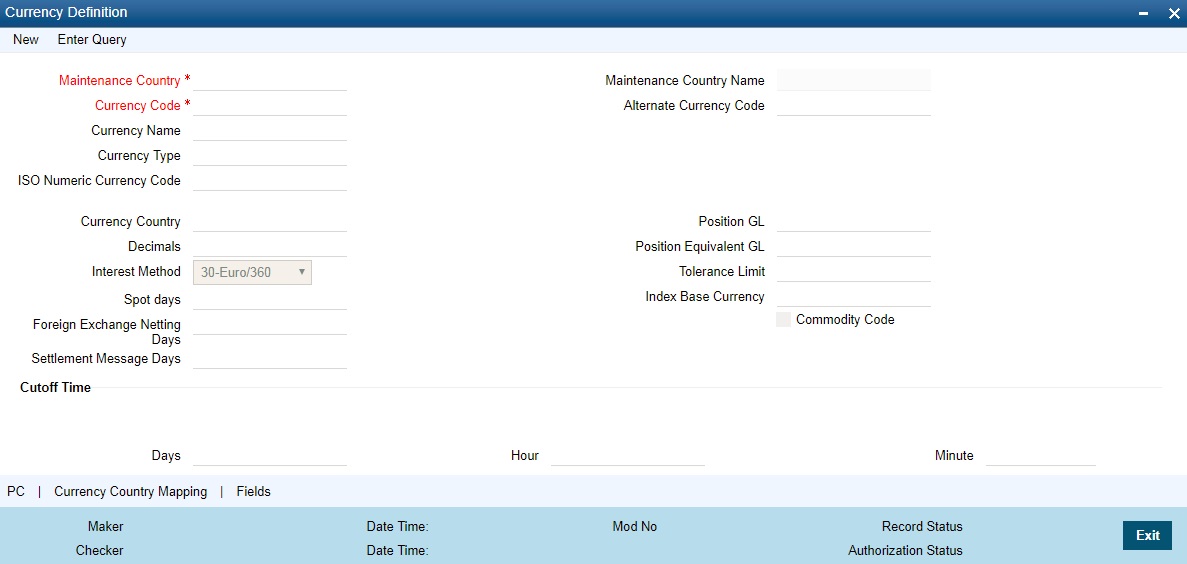

2.6.1 Maintaining Currency Definition

In the ‘Currency Definition’ screen, you define the attributes of the currencies in which your bank can deal. For each currency, you can define attributes like, the SWIFT code for the currency, the country to which the currency belongs, the interest method, the spot days, the settlement days, etc.

Currencies can be maintained only at the Head Office. The list of currencies will be made available to the branches based on the currencies that have been defined for the country linked to that branch.

Invoke this screen by typing ‘ ‘CYDCDEFE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Maintaining Currency Details

Maintenance Country

Specify the country code for which the currency is maintained. Alternatively, you can select the country code from the option list. The list displays all the authorized and open country codes along with their description maintained in the system.

For example, if you maintain the country code for a bank or a branch, which is operating in Singapore for the currency USD, then you should specify the country code as SG. The system defaults the field ‘Country’ as US.

Maintenance Country Name

The system displays the name of the country for which the currency is maintained.

Currency Code

Currencies are identified in Oracle FLEXCUBE by the SWIFT codes assigned to them. The currency will be identified by this code in all transactions that involve it.

Currency Name

You can enter the detailed name of the currency in not more than thirty-five alphanumeric characters.

Currency Type

As per your bank’s requirement you can choose to classify currencies into different currency types. The bank can use its own discretion to decide the basis of classifying currencies into different currency types. A currency type can consist of a maximum of three characters.

Depending on the customer account mask maintained, the value in the currency type field would be used during the generation of customer account numbers through the Customer Accounts Maintenance screen.

If you have decided to include currency type as part of the customer account number (in the account number mask), then at the time of creating a new customer account number, you will need to select the currency of the account number being generated. In the option-list provided for currency, the currency code is displayed along with the associated currency type say, USD – 1, GBP – 2 etc. When the account number gets populated, it is the currency type that forms a part of the customer account number.

ISO Numeric Currency Code

Specify the currency code specified by the International Standardization Organization.

Country

After you have identified the currency, you should indicate the country to which the currency belongs. You can select a country code from the option list available.

Decimals

You can indicate the number of decimal units up to which the currency can be denominated. The number of decimals allowed for any amount in the currency can be:

0 - Currency with no decimals

2 - Currency with two decimals

3 - Currency with three decimals

Interest Method

You can indicate the interest rate to be used for transactions that involve this currency. The interest options available are:

- Actual/Actual

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

Select the interest method that should be used by default whenever the currency is used in transactions. While processing a transaction that involves this currency, the interest method defined for the currency is defaulted. You have the option to change it for a specific transaction.

However, if you do not specify an interest method for a transaction, the method defined for the currency will be used (For details refer to Annexure on Page 140).

Spot Days

The number of spot working days applicable for the currency is specified here.

For example, the tenor of an MM contract is as follows:

Value Date - 01/01/99

Maturity Date - 31/01/99

Contract Currency - USD

Contract Amount - 5000

For USD, the number of Spot Days is specified as: Spot Days - 3

For this contract, the payment advices will be sent on 28/01/96.

Foreign Exchange Netting Days

Oracle FLEXCUBE provides a facility wherein all transactions relating to a customer, meant to be settled on a particular day and are made before a specific cut off day are collated, netted and a single payment message is sent instead of individual messages for each payment. This cut off day can be parameterized and is called ‘Netting Days’. The number of FX netting days applicable for the specified currency is maintained here.

Note

The system will validate that the FX Netting days are lesser than or equal to the spot days.

Settlement Days

In this screen, you can specify the ‘Settlement Days’ for a currency. Settlement messages for the components of a contract (in the LC, BC, LD, MM and FX modules) will be generated according to the settlement days specified for the currency of the settlement account. The following example illustrates this.

For example, when maintaining the details of USD in the Currency screen, you specify the ‘Settlement Days’ as ‘2’. This implies that two working days prior to the settlement of a component through a USD account, a settlement message will be automatically generated if specified (when you run the Settlement Messages function at the end of day).

The settlement details of a contract are as follows:

Settlement Date: 06 May 1999

Settlement Account Currency: USD

Component: Principal

Settlement Message: Yes

Component Currency: GBP

When you generate the Settlement Messages function, at the end of day, on 04 May 1999, a settlement message for the Principal component of the contract will be generated.

You can run Settlement Messages function as part of EOD operations from the Application Browser to automatically generate settlement messages for contracts marked out for automatic liquidation.

The settlement day specification for a currency will determine the contracts that are picked up for settlement message generation.

Cut-off Time

The Currency Cut-off time refers to the time by which all transactions involving a currency should be generated. For a currency, you can indicate the cut-off hour and minute. This time should be expressed in the local time of the bank.

The maintenance of a cut-off time for a currency has particular reference to outgoing funds transfers involving it.

Cut-off days

You can also specify the cut-off days and time for payment transactions involving the currency.

For example, the value date of a funds transfer transaction (incoming payment) involving USD, is 3rd June 2001. The number of cut-off days specified for the currency is 2. This means that the payment must be received on or before 1st June 2001. If the payment is received on 1st June, it must be received before the cut-off time specified for USD.

If the USD cut-off time is 1200 hrs, then, if the payment is received on 1st June 2001, it must be received before 1200 hrs.

The cut-off time (in hours and minutes) that you maintain to be applicable for payment transactions involving a currency are applicable to the head office branch of your bank.

If the branches are in time zones other than the head office branch time zone, you must maintain the offset time applicable for each branch, in the Branch Parameters screen.

Note

Even when cut-off days and cut-off time for a currency have both been specified, the cut-off checks are performed for a funds transfer transaction only if specified as applicable for the product involved in the transaction.

Tolerance Limit

When you are maintaining an ‘In’ Currency, or the Euro, in the Currency Definition screen, you can define a ‘Tolerance Limit’ for it. The limit is expressed as a percentage.

The implication:

During the transition period, settlement of components in ‘In’ currencies can be made either in the same currency or in the Euro (EUR) depending on the settlement account(s) maintained. (Similarly, components in Euro can either be settled in EUR or in an ‘In’ currency.) In the settlement messages that are generated (MT 100, MT202), the settlement amount would be reported in the Settlement Account Currency. However, you can opt to additionally furnish the value of the component in Euro Related Information (ERI) currency. You have to manually specify the settlement amount value, in the ERI currency, in the Settlement Message Details screen.

When generating the message towards settlement (MT100, MT202), the system ensures that the value you specify as the ERI Amount conforms to the Tolerance Limit defined for the ERI Currency (in the Currency Definition screen). That is, the system computes the ERI equivalent of the settling amount using the pegged rates, and compares the same against the ERI amount input by the user. If the difference is within the tolerance limits defined for the ERI currency, the user specified amount is used.

If the user specified ERI amount breaches the Tolerance Limit defined for the ERI currency, the system calculates and reports the ERI Amount on the basis of the exchange rate defined for the settlement currency vis-à-vis the ERI currency.

For example, in the SWIFT messages (MT 100 and MT 202) that are generated towards settlement, the value of the component can be reported both in Nostro account currency (in Field 32A) and in an ERI currency that you specify (in Field 72). In Oracle FLEXCUBE, this information is captured in the European Related Information (ERI) fields in the Settlement Message Details screen.

Assume the following scenario:

- The settlement account is an EUR account

- You have to settle an amount of DEM 10000

- You have defined the ERI currency for DEM as DEM

- The Tolerance Limit for DEM as 0.05%

- The exchange rate: 1 Euro = 1.30 DEM

The settlement amount in Euro would therefore be 7692.36 (rounded to nearest higher cent). This amount will be reported in Field 32A of the settlement messages. Now, if you want to furnish the settlement amount in the ERI currency (in this case, DEM) you have to manually enter the DEM value in the ERI Amount field. You may enter DEM 10000. (EUR 7692.36 actually converts into DEM 10000.068.)

The value that you have entered is well within the Tolerance Limit of 0.05% defined for DEM. Therefore, this value will be reported in Field 72 of the settlement messages.

Since the Tolerance Limit for DEM is 0.05%, you can specify an ERI Amount between DEM 9995 and DEM 10005 (DEM 10000 * 0.05/100 = DEM 5). If you enter an ERI value exceeding DEM 10005 or less than DEM 9950, the system recalculates the ERI Amount at the time of generating the settlement messages. The recalculation will be on the basis of the pegged rates between the Settlement Currency and the ERI currency.

Note

The system validates the ERI amount only when generating the settlement messages. It does not validate the ERI amount at the time of input (in the Settlement Message Details screen).

Index Base Ccy

Specify the currency that should be used to handle index-based securities traded by the banks, wherein the deals are done in index currency and their settlement is done through the local currency.

Commodity Code

Check this box to indicate that maintained currency code is a commodity code which is restricted not to populate in payment messages during message generation in the currency code field.

Generate 103+

You can enable the MT 103 + format option only if you would like to generate outgoing MT 103 messages in the MT 103 + format.

If you are enabling this option for a specific currency, ensure to also enable this option:

- For your bank branch in the Branch Parameters Maintenance

- For the customer of the contract, in the BIC Code Maintenance

- For the product used by the contract, in the Product Preferences

Consequently, while processing transactions in the specified currency for such a customer, branch and product, for which the MT 103+ option is enabled, the system generates outgoing payment messages in the MT 103 + format.

Note

Since the system is also capable of processing incoming MT 103 messages in the MT 103 + format. Therefore, during the upload process for your branch, the system considers an MT 103 payment message to be of MT 103+ format for those customer, currency and product combinations, for which the MT 103+ option has been enabled.

CLS currency

To allow customers of your bank to settle their FX deals via the CLS (Continuous Linked Settlements) Bank, you can identify the currency to be a ‘CLS Currency’. FX deals in the CLS currency only will be eligible to be routed through the CLS bank.

From the available list of CLS currencies, you can further maintain a list of ‘allowed’ or ‘disallowed’ currencies for a specific customer. Every customer who is a ‘CLS Participant’ will be allowed to trade in all the available CLS currencies unless specifically mentioned.

Refer the ‘Continuous Linked Settlements’ chapter of the Foreign Exchange User Manual for details on maintaining currency restrictions and other maintenances required for processing CLS deals in Oracle FLEXCUBE.

Index Flag

Check this box to derive index rate of the currency in Lending module.

Validate Tag 50F

Check this box to indicate that validations need to be performed for the 50F details captured for the ordering customer during contract input.

For more details on 50F validations, refer the chapter titled ‘Maintaining Addresses for a Customer’ in Messaging System user manual.

Note

Customer cover messages are always generated in new format (MT202COV or MT205COV).

For more details on new cover message formats, refer settlements user manual.

Indicating Rounding Preferences

Rule

This refers to the method to be followed for rounding off fractional units of a currency. The rounding preferences available are:

- Truncate — The amount is truncated to the number of decimals specified for the currency

- Round Up — The amount is rounded up based on the number of decimals and the nearest rounding unit

- Round Down —The amount is rounded down based on the number of decimals and the nearest rounding unit

For example,

Amount before Rounding |

Rounding Method |

No. of Decimals |

Rounding Unit |

Amount after Rounding |

1234.678 |

Truncate |

2 |

- |

1234.67 |

1234.678 |

Round up to the nearest rounding unit |

2 |

.01 |

1234.68 |

1234.678 |

Round down to the nearest rounding unit |

2 |

.01 |

1234.67 |

Unit

If you have selected Round Up or Round Down in the Rule field, you need to indicate the nearest unit to which the rounding should take place. The number of units specified here should not be greater than the number of decimals allowed for the currency.

Example

The decimal points specified for currency ‘A’ is 2. Rounding unit is .05

Amount for transaction is USD 100.326, which will be rounded off depending upon the decimals specified and the rounding rule and rounding unit.

For Rounding Rule ‘Up’, the amount available for transaction would be USD 100.35. For rounding rule ‘Down’, the transaction amount would have been rounded down to 100.30

If the rounding rule was specified as ‘truncate’ then, the amount would have rounded off to 100.32 (simply, knock off all decimal points beyond the stated decimals places to be rounded off). Thus whenever you specify a ‘truncate’ option you need not state the ‘Rounding unit’.

Specifying Amount Format Mask

Specify the format in which amounts in this currency are to be displayed for contracts in this currency. Two options are available:

999,999,999

9,999, 999, 99

The system defaults to the 999,999,999 format.

Euro Type

When maintaining a currency in the Currency Definition screen, you have to specify the ‘type’ of the currency with relation to transition phase of the European Economic and Monetary Union (EMU). You can do this in the ‘Euro Type’ field.

Your specifications in this field enable you to handle the first phase of the EMU, which commenced on 01 January 1999.

For more details on the manner in which Oracle FLEXCUBE handles the Euro, refer the chapter ‘Handling the Euro’.

By choosing the appropriate option, you can indicate if the currency is:

- The Euro

- An ‘In’ currency

- An ‘Out’ currency

- ‘Euro Closed’

National currencies of ‘In’ countries are referred to as ‘In’ currencies. When maintaining other currencies, you have to choose the ‘Out Ccy’ option under Euro Type.

When the transition period ends, the national currencies of the participating countries would cease to exist as valid legal tenders. The Euro would be the only legal tender in the participating countries. Consequently, the Euro changes made to Oracle FLEXCUBE will no longer be required.

You can turn off the changes at the end of the transition period by:

- Closing all ‘In’ currencies, and

- Choosing the ‘Euro Closed’ option (for the Euro)

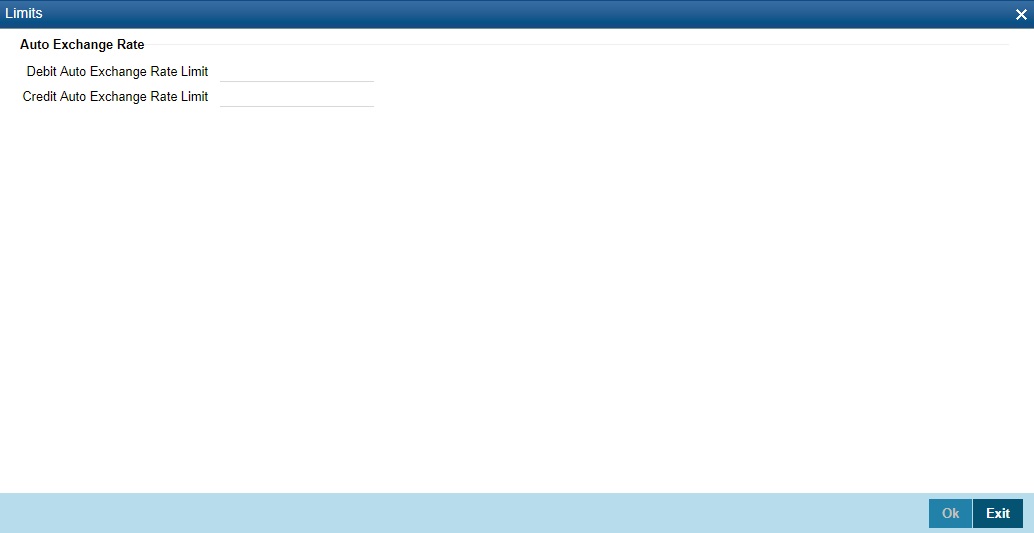

2.6.1.1 PC Button

Click ‘PC’ button in the Currency Definition screen to invoke ‘Limits’ screen.

You can specify the credit limit and the debit limit for the exchange rate in this screen. The transaction amount of a PC contract must not exceed the limit specified here.

Note

As PC remediated from ROFC, the system will not use these values anywhere even though you maintained the values in PC tab

2.6.1.2 Currency Country Mapping Button

Click ‘Currency Country Mapping’ button in the Currency Definition screen to invoke ‘Clearing Zones Country Codes for Currency’ screen.

The screen appears as shown below:

You can map a currency code to a country in this screen.

Currency Code

The system displays the currency code maintained in the system.

Maintenance Country

The system displays the maintenance country for the currency.

Maintenance Country Name

The system displays the name of the country for which the currency is maintained.

Country Code and Description

Country Code

Specify the clearing zone country code. Alternatively, you can select the country code from the option list. The list displays all the country codes maintained in the system.

Country Name

The system displays the name of the clearing zone country.

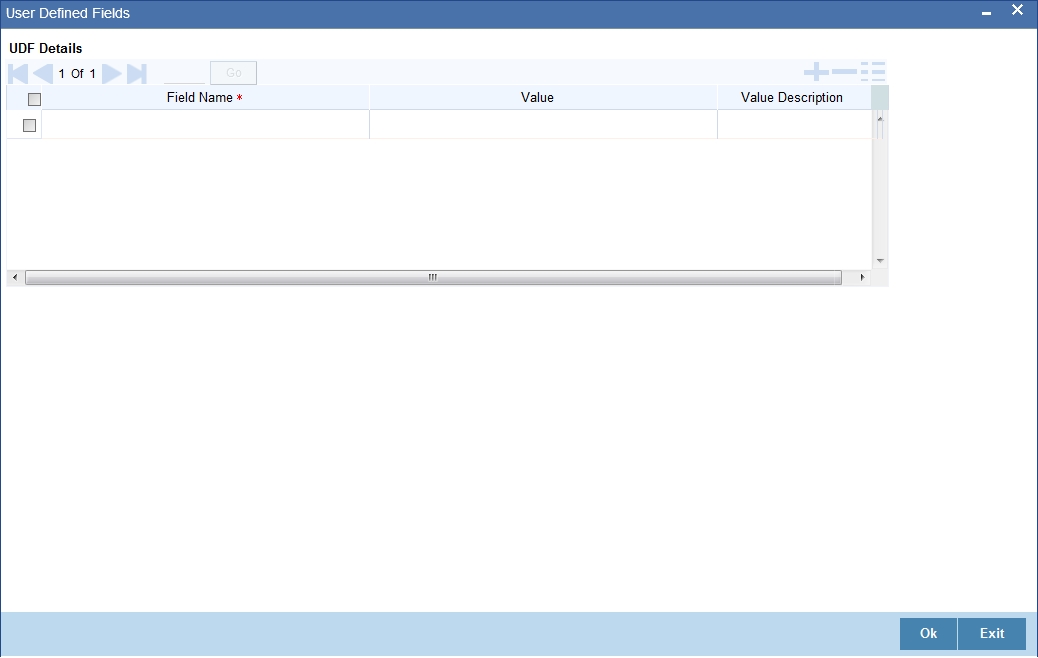

2.6.1.3 Fields Button

You can associate values to all the User Defined fields created and attached to the Currency Definition Screen. You can view the list of User Defined fields associated by clicking the ‘Fields’ button.

The screen appears as shown below:

You can enter the value for the UDFs listed here in the ‘Value’ column.

For more details on how to create user Defined fields, refer chapter ‘Creating custom fields in Oracle FLEXCUBE’ in the User Defined Fields User Manual under Modularity.

2.6.1.4 Annexure

The treatment for interest calculation varies with each of the interest calculation methods. Each method is dealt with individually below:

Actual/Actual Method

10,000x10/100 x (31/365 + 84/366)

In this method, the number of days is calculated as follows:

Dec. -31 days (include from date exclude to date)

Jan -31 days

Feb.-29 days (leap year)

March - 24 days (include from date exclude to date)

Total = 31 + (31+29+24=84) =115

Note

When the interest period crosses from a non-leap year to a leap year (or otherwise), the basis of actual days has to be treated separately in each year.

Therefore, the denominator for the 31 days in December is 365 as it is a non-leap year and the denominator for the 84 days in 2000 is 366 as it is a leap year.

Actual /365 Method

10,000x10/100x115/365

In this method, the number of days is calculated as follows:

Dec. -31 days (include from date exclude to date)

Jan -31 days

Feb.-29 days (leap year)

March - 24 days (include from date exclude to date)

Total=31+31+29+24=115

Actual/360 Method

10,000x10/100x115/360

In this method, the number of days is calculated as follows:

Dec. -31 days (include from date exclude to date)

Jan -31 days

Feb.-29 days (leap year)

March - 24 days (include from date exclude to date)

Total=31+31+29+24=115

30 Euro/Actual Method

10,000x10/100 x (30/365+84/366)

In this method, the number of days is calculated as follows:

Dec. - 30 days (include from date exclude to date)

Jan - 30 days (In 30 Euro Method, all months have 30 days, February included.)

Feb. - 30 days (In 30 Euro Method, February always has 30 days, leap year or not)

March - 24 days (include from date exclude to date)

Total = 113 days

Note

When the interest period crosses from a non-leap year to a leap year (or otherwise), the basis of actual days has to be treated separately in each year.

30 Euro/365 Method

10,000x10/100x114/365

In this method, the number of days is calculated as follows:

Dec. - 30 days (include from date exclude to date)

Jan - 30 days (In 30 Euro Method, all months have 30 days, February included.)

Feb. - 30 days (In 30 Euro Method, February always has 30 days, leap year or not)

March - 24 days (include from date exclude to date)

Total = 113 days

30 Euro/360 Method

10,000x10/100x114/360

In this method, the number of days is calculated as follows:

Dec. - 30 days (include from date exclude to date)

Jan - 30 days (In 30 Euro Method, all months have 30 days, February included.)

Feb. - 30 days (In 30 Euro Method, February always has 30 days, leap year or not)

March - 24 days (include from date exclude to date)

Total = 113 days

30 US/Actual Method

10,000x10/100 x (30/365+84/366)

In this method, the number of days is calculated as follows:

Dec. - 30 days (include from date exclude to date)

Jan - 30 days (In 30 US Method, all months have 30 days, only for February are the actual number of days calculated.)

Feb. - 29 days (In 30 US Method, actual days are accounted for the leap year.)

March - 24 days (include from date exclude to date)

Total = 113 days

Note

When the interest period crosses from a non-leap year to a leap year (or otherwise), the basis of actual days has to be treated separately in each year.

30US/365 Method

10,000x10/100x114/365

In this method, the number of days is calculated as follows:

Dec. - 30 days (include from date exclude to date)

Jan - 30 days (In 30 US Method, all months have 30 days, only for February are the actual number of days calculated.)

Feb. - 29 days (In 30 US Method, actual days are accounted for the leap year.)

March - 24 days (include from date exclude to date)

Total = 113 days

30US/360 Method

10,000x10/100x114/360

In this method, the number of days is calculated as follows:

Dec. - 30 days (include from date exclude to date)

Jan - 30 days (In 30 US Method, all months have 30 days, only for February are the actual number of days calculated.)

Feb. - 29 days (In 30 US Method, actual days are accounted for the leap year.)

March - 24 days (include from date exclude to date)

Total = 113 days

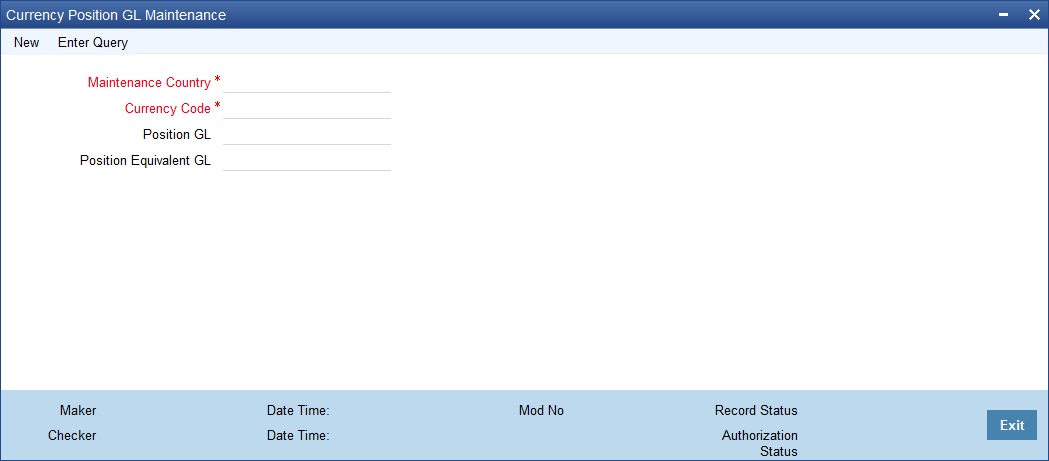

2.6.2 Maintaining Currency Position GL

You can maintain the currency position GL and position eqv GL in ‘Currency Position GL Maintenance’ screen. You can invoke this screen by typing ‘CYDPOSGL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Maintenance Country

Specify the country code for which the currency is maintained. Alternatively, you can select the country code from the option list. The list displays all the authorized and open country codes along with their description maintained in the system.

Currency Code

Specify the currency code. Currencies are identified in Oracle FLEXCUBE by the SWIFT codes assigned to them. The currency will be identified by this code in all transactions that involve it.

Position or Position Equivalent GL for a currency

If you have opted for position accounting in your bank, then you need to maintain the same using CYDPOSGL to indicate the Position GL and the Position Equivalent GL.

When maintaining GLs in your bank, you can opt to link different foreign currencies, associated with GL to either of the following:

- The Position GLs that you specify here (for the corresponding currency)

- Position GLs of your choice

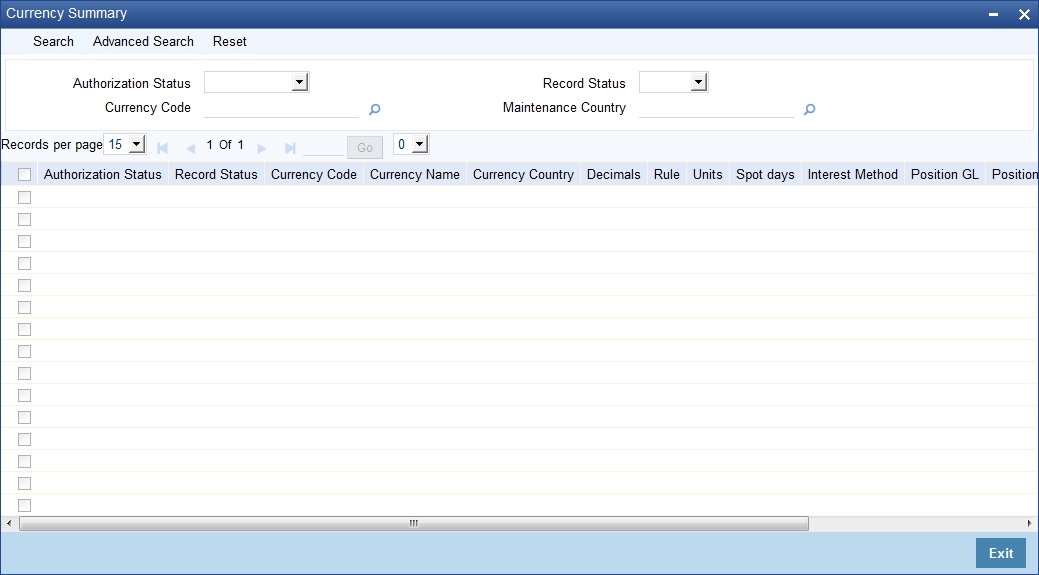

2.6.3 Viewing Currency Summary Details

You can view currency summary details in the ‘Currency Summary’ screen. You can invoke this screen by typing ‘CYSCDEFE’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Authorization Status

- Currency Code

- Record Status

- Maintenance Country

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Authorization Status

- Record Status

- Currency Code

- Currency Name

- Country

- Decimals

- Rule

- Units

- Spot days

- Interest Method

- Position GL

- Position Equivalent GL

- Maintenance Country

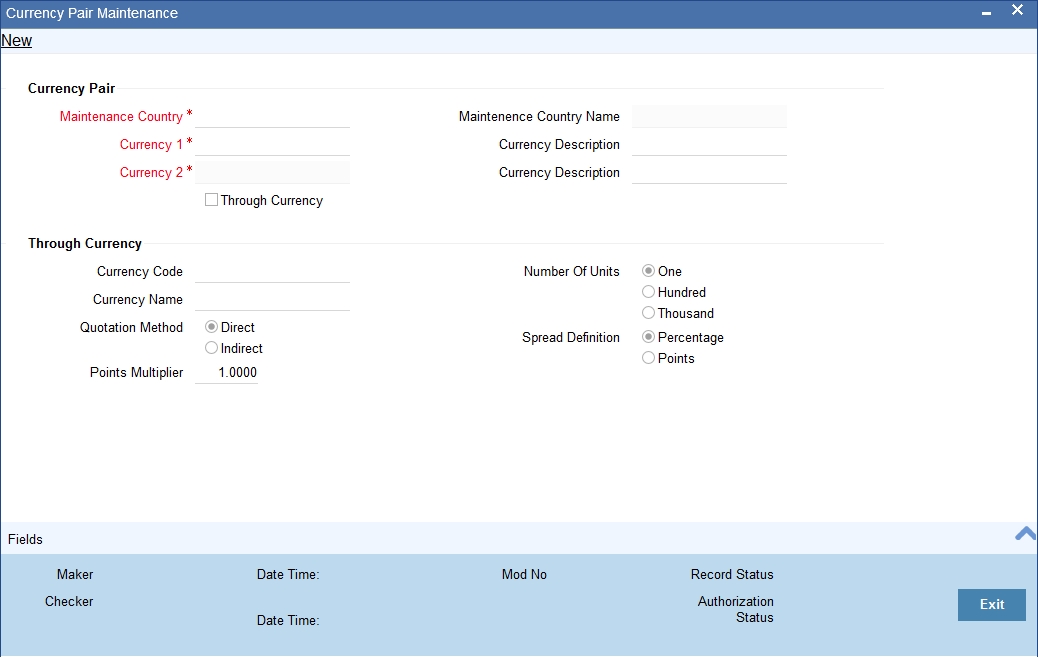

2.6.4 Maintaining Currency Pair

In the foreign exchange markets, the exchange rates for some currency pairs such as the USD-GBP or USD-JPY are easily obtainable, since these are frequently traded. The exchange rates of other currencies such as the ZAR-INR (South African Rand - Indian Rupee), which is not traded very often, is determined through a third currency. This third currency is usually the US dollar, since the US dollar is quoted in all trading centres.

In the Currency pair definition screen, you define the static attributes of currency pairs for which a regular market quote is readily available. For other pairs, which do not have a regular market quote, you need to specify the third currency through which the system should compute the exchange rate.

The currency pair screen is maintained at the bank level by your Head Office branch using the ‘Currency Pair Maintenance’ screen.

You can invoke this screen by typing ‘CYDCCYPR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

System Features

From among the currencies maintained in the currency screen, the system builds all possible combinations of currencies in pairs. For example, if you have maintained the following currency codes: USD, YEN. The system will give you a choice of defining parameters for the following pairs.

- USD-INR

- USD-YEN

- INR-USD

- INR-YEN

- YEN-USD

- YEN-INR

It is however, not obligatory to define parameters for all these pairs. A currency pair needs to be maintained only if:

- You want to define a direct exchange rate for the pair: for frequently traded currencies like INR-USD or USD-GBP or USD-JPY for which market quotes are available.

- You want to define a through currency for the pair: for those currencies which are not so well traded, market quotes may not be available. Therefore you can route the conversion rate for the pair via a ‘through currency’. For example, in the case of GBP-NLG, for which a direct exchange rate may not be available, you can define a through currency say, USD. The exchange rate between GBP-USD and NLG-USD will be picked up by the system to compute the exchange rate between GBP-NLG.

In the absence of a direct exchange rate, the system will look for a through currency to compute the rate. If a ‘through currency’ has not been maintained then the default local currency will be picked up as the through currency to compute the rate for a currency pair.

Currency Pair

Maintenance Country

Specify the country code for which the currency pair is maintained. Alternatively, you can select the country code from the option list. The list displays all the authorized and open country codes along with their description maintained in the system.

For example, if you maintain the country code for a bank or a branch, which is operating in Singapore for the currency USD, then you should specify the country code as SG. The system defaults the field ‘Country’ as US.

Maintenance Country Name

The system displays the name of the country for which the currency pair is maintained.

Currency Pair

A currency pair (specified as Currency1 and Currency2, in the Currency Pair screen) represents the two currencies for which you need to maintain exchange rates.

To specify the pair, choose from the list provided against Currency1. Select the pair for which you want to maintain parameters.

The pair should be selected according to the quotation method followed by the market, which could be direct or indirect (for details refer to the field ‘quotation method’). Exchange rates can be defined for currency1 against currency2 or currency2 against currency1.

The descriptions of the respective currencies are displayed below.

Through Currency

If the exchange rate for a particular currency pair is not to be maintained, specify the ‘Through Currency’ via which the exchange rate between the currencies should be calculated.

To maintain a through currency for a currency pair, check against the box ‘Through Currency’.

Then choose from the list codes provided against Code, Select the currency code, which you want to specify as the ‘through currency’. The exchange rate for the currencies involved in the pair will be calculated using the through currency.

Note

- While maintaining a pair involving an ‘In’ currency (‘In’ – ‘Out’ and ‘In’ – ‘In’), you can only specify the Euro as the ‘Through Currency’. Please note that you cannot maintain a ‘Through Currency’ for a pair constituted by an ‘In’ currency and the Euro.

For more details on the manner in which Oracle FLEXCUBE handles the Euro, refer the chapter ‘Handling the Euro’ in this manual.

Whenever, you define a through currency for a currency pair, you will not be allowed to specify the following for the pair:

- Number of units

- Spread definition

Quotation Method

This is the method to be followed for quoting the exchange rate. There are two methods direct and indirect.

In the Direct method the exchange rate for the currency pair is quoted as follows:

Buy rate = mid rate - buy spread

Sell rate = mid rate + sell spread

Ccy 1 = Rate x Ccy 2

In the Indirect method the exchange rate for the currency pair is quoted as follows:

Buy rate = mid rate + buy spread

Sell rate = mid rate - sell spread

Ccy 2 = Rate x Ccy 1

Example

The market follows the direct quote convention for the currency pair USD-DEM e.g., 1USD=1.6051DEM. To maintain this pair, you would specify currency 1 as USD and currency 2 as DEM, and specify “direct” in this field.

For the USD-GBP pair, which is quoted indirectly (1 GBP = 1, 5021 USD), the USD will be defined as currency 1 and the GBP as currency 2, with the quotation method “indirect”.

Number of Units

This indicates the number of units of currency to be used for currency conversion

Spread Definition

You need to indicate the method in which the spread for a currency pair needs to be defined. There are two ways of defining the spread -- in points and in percentage.

The effective spread can be calculated using any of the following two methods:

- In points — spread x points multiplier

- In percentage — spread/100 x mid rate

The method of spread definition that you specify here applies to two instances:

- While maintaining exchange rates for this currency pair

- While maintaining Customer Spread for this currency pair

2.6.4.1 Specifying Points Multiplier

Points are the smallest unit of measurement in the exchange rate of a currency pair. If you have opted for a points system of defining spread, you should specify the multiplication factor for the points to compute effective spread.

Suppose for the currency pair USD-DEM your rates are as follows:

Mid-Rate: 1.6045

Buy rate: 1.6040

Sell rate: 1.6051

The effective buy spread is 0.0005 (1.6045 - 1.6040) and the effective sell spread is 0.0006 (1.6051 - 1.6045).

In the Rates screen, where you define rates and spreads for a currency pair, you can specify the buy and sell spreads as 5 and 6 instead of as 0.0005 and 0.0006 (i.e., as spread points), and specify here the points multiplier as 0.0001.

The effective spread, buy and sell rates are then computed as follows:

Effective buy spread = Buy spread x Points multiplier = 5 x 0.0001 = 0.0005

Buy rate = Mid rate - Buy spread = 1.6045 – 0.0005 = 1.6040

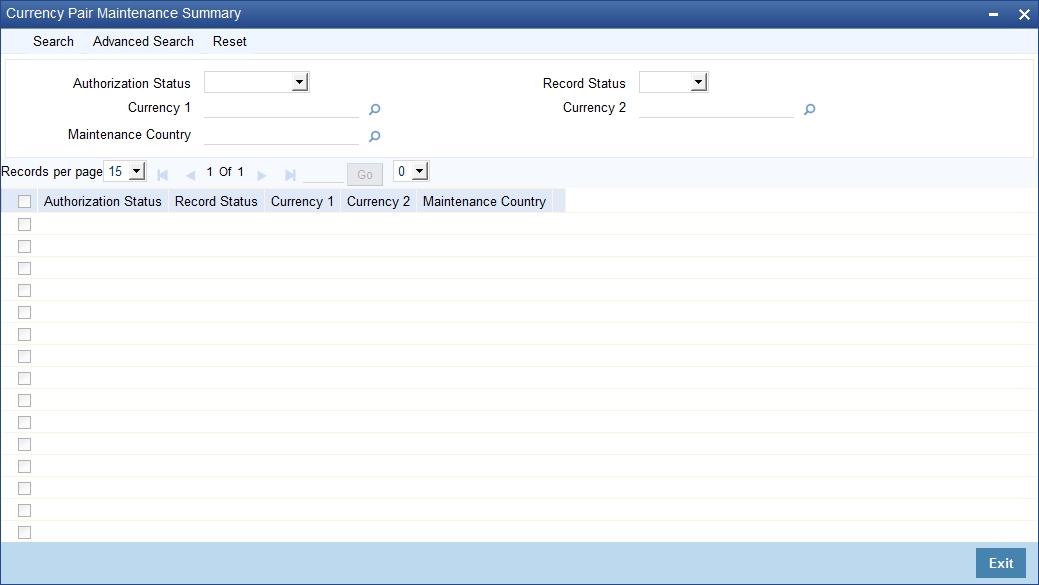

2.6.5 Viewing Currency Pair Summary

You can view the summary details of currency pair in the ‘Currency Pair Summary’ screen. You can invoke this screen by typing ‘CYSCCYPR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Authorization Status

- Currency 1

- Record Status

- Currency 2

- Maintenance Country

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Authorization Status

- Record Status

- Currency 1

- Currency 2

- Maintenance Country

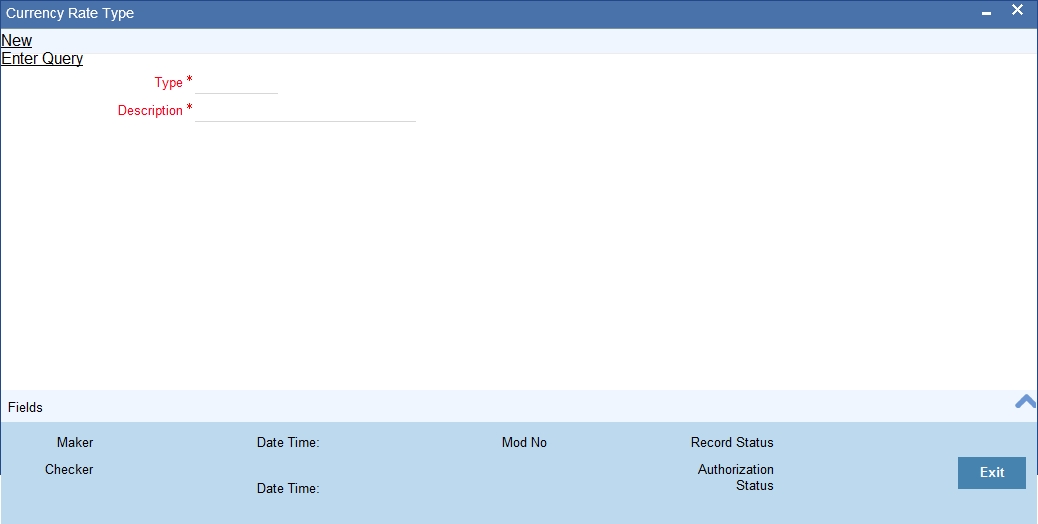

2.6.6 Maintaining Currency Rate Type

You can maintain currency rate types in this screen.

You can invoke ‘Currency Rate Type Maintenance’ screen by typing ‘CYDCRATY’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following fields

Type

Specify the currency rate type.

Description

The system displays the currency rate description.

2.6.7 Maintaining Currency Exchange Rates

In the Currency Rates screen, you can maintain exchange rates for a currency pair, the rates at which you buy and sell one currency for another.

A bank determines its buy and sell rate for a currency pair by applying a spread (i.e., its profit margin) to the mid-rate of the currency pair. Mid rate is the basic rate at which a currency pair is exchanged.

The spread applied for a currency pair varies with the transaction type, while the mid-rate usually remains constant. Consequently, different rates are applicable to different transaction types. For instance dollars in currency are purchased at a certain rate, while USD traveler’s checks are bought at a different rate. In Oracle FLEXCUBE, you can define a rate type which you would like to associate with a transaction type e.g., ‘CASH’, ‘TRAVCHKS’, etc., in the Rates screen.

In the Currency Rates Maintenance screen, you define the mid-rate, buy and sell spread applicable to each rate type; the buy and sell exchange rates are computed by the system.

Buy rates and sell rates can either be maintained by individual branches or can be input by the HO and propagated to all the branches.

If the flag ‘Copy Exchange Rates to Branches’ is set to Yes at ‘Bank Parameter Level’, then on authorization of exchange rate maintenance:

- If the branch for which the rate is being uploaded or maintained is the head office branch, then the rate would be copied to all those branches that have the same country code as the head office branch.

- If the branch for which the rate is being uploaded or maintained is not the head office branch, but it has the same country code as the head office branch, then the rate being uploaded or maintained would be specific to the branch and would not be copied to any other branch.

- If the branch for which the rate is being uploaded or maintained is not the head office branch and also does not have the same country code as the head office branch, then the rate being maintained would be copied to all the branches that has the same country code linked as the branch for which the rate is being maintained or uploaded.

In the Bank-wide Preferences screen, if you have not specified ‘copy exchange rate to branches’ then the ‘Currency Exchange Rates Input’ screen is maintained at the branch level by the different branches.

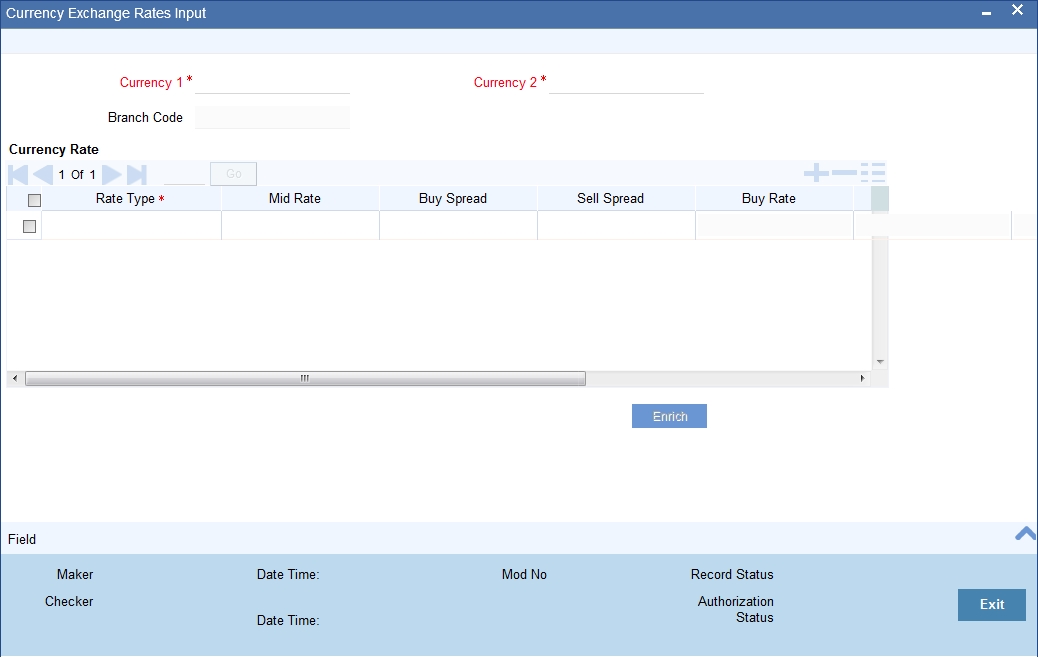

You can invoke this screen by typing ‘CYDRATEE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.The screen appears as shown below:

In this screen you maintain the following parameters for each rate type of a currency pair:

- Mid rate

- Buy spread and Sale spread

- Buy rate and Sale rate

Currency 1 and 2

Specify the currency pair for which you want to compute the exchange rates. The list displays the currency pair that are maintained for the country to which the branch belongs.

The pair should be selected keeping in mind the quotation method for exchange rates as followed by the market. The system offers the choice of maintaining both the currencies as currency1 or currency 2 -- USD against DEM and DEM against USD.

For the pair specified the following parameters need to be maintained to arrive at the buy and sell rate of currencies:

- Rate Type

- Mid Rate

- Buy Spread

- Sell Spread

Rate Type

This is the rate type for which you are maintaining exchange rates for a currency pair. For different transaction categories your bank would like to maintain different exchange rates. For example, traveller’s check is purchased at a certain rate whereas a bill of exchange is bought at a different rate.

In the front-end-modules, where you define products to cater to the various transaction types of your bank, you can link an appropriate rate type to the product. For instance, you create a product to cater to outgoing cross currency transfers by SWIFT. For this product, if you define the rate type to be STANDARD then for all contracts linked to this product, the Standard Rate Type would be applied.

Mid Rate

Mid rate is an indicative exchange rate for a currency pair. It is the average of the buy and sell rate quoted by the market for a currency pair.

For example,

currency 1 = USD

Currency 2 = INR

Buy rate -- 1 USD = 1.7020 INR

Sell rate -- 1 USD = 1.7040 INR

Mid-Rate = 1.7030

Buy Spread

This is the buy spread for a currency pair. It can be defined as the profit margin specified over the mid rate when you buy currency 1 for currency2. You can define the buy spread in two ways -- either in points or in percentage. The system computes the effective buy spread for you.

Sale Spread

This is the sell spread for a currency pair. It can be defined as the profit margin specified over the mid rate when you sell currency 1 for currency 2. You can define the sell spread either in points or in percentage. The system computes the effective sell spread for you.

Buy Rate

Buy rate is the rate of exchange for a currency pair, which is computed by the system based upon the mid rate, the spread specified, the spread definition and the quotation method maintained in the ‘Currency definition’ screen.

Sale Rate

Sell rate is the rate of exchange for a currency pair, which is computed by the system based upon the mid rate, the spread specified, the spread definition and the quotation method maintained in the ‘Currency definition’ screen.

You can also input the buy and sell rate for a currency pair. In which case, the system will compute the spread for the rate type.

Rate Date

This is a display field. When you enter the exchange rate for a currency pair, the system will default the Rate Date as the Application Date. The rate date will always be less than or equal to the application date.

Rate Serial

This is a running serial number for the Rate Date. You need to specify the serial number. You entry will be validated for uniqueness. For example, there could be only one exchange rate between USD and EUR for 31/07/2003 with Rate Type STANDARD with Rate Serial as 0001. Thus, this will be a unique rate serial for a currency pair, rate type combination for a given rate date.

When you enter the exchange rate for a currency pair, the system will default the Rate Date as the Application Date and the Rate Serial as the latest available serial for the currency pair + 1. The Rate Serial Number will be system generated. However, you can modify it if required. This number takes into account the Rate Serial Number present in the Currency Rates History screen too. The Rate Serial Number and the Rate Date will be displayed during authorization of the Rate in the Currency Authorization screen.

2.6.7.1 Authorizing Exchange Rates

Authorization of exchange rates is done from the Currency Exchange Rates input screen. Details like old value, new value for each field (buy rate, mid rate etc) are displayed. Click authorise icon to authorize the record.

2.6.7.2 Revising Exchange Rates

For revising the exchange rates for your bank or the branches invoke the ‘Currency Maintenance’ screen. Click the currency pair whose exchange rate you want to revise and click unlock icon on the toolbar. Input/modify the new rates for the pair.

2.6.8 Viewing Exchange Rates

You can view the exchange rates in the ‘Currency Exchange Rates View’ screen. You cannot input any values. You also have the option of specifying whether you want to view authorized rates or the unauthorized rates for any currency pair.

You can invoke this screen by typing ‘CYSRATEE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen appears as shown below:

If the branches pick up the exchange rates maintained by the HO, then each time you invoke the ‘currency view’ screen from a branch it is advisable to update this screen with the latest rate input, from the HO. To do this, click on ‘Refresh’. Refresh updates the screen with the last exchange rates input.

2.6.8.1 Currency Rate Notification

You can update the exchange rates in the screen or upload through XML or upload through generic interface. The system generates a notification on authorization of the modified exchange rates.

If the parameter ‘Copy Exchange Rates to Branches' at bank parameter level is selected, then the rates will be populated and notifications will be generated in all the branches.

2.7 Currency Holiday Maintenance

This section contains the following topics:

- Section 2.7.1, "Maintaining Currency Holiday Calendar"

- Section 2.7.2, "Steps to Define Currency Holidays"

- Section 2.7.3, "Defining Currency Holidays"

2.7.1 Maintaining Currency Holiday Calendar

You need to maintain a yearly list of holidays, for the currencies, defined in the currency screen. This is done in the ‘Currency Holiday Calendar’ screen.

The system uses the information maintained in this screen to check whether any settlement, involving a foreign currency (in the foreign Exchange, Money market, Funds Transfer, Loans & Deposit modules) falls on that currency’s holiday. If yes, then the system will display a message stating so, and ask the user for an override

For any schedule or contract maturing at a future date say, 5 years hence, you can input the future date, only if the calendar for that year has been maintained.

The currency holiday screen is maintained at the Bank Level by the Head Office

You can maintain holiday calender for a currency in this screen. You can invoke the ‘Currency Holiday Calender Maintenance’ screen by typing ‘STDCCHOL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following fields:

Currency code

Specify the currency code. Alternatively, you can select the currency code from the option list. The list displays all valid currency codes maintained in the system.

Year

Select the year.

In this screen, you can maintain a list of holidays for each of the currencies maintained in the ‘currency screen’, for any year between 1 AD and 4000 AD.

2.7.2 Steps to Define Currency Holidays

To define currency holidays for a year, (for instance, for 2000) you have to do the following:

Building the calendar for the year

Step 1

Select ‘new’ from the Actions menu in the Application tool bar or click new icon. A blank screen appears and the cursor moves to the field ‘Year’

Step 2

Enter the year -- 2000 or move to the year 2000 using the arrows

Step 3

To build the calendar for the year, 2000 click on the ‘Refresh’ button. This button is called the ‘refresh / build up’ button because it builds the calendar for you

Step 4

Select the currency for which you are defining holidays. Please note:

- On invoking the calendar of any year, you will notice that Saturdays and Sundays are marked as weekly holidays for the currency. This is the default setting of the system.

- For identification, the working days are marked in black and the holidays in red.

2.7.3 Defining Currency Holidays

To define any other weekly holiday for the currency, other than the default, double click the day of the week, listed on the top row of the screen. For instance, if you double click ‘F’, all Fridays in the year would be marked as holidays.

To clear off the default weekly holidays — Saturdays and Sundays, double click on ‘sa’ and ‘s’ written on the top row.

To define annual holidays, click on the particular date to mark the selected date as a holiday.

If you want to unmark a day specified earlier as a holiday, double click on it, once again. You will notice that the day gets marked in black.

2.8 Floating Rates Definition

This section contains the following topics:

- Section 2.8.1, "Invoking LD MM Floating Rate Input Screen"

- Section 2.8.2, "Invoking Rate Code Definition Screen"

- Section 2.8.3, "Capturing Currency Details"

- Section 2.8.4, "Specifying Effective Date and Amount Slab Details"

- Section 2.8.5, "Tenor and Interest Rate Details"

- Section 2.8.6, "Rate Code Usage"

2.8.1 Invoking LD MM Floating Rate Input Screen

The Interest Rate Type of a product can be one of the following:

- Fixed

- Floating

- Special

A Floating Rate corresponds to the market rates for the day. These rates are maintained and updated daily (or whenever they change) in the Floating Rates Table. The rates can be applied on a contract with or without a spread.

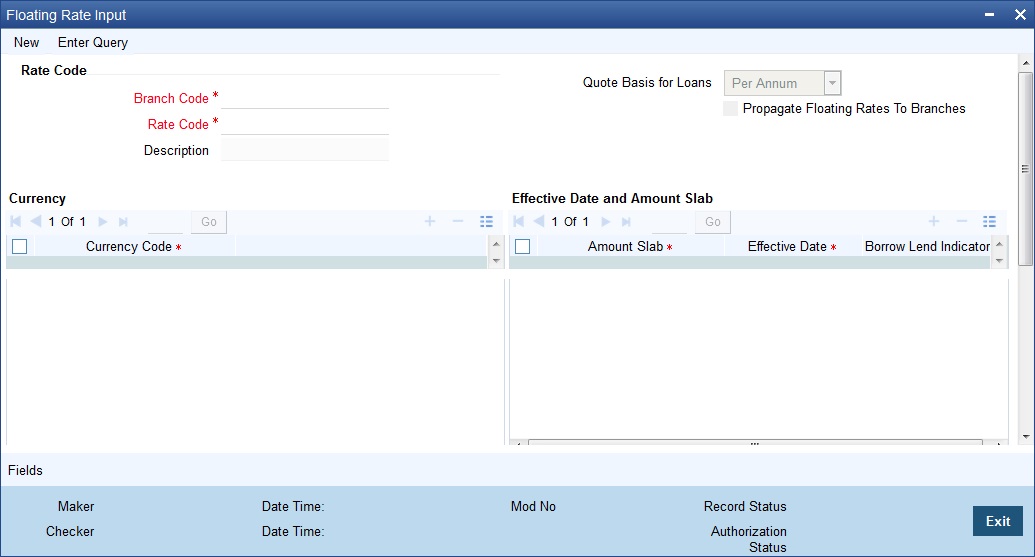

You can define Floating Interest Rates through the ‘LD MM Floating Rate Input’ screen. You can invoke this screen by typing ‘CFDFLTRI’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Rate Code

Specify the rate code to identify the Floating Rate you are defining. Alternatively, you can select the rate code from the list of values. The list displays all valid rate codes maintained in the ‘Rate Code Definition’ Screen (CFDFRTCD)

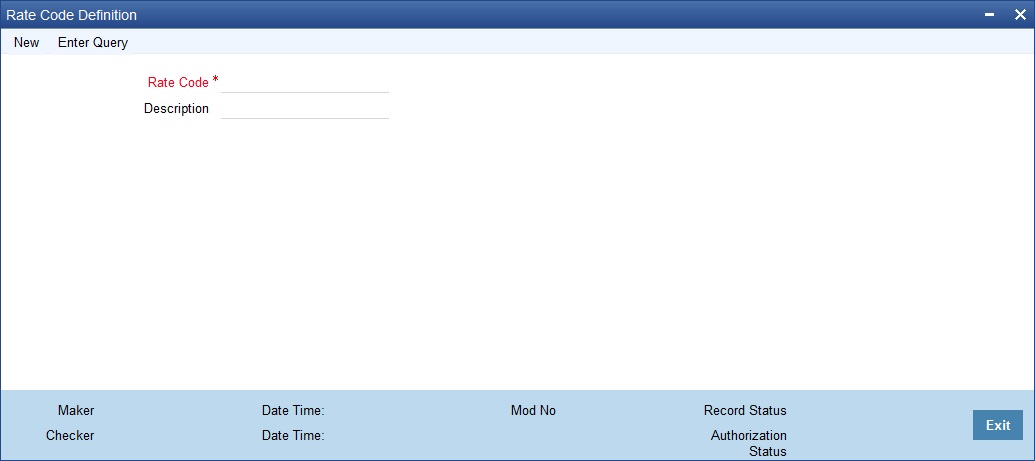

2.8.2 Invoking Rate Code Definition Screen

A Rate Code identifies a set of rates defined for a combination of Currency, Amount Limit (optional), Tenor and Effective Date. You can define rate codes through the ‘Rate Code Definition’ screen. You can invoke this screen by typing ‘CFDFRTCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Rate Code

Specify a code to identify the Floating Rate you are defining. You can associate several currencies to the rate code and specify rates for each currency. While processing a contract, you need to indicate this code to make the rate applicable to the contract.

Description

Specify a unique description for the rate code.

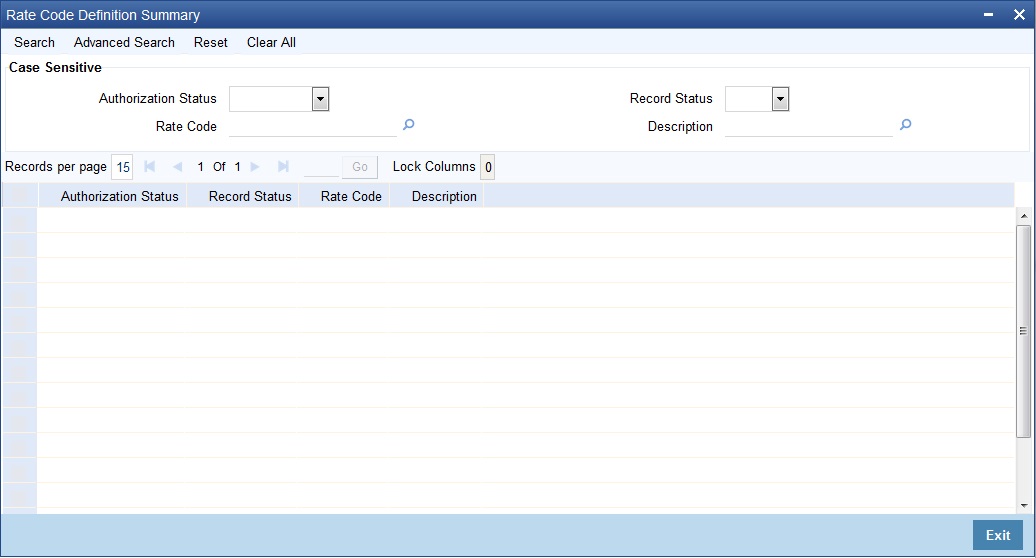

2.8.2.1 Viewing Rate Code Definition Summary

You can view the Rate Code Definition details using ‘Rate Code Definition Summary’ screen. You can invoke this screen by typing ‘CFSFRTCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

This summary screen can be used to search for external systems which match the data specified for any of the following criteria:

- Authorization Status

- Record Status

- Rate Code

- Description

For each record fetched by the system based on your query criteria, the following details are displayed:

- Authorization Status

- Record Status

- Rate Code

- Description

2.8.3 Capturing Currency Details

Each Rate Code is associated with a currency. You can define rates for the same Rate Code in different currencies.

For example, you can have a Rate Code TERMDEP45 (with a description of Rates for a Term Deposit of 45 days). Thus, you can define a set of rates for contracts in U S Dollar and another set for contracts in Great British Pounds.

When you link a contract in US Dollars to the Rate Code TERMDEP45, the rates defined for this currency will be applied. Similarly, if the contract is in Great Britain Pounds, the rates defined for that currency will be applied.

2.8.4 Specifying Effective Date and Amount Slab Details

Amount Slab

For a specific Rate Code and Currency combination, you can define an amount slab structure for application of interest rates. You should specify the upper limit of the slab to which a particular rate should be applied. A rate that has been defined for an Effective Date - Amount Slab combination will be applicable to an amount less than or equal to the specified amount. You can thus define interest rates for a slab structure.

Let us extend the example we discussed for Rates and Effective Dates to include amount limits.

Amount (USD) |

Effective Date |

Interest Rate |

10,000 |

01 January ‘97 |

12.5% |

50,000 |

01 January ‘97 |

13.0% |

999.9 million |

01 January ‘97 |

14.0% |

If the rates have to be applied on 01 January ‘97, they will be picked up as follows:

- For a deposit with an amount less than or equal to USD 10, 000, the rate will be 12.5%.

- For a deposit with an amount greater than USD 10,000 and less than or equal to 50,000, the rate will be 13%.

- For a deposit with an amount greater than USD 50,000 and less than or equal to USD 999.9 millionth, the rate applied will be 14%.

Note

Notice that a huge amount (999.9 million) has been given as the last amount limit. This denotes that after 50,000 there is no upper limit in the slab. Further, if the component amount is greater than the highest slab, the appropriate rate for highest amount slab will be applied. Similarly, if the component amount is lesser than the lowest amount slab, the appropriate rate for lowest slab will be applied.

Effective Date

Each rate that you define for a Rate Code and Currency combination should have an Effective Date associated with it. This is the date on which the rate comes into effect. Once a rate comes into effect, it will be applicable till a rate with another Effective Date is given for the same Rate Code and Currency combination.

The following example illustrates this point:

Rate Code: TERMDEP45

Currency: US Dollar

Effective Date |

Interest Rate |

01 January ‘97 |

12.5% |

14 January ‘97 |

12.0% |

31 January ‘97 |

13.0% |

These rates will be applicable as follows:

Period |

Interest Rate |

01 January to 13 January ‘97 |

12.5% |

14 January to 30 January ‘97 |

12.0% |

31 January to one day before the next date |

13.0% |

Note

The rates will be applied to a contract depending on whether it has been defined with Auto Rate Code Usage or Periodic Rate Code Usage. You can specify this in the Product ICCF Details screen.

Borrow/Lend Rate Indication

For every Amount Limit - Effective Date combination, you should define the rate to be applied as a borrow rate or a lend rate. You also have the option to specify the mid rate.

2.8.5 Tenor and Interest Rate Details

The rates that will be applied for a given combination of Amount Slab – Effective Date – Lend/Borrow Indication can be tenor based. In the table, you can define tenors and indicate the rates applicable to each tenor. The rate will be applied to contracts based on the slab into which it falls and the reset tenor defined for the component.

2.8.6 Rate Code Usage

If you specify Auto Rate Code usage, all the rate changes made during the liquidation or accrual period will be considered. If you specify periodic rate code usage, the rates will be periodically refreshed and the rates as of a specific frequency will be applied.

This frequency is specified in the Contract Schedules screen while the Rate Code Usage is specified in the Product ICCF Details screen. The following example illustrates the concept:

For example, you have a deposit that has a Start Date as 1 October 1997 and a Maturity Date as 30 November 1997. The interest payment frequency is to be monthly. The contract has been defined with a floating rate.

The rates in the floating rate table change in the following manner:

Effective Date |

Rate |

1 October ‘97 |

12 |

12 October ‘97 |

11.5 |

25 October ‘97 |

11 |

15 November ‘97 |

12 |

30 November ‘97 |

12.5 |

If you want the floating rates to be applied automatically every time they change, you should specify Auto Rate Code usage in the Product ICCF screen. When you do this, if the first interest payment is to be done on 31 October, all the rate changes between 1 October and 31 October will be considered automatically.

The rates will be applied for the number of days for which they remained unchanged in the rate table, as follows:

From |

To |

Rate |

1 October |

11 October |

12 |

12 October |

24 October |

11.5 |

25 October |

31 October |

11 |

If you want the floating rates to be refreshed periodically, you should first specify the rate code usage as periodic, through the Product ICCF Details screen.

Next, you should define the rate revision schedules to specify when these rates should be applied on the deposit (that is, the frequency at which rates should be refreshed).

To do this, through the Contract Schedules screen, mark the component as a revision schedule by checking the Rev box. Then, specify the component (for example, INTEREST). Specify the frequency at which the interest rate has to be refreshed, say every fortnight. Specify the Start Date as, say, 15 October. That is, for a deposit defined with periodic rate code application, the rates prevailing on the dates at the frequency you have specified will be used for accruals and liquidation.

In the deposit we are discussing, with the frequency at which the rates should be refreshed defined as fortnightly and the Start Date as 15 October, the rate applied for the payment on 31 October will be as follows:

From |

To |

Rate |

1 October |

15 October |

11.5 |

16 October |

31 October |

11 |

Note

Rev schedules are applicable only for contracts where the Rate Type is Floating and the Code Usage is Periodic. If the Code Usage is Automatic the system applies the effective rate whenever the underlying Rate gets updated.

2.9 External Entities Maintenance

This section contains the following topic:

- Section 2.9.1, "Maintaining External Chart of Accounts"

- Section 2.9.2, "Maintaining External Transaction Code"

- Section 2.9.3, "Maintaining External Credit Approval"

- Section 2.9.4, "Maintaining External Customer Input"

- Section 2.9.5, "Viewing External Customer Summary"

- Section 2.9.6, "Maintaining External Customer Account"

- Section 2.9.7, "Mapping External Multi Currency Accounts"

- Section 2.9.8, "Maintaining External Consumer Loan Account"

2.9.1 Maintaining External Chart of Accounts

You can invoke ‘External Chart of Accounts’ screen by typing ‘STDCRGLM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

GL Code

Specify a code for the General Ledger.

General Ledger Description

Specify a description for the General Ledger code.

GL Category

Select the category of the General Ledger from the drop-down list. The list displays the following values:

- Asset

- Liability

- Income

- Expense

- Contingent Asset

- Contingent Liability

- Memo

- Position

- Position Equivalent

Blocked

Check this box to block the GL for accounting entries.

2.9.2 Maintaining External Transaction Code

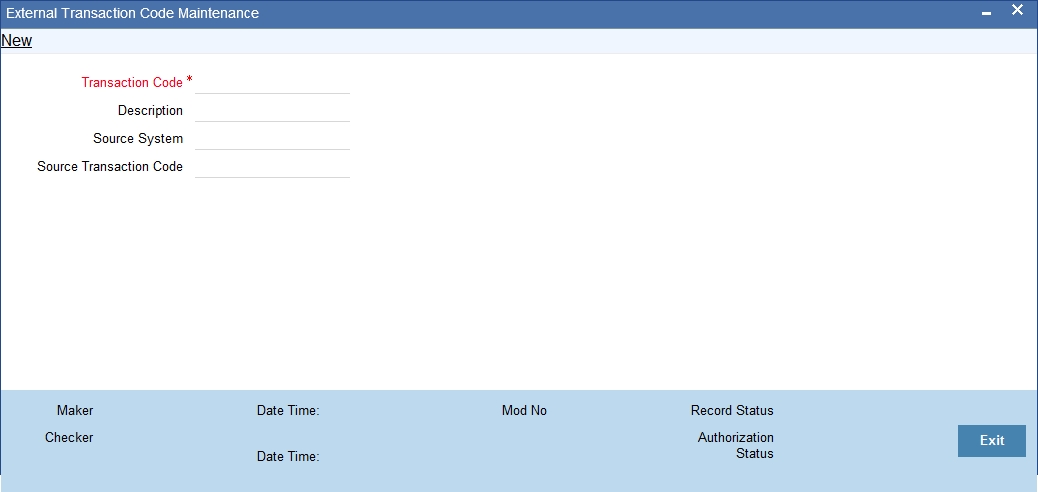

You can invoke ‘External Transaction Code Maintenance’ screen by typing ‘STDCRTRN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Transaction Code

Specify the transaction code of the external transaction.

Transaction Code Description

Specify the description of the transaction code.

Source System

Specify the source system of the transaction code.

Source Transaction Code

Specify the source of the transaction code.

2.9.3 Maintaining External Credit Approval

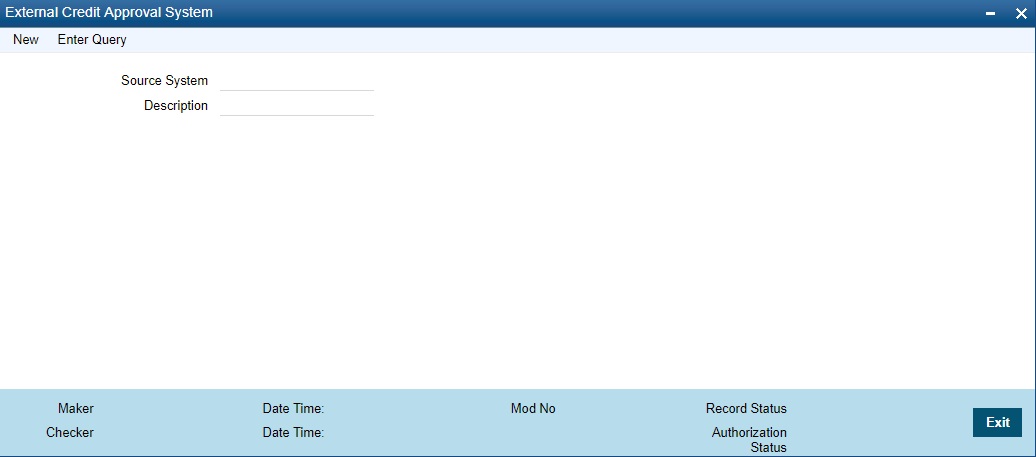

You can invoke ‘External Credit Approval System’ screen by typing STDECAMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Source System

Specify the source system.

Description

Specify the description of the source system.

2.9.4 Maintaining External Customer Input

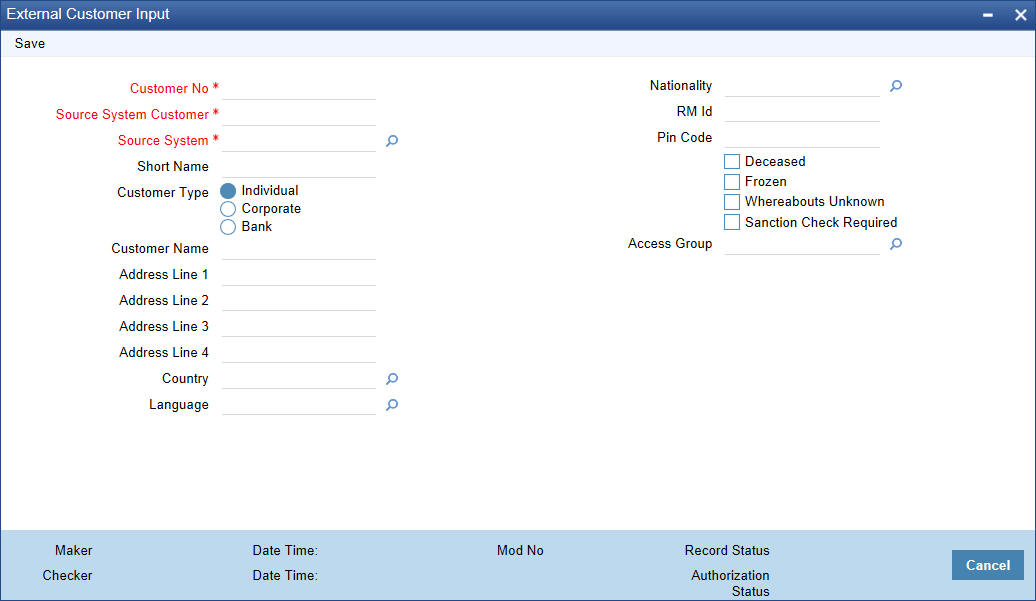

You can invoke ‘External Customer Input’ screen by typing ‘STDCIFCR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Customer Number

Specify the customer number.

Source System

Specifies the source system.

Source Customer ID

Specify the customer identification details as per the source system.

Short Name

Specifies the short name of the customer.

Customer Type

Select the required type of customer. Choose any of the following:

- Individual - Click this button if the customer is an individual customer.

- Corporate - Click this button if the customer is a corporate customer.

- Bank - Click this button if the customer is a bank employee.

Address Line 1

Specify the first line of the customer’s address.

Address Line 2

Specify the second line of the customer’s address.

Address Line 3

Specify the third line of the customer’s address.

Address Line 4

Specify the fourth line of the customer’s address.

Pin code

Specifies the pin code of the customer’s address.

Country

Select the country of the customer’s address.

Language

Select the language of customer’s preferred language of communication.

Nationality

Specify the nationality of the customer.

Customer Category

Specify the required category of customer.

Deceased

Check this box if the customer is deceased.

Frozen

Check this box if the customer’s account is frozen.

Whereabouts Unknown

Check this box of the customer’s whereabouts are not known.

RM ID

Specify the relationship id of the customer’s relationship manager.

Access Group

Specify the access group. Alternatively, you can select the access group from the option list. The list displays all valid access group maintained in ‘Customer Access Group Maintenance’ screen (STDACGRP).

Note

When you try viewing details of a customer whose data is forgotten, the system displays an error message.

For more information on forgetting customers refer Core Services - Security Management System user guide.

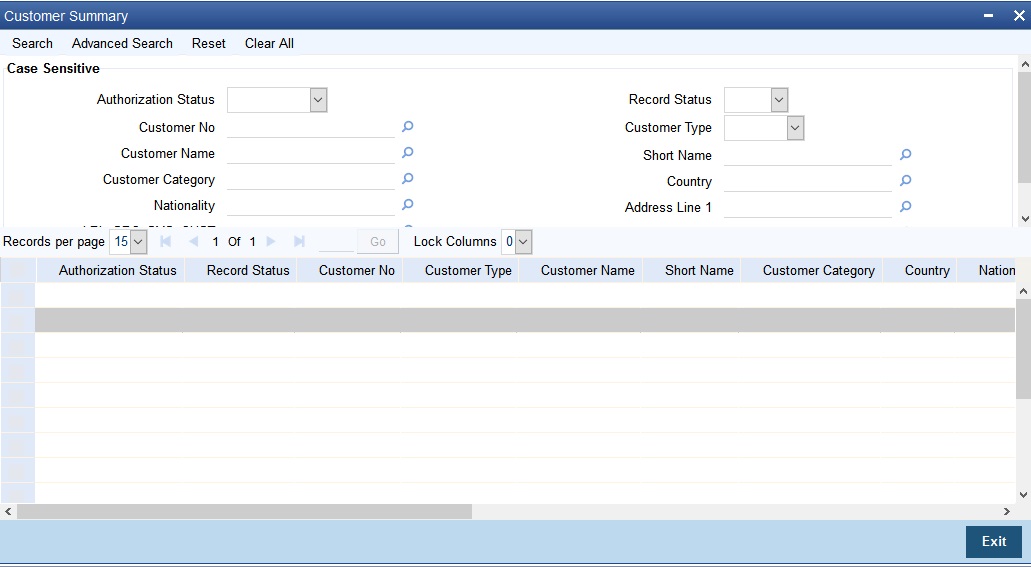

2.9.5 Viewing External Customer Summary

You can view the uploaded data in the ‘Customer Summary’ screen.You can invoke the ‘Customer Summary’ screen by typing ‘STSCIFCR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The query option is available on the following fields in this screen:

- Authorization Status

- Record Status

- Customer No.

- Customer Type

- Customer Name

- Short Name

- Customer Category

- Country

- Nationality

- Address Line 1

- Source System Customer

- Source System

Note:

When you try viewing details of a customer whose data is forgotten you see a message saying that no record exists.

For more information on forgetting customers refer Core Services - Security Management System user guide.

2.9.6 Maintaining External Customer Account

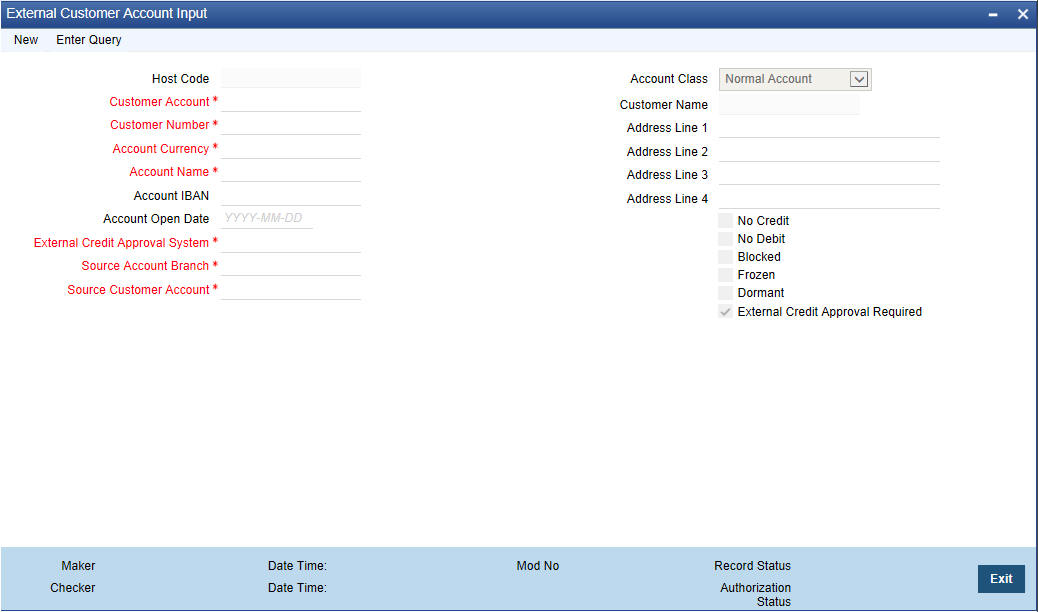

You can invoke ‘External Customer Account’ screen by typing ‘STDCRACC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Customer Account

Specify the customer account number.

Customer Number

Specify the required customer number. Alternatively, you can select the customer number from the option list. The list displays all valid customer numbers maintained in the system.

Account Branch

Specify the account branch.

Account Currency

Specify the required currency of the external customer. Alternatively, you can select the currency from the option list. The list displays all valid currencies maintained in the system.

Account IBAN

Specify the IBAN that is linked to the customer.

Account Name

Specify the name of the account holder.

Host Code

Specify the host code that is linked to the logged in user of the branch.

External Credit Approval System

Specify the External Credit Approval System for which accounts are mapped. Alternatively, you can select the ECA from the option list. The list displays all valid ECA systems maintained in the system.

Account Class

Select the required account class of the external customer account. Choose between the following:

- Normal Account

- Nostro Account

- Multi Currency Account

The account currency should be null if account class is selected as multi currency account. The system throws an error message if the account class is selected as multi currency account and the account currency is specified.

No Credit

Check this box to indicate that the account does not have any credit facility.

No Debit

Check this box to indicate that the account does not have any debit facility.

Blocked

Check this box to indicate that the account status is blocked.

Frozen

Check this box to indicate that the account status is frozen.

Dormant

Check this box to indicate that the account status is dormant.

External Credit Approval Required

Check this box to indicate that ECA check is required for the external customer account.

Note

When you try viewing details of a customer whose data is forgotten, the system displays an error message.

For more information on forgetting customers refer Core Services - Security Management System user guide.

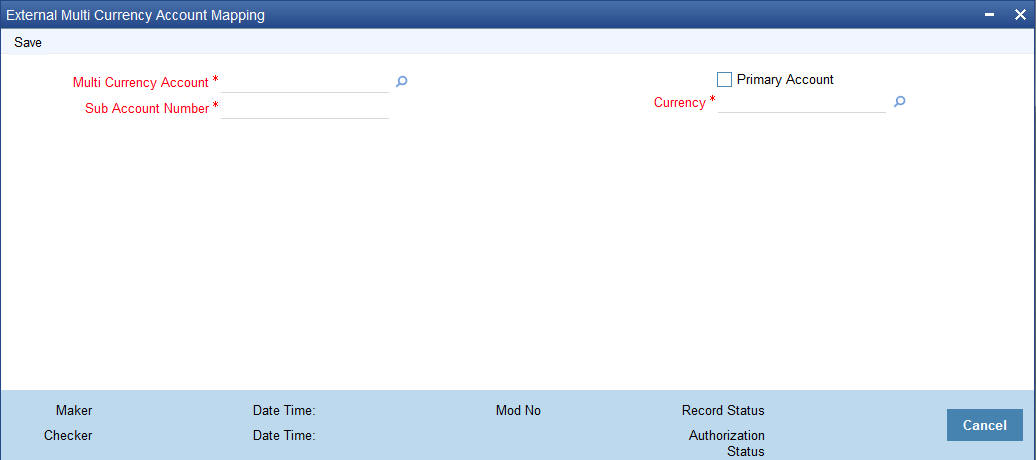

2.9.7 Mapping External Multi Currency Accounts

You can map multi currency accounts and their currency with real accounts using ‘External Multi Currency Account Mapping’ screen. You can invoke this screen by typing ‘STDCRMCA’ in the top right corner of the Application toolbar and clicking the adjoining arrow button.

You can maintain the following in this screen:

Multi Currency Account

Specify the multi currency account. Alternatively, you can select the multi currency account from the option list. The list displays all the external multi currency accounts.

Sub Account Number

Specify the sub account number.

Primary Account

Check this box to indicate that the selected sub account number is the primary account. You can mark only one account under a multi currency account as primary account.

Currency

Specify the currency of the sub account number. Alternatively, you can select the currency from the option list. The list displays all valid currencies maintained in the system.

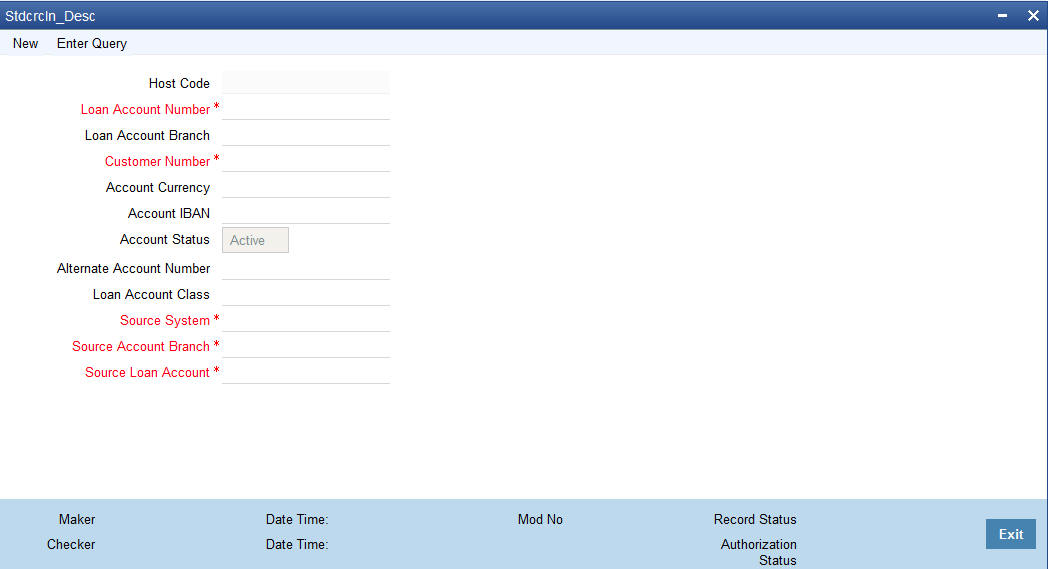

2.9.8 Maintaining External Consumer Loan Account

You can capture consumer loan account details in the ‘External Consumer Loan Account Input’ screen. You can invoke this screen by typing ‘STDCRCLN’ in the top right corner of the Application toolbar and clicking the adjoining arrow button.

Specify the following details:

Host Code

Specify the host code of the external consumer loan account.

Loan Account Number

Specify the consumer loan account number.

Loan Account Branch

Specify the consumer loan branch.

Customer Number

Specify the customer number of the external consumer loan account.

Account Currency

Specify the currency of external consumer loan account.

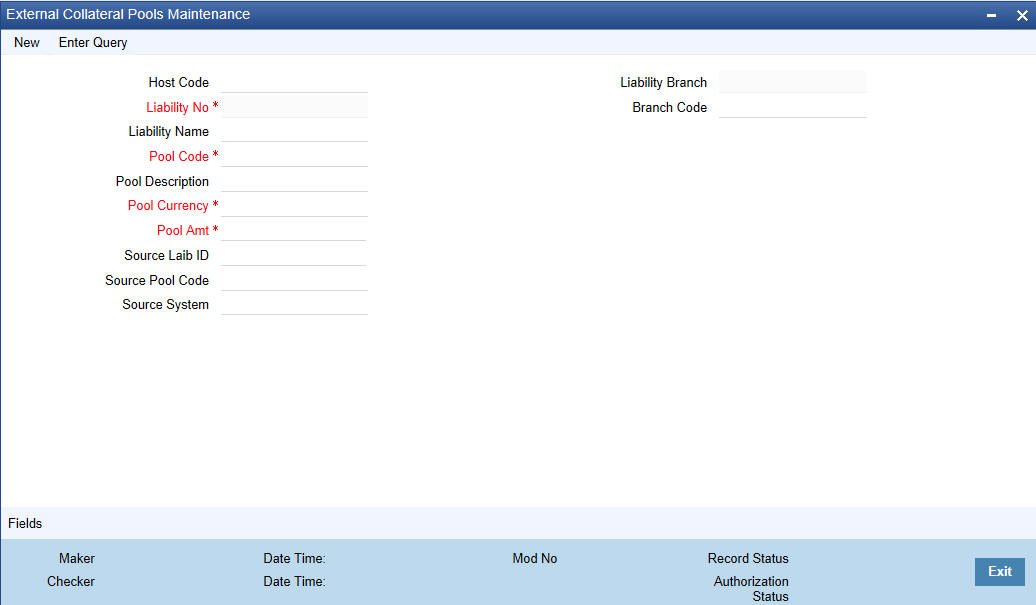

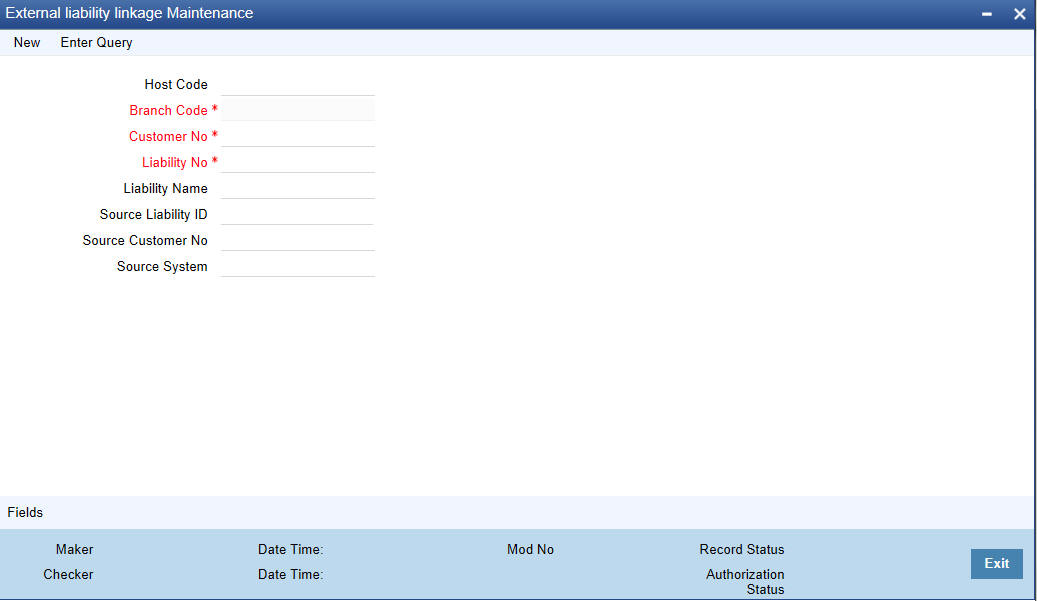

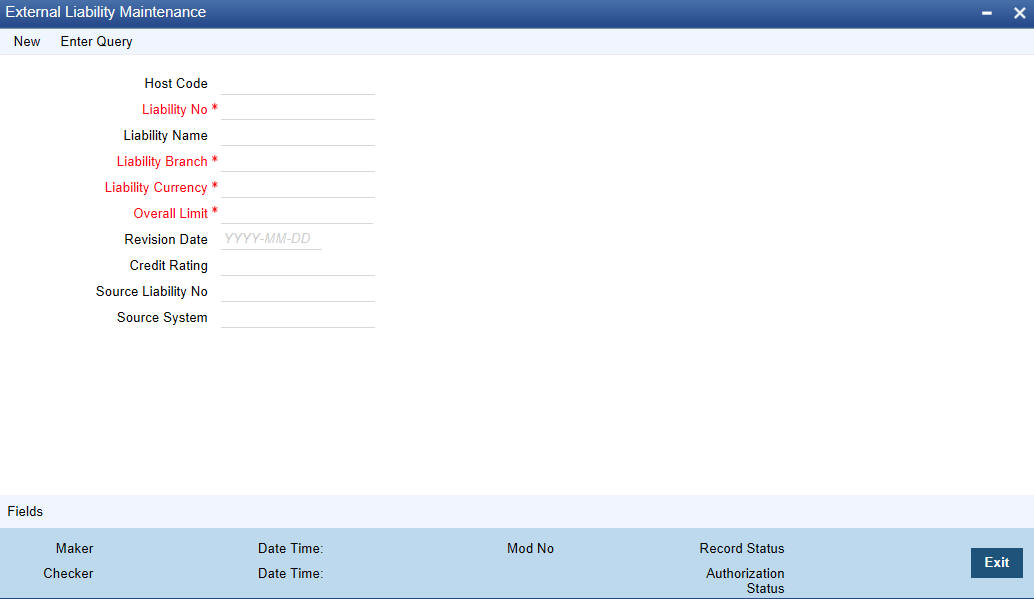

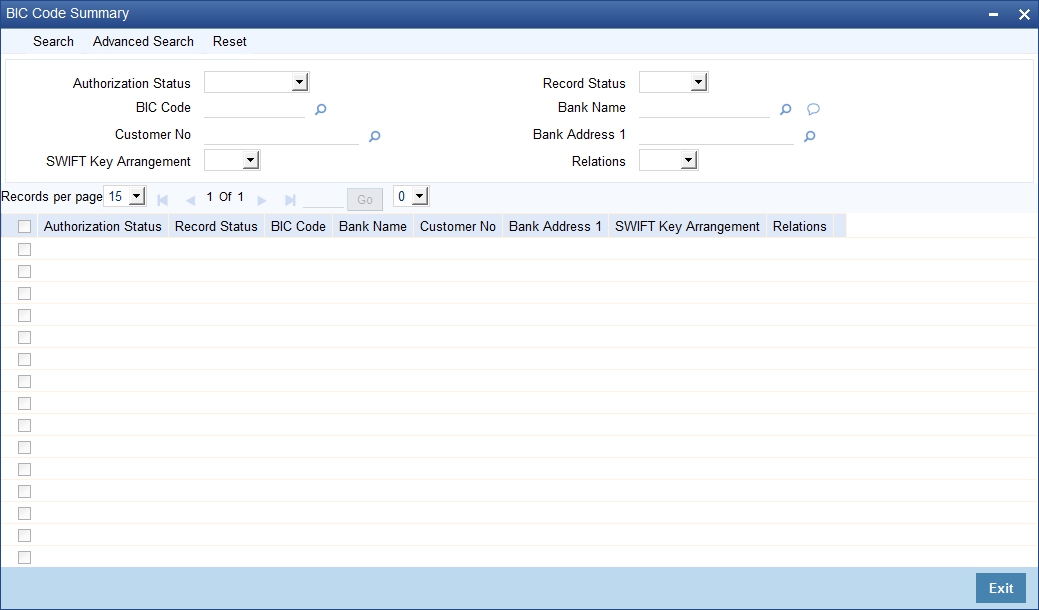

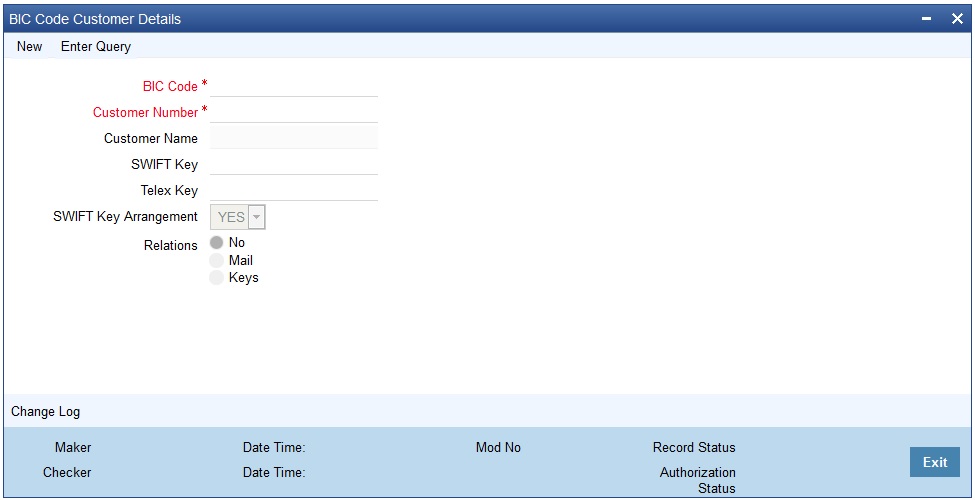

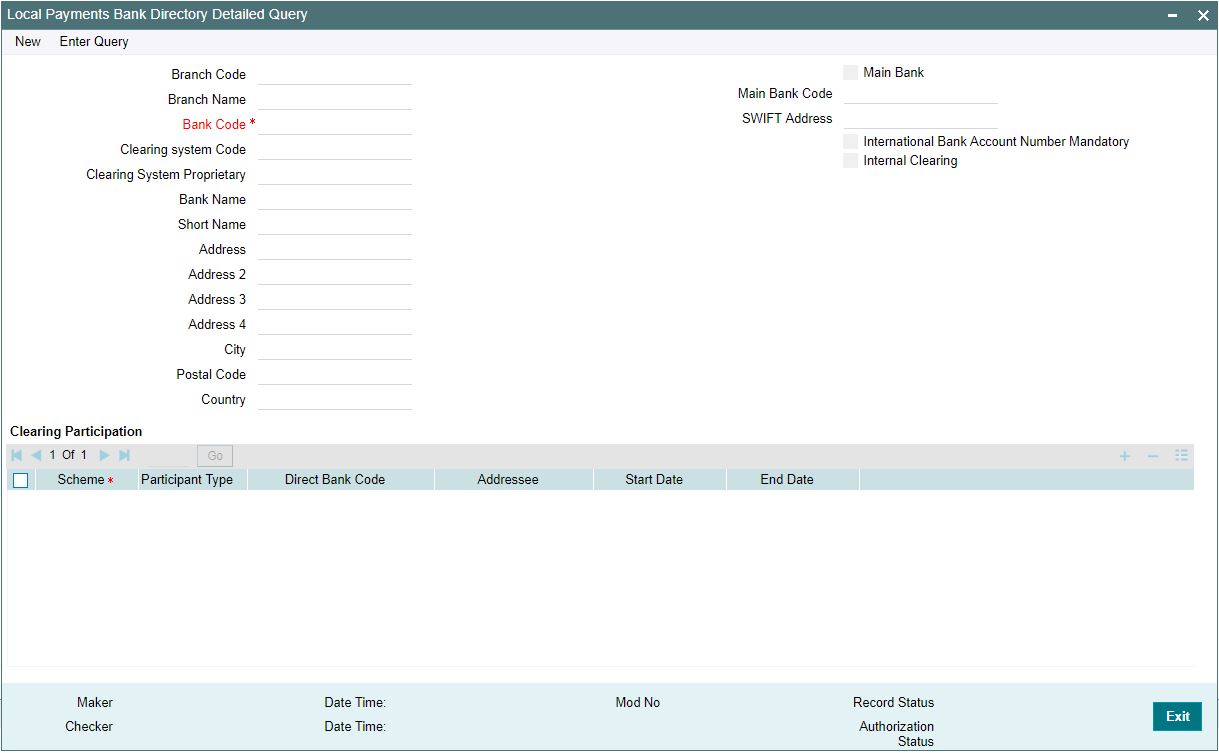

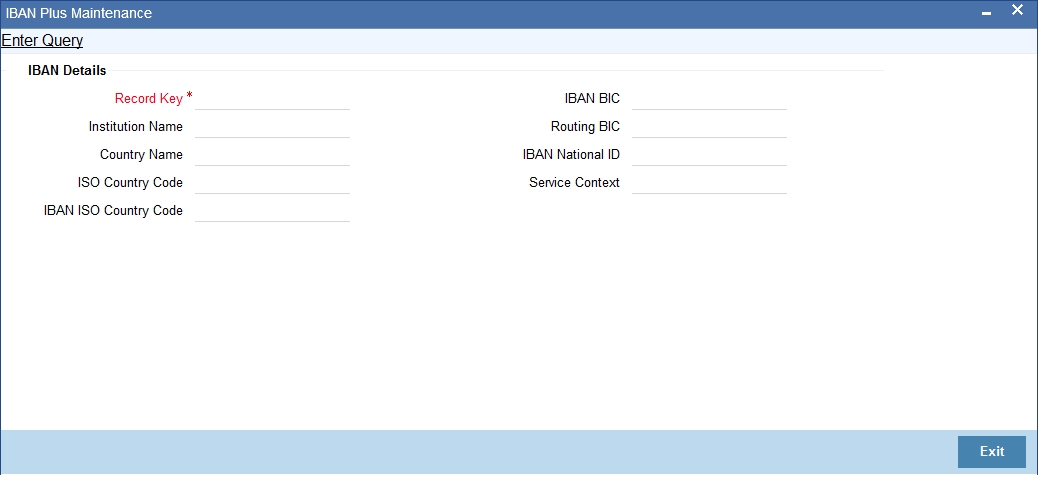

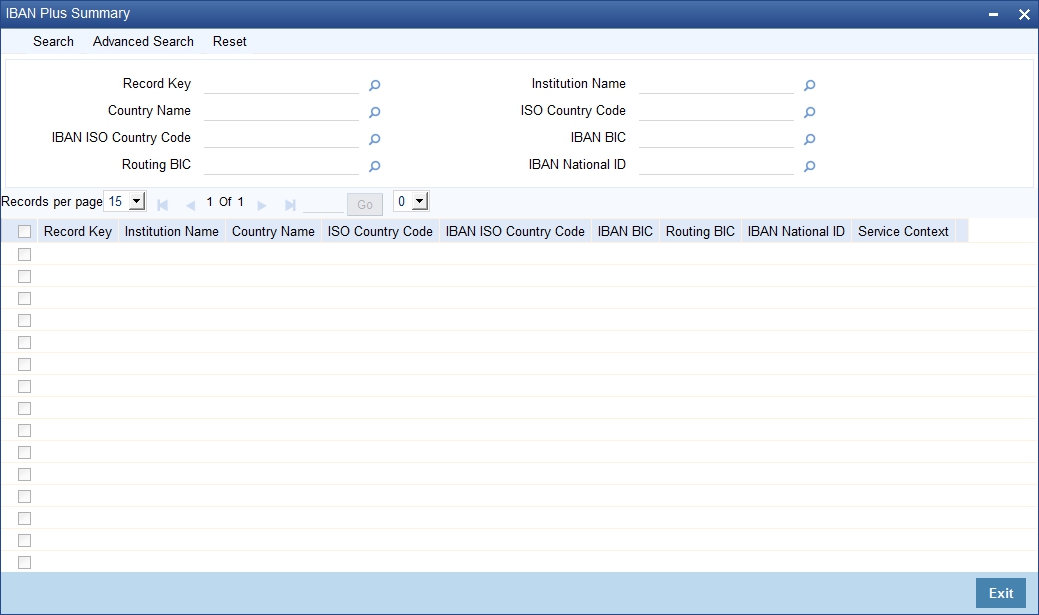

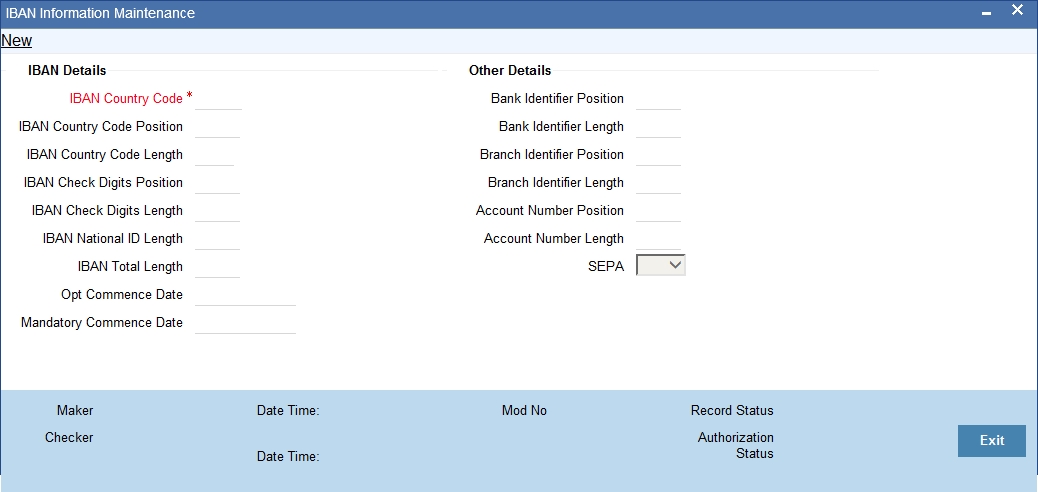

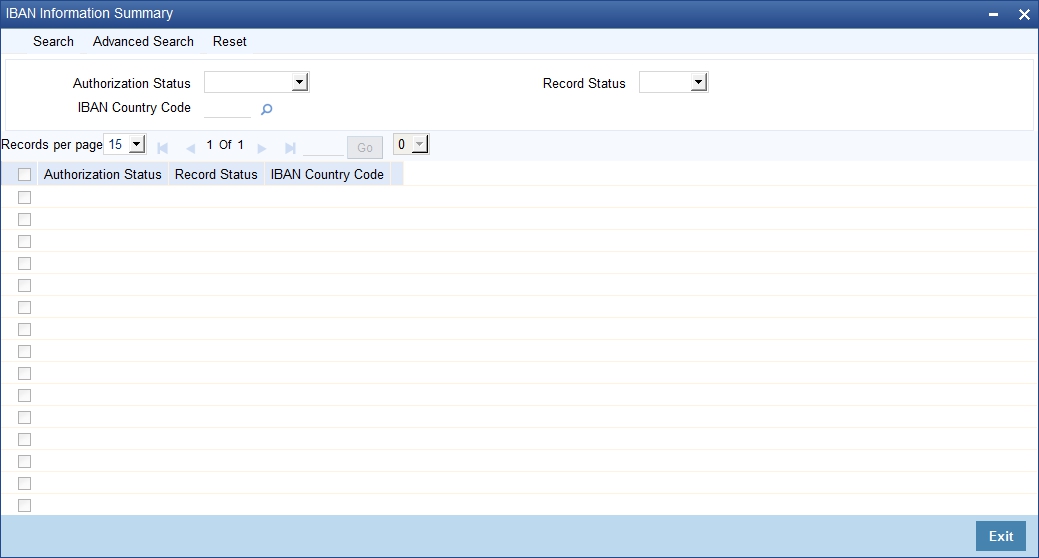

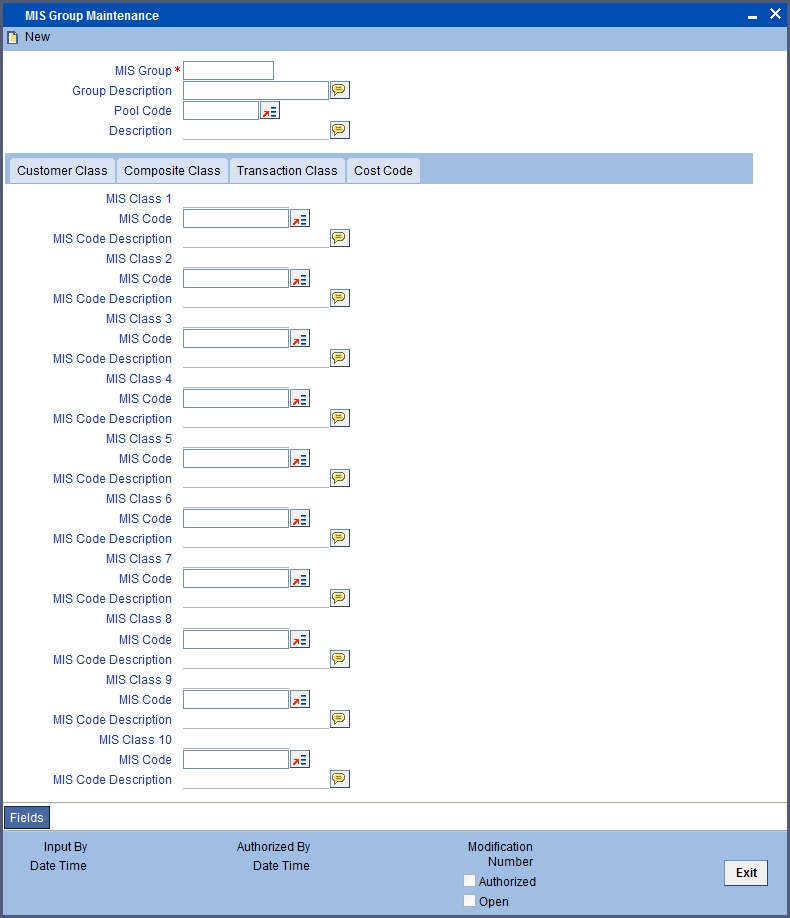

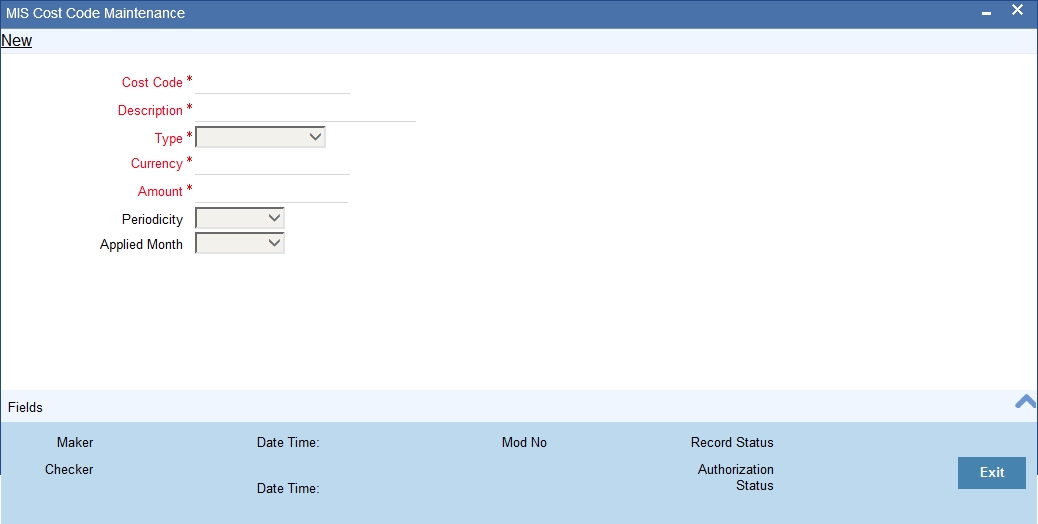

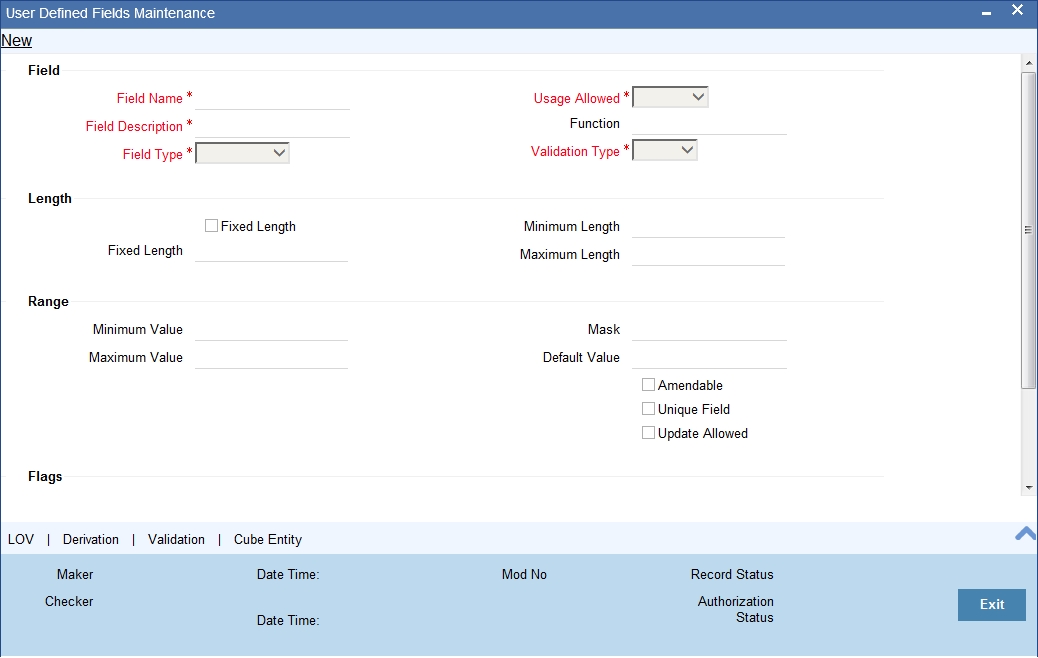

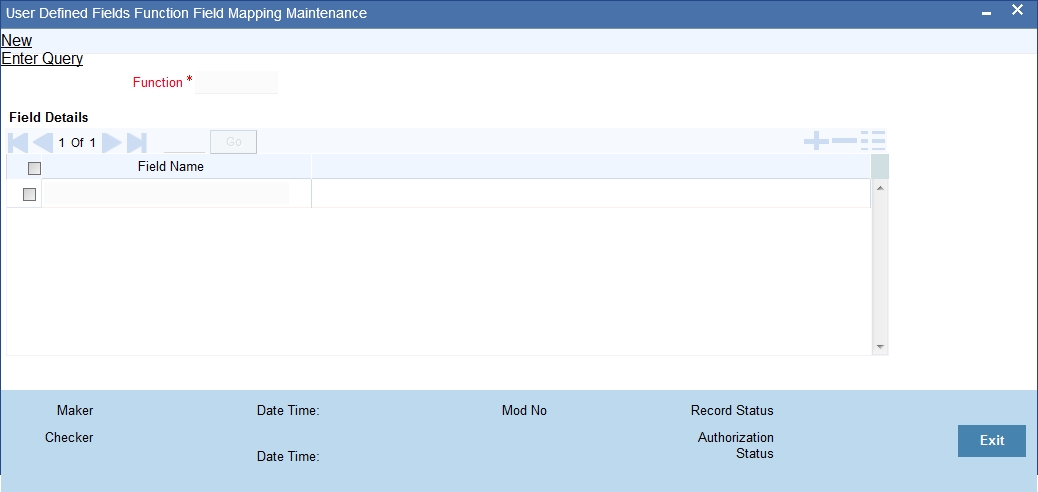

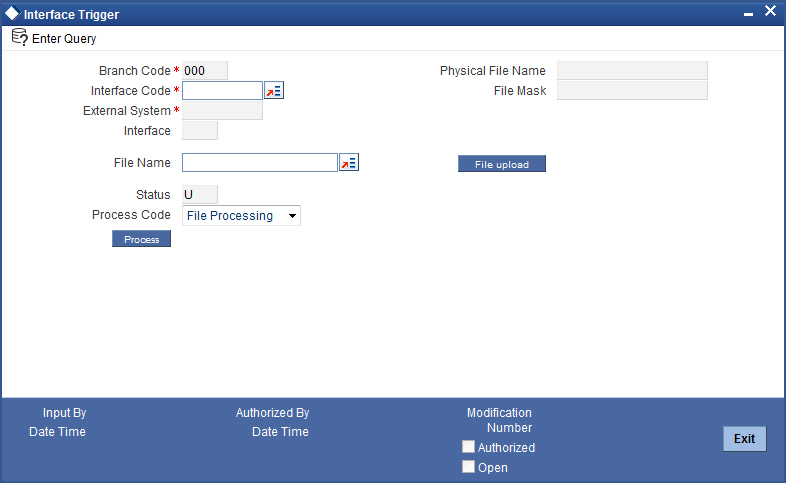

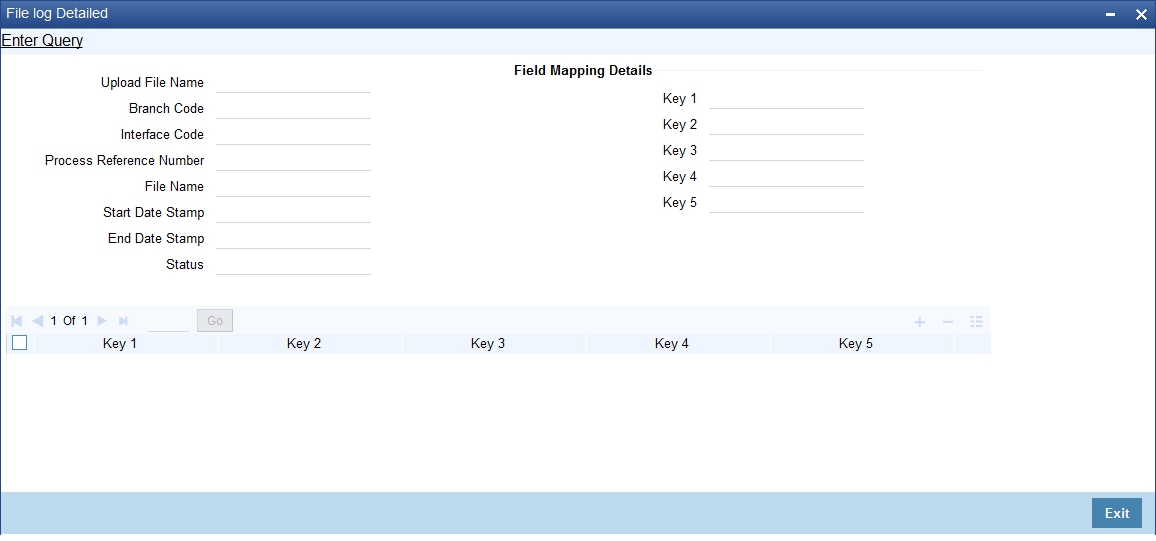

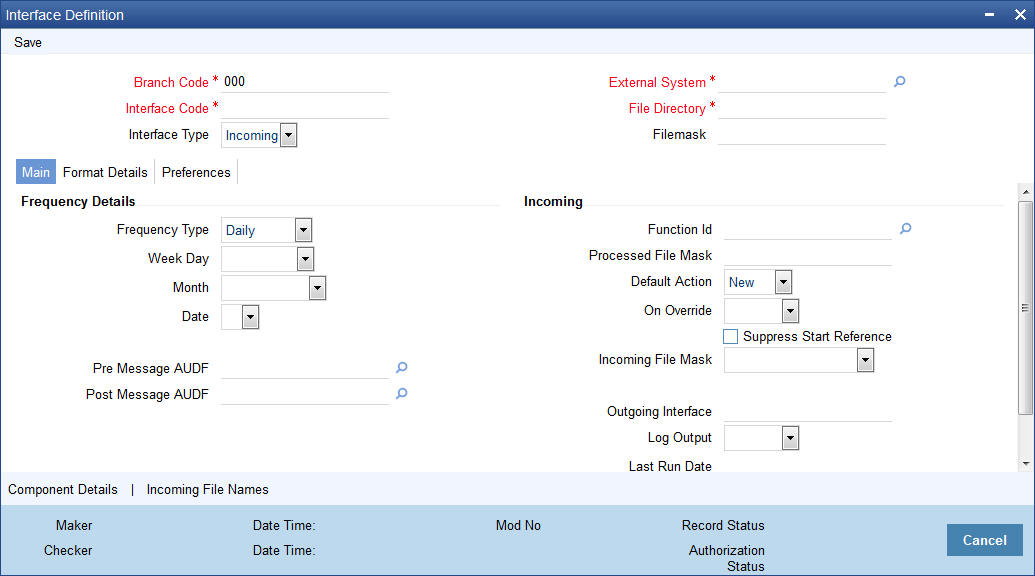

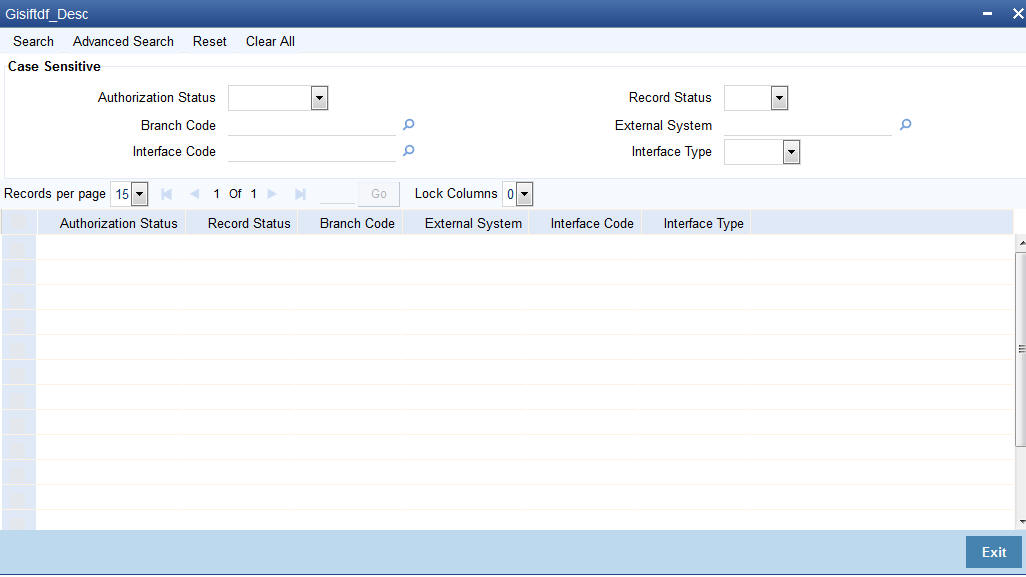

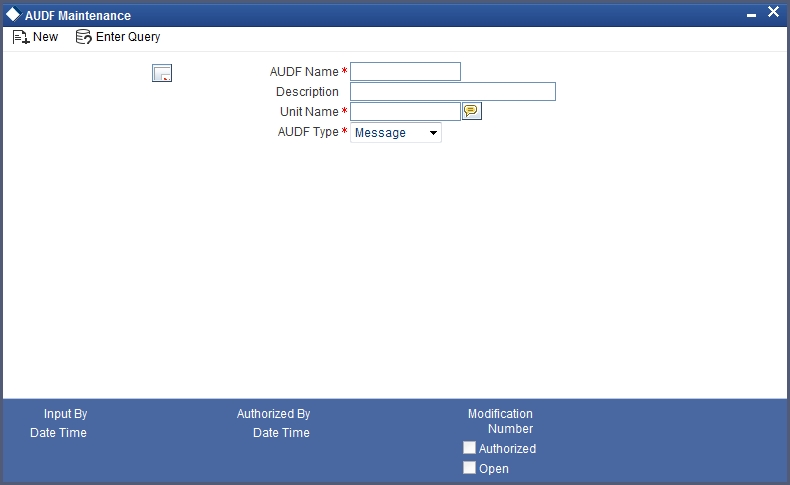

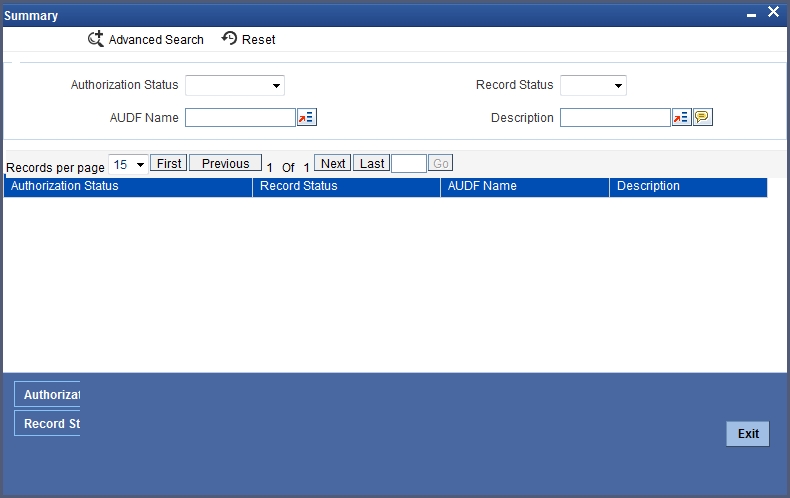

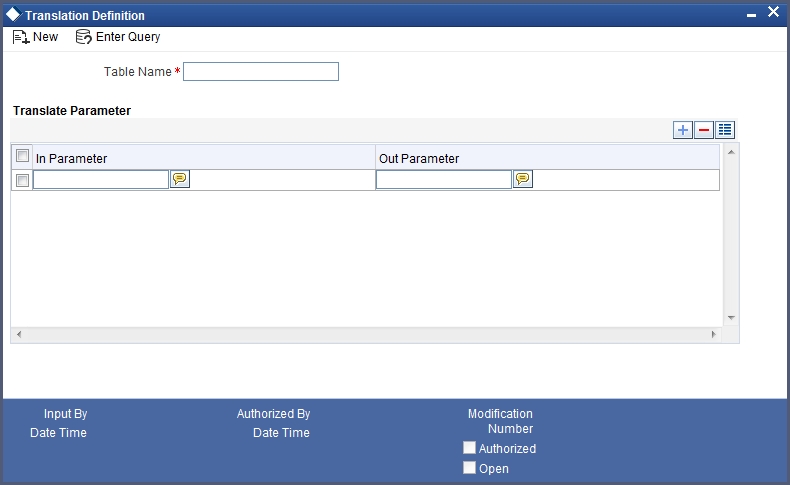

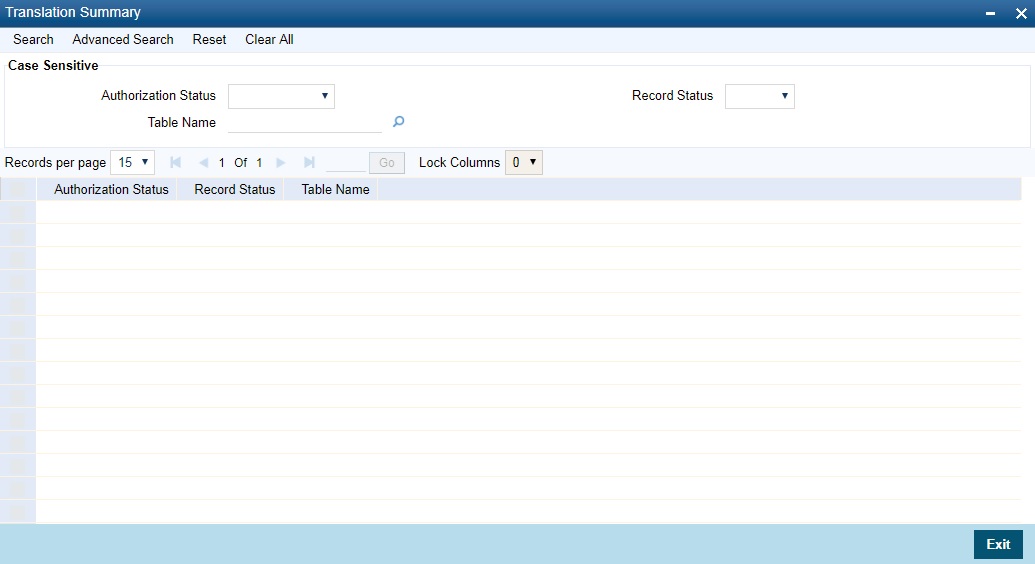

Account IBAN