4. Defining Attributes Specific to Derivative Products

In this chapter, we shall discuss the manner in which you can define attributes specific to a Derivative product.

This chapter contains the following sections:

- Section 4.1, "Derivatives Product Definition"

- Section 4.2, "Derivatives Revaluation Contract Fair Values"

- Section 4.3, "Derivatives Revaluation Branch Interest Rates"

- Section 4.4, "Derivatives Revaluation Contract Interest Rates"

4.1 Derivatives Product Definition

This section contains the following topics:

4.1.1 Creating Derivative Product

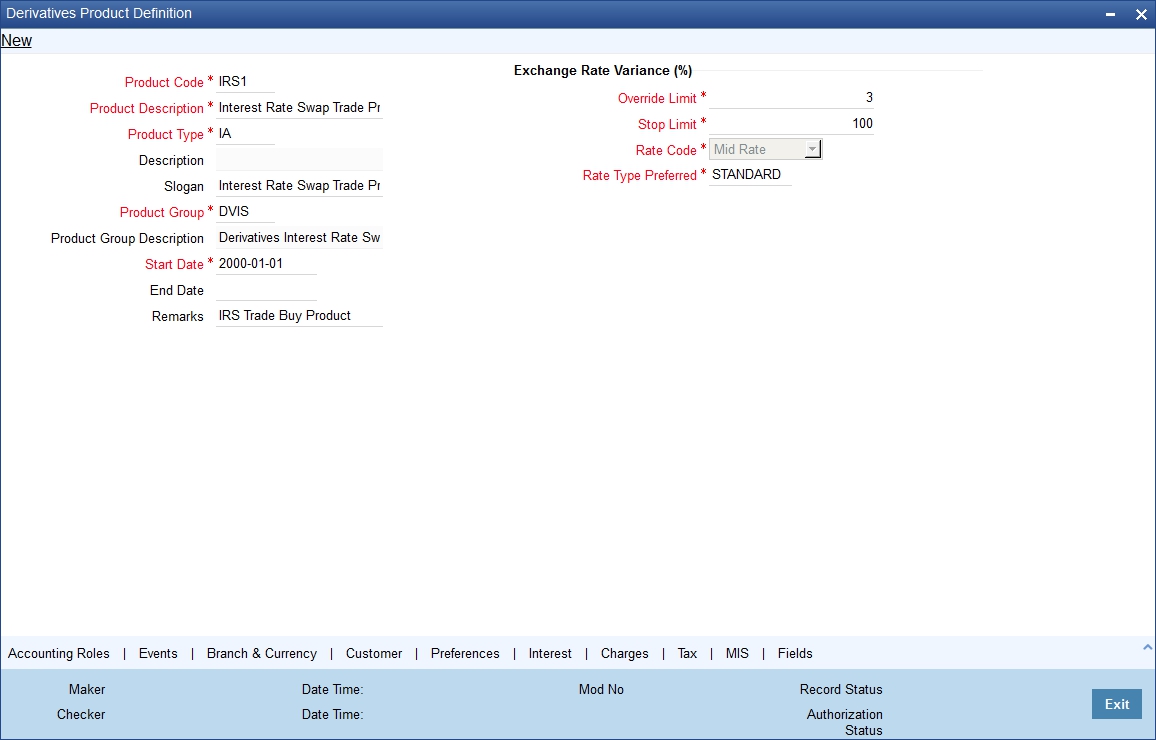

You can create a derivative product in the ‘Derivatives Product Maintenance’ screen, invoked from the Application Browser. In this screen, you can enter basic information relating to a derivative product such as the Product Code, the Description, etc.

You can invoke the ‘Derivatives Product Definition’ screen by typing ‘DVDPRMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

For any product you create in Oracle FLEXCUBE, you can define generic attributes, such as branch, currency, and customer restrictions, interest details, tax details, etc., by clicking on the appropriate icon in the horizontal array of icons in this screen. For a derivative product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this chapter.

You can define the attributes specific to a derivative product in the ‘Derivatives Product Maintenance’ screen and the ‘Product Preferences’ screen. In these screens, you can specify the product type and set the product preferences respectively.

For further information on the generic attributes that you can define for a product, please refer the following Oracle FLEXCUBE User Manuals under Modularity:

- Product Definition

- Interest

- Charges and Fees

- Tax

- User Defined Fields

- Settlements

Specify the following details.

Product Code

You need to identify the derivative product that you are creating with a unique Product Code. This code should be unique across all the modules of Oracle FLEXCUBE.

Product Description

You can briefly describe the product that you are creating in this field. The description that you enter here will help you identify the product all through the module.

Product Type

The product type identifies the basic nature of a product. The derivative types you have maintained through the ‘Derivative Type Maintenance’ screen will be reflected in the option list available for this field. A derivatives product that you create can belong to any one of the following types:

- Forward Rate Agreements.

- Interest Rate Swaps.

- Cross Currency Swaps.

Product Slogan

You can specify a slogan for the product that you are creating that suitably announces the product to your customers.

Product Group

Grouping products, according to the common features they share, helps you organize information relating to the services you provide. Product Groups also help you retrieve information easily.

You can invoke a list of the product groups that you have maintained in your bank and choose the product group to which the product that you are creating belongs.

Start Date

When you create a product, you must specify a date from which it can be offered. Specify this date in the Start Date field.

End Date

You can choose to specify the date up to which a product is open. Specify this date in this field. You cannot enter a date that is earlier than the current system date.

Note

You cannot offer a product beyond the specified end date. If you do not specify an end date for a product, you can offer it for an indefinite period.

Remarks

You can enter any remarks relating to the product for your reference here.

Exchange Rate Variance (in %)

You can define the exchange rate variance that you would like to allow for a derivatives product. This variance is expressed in terms of a percentage.

For a special customer, or in special cases, you may want to use an exchange rate (a special rate) that is greater than the exchange rate maintained for a currency pair. The variance is referred to as the Exchange Rate Variance.

When creating a product, you can express an Exchange Rate Variance Limit in terms of a percentage. This variance limit would apply to all contracts associated with the derivatives product.

Override Limit

If the variance between the default rate and the rate input varies by a percentage that is between the Override Limit and the Rate Stop Limit, you can save the transaction (involving the product) by providing an override.

Stop Limit

If the variance between the default rate and the rate input varies by a percentage greater than or equal to the Stop Limit, you cannot save the transaction involving the product.

Rate Code

For every Currency Pair and Rate Type combination you are required to maintain Buy, Sell, and Mid Rates.

You need to specify whether the Mid Rate should be used for all Cross Currency transactions or whether the Buy/Sell Rate should be used depending upon the nature of the transaction by selecting the appropriate rate from the option list available.

Rate Type Preferred

Specify the Rate Type that should be used for Cross Currency transactions. The adjoining option list displays all the Rate Types maintained through the ‘Rate Type Definition’ screen. You can choose the appropriate one.

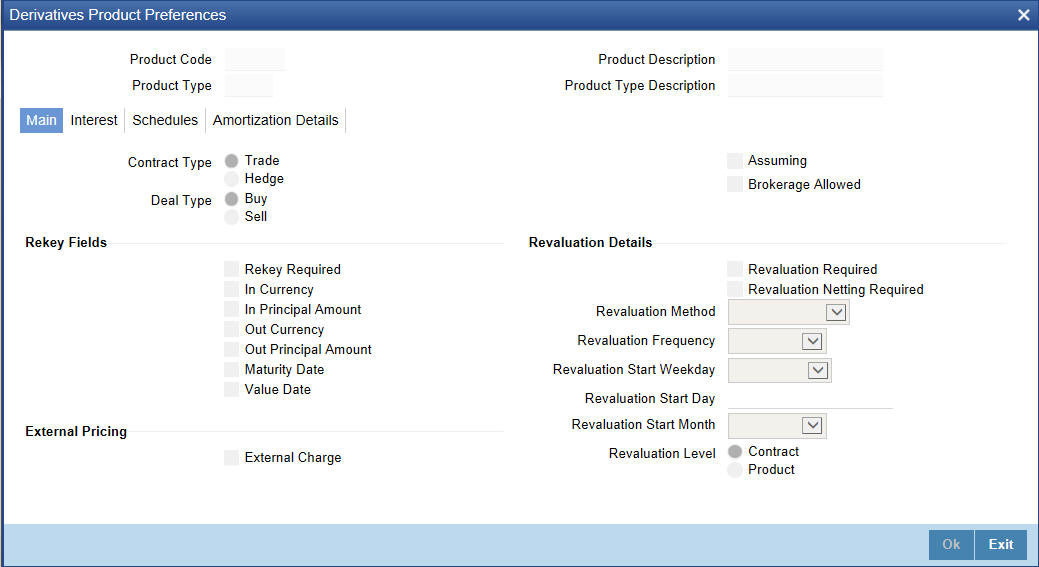

4.1.2 Preferences Button

Preferences are the options that are available to you for defining the attributes of a product. The preferences that you define for a product will be inherited by all derivative contracts that are associated with the product.

Click ‘Preferences’ button to invoke the ‘Derivatives Product Preferences’ screen. Through this screen you can define specific preferences for the product you are creating.

The Product Code and Product Type are defaulted from the ‘Product Maintenance’ screen. In this screen you can specify the following:

4.1.2.1 Main tab

Specify the following details.

Contract Type

You have to indicate whether the product for which you are defining preferences for is meant for Trade contracts or Hedge contracts.

Note

You can amend this preference while entering the details of the contract.

Deal Type

The first preference that you define for a derivative product is the Deal Type. You can indicate the default nature of deals that will be processed under this product. The choices available for this field are:

- Buy

- Sell

Note

The deal type that you specify will be defaulted to contracts under this product. However you are allowed to change this while entering the details of the contract.

Assuming

Check this box to indicate that the contract is assumed from the counterparty. You can uncheck this box i f the product will be used for a fresh contract.

Brokerage Allowed

You can specify whether brokerage should be applied on deals involving this product by checking the box. If brokerage is specified for the product, you can waive it for specific deals, but if you have specified that brokerage is not applicable to the product; you will not be able to levy brokerage on a specific deal involving the product.

Rekey Fields

When a derivative contract is invoked for authorization - as a cross-checking mechanism, you can specify that the values of certain fields should be entered before the contract is authorized. This is called the Rekey option.

While defining the product you have to indicate the fields whose values you need to specify before a contract is authorized. Thus it becomes mandatory for you to specify the values of rekey fields for all contracts linked to the product.

You can specify any or all of the following as rekey fields:

- In Currency

- Out Currency

- Maturity Date

- In Principal Amount

- Out Principal Amount

- Value Date

If no rekey fields have been defined, the details of the contract will be displayed immediately when the authorizer calls the product for authorization.

External Pricing

External Charge

Check this box to indicate that external charges can be fetched from external pricing and billing engine for contracts created under this product.

External Charge is enabled only when the system integrates with external pricing and billing engine (PRICING_INTEGRATION = Y at CSTB_PARAM level).

Revaluation Details

You may want to revalue your deal portfolio on a periodic basis to account for the gains and losses due to changes in the market interest rates or the exchange rates.

Oracle FLEXCUBE provides a feature to revalue the worth of derivative contracts linked to the product, based on the Fair Price, the Contract Rate or the Bank Rate.

Revaluation Required

You can revalue the worth of contracts associated with the product at regular intervals.

Check this box to indicate whether revaluation is required for the product you are defining. Else leave this box unchecked.

Note

At the time of processing a contract if you decide that revaluation is not required then you can choose to waive this option (even if at the product level you have specified that revaluation is necessary for contracts involving the product).

However, if at the product level you have specified that revaluation is not required, then while processing the contract you will not be allowed to choose the revaluation option.

Revaluation Netting Required

If you have indicated that revaluation is required for the product then you can also indicate whether accounting entries should be passed at the leg level or at the contract level.

Check this box to indicate that revaluation entries should be passed at the contract leg level.

Revaluation Level and Method

In Oracle FLEXCUBE, revaluation entries can be passed either at the product level or at the contract level.

After you indicate the level for revaluation, you can indicate the method to be used for revaluation. The options available are:

- Fair Price

- Contract Rate

- Branch specific Interest Rate

The revaluation level and method that you specify will determine the manner in which the product will be revalued.

Note

Each of the above methods is explained in detail in the chapter titled Defining Fair Price revaluation methods.

Revaluation Frequency

The frequency with which a product should be revalued has to be specified as a product preference. Once you have indicated the level and the method for revaluation, you can specify the frequency with which a product should be revalued.

The frequency can be one of the following:

- Daily

- Weekly

- Monthly

- Quarterly

- Half yearly

- Yearly

Note

If the revaluation date falls on a holiday, the revaluation is done as per your holiday handling specifications in the ‘Branch Parameters’ screen.

Revaluation Start Weekday

In case of weekly revaluation, you should specify the day of the week on which revaluation should be carried out. For instance if you specify that revaluation should be carried out every Friday, then the contract or product (depending on the level specified) will be revalued every Friday of the week.

Note

The Revaluation Frequency that you specify at the product level cannot be changed while processing the contract.

Revaluation Start Day

In the case of monthly, quarterly, half yearly or yearly revaluation, you should specify the date on which the revaluation should be done during the month. For example, if you specify the date as 30, revaluation will be carried out on that day of the month, depending on the frequency.

If you want to fix the revaluation date for the last working day of the month, you should specify the date as 31 and indicate the frequency. If you indicate the frequency as monthly, the revaluation will be done at the end of every month - that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February.

If you specify the frequency as quarterly and fix the revaluation date as 31, the revaluation will be done on the last day of the month at the end of every quarter. It works in a similar fashion for half-yearly and yearly revaluation frequency.

Revaluation Start Month

If you set the revaluation frequency as quarterly, half yearly or yearly, you have to specify the month in which the first revaluation has to begin, besides the date on which the revaluation should be done.

For instance,

You have selected the half-yearly option and specified the start date as 31 and the start month as June.

The system will do the first revaluation on the 30th of June for the period from 1st January to June 30th, and the second one on 31st December for the period from 1st July to 31st December.

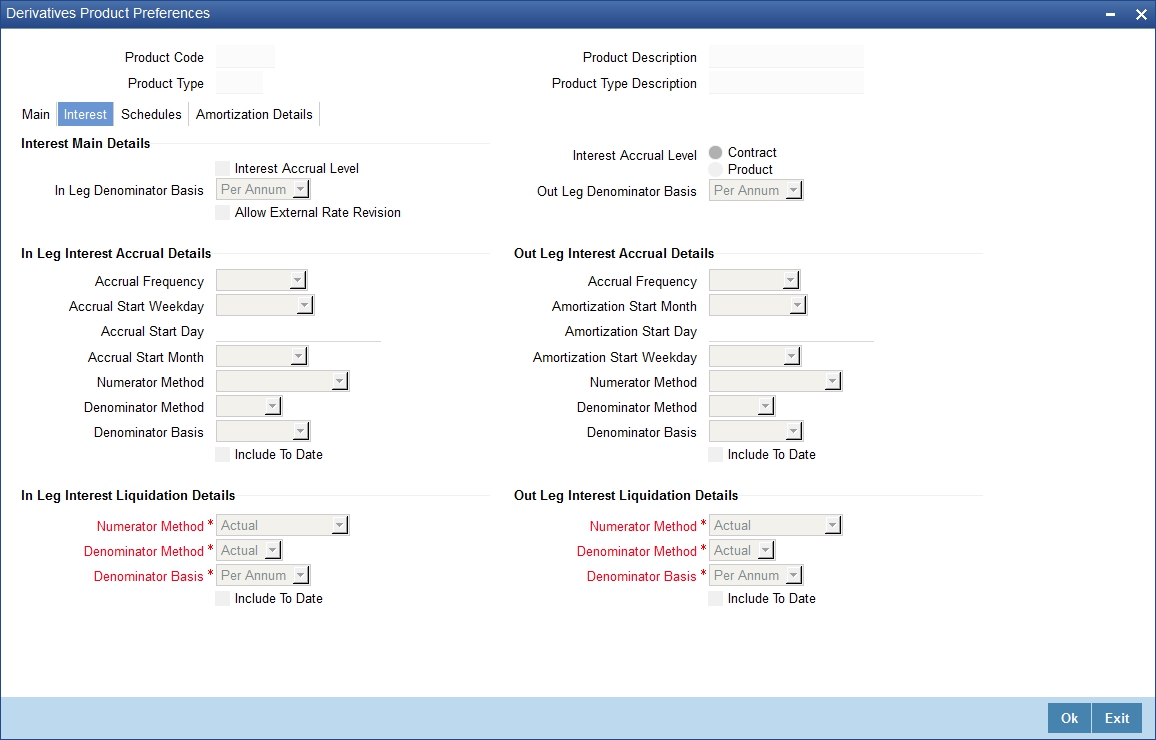

4.1.2.2 Interest Tab

As part of setting up the product preferences, you have to specify the relevant interest accrual details. The accrual details that you specify will be made applicable to all hedge contracts associated with the product.

You have to indicate whether interest should be accrued at the product or contract level for hedge deals. The interest accrual specifications should be done for both the inward and outward legs of the contract.

You can specify the interest accrual details by clicking on the Interest tab in the ‘Product Preferences’ screen.

Interest Main Details

Specify the following details.

Interest Accrual Level

As a product preference, you can indicate whether interest accrual is required for the contract by checking the box. You can leave the box unchecked to indicate that accrual is not applicable.

Note

If you indicate that interest accrual is required for the contract then you have to specify the accrual related details individually for the In and Out legs.

At the product level if you indicate that interest accrual is required and you choose not to accrue interest for a contract linked to the product you will be allowed to do so. However the opposite will not be allowed.

Interest Accrual Level

Here you can indicate the level at which accrual entries should be passed for the in leg of the contract. The options available are:

- Product

- Contract

At the product level, accruals will be passed for the product and currency combination. Those contracts for which accrual is required will be identified by the system and accrual entries will be passed based on the accounting entry set-up defined.

At the contract level accruals will be passed for individual contracts linked to the particular product.

In Leg Denominator Basis

You need to specify the interest accrual rate for the inward leg of the contract as one of the following:

- Per annum

- Per schedule period

Out Leg Denominator Basis

You need to specify the interest accrual rate for the outward leg of the contract as one of the following:

- Per annum

- Per schedule period

Allow External Rate Revision

Check the ‘Allow External Rate Revision’ to indicate that for the contracts linked to this product, you can allow rate revision based on the rates uploaded from an external system.

In Leg/Out Leg Interest Accrual Details

The details that you maintain here are specific to the interest calculation methods to be applied during accruals. Any of the following combinations are allowed for calculating interest:

Accural |

Description |

Actual / Actual |

The Actual number of days in the period/ The Actual number of days in that year. Click on Actual in Numerator Method field; click on Actual in Denominator Method field. |

Actual / 365 |

The number of actual calendar days for which calculation is done / 365 days in a year. Click on Actual in Numerator Method field; click on 365 days in Denominator Method field. |

Actual – Japanese / Actual |

This is similar to the Actual/365 method except that leap days are always ignored in the denominator day count calculation. Click on Actual in the Denominator Method field; click on Actual Japanese in the Numerator Method field. |

365 – ISDA / Actual |

Sum of (A) and (B) where: A = (Interest accrual days falling within the leap year) / 366 B = (Interest accrual Days not falling within the leap year) / 365 The denominator is the actual number of days in a year. Click on 365 ISDA in Numerator Method field; click on Actual in Denominator Method field. |

Actual / 360 |

The actual number of calendar days for which calculation is done / 360 days. Click on Actual in Numerator Method field; click on 360 in Denominator Method field. |

The General Formula used for the day count method is given below:

Day count fraction =

Number of Interest Accrual Days (Numerator) Days in the specified period (Per Annum/Per Period) (Denominator)

Note

Setting the Interest Frequency is done in the same manner as setting the Revaluation Frequency.

Include To Date

Check this box, if you would like to take into account the last day in an accrual period, when arriving at the accrual days.

In Leg/Out Leg Interest Liquidation Details

Specify the following details.

Liquidation Method

The interest accrued over a specific schedule period or per annum can be liquidated either automatically or manually. You have to indicate this preference at the time of product definition.

Indicate whether the in leg interest accruals due for derivatives within a product should be liquidated automatically or manually.

If you select the automatic option, the interest accruals for the in leg will be liquidated automatically on the liquidation date as part of the automatic processes run during beginning of day (BOD) or End of day (EOD).

Note

The method and basis for liquidation are as specified for interest accruals.

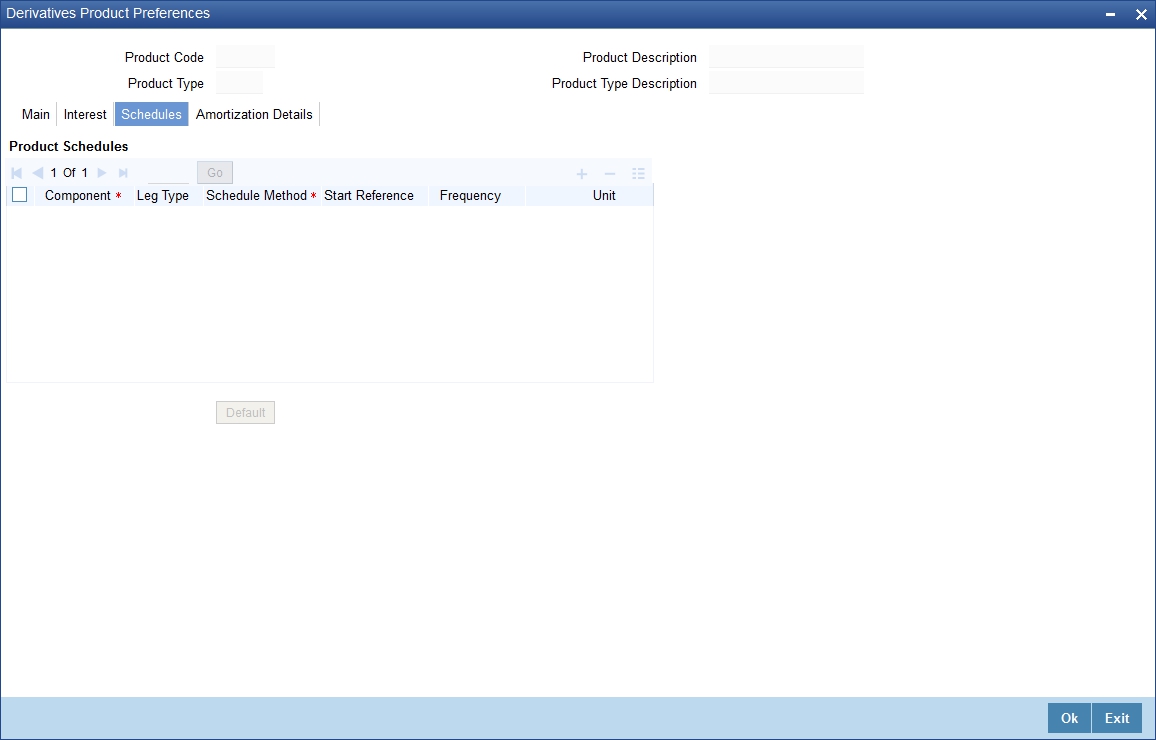

4.1.2.3 Schedules Tab

After you specify the interest accrual preferences you have to indicate the repayment schedules for the following components:

- Principal (Repayment of principal schedules)

- Interest (Repayment of interest schedules)

- Revision (Revision of interest rates for a contract with periodic interest rates).

The schedule preferences for each of these components have to be defined separately for both the In and Out legs. Click the ‘Schedules’ tab in the ‘Product Preferences’ screen.

Product Schedule Details

Specify the following details.

Component

Specify the component for which you are defining the schedule.

Leg Type

You need to indicate whether the component that is displayed is an ‘In leg’ component or an ‘Out leg’ component.

Schedule Type

You should indicate the schedule type to which the component belongs. The component can belong to any one of the following types:

- Principal (Repayment of principal schedules).

- Interest (Repayment of interest schedules).

- Revision (Revision of interest rates for a contract with periodic interest rates).

Start Reference

The reference date is the date based on which the repayment schedules for the various components (Principal, Interest, Revision) is calculated. You can specify that the schedule start period should either be based on the Value Date of the contract or that it should be based on a Calendar Date.

If you specify that the reference should be the Value Date the dates for schedule repayment dates will be determined by the date of initiation of the contract and the frequency that you specify.

If the Reference is specified as Calendar Date, the dates for schedule repayments will be based on the Start Day, Month and Frequency combination.

Frequency

The frequency of schedules that you specify along with the Start Reference and the Frequency Unit will determine the actual repayment schedules for the particular component. By default, the frequency will be Bullet, which means that all the repayments will be made as of the maturity date of the contract.

You can change the frequency to any one of the following options:

- Daily

- Weekly

- Monthly

- Quarterly

- Half-yearly

- Yearly

Note

If the Reference is set as the Value Date, the repayment dates will be calculated using the Value Date, the frequency and the Unit of Frequency. If the Reference is set as Calendar Date, the repayment dates will be calculated based on the Frequency, Unit of Frequency, Start Month and Start Day that you specify.

Frequency Unit

After you specify the frequency you have to indicate the unit of frequency you want to set for the Frequency, the Component (the Principal, Interest or Revision component) and Start Reference combination.

For example,

Scenario 1

You have indicated that the schedule liquidation should be based on the Calendar Date in the Start Reference field. Subsequently you indicate that liquidations should happen on every 25th of the month.

The Effective Date or the Value Date of the contract is 12th March 2000. Regardless of the effective date, the first liquidation will be carried out on the 25th of March.

Since you want this process to continue i.e., liquidations should be carried out on the 25th of every month till the contract matures. Therefore you need to specify the frequency as Monthly and enter 1 in Unit field.

Schedules will be repaid once in every month on the 25th till the contract matures.

Scenario 2

You have indicated that liquidation of schedules should be based on the Value Date and specify that the frequency for liquidation as Monthly. Next you specify that the frequency unit should be 2.

The schedules will be liquidated once in every two months, since the frequency unit is 2.

Schedule Start Weekday

When you set the repayment schedule frequency as Weekly you have to indicate the day of the week on which liquidation should be carried out.

For instance if you indicate the weekday preference as Wednesday then liquidation will be carried out on a weekly basis on every Wednesday.

Schedule Start Day

When the Start Reference is set as Calendar Date you have to indicate the date on which the schedule is due to start. For instance if the frequency you have specified is daily, set the date on which the first daily schedule should fall due.

Similarly when the frequency is monthly indicate the day of the month in which the liquidation should fall due. The schedule repayment dates will be computed using the Frequency, the Unit, (Start) Month and the (Start) Day that you specify.

Schedule Start Month

If you have set the Reference as Calendar Date, and the frequency as quarterly, half-yearly or annual, you can indicate the month in which the first schedule falls due. Based on your specification, the subsequent schedule dates will be calculated.

Adhere to Month End

If the schedule frequency is in terms of a month, you can choose to indicate that the schedule days should adhere to Month- Ends. The implication of this option is explained in the following example.

Example

You are defining preferences for a derivative product. You would like to maintain several derivatives under this product. We shall study the impact of the Adhere to Month End option with reference to a derivative maintained under the Product.

Assume the Effective Date of the contract (with floating interest) is 01 January 2000, and the Maturity Date is 31 December 2000.

You have specified that the principal schedule frequency is quarterly.

If you choose the Adhere to Month End option the schedules for this derivative would be due on the following dates:

- 31 March 2000

- 30 June 2000

- 30 September 2000

- 31 December 2000

If you do not choose the Adhere to Month End option the schedules for this derivative would be due on the following dates:

- 31 March 2000

- 30 June 2000

- 30 September 2000

- 30 December 2000

The schedule dates for all derivatives maintained under the product will be calculated in a similar manner.

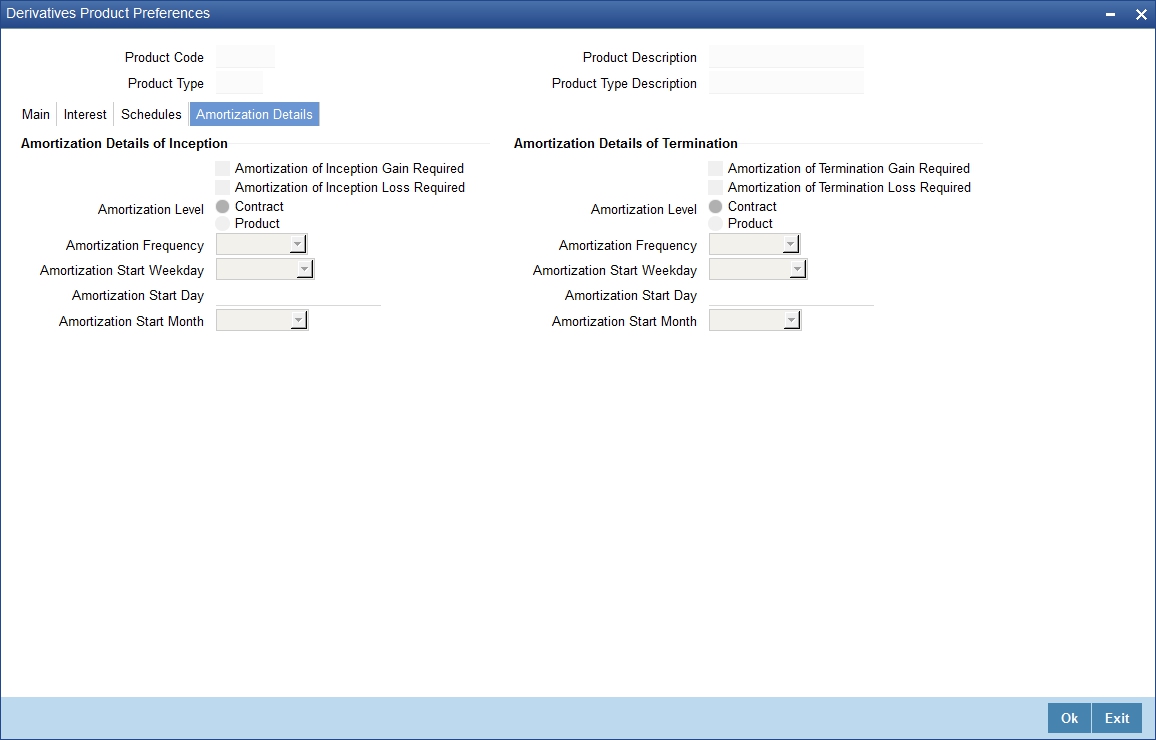

4.1.2.4 Amortization Details Tab

You can specify your preferences for amortization by clicking the Amortization Details tab in the ‘Product Preferences’ screen.

The Product Code and Product Type are defaulted from the ‘Product Maintenance’ screen. In this screen you can specify the following:

Amortization of Inception/Termination Gain Required

You have to indicate whether inception/termination gain needs to be amortized.

Check the respective box to indicate that amortization is required for inception/termination gain. Leave it unchecked if amortization is not required.

Note

If you choose these options, then amortization of inception/termination gain will be made applicable to all contracts associated with the product. You can however change it while entering the details of the contract. But if you indicate that amortization is not required then you will not be allowed to change this preference while processing the contract.

Amortization of Inception/Termination Loss Required

You have to indicate whether inception/termination loss needs to be amortized.

Check the respective box to indicate that amortization is required for inception/termination loss. Leave it unchecked if amortization is not required.

Note

- If you choose these options, then amortization of inception/termination loss will be made applicable all contracts associated with the product. You can however change it while entering the details of the contract.

- At the time of inception, Gain or Loss is distributed throughout the period from Effective Date to Maturity Date of the contract.

- At the time of termination, Gain or Loss is distributed throughout the period from Termination Date to Maturity Date of the contract.

- In case of Termination Gain/Loss, system amortizes from the Termination Date to the Maturity Date of the contract; Whereas, in case of Inception Gain/Loss, system amortizes from the Effective Date to the Maturity Date of the contract.

Amortization Level

Here you can indicate the level at which the amortization entries for inception/termination gain and/or loss should be passed. The options available are:

- Product

- Contract

At the product level, amortization entries will be passed for the product and currency combination. The system identifies those contracts, which need to be amortized for inception gain and/or loss and passes accounting entries based on the set-up defined for accounting entries.

At the contract level inception gain/loss amortization entries will be passed for individual contracts linked to the particular product.

Amortization Frequency

After you indicate the amortization level for gain and loss of contract inception and termination, you have to specify the frequency at which amortization should take place.

The frequency can be one of the following:

- Daily

- Weekly

- Monthly

- Quarterly

- Half yearly

- Yearly

Amortization Start Weekday

In the case of weekly accrual, you should specify the day of the week on which interest accruals should be carried out. For instance if you specify that accruals should be carried out every Friday, then the contract or product (depending on the level specified) will be accrued on every Friday of the week.

Amortization Start Day

In the case of monthly, quarterly, half yearly or yearly amortization, you should specify the date on which the amortization should be done during the month. For example, if you specify the date as 30, amortization will be carried out on that day of the month, depending on the frequency.

If you want to fix the amortization date for the last working day of the month, you should specify the date as 31 and indicate the frequency. If you indicate the frequency as monthly, the amortization will be done at the end of every month - that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February.

If you specify the frequency as quarterly and fix the amortization date as 31, amortization will be done on the last day of the month at the end of every quarter. It works in a similar fashion for half-yearly and yearly amortization frequency.

If the amortization date falls on a holiday, the amortization is done as per your holiday handling specifications in the ‘Branch Parameters’ screen.

Amortization Start Month

If you set the amortization frequency as quarterly, half yearly or yearly, you have to specify the month in which the first amortization has to begin, besides the date on which the amortization should be done.

Example:

You have selected the half-yearly option and specified the start date as 31 and the start month as June.

The system will do the first amortization on the 30 of June for the period from January 1 to 30th June. The second one will be done on the 31st of December for the period from 1st July to 31st December.

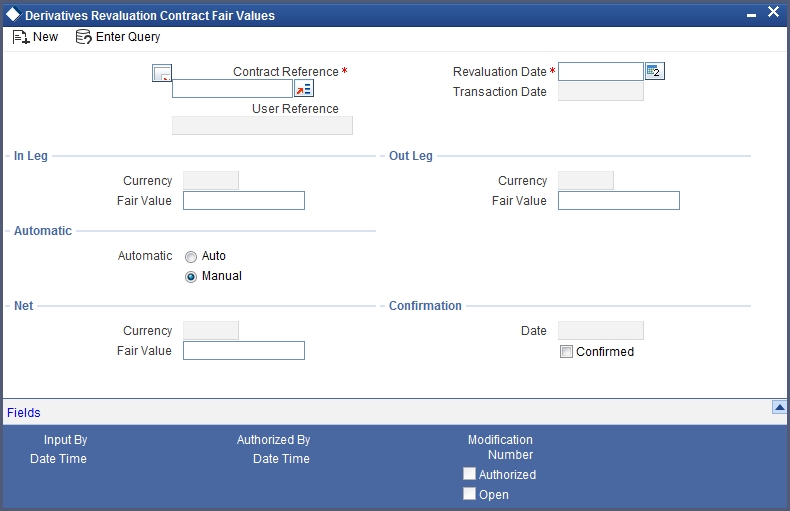

4.2 Derivatives Revaluation Contract Fair Values

This section contains the following topics:

- Section 4.2.1, "Defining the Fair Price Revaluation Methods"

- Section 4.2.2, "Maintaining Fair Values for Revaluing a Contract"

- Section 4.2.3, "Operations on the Contract Fair Price Maintenance record"

4.2.1 Defining the Fair Price Revaluation Methods

Revaluation is used to revalue all active trade deals based on the revaluation frequency parameters that you specify through the ‘Preferences’ screen while defining products. Since the market rates are constantly in a state of flux you may wish to revalue the worth of all active trade deals periodically.

In Oracle FLEXCUBE, you can revalue the worth of contracts by using either one of the following methods. They are as follows:

- Maintaining Contract Fair Prices whereby you have to indicate the fair price of individual contracts, which will be used for revaluation.

- Maintaining Branch Interest Rates whereby you can maintain branch level forward interest rates, which will determine the fair price to be used for revaluation. Fair price is calculated based on the interest rates and will be applicable to In or Out leg based on the contract.

- Maintaining Contract Interest Rates whereby you maintain contract specific forward interest rates which will determine the fair price to be used for revaluation. Fair price is calculated based on the interest rates and will be applicable to In or Out leg based on the contract.

Your preference for revaluing contracts linked to the particular product will be defaulted to all the contracts linked to that product. However you can change this preference at the time processing the contract.

Each of these revaluation methods have been explained in detail in the following sections.

4.2.2 Maintaining Fair Values for Revaluing a Contract

If you have indicated that a particular contract should be revalued based on the contract fair price the system automatically inserts a record in the ‘Revaluation Contract Fair Price Maintenance’ screen for that contract. This is done during the Beginning of Day batch process based on the revaluation frequency specified at the product level.

This concept can be explained with the help of an example:

Example

You have set the revaluation frequency of the contract bearing the reference number 000DV21992950177 to monthly. The first revaluation was done on 1st January 2000. The next is due on the 1st of February 2000. On the 1st of February 2000 the system automatically inserts another record in the ‘Contract Fair Price Maintenance’ screen for the contract 000DV21992950177. You have to unlock the record, enter the in/out leg values and the net fair value of the contract.

You can invoke the ‘Derivatives Revaluation Contract Fair Value’ screen by typing DVDCNVAL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

When you want to change the revaluation frequency of a specific contract, select ‘New’ from the Actions Menu in the Application tool bar or click new icon. The ‘Revaluation Contract Fair Value’ screen will be displayed without any details. Select the reference number of contract whose revaluation frequency is to be changed. Enter the revaluation date, the new in and out leg values and the net fair value.

If you are calling an existing contract price maintenance record choose the Summary option under Contract Price. From the ‘Summary’ screen, double click a record of your choice to open it.

To modify the in and out leg values click the unlock icon or select ‘Unlock’ from the menu. Enter the in and out leg values, and compute the new net fair value and save the record.

During bulk upload of these fair values for multiple contracts, Oracle FLEXCUBE expects the following information to be present in the upload message:

- Contract Reference No

- Effective Date

- InLeg Value

- OutLeg Value

If any of these values is missing for any record, the system will terminate the upload process and raise an error as ‘Net Fair value will be defaulted from Inleg and Outleg fairvalues.’

The single record and bulk record uploads requests are handled in bulk requests itself for the following:

- DV Fairvalue

- DV Rate Revision

The system will also raise an error if:

- Contract Reference Number is not valid

- Duplicate record exists for the Contract Reference Number and Effective date combination

- Revaluation date is greater than the application date

You can run the fair value upload process any time before the DV batch is processed during the day. During the DV batch, contract revaluation will be done based on the fair value uploaded.

Interest Revision

System selects the option ‘Auto’ if a revaluation record is created automatically during EOD batch. You can create the revaluation record manually and select the option as ‘Manual’.

Note

Typically the manul revaluation record is created on the booking date, as by then the EOD batch would not have run.

Net Fair Value

You have to indicate the net fair value of the contract as of the revaluation date. The value that you enter includes the effect of the in leg and out leg of the contract.

When the currencies of both the in and out leg of the contract are the same you have to calculate the net fair value of the contract by deducting the out leg amount from the in leg amount.

For example,

The Fair Value in the In Leg field amounts to USD 1,000,000.00.

The Fair Value in the Out Leg field amounts to USD 500,000.000

Since both the values are in the same currency, USD 500,000.000 deducted from USD 1,000,000.00 amounts to USD 500,000.000. Thus you can enter USD 500,000.000 as the Net Fair Value.

Supposing the currencies of both the legs of the contract are different then the Base Currency specified at the time of Contract Input will be the accepted as the default currency for the Net Fair Value. You have to compute the Net Fair value using the existing exchange rates.

Note

After indicating the respective values you must indicate your confirmation of the same. Only confirmed records will be picked up and processed for revaluation by the End of Day batch process.

4.2.3 Operations on the Contract Fair Price Maintenance record

Apart from maintaining a new fair price for a particular contract you can perform any of the following operations (if any function under the Actions menu is disabled, it means that the function is not allowed for the record) on an existing record.

- Amend the details of a record.

- Authorize a record.

Refer to the Oracle FLEXCUBE User Manual on Common Procedures for details of these operations.

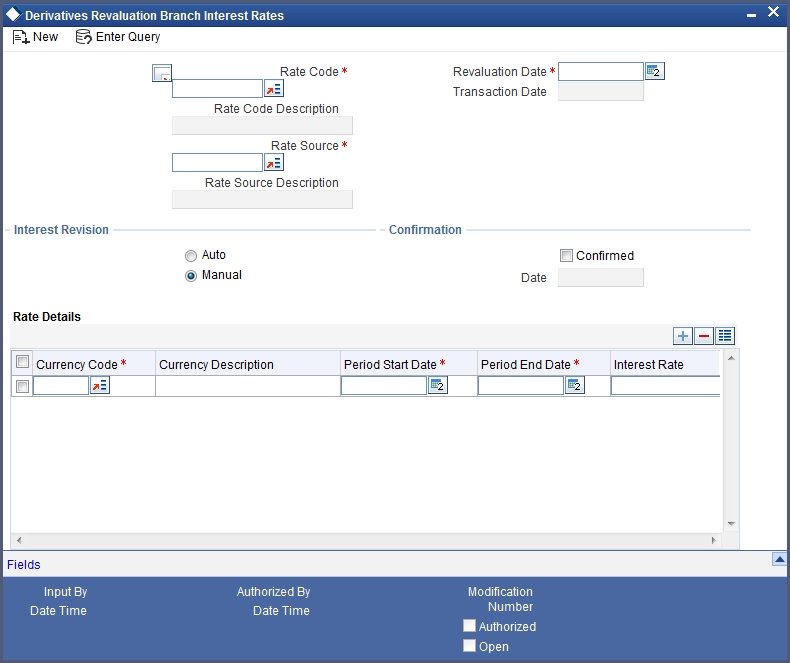

4.3 Derivatives Revaluation Branch Interest Rates

This section contains the following topics:

- Section 4.3.1, "Maintaining Branch-wise Forward Interest Rates"

- Section 4.3.2, "Operations on the Branch wise Forward Interest Rate Maintenance record"

4.3.1 Maintaining Branch-wise Forward Interest Rates

Branch level maintenance of forward interest rates is necessary for revaluing those contracts for which you have indicated that revaluation should be according to the Branch Rates.

Oracle FLEXCUBE identifies those contracts, which are to be revalued according to the forward interest rates maintained at the branch level and creates records in the ‘Revaluation Branch Interest Rates’ screen based on the revaluation date. You have to unlock each record and indicate appropriate interest rates for specific interest periods.

You can invoke the ‘Derivatives Revaluation Branch Interest Rates’ screen by typing ‘DVDBRRAT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The advantage in maintaining branch-wise interest rates is that when there are multiple contracts which require the same rate(s) for processing revaluation (the tenor and currency combination should be the same) the BOD function identifies all the required rates and inserts a single record into this screen.

If you are maintaining details of a new interest rate for your branch, select ‘New’ from the Actions menu in the Application tool bar or click new icon. The ‘Branch Interest Rates Maintenance’ screen will be displayed without any details.

If you are calling a branch interest rate record that has already been defined, choose the Summary option under Branch Rates. From the ‘Summary’ screen double click a record of your choice to open it.

To modify or update existing interest rates, click the unlock icon or select ‘Unlock’ from the menu. After indicating the new interest rate, the currency of the interest rate and the period for which the new rate is valid, save the record.

Rate Code and Rate Source

If you are maintaining the details of a new interest rate for your branch you have to indicate the rate code that is to be associated with the interest rate. You can identify a valid code from the list of rate codes available. Subsequently you also have to indicate the source to which the rate code belongs.

When you indicate the codes linked to the rate code and source the description assigned to them will be defaulted in the adjacent fields.

Revaluation Date

All those contracts, which should be revalued as per the interest rates maintained at the branch level, will be revalued as of the revaluation date. While maintaining details of a new interest rate you have to indicate the date based on which contracts should be revalued.

Interest Revision

The system revises interest rates automatically when the daily batch for derivatives is run using the Branch specific Interest rate revaluation method.

Confirmation

Check this box to confirm that the interest rate entered is correct. Once you check this box the current system date will be displayed in the Date field.

Note

If you leave this box unchecked then this record will not be taken up for revaluation processing.

Rate Details

Since the system identifies the currency and tenor of forward rates required for each revaluation date, on the Revaluation Date only those contracts with the particular Rate Code, Rate Source and Currency combination will be considered for revaluation.

Currency Code

Choose the currency in which you want to maintain the Interest Rate. Once you select the Currency Code the description assigned to it will be displayed in the adjacent field.

Period Start and End Date

Specify the start and end dates for the interest rate you are defining.

Interest Rate

Enter the interest rate for the particular rate code. The interest rate that you specify here is meant for your branch and will be used to determine the Fair Value of all those contracts for which you have indicated that branch level interest rates are to be used for revaluation.

Moreover, revaluation will be done for only those contracts with the particular Rate Code, Rate Source and Currency combination for the particular Revaluation Date.

To define a new forward interest rate for a specific interest period, click the add button and enter the relevant details. To delete an existing rate, highlight the rate and click on the delete button.

4.3.2 Operations on the Branch wise Forward Interest Rate Maintenance record

Apart from maintaining a new forward interest rate, you can perform any of the following operations (if any function under the Actions menu is disabled, it means that the function is not allowed for the record) on an existing record.

- Amend the details of a record.

- Authorize a record.

Refer to the Oracle FLEXCUBE User Manual on Common Procedures for details of these operations.

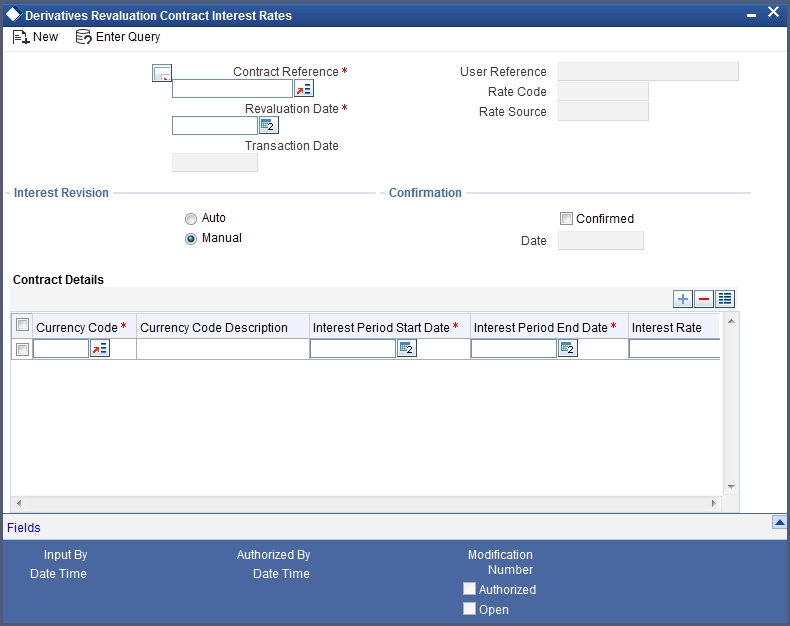

4.4 Derivatives Revaluation Contract Interest Rates

This section contains the following topics:

- Section 4.4.1, "Maintaining Contract specific Forward Interest Rates for Revaluation"

- Section 4.4.2, "Operations on the Contract Specific Forward Interest Rate Maintenance record"

4.4.1 Maintaining Contract specific Forward Interest Rates for Revaluation

You need to maintain contract specific forward interest rates to revalue those contracts whose fair price is to be determined based on the forward interest rates maintained for the particular contract.

The system creates and stores records in the ‘Contract Interest Rates Maintenance’ screen for those contracts whose fair price is to be determined based on the forward interest rates maintained for the contract. You can invoke the ‘Derivatives Revaluation Contract Interest Rates’ screen by typing ‘DVDCNRAT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To indicate the forward interest rates of individual contracts you have to invoke the ‘Contract Summary’ screen by selecting the Summary option under Contract Rates. From the ‘Summary’ screen double click the record of your choice to open it. Select ‘Unlock’ from the Actions menu in the Application tool bar or click unlock icon. Enter the interest rate(s) required for each contract and confirm it.

For an ad hoc revaluation of a particular contract, select ‘New’ from the Actions menu in the Application tool bar or click new icon. The ‘Contract Interest Rates Maintenance’ screen will be displayed without any details. Select the reference number of the contract which is to be revalued after you indicate the new revaluation date of the contract you can specify the new interest rate for the interest period.

Note

The interest rate(s) that you enter here will be used to determine the Fair Value for revaluing that particular contract.

4.4.2 Operations on the Contract Specific Forward Interest Rate Maintenance record

Apart from maintaining a new contract specific forward interest rate, you can perform any of the following operations (if any function under the Actions menu is disabled, it means that the function is not allowed for the record) on an existing record.

- Amend the details of a record.

- Authorize a record.

Refer to the Oracle FLEXCUBE User Manual on Common Procedures for details of these operations.