4. Defining Attributes specific to FX Products

4.1 Introduction

Broadly speaking, to meet your requirements, you will enter into two types of foreign exchange deals. They are:

- Spot deals

- Forward deals

Spot deals

When a foreign exchange deal is settled within spot days (usually two days) of entering into the deal, it is referred to as a Spot Deal.

While spot deals settle on the spot date,

- Cash deals settle on the same day

- Tomorrow, or TOMs, settle on the next working day

Forward deals

A foreign exchange deal that is settled beyond the spot days (of entering the deal) is referred to as a forward deal.

In this chapter, we shall discuss the manner in which you can define attributes specific to a Foreign Exchange (FX) deal as a product.

This chapter contains the following sections:

4.2 FX Products

This section contains the following topics:

- Section 4.2.1, "Invoking FX Product Definition Screen"

- Section 4.2.2, "Preferences Tab"

- Section 4.2.3, "Additional Tab"

4.2.1 Invoking FX Product Definition Screen

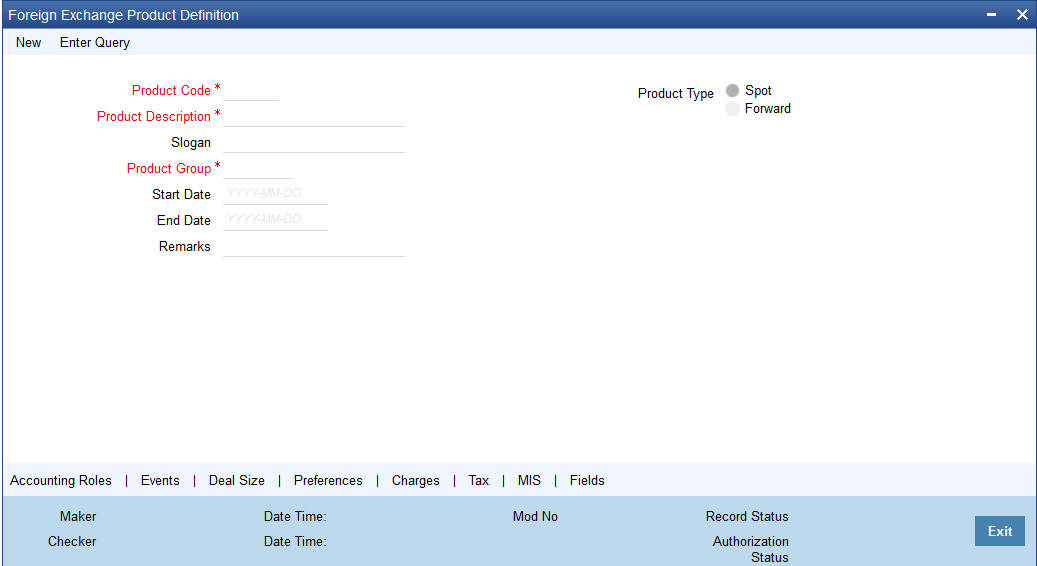

You can create FX products using the ‘Foreign Exchange Product Definition’ screen. You can invoke the ‘Foreign Exchange Product Definition’ screen by typing ‘FXDPRMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you can enter basic information relating to a deposits product such as the Product Code, the Description, etc.

For any product you create in Oracle FLEXCUBE, you can define generic attributes, such as branch, currency, and customer restrictions, interest details, tax details, etc., by clicking on the appropriate icon in the horizontal array of icons in this screen. For a foreign exchange product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this chapter.

You can define the attributes specific to a deposits product in the ‘Foreign Exchange Product Definition Main’ screen and the ‘Foreign Exchange Product Preferences’ screen. In these screens, you can specify the product type and set the product preferences respectively.

For further information on the generic attributes that you can define for a product, please refer the following Oracle FLEXCUBE User Manuals under Modularity:

- Product Definition

- Interest

- Class

- Charges and Fees

- Tax

- User Defined Fields

- Settlements

You can define product restrictions for branch, currency, customer category and customer in Product Restrictions (CSDPRDRS) screen.

For details on product restrictions refer Product Restriction Maintenance chapter in Core Service User Manual.

You can define User Defined Fields in ‘Product UDF Mapping’ screen (CSDPDUDF).

For details on User Defined Fields screen refer Other Maintenances chapter in Core Service User Manual.

Code

Specify the code of the FX product.

Description

Enter a small description for the product.

Type

The first attribute that you define for a product is its type. You can broadly classify products into two types in the Foreign Exchange module of Oracle FLEXCUBE - Spot and Forward.

For example, you want to create a product for GBP/USD spot (buy) deals called BuyGBP. When you define the product you would indicate that the product type of this product is Spot.

Under each product type you can create any number of products.

Slogan

Enter a slogan for the product.

Group

Select the group to which the product belongs.

Start Date

Select the date from which the product is effective.

End Date

Select the date till which the product can be used.

Remarks

Enter any additional remarks about the product.

4.2.2 Preferences Tab

Preferences are the attributes or terms defined for a product that can be changed for a deal involving the product. By default, an FX deal acquires the attributes defined for the product to which it belongs.

However, the attributes that are defined as the product’s “preferences” can be changed for a deal. To invoke the ‘Preferences’ screen click ‘Preferences’ button.

You can define the preferences for a product in the ‘FX Product Preferences’ screen. The following are the preferences that you can define for a product.

The product for which you are maintaining preferences is defaulted here.

Description

The description of the product is displayed here.

Specifying Preferences for Forward Contracts

Option Date Allowed

For a product, you can indicate whether an Option Date can be specified for forward deals during deal processing. If you specify an option date, then you can change the contract value date to any date between the option date and the original value date, This means that the contract may be liquidated anytime between the option date and the value date of the contract.

To allow an option date, check this box.

However, if you have allowed an option date for a product, you need not necessarily enter an option date during deal processing.

Max Tenor (In Months)

When you create a product, you can specify the maximum tenor for forward deals involving the product. You cannot enter a deal with a tenor that exceeds that specified for the related product. However, you can enter an FX deal with a tenor that is less than that specified for the product.

To specify the maximum allowed tenor for a product, enter an absolute value (in months) in the ‘Max Tenor’ field.

Indicating the Contract Details to be Rekeyed

All contracts entered in the system should be ratified or ‘authorized’ by a user with the requisite rights. This is a security feature.

When creating a product, you can indicate if the authorizer of contracts involving the product needs to rekey important contract details. This is to ensure that the contract is not mechanically authorized. If you opt for rekey of details click on the button against ‘Yes’ under Rekey required field.

Rekey Required

Select ‘Yes’ if you want to rekey the details, else select ‘No’.

Selecting Fields for Rekey

Counterparty

Check this box if you want the counterparty details to be rekeyed.

Deal Currency

Check this box if you want the deal currency details to be rekeyed.

Deal Amount

Check this box if you want the deal amount details to be rekeyed.

Value Date

Check this box if you want the Value date details to be rekeyed.

Exchange Rate

Check this box if you want the exchange rate details to be rekeyed.

You can specify any or all of the above details for rekey.

Under Rekey Fields you can indicate which of the details that you would like the authorizer to rekey. Click on the box adjacent to each contract detail to indicate that it should be rekeyed.

Specify the mode through which product can be used to book contracts. The options available are:

- Input Only - Product can be used only from front end Oracle FLEXCUBE

- Upload Only: Product can be used during upload of FX contract only

- Input and Upload: Product can be used both in case of Manual input through Oracle FLEXCUBE as well as through upload

Tenor Type

Select the tenor for calculation of risk weighted amount. It can be either ‘Fixed’ or ‘Rolling’.

The tenor of FX contract will be arrived as follows:

- Fixed: Bought value date – booking date

- Rolling: Bought value date – Branch date

Method

If you have opted to revalue the foreign currency liability for a product, you must also specify the revaluation method by which the profit or loss is to be calculated. You can revalue the profit or loss in different ways. They are:

- NPV (Net Present Value)

- Rebate

- Straight Line

- Discounted Straight Line

Confirmations

Event wise Confirmation

Check this box to move the confirmation status of FX deal to ‘Unconfirmed’ during amendment/cancellation/reverse/rollover, if outgoing confirmation message is configured for the event.

Payment on Confirmation

If this field is checked, the External Payment System will send the payment messages.

Non-Deliverable Forward Details

A Non-Deliverable Forward (NDF) is an outright forward or futures contract in which counterparties settle the difference between the contracted NDF price or rate and the prevailing spot price or rate on an agreed notional amount.

The NDFs have a fixing date and a settlement date. The fixing date is the date at which the difference between the prevailing market exchange rate and the agreed upon exchange rate is calculated. The settlement date is the date by which the payment of the difference is due to the party receiving the payment.

Oracle FLEXCUBE supports NDF functionality for FX contracts. The settlement for the NDF forward contract will be for NDF net settlement amount in the settlement currency, which is the difference between the settlement amount exchanged and the amount at the fixing rate. The fixing rate will be provided on the fixing date.

Oracle FLEXCUBE supports the NDF forward contract using a “Two deal approach”. In this approach two contracts are initiated manually, they are:

- First deal (NDF Forward Contract) is a forward deal between the settlement currency and the NDF currency.

- Second deal (NDF Fixing Contract) will be a spot deal which is used as a fixing deal for the NDF deal.

Note

You can initiate manually NDF Fixing Contract.

The fixing date for the NDF Forward Contract will be the settlement days for the settlement currency before the maturity date of the NDF Forward Contract.

For both the contracts (NDF Forward Contract and NDF fixing contract) the NDF currency amount is the same, only the settlement currency amount changes depending on the exchange rate at the day of booking NDF forward contract and NDF fixing contract.

Specify the following details in this section:

NDF Indicator

Check this field to indicate whether the product is NDF product or not. By default this field is unchecked.

For forward product type, if the NDF indicator is checked, then the product is for NDF Forward Contract. For spot product type, if the NDF indicator is checked then the product is for NDF Fixing Contract.

Default NDF Currency

Specify the Default NDF Currency from the option list. This field is activated when the NDF indicator is checked. The option list for this field will be list of all BOT and SOLD currency allowed for the branch.

NDF Basis

Specify the NDF Basis from the option list. This field is enabled if the NDF indicator is checked. NDF basis is used to generate the NDF advices for the NDF Forward contract.

Product Restriction

Branch List

Indicate whether you want to create a list of allowed branches or disallowed branches by selecting one of the following options:

- Allowed

- Disallowed

Currency Restrictions

Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options:

- Allowed

- Disallowed

Categories List

Indicate whether you want to create a list of allowed customers or disallowed customers by choosing one of the following options:

- Allowed

- Disallowed

Pricing Details

External Charge

Check this box to indicate that external charges can be fetched from external pricing and billing engine for contracts created under this product.

External Charge is enabled only when the system integrates with external pricing and billing engine (PRICING_INTEGRATION = Y at CSTB_PARAM level).

4.2.3 Additional Tab

Revaluation is the process of stating your foreign currency assets and liabilities in terms of the current exchange rates. Revaluation of your foreign exchange assets and liabilities can result in either a profit or a loss for your bank. This is because, the equivalent of the foreign currency assets and liabilities in the local currency would be recorded in the books at rates other than the current exchange rates and converting the assets and liabilities to the current/revaluation rate would result in a change in the local currency equivalent amounts. This change can be a profit or a loss.

Specify the following details.

Revaluation

To allow revaluation of deals involving a product, choose ‘Yes’ by clicking on the button against it. You can disallow revaluation by clicking on the button against ‘No’.

Frequency

If you allow revaluation of your foreign currency liabilities for a product, all deals involving the product will be revalued regularly. You can opt to revalue deals related to a product:

- Daily

- Monthly

If you want to revalue deals on a daily basis click on the button against ‘Daily’ in the Frequency field. If you want to revalue deals on a monthly basis, choose ‘Monthly’ by clicking on the button against it.

Note

Spot contracts can only be revalued on a daily basis – you will not be allowed to choose revaluation frequency as ‘Monthly’.

When you run the End of Day processes in your bank, deals involving products specified for daily revaluation will be revalued. In case of products specified for monthly revaluation the deals involving the products will be revalued during the End of Month processes. Typically, the End of Day operator would perform the revaluation process.

On Booking an FX deal:

If it is an LCY-FCY deal, the discounted amount of the LCY leg is taken as the LCY Equivalent of contract.

For an FCY-FCY deal, the local currency equivalent of the discounted amount of the non-deal currency (calculated at the prevailing exchange rate) is taken as the LCY equivalent of the contract.

Note

Contingent booking entries are passed for the discounted amounts.

On Revaluation:

The interest in both the currencies is accrued separately on a daily basis, starting from the spot date till the maturity date of the contract. The local currency equivalent of the FCY accrual entries is calculated at prevailing rates. Also the previous FCY accrual entries are revalued when you run the account revaluation batch function as part of the EOD operations.

Contract level revaluation of the Discounted Amounts (Contingent Amounts) is done starting from the booking date till maturity of the contract.

These revaluations may result in a profit or a loss for your bank on the contract.

The revaluation entries are passed depending on the frequency you specify.

On the maturity date, the contingent entries are reversed; settlement entries are passed into the nostro accounts for the full deal amounts and the interest receivable and the interest payable are booked into the FX gain/loss GLs.

The method is explained using the example below:

You can indicate the method of revaluation by clicking on the button against the respective methods.

Revaluation method for Spot Contracts

None of the above-mentioned revaluation methods are available for Spot FX contracts. The revaluation of Spot FX contracts simply involves marking them to market, as shown in the following example.

4.2.3.1 Deal level reversal of Revaluation Entries

If you have opted for deal level revaluation reversal while defining FX Branch Parameters, you have to run the deal level revaluation reversal batch process before the EOD contract revaluation process is triggered. This batch process performs reversal of revaluation entries at the level of individual contracts.

See the chapter – Maintaining Data Specific to the FX Module – in this User Manual for more details on maintaining FX Branch Parameters for deal level revaluation reversal.

Refer to the chapter – Beginning of Day Operations – for details of running the deal level revaluation reversal batch process.

Note

If you try to run the deal level revaluation reversal batch in spite of having opted for Account Revaluation as part of FX Branch Parameters definition, an error message is displayed.

The deal level revaluation reversal batch process involves the following:

For spot / forward contracts with NPV / Rebate revaluation

Revaluation entries posted into the Exchange P&L GL are reversed. If the processing date for the revaluation reversal batch process is the first day of a new financial year, the entries posted into the Previous Year Adjustment GL (maintained in the Chart of Accounts) are reversed. This is because, while closing the books of accounts for the previous year, the balances in the Exchange P&L GLs would have been transferred to the Previous Year Adjustment GL.

For details on maintaining Previous Year Adjustment GL, refer to the General Ledger (Chart of Accounts) User manual.

For forward contracts with Straight Line revaluation

Revaluation entries posted into the Exchange P&L GL are reversed, along with Forward Premium / Discount accruals. Current Premium / Discount accruals are not reversed. If the processing date for the revaluation reversal batch process is the first day of a new financial year, the entries posted into the Previous Year Adjustment GL (maintained in the Chart of Accounts) are reversed, instead of reversing the entries in the Exchange P&L GL.

For forward contracts with discounted straight line revaluation

No revaluation reversal takes place.

Refer to ‘Appendix A - Accounting Entries and Advices’ for the FX module’ for descriptions of Accounting Roles and Amount Tags and for generic event-wise accounting entries.

Note

If you have opted for deal level revaluation reversal while defining FX Branch Parameters, revaluation reversal is triggered once before liquidation of a contract. This reverses any existing entries in Exchange P&L GL’s, as also forward premium/discount accruals.

You may opt to allow or disallow brokers while creating a product. If you allow brokers for a product, you can enter into deals that may or may not involve brokers. If you disallow brokers, you cannot enter deals involving brokers, for the product.

To allow brokers, choose ’Yes’ by clicking on the button against it. To disallow brokers choose ‘No’ by clicking on the button against it.

When a deal involving a broker is processed, the brokerage applicable to the broker will be picked up from the Brokerage Rules table.

Cross Currency Deals Allowed

If a deal involves currencies other than the local currency, it is referred to as a cross currency deal. For a product that you are creating, you can opt to allow or disallow cross currency deals.

- If you opt to disallow cross currency deals for a product, you cannot enter a deal that does not involve the local currency.

- If you opt to allow cross currency deals, you can enter a deal involving or not involving the local currency.

To allow cross currency deals, choose ’Yes’ by clicking on the button against it. To disallow cross currency deals choose ‘No’ by clicking on the button against it.

Auto Liquidation Allowed

Foreign exchange deals can be liquidated automatically or manually. In the ‘Product Preferences’ screen, you can indicate whether the mode of liquidation of deals, involving a product, is

- Manual

- Automatic

If you specify the automatic mode of liquidation, deals involving the product will automatically be liquidated on the Settlement Date during the Beginning of Day processing (by the Automatic Contract Update function).

If you do not specify auto liquidation for a product, you have to give specific instructions for liquidation, through the ‘Manual Liquidation’ screen, on the day you want to liquidate a deal.

Note

If the Value Date of a deal is a holiday, the deal will be liquidated depending on your specifications in the Branch Parameters table. In this table

- If you have specified that processing has to be done on the last working day (before the holiday), for automatic events, the deal falling on the holiday will be liquidated during the End of Day processing on the last working day before the holiday.

- If you have specified that processing has to be done only on the system date, for automatic events, the deal falling on a holiday will be processed on the next working day after the holiday, during Beginning of Day processing.

You can specify whether foreign exchange deals, involving the product that you are defining, can be rolled over into a new deal if it is not liquidated on its Value Date.

If you specify that rollover is allowed for the product, it will apply to all the deals involving the product. However, at the time of processing a specific deal involving the product, you can choose not to rollover the deal.

If you specify that rollover is not allowed for a product, you cannot rollover a deal involving the product.

When a contract is rolled over, the terms of the original contract will apply to the new contract. If you want to change the terms of a rolled over contract you can do so during contract processing.

Note

The rolled over contract will retain the reference number of the original contract.

For a product, you can indicate whether the Value Date (settlement date) of the Bought and Sold legs of FX deals, linked to the product, can be different.

If you select Yes, you can specify different value dates for the Bought and the Sold legs of the contract during deal processing. However, deals with the same Value Date can also be entered for the product.

If you select No, the Value Date (settlement date) should be the same for both legs of the deal.

You can choose to allow extension of the Value Date of FX deals involving a product.

If you disallow the extension of value dates for a product, you cannot extend the Value Date of deals involving the product.

Local Holiday Check

After you have specified all your preferences in this screen, click on ‘Yes’ button to store them in the system. Click on ‘No’ button if you do not want to store your preferences in the system.

4.3 Product Combinations

A swap deal is usually a combination of two foreign exchange contracts. These contracts could be Spot - Forward or Forward - Forward contracts. It involves a simultaneous buying and selling of currencies, wherein, the currencies traded in the first deal are reversed in the next.

A swap deal would be defined in Oracle FLEXCUBE as a Product Combination - that is, involving two different products (a particular spot or forward product and another spot or forward product).

This section contains the following topics:

- Section 4.3.1, "Maintaining Product Combinations"

- Section 4.3.2, "Creating a Product Combination"

- Section 4.3.3, "Maintaining Product Category Details for Internal Swap Transactions"

4.3.1 Maintaining Product Combinations

A swap deal is, in effect, a combination of two foreign exchange contracts. These contracts could be

- Spot - Forward OR

- Spot - Spot contracts

A swap deal will therefore involve two distinct products that you have created. The first leg of the deal will involve a particular product. And the second leg of the contract will involve a different product.

For exam[ple, You have defined a product for spot deals for buying USD with INR called BuyUSD. You have created another product for buying INR with USD called BuyINR.

You enter a swap deal in which in the first leg you buy USD and sell INR and in the next leg you buy INR and sell USD.

If you do not maintain a product combination, you will enter a different contract for each leg of the swap deal. For the first leg of the swap you will enter a spot deal to buy USD and sell INR. The product involved would be BuyUSD. In the second leg of the swap, you will enter a spot deal to buy INR and sell USD. The second leg of the swap would involve BuyINR.

4.3.2 Creating a Product Combination

Instead of entering two contracts for the different legs of the contract, (involving two products) you can enter one using a single product. This product would be a combination of the two products.

You can define products that are a combination of two other products through the ‘Foreign Exchange Combination Product Maintenance’ screen.

You can invoke the ‘Foreign Exchange Combination Product Maintenance’ screen by typing ‘FXDPRDCO’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can enter the following details relating to FX Product Combination Definition

Product Combination Code

In this field, you should specify the code by which the product combination is identified in the system. If you are defining a new product combination, enter a new code in this field. You can define a product that is a combination of two different products.

Description

Enter a description for the product.

Start Date

You can create a product such that it can only be used over a particular period. The starting date for this period should be specified in this field. The system defaults to today’s date. Enter a date that is the same as, or later than, today’s date.

End Date

You can create a product that it can only be used over a particular period. The End Date of this period is specified in this field.

Number of Legs

This field identifies the number of contract legs that can be defined under this product combination. The system defaults to a value of two legs. This cannot be changed.

Slogan

This is the marketing punch line for the product. The slogan that you enter here will be printed on the mail advices that are sent to the counter parties who are involved in deals involving the product.

Product Code 1

If the product is a combination of two other products, each leg of the deal corresponds to one product in the combination. Specify which product corresponds to which leg in the ‘Product Combination’ screen. For deals involving such a product, select the product for the first leg of the deal.

Product Code 2

Select the product for the second leg of the deal.

Single Swap Advice Required

Even if you have specified swap advices for both products in a combination, you can generate a single swap advice by choosing this option.

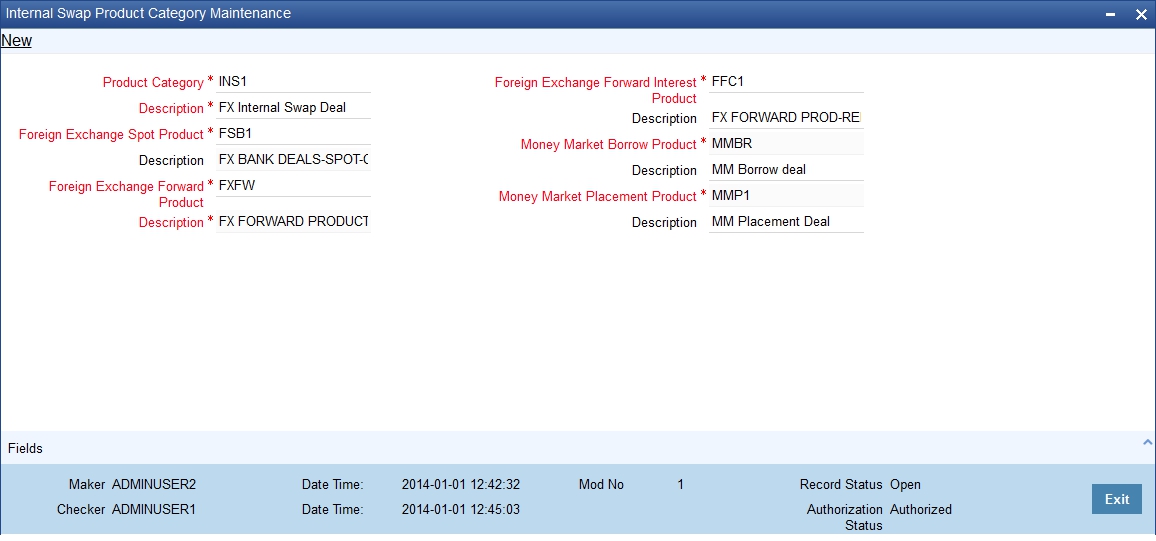

4.3.3 Maintaining Product Category Details for Internal Swap Transactions

You can maintain product category details for internal swap transactions through the ‘Internal SWAP Product Category Maintenance’ screen. An internal swap transaction is a combination of FX and MM transactions generated for a deal between the FX desk and the MM desk. Such deals are usually done to take advantage of prevailing market conditions.

You can invoke the ‘Internal SWAP Product Category Maintenance’ screen by typing ‘FXDISPCM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details.

Product Category

You need to specify the Product Category for internal swap transactions.

Product Category Description

Enter a small description for the Product Category.

Foreign Exchange Spot Product

You need to specify the FX Spot Product for internal swap transactions.

Foreign Exchange Spot Product Description

Enter a small description for the Foreign Exchange Spot Product.

Foreign Exchange Forward Product

You need to specify the FX Forward Product for internal swap transactions.

Foreign Exchange Forward Product Description

Enter a small description for the Foreign Exchange Forward Product.

Foreign Exchange Forward Interest Product

You need to specify the FX Forward Interest Product for internal swap transactions.

Foreign Exchange Forward Interest Product Description

Enter a small description for the Foreign Exchange Forward Interest Product.

Money Market Borrow Product

You need to specify the MM product for Borrowing for internal swap transactions.

Money Market Borrow Product Description

Enter a small description for the Money Market Borrow Product.

Money Market Placement Product

You need to specify the MM Placement product for internal swap transactions.

Money Market Placement Product Description

Enter a small description for the Money Market Placement Product.

4.3.3.1 Validations for Product Category Details for Internal Swap Transactions

- The Product category should be unique across all categories and Oracle FLEXCUBE products.

- No modification should be allowed (except closure) once a product category has been authorized.

- The MM Products should have auto liquidation marked as YES

- The MM Products should have payment type as Bearing

- The MM products should have rollover set to NO

- The MM products should have only one interest component (main) defined for the principal amount

- The rate type of the main interest component should be fixed for both MM products

- The schedule type for the principal and the interest component should be BULLET at the MM product level.

- The FX products should have Cross Currency deals allowed set to YES

- The FX products should have rollover allowed set to NO

- The FX products should have Auto liquidation allowed set to YES