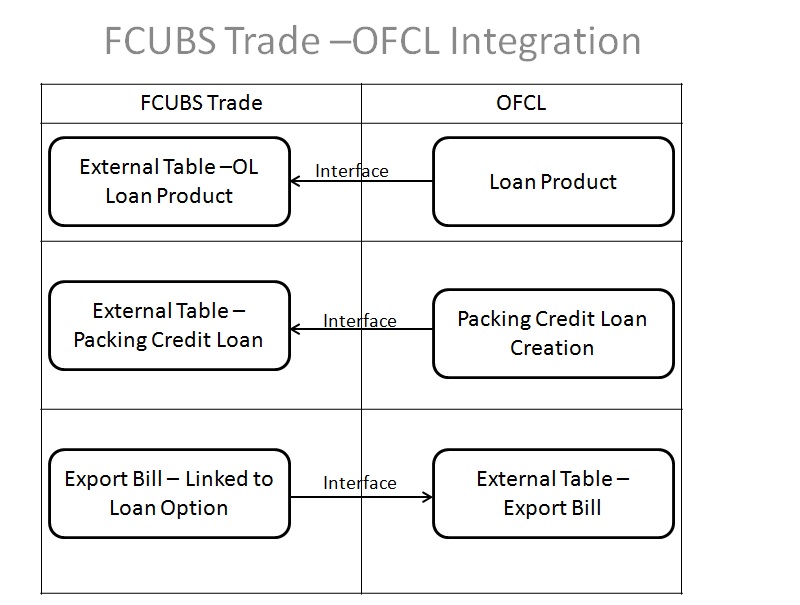

2. FCUBS Trade - OBCL Integration

The integration between FCUBS trade and OBCL enables banks to do the following:

- Loan processing during import bill liquidation with multi limit support

- Loan processing during shipping guarantee creation

- Loan processing during guarantee/SBLC claim settlement with multi limit support

- Linkage of packing credits in export bills with multi loan payment support

- Linking the loan to the bill

This chapter contains the following sections:

2.1 Scope

This section contains the following topic:

2.1.1 Integration Scope

The following are the integration scope of FCUBS with OBCL:

- You can liquidate an import bill by taking loan. The loan is created in OBCL after FCUBS saves and authorizes import bill liquidation request. The request and response of loan creation are logged in the staging table.

- You can create loan for shipping guarantee for products for which ‘Collateral Funding by Loan’ is enabled. The loan is created in OBCL and the details are logged in the staging table. The loan is created in OBCL once shipping guarantee is saved and authorized in FCUBS.

- While creating export bills, you can request OBCL to liquidate the linked packing credit loan. On successful liquidation of packing credit loans, the bill will be authorized. Packing credit loans can be linked during purchase or discount of export bills or liquidation of export collection bills. The payment request is posted in OBCL once export bill transaction is saved and authorized in FCUBS.

- The bills which has ‘Link to Loan’ option enabled will be handed over to OBCL to create the loan and link the bill with the loan.

- Loan products which are exposed from OBCL will be available in FCUBS to link in LC and BC product level.

- Oracle Lending products and contracts that are created or modified and interest components for loan products in OBCL will be exposed to FCUBS through webservice.

- Loan processing request from FCUBS will be send to OBCL during Guarantee Claim Settlement authorization.

2.2 Prerequisites

This section contains the following topics:

- Section 2.2.1, "Prerequisites in Oracle FLEXCUBE Universal Banking System"

- Section 2.2.2, "Prerequisites in Oracle Banking Corporate Lending"

2.2.1 Prerequisites in Oracle FLEXCUBE Universal Banking System

The prerequisites in FCUBS for this integration are as follows:

- The parameter ‘LOAN_PROCESSOR’ in CSTB_PARAM should be ‘E’ (External) for FCUBS to interface with OBCL.

- You have to maintain the following details in ‘External System

Maintenance’ (IFDEPSMT) screen:

- External System Type should be 'Loans'

- Bridge GL to be maintained in Inter System Bridge GL

- Source System to be maintained

- Read Timeout, Connection Timeout and Archival Days to be maintained

- Service Code to be 'GenLoanMessage'

- Service Name to be 'FCUBSOLService'

- Web Service User Option should be 'Contract'

- OL Web Service to be maintained in Web Service URL

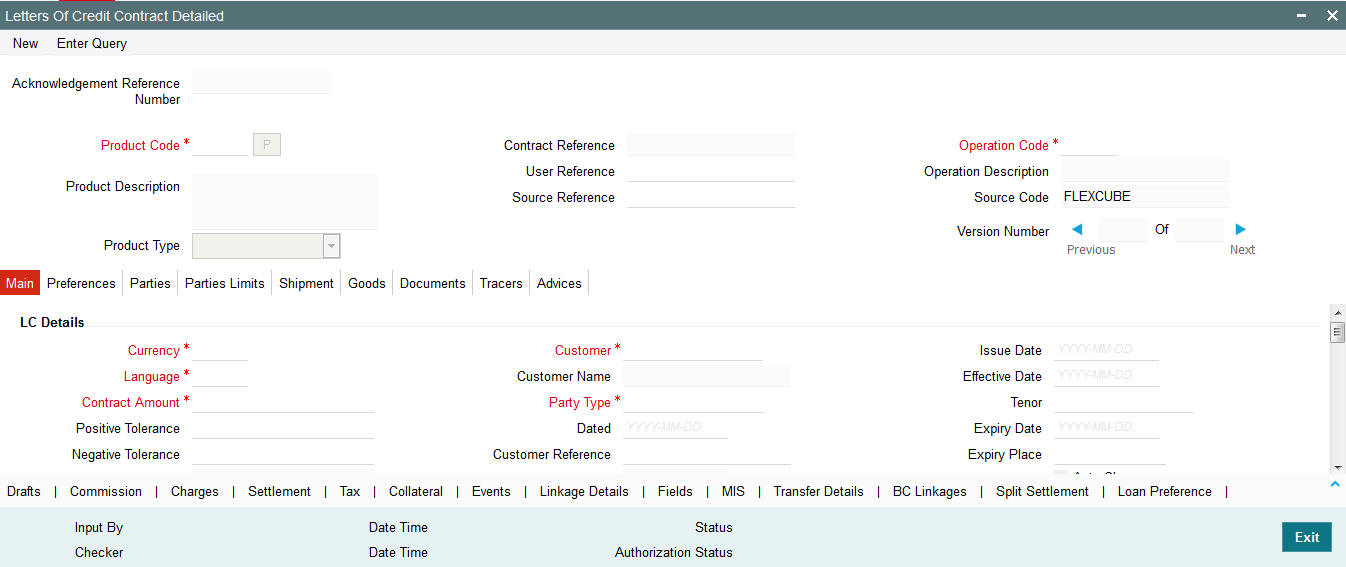

- Import bill liquidation - Book bill by enabling 'Advance by Loan' check box in Bills and Collections Contract Input screen (BCDTRONL)

- Shipping guarantee creation - Enable ‘Loan for Collateral’ flag in LC Product (LCDPRMNT) and LC Contract Input screen (LCDTRONL). You have to maintain split details in Split Settlement sub-screen in LC Contract Input screen (LCDTRONL)

- Packing credit - OL contracts with ‘Packing Credit’ flag enabled will be available in FCUBS. You can link packing credit loan to an export bill during purchase, discount or collection liquidation.

- Link to loan - Enable ‘Link to Loan’ flag at BC Product (BCDPRMNT) level and BC Contract Input (BCDTRONL) and create the bill

2.2.2 Prerequisites in Oracle Banking Corporate Lending

The prerequisites in OL for this integration are as follows:

- An external system should be created for trade. The WSDL should me mapped to the external system in the IFDINPRM screen along with a user that is specifically created and used for the integration.

- Loan product enabled with 'Advance By Loan' option created in OBCL to be handed over to FCUBS.

- Packing credit loan created in OBCL is handed over to FCUBS. Outstanding amount to be updated in FCUBS on payment, amendment or any other event that occurs in loan contract. In case of loan closure, the status has to be updated in FCUBS.

- Export bill contract with ‘Linked to Loan’ option created

in FCUBS to be provided to OBCL.

2.3 Integration Process

This section contains the following topics:

- Section 2.3.1, "Loan Creation during Import Bill Liquidation"

- Section 2.3.2, "Loan Creation during Shipping Guarantee Creation"

- Section 2.3.3, "Loan Creation during Guarantee Claim Settlements"

- Section 2.3.4, "Linkage of Packing Credit Loan in Export Bills"

- Section 2.3.5, "Link to a Loan"

- Section 2.3.6, "OL Products and Contracts from OBCL to FCUBS"

- Section 2.3.7, "ELCM Limit Processing"

- Section 2.3.8, "Job Processing"

- Section 2.3.9, "Trade-OL Transaction Log"

2.3.1 Loan Creation during Import Bill Liquidation

Import bills are created for products with ‘Advance by Loan’ option selected.

Saving Import Bill Liquidation

During liquidation of import bills, partial or full liquidation, details for loan creation will be available in Loan Preference screen. The details should be maintained as below:

- Loan Amount = Bill liquidation amount minus Cash collateral in Bills, Collateral from LC and available amount in settlement account if 'Liquidate using Collateral' and 'Settle available Amount' flag are checked. If not, then Loan Amount = Liquidation Amount

- Loan currency = Local currency or Bill Currency

- Counterparty = Counterparty of the Import Bill

- Value date = Liquidation date

- Maturity date = Value Date + Tenor of loan product

- Interest rate = Defaulted from Loan Product screen

- Suspense GL = Bridge GL maintained at Import Bill product maintenance. Suspense GL in FCUBS and OBCL should be the same

BC Limits will be defaulted to Loan Preference and you can modify the same.

Authorizing Import Bill Liquidation

During manual bill liquidation authorization, if the limits are tracked in the bill, then request for limit de-utilization will be posted to ELCM with process status as ‘U’ (in STTB_REQ_MASTER). If the de-utilization is successful then the process will be ‘P’. Bill authorization can proceed only if de-utilization is successful.

If any dual authorization overrides are logged during save of bill liquidation, then authorization of bill liquidation will fail with error ‘Contract Authorization possible only after authorizing the overrides'. You have to authorize the override manually and then proceed for authorization of bill liquidation.

Request for loan creation and authorization will be posted in intermediate store with the following details:

- Unique Queue Reference Numbers will be generated

- User Id for Loan creation request to be 'SYSTEM'

- User Id for loan authorization request to be Bill liquidation authorization user Id. Bill authorization user logged in Queue table will be provided in Loan authorization request.

- Status of Loan creation request will be based on limit tracking in Bills

- If Bill is booked with Limit Tracking, status of loan creation request to be 'Pending'. Once limit de-utilization is successful, status will be changed from 'Pending' to 'Unprocessed.

- If Bill is booked without Limit Tracking, status of loan creation request to be 'Unprocessed'

- Status of Loan authorization request will be ‘Hold’

If loan processing has failed and the user tries to authorize, the system displays an error message.

If Loan authorization has failed due to rejection of Credit Exception, manual authorization can be initiated again

Deleting Import Bill Liquidation

If ‘External Loan Request Status’ is ‘Unprocessed’ then you cannot delete the bill. If ‘External Loan Request Status’ is ‘Failed’, then you can delete the bill. On successful Bill deletion entries from staging tables will be moved to History tables.

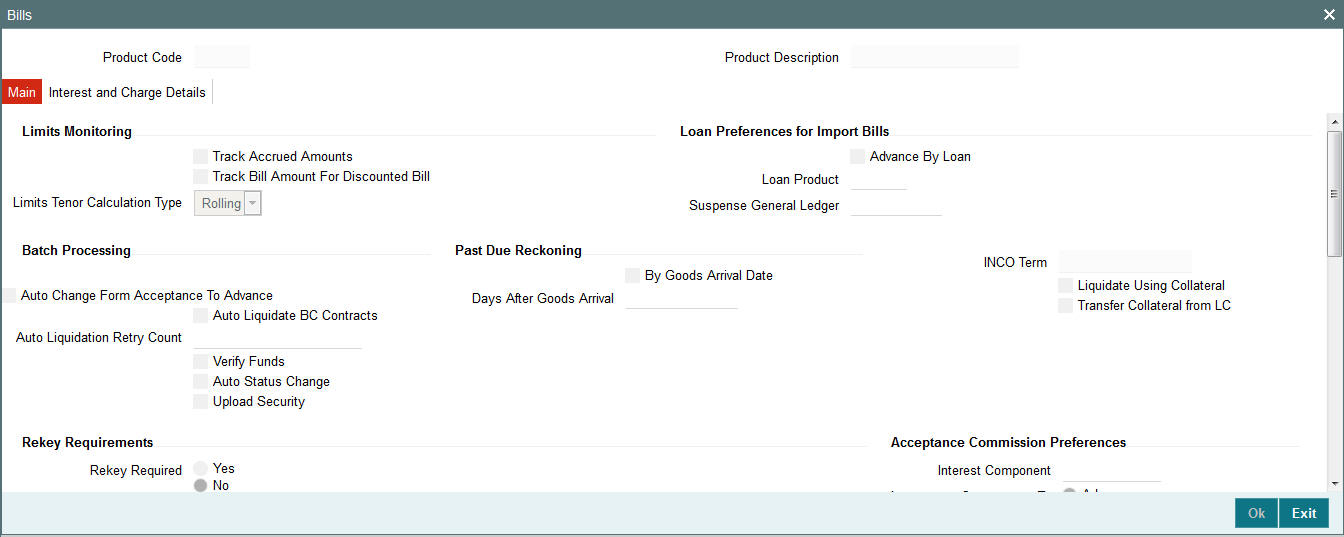

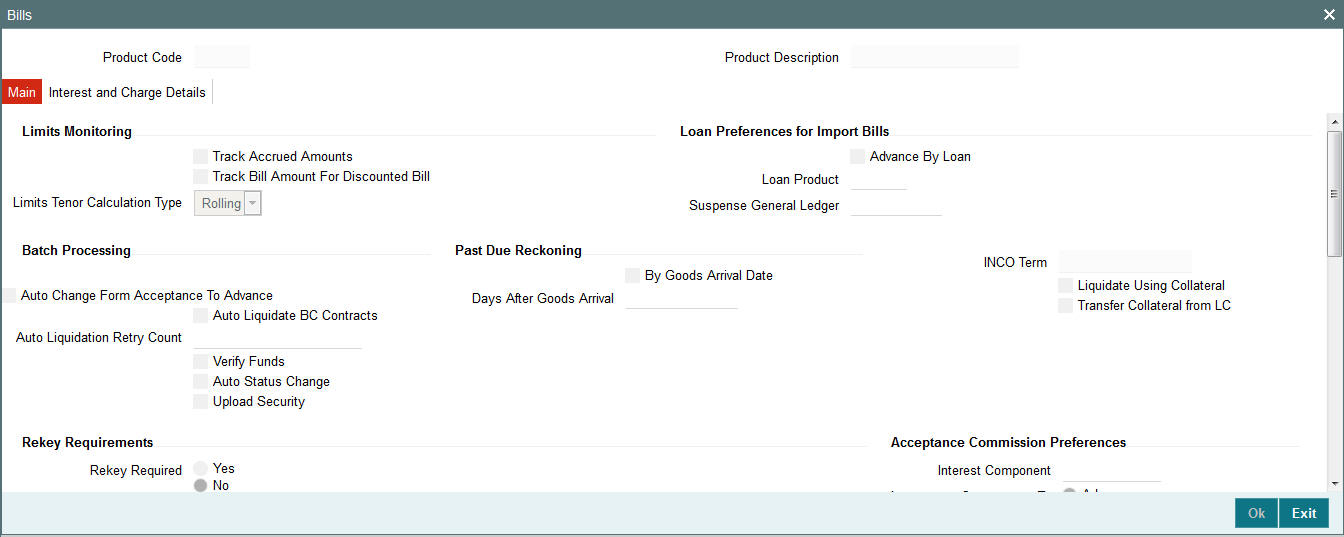

2.3.1.1 Product Maintenance

You have to maintain the loan product in the Bills and Collections Product Definition (BCDPRMNT) screen. You can invoke this screen by typing ‘BCDPRMNT’ in the top right corner of Application toolbar and clicking the adjoining arrow button. The loan products are displayed in ‘Loan Product’ option in ‘Loan Preferences for Import Bills in Preferences’ section.

You have to maintain the following in this screen to create Import bill product:

Advance by Loan

Check this box to create import bill.

Loan Product

Specify the loan product. Alternatively, you can select the loan product from the option list. The list displays all valid options maintained in FCUBS and OBCL.

If 'LOAN_PROCESSOR' in CSTB_APARM is 'E', then the system will interface with OBCL. The Loan Product option list will fetch only OL products. If the parameter value is 'I' (Internal), system will continue with CL Module.

Inter System Bridge GL configured for External System Type ‘Loans’ to be available in Suspense General Ledger option list.

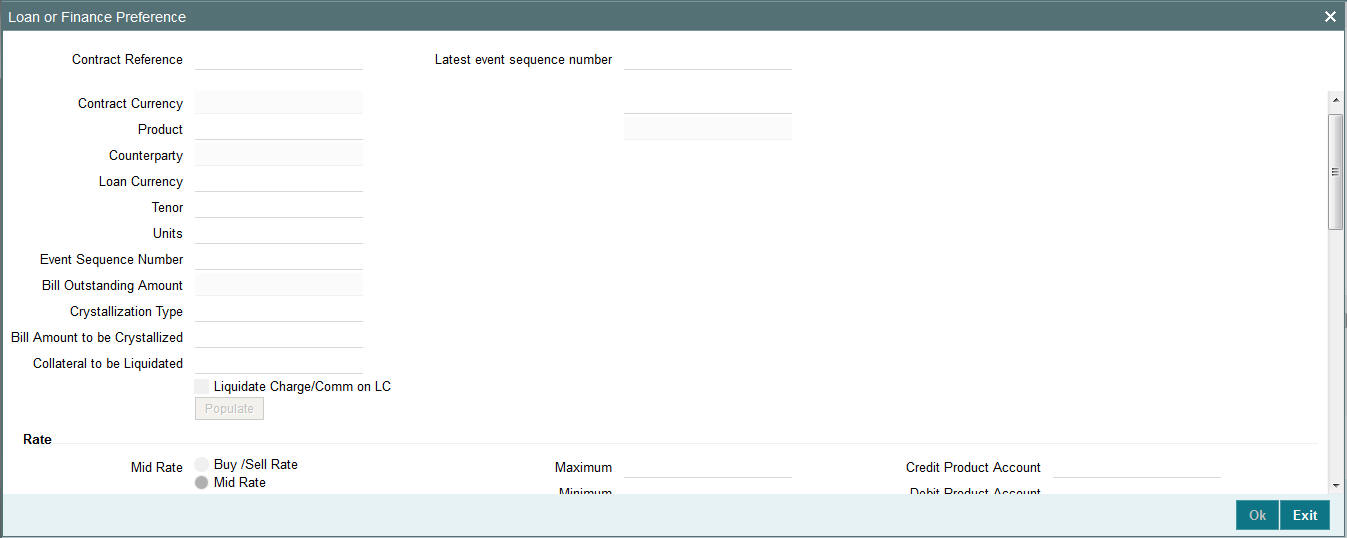

2.3.1.2 Loan Preferences

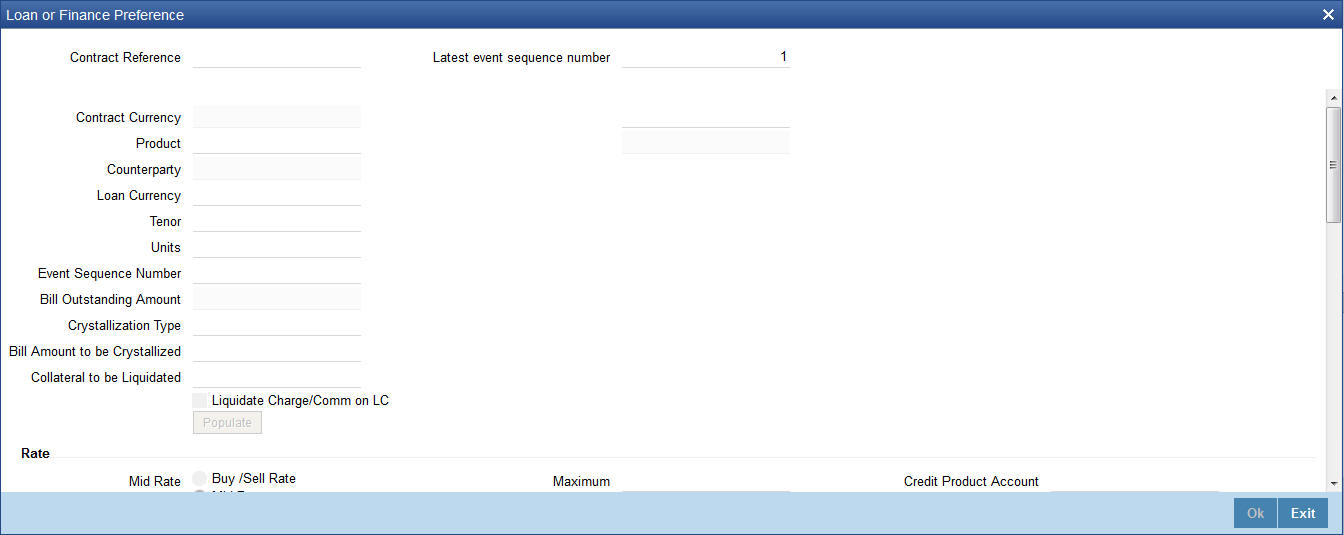

You have to maintain the loan product in the contract screen also. The system supports multi limits for loan processing.You can invoke ‘Bills and Collections Contract Input’ screen by typing ‘BCDTRONL’ in the top right corner of the Application toolbar and clicking adjoining arrow button.From BCDTRONL, click ‘Loan Preference’ link to invoke Loan or Finance Preference screen.

Product

Specify the product code. Alternatively, you can select the product code from the option list. The list displays all valid options maintained in FCUBS and OBCL.

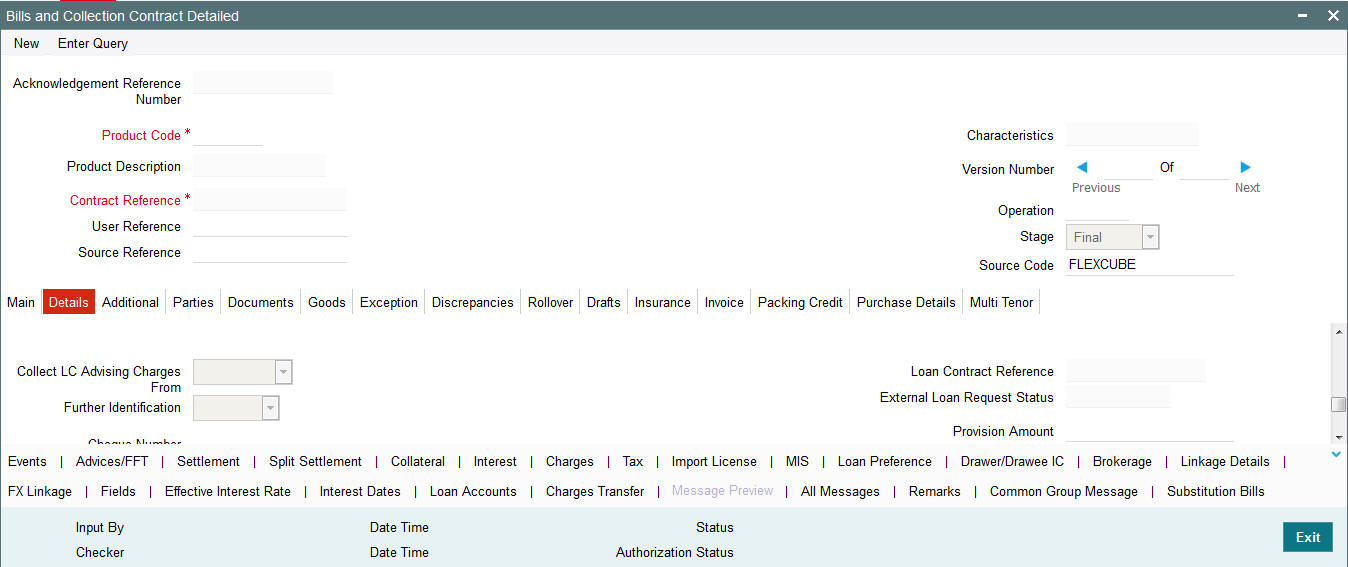

2.3.1.3 Import Bill Processing

You can view the status of loan request in ‘External Loan Request Status’ field in the ‘Details’ tab of this screen.

2.3.2 Loan Creation during Shipping Guarantee Creation

Loan as collateral is created for a Shipping Guarantee product if ‘Collateral Funding by Loan’ is checked. The following steps are performed while creating a loan as a collateral for shipping guarantee issuance.

Saving Shipping Guarantee Creation

- During creation of shipping guarantee, the following details should

be maintained for loan creation:

- Branch Code - Branch code of the account

- Loan Product - Loan product for which shipping guarantee has to be created

- Loan Amount - Amount provided in Split Settlement for loan creation

- Loan Currency - Local currency (or) Contract Currency to be maintained

- Counterparty - Counterparty of the shipping guarantee

- Value Date - Issue date of shipping guarantee

- Maturity Date - Issue date of shipping guarantee + tenor of loan product

- Suspense GL - The Bridge GL maintained at shipping guarantee product maintenance. Suspense GL in FCUBS and OBCL should be the same.

- Interest components will be defaulted in UDE Details

- Rate Code will be available for Fixed Rate type and it can be modified. If Rate Code is not available, Interest rate can be provided in UDE Value. Interest Rate should not be negative.

- Floating Rate Type - The system defaults Usage. You can modify it.

Authorizing Shipping Guarantee Creation

Shipping Guarantee authorization will fail if there are any dual authorization overrides and system will display an error message. User has to authorize the override manually and then proceed for authorization of shipping guarantee.

Loan creation and loan authorization requests will be posted in intermediate store with the following details:

- User ID for Loan creation request will be posted as 'SYSTEM'

- User ID for Loan authorization request will be posted as Shipping Guarantee authorization user

- Status of Loan creation request will be ‘Unprocessed’.

- Status of Loan authorization request will be ‘Hold’

The ‘External Loan Request Status’ in LCDTRONL will be updated as ‘Unprocessed’. If you try to delete, modify or authorize the Shipping Guarantee, the system displays an error message.

- On receiving success response, if you try to delete the shipping guarantee, the system displays an error message as the loan is authorized.

- In case of failure response, you have to manually delete the shipping guarantee.

2.3.2.1 Product Maintenance

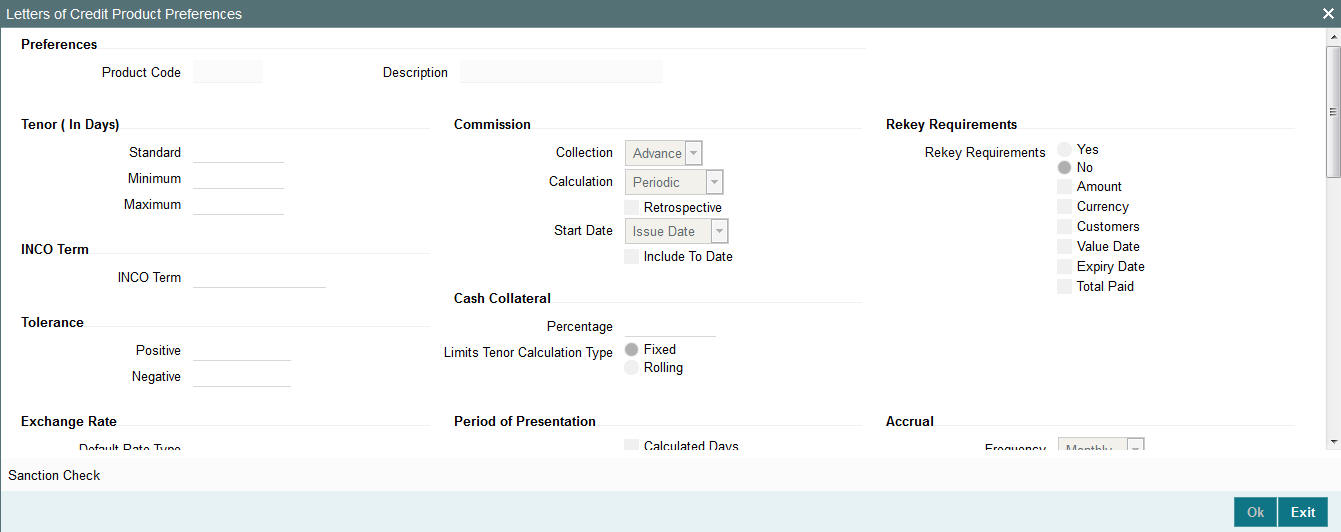

You can invoke the ‘Letters of Credit Product Definition’ by typing ‘LCDPRMNT’ in the top right corner of the Application toolbar and clicking the adjoining arrow button.

You have to maintain the following in this screen to create Shipping Guarantee product:

Collateral Funding by Loan

Check this box to create loan for shipping guarantee.

Loan Product

Specify the loan product. Alternatively, you can select the loan product from the option list. The list displays all valid options maintained in FCUBS and OBCL.

2.3.2.2 Loan Preferences

You can invoke ‘Letter of Credit Contract Input’ screen by typing ‘LCDTRONL’ in the top right corner of the Application toolbar and clicking adjoining arrow button. Click ‘Loan Preference’ button to invoke ‘Loan or Finance Preference’ screen.

Product

Specify the product code. Alternatively, you can select the product code from the option list. The list displays all valid options maintained in FCUBS and OBCL.

2.3.2.3 Shipping Guarantee Processing

You can view the status of loan request in ‘External Loan Request Status’ field in the ‘Main’ tab of this screen.

2.3.3 Loan Creation during Guarantee Claim Settlements

The request for loan processing will be sent to OBCL through web service during authorization of Guarantee Claim Settlement.

Saving Guarantee Claim Settlement Creation

When Claim Settlement is done for a guarantee contract created with Claim Settlement by Loan option, then the following details for loan creation will be defaulted in Loan Preference screen:

- Loan amount will be the amount provided in split settlement for loan creation.

- Loan Currency: Loan Currency to be local currency or Contract currency

- Counter Party: Counterparty of the Guarantee

- Value Date: Value date to be Claim Payment Date

- Maturity Date: Maturity Date to be Claim Payment Date+ tenor of loan product

- Suspense GL: Suspense GL will be the Bridge GL maintained at Guarantee product maintenance. Suspense GL in FCUBS and OBCL should be the same. This should be operationally controlled.

- Interest components will be defaulted in UDE details. Interest type can be Fixed or Floating

- Rate Code will be defaulted for Floating Rate Type.

Authorizing Guarantee Claim Settlement Creation

Claim Settlement Authorization will fail if there are any dual authorization overrides and system displays an error message. You can authorize the override manually and then proceed for authorization of Claim Settlement.

Loan creation and authorization requests will be posted in intermediate store with the following details:.

- Claim Settlement with Limits - Status of Loan creation request will be 'Pending'

- Claim Settlement without Limits - Status of Loan creation request will be 'Unprocessed'

- Status of Loan authorization request will be 'Hold'

The ‘External Loan request Status’ in LCDGCLP will be updated as ‘Unprocessed’. If you try to delete, modify or authorize the Claim Settlement, the system displays an error message.

Limits utilized during Guarantee Issuance and/or Amendment will be de-utilized to the extent of the claim amount while settling the claim.

Liability amount and/or available amount will be reduced to the extent of claim amount upon settlement.

2.3.3.1 Loan Processing

When a loan creation request is sent to OBCL through web service, the loan will be created and saved. You can process loan creation requests with multi limits.

If loan authorization is successful, External Loan Request Status will be ‘Processed’ and if authorization is failed then the status will be ‘Failed’.

If loan deletion request is sent, OBCL will process the same and responses will be send to FCUBS. On successful loan deletion, underlying Claim Settlement will be deleted.

The loan which is created and unauthorized from FCUBS, will not be allowed to modify, delete and authorize manually in OBCL.

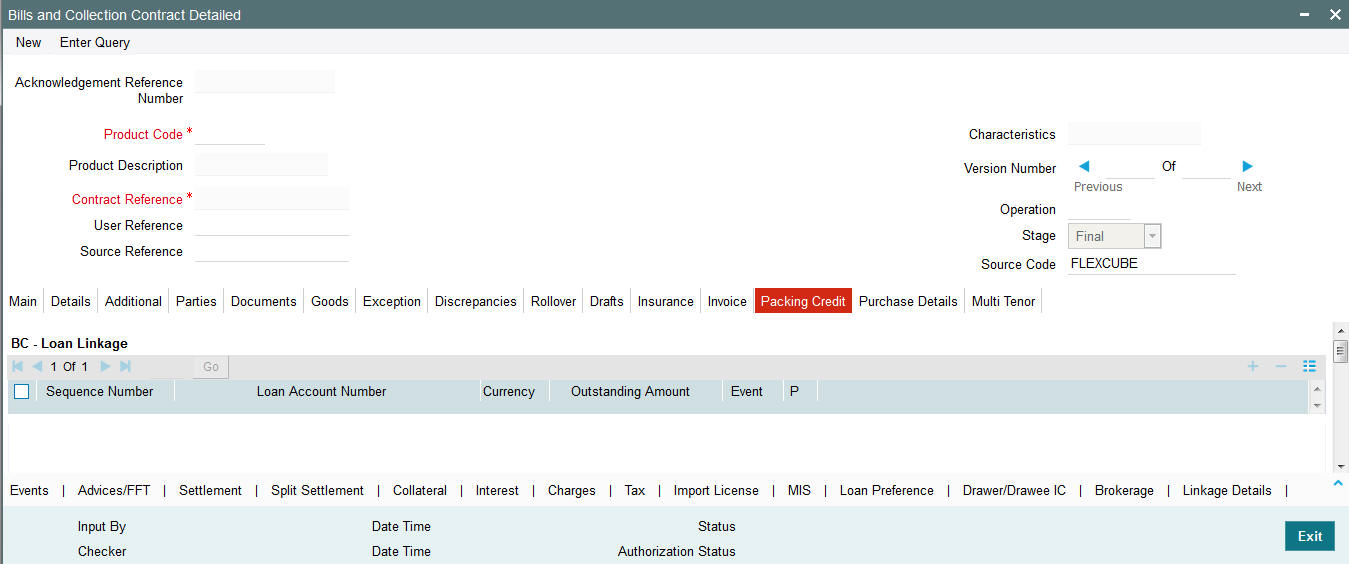

2.3.4 Linkage of Packing Credit Loan in Export Bills

The following steps are performed while processing the export bill with packing credit loan attached.

- Packing credit loans created in OBCL is provided to FCUBS.

- Packing credit loans can be linked during purchase or discount of Export Bills / Liquidation of Export Collection Bills.

- Multiple Packing Credit Loans can be linked to a bill. Sum of linked loan amount should not be greater than the purchase amount. You can attach multiple loans for packing credit loan.

- On Save and Authorize of Export Bill, request to liquidate multiple Packing Credit Loan is logged in staging table and related accounting entries are posted.

- You can view the status of loan request processing in ‘External Loan Request Status’ field in Bills and Collections Contract Input screen.

- System posts the multi loan payment request to OBCL and the responses are sent to FCUBS. The successful payments are auto-authorized.

- On successful loan liquidation and authorization, the system authorizes the bill automatically.

- In case of failure response you have to manually delete the operation.

2.3.4.1 Linking Packing Credit Loans in the Contract screen

In Bills and Collections Contract Detailed screen, under Packing Credit tab, Packing credit loans can be linked during purchase or discount of Export Bills /Liquidation of Export Collection Bills.You can invoke ‘Bills and Collections Contract Input’ screen by typing ‘BCDTRONL’ in the top right corner of the Application toolbar and clicking adjoining arrow button.

Loan Account Number

Specify the loan account number. Alternatively, you can select the loan account number from the option list. The list displays all valid options maintained in both FCUBS and OBCL.

2.3.5 Link to a Loan

The following steps are performed while linking a loan.

- Export Bill products created in FCUBS with ‘Link to Loan’ option selected is provided to OBCL.

- During loan creation in OBCL, export bills should be allowed for linkage. On successful linkage of export bill in OBCL, request will be sent to FCUBS to trigger BLNK event for the bill.

- During Reversal of Loan in OBCL, request will be sent to FCUBS to trigger BLRV event.

- You can settle the loan in OBCL before liquidation of the bill.

- On liquidation of bill in FCUBS, request will be sent to OBCL to update Bill due amount.

- In OBCL, value date of the loan cannot be less than Bill value date and cannot be greater than Bill maturity date.

- The sum total of all loan amount financed must be greater than Bill Outstanding Amount

Export Bills contract should be created for the products with Link to Loan as ‘Y’ and it should be provided to OBCL. You can access Link to Loan in FCUBS through external option list.

2.3.6 OL Products and Contracts from OBCL to FCUBS

OL Product

Oracle Lending products that are created or modified in OBCL will be exposed to FCUBS through the following operations in FCUBSIFService:

- FCUBSIFService.CreateOLProduct

- FCUBSIFService.ModifyOLProduct

- FCUBSIFService.CloseOLProduct

Interest components for loan products also will be sent to FCUBS.

OL Contracts

Oracle Lending contracts that are created or modified in OBCL will be exposed to FCUBS through the following operations in FCUBSIFService:

- FCUBSIFService.CreateOLContract

- FCUBSIFService.ModifyOLContract

2.3.7 ELCM Limit Processing

During manual Bill liquidation authorization, if limits are tracked in Bill then request for Limit line de-utilization will be posted to ELCM and it will be logged in STTB_REQ_MASTER with Process Status 'U'. If de-utilization is successful, process status will be 'P'. Bill authorization can be processed only if de-utilization is successful.

The system also supports multi limits during loan creation. If there are adequate limits, then the limit utilization will be successful. If there is breach of limits, then credit exception will be raised. You can resolve or reject the credit exception manually through GEDAUTH screen.

2.3.8 Job Processing

Scheduler job ‘ELSLOANPROC’ processes request from FCUBS to OBCL.The request processing is based on the following loan actions:

- CREATELOAN - Request to create a loan will be initiated

- LOANREVERSAL - Request for payment reversal will be initiated

- LINKTOLOAN - Bill details with link to loan enabled has to be intimated

- LOANPAYMENT - Request for loan payment will be initiated

- LOANPAYMENTAUTH - Request for loan liquidation authorization will be initiated

Note

For LOANREVERSAL, if a bill has multiple packing credit loans linked to it and if the payment of loans are partially success then the bill can be deleted. If the bill is deleted a reversal of payment request should be initiated for the loans that were successful.

The following request and response will be processed through web service:

- Loan Creation with Multi Limits

- Loan Authorization

- Loan Deletion

- Multi Loan Payment (Save)

- Multi Loan Payment (Authorization)

- Multi Loan Payment (Deletion)

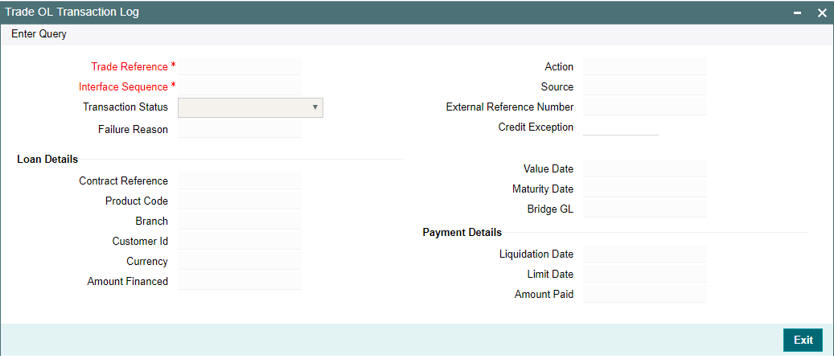

2.3.9 Trade-OL Transaction Log

You can view the log of Trade-OL interface transactions through ‘Trade OBCL Manual Status Change’ screen. You can invoke this screen by typing ‘IFDLMNPC’ in the top right corner of the Application toolbar and clicking adjoining arrow button.

Trade Reference

Specify the trade reference number.

Interface Sequence

Specify the interface sequence number.

Transaction Status

Select the transaction status from the drop-down list. The list displays the following values:

- Failed

- Processed

- Reversed

- Unprocessed

- Hold

- Limits Verification Pending

The system displays the following details:

- Action

- Source

- External Reference Number

- Credit Exception

Note

Requests with status ‘Failed’ can be modified to ‘Unprocessed’ for job pickup.

Request with status 'Failed' for loan authorization cannot be modified to 'Unprocessed' once Loan deletion request for the same is posted in intermediate store.

During Packing Credit - Multi Loan Payment, if payment of one of the loans has failed, then you can choose BC contract and any interface sequence number. While changing status from 'Failed' to 'Unprocessed' system will update status of all Payment Requests to Unprocessed.

Loan Details

- Contract Reference

- Product Code

- Branch

- Customer Id

- Currency

- Amount Financed

- Value Date

- Maturity Date

- Bridge GL

Payment Details

- Liquidation Date

- Limit Date

- Amount Paid

On receipt of Loan creation request through Webservice, loan contract will be created and saved. If Loan creation is with limit utilization and if limit is not available, credit exception will be raised, however loan will be saved.

The loan authorization status and corresponding credit exception status will be as follows:

Loan Authorization Status |

Credit Exception Status |

Processed |

Not Applicable |

Failed |

Unresolved |

Processed |

Resolved |

Failed |

Rejected |

The loan request will be deleted if Credit Exception is Rejected.

Multi Loan Payment Processing

On receipt of Multi Loan Payment Save request, with multiple packing credit loans, system will liquidate all the Packing Credit loans received. On receipt of multi loan payment deletion, system will initiate deletion of each payment. Response for each payment deletion will be sent to FCUBS.Multi Loan Payment authorization response will have responses for each payment authorization.

The loans which are created and unauthorized from FCUBS, will not be allowed to modify, delete or authorize manually in OBCL.

2.3.9.1 Viewing Trade OBCL Transaction Details

You can view details of Transaction log of Trade-OBCL integration in ‘Trade OBCL Summary’ screen. You can invoke this screen by typing ‘IFSLMNPC’ the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search records based on the following parameters:

- Contract Reference

- Trade Reference

Click on ‘Search’ button with or without entering any of the above search parameters. All records matching the search criteria are displayed. To view a particular record double click on the desired record displayed in the list of records. The following details pertaining to each record is displayed:

- Action

- Amount Financed

- Branch

- Bridge GL

- Contract Reference

- Currency

- Trade Reference

- Transaction Status

- Interface Sequence

- Liquidation Date

- External Reference Number

- Maturity Date

- Source

- Customer ID

- Amount Paid

- Limit Date

- Product Code

- Value Date