2. Single Customer View Handoff

The Financial Services Authority (FSA), UK's previous regulator, mandates the Financial Services Compensation Scheme (FSCS) and deposit takers to ensure that eligible depositors will be compensated more quickly if a deposit taker fails.The Deposit Guarantee Schemes Directive (DGSD) enforces deposit guarantee schemes (i.e., FSCS in the UK) to pay out compensation within 20 business days of the default of a deposit taker.

A Single Customer View (SCV) provides FSCS with the information required to make a faster payout, with a payout target of seven days from the default and in any event within the DGSD timeframes. An SCV, is a file that contains the data of customer/depositor and the related accounts/deposits for the FSCS in order to speed up the compensation payout process in case bank fails.

In order to address this regulatory requirement, following parameters are required to be captured:

- SCV Exclusion - This indicates the type of exclusion from the SCV

file. Such customer and accounts needs to be reported in the exclusion

files. The values are:

- 1 - Sanctioned Account

- 2 - Legally Disputed Account

- 3 - Legally Dormant Account

- 4 - Beneficiary Account

- SCV Ineligible - The bank indicates if the customer is eligible or not for SCV handoff. If this value is 'Yes', then such customer and related account needs to be reported in the ineligible files.

- Small-Medium Enterprise - An indicator to specify if the customer is small or medium enterprise.

- Firm Registration Number - A reference number issued to the bank by FSA.

- Compensation amount for Single Account Holder.

- Compensation amount for Joint Account Holder.

The following files are generated in a CSV format:

- SCV Depositor and Account Information

- SCV Details of Account

- Exclusion Depositor and Account Information

- Exclusion Details of Account

- Ineligible Depositor and Account Information

- Ineligible Details of Account

Note

The hand off files are generated from Head Office and local currency of the Head Office is considered.

The file naming convention for the files are as follows:

- FRN-YYYYMMDDHHMMSSSCVDepositorandaccountinformation.CSV

- FRN-YYYYMMDDHHMMSSSCVDetailsofaccount.CSV

- FRN-YYYYMMDDHHMMSSEXCDepositorandaccountinformation.CSV

- FRN-YYYYMMDDHHMMSSEXCDetailsofaccount.CSV

- FRN-YYYYMMDDHHMMINELIGDepositorandaccountinformation.CSV

- FRN-YYYYMMDDHHMMINELIGDetailsofaccount.CSV

Where FRN is the Firm Registration Number, YYYYMMDDHHMMSS is the file creation date and time. The data is separated by '|'.

Note

The files are generated on an ad hoc basis and also during end of day based on predefined frequency.

You need to do the following maintenance in Oracle FLEXCUBE to generate the handoff file required for the regulatory authority:

- SCV Bank Parameter Maintenance - To define the bank level parameters for SCV handoff.

- SCV Customer Parameter Maintenance - To define the customer level parameters for SCV handoff

- Generic Interface Maintenance - To generate the required handoff files

This chapter includes the following sections:

2.1 SCV Bank Parameter Maintenance

This section contains the following topics:

2.1.1 Maintaining SCV Bank Parameters

You can maintain the Firm Registration Number, compensation amount and compensation priority based on account class and corporate deposit products at the bank level using the “SCV Bank Parameter” screen. You can invoke the screen by typing ‘STDSCVBP' in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The following details are captured here:

Bank Code

Specify the bank code here. Alternatively, you can also select the bank code from the adjoining option list. The list contains all the bank codes maintained in the system.

Firm Registration Number

Specify the firm registration number issued for the bank.You can enter a maximum of 35 characters here.

Compensation Amount

Specify the compensation amount in branch local currency to be issued to the customer.

Compensation Priority

Priority

Specify a numeric value between 1 and 99 to set the hierarchy for the account class or corporate deposit product.

Product /Account Class

Specify the corporate deposit product code or account class against the input priority. Alternatively, you can also select the product code or account class from the adjoining option list. The list displays all valid product codes or account classes available in the selected branch.

Product Description

The description of the selected product code/account class is displayed here.

Note

The default priority will be 99 for account classes and deposit products not mapped to the compensation priority in the SCV Bank Parameter Maintenance.

2.2 SCV Customer Parameter Maintenance

This section contains the following topics:

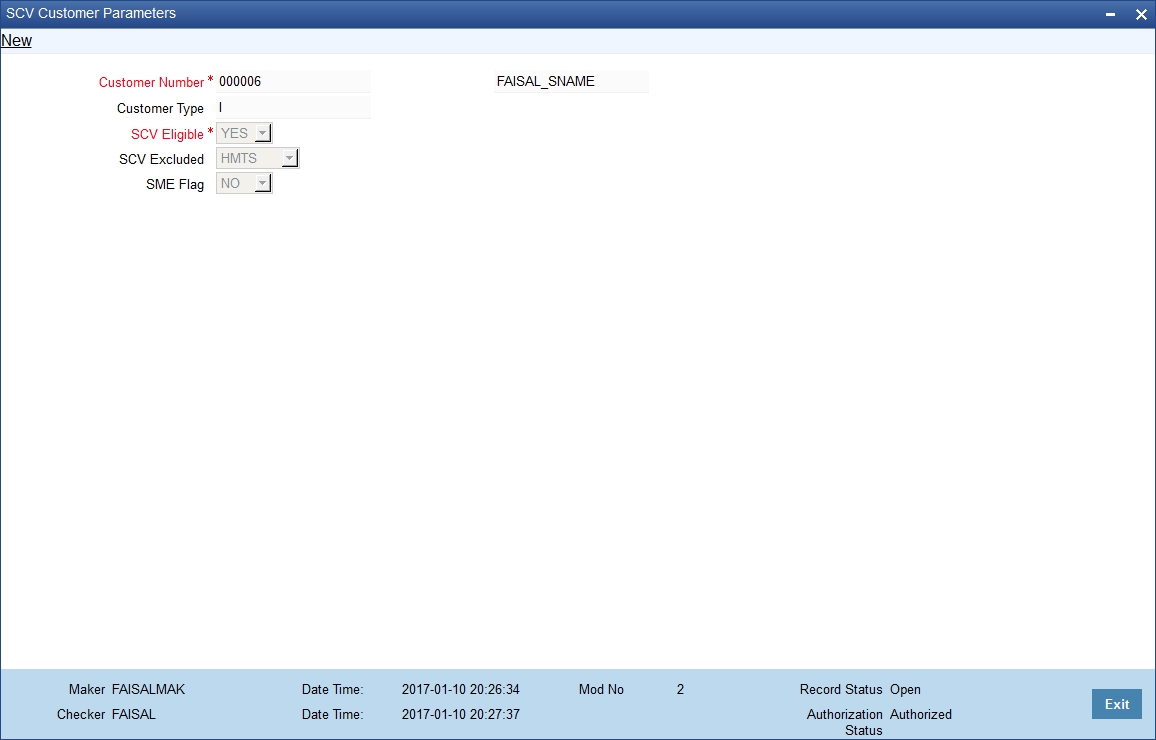

2.2.1 Maintaining SCV Customer Parameters

You can maintain the customer level parameters to determine the eligibility of the customer for inclusion or exclusion from the SCV file list for hand off. If no record is maintained for a customer, then system would consider the customer to be in-eligible and would go in the ineligible file.These parameters are maintained in the “SCV Customer Parameter” screen. You can invoke the screen by typing ‘STDSCVCP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The following details are captured here:

Customer Number

Specify the customer number for whom the SCV parameters have to be defined. Alternatively, you can also select the customer number from the adjoining option list. The list contains all valid, open, and authorized customer numbers maintained in the system.

Customer Name

The short name of the selected customer is displayed here.

Customer Type

Specify the type of customer here.

SCV Eligible

Select the option to indicate whether the customer is eligible for SCV or not, from the drop-down list. The options available are:

- Yes

- No

SCV Excluded

Select the option to indicate whether the customer is excluded from the SCV list or not, from the drop-down list. The options available are:

- 1 - Sanctioned Account

- 2 - Legally Disputed Account

- 3 - Legally Dormant Account

- 4 - Beneficiary Account

Note

This is enabled only if ‘SCV Eligible’ is selected as ‘Yes’.

SME Flag

Select the option to indicate if the corporate customer is a Small-Medium Enterprise that needs to be reported in the handoff file, from the drop-down list. The options available are:

- Yes - Select this option only if the customer is a corporate.

- No

2.3 SCV Handoff Process

This section contains the following topics:

2.3.1 Maintaining Generic Interface Details

The following interfaces are defined in the GIDIFTDF “Interface Definitions” screen for generating the required files:

- STOSCVCU

- STOSCVAC

- STOEXCCU

- STOEXCAC

- STONELCU

- STONELAC

For more details on Generic Interface refer “Generic Interface” User Manual

Note

- Handoff files are generated in the directory path setup for the interface code.

- The total balance is calculated as sum of available balance and uncollected funds for the account. This is to ensure that the balance include un-cleared cheques.

- The National Insurance for a customer is defined as Unique Identifier name in STDCIF function.

- If the amount field value size is greater than 15 (as per field specification

in the file) then system would send blank in the amount field.

2.3.2 File Formats

The formats of the SCV files generated are discussed below:

2.3.2.1 STOSCVCU - SCV Customer Handoff (Depositorandaccountinformation)

This file contains the details of the customer like name, unique id, contact details and also the aggregate balance and compensation amount across account. The data of open, authorized, eligible, and not excluded customers of type individual and corporate would be considered.

File Name:

Name Element |

Representation |

Comment |

FRN |

000000 |

The value should be manually provided in the File Mask field of the interface definition. |

Spacer |

‘-‘ character |

|

SCV Date and Time |

YYYYMMDDHHMMSS |

File creation date and time |

SCV Type |

|

SCVDepositorandaccountinformation |

Suffix |

CSV |

|

Field Specification:

Sr No |

Field Name |

Data Type |

Max Field Length |

Mandatory |

Flexcube Field Mapping |

Derivation Logic |

1 |

SCV Record Number |

Character |

100 |

Yes |

|

Concatenation of Firm Registration Number and STTM_CUSTOMER.CUSTOMER_NO |

2 |

Title |

Character |

20 |

|

STTM_CUSTOMER.CUSTOMER_PREFIX |

|

3 |

Customer First Forename |

Character |

50 |

|

STTM_CUST_PERSONAL.FIRST_NAME |

|

4 |

Customer Second Forename |

Character |

50 |

|

STTM_CUST_PERSONAL.MIDDLE_NAME |

|

5 |

Customer Third Forename |

Character |

50 |

|

Blank |

|

6 |

Customer Surname or Company Name |

Character |

100 |

Yes |

Blank |

IF STTM_CUSTOMER.CUSTOMER_TYPE = 'I' THEN STTM_CUST_PERSONAL.LAST_NAME ELSE STTM_CUST_CORPORATE.CORPORATE_NAME END IF |

7 |

Previous Name |

Character |

200 |

|

Blank |

|

8 |

National Insurance Number |

Character |

9 |

|

|

STTM_CUSTOMER.UNIQUE_ID_VALUE WHERE UNIQUE_ID_NAME = "NI Number" |

9 |

Passport Number |

Character |

200 |

|

STTM_CUST_PERSONAL.PASSPORT_NO |

|

10 |

Other National Identifier |

Character |

3 |

|

Blank |

|

11 |

Other National Identity Value |

Character |

50 |

|

Blank |

|

12 |

Company Number |

Character |

50 |

|

STTM_CUST_CORPORATE.C_NATIONAL_ID |

|

13 |

DOB |

Date(DDMMYYYY) |

8 |

|

STTM_CUST_PERSONAL.DATE_OF_BIRTH |

|

14 |

SCV Record Number |

Character |

100 |

Yes |

Same as SCV Record Number populated above |

|

15 |

Address Line 1 |

Character |

100 |

Yes |

STTM_CUSTOMER.ADDRESS_LINE1 |

|

16 |

Address Line 2 |

Character |

100 |

Yes |

STTM_CUSTOMER.ADDRESS_LINE2 |

|

17 |

Address Line 3 |

Character |

100 |

|

STTM_CUSTOMER.ADDRESS_LINE3 |

|

18 |

Address Line 4 |

Character |

100 |

|

STTM_CUSTOMER.ADDRESS_LINE4 |

|

19 |

Address Line 5 |

Character |

100 |

|

Blank |

|

20 |

Address Line 6 |

Character |

100 |

|

Blank |

|

21 |

Post Code |

Character |

30 |

|

STTM_CUSTOMER.PINCODE |

|

22 |

Country |

Character |

30 |

|

|

IF STTM_CUSTOMER.COUNTRY <> 'GB' THEN 30 characters of STTM_COUNTRY.DESCRIPTION for STTM_CUSTOMER.COUNTRY ELSE Blank |

23 |

Email Address |

Number |

50 |

|

STTM_CUST_PERSONAL.E_MAIL |

|

24 |

Main Phone Number |

Number |

40 |

|

STTM_CUST_PERSONAL.TELEPHONE |

|

25 |

Evening Phone Number |

Number |

40 |

|

STTM_CUST_PERSONAL.TELEPHONE |

|

26 |

Mobile Number |

Number |

30 |

|

STTM_CUST_PERSONAL.MOBILE_NUMBER |

|

27 |

Aggregate balance across all accounts |

Number |

15 |

|

|

|

28 |

Compensatable Amount |

Number |

15 |

|

|

|

2.3.2.2 STOSCVAC – SCV Account Handoff (Detailsofaccount)

This file contains the details of the accounts like name, type, BIC, sort code and balances. The data of open, authorized, eligible and not excluded customer accounts, individual and corporate, are considered.

File Name:

Name Element |

Representation |

Comment |

FRN |

000000 |

The value should be manually provided in the File Mask field of the interface definition. |

Spacer |

‘-‘ character |

|

SCV Date and Time |

YYYYMMDDHHMMSS |

File creation date and time |

SCV Type |

|

SCVDetailsofaccount |

Suffix |

CSV |

|

Field Specification:

Sr No |

Column Name |

Data Type |

Max Field Length |

Mandatory |

Flexcube Field Mapping |

Derivation Logic |

|||||||

1 |

SCV Record Number |

Character |

100 |

Yes |

|

Concatenation of Firm Registration Number and STTM_CUSTOMER.CUSTOMER_NO |

|||||||

2 |

Account Title |

Character |

50 |

|

STTM_CUST_ACCOUNT.AC_DESC |

|

|||||||

3 |

Account Number |

Number |

35 |

Yes |

STTM_CUST_ACCOUNT.CUST_AC_NO |

|

|||||||

4 |

BIC |

Character |

11 |

|

STTM_CUSTOMER.SWIFT_CODE |

|

|||||||

5 |

IBAN |

Character |

34 |

|

STTM_CUST_ACCOUNT.IBAN_AC_NO |

|

|||||||

6 |

Sort Code |

Number |

6 |

|

STTM_BRANCH.CLEARING_BANK_CODE |

|

|||||||

7 |

Product Type |

Number |

5 |

Yes |

|

HIERARCHY of the Account Class / CD products |

|||||||

8 |

Product Name |

Character |

50 |

Yes |

STTM_ACCOUNT_CLASS.DESCRIPTION |

|

|||||||

9 |

Account Holder Indicator |

Character |

3 |

Yes |

|

STTM_CUST_ACCOUNT.JOINT_AC_INDICATOR If JOINT_AC_INDICATOR =’S’ Then JOINT_AC_INDICATOR=’1’

If JOINT_AC_INDICATOR =’J’ Then JOINT_AC_INDICATOR=Number of Joint Account Holders including primary customer |

|||||||

10 |

Account Status Code |

Character |

50 |

Yes |

STTM_CUST_ACCOUNT.RECORD_STAT |

|

|||||||

11 |

Exclusion Type |

Character |

6 |

Yes |

|

SCV Exclusion type |

|||||||

12 |

Recent Transaction |

Character |

3 |

Yes |

|

credits or debits that have occurred in the account for the last 24 months from the generation date of the SCV files. All credits and debits entries posted to the account will be considered as an activity in the account. The field will be marked ‘Yes’ in case there is an activity else the field will be marked ‘No’. If Credit Interest Liquidation not to be considered for the reporting then the transaction code used for credit interest liquidation should have the parameter Consider for Activity set as No |

|||||||

13 |

Account Branch Jurisdiction |

Character |

3 |

|

UK |

|

|||||||

14 |

BRRD Marking |

Character |

3 |

Yes |

|

This field will be populated with ‘Yes’ for all Individual customers. For corporate customers, the SME is Yes in SCV Customer parameter is Yes, then the field will be populated with ‘Yes’. If the SME Flag is No, the field will be populated with ‘No’. |

|||||||

15 |

Structured Deposit Accounts |

Character |

3 |

Yes |

'No' |

|

|||||||

16 |

Account Balance Sterling |

Number |

15 (16 if negative balance) |

Yes |

|

|

|||||||

17 |

Authorized Negative Balance |

Number |

15 (16 if negative balance) |

Yes |

|

If an Overdraft limit is attached to an account, the approved amount will be displayed in this field. If no Overdraft is attached but a Sublimit is attached to the account, then the approved amount of the respective Sublimit will be displayed in the field. If both Overdraft limit and Sublimit are attached to an account, then Main Limit amount will be taken. If both Overdraft limit and Sublimit are not attached to an account, the field will be left blank. If more than one main limit is attached, system will consider the sum of all the attached overdraft limit amount. |

|||||||

18 |

Currency of Account |

Character |

3 |

Yes |

STTM_CUST_ACCOUNT.CCY |

|

|||||||

19 |

Account Balance in original Currency |

Number |

15 (16 if negative balance) |

Yes |

|

|

|||||||

20 |

Exchange Rate |

Number |

29 |

Yes |

|

The standard mid-rate applicable for the account currency and local currency pair will be applied for arriving at the value for account balance in local currency. The exchange rate applied to arrive at the converted balance will be displayed in this field. |

|||||||

21 |

Original Account Balance before Interest |

Number |

15 (16 if negative balance) |

Yes |

|

|

|||||||

22 |

Transferable Eligible Deposit |

Number |

15 |

Yes |

|

|

|||||||

2.3.2.3 STOEXCCU - Excluded Customer Handoff (Depositorandaccountinformation)

This file would contain the details of the customer like name, unique id, contact details and also the aggregate balance and compensation amount across account, similar to the SCV file except that customer list is excluded. The SCV eligible parameter should be set to Yes for such excluded customers. Criteria: All open, authorized and SCV Excluded field are set to the value between 1 and 4 for the customer records.

File Name:

Name Element |

Representation |

Comment |

FRN |

000000 |

The value should be manually provided in the File Mask field of the interface definition. |

Spacer |

‘-‘ character |

|

SCV Date and Time |

YYYYMMDDHHMMSS |

File creation date and time |

SCV Type |

|

EXCDepositorandaccountinformation |

Suffix |

CSV |

|

Field Specification:

Sr No |

Field Name |

Data Type |

Max Field Length |

Mandatory |

Flexcube Field Mapping |

Derivation Logic |

1 |

SCV Record Number |

Character |

100 |

Yes |

|

Concatenation of Firm Registration Number and STTM_CUSTOMER.CUSTOMER_NO |

2 |

Title |

Character |

20 |

|

STTM_CUSTOMER.CUSTOMER_PREFIX |

|

3 |

Customer First Forename |

Character |

50 |

|

STTM_CUST_PERSONAL.FIRST_NAME |

|

4 |

Customer Second Forename |

Character |

50 |

|

STTM_CUST_PERSONAL.MIDDLE_NAME |

|

5 |

Customer Third Forename |

Character |

50 |

|

Blank |

|

6 |

Customer Surname or Company Name |

Character |

100 |

Yes |

Blank |

IF STTM_CUSTOMER.CUSTOMER_TYPE = 'I' THEN STTM_CUST_PERSONAL.LAST_NAME ELSE STTM_CUST_CORPORATE.CORPORATE_NAME END IF |

7 |

Previous Name |

Character |

200 |

|

Blank |

|

8 |

National Insurance Number |

Character |

9 |

|

|

STTM_CUSTOMER.UNIQUE_ID_VALUE WHERE UNIQUE_ID_NAME = "NI Number" |

9 |

Passport Number |

Character |

200 |

|

STTM_CUST_PERSONAL.PASSPORT_NO |

|

10 |

Other National Identifier |

Character |

3 |

|

Blank |

|

11 |

Other National Identity Value |

Character |

50 |

|

Blank |

|

12 |

Company Number |

Character |

50 |

|

STTM_CUST_CORPORATE.C_NATIONAL_ID |

|

13 |

DOB |

Date(DDMMYYYY) |

8 |

|

STTM_CUST_PERSONAL.DATE_OF_BIRTH |

|

14 |

SCV Record Number |

Character |

100 |

Yes |

Same as SCV Record Number populated above |

|

15 |

Address Line 1 |

Character |

100 |

Yes |

STTM_CUSTOMER.ADDRESS_LINE1 |

|

16 |

Address Line 2 |

Character |

100 |

Yes |

STTM_CUSTOMER.ADDRESS_LINE2 |

|

17 |

Address Line 3 |

Character |

100 |

|

STTM_CUSTOMER.ADDRESS_LINE3 |

|

18 |

Address Line 4 |

Character |

100 |

|

STTM_CUSTOMER.ADDRESS_LINE4 |

|

19 |

Address Line 5 |

Character |

100 |

|

Blank |

|

20 |

Address Line 6 |

Character |

100 |

|

Blank |

|

21 |

Post Code |

Character |

30 |

|

STTM_CUSTOMER.PINCODE |

|

22 |

Country |

Character |

30 |

|

|

IF STTM_CUSTOMER.COUNTRY <> 'GB' THEN 30 characters of STTM_COUNTRY.DESCRIPTION for STTM_CUSTOMER.COUNTRY ELSE Blank |

23 |

Email Address |

Number |

50 |

|

STTM_CUST_PERSONAL.E_MAIL |

|

24 |

Main Phone Number |

Number |

40 |

|

STTM_CUST_PERSONAL.TELEPHONE |

|

25 |

Evening Phone Number |

Number |

40 |

|

STTM_CUST_PERSONAL.TELEPHONE |

|

26 |

Mobile Number |

Number |

30 |

|

STTM_CUST_PERSONAL.MOBILE_NUMBER |

|

27 |

Aggregate balance across all accounts |

Number |

15 |

|

|

|

28 |

Compensatable Amount |

Number |

15 |

|

|

|

2.3.2.4 STOEXCAC – Excluded Customer Account Handoff (Detailsofaccount)

This file contains the details of the accounts like name, type, BIC, sort code and balances, but for the accounts where the customer is excluded from SCV.

Criteria: All open accounts, authorized accounts and SCV Excluded field are set to the value between 1 and 4 for the customer of the account.

File Name:

Name Element |

Representation |

Comment |

FRN |

000000 |

The value should be manually provided in the File Mask field of the interface definition. |

Spacer |

‘-‘ character |

|

SCV Date and Time |

YYYYMMDDHHMMSS |

File creation date and time |

SCV Type |

|

EXCDetailsofaccount |

Suffix |

CSV |

|

Field Specification:

Sr No |

Column Name |

Data Type |

Max Field Length |

Mandatory |

Flexcube Field Mapping |

Derivation Logic |

1 |

SCV Record Number |

Character |

100 |

Yes |

|

Concatenation of Firm Registration Number and STTM_CUSTOMER.CUSTOMER_NO |

2 |

Account Title |

Character |

50 |

|

STTM_CUST_ACCOUNT.AC_DESC |

|

3 |

Account Number |

Number |

35 |

Yes |

STTM_CUST_ACCOUNT.CUST_AC_NO |

|

4 |

BIC |

Character |

11 |

|

STTM_CUSTOMER.SWIFT_CODE |

|

5 |

IBAN |

Character |

34 |

|

STTM_CUST_ACCOUNT.IBAN_AC_NO |

|

6 |

Sort Code |

Number |

6 |

|

STTM_BRANCH.CLEARING_BANK_CODE |

|

7 |

Product Type |

Number |

5 |

Yes |

|

HIERARCHY of the Account Class / CD products |

8 |

Product Name |

Character |

50 |

Yes |

STTM_ACCOUNT_CLASS.DESCRIPTION |

|

9 |

Account Holder Indicator |

Character |

3 |

Yes |

|

STTM_CUST_ACCOUNT.JOINT_AC_INDICATOR If JOINT_AC_INDICATOR =’S’ Then JOINT_AC_INDICATOR=’1’

If JOINT_AC_INDICATOR =’J’ Then JOINT_AC_INDICATOR=Number of Joint Account Holders including primary customer |

10 |

Account Status Code |

Character |

50 |

Yes |

STTM_CUST_ACCOUNT.RECORD_STAT |

|

11 |

Exclusion Type |

Character |

6 |

Yes |

|

SCV Exclusion Type |

12 |

Recent Transaction |

Character |

3 |

Yes |

|

credits or debits that have occurred in the account for the last 24 months from the generation date of the SCV files. All credits and debits entries posted to the account will be considered as an activity in the account. The field will be marked ‘Yes’ in case there is an activity else the field will be marked ‘No’. If Credit Interest Liquidation not to be considered for the reporting then the transaction code used for credit interest liquidation should have the parameter Consider for Activity set as No. |

13 |

Account Branch Jurisdiction |

Character |

3 |

|

UK |

|

14 |

BRRD Marking |

Character |

3 |

Yes |

|

This field will be populated with ‘Yes’ for all Individual customers. For corporate customers, the SME is Yes in SCV Customer parameter is Yes, then the field will be populated with ‘Yes’. If the SME Flag is No, the field will be populated with ‘No’. |

15 |

Structured Deposit Accounts |

Character |

3 |

Yes |

'No' |

|

16 |

Account Balance Sterling |

Number |

15 (16 if negative balance) |

Yes |

|

|

17 |

Authorized Negative Balance |

Number |

15 (16 if negative balance) |

Yes |

|

If an Overdraft limit is attached to an account, the approved amount will be displayed in this field. If no Overdraft is attached but a Sublimit is attached to the account, then the approved amount of the respective Sublimit will be displayed in the field. If both Overdraft limit and Sublimit are attached to an account, then Main Limit amount will be taken. If both Overdraft limit and Sublimit are not attached to an account, the field will be left blank. If more than one main limit is attached, system will consider the sum of all the attached overdraft limit amount. |

18 |

Currency of Account |

Character |

3 |

Yes |

STTM_CUST_ACCOUNT.CCY |

|

19 |

Account Balance in original Currency |

Number |

15 (16 if negative balance) |

Yes |

|

|

20 |

Exchange Rate |

Number |

29 |

Yes |

|

The standard mid-rate applicable for the account currency and local currency pair will be applied for arriving at the value for account balance in local currency. The exchange rate applied to arrive at the converted balance will be displayed in this field. |

21 |

Original Account Balance before Interest |

Number |

15 (16 if negative balance) |

Yes |

|

|

22 |

Transferable Eligible Deposit |

Number |

15 |

Yes |

|

|

2.3.2.5 STONELCU – Ineligible Customer Handoff (Depositorandaccountinformation)

This file contains the details of the customer like name, unique id, contact details and also the aggregate balance and compensation amount across account same as in SCV except that the customers are marked for ineligibility.

Criteria: All open, authorized and SCV Eligible field are set to No for the customer.

File Name:

Name Element |

Representation |

Comment |

FRN |

000000 |

The value should be manually provided in the File Mask field of the interface definition. |

Spacer |

‘-‘ character |

|

SCV Date and Time |

YYYYMMDDHHMM |

File creation date and time |

SCV Type |

|

INELIGDepositorandaccountinformation |

Suffix |

CSV |

|

Field Specification:

Sr No |

Field Name |

Data Type |

Max Field Length |

Mandatory |

Flexcube Field Mapping |

Derivation Logic |

1 |

SCV Record Number |

Character |

100 |

Yes |

|

Concatenation of Firm Registration Number and STTM_CUSTOMER.CUSTOMER_NO |

2 |

Title |

Character |

20 |

|

STTM_CUSTOMER.CUSTOMER_PREFIX |

|

3 |

Customer First Forename |

Character |

50 |

|

STTM_CUST_PERSONAL.FIRST_NAME |

|

4 |

Customer Second Forename |

Character |

50 |

|

STTM_CUST_PERSONAL.MIDDLE_NAME |

|

5 |

Customer Third Forename |

Character |

50 |

|

Blank |

|

6 |

Customer Surname or Company Name |

Character |

100 |

Yes |

Blank |

IF STTM_CUSTOMER.CUSTOMER_TYPE = 'I' THEN STTM_CUST_PERSONAL.LAST_NAME ELSE STTM_CUST_CORPORATE.CORPORATE_NAME END IF |

7 |

Previous Name |

Character |

200 |

|

Blank |

|

8 |

National Insurance Number |

Character |

9 |

|

|

STTM_CUSTOMER.UNIQUE_ID_VALUE WHERE UNIQUE_ID_NAME = "NI Number" |

9 |

Passport Number |

Character |

200 |

|

STTM_CUST_PERSONAL.PASSPORT_NO |

|

10 |

Other National Identifier |

Character |

3 |

|

Blank |

|

11 |

Other National Identity Value |

Character |

50 |

|

Blank |

|

12 |

Company Number |

Character |

50 |

|

STTM_CUST_CORPORATE.C_NATIONAL_ID |

|

13 |

DOB |

Date(DDMMYYYY) |

8 |

|

STTM_CUST_PERSONAL.DATE_OF_BIRTH |

|

14 |

SCV Record Number |

Character |

100 |

Yes |

Same as SCV Record Number populated above |

|

15 |

Address Line 1 |

Character |

100 |

Yes |

STTM_CUSTOMER.ADDRESS_LINE1 |

|

16 |

Address Line 2 |

Character |

100 |

Yes |

STTM_CUSTOMER.ADDRESS_LINE2 |

|

17 |

Address Line 3 |

Character |

100 |

|

STTM_CUSTOMER.ADDRESS_LINE3 |

|

18 |

Address Line 4 |

Character |

100 |

|

STTM_CUSTOMER.ADDRESS_LINE4 |

|

19 |

Address Line 5 |

Character |

100 |

|

Blank |

|

20 |

Address Line 6 |

Character |

100 |

|

Blank |

|

21 |

Post Code |

Character |

30 |

|

STTM_CUSTOMER.PINCODE |

|

22 |

Country |

Character |

30 |

|

|

IF STTM_CUSTOMER.COUNTRY <> 'GB' THEN 30 characters of STTM_COUNTRY.DESCRIPTION for STTM_CUSTOMER.COUNTRY ELSE Blank |

23 |

Email Address |

Number |

50 |

|

STTM_CUST_PERSONAL.E_MAIL |

|

24 |

Main Phone Number |

Number |

40 |

|

STTM_CUST_PERSONAL.TELEPHONE |

|

25 |

Evening Phone Number |

Number |

40 |

|

STTM_CUST_PERSONAL.TELEPHONE |

|

26 |

Mobile Number |

Number |

30 |

|

STTM_CUST_PERSONAL.MOBILE_NUMBER |

|

27 |

Aggregate balance across all accounts |

Number |

15 |

|

|

|

28 |

Compensatable Amount |

Number |

15 |

|

|

|

2.3.2.6 STONELAC – Ineligible Customer Account Handoff (Detailsofaccount)

This file would contain the details of the accounts like name, type, BIC, sort code and balances, but for the accounts where SCV Eligible is set to NO for the customer.

Criteria: All open accounts, authorized accounts and SCV Eligible is set to the value No for the customer of the account.

File Name:

Name Element |

Representation |

Comment |

FRN |

000000 |

The value should be manually provided in the File Mask field of the interface definition. |

Spacer |

‘-‘ character |

|

SCV Date and Time |

YYYYMMDDHHMM |

File creation date and time |

SCV Type |

|

INELIGDetailsofaccount |

Suffix |

CSV |

|

Field Specification:

Sr No |

Column Name |

Data Type |

Max Field Length |

Mandatory |

Flexcube Field Mapping |

Derivation Logic |

1 |

SCV Record Number |

Character |

100 |

Yes |

|

Concatenation of Firm Registration Number and STTM_CUSTOMER.CUSTOMER_NO |

2 |

Account Title |

Character |

50 |

|

STTM_CUST_ACCOUNT.AC_DESC |

|

3 |

Account Number |

Number |

35 |

Yes |

STTM_CUST_ACCOUNT.CUST_AC_NO |

|

4 |

BIC |

Character |

11 |

|

STTM_CUSTOMER.SWIFT_CODE |

|

5 |

IBAN |

Character |

34 |

|

STTM_CUST_ACCOUNT.IBAN_AC_NO |

|

6 |

Sort Code |

Number |

6 |

|

STTM_BRANCH.CLEARING_BANK_CODE |

|

7 |

Product Type |

Number |

5 |

Yes |

|

HIERARCHY of the Account Class / CD products |

8 |

Product Name |

Character |

50 |

Yes |

STTM_ACCOUNT_CLASS.DESCRIPTION |

|

9 |

Account Holder Indicator |

Character |

3 |

Yes |

|

STTM_CUST_ACCOUNT.JOINT_AC_INDICATOR If JOINT_AC_INDICATOR =’S’ Then JOINT_AC_INDICATOR=’1’

If JOINT_AC_INDICATOR =’J’ Then JOINT_AC_INDICATOR=Number of Joint Account Holders including primary customer |

10 |

Account Status Code |

Character |

50 |

Yes |

STTM_CUST_ACCOUNT.RECORD_STAT |

|

11 |

Exclusion Type |

Character |

6 |

Yes |

|

SCV Exclusion Type |

12 |

Recent Transaction |

Character |

3 |

Yes |

|

credits or debits that have occurred in the account for the last 24 months from the generation date of the SCV files. All credits and debits entries posted to the account will be considered as an activity in the account. The field will be marked ‘Yes’ in case there is an activity else the field will be marked ‘No’. If Credit Interest Liquidation not to be considered for the reporting then the transaction code used for credit interest liquidation should have the parameter Consider for Activity set as No. |

13 |

Account Branch Jurisdiction |

Character |

3 |

|

UK |

|

14 |

BRRD Marking |

Character |

3 |

Yes |

|

This field will be populated with ‘Yes’ for all Individual customers. For corporate customers, the SME is Yes in SCV Customer parameter is Yes, then the field will be populated with ‘Yes’. If the SME Flag is No, the field will be populated with ‘No’. |

15 |

Structured Deposit Accounts |

Character |

3 |

Yes |

'No' |

|

16 |

Account Balance Sterling |

Number |

15 (16 if negative balance) |

Yes |

|

|

17 |

Authorized Negative Balance |

Number |

15 (16 if negative balance) |

Yes |

|

If an Overdraft limit is attached to an account, the approved amount will be displayed in this field. If no Overdraft is attached but a Sublimit is attached to the account, then the approved amount of the respective Sublimit will be displayed in the field. If both Overdraft limit and Sublimit are attached to an account, then Main Limit amount will be taken. If both Overdraft limit and Sublimit are not attached to an account, the field will be left blank. If more than one main limit is attached, system will consider the sum of all the attached overdraft limit amount. |

18 |

Currency of Account |

Character |

3 |

Yes |

STTM_CUST_ACCOUNT.CCY |

|

19 |

Account Balance in original Currency |

Number |

15 (16 if negative balance) |

Yes |

|

|

20 |

Exchange Rate |

Number |

29 |

Yes |

|

The standard mid-rate applicable for the account currency and local currency pair will be applied for arriving at the value for account balance in local currency. The exchange rate applied to arrive at the converted balance will be displayed in this field. |

21 |

Original Account Balance before Interest |

Number |

15 (16 if negative balance) |

Yes |

|

|

22 |

Transferable Eligible Deposit |

Number |

15 |

Yes |

|

|

2.3.2.7 File Footer

Footer |

Trailer record Twenty digits of character ‘9’ e.g. 99999999999999999999 |

2.3.2.8 Aggregate Balance across all accounts

The value of this field is arrived by summing up all the positive account balances of a customer inclusive of any accrued debit/credit interest. However, the accounts with negative balances will not be considered for arriving at the balances for this field. For a customer having Joint Accounts (2 or more Holders), the balance is split equally between the holders.

For Example 1: Single Account Holder. Generation date is on 10th August 2016. The data as on this date would be as follows:

Customer No |

Account/CD Ref No |

Currency |

Balance |

Accrued Interest |

Value of Aggregate Balance

|

A00001 |

A00001001 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP |

A00001 |

A00001002 |

USD |

25,000.00 |

350.47 |

|

A00001 |

A00001003 |

GBP |

-13,500.00 |

-23.33 |

|

A00001 |

000CD0112345789 |

GBP |

20,000.00 |

57.12 |

For Example 2: Joint Account Holder. Generation date is on 10th August 2016. The data as on this date would be as follows:

Customer No |

Account/CD Ref No |

HIERARCHY |

Currency |

Balance |

Accrued Interest

|

Value of Aggregate Balance

|

A00001 |

A00001001 |

1 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP 90,077.23 + 22,517 = 1,12,594.234 GBP |

A00001 |

A00001002 |

2 |

USD |

25,000.00 |

350.47 |

|

A00001 |

A00001003 |

2 |

GBP |

-13,500.00 |

-23.33 |

|

A00001 |

000CD0112345789 |

|

GBP |

20,000.00 |

57.12 |

|

A00002 |

A00002001 |

2 |

GBP |

45,000.00 |

34.00 |

22,5173 GBP |

A00001 |

|

- At the rate of 0.77 GBP, the value of 25,350.47 USD is 19,519.86 GBP

- The negative balance of account A00001003 is not considered for the aggregate balance.

- Customer A00002 is a joint account holder for account A00002001. The total balance is divided by 2.

- Customer A00001 is also joint account holder for A00002001. Half of its balance would get added to his other balance.

2.3.2.9 Compensatable Amount

This indicates the covered funds for a customer. If it is fully covered it will be equal to compensation amount defined for the bank. But it can be lesser to the extent of the various account balances contributing towards this customer. The accounts with negative balances are not considered for this field.

If aggregate balance is greater than the compensation amount then the value would be the compensation amount for the customer else it would be the aggregate balance.

For Example 1: Single Account Holder. Generation date is on 10th August 2016. The compensation amount for customer is maintained to be 75,000.00 GBP. The data as on this date would be as follows:

Customer No |

Account/CD Ref No |

Currency |

Balance |

Accrued Interest |

Value of Aggregate Balance |

Compensatable Amount |

A00001 |

A00001001 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP |

90,077.23GBP is greater than the compensation amount 75,000.00 GBP. Hence the value for this customer would be 75,000.00 GBP. |

A00001 |

A00001002 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

GBP |

20,000.00 |

57.12 |

For Example 2: Joint Account Holder. Generation date is on 10th August 2016. The compensation amount for customer is also 75,000.00 GBP. The data as on this date would be as follows:

Customer No |

Account/CD Ref No |

HIERARCHY |

Currency |

Balance |

Accrued Interest |

Value of Aggregate Balance |

Compensatable Amount |

A00001 |

A00001001 |

1 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP 90,077.23 + 22,517 = 1,12,594.234 GBP |

75,000.00 GBP |

A00001 |

A00001002 |

2 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

2 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

|

GBP |

20,000.00 |

57.12 |

||

A00002 |

A00002001 |

2 |

GBP |

45,000.00 |

34.00 |

22,5173 GBP |

22,517.00 GBP |

A00001 |

|

|

- At the rate of 0.77 GBP, the value of 25,350.47 USD is 19,519.86 GBP

- The negative balance of account A00001003 is not considered for the aggregate balance.

- Customer A00002 is a joint account holder for account A00002001. The total balance is divided by 2.

- Customer A00001 is also joint account holder for A00002001. Half of this account balance would get added to the other balance.

2.3.2.10 Account Balance in Local Currency (Account Balance in Sterling field)

This is the balance in the account inclusive of the debit/credit interest accrued. It would also consider the negative balance.

For Example 1: Single Account Holder. Generation date is on 10th August 2016. The compensation amount for single is maintained to be 75,000.00 GBP. The data as on this date would be as follows:

Customer No |

Account/CD Ref No |

Currency |

Balance |

Accrued Interest

|

Value of Aggregate Balance |

Compensatable Amount |

A00001 |

A00001001 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP |

90,077.23GBP is greater than the compensation amount 75,000.00 GBP. Hence the value for this customer would be 75,000.00 GBP. |

A00001 |

A00001002 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

GBP |

20,000.00 |

57.12 |

Account File

Account/CD Ref No |

Currency |

HIERARCHY |

Acc Bal in Local Currency (Ex: GBP) |

A00001001 |

GBP |

1 |

50500.25 |

A00001002 |

USD |

2 |

19519.86 |

A00001003 |

GBP |

2 |

-13523.33 |

000CD0112345789 |

GBP |

|

20057.12 |

For Example 2: Joint Account Holder. Generation date is on 10th August 2016. The compensation amount for joint is also 75,000.00 GBP. The data as on this date would be as follows::

Customer No |

Account/CD Ref No |

HIERARCHY |

Currency |

Balance |

Accrued Interest

|

Value of Aggregate Balance

|

Compensatable Amount

|

A00001 |

A00001001 |

1 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP 90,077.23 + 22,517 = 1,12,594.234 GBP |

75,000.00 GBP |

A00001 |

A00001002 |

2 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

2 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

|

GBP |

20,000.00 |

57.12 |

||

A00002 |

A00002001 |

2 |

GBP |

45,000.00 |

34.00 |

22,5173 GBP |

22,517.00 GBP |

A00001 |

|

|

- At the rate of 0.77 GBP, the value of 25,350.47 USD is 19,519.86 GBP

- The negative balance of account A00001003 is not considered for the aggregate balance.

- Customer A00002 is a joint account holder for account A00002001. The total balance is divided by 2.

- Customer A00001 is also joint account holder for A00002001. Half of this account balance would get added to the other balance.

Account File:

SCV Id |

Account/CD Ref No |

Currency |

HIERARCHY |

Acc Bal in Local Currency (Ex: GBP) |

11111A00001 |

A00001001 |

GBP |

1 |

50500.25 |

11111A00001 |

A00001002 |

USD |

2 |

19519.86 |

11111A00001 |

A00001003 |

GBP |

2 |

-13523.33 |

11111A00001 |

A00002001 |

GBP |

2 |

22,517.00 |

11111A00001 |

000CD0112345789 |

GBP |

|

20057.12 |

11111A00002 |

A00002001 |

GBP |

2 |

22,517.00 |

2.3.2.11 Account Balance in original currency

The balance in the account currency along with accrued debit/credit interest (in account currency) is populated in this field. If there is a negative balance for an account, the ‘–‘symbol is prefixed to the balance displayed in this field.

For Example 1: Single Account Holder. Generation date is on 10th August 2016. The compensation amount for single is maintained to be 75,000.00 GBP. The data as on this date would be as follows:

Customer No |

Account/CD Ref No |

Currency |

Balance |

Accrued Interest |

Value of Aggregate Balance |

Compensatable Amount |

A00001 |

A00001001 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP |

90,077.23GBP is greater than the compensation amount 75,000.00 GBP. Hence the value for this customer would be 75,000.00 GBP. |

A00001 |

A00001002 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

GBP |

20,000.00 |

57.12 |

Account File:

Account/CD Ref No |

Currency |

HIERARCHY |

Acc Bal in Local Currency (Ex: GBP)

|

Acc Bal in Acc Currency

|

A00001001 |

GBP |

1 |

50500.25 |

50500.25 |

A00001002 |

USD |

2 |

19519.86 |

25350.47 |

A00001003 |

GBP |

2 |

-13523.33 |

-13523.33 |

000CD0112345789 |

GBP |

|

20057.12 |

20057.12 |

For Example 2: Joint Account Holder. Generation date is on 10th August 2016. The compensation amount for joint is also 75,000.00 GBP. The data as on this date would be as follows:

Customer No |

Account/CD Ref No |

HIERARCHY |

Currency |

Balance |

Accrued Interest |

Value of Aggregate Balance |

Compensatable Amount |

A00001 |

A00001001 |

1 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP 90,077.23 + 22,517 = 1,12,594.234 GBP |

75,000.00 GBP |

A00001 |

A00001002 |

2 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

2 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

|

GBP |

20,000.00 |

57.12 |

||

A00002 |

A00002001 |

2 |

GBP |

45,000.00 |

34.00 |

22,5173 GBP |

22,517.00 GBP |

A00001 |

|

|

- At the rate of 0.77 GBP, the value of 25,350.47 USD is 19,519.86 GBP

- The negative balance of account A00001003 is not considered for the aggregate balance.

- Customer A00002 is a joint account holder for account A00002001. The total balance is divided by 2.

- Customer A00001 is also joint account holder for A00002001. Half of this account balance would get added to the other balance.

Account File:

SCV Id |

Account/CD Ref No |

Currency |

HIERARCHY |

Acc Bal in Local Currency(Ex: GBP) |

Acc Bal in Acc Currency |

11111A00001 |

A00001001 |

GBP |

1 |

50500.25 |

50500.25 |

11111A00001 |

A00001002 |

USD |

2 |

19519.86 |

19519.86 |

11111A00001 |

A00001003 |

GBP |

2 |

-13523.33 |

-13523.33 |

11111A00001 |

A00002001 |

GBP |

2 |

22,517.00 |

22517.00 |

11111A00001 |

000CD0112345789 |

GBP |

|

20057.12 |

20057.12 |

11111A00002 |

A00002001 |

GBP |

2 |

22,517.00 |

22517.00 |

2.3.2.12 Original Account Balance before interest

The account balance in account currency without considering the accrued debit/credit interest will be displayed in this field. If there is a negative balance for an account, the ‘–‘symbol is prefixed to the balance displayed in this field.

For Example 1: Single Account Holder. Generation date is on 10th August 2016. The compensation amount for single is maintained to be 75,000.00 GBP. The data as on this date would be as follows:

Customer No |

Account/CD Ref No

|

Currency |

Balance |

Accrued Interest |

Value of Aggregate Balance |

Compensatable Amount |

A00001 |

A00001001 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP |

90,077.23GBP is greater than the compensation amount 75,000.00 GBP. Hence the value for this customer would be 75,000.00 GBP. |

A00001 |

A00001002 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

GBP |

20,000.00 |

57.12 |

Account File:

Account/CD Ref No |

Currency |

HIERARCHY |

Acc Bal in Local Currency (Ex: GBP) |

Acc Bal in Acc Currency |

Bal before interest in Acc Currency |

A00001001 |

GBP |

1 |

50500.25 |

50500.25 |

50000 |

A00001002 |

USD |

2 |

19519.86 |

25350.47 |

25000 |

A00001003 |

GBP |

2 |

-13523.33 |

-13523.33 |

-13500 |

000CD0112345789 |

GBP |

|

20057.12 |

20057.12 |

20000 |

For Example 2: Joint Account Holder. Generation date is on 10th August 2016. The compensation amount for joint is also 75,000.00 GBP. The data as on this date would be as follows:

Customer No |

Account/CD Ref No

|

HIERARCHY

|

Currency

|

Balance

|

Accrued Interest

|

Value of Aggregate Balance

|

Compensatable Amount

|

A00001 |

A00001001 |

1 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP 90,077.23 + 22,517 = 1,12,594.234 GBP |

75,000.00 GBP |

A00001 |

A00001002 |

2 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

2 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

|

GBP |

20,000.00 |

57.12 |

||

A00002 |

A00002001 |

2 |

GBP |

45,000.00 |

34.00 |

22,5173 GBP |

22,517.00 GBP |

A00001 |

|

|

- At the rate of 0.77 GBP, the value of 25,350.47 USD is 19,519.86 GBP

- The negative balance of account A00001003 is not considered for the aggregate balance.

- Customer A00002 is a joint account holder for account A00002001. The total balance is divided by 2.

- Customer A00001 is also joint account holder for A00002001. Half of this account balance would get added to the other balance.

Account File:

SCV Id |

Account/CD Ref No |

Currency |

HIERARCHY |

Acc Bal in Local Currency (Ex: GBP) |

Acc Bal in Acc Currency |

Bal before interest in Acc Currency |

11111A00001 |

A00001001 |

GBP |

1 |

50500.25 |

50500.25 |

50000 |

11111A00001 |

A00001002 |

USD |

2 |

19519.86 |

25350.47 |

25000 |

11111A00001 |

A00001003 |

GBP |

2 |

-13523.33 |

-13523.33 |

-13500 |

11111A00001 |

A00002001 |

GBP |

2 |

22,517.00 |

22517.00 |

22500 |

11111A00001 |

000CD0112345789 |

GBP |

|

20057.12 |

20057.12 |

20000 |

11111A00002 |

A00002001 |

GBP |

2 |

22,517.00 |

22517.00 |

22500 |

2.3.2.13 Transferrable Eligible Deposit

The contribution towards the covered funds (Compensatable amount) by the various accounts of a customer will be governed by prioritization rules (HIERARCHY and pari paasu-Equal footing) and would be populated in this field.

The accounts with negative balance, considering available balance + uncollected funds +/- interest, will not be considered towards contribution for this field.

The contribution by the various accounts of a customer will be governed by the Hierarchy level of the customer account . Contribution should be first made from an account higher up in hierarchy than one at a lower level I.e. IAA accounts should make up the compensation amount first and if there is not enough in this account then it should move onto the next account in the hierarchy and so on.

If there are two accounts within the same hierarchy then the excess amount should be taken equally from each (pari paasu-Equal footing).

The transferrable eligible balance would be arrived from the balances of each individual accounts/deposits by taking off the excess amounts from the balances of accounts/deposits based on hierarchy and by using the Bottom-Up approach. That is, the excess amount would first be taken out from the account/deposit in the lowest hierarchy moving upward.

For Example 1: Single Account Holder. Generation date is on 10th August 2016. The compensation amount for single is maintained to be 75,000.00 GBP. The data as on this date would be as follows:

Customer No

|

Account/CD Ref No |

Currency |

Balance |

Accrued Interest |

Value of Aggregate Balance |

Compensatable Amount |

A00001 |

A00001001 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP |

90,077.23GBP is greater than the compensation amount 75,000.00 GBP. Hence the value for this customer would be 75,000.00 GBP. Excess Amount is 15077.23 GBP

This excess amount is divided by 2 as there are 2 accounts in hierarchy 2 with the positive balance. So the equal amount to be taken out from the each account is 7538.615 |

A00001 |

A00001002 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

GBP |

20,000.00 |

57.12 |

Account File:

Account/CD Ref No |

Currency |

HIERARCHY |

Acc Bal in Local Currency(Ex: GBP) |

Acc Bal in Acc Currency |

Bal before interest in Acc Currency |

Transferrable Eligible Amount |

A00001001 |

GBP |

1 |

50500.25 |

50500.25 |

50000 |

50500.25 |

A00001002 |

USD |

2 |

19519.86 |

25350.47 |

25000 |

19519.86-7538.62 = 11981.2 |

A00001003 |

GBP |

2 |

-13523.33 |

-13523.33 |

-13500 |

|

000CD0112345789 |

GBP |

2 |

20057.12 |

20057.12 |

20000 |

20057.12 – 7538.62 = 12518.5 |

For Example 2: Joint Account Holder. Generation date is on 10th August 2016. The compensation amount for joint is also 75,000.00 GBP. The data as on this date would be as follows:

Customer No |

Account/CD Ref No |

HIERARCHY |

Currency |

Balance |

Accrued Interest |

Value of Aggregate Balance |

Compensatable Amount |

A00001 |

A00001001 |

1 |

GBP |

50,000.00 |

500.25 |

(50,000.00+500.25) + (25,000.00+350.47)1 GBP equivalent + (20,000.00+57.12) = 50,500.25+19,519.86+20,057.12 = 90,077.232 GBP 90,077.23 + 22,517 = 1,12,594.234 GBP |

75,000.00 GBP Excess Amount is 37594.23 GBP.

The equal amount to be taken out from each account under same hierarchy 2 is, 12531.41 GBP |

A00001 |

A00001002 |

2 |

USD |

25,000.00 |

350.47 |

||

A00001 |

A00001003 |

2 |

GBP |

-13,500.00 |

-23.33 |

||

A00001 |

000CD0112345789 |

|

GBP |

20,000.00 |

57.12 |

||

A00002 |

A00002001 |

2 |

GBP |

45,000.00 |

34.00 |

22,5173 GBP |

22,517.00 GBP |

A00001 |

|

|

- At the rate of 0.77 GBP, the value of 25,350.47 USD is 19,519.86 GBP

- The negative balance of account A00001003 is not considered for the aggregate balance.

- Customer A00002 is a joint account holder for account A00002001. The total balance is divided by 2.

- Customer A00001 is also joint account holder for A00002001. Half of this account balance would get added to the other balance.

Account File:

SCV Id

|

Account/CD Ref No

|

Currency

|

HIERARCHY

|

Acc Bal in Local Currency(Ex: GBP)

|

Acc Bal in Acc Currency

|

Bal before interest in Acc Currency

|

Transferrable Eligible Deposit |

11111A00001 |

A00001001 |

GBP |

1 |

50500.25 |

50500.25 |

50000 |

50500.25 |

11111A00001 |

A00001002 |

USD |

2 |

19519.86 |

25350.47 |

25000 |

19519.86 – 12531.41 = 6988.45 |

11111A00001 |

A00001003 |

GBP |

2 |

-13523.33 |

-13523.33 |

-13500 |

|

11111A00001 |

A00002001 |

GBP |

2 |

22,517.00 |

22517.00 |

22500 |

22517 – 12531.41 = 9985.59 |

11111A00001 |

000CD0112345789 |

GBP |

2 |

20057.12 |

20057.12 |

20000 |

20057.12-12531.41 = 7525.71 |

11111A00002 |

A00002001 |

GBP |

2 |

22,517.00 |

22517.00 |

22500 |

22517.00 |