2. Oracle FLEXCUBE – Tax Payment Interface

Oracle FLEXCUBE interfaces with the Tax Payment System for exchange of the tax payment details of customers. This interface also helps you view the reports related to customers’ tax payments.

This chapter contains the following sections:

- Section 2.1, "Details for Tax Payment Interface"

- Section 2.2, "Incoming Files"

- Section 2.3, "Customer Tax Payment Report"

2.1 Details for Tax Payment Interface

This section contains the following topic:

The following are maintained for Tax Payment interface, internally:

- Details of External System (EXTSTPS)

- Details of the Interface

- Interface Parameterization.

For further details on maintaining external system and interface, refer to the Oracle FLEXCUBE Generic Interface user manual.

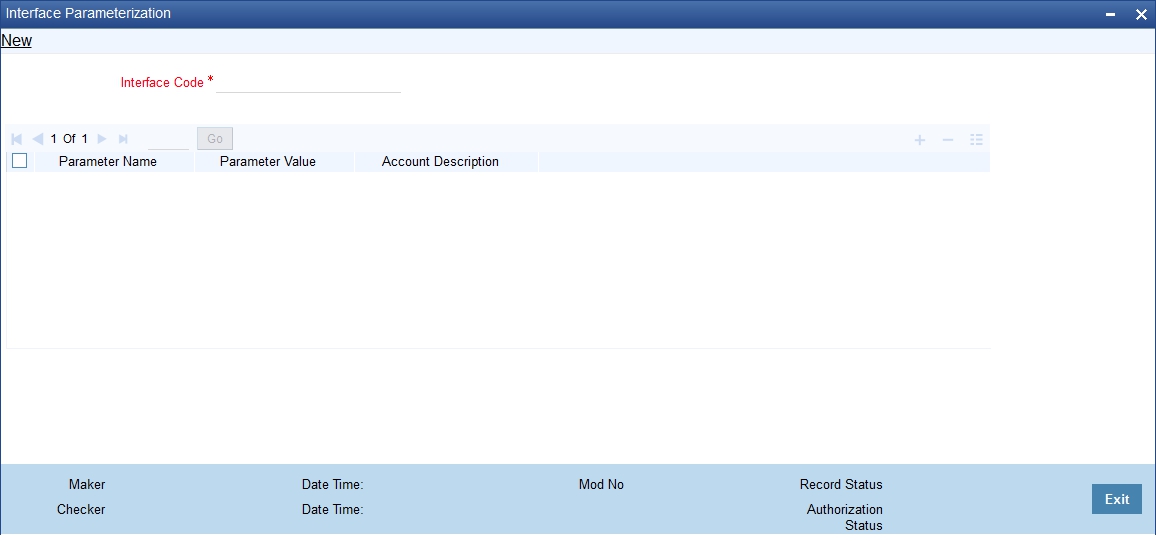

2.1.1 Maintaining Interface Parameterization

For tax payment interface, you need to maintain the interface parameterization details. To invoke the ‘Interface Parameterization’ screen, type ‘IFDPARAM’ in the field at the top right corner of the Application toolbar and click the adjoining arrow button.

Specify the following details:

Interface Code

Select the interface code from the adjoining option list. This list displays all interface codes maintained in the system.

Parameter Name

Specify a unique parameter name for the interface upload.

Parameter Value

Specify the default values assigned for every unique parameter name and interface code.

Account Description

Specify the description of the selected parameter is here.

2.2 Incoming Files

Oracle FLEXCUBE picks up the file containing the tax payment details of customers from the intermediate data store. This file contains the following information:

- Customer account number

- Tax amount

The system further debits the tax amount from the customer account and credits the 'SIMPATI' GL.

The system will not process if the records are empty or does not contain mandatory fields.

Before passing the accounting entries, the system checks whether sufficient balance is available in the account. In case of insufficient balance, the transaction is rejected.

This section contains the following topic:

2.2.1 Incoming File Format

The file format is given below:

Attribute Name |

Attribute Value |

Interface Type |

Incoming |

From System |

EXTSTPS |

To System |

FLEXCUBE |

Directory Location |

To be Confirmed |

File Name |

TxPmt$Y$M$D$H$M$S.txt |

Frequency |

Daily |

Character Set |

ASCII |

File Header |

No |

File Footer |

No |

Delimiter |

| |

Record Length |

Variable |

Format |

Line Sequential, Variable Length Records |

End of the Record |

CR/LF |

Numeric padding |

No |

Text padding |

No |

2.3 Customer Tax Payment Report

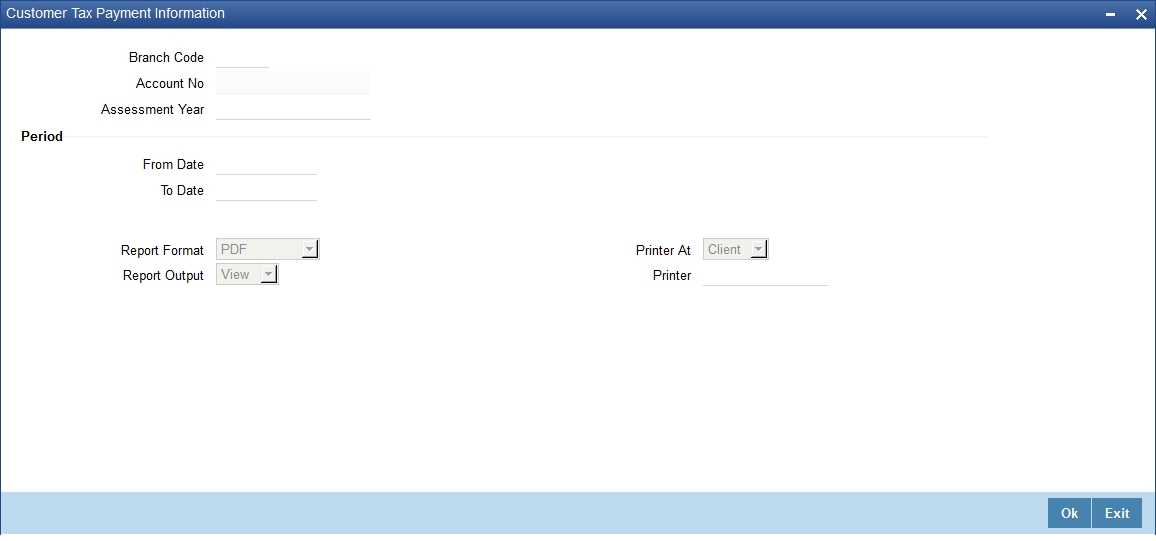

You can generate and view customer tax payment reports using ‘Customer Tax Payment’ screen. To invoke the screen, type ‘IFRTXPM’ in the field at the top right corner of the Application toolbar and click the adjoining arrow button.

To generate the report, you need to specify the following details:

Branch Code

The system displays the branch code.

Account Number

Specify the account number for which you need to generate the tax payment report.

Assessment Year

Specify the assessment year. The tax payment report will contain the details of payment of tax during the assessment year specified here.

From Date

You need to indicate period. Specify the start date of the tax payment report period here. The system will generate the report for the period from this date.

To Date

You need to indicate period. Specify the end date of the tax payment report period here. The system will generate the report for the period from the start date until this date.

Once you have captured the details, click ‘Ok’ button. The system generates and displays the tax payment report for the selected account and period.

2.3.1 Contents of the Report

The tax payment report contains the following details:

- Report name

- Branch code

- Assessment year

- Period

- Source

- Customer number

- Account number

- Taxable amount

- Paid amount

- Payment date

- Tax reference number