2. Oracle FCUBS – FCPB Interface

Oracle FLEXCUBE Private Banking (FCPB) helps banks, financial institutions and wealth management service providers deliver advisory-driven solutions. The services include portfolio management, management of multiple asset-classes and advisory services.

The interface between FCUBS and FCPB enables the exchange of information related to day-to-day transactions and maintenances. FCUBS generates the required data for exchange in ASCII format and places the files in a predefined directory in the database server. This directory is accessible by FCPB.

The data types permitted in a handoff file are given below:

Data Type |

Description |

Text |

Text fields can have alphanumeric characters as per the length specified for the field. |

Numeric |

Numeric fields contain the following information: Amounts – This type of fields contain digits (0-9) and a decimal separator (.). The number of decimal digits is driven by the currency maintenance of FCUBS. Numbers without decimals – This type of fields contain digits (0-9) only. Numbers with decimals – This type of fields contain digits (0-9) and a decimal separator (.). However, these digits do not represent amounts. For example, exchange rates of currencies may contain decimal. |

Date |

Dates are represented in YYYYMMDD format. For instance, March 30, 2012 is represented as 20120330. |

This chapter contains the following sections:

- Section 2.1, "Details Handed off from FCUBS to Oracle FCPB"

- Section 2.2, "Interface Definition"

- Section 2.3, "FATCA Interface between Oracle FCUBS and FCPB"

- Section 2.4, "Online Notifications"

- Section 2.5, "Interface Details for Data Handoff"

2.1 Details Handed off from FCUBS to Oracle FCPB

Oracle FLEXCUBE hands off the following details to Oracle FCPB:

Entity |

Action |

Frequency |

Core/Security |

TD Account Creation |

Add |

On-line |

Core |

TD Premature Withdrawal |

Add |

On-line |

Core |

CASA Account Creation |

Add |

On-line |

Core |

CIF Authorization/Modification/Closure |

Add |

On-line |

Core |

Broker Data |

Add |

On-line |

Core |

CASA Account Balances |

Add |

On-line |

Core |

Segmentation Information |

Add |

On-line |

Core |

TD Maturity with Interest Liquidation |

Add |

Batch |

Core |

Daily Accrued Interest on TD |

Add |

Batch |

Core |

Penalty on TD |

Add |

Batch |

Core |

Loan and Liability Information |

Add |

Batch |

Core |

Segmentation Status Information |

Add |

Batch |

Core |

2.2 Interface Definition

This section contains the following topic:

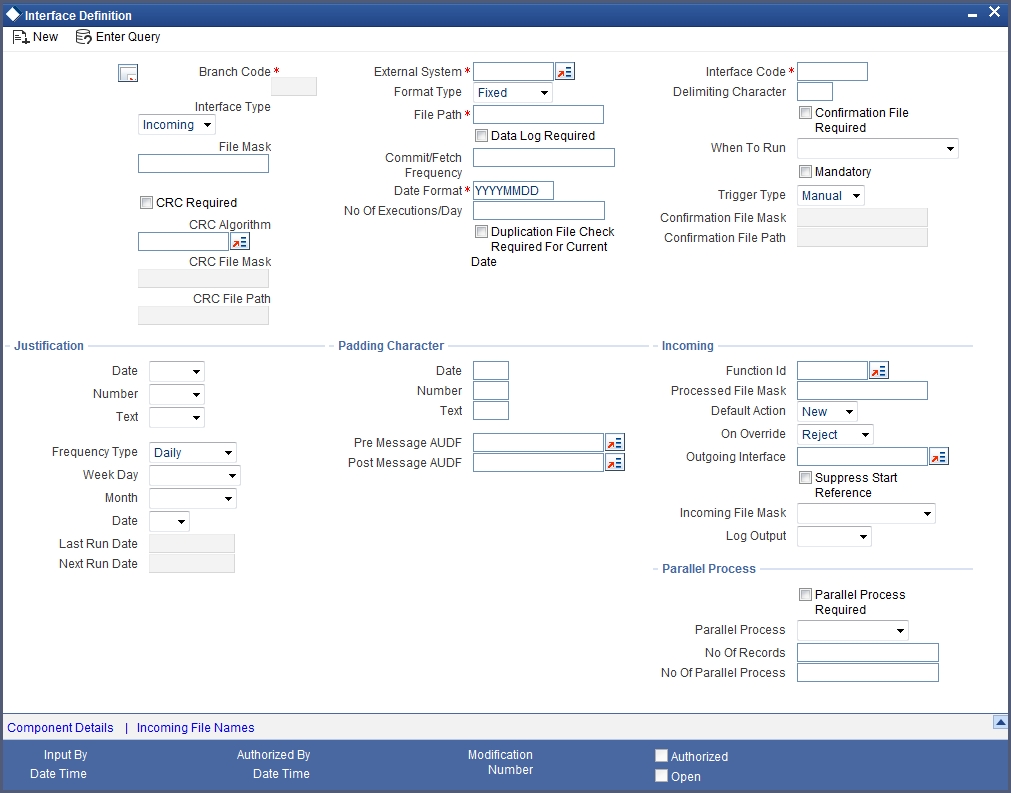

2.2.1 Defining Interface Details for Oracle FCPB

In order to enable the interface, you need to define the interface details for Oracle FCPB in FCUBS. You can define the format details and properties of interface files using ‘Interface Definition’ screen. To invoke this screen, type ‘GIDIFTDF’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You need to define the interface details.

External System

Specify the code that identifies the external system. The interface details defined on this screen are applicable to the interface between FCUBS and the external system selected here.

For FCPB interface, you need to specify ‘FCPB’ as the external system.

Interface Code

Specify a unique code that identifies the interface between the above external system and FCUBS.

Interface Type

Select the interface type from the following options:

- Incoming - Select this for interfaces that upload data into FCUBS

- Outgoing - Select this for interfaces that facilitate handoff of data from FCUBS

File Mask

Specify the file mask for the outgoing interface file. The system decides the name of the handoff file based on the file mask defined here.

Format Type

Select the message format type. Choose one of the following format types based on the data length:

- Fixed - Select this format type if the interface data is within fixed width.

- Delimited - Select this format type if the interface data is in delimited format.

If you select ‘Delimited’, the system enables the field ‘Delimiting Character’.

File Path

Specify the directory in which the interface file is stored.

For further details on the fields on ‘Interface Definition’ screen, refer to the section ‘Specifying Interface Definition Details’ under chapter ‘Generic Interface’ of Generic Interface user manual.

2.2.1.1 Defining Component Details

As part of interface definition, you need to capture specific component details for both handoff and upload. Click ‘Component Details’ button on the ‘Interface Definition’ screen.

You can capture the details of the header, body and footer under ‘Component Linkage’ section. Below that, under ‘Component Field Linkage’ section, you can define the details pertaining to table columns, field type, field length, field name and other relevant details.

For more details of the fields on this screen, refer the chapter ‘Generic Interface’ in the Generic Interface User Manual.

2.3 FATCA Interface between Oracle FCUBS and FCPB

As part of the GIDPRSIF batch, Oracle FCUBS hands off FATCA (Foreign Account Tax Compliance Act) related data to FCPB. This batch is part of the end of day operations. Once a customer gets upgraded as per the segmentation rules, FCUBS generates a handoff file to FCPB. Subsequently, the customers will receive an online notification.

The system generates the following handoff files during EOD operations:

The Customer Master File

This file contains the following information related to FATCA.

- Information available in the FATCA related fields

- Any field information related to 'Director' in the existing customer master file will be removed as part of the batch. Such details will form a part of the 'Directors' hand-off file.

The interface code for Customer Master File (UBS_SEG_CUSTOMER.CSV) is IFCUSSEG

Directors File

Any field information related to 'Director' will form a part of the 'Directors' hand-off file. This file supports one-to-many relationships between customer and directors.

The interface code for Directors (UBS_SEG_AUTH_SIGN.CSV) is IFCUSCOR

Customer FATCA Classification File

This file contains FATCA classification details of the customers.

The interface code for Customer FATCA Classification file (UBS_SEG_CUST_FATCA.CSV) is IFFATCA

2.4 Online Notifications

FCUBS sends an online notification to Oracle FCPB at the following occasions:

- Creation of term deposit account in FCUBS

- Premature withdrawal (redemption before maturity date) of the term deposit amount

- Creation of customer accounts in FCUBS

- Change in the balance in the customer accounts

- Creation, modification or closure of customer information

- Creation of Brokers (customer under the customer category ‘Broker’) in FCUBS

- Modification of term deposit account in FCUBS

- Premature withdrawal (redemption before maturity date) of the term deposit amount

Note

Online Notification for TD redemption through 1317 redemption screen is not supported.

- Rollover of Term deposit account in FCUBS

- Creation of Recurring deposit account in FCUBS

- Customer creation under ‘BROKER’ category

- Amendment of the segmentation code, net worth amount, net worth currency and customer currency of customer Segmentation

- Amendment of the segmentation status from Upgraded to Downgraded and Re-Upgraded to Downgraded

Note

Notification will be fired only for segmented customer. That is when the segment status and segment code for the customer are not null.

Customer status cannot be modified to downgrade on the same day of upgrade.

The details of online notification processed from FCUBS are given below:

Instance |

Notification Code |

Operation |

Service |

XSD Name |

TD account creation |

NOTIF_TD_TDACC_NEW |

QuerycustAccountDetails |

FCUBSAccService |

TD-NewAccount-Notify-MSG.xsd |

TD Account modification |

NOTIF_TDMOD_PB |

QuerycustAccountDetails |

FCUBSAccService |

TD-NewAccount-Notify-MSG.xsd |

TD premature withdrawal |

NOTIF_ICREDM |

QueryTDRedemption |

FCUBSAccService |

IC-QueryTDRedem-Res-Full-MSG.xsd IC-QueryTDRedem-Req-IO-MSG.xsd |

TD rollover |

NOTIF_TD_ROLLOVER |

QueryTDRollover |

FCUBSTDService |

ST-QueryTDRollover-Req-IO-MSG.xsd ST-QueryTDRollover-Res-Full-MSG.xsd |

CASA account creation |

NOTIF_CA_CUSTACC_NEW |

QuerycustAccountDetails |

FCUBSAccService |

CA-NewCustomerAccount-Notify-MSG.xsd |

CIF authorization/ modification/ Closure |

NOTIF_CO_CUSTOMER_MOD |

QueryCustomer |

FCUBSCustomerService |

ST-ModifyCustomer-Notify-MSG.xsd |

Broker creation |

NOTIF_CO_CUSTOMER_NEW |

QueryCustomer |

FCUBSCustomerService |

ST-NewCustomer-Notify-MSG.xsd |

CASA account balance change |

NOTIFY_AC_BAL |

QuerycustAccountDetails |

FCUBSAccService |

TD-AccStat-Notif.xsd |

Customer creation |

NOTIF_PB_CUSTOMER |

Customer creation under ‘Broker’ category |

|

|

Segmentation code |

NOTIF_PB_CUSTOMER |

|

|

CUSTSEGCD |

Net worth Amount |

NOTIF_PB_CUSTOMER |

|

|

NETWORTH |

Net worth Currency |

NOTIF_PB_CUSTOMER |

|

|

NETWORTHCCY |

customer currency |

NOTIF_PB_CUSTOMER |

|

|

CUSTCCY |

Segmentation status |

NOTIF_PB_CUSTOMER |

|

|

CUSTSEGSTATUS |

New tags CUSTSEGCD, CUSTSEGSTATUS, NETWORTH, NETWORTHCCY and CUSTCCY will be available in the notification XSD.

2.5 Interface Details for Data Handoff

FCUBS hands off the details of maintenances and transactions to Oracle FCPB for processing. You need to maintain separate interface details to enable handoff of the following details:

- TD maturity with interest liquidation

- Daily accrued interest on TD

- Penalty on TD

- Loan and Liability Information

The maintenances required for enabling the data upload are discussed under the following headings.

This section contains the following topics:

- Section 2.5.1, "Term Deposit Maturity with Interest Liquidation"

- Section 2.5.2, "Daily Accrued Interest on Term Deposits"

- Section 2.5.3, "Penalty on Term Deposits "

- Section 2.5.4, "Loan and Liability Information"

- Section 2.5.5, "Term Deposit Rollover"

- Section 2.5.6, "Segmentation Status Information"

2.5.1 Term Deposit Maturity with Interest Liquidation

On the maturity date of a term deposit, FCUBS hands off the term deposit maturity details to Oracle FCPB. In addition to that, the system also hands off the interest details after interest liquidation.

This handoff happens only for the customers whose segment code and segment status are defined in the system.

To enable the data handoff from FCUBS, you need to define the interface details as given in the following table:

Field |

Value |

Interface Code |

STOIMDTL |

Interface Type |

Outgoing |

From System |

FCUBS |

To System |

FCPB |

Dateformat |

YYYYMMDD |

File Mask |

/U/B/S/_/T/D/M/A/T$D$M$Y$h$m$s/E/N/D/./C/S/V |

Whentorun |

Beginning of day |

Frequency |

Daily |

Character Set |

ASCII |

Format |

Delimited |

Delimiter |

^ |

File Header record length |

3 , Default value HDR |

Body Record Length |

36 |

File Footer record length |

3, default value TLR |

Numeric padding |

Left padding with Zeros |

Text padding |

Left padding with spaces |

Datalog Required |

Yes |

CRC Required |

No |

Triggering |

System |

In ‘Component Details’ sub-screen, you need to maintain the following details:

Field Name |

Table Name |

Column Name |

Data Type |

Field Length |

Position |

HEADER |

|

|

VARCHAR2 |

3 |

1 |

AC_REF_NO |

TDVWS_TD_MATURITY_DETAILS |

AC_ENTRY_SR_NO |

NUMBER |

10 |

1 |

CUST_NO |

TDVWS_TD_MATURITY_DETAILS |

CUSTOMER_NO |

VARCHAR2 |

9 |

11 |

CUST_NAME |

TDVWS_TD_MATURITY_DETAILS |

CUSTOMER_NAME1 |

VARCHAR2 |

105 |

20 |

TD_ACC |

TDVWS_TD_MATURITY_DETAILS |

ACC |

VARCHAR2 |

20 |

125 |

ACC_CLASS |

TDVWS_TD_MATURITY_DETAILS |

ACCOUNT_CLASS |

VARCHAR2 |

6 |

145 |

TRN_DT |

TDVWS_TD_MATURITY_DETAILS |

TRN_DT |

DATE |

10 |

151 |

LCY_AMOUNT |

TDVWS_TD_MATURITY_DETAILS |

AMOUNT |

NUMBER |

22 |

161 |

DR_CR_ACC |

TDVWS_TD_MATURITY_DETAILS |

AC_NO |

VARCHAR2 |

20 |

183 |

AC_CCY |

TDVWS_TD_MATURITY_DETAILS |

AC_CCY |

VARCHAR2 |

3 |

203 |

REC_STAT |

TDVWS_TD_MATURITY_DETAILS |

RECORD_STAT |

VARCHAR2 |

1 |

206 |

TXN_TYPE |

TDVWS_TD_MATURITY_DETAILS |

TRANSACTION_TYPE |

VARCHAR2 |

9 |

207 |

TRAILER |

|

|

VARCHAR2 |

3 |

1 |

2.5.2 Daily Accrued Interest on Term Deposits

FCUBS hands off the details of the accrued interest on the term deposits to Oracle FCPB on a daily basis. This handoff happens only for the customers whose segment code and segment status are defined in the system.

Note

Discounted TD’s accrual record will not be sent to Oracle FCPB. Interest Liquidation for Discounted TD’s will be sent upfront in TD Maturity with interest liquidation file.

To enable handoff of this data from FCUBS, you need to define the interface details as given in the following table:

Field |

Value |

Interface Code |

DLACCRNT |

Interface Type |

Outgoing |

From System |

FCUBS |

To System |

FCPB |

Dateformat |

YYYYMMDD |

File Mask |

/M/K$D$M$Y$h$m$s/E/N/D |

Whentorun |

End of Transaction input |

Frequency |

Daily |

Character Set |

ASCII |

Format |

Delimited |

Delimiter |

^ |

File Header record length |

3 , Default value HDR |

Body Record Length |

36 |

File Footer record length |

3, default value TLR |

Numeric padding |

Left padding with Zeros |

Text padding |

Left padding with spaces |

Datalog Required |

Yes |

CRC Required |

No |

Triggering |

System |

In ‘Component Details’ sub-screen, you need to maintain the following details:

Field Name |

Table Name |

Column Name |

Data Type |

Field Length |

Position |

CUSTNO |

ICVW_ACCRUAL_DETAILS |

CUST_NO |

VARCHAR2 |

9 |

1 |

SHRTNM |

ICVW_ACCRUAL_DETAILS |

SHORT_NAME |

VARCHAR2 |

20 |

10 |

ACC |

ICVW_ACCRUAL_DETAILS |

ACC |

VARCHAR2 |

20 |

30 |

ACCL |

ICVW_ACCRUAL_DETAILS |

ACCOUNT_CLASS |

VARCHAR2 |

6 |

50 |

ACRAMT |

ICVW_ACCRUAL_DETAILS |

ACCRUED_AMT |

NUMBER |

22 |

56 |

ENTDT |

ICVW_ACCRUAL_DETAILS |

ENT_DT |

VARCHAR2 |

10 |

78 |

CCY |

ICVW_ACCRUAL_DETAILS |

CCY |

VARCHAR2 |

3 |

88 |

PROD |

ICVW_ACCRUAL_DETAILS |

PROD |

VARCHAR2 |

4 |

91 |

HEADER |

|

|

VARCHAR2 |

3 |

1 |

TRAILER |

|

|

VARCHAR2 |

3 |

1 |

2.5.3 Penalty on Term Deposits

FCUBS hands off to Oracle FCPB the details of penalties applied on term deposits. This handoff happens only for the customers whose segment code and segment status are defined in the system.

To enable handoff of this data from FCUBS, you need to define the interface details as given in the following table:

Field |

Value |

Interface Code |

STOIMDTL |

Interface Type |

Outgoing |

From System |

FCUBS |

To System |

FCPB |

Dateformat |

YYYYMMDD |

File Mask |

/U/B/S/_/T/D/M/A/T$D$M$Y$h$m$s/E/N/D/./C/S/V |

Whentorun |

Beginning of day |

Frequency |

Daily |

Character Set |

ASCII |

Format |

Delimited |

Delimiter |

^ |

File Header record length |

3 , Default value HDR |

Body Record Length |

36 |

File Footer record length |

3, default value TLR |

Numeric padding |

Left padding with Zeros |

Text padding |

Left padding with spaces |

Datalog Required |

Yes |

CRC Required |

No |

Triggering |

System |

In ‘Component Details’ sub-screen, you need to maintain the following details:

Field Name |

Table Name |

Column Name |

Data Type |

Field Length |

Position |

HEADER |

|

|

VARCHAR2 |

3 |

1 |

AC_REF_NO |

TDVW_TD_DETAILS |

AC_ENTRY_SR_NO |

NUMBER |

10 |

1 |

CUST_NO |

TDVW_TD_DETAILS |

CUSTOMER_NO |

VARCHAR2 |

9 |

11 |

CUST_NAME |

TDVW_TD_DETAILS |

CUSTOMER_NAME1 |

VARCHAR2 |

105 |

20 |

TD_ACC |

TDVW_TD_DETAILS |

ACC |

VARCHAR2 |

20 |

125 |

ACC_CLASS |

TDVW_TD_DETAILS |

ACCOUNT_CLASS |

VARCHAR2 |

6 |

145 |

TRN_DT |

TDVW_TD_DETAILS |

TRN_DT |

DATE |

10 |

151 |

LCY_AMOUNT |

TDVW_TD_DETAILS |

AMOUNT |

NUMBER |

22 |

161 |

DR_CR_ACC |

TDVW_TD_DETAILS |

AC_NO |

VARCHAR2 |

20 |

183 |

AC_CCY |

TDVW_TD_DETAILS |

AC_CCY |

VARCHAR2 |

3 |

203 |

REC_STAT |

TDVW_TD_DETAILS |

RECORD_STAT |

VARCHAR2 |

1 |

206 |

TXN_TYPE |

TDVW_TD_DETAILS |

TRANSACTION_TYPE |

VARCHAR2 |

9 |

207 |

TRAILER |

|

|

VARCHAR2 |

3 |

1 |

2.5.4 Loan and Liability Information

FCUBS hands off the details of loan accounts to Oracle FCPB. This handoff happens only for the customers whose segment code and segment status are defined in the system.

The handoff file contains the following details of the loan accounts maintained in FCUBS:

- Principal outstanding amount

- Maturity date

- Interest rate

- Tenor of the loan

- Accrued amount

- Amount paid

- Last paid date

To enable handoff of this data from FCUBS, you need to define the interface details as given in the following table:

Field |

Value |

Interface Code |

CLOLNDTL |

Interface Type |

Outgoing |

From System |

FCUBS |

To System |

FCPB |

Dateformat |

YYYYMMDD |

File Mask |

/U/B/S/_/P/R/O/D/B/L$D$M$Y$h$m$s/E/N/D |

Whentorun |

End of Transaction input |

Frequency |

Daily |

Character Set |

ASCII |

Format |

Delimited |

Delimiter |

^ |

File Header record length |

3 , Default value HDR |

Body Record Length |

36 |

File Footer record length |

3, default value TLR |

Numeric padding |

Left padding with Zeros |

Text padding |

Left padding with spaces |

Datalog Required |

Yes |

CRC Required |

No |

Triggering |

System |

In ‘Component Details’ sub-screen, you need to maintain the following details:

Field Name |

Table Name |

Column Name |

Data Type |

Field Length |

Position |

HEADER |

|

|

VARCHAR2 |

3 |

1 |

CUSTID |

CLVW_LOAN_INT_DETAILS |

CUSTOMER_ID |

VARCHAR2 |

35 |

1 |

ACCNO |

CLVW_LOAN_INT_DETAILS |

ACCOUNT_NUMBER |

VARCHAR2 |

35 |

2 |

PRODAC |

CLVW_LOAN_INT_DETAILS |

DR_PROD_AC |

VARCHAR2 |

20 |

36 |

PROD |

CLVW_LOAN_INT_DETAILS |

PRODUCT_CODE |

VARCHAR2 |

4 |

56 |

BOOKDT |

CLVW_LOAN_INT_DETAILS |

BOOK_DATE |

VARCHAR2 |

10 |

60 |

VALDT |

CLVW_LOAN_INT_DETAILS |

VALUE_DATE |

VARCHAR2 |

10 |

70 |

PRNOUTAMT |

CLVW_LOAN_INT_DETAILS |

PRNOUTSTANDING |

NUMBER |

22 |

80 |

CCY |

CLVW_LOAN_INT_DETAILS |

CURRENCY |

VARCHAR2 |

3 |

102 |

MATDT |

CLVW_LOAN_INT_DETAILS |

MATURITY_DATE |

VARCHAR2 |

10 |

105 |

ACCSTAT |

CLVW_LOAN_INT_DETAILS |

ACCOUNT_STATUS |

VARCHAR2 |

1 |

115 |

ACSUBTYP |

CLVW_LOAN_INT_DETAILS |

ACCT_SUB_TYPE |

VARCHAR2 |

10 |

116 |

ACCBRN |

CLVW_LOAN_INT_DETAILS |

DR_ACC_BRN |

VARCHAR2 |

3 |

126 |

MICR |

CLVW_LOAN_INT_DETAILS |

MICR |

VARCHAR2 |

10 |

129 |

RSLDVAL |

CLVW_LOAN_INT_DETAILS |

RESOLVED_VALUE |

NUMBER |

22 |

139 |

TENOR |

CLVW_LOAN_INT_DETAILS |

TENOR |

NUMBER |

22 |

161 |

ACCRAMT |

CLVW_LOAN_INT_DETAILS |

ACCRAMT |

NUMBER |

22 |

183 |

LTINACDT |

CLVW_LOAN_INT_DETAILS |

LAST_INT_ACCR_DATE |

VARCHAR2 |

10 |

205 |

AMTSTLD |

CLVW_LOAN_INT_DETAILS |

AMTSTLD |

NUMBER |

22 |

215 |

LTPMTDT |

CLVW_LOAN_INT_DETAILS |

LAST_PMT_DT |

VARCHAR2 |

10 |

237 |

ACTADD |

CLVW_LOAN_INT_DETAILS |

ACCT_ADDRESS |

VARCHAR2 |

10 |

247 |

HLDAMT |

CLVW_LOAN_INT_DETAILS |

HOLD_AMOUNT |

NUMBER |

22 |

257 |

TRAILER |

|

|

VARCHAR2 |

3 |

1 |

2.5.5 Term Deposit Rollover

FCUBS hands off the details of manual and automatic rollovers of term deposits to Oracle FCPB. This handoff happens only for the customers whose segment code and segment status are defined in the system.

The Notification contains the following details of the TD accounts maintained in FCUBS:

- Branch

- Deposit account number

- Old maturity date

- New maturity date

- Renewal date

- Rollover type

- Total interest on the TD

- Principal

- Rollover amount

- Balance interest paid out during rollover

- Interest rate

- Tenor

- Customer number

- Currency

2.5.6 Segmentation Status Information

When a customer segmentation status is updated to ‘Upgraded’ as per the segmentation rules, FCUBS generates an End Of Day (EOD) and Beginning Of Day (BOD) files handoff for the corresponding customers and triggers the handoffs to FCPB. As a part of this interface, the following files will be generated whenever the customer segmentation status is upgraded:

- Customer File

FCUBS will generate outgoing files for the upgraded customers and the account details of the corresponding primary account holder will be handed off to FCPB.

- Customer Account File

FCUBS will generate outgoing files for the CASA accounts of the upgraded customers and the corresponding open accounts will be handed off to FCPB.

- Customer Balances – CASA File

FCUBS will generate outgoing files for the CASA accounts and the balance of the upgraded customers. The balance details of the corresponding open accounts will be handed off to FCPB.

- Customer Balances – Loan File

FCUBS will generate outgoing files for the Loan accounts and the balance of the upgraded customers. The active loans of the corresponding customers will be handed off to FCPB.

- Customer TD Booked & Rollover File

FCUBS will generate outgoing files for the TD accounts which underwent the following changes as of segmentation date:

- Booked

- Rollover

- Partial Redemption

The following details are sent to the FCPB:

- Details of all open TD accounts

- Partial redeemed TD details

- TD renewal details

- Customer TD Interest Liquidation, Penalty File - Segment Upgrade Details

FCUBS will generate outgoing files at BOD, for the TD accounts undergoing the following changes as of segmentation date:

- Interest liquidation

- Penalty

The following TD details are sent to FCPB:

- TD with interest liquidation

- TD with penalty entries for partial redemption

2.5.6.1 Segment Upgrade - File Formats

The formats of the above files are given below.

Customer File Format

The format of the customer file is given below.

FIELD NAME |

DESCRIPTION |

MANDATORY |

FCUBS COLUMN NAME |

TABLE NAME |

LENGTH |

EXTERNAL_ID |

External client id of customer |

YES |

EXT_REF_NO |

STTM_CUSTOMER |

20 |

FCPB CLIENT_ID |

FCPB Client ID of customer |

|

|

NULL |

10 |

SALUTATION |

Salutation |

YES |

CUSTOMER_PREFIX |

STTM_CUST_PERSONAL |

30 |

FIRST_NAME |

First Name |

YES |

FIRST_NAME |

STTM_CUST_PERSONAL |

105 |

MIDDLE_NAME |

Middle Name |

NO |

MIDDLE_NAME |

STTM_CUST_PERSONAL |

105 |

LAST_NAME |

Last Name |

NO |

LAST_NAME |

STTM_CUST_PERSONAL |

105 |

PHONE_RESI_COUNTRY_CODE |

Telephone international country code |

NO |

TEL_ISD_NO |

STTM_CUST_PERSONAL |

10 |

PHONE_HOME |

Home Phone |

NO |

TELEPHONE |

STTM_CUST_PERSONAL |

105 |

MOBILE_ADDN_COUNTRY_CODE |

Mobile international country code |

NO |

MOB_ISD_NO |

STTM_CUST_PERSONAL |

10 |

PHONE_MOBILE |

Mobile Phone |

NO |

MOBILE_NUMBER |

STTM_CUST_PERSONAL |

22 |

PHONE_OFC_COUNTRY_CODE |

Office Telephone international country code |

NO |

|

NULL |

3 |

PHONE_WORK |

Work Phone |

NO |

E_TELEPHONE |

STTM_CUST_PROFESSIONAL |

10 |

NO |

E_MAIL |

STTM_CUST_PERSONAL |

255 |

||

GENDER |

Gender:(M) Male, (F) Female |

YES |

SEX |

STTM_CUST_PERSONAL |

1 |

DOB |

Date OF Birth |

NO |

DATE_OF_BIRTH |

STTM_CUST_PERSONAL |

10 |

TAX_ID |

Income Tax ID |

YES |

TAX_ID |

STTM_CORP_DIRECTORS |

105 |

CLIENT_SEG |

Client Segment |

YES |

CUST_SEGMENT_CODE |

STTM_CUSTOMER |

|

OCCUPATION |

Occupation |

YES |

DESIGNATION |

STTMS_CUST_PROFESSIONAL |

105 |

CLIENT_TYPE |

Client IT type |

YES |

CUSTOMER_TYPE |

STTM_CUSTOMER |

1 |

HOME_BRANCH |

Branch code of the customer |

YES |

LOCAL_BRANCH |

STTM_CUSTOMER |

3 |

ACQ_DATE |

Acquisition Date |

NO |

|

NULL |

|

BANKER |

Banker Code |

YES |

BANK_CODE |

STTM_BANK |

4 |

ADDR_LINE1 |

Mailing Address 1 |

NO |

ADDRESS1 |

MSTM_CUST_ADDRESS |

105 |

ADDR_LINE2 |

Mailing Address 2 |

NO |

ADDRESS2 |

MSTM_CUST_ADDRESS |

105 |

ADDR_LINE3 |

Mailing Address 3 |

NO |

ADDRESS3 |

MSTM_CUST_ADDRESS |

105 |

STATE_MAILING |

State of the Mailing address |

NO |

|

NULL |

|

COUNTRY_MAILING |

Country of the mailing address |

NO |

COUNTRY |

MSTM_CUST_ADDRESS |

3 |

ZIP_MAILING |

Zip code of the mailing address |

NO |

|

NULL |

|

ADDR_LINE1 |

Home Address 1 |

YES |

ADDRESS_LINE1 |

STTM_CUSTOMER |

105 |

ADDR_LINE2 |

Home Address 2 |

YES |

ADDRESS_LINE3 |

STTM_CUSTOMER |

105 |

ADDR_LINE3 |

Home Address 3 |

YES |

ADDRESS_LINE2 |

STTM_CUSTOMER |

105 |

STATE_HOME |

State of the Home address |

NO |

|

NULL |

|

COUNTRY_HOME |

Country of the Home address |

YES |

COUNTRY |

STTM_CUSTOMER |

3 |

ZIP_HOME |

Zip code of the Home address |

NO |

|

NULL |

|

ADDR_LINE1 |

Work Address 1 |

NO |

E_ADDRESS1 |

STTMS_CUST_PROFESSIONAL |

105 |

ADDR_LINE2 |

Work Address 2 |

NO |

E_ADDRESS2 |

STTMS_CUST_PROFESSIONAL |

105 |

ADDR_LINE3 |

Work Address 3 |

NO |

E_ADDRESS3 |

STTMS_CUST_PROFESSIONAL |

105 |

STATE_WORK |

State of the work address |

NO |

|

NULL |

|

COUNTRY_WORK |

Country of the work address |

NO |

|

NULL |

|

ZIP_WORK |

Zip code of the work address |

NO |

|

NULL |

|

FAX_HOME_COUNTRY_CODE |

FAX international country code |

NO |

FAX_ISD_NO |

STTM_CUST_PERSONAL |

10 |

FAX |

Fax Number |

NO |

FAX_NUMBER |

STTM_CUSTOMER |

105 |

NATIONALITY |

Nationality - If Customer type is "I" (Individual) Nationality required to be provided If Customer type is "C" (Corporate) Country of Incorporation to be provided |

YES |

NATIONALITY/INCORP_COUNTRY |

STTM_CUSTOMER/STTMS_CUST_CORPORATE |

3 |

LANGUAGE |

Preferred language of the customer |

YES |

LANGUAGE |

STTM_CUSTOMER |

3 |

CCY_ID |

Customer Currency |

YES |

PORTFOLIO_CCY_CODE |

SETM_PORTFOLIO_MASTER |

3 |

PREF_COMM_MODE |

Preferable communication mode |

YES |

DEFAULT_MEDIA |

STTM_CUSTOMER |

12 |

CLIENT_CATEGORY |

Client category |

YES |

CUSTOMER_CATEGORY |

STTM_CUSTOMER |

10 |

CLIENT_CLASSIFICATION |

Client Classification |

YES |

CUST_CLASSIFICATION |

STTM_CUSTOMER |

20 |

MINOR_FLAG |

Flag indicating if minor |

YES |

MINOR |

STTM_CUST_PERSONAL |

1 |

BIRTH_PLACE |

Place of Birth |

NO |

PLACE_OF_BIRTH |

STTM_CUST_PERSONAL |

100 |

COB_COUNTRY_ID |

Country of birth |

NO |

BIRTH_COUNTRY |

BIRTH_COUNTRY |

3 |

DOMICILE |

Domicile Country details |

NO |

D_COUNTRY |

STTM_CUSTOMER |

3 |

SIGNIF_STY_IN_USA_YN |

Visited US in last 3 years |

|

VST_US_PREV |

STTM_CUST_PERSONAL |

1 |

POA FLAG |

Power of Attorney flag, If POA flag is "Y" FCPB should consider the holder details and update Signatory type in CRM_AUTHORIZED_SIGNATORY table as "PA" |

NO |

PA_ISSUED |

STTM_CUST_PERSONAL |

1 |

AUTH_SIGN_FNAME |

First name of the Power of Attorney Holder |

NO |

PA_HOLDER_NAME |

STTM_CUST_PERSONAL |

105 |

AUTH_SIGN_LNAME |

Last name of the Power of Attorney Holder |

NO |

|

NULL |

|

AUTH_SIGN_DOB |

Date of birth of the Power of Attorney Holder |

NO |

|

NULL |

|

AUTH_SIGN_MOBILE |

Mobile international country code of the guardian/Power of Attorney Holder |

NO |

|

NULL |

|

AUTH_SIGN_HOME |

Mobile number of the Power of Attorney Holder |

NO |

|

NULL |

|

PH_HOME_COUNTRY_CODE |

Telephone Code of home telephone number of the Power of Attorney holder |

|

PA_HOLDER_TEL_ISD |

STTM_CUST_PERSONAL |

10 |

AUTH_SIGN_HOME |

Telephone number of the Power of Attorney holder |

NO |

PA_HOLDER_TEL_NO |

STTM_CUST_PERSONAL |

20 |

AUTH_SIGN_TAX_ID |

Tax identifier of the Power of Attorney Holder |

NO |

|

NULL |

15 |

AUTH_SIGN_REL |

Relationship of the Power of Attorney Holder |

NO |

|

NULL |

5 |

AUTH_SIGN_TYPE |

Type of the Power of Attorney Holder |

NO |

|

NULL |

3 |

AUTH_SIGN_DOMICILE |

Country of the Power of Attorney Holder |

NO |

|

NULL |

20 |

NATIONALITY_COUNTRY_CODE |

Nationality Country ID of the Power of Attorney holder |

|

PA_HOLDER_NATIONALTY |

STTM_CUST_PERSONAL |

3 |

AUTH_SIGN_ADDRESS |

Address of the Power of Attorney holder |

|

PA_HOLDER_ADDR |

STTM_CUST_PERSONAL |

105 |

AUTH_SIGN_COUNTRY |

Address Country ID of the Power of Attorney holder |

|

PA_HOLDER_ADDR_COUNTRY |

STTM_CUST_PERSONAL |

3 |

LOCATION |

Location code/details of customer |

NO |

|

NULL |

|

EXT_PORTFOLIO_ID |

UBS Investment portfolio ID |

NO |

PORTFOLIO_ID |

SETM_PORTFOLIO_MASTER |

16 |

REG_COUNTRY_ID |

Registered country for the corporate |

NO |

R_COUNTRY |

STTMS_CUST_CORPORATE |

3 |

INCORP_COUNTRY_ID |

Incorporated country for the corporate |

NO |

INCORP_COUNTRY |

STTMS_CUST_CORPORATE |

3 |

CUSTOMER_STATUS |

Status of the customer |

NO |

CIF_STATUS |

STTM_CUSTOMER |

20 |

UDF_NUM_1 |

UDF NUM 1 |

NO |

FIELD_VAL_1 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_NUM_2 |

UDF NUM 2 |

NO |

FIELD_VAL_2 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_NUM_3 |

UDF NUM 3 |

NO |

FIELD_VAL_3 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_NUM_4 |

UDF NUM 4 |

NO |

FIELD_VAL_4 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_NUM_5 |

UDF NUM 5 |

NO |

FIELD_VAL_5 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_TXT_1 |

Guardian name - It is mandatory if minor flag is ‘Y’ |

NO |

LEGAL_GUARDIAN |

STTM_CUST_PERSONAL |

105 |

UDF_TXT_2 |

UDF TXT 2 |

NO |

FIELD_VAL_7 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_TXT_3 |

UDF TXT 3 |

NO |

FIELD_VAL_8 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_TXT_4 |

UDF TXT 4 |

NO |

FIELD_VAL_9 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_TXT_5 |

UDF TXT 5 |

NO |

FIELD_VAL_10 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_DATE_1 |

|

NO |

FIELD_VAL_11 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_DATE_2 |

|

NO |

FIELD_VAL_12 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_DATE_3 |

|

NO |

FIELD_VAL_13 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_DATE_4 |

|

NO |

FIELD_VAL_14 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

UDF_DATE_5 |

|

NO |

FIELD_VAL_15 |

CSTM_FUNCTION_USERDEF_FIELDS |

150 |

Customer Account File Format

The format of the customer account file is given below:

FIELD NAME |

DESCRIPTION |

LENGTH |

MANDATORY |

FCC_COLUMNS |

LENGTH |

TABLE NAME |

Fcubs Remarks |

T_EXT_CLIENT_ID |

External client id |

10 |

YES |

CUST_NO |

9 |

STTM_CUST_ACCOUNT |

|

T_BANK_ACCT_ID |

Bank account id |

16 |

YES |

CUST_AC_NO |

20 |

STTM_CUST_ACCOUNT |

|

T_ACCT_STATUS |

Account status |

1 |

YES |

ACC_STATUS |

4 |

STTM_CUST_ACCOUNT |

|

T_ACCT_SUB_TYPE |

Account sub type |

5 |

YES |

ACCOUNT CALSS |

6 |

STTM_CUST_ACCOUNT |

|

T_CURR |

Currency |

3 |

YES |

CCY |

3 |

STTM_CUST_ACCOUNT |

|

T_ACCT_BRANCH |

Account branch |

50 |

YES |

BRANCH_CODE |

3 |

STTM_CUST_ACCOUNT |

|

T_MICR |

MICR |

24 |

NO |

NULL |

|

|

|

T_ACCT_TYP |

Account type |

5 |

YES |

ACCOUNT_TYPE |

1 |

STTM_CUST_ACCOUNT |

S- Savings, U - Current |

T_SALES_REP_ID |

Sale representative id |

50 |

NO |

NULL |

|

|

|

T_OPPORTUNITY_ID |

Sale oppurtinity id |

50 |

NO |

NULL |

|

|

|

OPENING_DATE |

Opening date |

|

YES |

AC_OPEN_DATE |

8 |

STTM_CUST_ACCOUNT |

|

CLOSING_DATE |

Closing date |

|

NO |

AC_SET_CLOSE_DATE |

8 |

STTM_CUST_ACCOUNT |

|

T_ACCT_ADDRESS |

Address |

200 |

YES |

ADDRESS1 |

105 |

STTM_CUST_ACCOUNT |

|

T_ACCT_ADDRESS1 |

Address line 1 |

200 |

NO |

ADDRESS2 |

105 |

STTM_CUST_ACCOUNT |

|

T_ACCT_ADDRESS2 |

Address line 1 |

200 |

NO |

ADDRESS3 |

105 |

STTM_CUST_ACCOUNT |

|

T_ACCT_CITY |

Account city |

100 |

NO |

LOCATION |

15 |

STTM_CUST_ACCOUNT |

|

T_ACCT_COUNTRY_ID |

Account country id |

3 |

NO |

NULL |

|

|

|

T_HLD_ACCT_YN |

Held away accoutn YN |

1 |

YES |

"N" |

1 |

|

DEFAULT VALUE "N" |

T_ACCT_DESCRIPTION |

Accound description |

20 |

NO |

AC_DESC |

|

STTM_CUST_ACCOUNT |

|

Customer Balance – CASA File Format

The format of the customer balance file is given below:

FIELD NAME |

DESCRIPTION |

TYPE |

LENGTH |

MANDATORY |

FCC_COLUMN |

LENGTH |

FCC Table name |

FCC Remarks |

CLIENT_ID |

Client id |

VARCHAR |

10 |

YES |

CUST_NO |

9 |

STTM_CUST_ACCOUNT |

|

BANK_ACCT_ID |

Bank account id /loan account id |

VARCHAR |

16 |

YES |

CUST_AC_NO |

20 |

STTM_CUST_ACCOUNT |

|

PROD_ID |

product id |

VARCHAR |

5 |

YES |

PROD |

4 |

ICTB_ENTRIES |

Interest Product associated.One account can have multiple interest product |

BOOKING_DATE |

booking date |

DATE |

|

YES |

AC_OPEN_DATE |

|

STTM_CUST_ACCOUNT |

|

VALUE_DATE |

value date |

DATE |

|

YES |

|

8 |

|

Default Value Application date |

AMOUNT |

amount |

NUMBER |

24,6 |

YES |

ACY_AVL_BAL |

22 |

STTM_CUST_ACCOUNT |

|

CCY_ID |

Currency |

VARCHAR |

3 |

YES |

CCY |

3 |

STTM_CUST_ACCOUNT |

|

MATURITY_DATE |

Maturity date |

DATE |

|

NO |

NULL |

|

|

|

ACCT_SUB_TYPE |

Account sub type |

VARCHAR |

5 |

YES |

ACCOUNT_CLASS |

6 |

STTM_CUST_ACCOUNT |

|

INT_RATE |

interest rate |

NUMBER |

24,6 |

NO |

AMT/RATE |

22 |

ICTB_UDEVALS |

|

TENOR |

tenor |

NUMBER |

10 |

YES |

NULL |

|

|

|

ACCR_INT |

Accrued interest |

NUMBER |

24,6 |

NO |

AMT |

22 |

ICTB_ENTRIES |

This will be sum of total credit interest accrued for that product includes all credit formula associated to it |

LAST_INT_ACCR_DATE |

Last interest paid |

DATE |

|

NO |

LAST_ACCR_DT |

8 |

ICTB_ACC_PR |

|

INTEREST_PAID |

interest paid |

NUMBER |

24,6 |

NO |

AMT |

22 |

ICTB_ENTRIES |

This will be sum of total credit interest liquidated for the product includes all credit formula associated to it |

LAST_INT_DATE |

Last interest date |

DATE |

|

NO |

LAST_ACCR_DT |

8 |

ICTB_ACC_PR |

|

HOLD_AMOUNT |

Hold amount |

NUMBER |

24,6 |

NO |

ACY_BLOCKED_AMOUNT |

22 |

STTM_CUST_ACCOUNT |

|

Customer Balance – Loan File Format

The format of the customer loan balance file is given below:

FIELD NAME |

DESCRIPTION |

TYPE |

LENGTH |

MANDATORY |

FCC_COLUMN |

LENGTH |

FCC Table name |

FCC Remarks |

CLIENT_ID |

Client id |

VARCHAR |

10 |

YES |

CUSTOMER_ID |

9 |

CLTB_ACCOUNT_MASTER |

|

BANK_ACCT_ID |

Bank account id /loan account id |

VARCHAR |

16 |

YES |

CUST_AC_NO |

20 |

STTM_CUST_ACCOUNT |

|

PROD_ID |

product id |

VARCHAR |

5 |

YES |

PRODUCT_CODE |

4 |

CLTB_ACCOUNT_MASTER |

|

BOOKING_DATE |

booking date |

DATE |

|

YES |

BOOK_DATE |

8 |

CLTB_ACCOUNT_MASTER |

YYYYMMDD format |

VALUE_DATE |

value date |

DATE |

|

YES |

VALUE_DATE |

8 |

CLTB_ACCOUNT_MASTER |

YYYYMMDD format |

AMOUNT |

amount |

NUMBER |

24,6 |

YES |

AMOUNT_FINANCED |

|

CLTB_ACCOUNT_MASTER |

|

CCY_ID |

Currency |

VARCHAR |

3 |

YES |

CURRENCY |

3 |

CLTB_ACCOUNT_MASTER |

|

MATURITY_DATE |

Maturity date |

DATE |

|

NO |

MATURITY_DATE |

8 |

CLTB_ACCOUNT_MASTER |

YYYYMMDD format |

ACCT_SUB_TYPE |

Account sub type |

VARCHAR |

5 |

YES |

"L" |

1 |

|

Default Value "L" - Loan |

INT_RATE |

interest rate |

NUMBER |

24,6 |

NO |

UDE_VALUE |

|

CLTB_ACCOUNT_UDE_VALUES |

|

TENOR |

tenor |

NUMBER |

10 |

YES |

NULL |

|

CLTB_ACCOUNT_MASTER |

|

ACCR_INT |

Accrued interest |

NUMBER |

24,6 |

NO |

ACCRUED_AMOUNT |

|

CLTB_ACCOUNT_SCHEDULES |

|

LAST_INT_ACCR_DATE |

Last interest paid |

DATE |

|

NO |

EVENT_DATE |

8 |

CLTB_ACCOUNT_EVENTST_DIARY |

Last accrual event happened date |

INTEREST_PAID |

interest paid |

NUMBER |

24,6 |

NO |

AMOUNT_SETTLED |

22 |

CLTB_ACCOUNT_SCHEDULES |

|

LAST_INT_DATE |

Last interest date |

DATE |

|

NO |

EVENT_DATE |

8 |

CLTB_ACCOUNT_EVENTST_DIARY |

Last liquidation event happened date |

HOLD_AMOUNT |

Hold amount |

NUMBER |

24,6 |

NO |

AMOUNT_FINANCED MINUS AMOUNT_DISBURSED |

22 |

CLTB_ACCOUNT_MASTER |

This will be derived from

|

Customer TD Booked File Format

The format of the customer TD booked file is given below:

FIELD NAME |

DESCRIPTION |

TYPE |

LENGTH |

MANDATORY |

REMARKS |

SAMPLE VALUES |

CLIENT_ID |

External customer ID |

Varchar |

10 |

Yes |

|

|

TRAN_TYPE |

Tran type |

Varchar |

15 |

Yes |

|

Could be NEW for Booking, PAR for Partial Uplift or RNW for Rollover |

ACCOUNT_NO |

Acount no |

Varchar |

16 |

Yes |

|

|

TRAN_DATE |

Transaction date |

Date |

|

Yes |

|

|

AMOUNT |

Amount |

Number |

24,6 |

Yes |

Could be BookingAMt or PARAMt (For PAR TranType) or RolloverAMt (for RNW tranType) |

|

CURRENCY |

Currency |

Varchar |

3 |

Yes |

|

|

MAT_DATE |

Maturity date |

Date |

|

Yes |

Could be MatDt for Booking OR New MatDt for Rollovers |

|

TENOR |

Tenor |

Number |

10 |

Yes |

|

|

INT_RATE |

Interest rate |

Number |

23,6 |

NO |

Has been made non-mandatory as FCUBS request; but Should be mandatory for Booking IntRate or Rollover IntRate (for RNW tranType) |

|

EXTERNAL_TRAN_ID |

external tran id |

Varchar |

40 |

No |

Since FCUBS does not have any separate TransactionId for TD and only uses TD Ref Number, this should be sent as NULL/BLANK |

|

TRAN_STATUS |

Tran Status |

Varchar |

1 |

Yes |

No need to send CLOSED TDs..only Active TDs to be sent |

|

SPREAD |

Spread in BPS |

Number |

24,6 |

Yes |

Only for Floating we have Spread; Fixed Deposit only has Customer Level Spread -Bala to get back |

|

ACCOUNT_CLASS |

Product alt id |

Varchar |

5 |

Yes |

|

|

ROLLOVER_TYPE |

Rollover Type |

Varchar |

1 |

Yes |

Mandatory for rollover TransactionType oNLY |

Can be P or 'P+I' as Rollover Type |

INTEREST_AMOUNT |

Interest Amt for Rollover 'P' type |

Number |

24,6 |

No |

|

This indicates the Interest to be paid to customer on the RolloverDate for a 'P' type of Rollover |

Customer TD Interest Liquidation, Penalty File Format

The format of the customer TD interest liquidation, penalty file is given below:

FIELD NAME |

DESCRIPTION |

MANDATORY |

REMARKS |

SAMPLE VALUES |

TRAN REF NO |

Can be stored as Ext_Tran_Idn or Ext_Tran_Ref |

Yes |

|

|

CUSTOMER_NO |

Client_id |

Yes |

|

|

CUSTOMER_NAME1 |

ignored |

NO |

|

|

ACC |

Sub_portfolio_id |

Yes |

|

|

ACCOUNT_CLASS |

Based on Account class(whether it is TD or call deposit, instrument id and instrument type would be populated)- details in FCPB_FS_CASA_Includeinholdings_Rel2.1- section 8) |

Yes |

|

|

|

|

|

|

|

TRN_DT |

Tran_Date |

Yes |

Interest Liquidation Date, Penalty Charging Date |

|

LCY_AMOUNT |

Amount |

Yes |

Interest, Penalty |

|

AC_NO |

Indicates Dr/Cr AcctNumber n ignored |

NO |

|

|

AC_CCY |

Amt_ccy |

YES |

|

|

RECORD_STAT |

ignored |

NO |

|

|

TRANSACTION_TYPE |

Tran_Type |

Yes |

|

Interest, Penalty |

Corporate Directors File Format

The format of the corporate directors file is given below:

FIELD NAME |

DESCRIPTION |

MANDATORY |

FCUBS Column Name |

FCUBS Table Name |

LINKED_CLIENT_ID |

External client id of customer |

YES |

CUSTOMER_NO |

STTM_CUSTOMER |

FCPB CLIENT_ID |

FCPB Client Id of customer |

|

|

NULL |

AUTH_SIGN_FNAME |

First Name of the authorized signatory |

NO |

DIRECTOR_NAME |

STTM_CORP_DIRECTORS |

AUTH_SIGN_LNAME |

Last Name of the authorized signatory |

NO |

|

NULL |

AUTH_SIGN_DOB |

Date of birth of the authorized signatory |

NO |

|

NULL |

MOBILE_COUNTRY_CODE |

Mobile international country code of the authorized signatory |

NO |

MOB_ISD_NO |

STTM_CORP_DIRECTORS |

AUTH_SIGN_MOBILE |

Mobile number of the authorized signatory |

NO |

MOBILE_NUMBER |

|

PH_HOME_COUNTRY_CODE |

Telephone international country code of the authorized signatory |

NO |

TEL_ISD_NO |

STTM_CORP_DIRECTORS |

AUTH_SIGN_HOME |

Home number of the authorized signatory |

NO |

TELEPHONE |

STTM_CORP_DIRECTORS |

AUTH_SIGN_TAX_ID |

Tax identified of the authorized signatory |

NO |

TAX_ID |

STTM_CORP_DIRECTORS |

AUTH_SIGN_REL |

Relationship of the authorized signatory |

NO |

|

|

AUTH_SIGN_TYPE |

Type of the authorized signatory |

NO |

|

|

NATIONALITY_COUNTRY_CODE |

Nationality of the authorized signatory |

NO |

NATIONALITY |

STTM_CORP_DIRECTORS |

AUTH_SIGN_ADDRESS |

Address of the authorized signatory |

NO |

ADDRESS_LINE1 |

STTM_CORP_DIRECTORS |

AUTH_SIGN_COUNTRY |

Country-Address of the authorized signatory |

NO |

ADDR_COUNTRY |

STTM_CORP_DIRECTORS |

AUTH_SIGN_DOMICILE |

Country-Address of the authorized signatory |

NO |

|

NULL |

Customer FATCA File Format

The format of the customer FATCA handoff file is given below:

FIELD NAME |

DESCRIPTION |

MANDATORY |

FCUBS Column Name |

FCUBS Table Name |

LINKED_CLIENT_ID |

External client id of customer |

YES |

CUSTOMER_NO |

STTM_CUSTOMER |

FCPB CLIENT_ID |

FCPB Client Id of customer. In case if external ID is does not provided in this file, then process customer upload based on FCPB_CLIENT_ID |

|

|

NULL |

US_INDICIA |

US INDICIA PRESENT |

NO |

US_INDICIA |

STTM_CUST_FATCA |

FATCA_ID |

FATCACLASSIFICATION (to be arrived based on values provided by FCUBS - consider as it is assuming that there would be synch between both the systems) |

NO |

FATCA_CLASFCN |

STTM_CUST_FATCA |

RECALCITRANT |

Recalcitrant |

NO |

RECALCITRANT |

STTM_CUST_FATCA |

EIN |

EIN |

NO |

CUST_EIN |

STTM_CUST_FATCA |

DATE_OF_ISSUE |

ISSDATE |

NO |

EIN_ISSUE_DT |

STTM_CUST_FATCA |

DATE_OF_EXPIRY |

EXPDATE |

NO |

EIN_EXPIRY_DT |

STTM_CUST_FATCA |

TIN |

TIN |

NO |

CUST_TIN |

STTM_CUST_FATCA |

TIN_DATE_OF_EXPIRY |

TIN EXPIRY DATE |

NO |

TIN_EXPIRY_DT |

STTM_CUST_FATCA |

GIIN |

GIIN |

NO |

TIN_EXPIRY_DT |

STTM_CUST_FATCA |

COMMENTS |

User Comments |

NO |

REMARKS |

STTM_CUST_FATCA |

EFFECTIVE DATE |

FCPB: Effective date of FATCA classification (should get auto-populated as current business date in FCPB).NOT EXPECTED FROM FCUBS,SHOULD BE BLANK |

|

|

NULL |