6. Annexure B – IP Rule Set-up

6.1 Introduction

This Annexure lists the Profit and Charge (IP) rules that need to be maintained for the Integrated Liquidity Management module of Oracle FLEXCUBE. It also gives the UDEs and rates for which values need to be maintained.

This chapter contains the following sections:

6.2 IC Rule Maintenance

This section contains the following topics:

- Section 6.2.1, "Maintaining IC Rule"

- Section 6.2.2, "Pool Header "

- Section 6.2.3, "Pool Reallocation "

6.2.1 Maintaining IC Rule

The components required to calculate profit (the principal, period, and rate) are broadly referred to as ‘Data Elements’. Data elements are of two types:

- System Data Elements (SDEs)

- User Data Elements (UDEs)

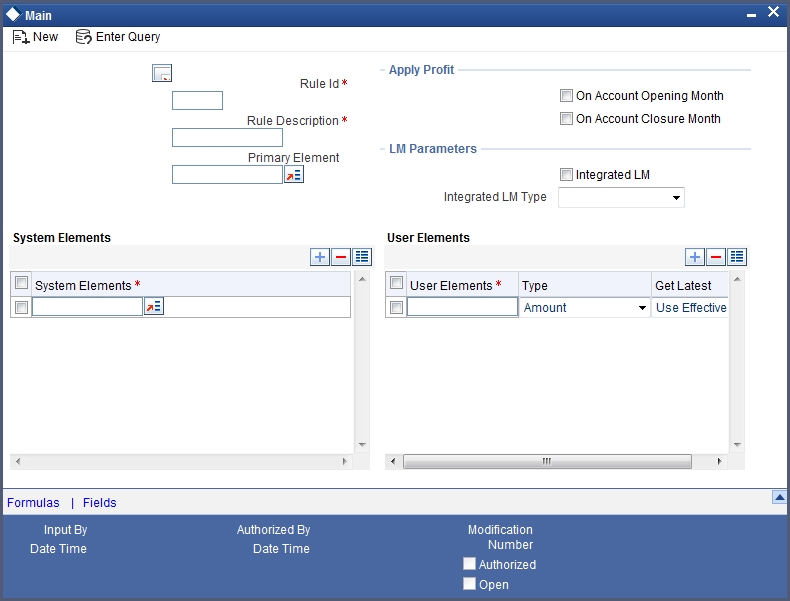

In addition to specifying how the SDEs and UDEs are connected through the formulae, you also define certain other attributes for a rule using the ‘Profit and Charges Rule Maintenance’ screen. You can invoke this screen by typing ‘IPDRLMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

For details about the screen, refer the chapter ‘Maintaining Interest Rules’ in the Interest and Charges User Manual.

You can maintain rules for the following:

- Pool Header

- Pool Reallocation

6.2.2 Pool Header

Specify the following details:

On Account Opening Month

Check this box.

On Account Closure Month

Check this box.

SDE

Maintain the following SDEs:

- DAYS

- ILVD_ULT_CR_BAL

- ILVD_ULT_DR_BAL

UDE

You can maintain the following UDE:

MUDARABAH_RATE Type

For the UDE, select the option ‘Rate’ from the adjoining drop-down list.

Get Latest

For the UDE, select the option ‘Use Effective’ from the adjoining drop-down list.

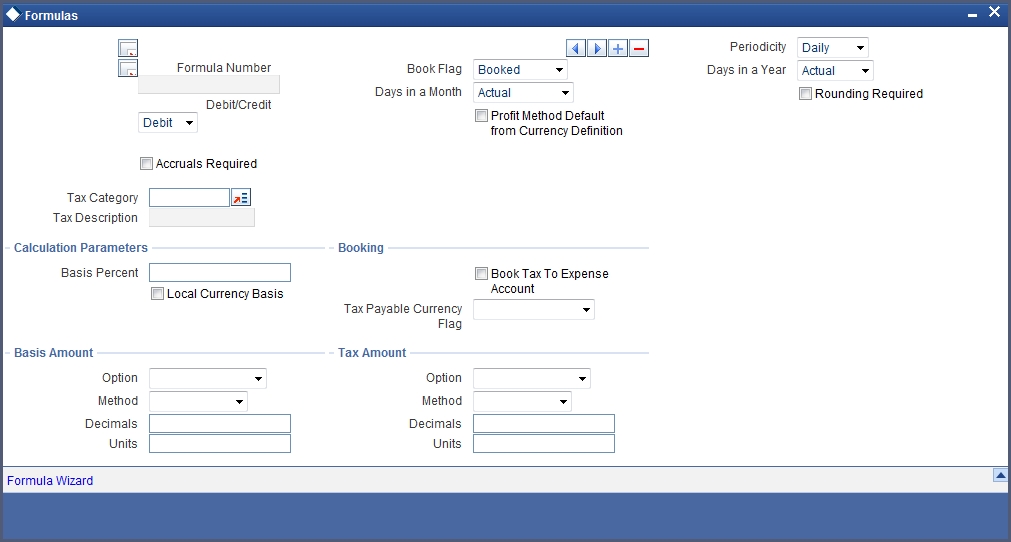

Click ‘Formulas’ button and invoke the ‘Formulas’ screen.

You need to maintain two booked and two tax formulae.

Formula 1 – being the debit formula

Specify the following details:

Book Flag

Select ‘Booked’ from the adjoining drop-down list.

Periodicity

Choose ‘Daily’ from the adjoining drop-down list.

Debit/Credit

Select ‘Debit’ from the adjoining drop-down list.

Days in a Month

Select ‘Actuals’ from the adjoining drop-down list.

Days in a Year

Select ‘365’ from the adjoining drop-down list.

Accrual Required

Check this box.

Rounding Required

Check this box.

Click ‘Formula Wizard’ button and invoke the ‘Formula Wizard’ screen.

Specify the following expressions:

Case |

Result |

ILVD_UTL_DR_BAL>0 |

(ILVD_ULT_DR_BAL*MUDARABAH_RATE*DAYS)/36500 |

Formula 2 – being the credit formula

Specify the following details:

Book Flag

Select ‘Booked’ from the adjoining drop-down list.

Periodicity

Choose ‘Daily’ from the adjoining drop-down list.

Debit/Credit

Select ‘Credit’ from the adjoining drop-down list.

Days in a Month

Select ‘Actuals’ from the adjoining drop-down list.

Days in a Year

Select ‘365’ from the adjoining drop-down list.

Accrual Required

Check this box.

Rounding Required

Check this box.

Click ‘Formula Wizard’ button and invoke the ‘Formula Wizard’ screen. In this screen, you need to maintain the following expressions:

Case |

Result |

ILVD_UTL_CR_BAL>0 |

(ILVD_ULT_CR_BAL*MUDARABAH_RATE*DAYS)/36500 |

Formula 3 – being the tax formula for debit

Specify the following details:

Book Flag

Select ‘Tax’ from the adjoining drop-down list.

Periodicity

Choose ‘Periodic’ from the adjoining drop-down list.

Debit/Credit

Select ‘Debit’ from the adjoining drop-down list.

Days in a Month

Select ‘Actuals’ from the adjoining drop-down list.

Days in a Year

Select ‘Actuals’ from the adjoining drop-down list.

Rounding Required

Check this box.

Tax Category

Select ‘TAXAPPLIC’ from the adjoining drop-down list.

Basis Percent

Specify ‘100’ as the basis percent.

Local Currency Basis

Check this box.

Tax Payable Currency Flag

Specify ‘Local Currency’ here.

Basis Amount Option

Select ‘Currency Default’ from the adjoining drop-down list.

Click ‘Formula Wizard’ button and invoke the ‘Formula Wizard’ screen. In this screen, you need to maintain the following expressions:

Case |

Result |

FORMULA1>0 |

ROUND(FORMULA1*HTAX_RATE/100,2) |

Formula 4 – being the tax formula for credit

Specify the following details:

Book Flag

Select ‘Tax’ from the adjoining drop-down list.

Periodicity

Choose ‘Periodic’ from the adjoining drop-down list.

Debit/Credit

Select ‘Credit’ from the adjoining drop-down list.

Days in a Month

Select ‘Actuals’ from the adjoining drop-down list.

Days in a Year

Select ‘365’ from the adjoining drop-down list.

Rounding Required

Check this box.

Click ‘Formula Wizard’ button and invoke the ‘Formula Wizard’ screen. In this screen, you need to maintain the following expressions:

Case |

Result |

FORMULA2>0 |

ROUND(FORMULA2* HTAX_RATE / 100,2) |

6.2.3 Pool Reallocation

Specify the following details:

On Account Opening Month

Check this box.

On Account Closure Month

Check this box.

SDE

Maintain the following SDEs:

- DAYS

- ILVD_CP_CR_CONT

- ILVD_CP_DR_CONT

- ILVD_NCP_CR_CONT

- ILVD_NCP_DR_CONT

UDE

You can maintain the following UDE:

MUDARABAH_RATE Type

For the UDE, select the option ‘Rate’ from the adjoining drop-down list.

Get Latest

For the UDE, select the option ‘Use Effective’ from the adjoining drop-down list.

Click ‘Formulas’ button and invoke the ‘Formulas’ screen. You need to maintain two booked and one tax formulae.

Formula 1 – being the debit formula

Specify the following details:

Book Flag

Select ‘Booked’ from the adjoining drop-down list.

Periodicity

Choose ‘Daily’ from the adjoining drop-down list.

Debit/Credit

Select ‘Debit’ from the adjoining drop-down list.

Days in a Month

Select ‘Actuals’ from the adjoining drop-down list.

Days in a Year

Select ‘365’ from the adjoining drop-down list.

Rounding Required

Check this box.

Click ‘Formula Wizard’ button and invoke the ‘Formula Wizard’ screen. You need to maintain three booked and three non-booked formulae.

Formula 1

Specify the following expression:

Case |

Result |

( ILVD_CP_DR_CONT + ILVD_NCP_DR_CONT ) > 0 |

(( ILVD_CP_DR_CONT + ILVD_NCP_DR_CONT ) * MUDARABAH_RATE* DAYS ) / 36500 |

Formula 2 – being the credit formula

Specify the following details:

Book Flag

Select ‘Booked’ from the adjoining drop-down list.

Periodicity

Choose ‘Daily’ from the adjoining drop-down list.

Debit/Credit

Select ‘Credit’ from the adjoining drop-down list.

Days in a Month

Select ‘Actuals’ from the adjoining drop-down list.

Days in a Year

Select ‘365’ from the adjoining drop-down list.

Rounding Required

Check this box.

Click ‘Formula Wizard’ button and invoke the ‘Formula Wizard’ screen. In this screen, you need to maintain the following expressions:

Case |

Result |

( ILVD_CP_CR_CONT + ILVD_NCP_CR_CONT ) > 0 |

(( ILVD_CP_CR_CONT + ILVD_NCP_CR_CONT ) * MUDARABAH_RATE* DAYS ) / 36500 |

Formula 3 – being the tax formula for debit

Specify the following details:

Book Flag

Select ‘Tax’ from the adjoining drop-down list.

Periodicity

Choose ‘Periodic’ from the adjoining drop-down list.

Debit/Credit

Select ‘Debit’ from the adjoining drop-down list.

Days in a Month

Select ‘Actuals’ from the adjoining drop-down list.

Days in a Year

Select ‘365’ from the adjoining drop-down list.

Rounding Required

Check this box.

Click ‘Formula Wizard’ button and invoke the ‘Formula Wizard’ screen. In this screen, you need to maintain the following expressions:

Case |

Result |

FORMULA2>0 |

ROUND(FORMULA2* CTAX_RATE / 100,2) |

6.3 UDE Value Maintenance

You can maintain UDE values for the rules using the ‘Profit & Charges User Data Element Maintenance’ screen. You can invoke the ‘Profit & Charges User Data Element Maintenance’ screen by typing ‘IPDUDVAL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

For details about the screen, refer the chapter ‘Giving UDE Values for Condition’ in the Interest and Charges User Manual.