3. General Maintenance

3.1 Introduction

You need to maintain the following details in order to process transactions using intermediary services:

- Branch Parameters

- Intermediary System Data Element (SDE) Details

- Intermediary Rules

- Intermediary Group

- Intermediary Hierarchy

- External UDE Values

This chapter contains the following sections:

- Section 3.2, "Branch Parameters"

- Section 3.3, "Intermediary SDE Details"

- Section 3.4, "Intermediary Rule"

- Section 3.5, "Intermediary Group"

- Section 3.6, "Intermediary Hierarchy Details"

- Section 3.7, "External UDE Values"

3.2 Branch Parameters

This section contains the following topics:

- Section 3.2.1, "Capturing Branch Parameters "

- Section 3.2.2, "Actions Allowed"

- Section 3.2.3, "Viewing Branch Parameters Summary"

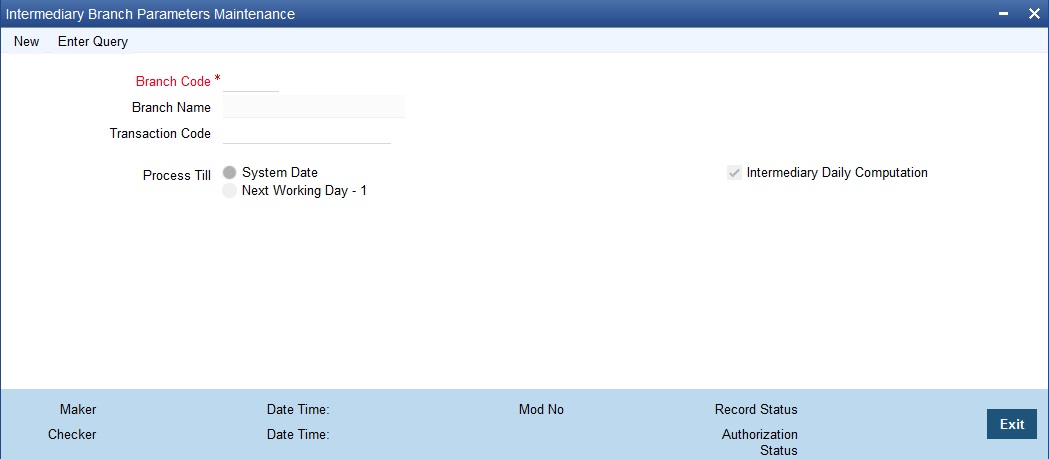

3.2.1 Capturing Branch Parameters

You can maintain branch-level parameters for all transaction involving the intermediary module, using the ‘Intermediary Branch Parameters Maintenance’ screen. You can invoke this screen by typing ‘INDBRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details.

Branch Code

Specify the branch code for which you are maintaining parameters. The adjoining option list displays all valid branch codes maintained in the system. You can select the appropriate one.

Branch Name

The system displays the branch name associated with the branch code.

Transaction Code

Specify the transaction code.

Process Till

This specification determines the day on which automatic events such accrual, liquidation etc. falling due on a holiday, should be processed. Indicate your preference by selecting the appropriate option. The available options here are:

- System Date - If you select this option, events will be scheduled as per the date irrespective of whether it is a holiday or not.

- Next Working Day -1 - If you select this option, events scheduled for a holiday will be processed on the last working day before the holiday.

Intermediary Daily Computation

Check this box to indicate that SDE calculation should happen daily for every intermediary.

3.2.2 Actions Allowed

You can perform the following actions on a record:

- New

- Delete

- Unlock

- Save

- Auth (Authorise)

- Reverse

- Execute

- Query

Refer the Procedures User Manual for details about each action.

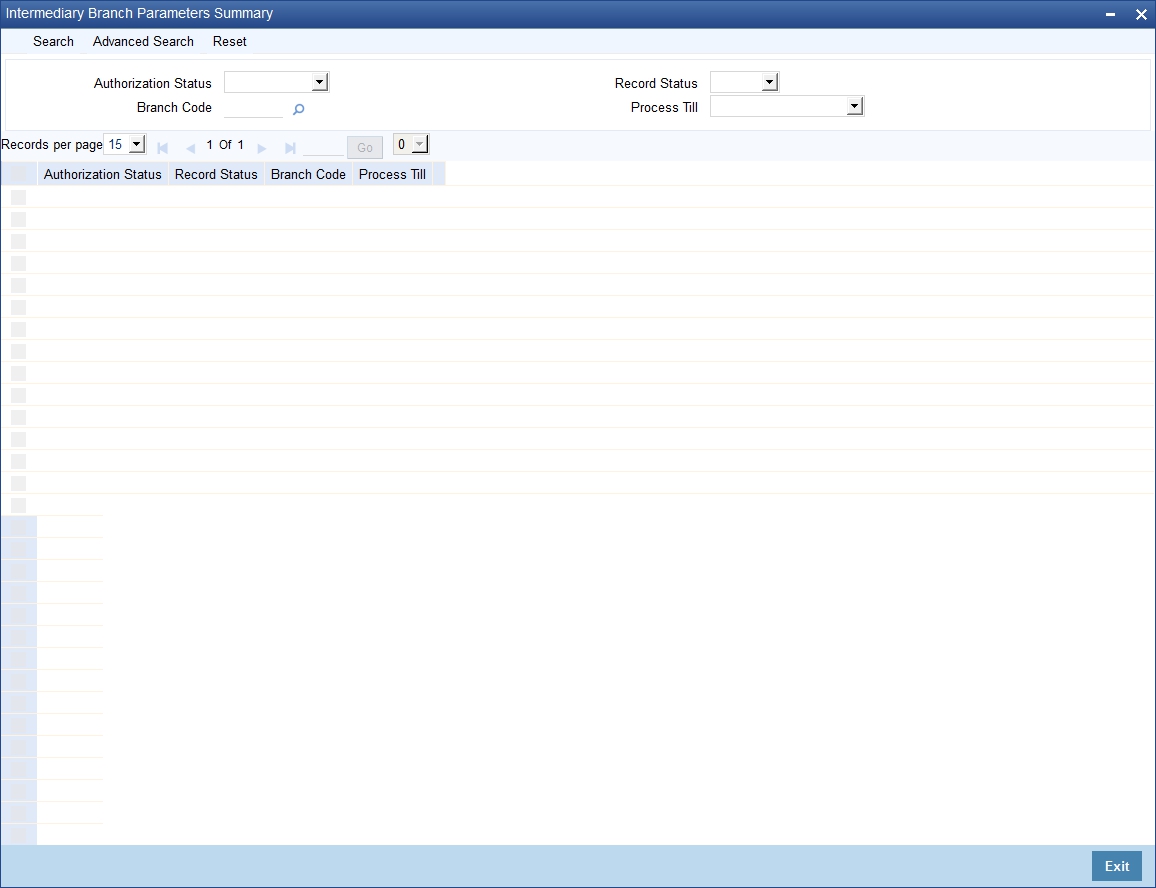

3.2.3 Viewing Branch Parameters Summary

You can view parameters maintained for every branch, using the ‘Intermediary Branch Parameters Summary’ screen. You can invoke this screen by typing ‘INSBRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query on records based on any or all of the following criteria:

- Authorization Status

- Record Status

- Branch Code

- Process Till

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Authorization Status

- Record Status

- Branch Code

- Process Till

3.3 Intermediary SDE Details

This section contains the following topics:

- Section 3.3.1, "Capturing Intermediary SDE Details"

- Section 3.3.2, "Actions Allowed"

- Section 3.3.3, "Viewing SDE Summary Details"

3.3.1 Capturing Intermediary SDE Details

The following System Data Elements (SDEs) are available in the system.

Element |

Description |

Calculation method |

LOAN_COUNT |

This SDE returns the total number of loans created by a particular Intermediary |

Periodic |

LOAN_DISBURSED_AMT |

This SDE returns the sum of amount disbursed of all loans created by a particular Intermediary. |

Periodic |

LOAN_OVERDUE_AMT |

This SDE returns the sum of all overdue amount i.e. sum of all overdue components i.e. PRINCIPAL, INTEREST etc. of all the loans created by a particular Intermediary. |

As of date |

LOAN_OVERDUE_PRINC |

This SDE returns the sum of the overdue principal amount i.e. sum of PRINCIPAL of all the loans created by a particular Intermediary. |

As of date |

LOAN_OUTSTAND_PRINC |

This SDE returns the sum of outstanding principal of all the loans created by a particular Intermediary. |

As of date |

LOAN_ PREPAID_AMT |

This SDE returns the sum of amount paid as pre-payment on all loans created by a particular Intermediary. |

Periodic |

LOAN_BOOKED_AMT |

This SDE returns the sum of amount booked on all loans created by a particular Intermediary. |

Periodic |

LOAN_COLLECTED_AMT |

This SDE returns the sum of amount collected by the Intermediary for the current cycle of liquidation. This is the actual amount collected and it excludes the amount paid and reversed in the current liquidation cycle. |

Periodic |

LOAN_COLL_REV_AMT |

This SDE returns the sum of reversed amount, which was collected by the Intermediary for the previous cycle but was reversed in the current liquidation cycle. |

Periodic |

CASA_COUNT |

This SDE returns the total number of CASA applications created by a particular intermediary for all the customers. |

Periodic |

CASA_MIN_BALANCE |

The SDE returns the minimum balance required to be maintained for CASA applications created by a particular intermediary. |

Periodic |

ISLAMIC_CASA_MIN_BALANCE |

The SDE returns the minimum balance required to be maintained for Islamic CASA applications created by a particular Intermediary. |

Periodic |

TD_ COUNT |

The SDE returns the count of Term deposit account referred by a particular Intermediary |

Periodic |

ISLAMIC_CASA_COUNT |

The SDE returns the count of Islamic CASA account referred by a particular Intermediary. |

As of date |

ISLAMIC_TD_COUNT |

The SDE returns the count of Islamic term deposit account referred by a particular intermediary |

Periodic |

TD_AMOUNT |

The SDE returns the sum TD amount by a particular intermediary. |

As of date |

TD_PART_WITHDRAW |

The SDE returns the sum of the amount withdrawn partially for TD by a particular intermediary |

As of date |

TD_ROLLOVER_AMOUNT |

The SDE returns the sum of the rollover amount by a particular intermediary. |

As of date |

ISLAMIC_TD_AMOUNT |

The SDE returns the sum of the Islamic TD amount by a particular Intermediary. |

As of date |

ISLAMIC_ PART_WITHDRAW |

The SDE returns the sum of the amount withdraw partially for Islamic TD by a particular intermediary. |

As of date |

ISLAMIC_ TD_ROLLOVER_AMOUNT |

The SDE returns the sum of the rollover amount by a particular Intermediary for Islamic TD |

As of date |

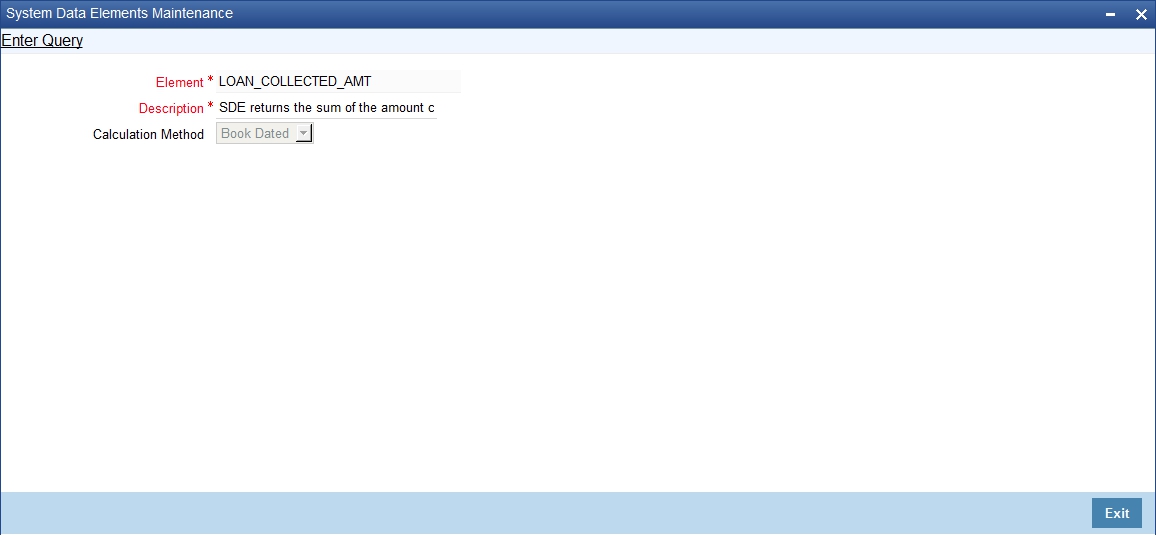

You can view details of each one of them in the ‘Intermediary SDE Maintenance’ screen. You can invoke this screen by typing ‘INDSDEMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can view the following details.

Element

The system displays a unique identification code for the System Data Element (SDE).

Description

The system displays a brief description for the System Data Element.

Calculation Method

The system displays the method that should be used for calculation purposes from the adjoining drop-down list. The options available are:

- Periodic - These SDEs will always aggregate data for an intermediary between the last settlement date and the next settlement date. The computation of all such SDEs will be based on the booking date.

- As of date - These SDEs will be the aggregated data as of that point in time.

3.3.2 Actions Allowed

You can perform the following actions on a record:

- Query

Refer the Procedures User Manual for details about each action.

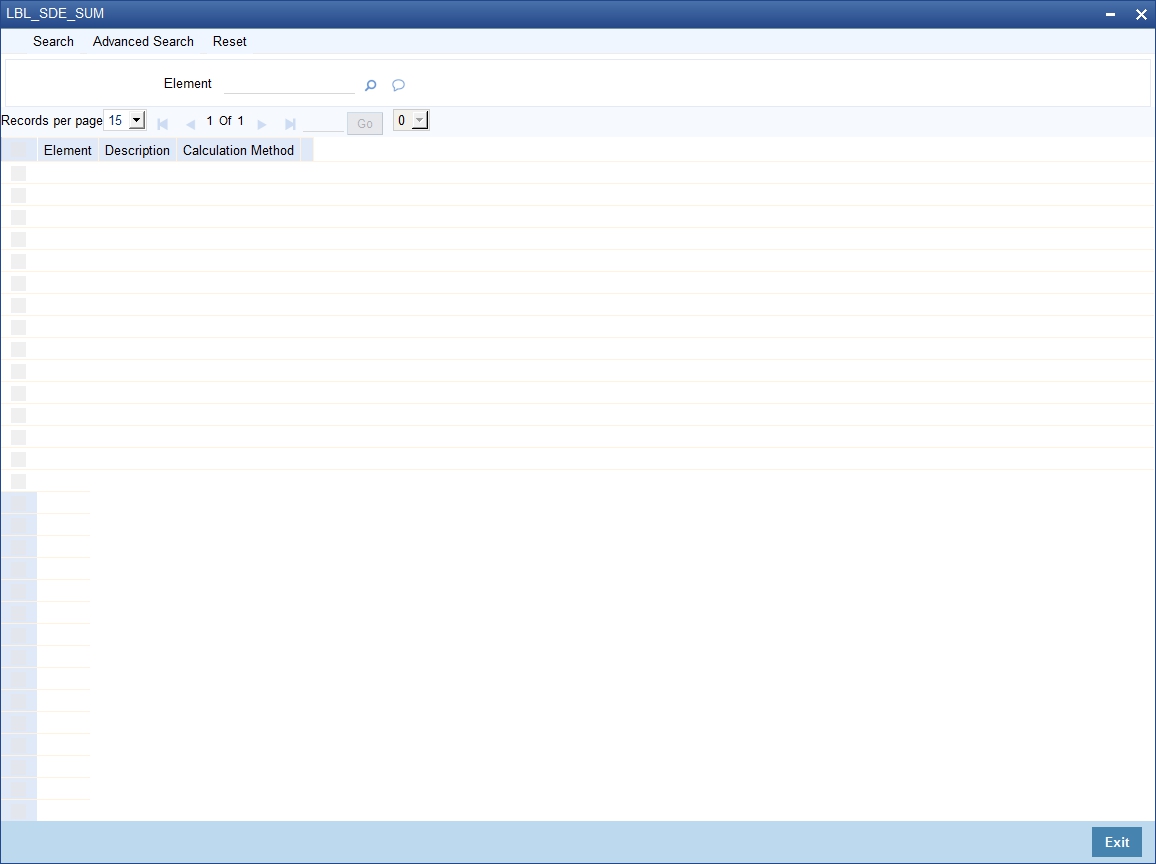

3.3.3 Viewing SDE Summary Details

You can view all SDEs maintained for intermediaries in the ‘Intermediary SDE Maintenance Summary’ screen. You can invoke this screen by typing ‘INSSDEMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query based on the SDE ID.

Click ‘Search’ button. The system identifies all records matching the criteria specified and displays the following details for each of them:

- Element

- Description

- Calculation Method

3.4 Intermediary Rule

This section contains the following topics:

- Section 3.4.1, "Defining an Intermediary Rule"

- Section 3.4.2, "Capturing Rule Formula"

- Section 3.4.3, "Actions Allowed"

- Section 3.4.4, "Viewing Rule Summary Details"

3.4.1 Defining an Intermediary Rule

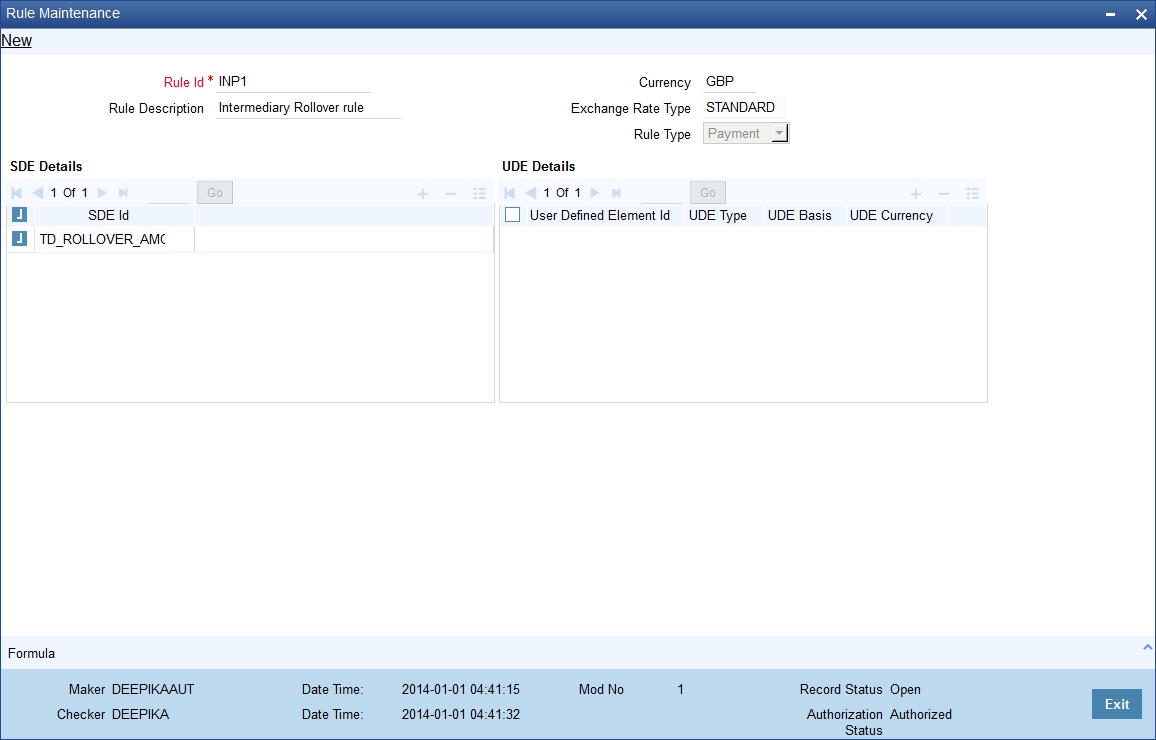

An Intermediary Rule identifies the method to calculate commission payable to the Intermediary and Pre-Payment/Late Payment penalty charge to be recovered from the Intermediary. You can maintain such rules in the ‘Intermediary Rule Maintenance’ screen. You can invoke this screen by typing ‘INDRLMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details.

Rule ID

Specify a unique rule identification code for the Intermediary rule you are creating.

Rule Description

Give a brief description for the rule ID.

Currency

Specify the currency in which the aggregation of total amount should be considered in the rule. The adjoining option list displays all valid currencies maintained in the system. You can choose the appropriate one.

Exchange Rate Type

Specify the rate type to be used for cross currency transactions. The adjoining option list displays all valid exchange rate types maintained in the system. You can choose the appropriate one.

Rule Type

Select the type of rule from the adjoining drop-down list. The options available here are:

- Payment

- Collection

This value determines the accounting set-up that needs to be done for the intermediary product.

Refer the chapter titled ‘Setting up A Product’ in this User Manual for details about product set-up.

SDE Details

You can specify the following details for SDEs.

SDE ID

Specify the System Data Elements ID to be included in the rule. The adjoining option list displays all valid SDE IDs available in the system. You can choose the appropriate one.

You can maintain multiple SDEs.

UDE ID

Specify the User Data Element ID to be included in the rule.

UDE Type

Select the type of the UDE from the adjoining drop-down list. The following options are available:

- Amount

- Rate

- Number

UDE Basis

Select the UDE basis from the adjoining drop-down list. The following options are available:

- Internal

- External

UDE Currency

Specify the UDE currency. The adjoining option list displays all valid currency codes maintained in the system. You can choose the appropriate one.

Note

You can specify the currency only if UDE type if ‘Amount’ and basis is ‘External’.

You can maintain multiple UDEs.

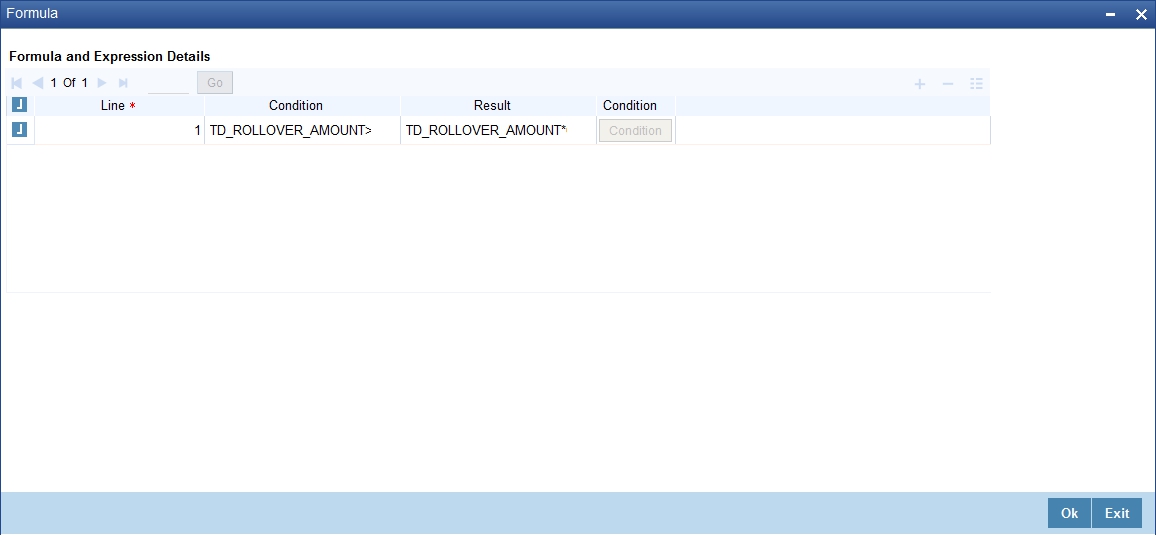

3.4.2 Capturing Rule Formula

You can specify the formula for the rule using the ‘Formula’ screen. You can invoke this screen by clicking ‘Formula’ button in the ‘Intermediary Rule Maintenance’ screen.

Specify the following details.

Line

Assign a unique sequence number/formula number for each condition. The conditions are evaluated based on this number.

Condition

Specify the condition for the rule.

Result

Specify the result of the condition being satisfied.

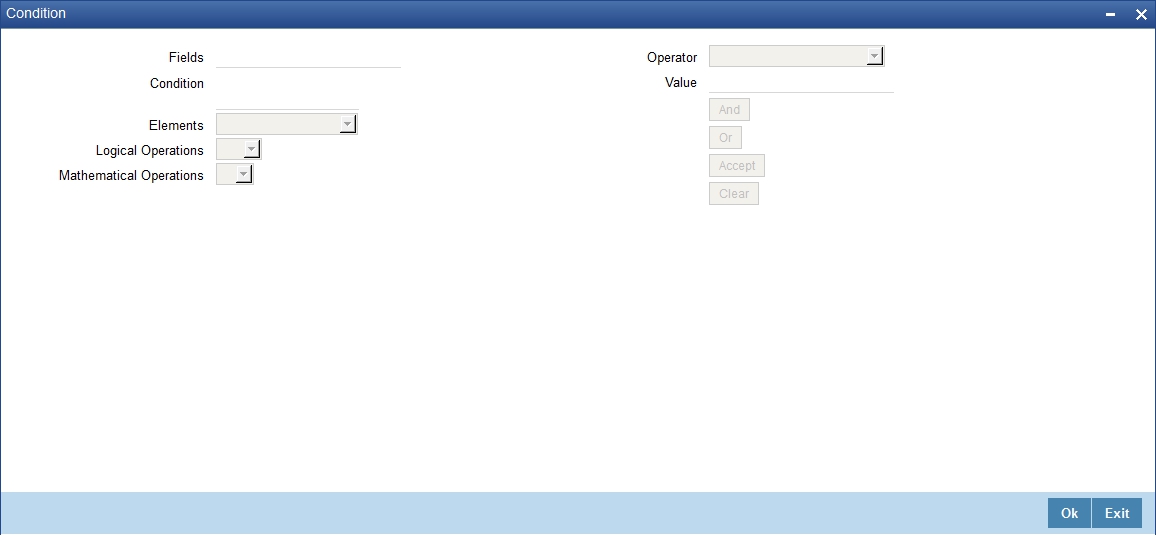

To define a condition, click on ‘Condition’ in the screen above. The following screen is displayed:

In this screen, you can use the elements, operators, and logical operators to build a condition.

Although you can define multiple expressions for a component, if a given condition is satisfied, subsequent conditions are not evaluated. Thus, depending on the condition of the expression that is satisfied, the corresponding formula result is picked up for component value computation. Therefore, you have the flexibility to define a computation logic for each component of the product.

3.4.3 Actions Allowed

You can perform the following actions on a record:

- New

- Delete

- Unlock

- Save

- Auth (Authorise)

- Reverse

- Execute

- Query

Refer the Procedures User Manual for details about each action.

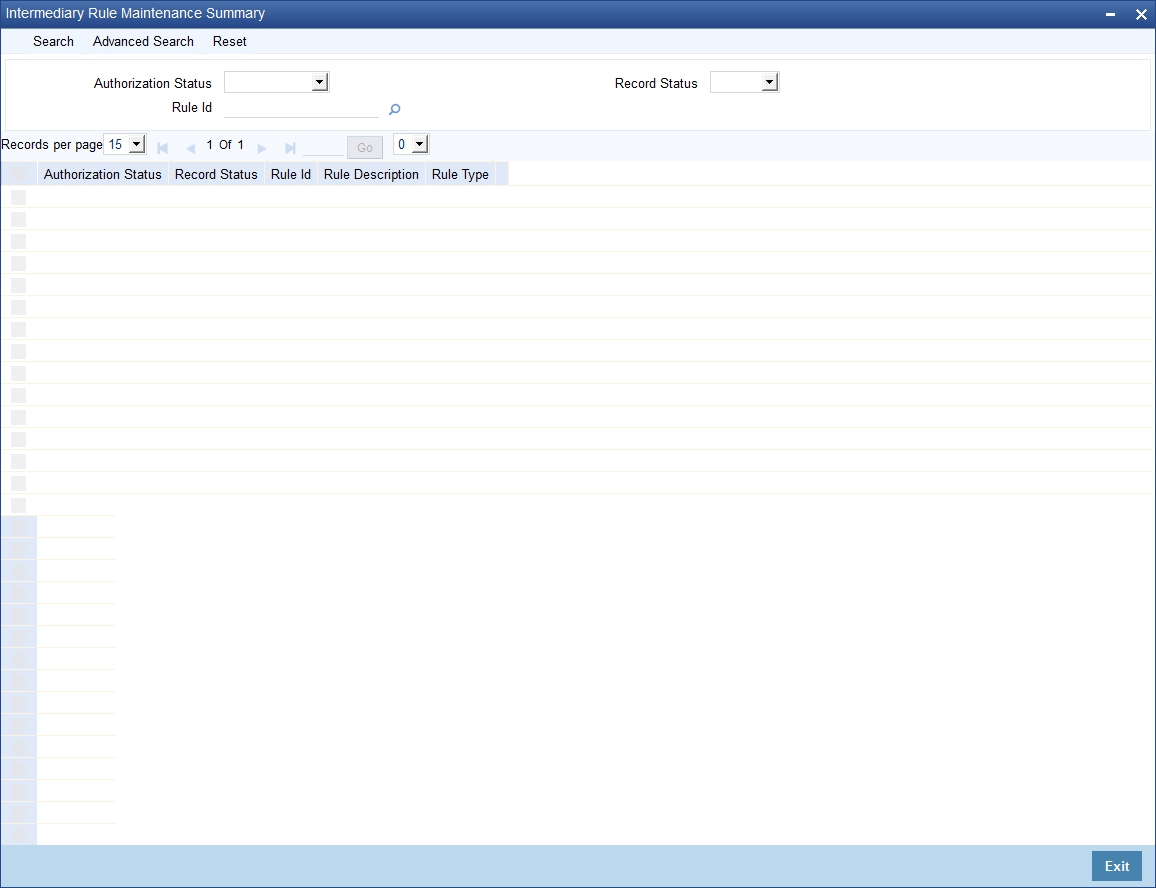

3.4.4 Viewing Rule Summary Details

You can view details of all intermediary rules maintained in the system, using the ‘Intermediary Rule Maintenance Summary’ screen. You can invoke this screen by typing ‘INSRLMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query based on the following criteria:

- Authorization Status

- Record Status

- Rule ID

Click ‘Search’ button. The system identifies all records matching the criteria specified and displays the following details for each of them:

- Authorization Status

- Record Status

- Rule ID

- Rule Description

- Rule Type

3.5 Intermediary Group

This section contains the following topics:

- Section 3.5.1, "Maintaining Intermediary Group"

- Section 3.5.2, "Actions Allowed"

- Section 3.5.3, "Viewing Group Summary Details"

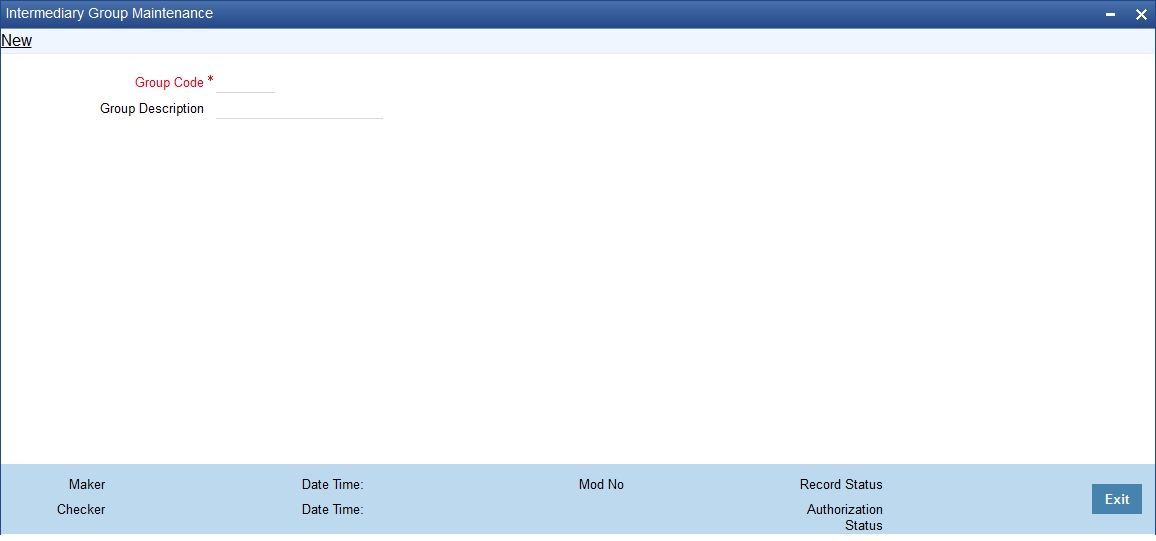

3.5.1 Maintaining Intermediary Group

You can associate a set of intermediaries to a group and link the group to transactions. You can maintain such intermediary groups using the ‘Intermediary Group Maintenance’ screen. You can invoke this screen by typing ‘INDGRPMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details:

Group Code

Specify a unique code to identify the group that you want to maintain.

Description

Specify a brief description for the group code.

3.5.2 Actions Allowed

You can perform the following actions on a record:

- New

- Delete

- Unlock

- Save

- Auth (Authorise)

- Reverse

- Execute

- Query

Refer the Procedures User Manual for details about each action.

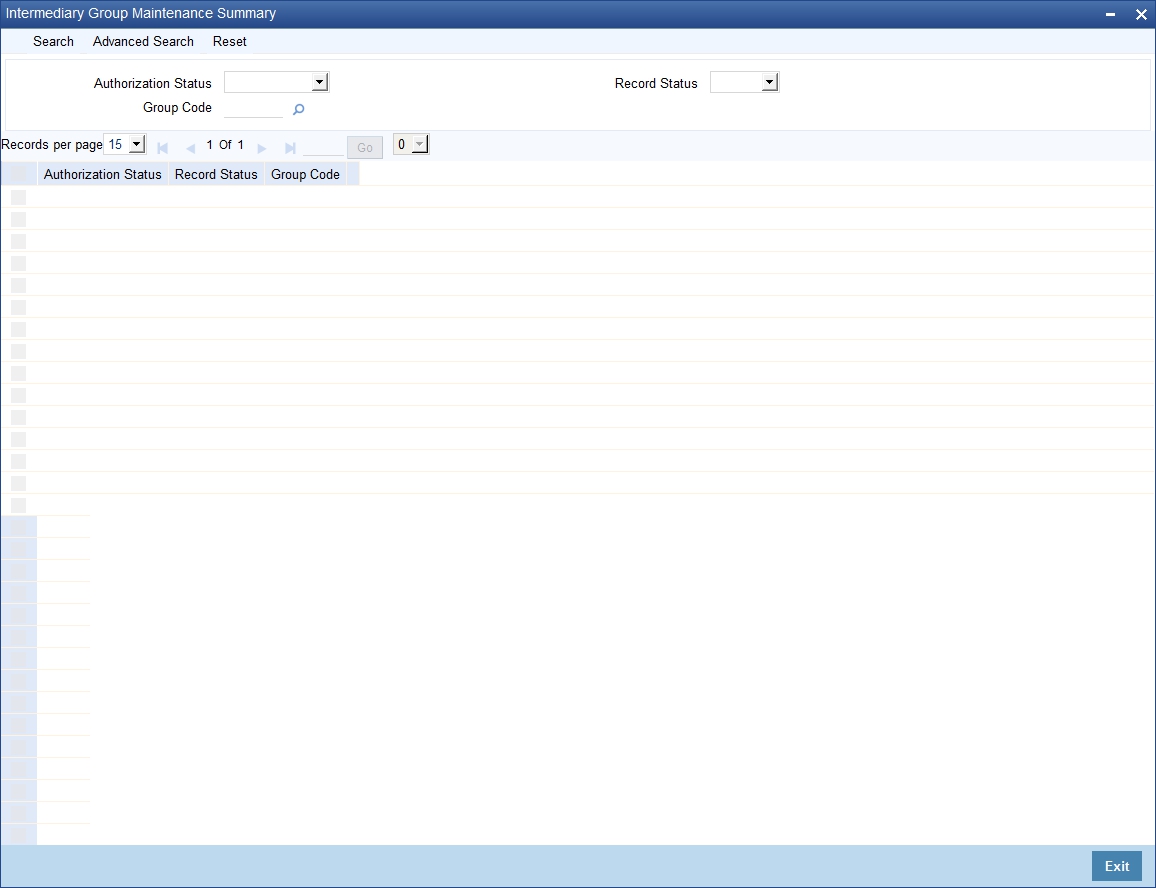

3.5.3 Viewing Group Summary Details

You can view all the details of intermediary groups in the ‘Intermediary Group Maintenance Summary’ screen. You can invoke this screen by typing ‘INSGRPMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query based on the following criteria:

- Authorization Status

- Record Status

- Group Code

Click ‘Search’ button. The system identifies all records matching the criteria specified and displays the following details for each of them:

- Authorization Status

- Record Status

- Group Code

3.6 Intermediary Hierarchy Details

This section contains the following topics:

- Section 3.6.1, "Maintaining Intermediary Hierarchy Details"

- Section 3.6.2, "Intermediary Tab"

- Section 3.6.3, "Settlement and Statement Tab"

- Section 3.6.4, "Products Tab"

- Section 3.6.5, "Capturing Events"

- Section 3.6.6, "Maintaining MIS Details"

- Section 3.6.7, "Viewing UDE Values"

- Section 3.6.8, "Actions Allowed"

- Section 3.6.9, "Viewing Intermediary Summary Details"

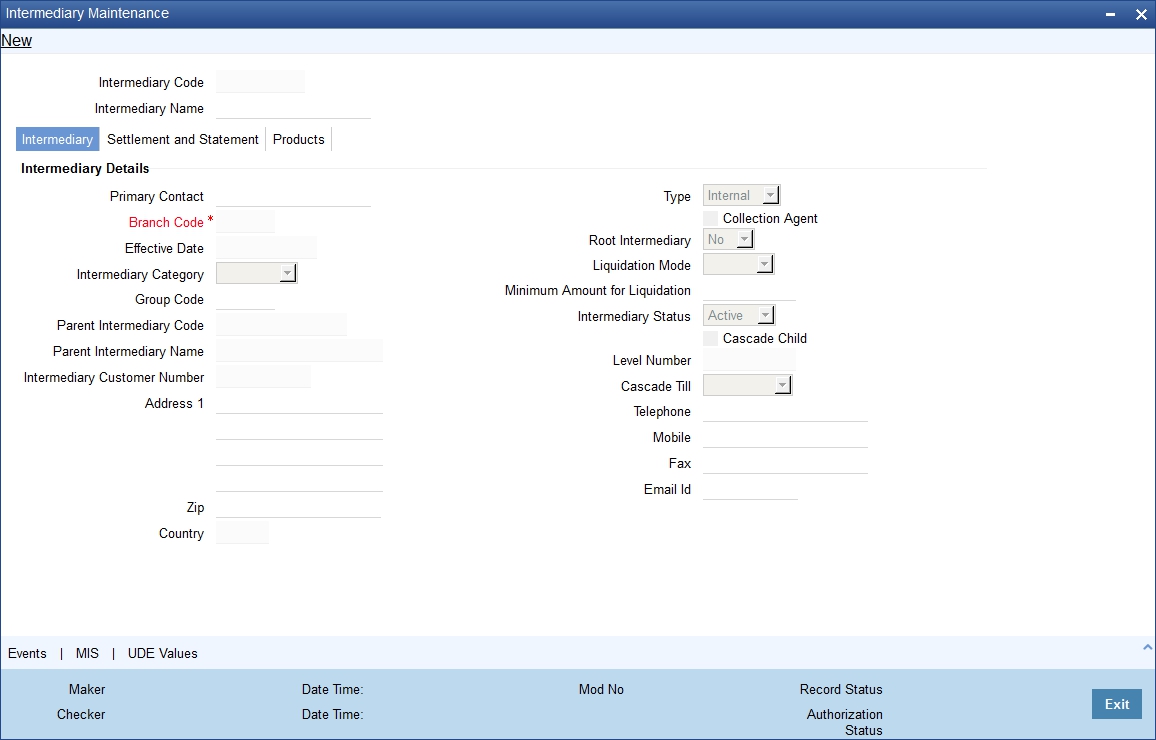

3.6.1 Maintaining Intermediary Hierarchy Details

You can maintain intermediaries in Oracle FLEXCUBE. You can also create a hierarchy of intermediaries and specify commission processing share for each one in the hierarchy.

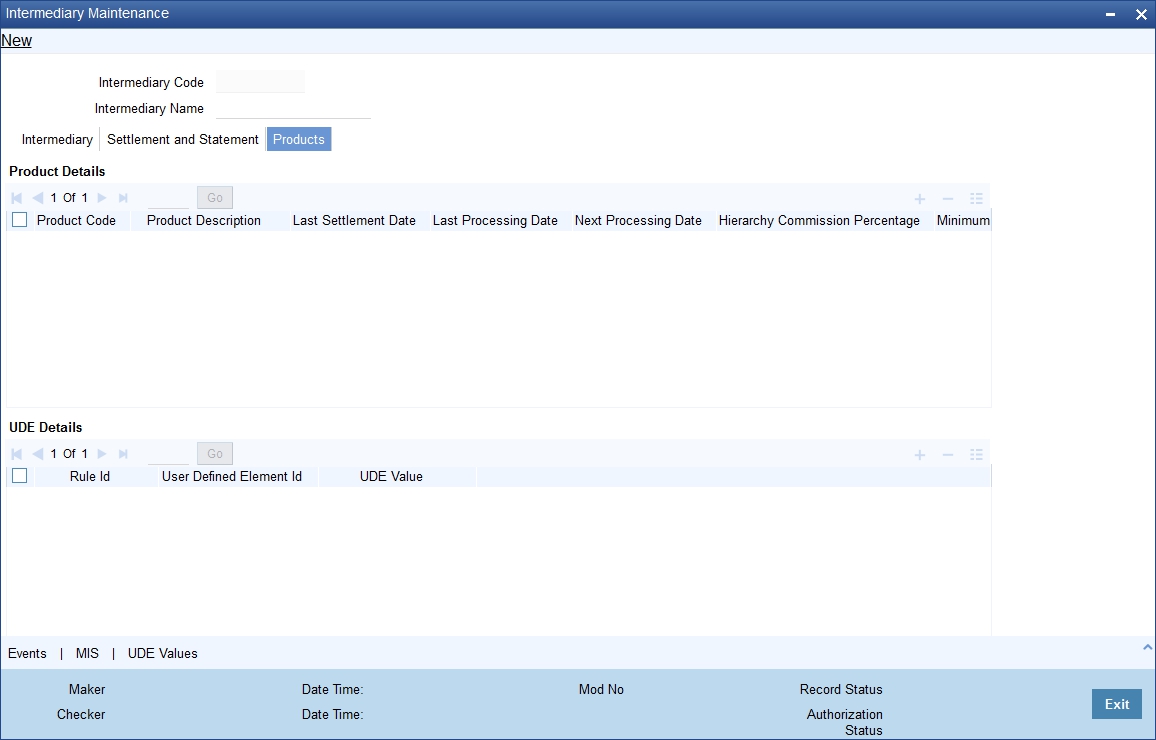

You can maintain such hierarchy details through the ‘Intermediary Maintenance’ screen. You can then link the intermediary to a loan. You can invoke this screen by typing ‘INDINMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You should specify the following details in the above screen.

Intermediary Code

The system generates a unique numeric intermediary code for every intermediary as per the following mask:

NNNNNNNNN

Where,

NNNNNNNNN - Running sequence number

Intermediary Name

Specify the name of the Intermediary associated with the bank.

You can specify additional details for the intermediary in the following tabs:

- Intermediary

- Settlement and Statement

- Products

3.6.2 Intermediary Tab

The system displays this tab by default when you invoke this screen.

Intermediary Details

You can specify the following details.

Primary Contact

Specify the name of the person to be contacted from the intermediary.

Type

Indicate whether the intermediary is internal or external to your bank by selecting the one of the options from the adjoining drop-down list:

- Internal

- External

Branch Code

This field indicates the Home Branch of the intermediary. This value is defaulted based on the current logged-in branch.

Effective Date

The system displays the current system date.

Intermediary Category

Specify weather the Intermediary is a single entity or group of intermediaries. The options available here are:

- Individual

- Group

Group Code

If you have selected the category as ‘Group’, then you have to specify the group code to which the intermediary should belong. The adjoining option list displays all valid intermediary group codes maintained in the system. You can choose the appropriate one.

Parent Intermediary Code

In order to build a hierarchy of intermediaries, you need to specify the parent intermediary code. The adjoining option list displays all valid intermediary codes maintained in the system. You can choose the appropriate one.

The system will allow only intermediaries with the same home branch to be linked as parent intermediary.

Parent Intermediary Name

Based on the parent intermediary code, the system displays the corresponding intermediary name.

Intermediary Customer Number

Specify the customer number of the intermediary. You can choose the appropriate customer number from the adjoining option list. This list displays all valid and open accounts maintained in the system.

Address

Specify the address of the intermediary.

The system retrieves the address based on the customer number (CIF). However, you can change it.

ZIP

Specify the ZIP code of the address.

The system retrieves the ZIP code based on the customer number (CIF). However, you can change it.

Country

Specify the country in which intermediary resides. The adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

The system retrieves the country based on the customer number (CIF). However, you can change it.

Collection Agent

Check this box to indicate that the Intermediary can act as a collection agent.

Root Intermediary

Indicate whether the intermediary is at the root of the hierarchy or not by selecting one of the following options:

- Yes

- No

Liquidation Mode

Select the mode of liquidation for settlement of intermediary transactions from the adjoining drop-down list. The options available are:

- Automatic

- Manual

Minimum Amount for Liquidation

Specify the minimum amount required for primary commission liquidation. While processing transactions for the intermediary, if the calculated amount is less than the amount maintained here, it will not consider the amount for liquidation.

Intermediary Status

Indicate the status of the intermediary by choosing one of the following options from the adjoining drop-down list:

- Active

- Inactive

Cascade Child

Check this box to indicate that status of the parent should be applied to the child intermediaries. Once checked, if you change the status of a parent intermediary from active to inactive, the system will make all child intermediaries inactive. However, you can also leave the box unchecked. In such case, the status of parent intermediary will not be applied to the child intermediaries. During hierarchy commission distribution, the system will stop processing on encountering the first inactive record.

Level Number

The system updates the level of the intermediary in the hierarchy on saving the record.

Cascade Till

Indicate the level until which the system should process hierarchy commission by choosing one of the following values from the adjoining drop-down list:

- Immediate - If you select this option, commission hierarchy will be processed only up to immediate parent.

- Root - If you select this option, commission hierarchy will be processed up to the root intermediary till the minimum hierarchy commission amount is reached.

Telephone

Specify the telephone number of the intermediary.

The system retrieves the telephone number based on the customer number (CIF). However, you can change it.

Mobile

Specify the mobile number of the intermediary.

The system retrieves the mobile number based on the customer number (CIF). However, you can change it.

Fax

Specify the facsimile (fax) number of the intermediary.

The system retrieves the fax number based on the customer number (CIF). However, you can change it.

E-Mail ID

Specify the e-mail ID of the intermediary.

The system retrieves the e-mail ID based on the customer number (CIF). However, you can change it.

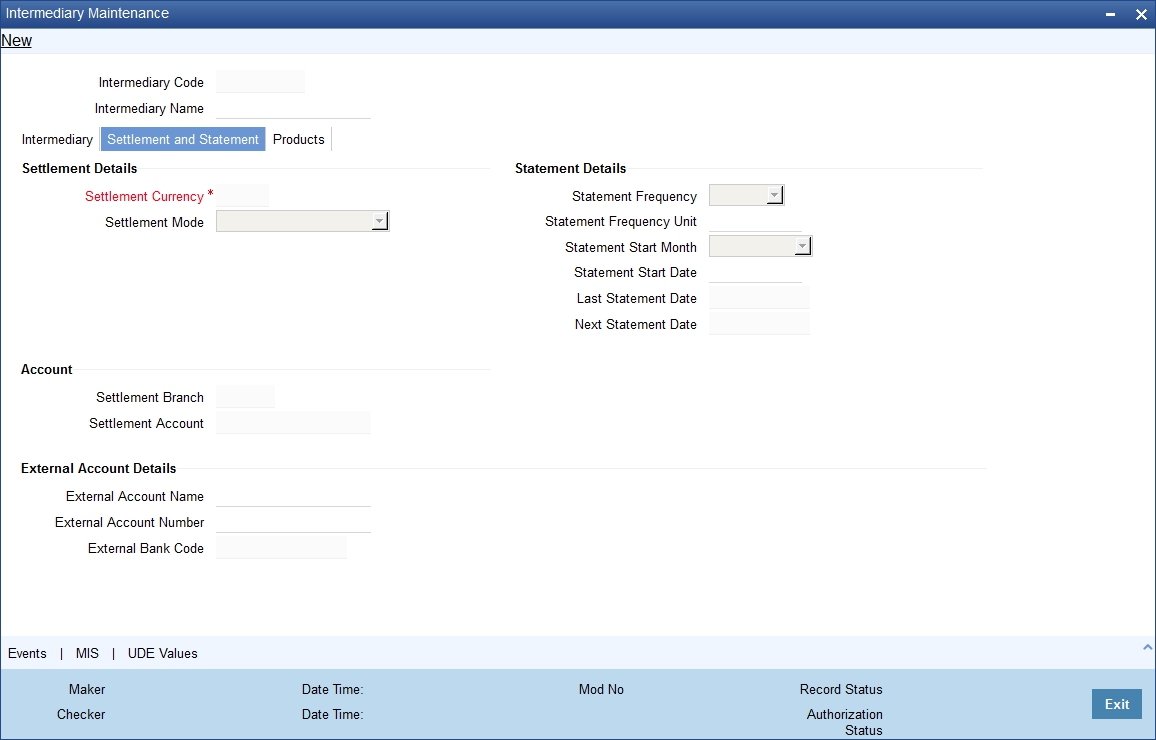

3.6.3 Settlement and Statement Tab

Click ‘Settlement and Statement’ tab to capture details about settlement processing.

You can specify the following details.

Settlement Details

Specify the following details for settlement processing.

Settlement Currency

Specify the currency to be used for settlement processing. The adjoining option list displays all valid currency codes maintained in the system. You can select the appropriate one.

Settlement Mode

Indicate the settlement mode by choosing one of the following values from the adjoining drop-down list:

- CASA

- External

If you choose ‘CASA’, you will have to specify the settlement account under ‘CASA’ section. If you choose ‘External’, you will have to specify the settlement account for CASA as well as external account details under the ‘External Account’ section.

Statement Details

Specify the following details for statement generation.

Statement Frequency

Select the frequency at which statement should be generated for the intermediary, from the adjoining drop-down list. The following values are available:

- Daily

- Weekly

- Monthly

- Yearly

Statement Frequency Unit

Specify a numeric value to denote the unit of statement frequency. For example, if the frequency is daily and the unit is specified as ‘3’, it will imply that statements should be generated every 3 days.

Statement Start Month

From the adjoining drop-down list, select the month from which statement generation should begin if you have chosen the frequency as ‘Monthly’ or ‘Yearly’.

Statement Start Date

Specify the date from which the statement generation should begin based on the given frequency, using the adjoining calendar.

Last Statement Date

The system displays the date of last statement generation.

Next Statement Date

Based on the statement generation parameters, the system arrives at the next statement date and displays it here.

CASA

If settlement needs to be done using an internal account (CASA), you need to specify the following details.

Settlement Branch

Specify the branch code where the settlement needs to be done. The adjoining option list displays all valid branch codes maintained in the system. You can select the appropriate one.

Settlement Account

Specify the account from which settlement needs to be done. The adjoining option list displays all valid accounts available for the CIF. You can select the appropriate one.

Input to this field is mandatory for both CASA and External modes of settlement.

External Account

If settlement needs to be done using an external account, you need to specify the following details.

External Account Name

Specify the name of the external account.

External Account Number

Specify the external account number.

External Bank Code

Specify the bank code to which the external account belongs. The adjoining option list displays all valid bank codes maintained in the system. You can select the appropriate one.

3.6.4 Products Tab

Click ‘Products’ tab to capture details about products under which the intermediary can transact.

Specify the following details:

Product Code

Specify the intermediary product in which the intermediary can transact. The adjoining option list displays all open and authorized intermediary products maintained in the system. You can choose the appropriate one.

You can link multiple products to the intermediary.

Product Description

The system displays a brief description of the product.

Last Settlement Date

The system displays the last settlement date for the product.

Last Processing Date

The system displays the last processing date for the product.

Next Processing Date

The system displays the next settlement date for the product based on the settlement frequency.

Hierarchy Commission Percentage

Specify the commission that the intermediary should get in terms of a percentage of the transaction amount.

Minimum Hierarchy Commission

Specify the minimum amount that should be granted as commission.

UDE Details

The system displays all rules linked to the product. You can specify the UDE values for them.

Rule ID

The system displays the rules that are linked to the product.

UDE ID

The system displays the UDE ID associated with the rule.

UDE Value

Specify the value for the UDE IDs.

3.6.5 Capturing Events

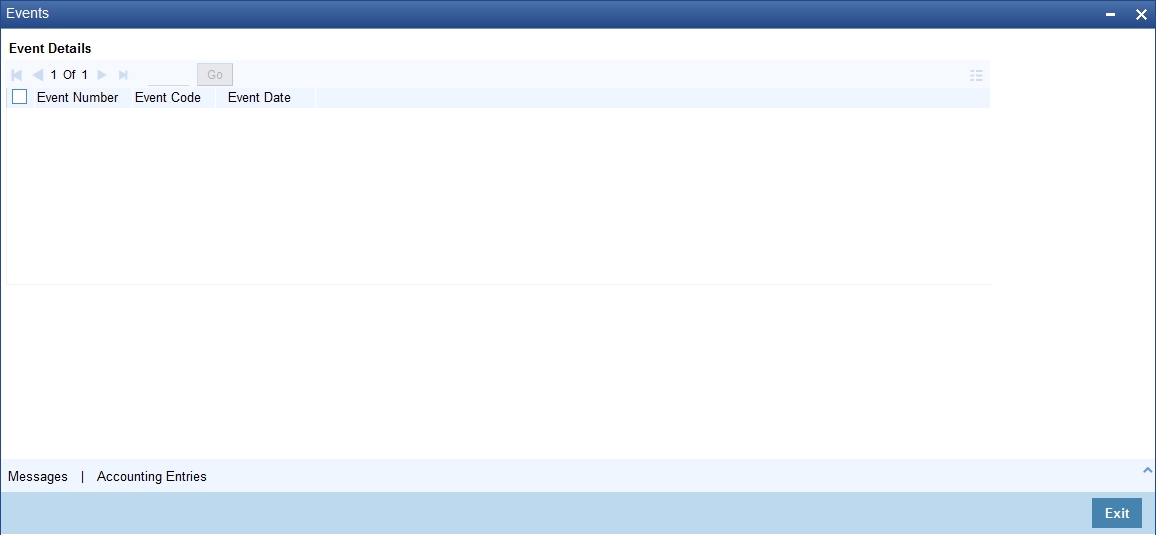

Click ‘Events’ button in the ‘Intermediary Maintenance’ screen and invoke the ‘Events’ screen.

Here you can view the following details:

- Event Number

- Event Code

- Event Date

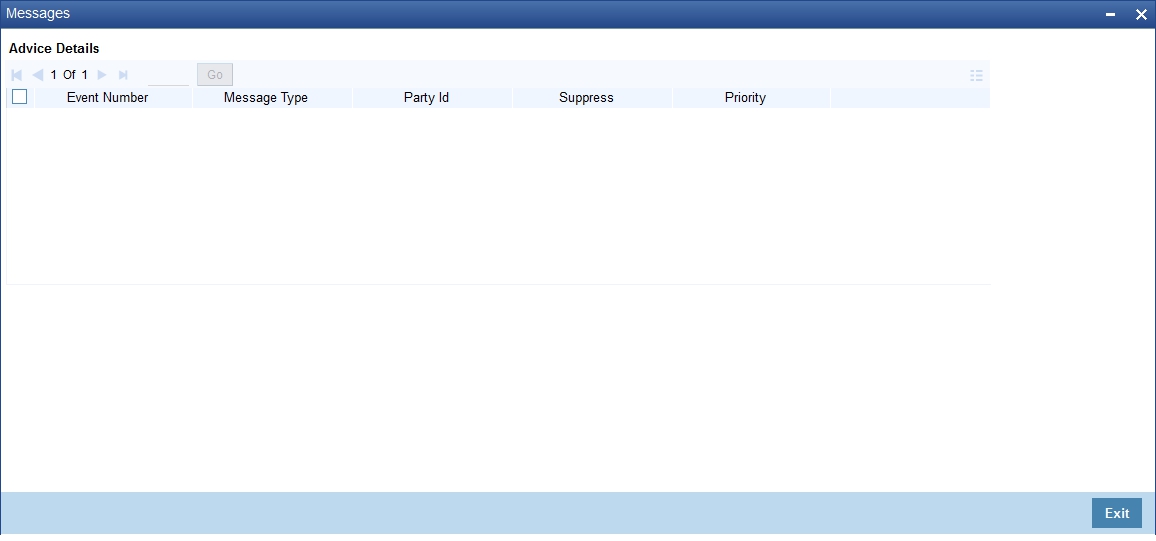

Click ‘Messages’ button and invoke the ‘Messages’ screen to view the messages generated for the intermediary.

Here you can view the following details:

- Event Number

- Message Type

- Party ID

- Suppress

- Priority

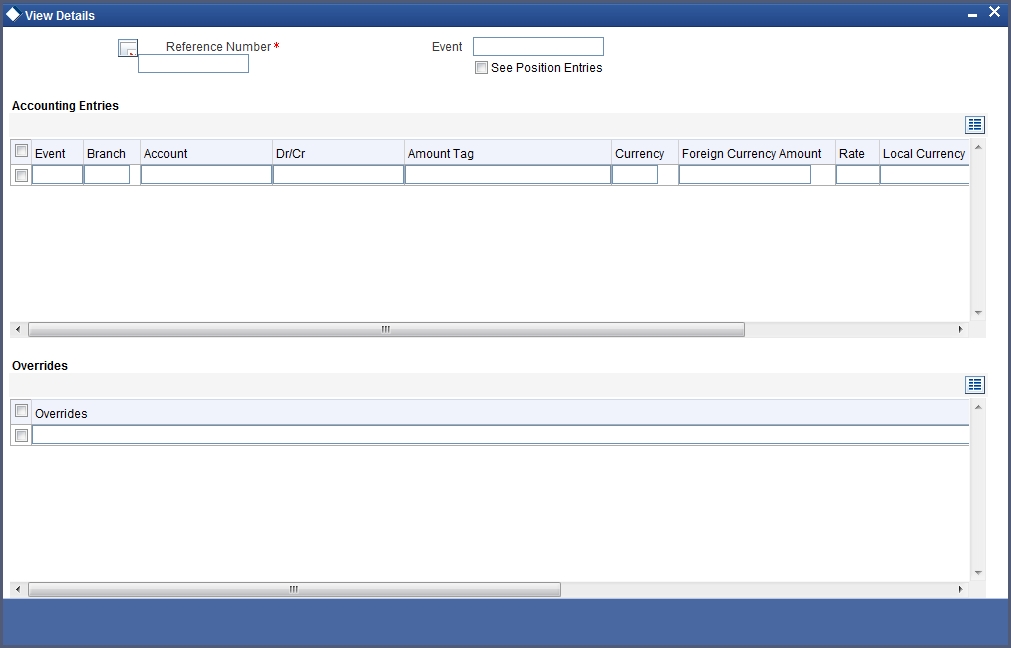

Click ‘Accounting Entries’ button and invoke the ‘Accounting Entries’ screen to view accounting entries posted for transactions of the intermediary.

Here you can view the following details:

- Branch Code

- Account Number

- D/C

- Local Currency

- Local Ccy Amount

- Exchange Rate

- Foreign Ccy Amount

- Date

- Value date

- Amount Tag

- Code

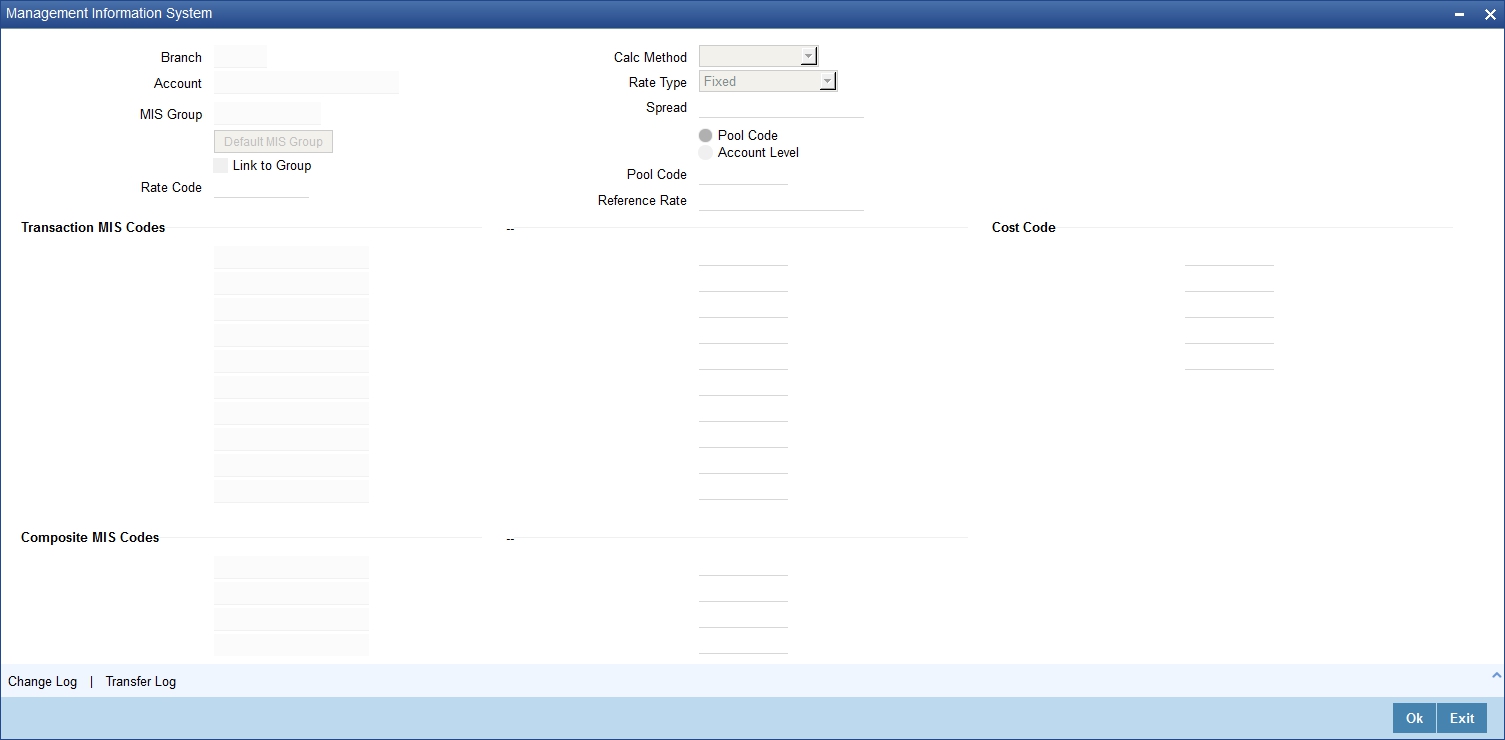

3.6.6 Maintaining MIS Details

Click ‘MIS’ button in the ‘Intermediary Maintenance’ screen and invoke the ‘Management Information System’ screen.

Refer the User Manual on MIS for further details.

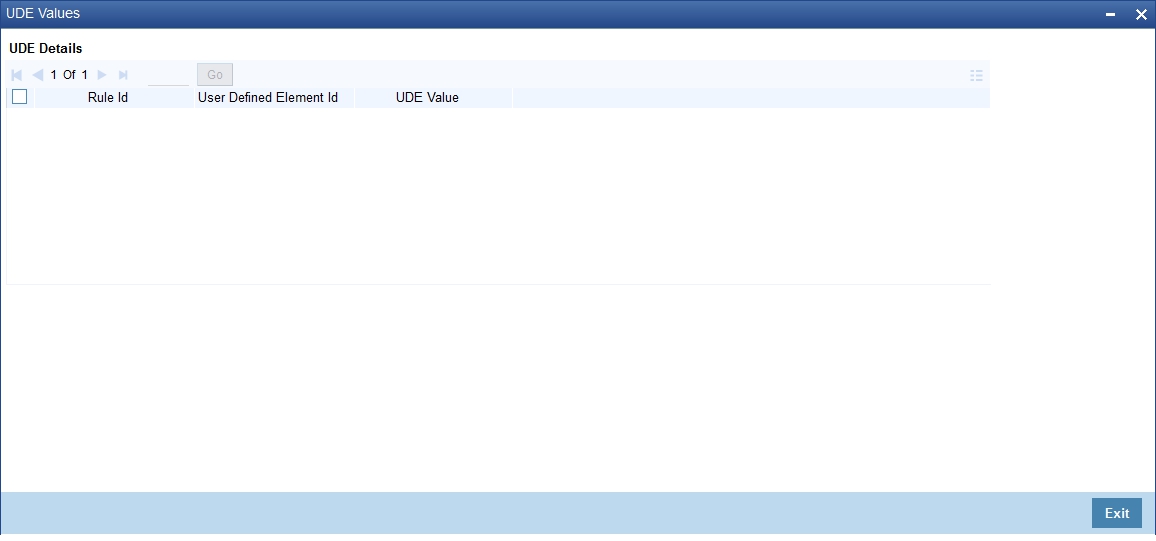

3.6.7 Viewing UDE Values

Click ‘UDE Values’ button in the ‘Intermediary Maintenance’ screen to invoke the ‘UDE Values’ screen. You can view values for all UDEs applicable to the Intermediary in this screen. Note that you will be able to invoke this screen only in the Query mode. In all other cases, this button will be disabled.

Here you can view the following details:

- Rule ID

- UDE ID

- UDE Value

3.6.8 Actions Allowed

You can perform the following actions on a record:

- New

- Delete

- Unlock

- Save

- Auth (Authorise)

- Reverse

- Execute

- Query

Refer the Procedures User Manual for details about each action.

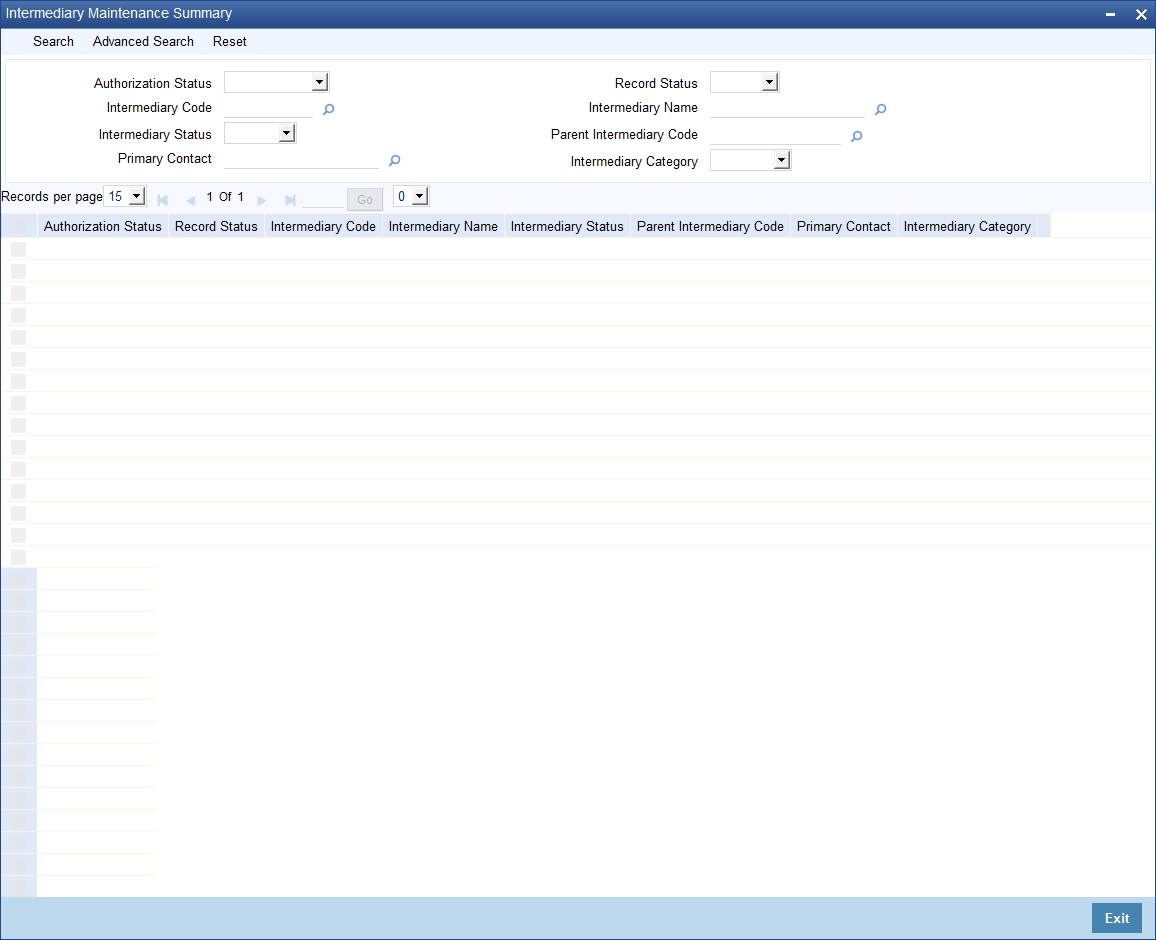

3.6.9 Viewing Intermediary Summary Details

You can view details of all intermediaries in the ‘Intermediary Maintenance Summary’ screen. You can invoke this screen by typing ‘INSINMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query on records based on any or all of the following criteria:

- Authorization Status

- Record Status

- Intermediary Code

- Intermediary Name

- Intermediary Status

- Parent Intermediary Code

- Primary Contact

- Intermediary Category

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Authorization Status

- Record Status

- Intermediary Code

- Intermediary Name

- Intermediary Status

- Parent Intermediary Code

- Primary Contact

- Intermediary Category

3.7 External UDE Values

This section contains the following topics:

- Section 3.7.1, "Specifying External UDE Values"

- Section 3.7.2, "Actions Allowed"

- Section 3.7.3, "Viewing External UDE Summary "

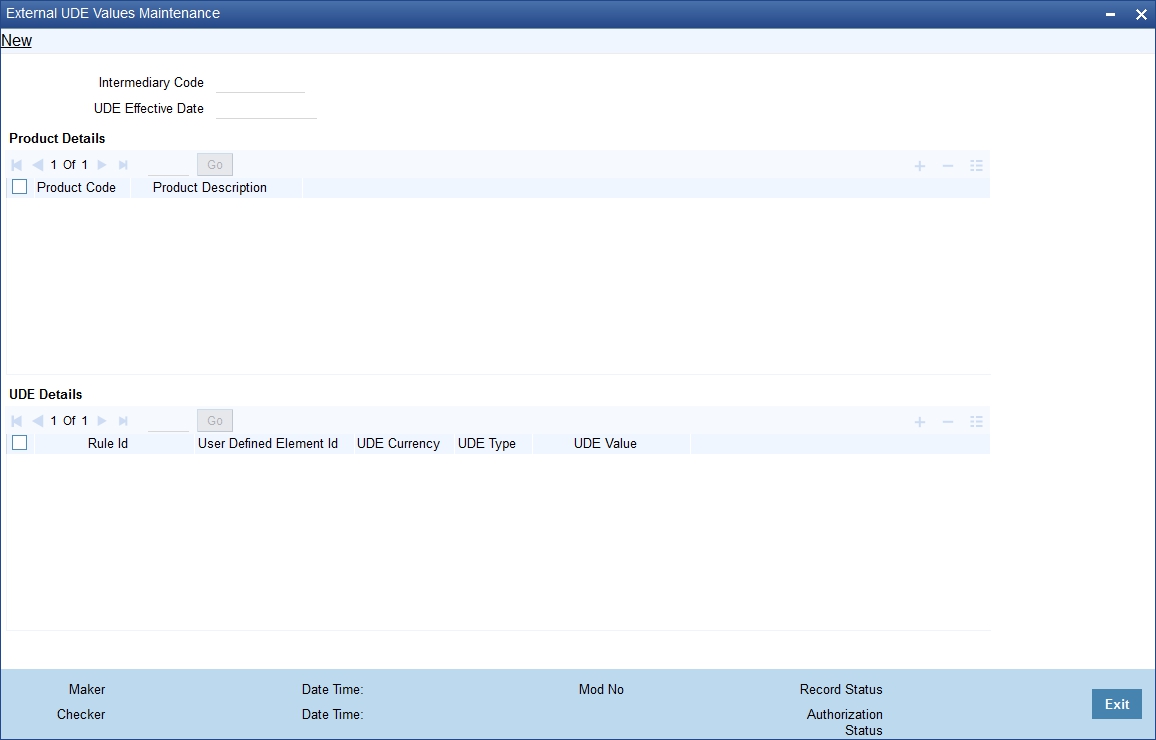

3.7.1 Specifying External UDE Values

You may need to capture data from external systems for computation of intermediary commission. You can capture such data in the ‘External UDE Values Maintenance’ screen. You can invoke this screen by typing ‘INDUDEMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.I

Specify the following details.

Intermediary Code

Specify the intermediary code for which you want to capture external UDE values. The adjoining option list displays all valid intermediary codes maintained in the system. You can choose the appropriate one.

UDE Effective Date

Specify the date from which the UDE should be effective.

Product Details

You can link products to the intermediary code.

Product Code

Specify the intermediary product code for which you want to capture external UDE values. The adjoining option list displays all valid intermediary product codes maintained in the system. You can choose the appropriate one.

Product Description

The system displays a brief description of the product.

UDE Details

The system displays all rules linked to the specified product code.

Rule ID

The system displays all rules linked to the product.

UDE ID

Specify the external UDE ID that you want to attach to the rule. The adjoining option list displays all valid UDEs maintained in the system. You can select the appropriate one.

UDE Currency

The system displays the UDE currency based on the UDE ID. However you can change it. The adjoining option list displays all valid currency codes maintained in the system. You can choose the appropriate one.

UDE Type

The system displays the UDE type based on the UDE ID. However you can change it. Select the type of the UDE from the adjoining drop-down list. The options available here are:

- Number

- Rate

- Amount

UDE Value

Specify the external UDE value. At the time of processing, the system checks the UDE value for the corresponding product maintained in this screen for the maximum effective date falling between the last liquidation date and the calculation date. If no value is maintained in this screen, the UDE value will be considered as ‘0’.

3.7.2 Actions Allowed

You can perform the following actions on a record:

- New

- Delete

- Unlock

- Save

- Auth (Authorise)

- Reverse

- Execute

- Query

Refer the Procedures User Manual for details about each action.

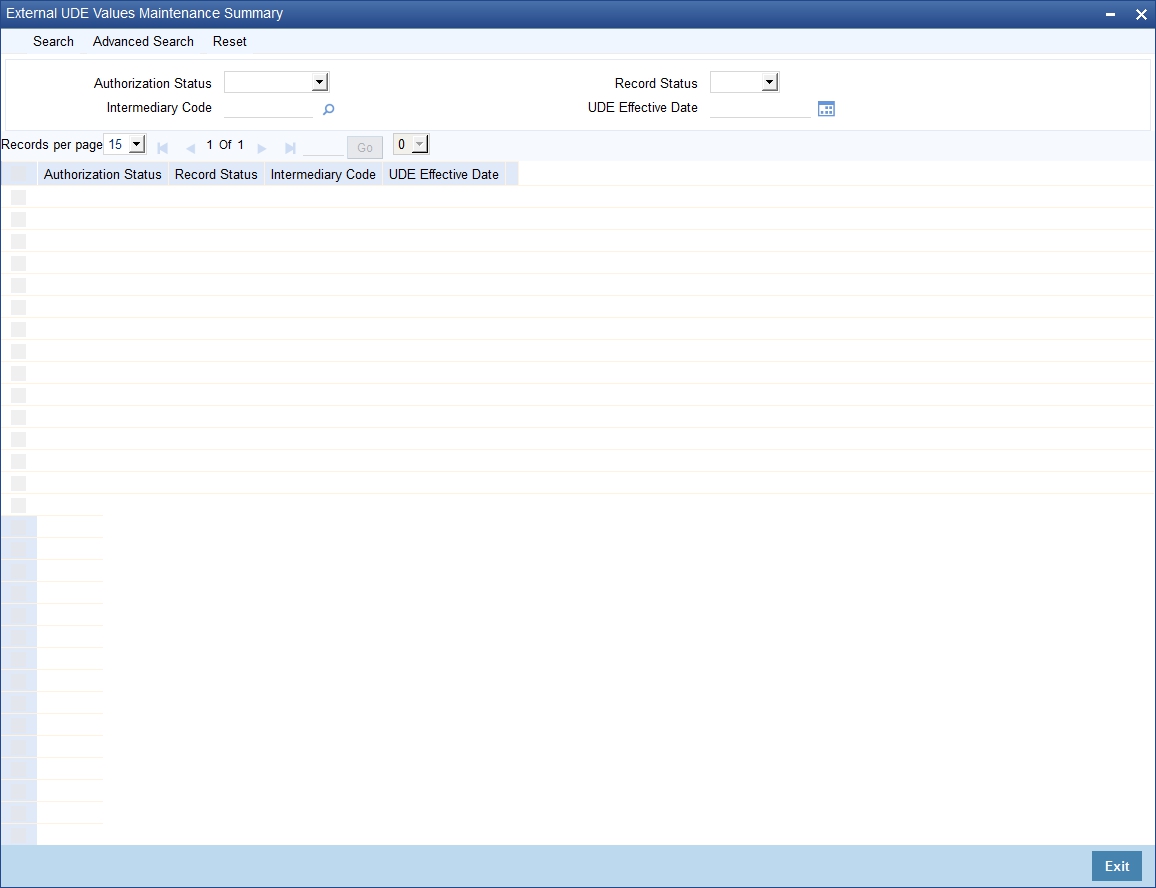

3.7.3 Viewing External UDE Summary

You can view details of all external UDEs through ‘External UDE Value Maintenance Summary’ screen. You can invoke this screen by typing ‘INSUDEMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query on records based on any or all of the following criteria:

- Authorization Status

- Record Status

- Intermediary Code

- UDE Effective Date

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Authorization Status

- Record Status

- Intermediary Code

- UDE Effective Date