4. Maintaining System Data Elements

To calculate interest or charges for an account, you require the following data:

- Principal - The amount for which you want to calculate interest

- Interest period - The number of days for which you want to apply interest

- Interest rate

These components, required to calculate interest, are called ‘data elements’ (the elements that provide the required data to calculate interest). Data elements are of two types:

- System Data Elements (SDEs)

- User Data Elements (UDEs)

System Data Elements (SDEs) can include be any of the following:

- Values for data elements like the balance in an account, on which interest has to be applied

- Number of transactions in a day

Information, such as the ones listed above, is constantly updated in the system and is readily available for computation of interest. They are therefore called SDEs.

As a corollary, these values will necessarily be picked up by the system while applying interest. You cannot, for example, indicate to the system that a certain amount should be picked up as the balance if that is not the balance in the account. On the other hand, you can indicate to the system that interest should be applied at a specific rate. For a certain period, you can indicate that interest should be calculated at five percent. While, for some other period, you can indicate that interest should be applied at six percent.

Thus, the interest rate is a value that you have control on and whose value you can specify. Such elements are called User Data Elements (UDEs). Another example for UDEs is the tier or slab structure based on which interest has to be applied on an account (since you would specify the slab and the tier structure). SDEs and UDEs are used to build formulae that result in the amount of interest that has to be applied.

This chapter contains the following sections:

4.1 System Data Elements Maintenance

This section contains the following topics:

- Section 4.1.1, "Invoking System Data Elements Maintenance"

- Section 4.1.2, "Maintaining SDE for Interest Calculation on Daily Average Balance"

- Section 4.1.3, "Maintaining SDE to Compute Average Balance of Two Consecutive Months"

- Section 4.1.4, "Maintaining SDE for ELCM related Values"

- Section 4.1.5, "Maintaining SDE for Tax Exemption"

- Section 4.1.6, "Maintaining SDEs for Computing TDS"

- Section 4.1.7, "Maintaining SDEs for Computing Advance Interest"

- Section 4.1.8, "Maintaining SDEs for Computing Overdraft Interest"

- Section 4.1.9, "Maintaining SDE for Computing commission on Highest Debit Balance"

- Section 4.1.11, "Maintaining SDE for Virtual Accounts"

- Section 4.1.12, "Maintaining SDE for Capitalized Back Value Recalculation"

4.1.1 Invoking System Data Elements Maintenance

You will have different types of accounts in your bank, such as current accounts, savings accounts, etc. On each of these accounts you would want to apply interest differently. On a savings account, for example, you may want to apply credit interest on the basis of the minimum credit balance during the month. On a current account you may want to apply charges on the basis of the turnovers, or, levy debit interest on the basis of overdrafts. Similarly, there may be various criteria based on which you would want to apply interest on an account.

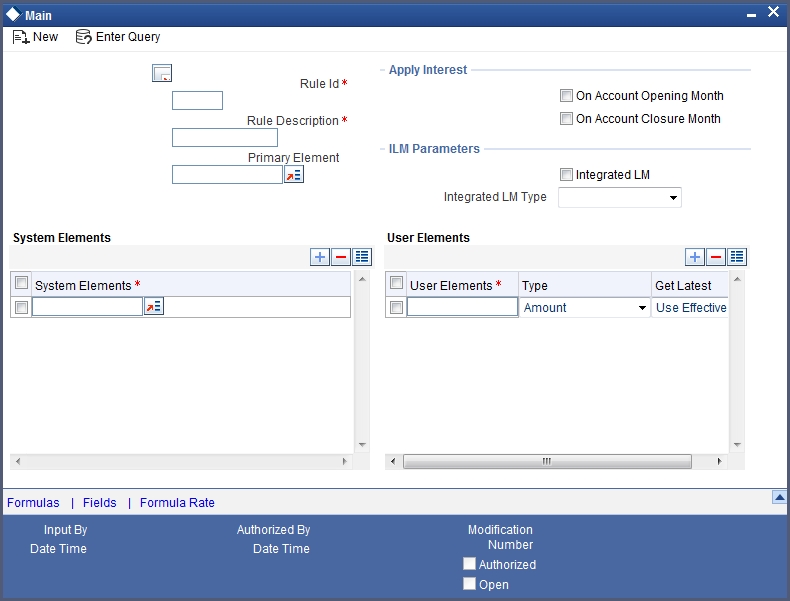

Each such criterion (which the system has to pick up) has to be defined as an SDE in the ‘Interest & Charges System Data Element Maintenance’ screen. You can invoke the ‘Interest & Charges System Data Element Maintenance’ screen by typing ‘ICDSDEMN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

SDEs should be combined with UDEs into formulae to arrive at a method in which interest or charge has to be calculated.

Follow the example below, which illustrate transactions that typically take place in a current account, to understand how SDEs are defined.

Element

Enter a unique ID for the System Data Element that you are maintaining.

Description

Enter a description of the SDE that you are maintaining in this field.

Nature

Once you fix the ‘basis’ on which you want to apply interest for the SDE that you are defining (either balances or turnovers which, in turn, could be as of the booking date or the value date), you have to specify the nature of the balance or turnover. The nature could be:

- Debit

- Credit

- Net

In the example discussed in the beginning of this section, we have seen various types of balances: on certain days there is a debit balance while on certain other days there is a credit balance in the account. These are referred to as debit balances and credit balances respectively.

Each balance in turn will have a periodicity and an aggregation operation attached to it. These two are explained subsequently.

Basis

Interest can be applied on this account differently, using different data as the basis. That is, you can apply interest on the basis of ‘item count’, the balance, or the turnover in the account. In Oracle FLEXCUBE, Balances and Turnovers are referred to as ‘Basis’. While balances will typically be used for interest application, turnovers could be considered for charges.

Note

A ‘turnover’ is any movement in an account.

Balances and turnovers, in turn, can be considered as of the ‘booking date’ or the ‘value date’ of a transaction.

The booking date is the date on which a transaction is captured in the system. However, the date on which a transaction takes effect (that is, the date as of which the accounting entries are passed and the balances updated) could either be the booking date itself, or a date in the past, or future. This date is called the value date of the transaction. The following are examples of value dates and booking dates:

- Ms. Yvonne Cousteau, withdraws cash from her account today. The booking date and the value date of the transaction are the same (that is, today’s date).

- You pass a loan interest recovery transaction into your customer's account, as of a date in the past. The booking date of the transaction will be today while the value date will be the date as of which the transaction has to take effect. The account will be debited as of the value date.

- A customer presents a cheque which has to be sent for clearing. The float period for clearing is three days. The booking date for this transaction is today’s date and the value date three days hence.

The Basis could be one of the below:

- Balance

- Turnovers

- Loan Outstanding

A system data element based on Loan Outstanding gives outstanding amount of the loan account after deducting the balance in the savings account from the principal amount. Interest for a mortgage account is calculated on the basis of this outstanding amount.

Balance

The balance in an account will be different when you consider it to be as of the booking date or as of the value date.

If you want to apply interest on an account based on the balance in the account, you have to first specify whether you would want to consider booking dated or value dated balances. Subsequently, you have to specify other characteristics for the balance.

When you are setting up the SDE, you can use normal balance or the balance due to the IC transactions. The basis for such SDEs is IC balance.

If the basis of an SDE is IC balance, then by rule, the nature of the SDE will be Net, the type of the SDE will always be the value dated balance and no further operations will be allowed on the SDE.

The charges that you apply on an account can be based on the turnover in the account. Turnovers can either be debit or credit in nature.

The sum of all the debit transactions in an account, in a day, is the daily debit turnover of the account. When calculating the debit turnover, the credit transactions involving the account would not be considered. If there are, say, two debit transactions in an account in a day, the debit turnover for the day would be the sum of the two - irrespective of the credit transactions involving the account on that day. The same concept applies to credit turnovers also. You could have monthly debit or credit turnover also.

Note

An SDE based on turnovers will be applied on an account only if the transaction code of the transaction is defined with ‘Include for Account Turnover = Yes.’

Type

If you have indicated that the system data element is to be calculated on the turnover of an account, you should specify the date to be used for calculation. The calculation date can either be:

- The Booking dated

- The Value date of the turnovers

Periodicity

The periodicity decides the period over which a balance or a turnover should be considered for interest application. This periodicity could be daily, monthly, quarterly (three months), semi annual (six months), or annual. When a balance or turnover has to be picked up for interest application, it will be picked up for this period.

An example for a balance with daily periodicity could be the daily net balance in the account. Similarly, the monthly minimum credit balance, monthly maximum debit balance, etc. are examples of a balance with monthly periodicity. Similarly, you could consider the minimum credit balance over a quarter for interest application.

Note

This periodicity is for picking up the value of an SDE. It is not the periodicity at which interest is liquidated. The periodicity with which interest is liquidated is called ‘Liquidation Frequency’. Whenever interest has to be liquidated (either according to the liquidation frequency or on an ad-hoc basis, the balance will be picked up based on the SDE periodicity and applied for the entire liquidation period.

The periodicity that you define for an SDE is not the same as the periodicity of rule application (defined for an interest rule). The periodicity of rule application (which could be daily or by periodic) also has a role in the way an SDE is picked up (please refer the chapter ‘Maintaining Rules’ for details).

Operation

An aggregation operation denotes the method in which a balance or turnover should be picked up over its periodicity. As discussed under ‘Periodicity’, for the ‘Minimum’ credit balance that has to be picked up over a month, the ‘Maximum’ debit balance for the month, the ‘Minimum’ and ‘Maximum’ denote an aggregation operation. Another aggregation operation would be the ‘average’. For example, you could have the average monthly debit balance or the average monthly credit balance as the attributes of an SDE.

If you choose to apply interest on the basis of the credit, debit or the net balance, you can specify that the balance to be considered is:

- the minimum

- the maximum

- the average balance in the account, over the period specified by you

Note

If the periodicity for an SDE is daily and the basis is balance, the balance taken will always be the net balance for the day. It cannot be the minimum, maximum or average balance.

The aggregation operation of ‘sum’ can be used when you want the SDE to return a value that is a sum of a few values. A typical usage of this aggregation operation will be when you want the sum of turnovers (debit or credit), or a sum of debit or credit items, over a period.

Days from Start

You can enter a value in this field if you want to compute interest for an account on the monthly minimum credit balance or the maximum monthly debit balance or the average balance for a specific period.

The balance in the account, between the date that you specify here and the date that you specify in the ‘Last Day of Calculation’ field, will be picked up for the purpose of calculation of interest.

The default value in this field should be specified as ‘1’. However, you can enter any date here. For example, if you want to calculate interest from the 15th of a month enter ‘15’ here.

Last Day of Calculation

You may have a requirement wherein you have to consider the balances or turnovers, only during a specific period of the month. For example, in some countries, credit interest for Savings Bank accounts is given for the minimum credit balance in the account during the month, between the 10 and 25 of the month. To define an SDE that returns the minimum balance between 10 and 25 of the month, you should define it as follows:

Basis |

Balance |

Nature |

Credit |

Type |

Value dated |

Periodicity |

Monthly |

Operation |

Minimum |

Days from Start |

10 |

Last Day of Calculation |

25 |

The minimum balance between 10 and 25 (both inclusive) will be returned by this SDE. However, the number of interest days will be the entire month, unless you specify otherwise while defining the interest calculation formulae for an Interest Rule involving the SDE (Please refer the chapter ‘Building formulae’).

The following is a list of the SDEs available in the system:

- ACCOUNT_LIMIT

- ACCOUNT_TOD

- LINE_AMOUNT

- REPORTING_AMOUNT

- DAYS

- MONTH

- YEAR

- MIN_BAL_REQD

- CURRENT_BAL

- OPENING_BAL

- MON_AVG_BAL_CONS

- OD_APPLICABLE

- LIMIT_AMOUNT

- EFF_LIMIT_AMOUNT

- MATURED_AMOUNT

- VIR_ACCT_COUNT

- OD_LIMIT

- AUF_LIMIT

- ACC_OD_INT_CALC

- NET_BACK_VAL_ADJ_INT

4.1.2 Maintaining SDE for Interest Calculation on Daily Average Balance

You need to maintain an SDE for interest calculation on daily average balance. This SDE gives the difference between the ‘PRINCIPAL_EXPECTED’ and the value dated balance of the CASA account.

The system calculates interest on the minimum of the ‘PRINCIPAL_EXPECTED’ and the value dated balance of the CASA account. If the CASA account balance is greater than the ‘PRINCIPAL_EXPECTED’ amount, the system calculates the savings interest on the PRINCIPAL_EXPECTED amount only. For calculating interest on the balance over and above the PRINCIPAL_EXPECTED amount, an SDE basis ‘Differential Balance’ is provided in ‘Interest & Charges - System Data Element Maintenance’ screen. This SDE gives the difference of PRINCIPAL_EXPECTED component in the loan account and the balance in the CASA account.

CASA Balance (USD) |

MO Loan Principal Expected (USD) |

CL_EXPECTED (USD) |

10000 |

15000 |

0 |

5000 |

10000 |

0 |

15000 |

10000 |

5000 |

8000 |

8000 |

0 |

Similarly, you need to create another SDE by name ‘CL_LINKED’. This SDE can be used to check whether the CASA account is linked to a savings component of a contract for offsetting the interest.You also need to define the purpose formula for calculating interest on the excess amount.

You can use SDE ‘DEPOSIT_AMOUNT’ for displaying the maturity amount based on interest capitalization.

4.1.3 Maintaining SDE to Compute Average Balance of Two Consecutive Months

You can apply average balance charges to CASA accounts if average balance is not maintained for two consecutive months. The following SDEs are used to compute average balance for current and immediate previous month:

- AVG_MON_BAL_CURR - It fetches the average value dated balance for the current month. You can define this in SDE maintenance screen.

- AVG_MON_BAL_PREV - This SDE fetches the average value dated balance for the previous month.

If an account is opened in the middle of a month, the average balance will be calculated for the period for which account has remained open.

You have to disable the flag ‘On Account Opening Month’ at the IC Rule Maintenance screen to ensure that average balance charges are not applied on the account opening month.

At IC product level, the calculation and liquidation frequency should be set as monthly and liquidation at month end option should be selected. You should not enable ‘Back Value Recalculation’ for the IC product.

4.1.4 Maintaining SDE for ELCM related Values

For computing interest based on ELCM related values, you need to use the following SDEs available in the system:

- LIMIT_AMOUNT

- EFF_LIMIT_AMOUNT

- MATURED_AMOUNT

To track the above SDEs, you need to specify the 'Interest Calculation account' on facility screen. It fetches the accounts which are coming under the main liability.

- LIMIT_AMOUNT - It captures the limit amount of the facility

- EFF_LIMIT_AMOUNT - It captures the effective limit amount in the facility. It may be only Limit amount or Limit amount + Collateral (which is linked with same facility) or Minimum of Line Amount and Collateral (i.e., effective limit amount basis maintained on facility)

- MATURED_AMOUNT - It captures the repayment of facility utilization amount. Repayment of utilization on facility will be tracked against "Matured_util" in GETM_FACILITY table.

Note

There is no option to view the matured utilization amount details at facility screen level.

4.1.5 Maintaining SDE for Tax Exemption

Deposit Interest Retention Tax (DIRT) is payable on interest on deposits and accounts. Customers belonging to certain customer categories can be exempt from paying DIRT. For maintaining DIRT exemption for accounts, you need to use the SDE provided for this purpose.

By attaching this ‘DIRT _TEST’ SDE to a rule, building that rule into an interest product and attaching the product to an account class, you can ensure that no DIRT is deducted from the interest on accounts under that account class. You have to specify the parameters for this SDE in line with the parameters that you set for the other SDEs that you use to calculate interest in the same rule.

4.1.6 Maintaining SDEs for Computing TDS

Oracle FLEXCUBE provides you the facility to compute TDS (Tax Deducted at Source) on interest earned for a customer. The IC products are classified as Tax and Non-tax product. Non-Tax products are used to compute the credit interest for the account and the Tax products are used to calculate the TDS amount and also book.

All the accounts belonging to product, for which the check box ‘Include for TDS Calc’ is enabled, will be taken for computing the TDS. Three new SDEs are created for this purpose:

- TDS_AMOUNT

- TOT_INT_AMOUNT

- INTEREST_AMOUNT

For computing TDS on interest earned for a customer, you need to use the following SDEs available in the system:

- TDS_AMOUNT – the total TDS amount deducted from the customer account.

- TOT_INT_AMOUNT - the total interest amount for the customer for the current financial year. This encapsulates the credit interest accrued across the customers account.

- INTEREST_AMOUNT – captures the interest amount for the period for the particular customer account. This is the amount used for computing the TDS amount.

By attaching these SDEs to a rule, building that rule into an interest product and attaching the product to an account class, you can ensure that these SDEs are used in the formula for computing the TDS amount for accounts under that account class. You have to specify the parameters for these SDEs in line with the parameters that you set for the other SDEs.

Refer to the chapter titled ‘Building Formulae’ of this user manual for more details on creating a formula.

4.1.7 Maintaining SDEs for Computing Advance Interest

You can maintain SDE for advance interest calculation on the withdrawal amount from the customer account. All accounts belonging to a product, for which the option ‘Advance Interest’ in ‘Notice Preferences’ screen is enabled, are taken up for computing the Advance Interest.

For computing the advance interest you have to specify the preferences as follows:

- Element - ADV_INT_BASIS

- Description - ADV_INT_BASIS

- Basis - ‘Advance Interest

- Periodicity - ‘Liquidation Cycle’

- Nature - ‘Net’

- Type - ‘Booking Dated’

- Operation - ‘No operation’

4.1.8 Maintaining SDEs for Computing Overdraft Interest

For customer accounts where the customer uses the overdraft facility against the collateral, lower interest rates are applied initially for the overdraft amount utilized and then the interest rate goes higher.

The following SDEs are used to compute the overdraft interest rate:

- OD_LIMIT - Returns total account level OD amount available for the account

- ACC_OD_INT_CALC - To return Sum of 'Principal*Rate' for all account level OD's available under 'CASA OD Details' grid. The utilization among these limits will be considered to occur in the increasing order of interest rate for the limit. That is lowest interest rate first and highest interest rate at the end.

- DLY_NET_VD_BAL - used to get the available balance in the account.

When customer repays the overdraft utilized amount, the higher interest rate overdraft is repaid before repaying the lower interest rate overdraft facility.

Note

- AUF_LIMIT SDE is used to return Minimum AUF limit specified at account (Uncollected Funds after applying Margin Percentage of Uncollected Funds)

- ACCOUNT_TOD is used to return TOD limit available for account

4.1.9 Maintaining SDE for Computing commission on Highest Debit Balance

You can maintain an SDE for calculating commission on Highest Debit Balance (HDB) with following details. This SDE gives the highest Debit Balance of the month.

SDE Name: HDB

Basis |

Periodicity |

Nature |

Type |

Operation |

Balance |

Monthly |

Debit |

Value Dated |

Maximum |

4.1.10 Maintaining SDE for FATCA

You can maintain an SDE to return a FATCA tax during rule maintenance.

The following SDEs are used to return a FATCA tax:

- FATCA_RECALCITRANT: This SDE will return the status of the entity. If the customer is marked as a recalcitrant will return 1 (Yes) otherwise it will return 0 (No). The customer for whom the recalcitrant check needs to be performed will be the customer who owns the account to which the interest is being credited. If the account to which interest is being credited is a General Ledger, then the customer who owns the account which is generating the interest will be evaluated.

- FATCA_US_SOURCED: This SDE will return the status of the account (whether it is marked as US Sourced or not). The SDE will return a value 1 (Yes) if the account is marked as will be returned after validating the account number with the FATCA obligation record maintained.

- FATCA_GRANDFATHERED: This SDE will return the grandfathered status of the account. The grandfathered status of the account is maintained at the FATCA obligation record. The SDE will verify the account’s grandfathered status and return 1 (Yes) if the account is grandfathered obligation otherwise, it would return 0 (No).

- FATCA_EXT_CUST: This SDE will return the external status of the customer, who owns the account receiving interest income. This will be applicable only if the customer is a bank type customer and has “Withhold for this financial Institution” set as YES. The SDE will return 1 if the customer is a bank and has Withhold for this financial institution as YES, otherwise it will return 0 (NO)

- FATCA_CUST_TYPE: This SDE will return the entity type. The values will be returned from the entity type maintained in the Entity FATCA classification record. The possible values returned will be 0 (Individual), 1 (Corporate) and 2 (Bank).

For instance, in an IC product TD01 (TD Interest), the formula 1 is for calculating interest and formula 2 is for calculating FATCA interest and an UDE called FATCA_RATE has been maintained as part of the rule. The formula (formula 2) for calculating FATCA tax can be written in expression builder as follows:

Expr No |

Expression |

Result |

|

FATCA_RECALCITRANT = 1 AND FATCA_US_SOURCED = 1 AND FATCA_GRANDFATHERED = 0 AND FATCA_EXT_CUST = 0 |

FORMULA1*FATCA_RATE |

|

FATCA_EXT_CUST = 1 AND FATCA_US_SOURCED = 1 AND FATCA_GRANDFATHERED = 0 |

FORMULA1*FATCA_RATE |

|

|

0 |

4.1.11 Maintaining SDE for Virtual Accounts

You can maintain an SDE (VIR_ACCT_COUNT) to count the number of virtual account records under a physical account. This count is based on the ‘Active’ and ‘Inactive’ virtual accounts with record status as ‘Open’ as updated in the ‘Virtual Accounts Maintenance’ (STDVIRAC) screen. Virtual accounts with record status as closed, is not considered while counting the number of virtual accounts under the physical accounts. The ‘As on Date’ record status of the virtual account is considered, that is, if you have opened a virtual account with a future date but as on the charging date the record status is ‘open’, then this virtual account will be considered for charges.

A new debit interest product can be created for charging the customer based on the number of virtual accounts. Using this SDE, charges will be configured in the debit interest product.

4.1.12 Maintaining SDE for Capitalized Back Value Recalculation

You can maintain an SDE 'NET_BACK_VAL_ADJ_INT' for extending the compounding of Interest when Back Value Dated entry comes into CASA account. This SDE will capture Net Back Valued Adjustment Interest. The nature of this SDE is 'Net', so it would return a positive value on Credit Interest and Negative value on Debit Interest. This SDE can be used along with the balance SDE having 'Net' nature. It is of type 'Value Dated' i.e it acts on Value date, with Basis 'Others' and Liquidation cycle periodicity. This SDE will not be applicable for debit interest -Liquidate using Receivable feature.

4.2 Customer TDS Details

This section contains the following topics:

- Section 4.2.1, "Invoking Customer TDS Details Screen"

- Section 4.2.2, "Maintaining SDEs for Deducting Charges on Dormant Accounts"

- Section 4.2.3, "Implications of Working with User Defined Fields"

4.2.1 Invoking Customer TDS Details Screen

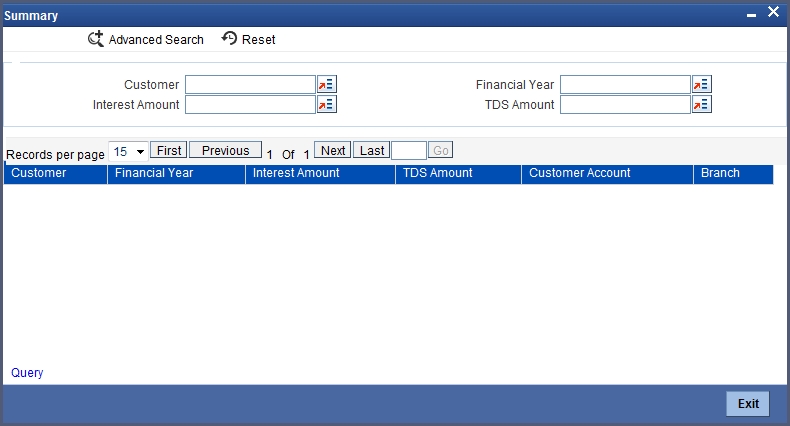

You can view the TDS details of the customer in the ‘Interest & Charges TDS Query’ screen. You can invoke the ‘Interest & Charges TDS Query’ screen by typing ‘TDSQUERY’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Customer

- Financial Year

- Interest Amount

- TDS Amount

Select any or all of the above parameters for a query and click ‘Search’ button. The records meeting the selected criteria are displayed.

System displays the following details pertaining to the fetched records:

- Customer

- Financial Year

- Interest Amount

- TDS Amount

- Customer Account

- Branch

4.2.2 Maintaining SDEs for Deducting Charges on Dormant Accounts

Oracle FLEXCUBE provides you the facility to collect charges on customer accounts that are dormant. The dormancy period is determined by the number of days the accounts have been inactive in the current liquidation cycle. However, the period for which the accounts have a full amount block will not be included for calculation of dormancy days. The accounts may be blocked either internally for being linked to loans availed by the customers or specifically, at the customer’s request.

For computing charges on accounts with dormant status, you need to use the following SDEs available in the system:

- Ac-Dormancy-Days: As stated earlier, charge will be computed based on the number of days the account was dormant in the current liquidation cycle.

- Ac-Dormant: This SDE will indicate whether the account is dormant or not depending on the dormancy period that you maintain.

You can then, attach these SDEs to a charge computation rule maintained through the ‘Interest & Charges Rule Maintenance’ screen.

Refer to the chapter titled ‘Maintaining Interest Rules’ of this user manual for more details on defining a rule.

Subsequent to defining a rule, you can create a formula to compute the charges. The result obtained by using the formula will give you the charge that has to be applied on a dormant account.

Refer to the chapter titled ‘Building Formulae’ of this user manual for more details on creating a formula.

The ‘Rule’ can then be linked to the appropriate product that you have maintained for calculation of charge on dormant accounts. To define a special charge for a specific customer, you can link the product to the account itself (special condition) rather than linking it to an account class.

Refer to ‘Interest Application’ chapter of this user manual for more details on applying interest/charge product on an account.

4.2.3 Implications of Working with User Defined Fields

To associate different tax statuses with individual customers belonging to the same account class, you may choose to associate the corresponding SDE with a user-defined field maintained at the customer account level.

Select 1 from the option list to indicate that tax needs to be levied on the interest earned by the particular customer. Select zero to indicate that tax on interest can be waived.