5. Processing an Islamic LC Contract

A Letter of Credit contract is an instruction wherein a customer requests the bank to issue, advice or confirm a letter of credit, for a trade transaction. An Islamic Letter of Credit (Islamic LC) substitutes a bank’s name and credit for that of the parties involved. The bank thus undertakes to pay the seller/beneficiary even if the remitter fails to pay.

The sequence of the events involved, in processing the Islamic LC can be considered an Islamic LC contract. The specific letters of credit thus processed for the customers of your bank constitutes a contract.

An Islamic LC Contract would therefore require information on:

- Who is the buyer or importer?

- Who is the seller or the exporter?

- The operation that your branch is performing on the Islamic LC

- The merchandise traded under the Islamic LC

- Specifications for the transportation of the consignment

- The documents that should accompany the Islamic LC

- The amount for which the Islamic LC is drawn

- Details of the parties involved in the Islamic LC

- The type of Islamic LC you are processing

- The details of the insurance company under which the goods traded are covered

You have defined products to group together or categorize Islamic LC which share broad similarities. Under each Product that you have defined, you can enter specific Islamic LCs based on your customers’ needs. Each of these will constitute a contract. While products provide a general framework and serve to classify or categorize Islamic LCs, contracts are customer specific.

By default an Islamic LC inherits the attributes of the product to which it is associated. This means that you will not have to define these general attributes each time you input an Islamic LC involving a product.

This chapter contains the following sections:

- Section 5.1, "Islamic LC Contract Details Screen"

- Section 5.2, "Islamic LC Contract Details Screen Description"

- Section 5.3, "Contracts to Deposits and Accounts Details"

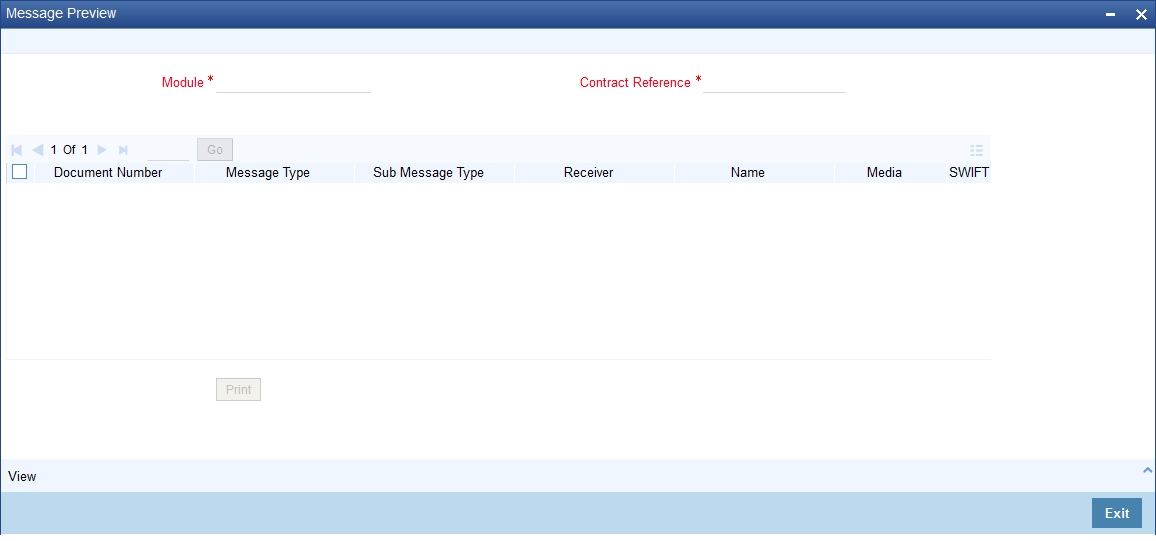

- Section 5.4, "Previewing Messages"

- Section 5.5, "Viewing Different Versions of a Contract"

- Section 5.6, "Cancelling an Islamic LC"

- Section 5.7, "Closing, Reopening, and Black listing an Islamic LC"

- Section 5.8, "Reversing Islamic LC"

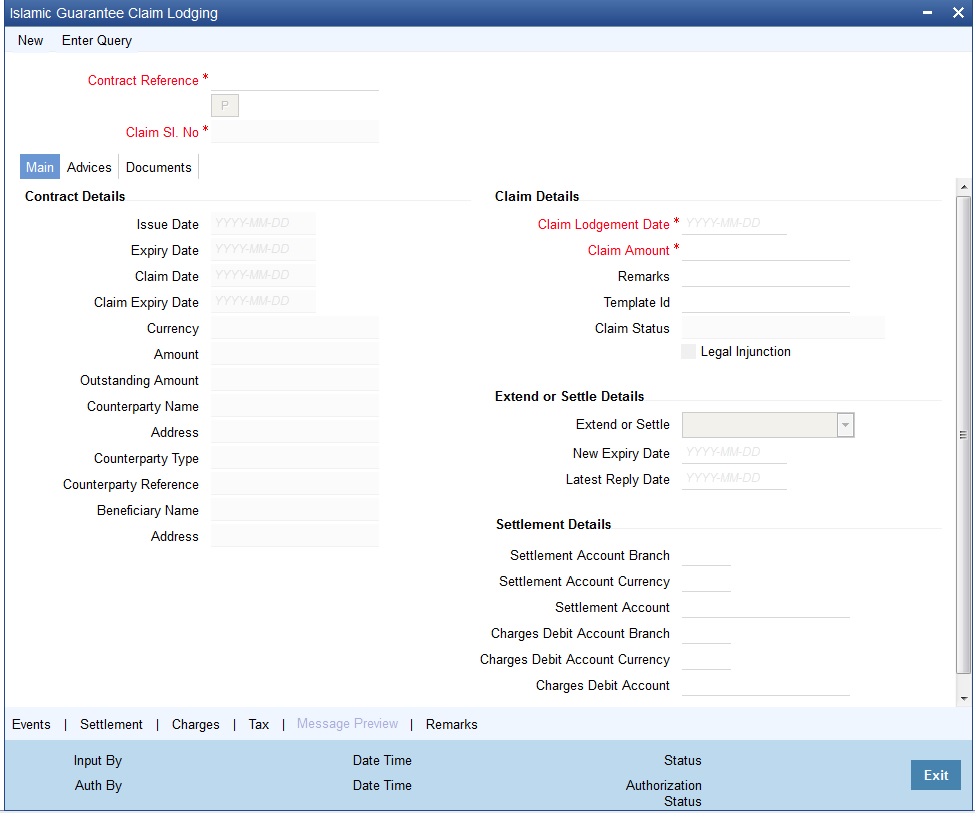

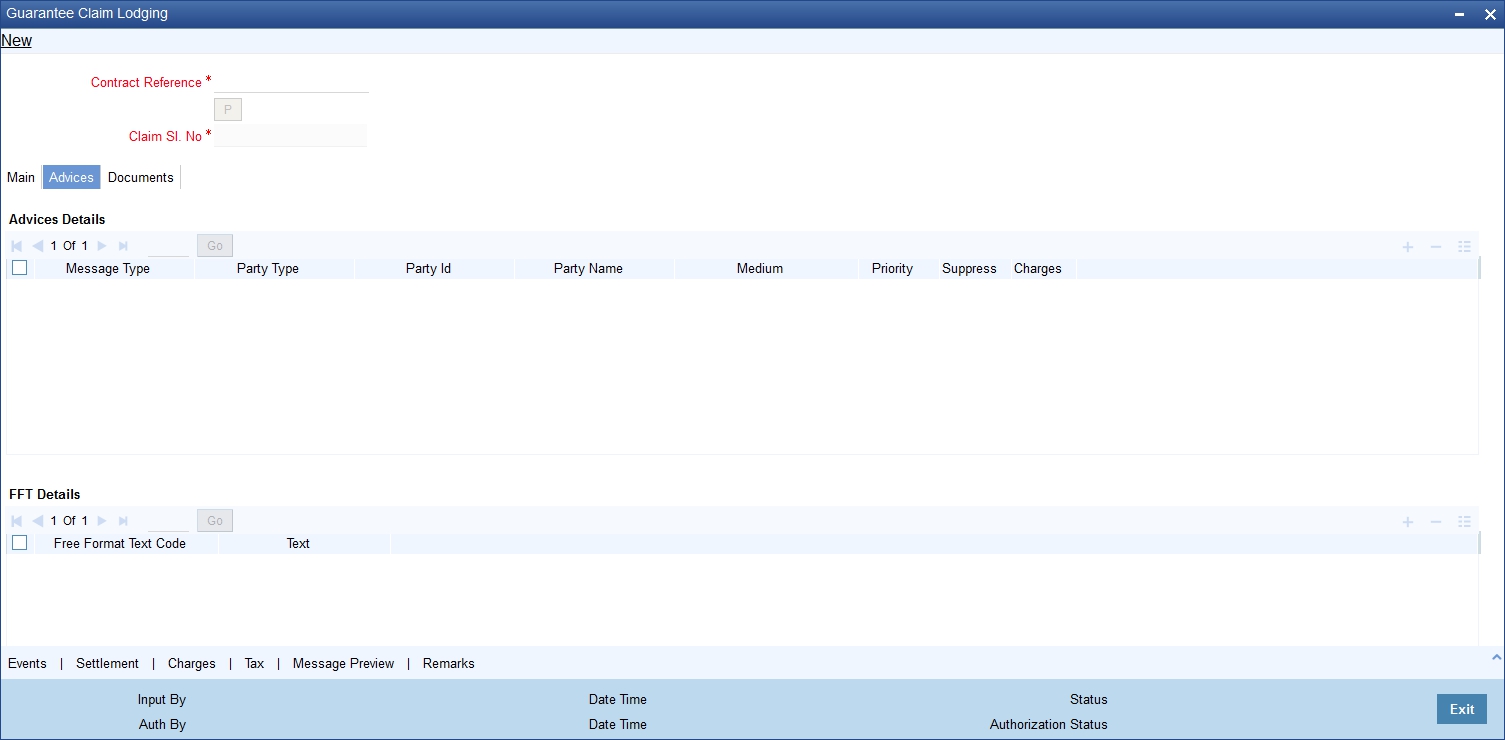

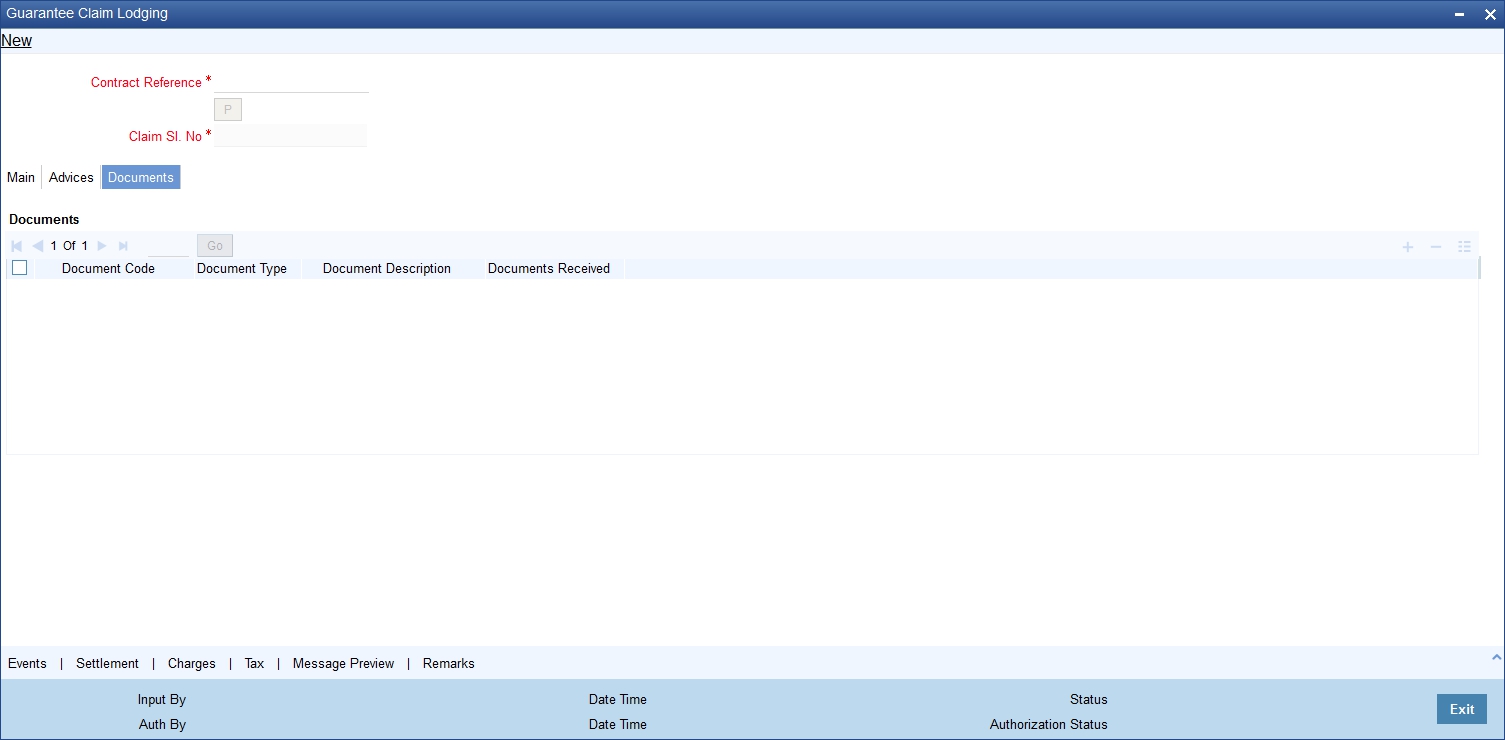

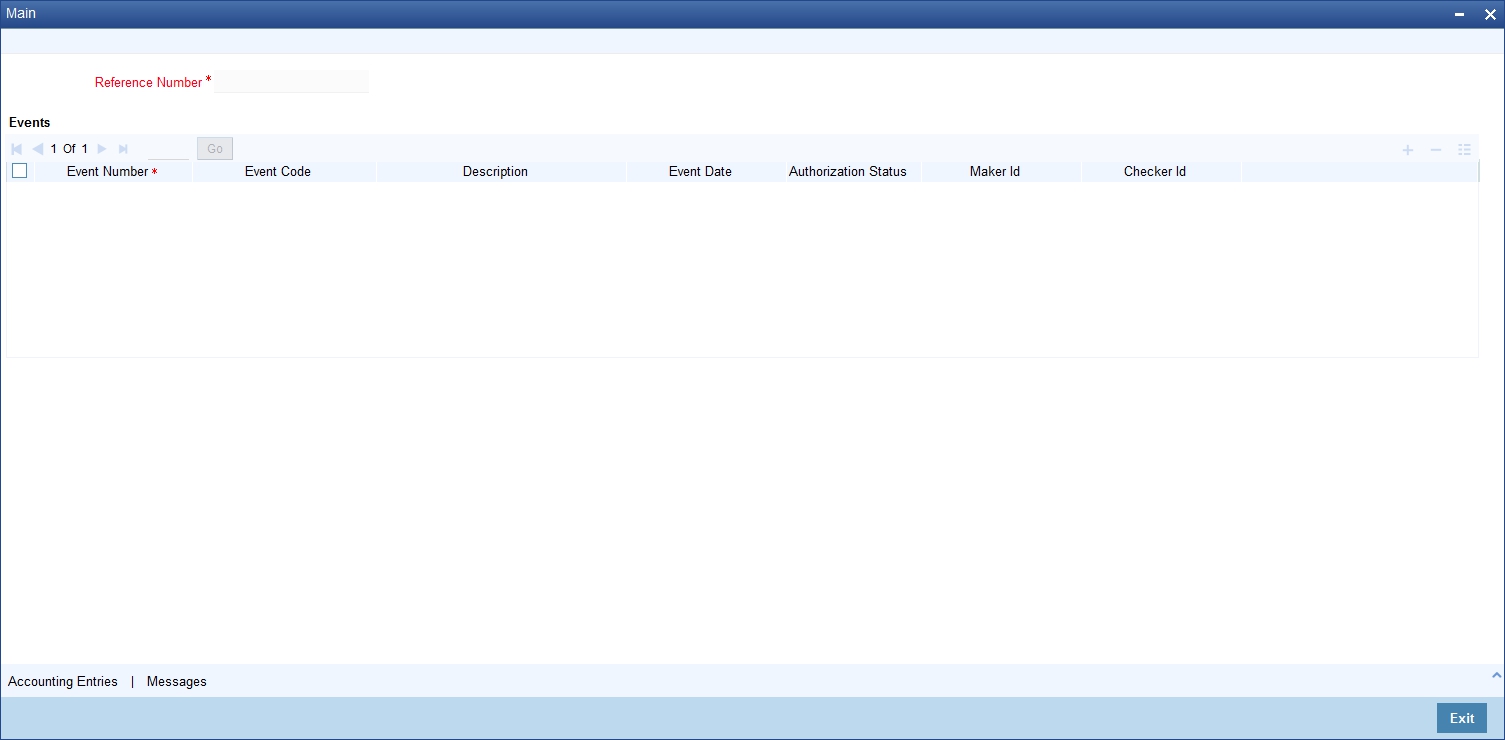

- Section 5.9, "Lodging Islamic Guarantee Claim"

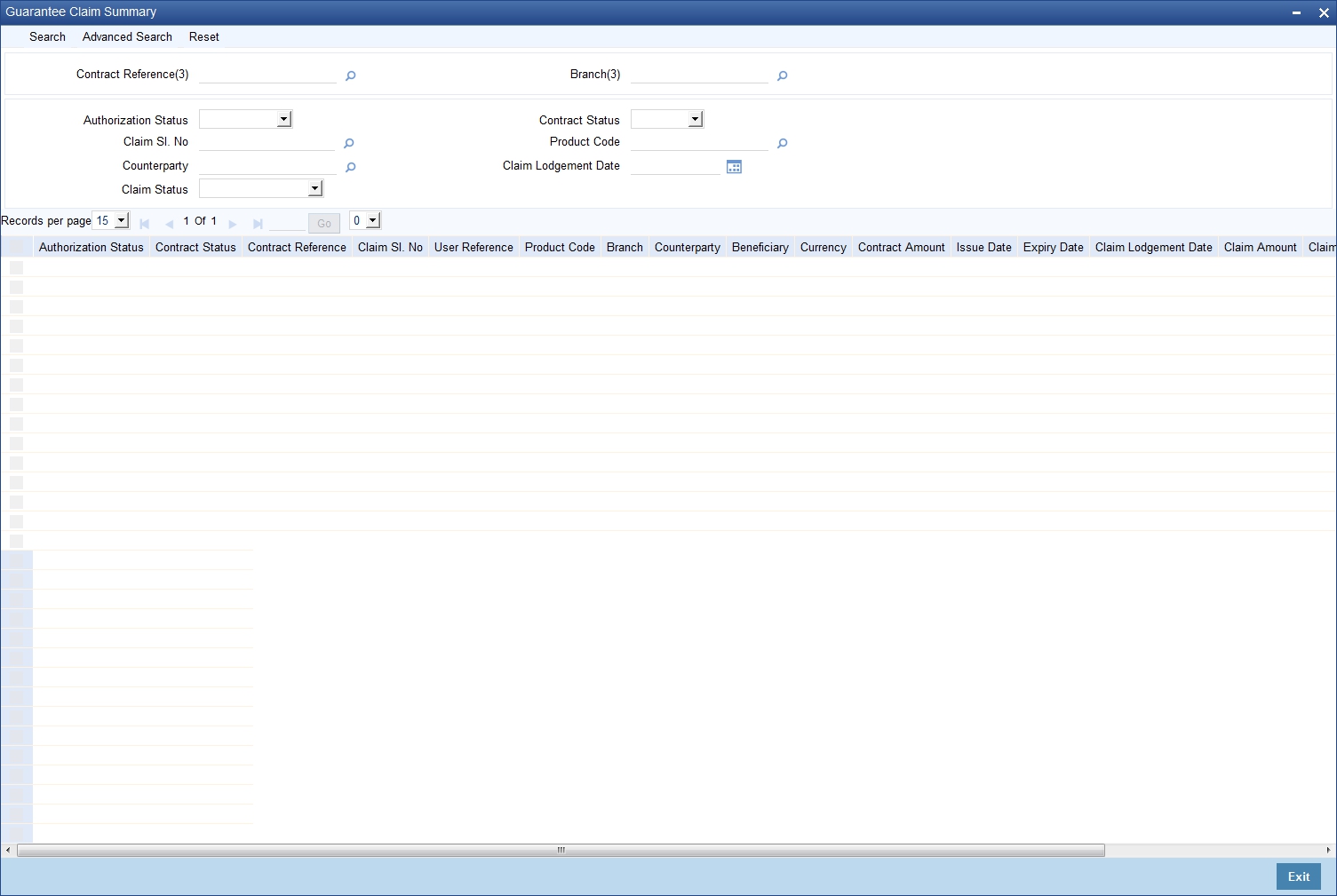

- Section 5.10, "Viewing Islamic Guarantee Claim Details"

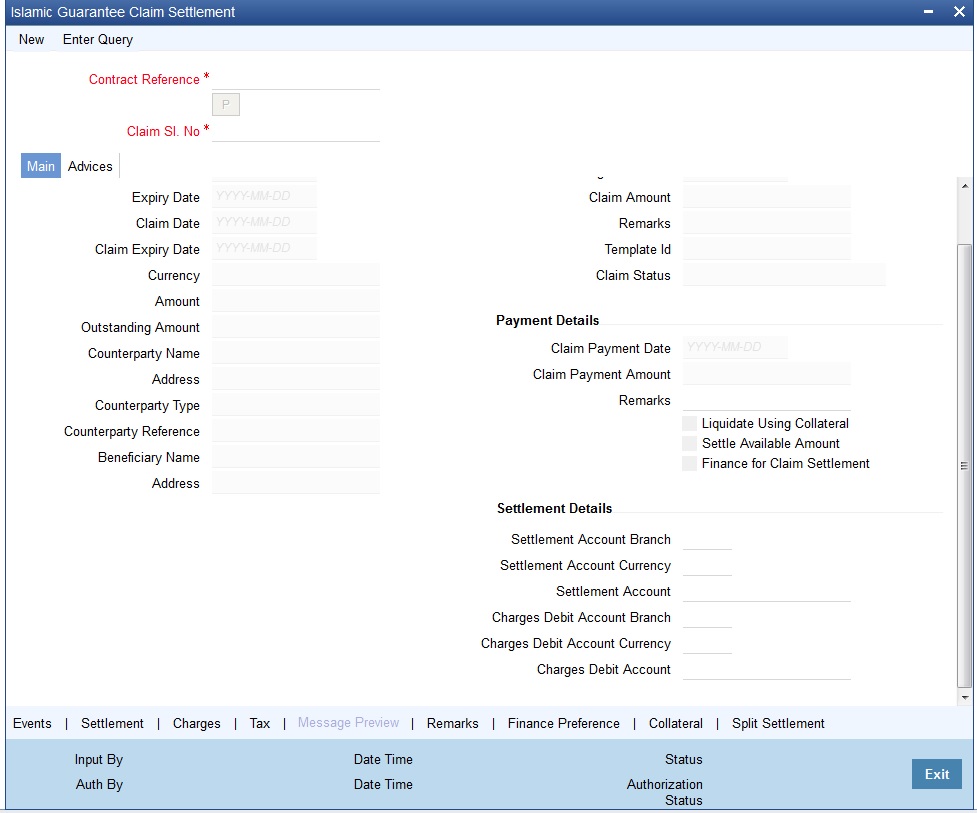

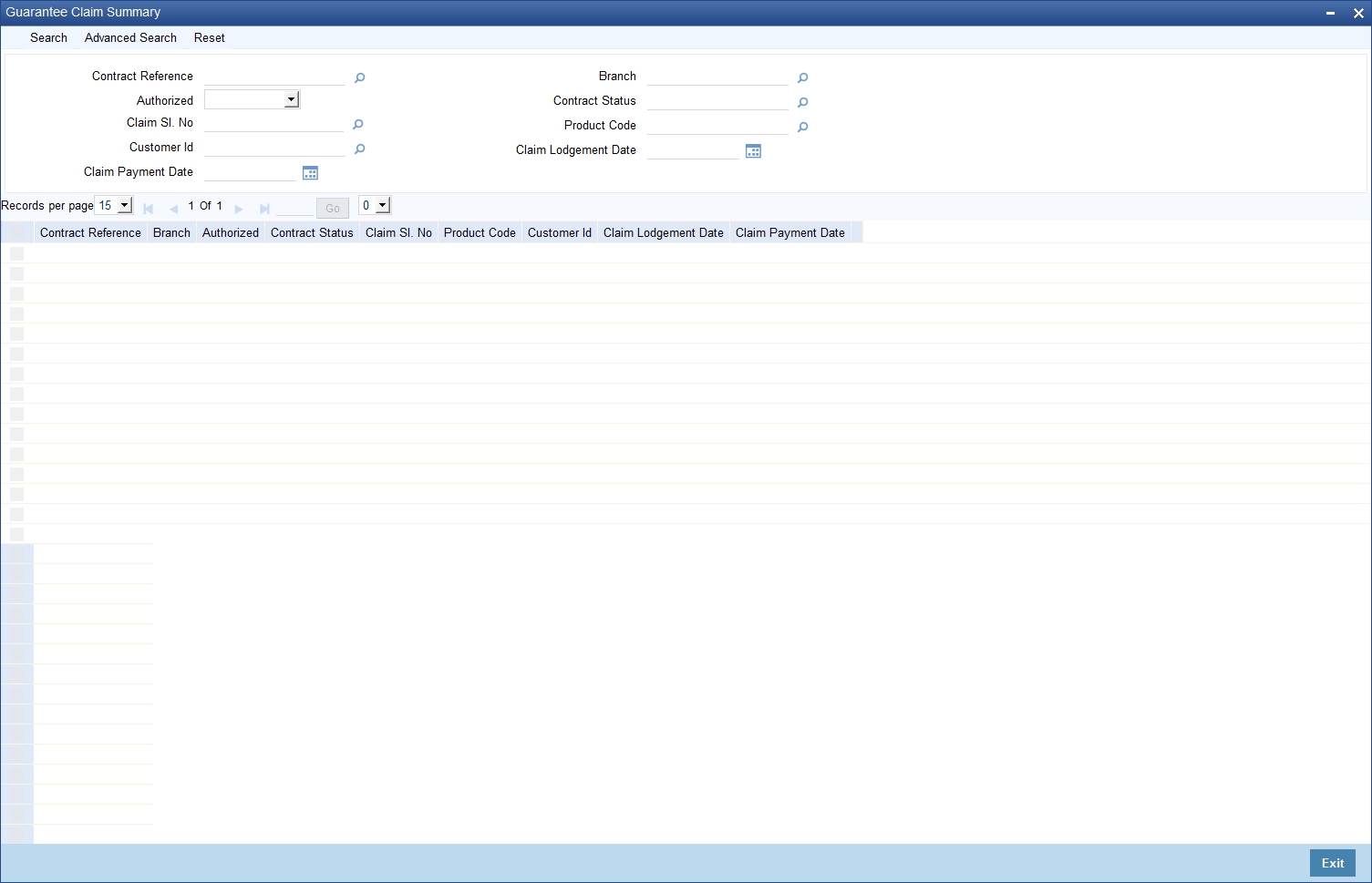

- Section 5.11, "Guarantee Claim Settlement"

5.1 Islamic LC Contract Details Screen

This section contains the following topics:

- Section 5.1.1, "Invoking the Islamic LC Contract Details Screen"

- Section 5.1.2, "Specifying Details of an Islamic LC"

- Section 5.1.3, "Uploading Islamic LCs/Guarantees"

5.1.1 Invoking the Islamic LC Contract Details Screen

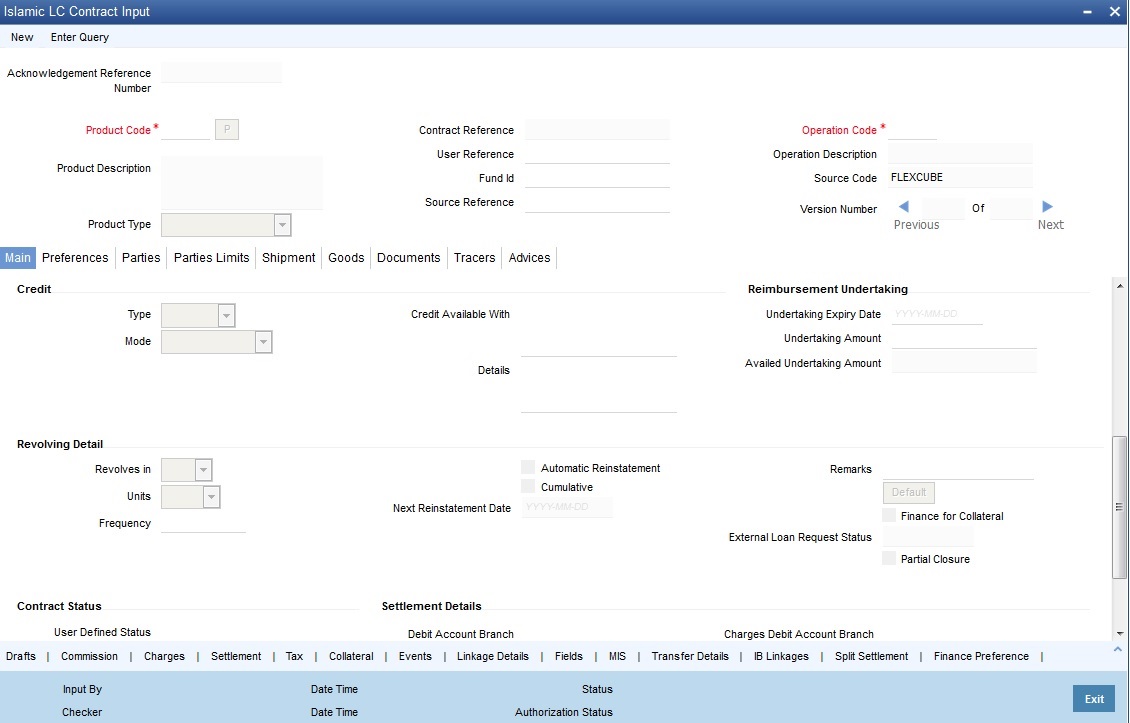

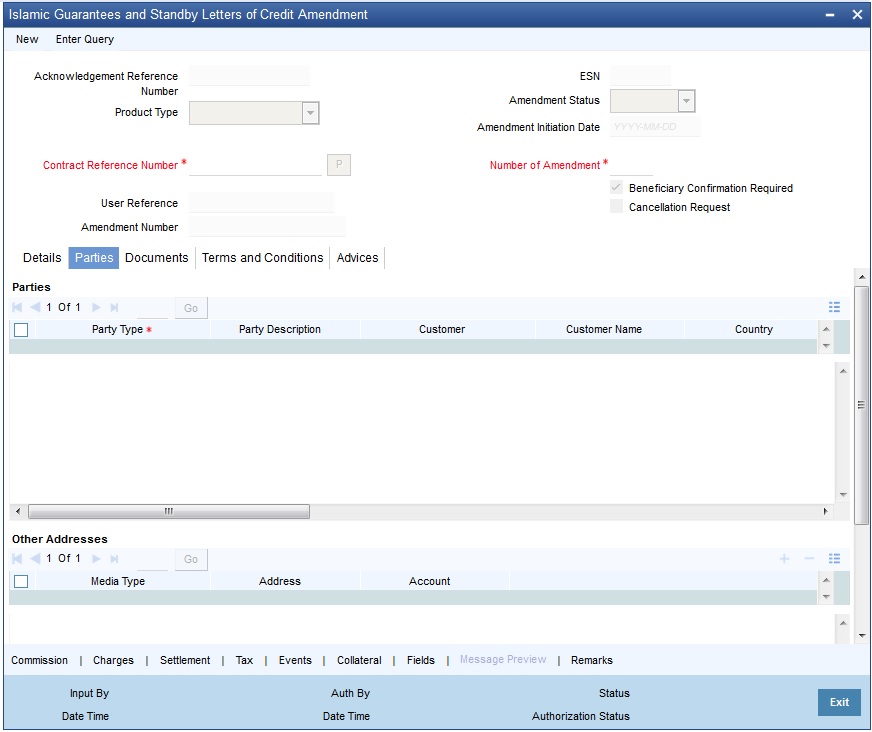

You can invoke ‘Islamic LC Contract Input’ screen by typing ‘LIDTRONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. Click ‘New’ icon in the application toolbar. The ‘Islamic LC Contract Input’ screen with no values in the fields is displayed.

If you are calling a contract that has already been created, click on Summary view. You can invoke ‘Islamic LC Contract Summary’ screen by typing ‘LISTRONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. You can open an existing contract by double clicking the contract.

You can enter the following details here:

Acknowledgement Reference Number

Specify the acknowledgement reference number. Alternatively, you can select the reference number from the option list. The list displays all the acknowledgement reference numbers and type of registration maintained at LC registration screen which are authorized and unprocessed.

The system defaults the details captured in registration screen if acknowledgement is captured on clicking populate (P) button beside Product Code.

If Registration is for LC issuance and product code is selected BG Issue/SG issue, then the system displays configurable override on product default.

Note

System will update the status of registration as ‘Processed’ and contract reference no at registration screen, if acknowledgement reference number is captured at contract screen and (new) contract is created.

Product Code

Select the product from the list of products created in the Islamic LC. Click ‘Populate’ button for details of this product to get defaulted from the Product screen.

Product Description

Product description given for this product gets defaulted from the Product screen.

Contract Reference Number

The Contract Reference Number identifies a contract uniquely. It is automatically generated by the system for each contract. The Contract Reference Number is a combination of the branch code, the product code, the date on which the contract is booked (in Julian format) and a running serial number for the booking date.

The Reference Number consists of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number.

The Julian Date has the following format:

YYDDD

Here, YY stands for the last two digits of the year and DDD for the number of day(s) that has/have elapsed, in the year.

Product Type

The type of product gets displayed here from the product screen, specifying if the product is of type import/export or revolving or non-revolving.

In addition, a contract is also identified by a unique User Reference Number. By default, the Contract Reference Number generated by the system will be taken as the User Reference Number. But you have the option to change the User Ref Number.

Oracle FLEXCUBE also provides you the facility to generate the user reference number in a specific format.

Note

You can specify a format for the generation of the User Reference Number in the ‘Sequence Generation’ screen available in the Application Browser. Refer to the Core Services User Manual for details on maintaining a sequence format.

Source Reference

The system automatically generates the Source Reference number. You can change it if required.

This message identification number will be used to identify an incoming message coming from an external system. This is defined as the ICN number. On upload of an incoming message into Oracle FLEXCUBE, this number, given by the external system, will be stored in Oracle FLEXCUBE and passed on to the contract generated as a result of the incoming message. If the incoming message results in an outgoing message, the ICN number will be linked to the outgoing message also.

This number will help you in creating a relationship between the incoming message, the resultant contract in Oracle FLEXCUBE, and the outgoing message, if any.

If an Incoming message results in an outgoing contract (outgoing message), Oracle FLEXCUBE will store the source reference number (ICN Number) at the following levels.

- Incoming Message Level

- Contract Level (Resulted due to the Incoming message)

- Outgoing message (As a result of the above contract)

You can capture the same source reference number for LC advising and reimbursement contracts if LC Issuance (MT700) and LC Reimbursement Authority (MT740) are received from the same issuing bank.

Note

The system will not allow to capture, the same source reference number for more than one advising or reimbursing contracts.

Fund ID

Select the fund id from the adjoining option list. The system defaults the value of Default Mudarabah Fund as fund id.

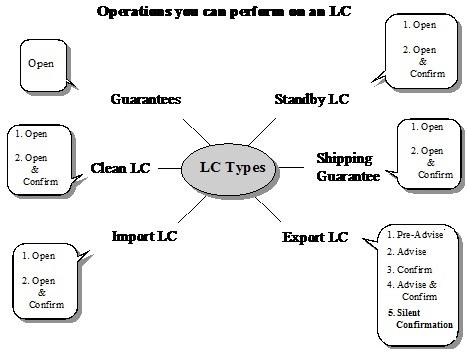

Operation Code

The operations that you can perform on an Islamic LC are determined by the type of Islamic LC being processed. The operation that you specify will determine the accounting entries that are passed and the messages that will be generated.

You can select operation code from the list of valid operation code value based on Product Type. The type of operation that you can perform on an Islamic LC has been diagrammatically represented below:

5.1.2 Specifying Details of an Islamic LC

Through the screens that follow in this section, you can process all types of Islamic LCs (import, export, invoice, clean, guarantees, shipping guarantees).

You can choose to enter the details of a contract using the following methods:

- Copying the details from an existing contract and changing only the details that are different for the Islamic LC you are entering

- Using your keyboard or the option lists that are available at the various fields to enter the details of the Islamic LC afresh

To facilitate quick input, you only need to input the product code. Based on the product code, many of the fields will be defaulted. Overwrite on these defaults to suit your requirement. You can add details that are specific to the Islamic LC like the Islamic LC amount, details of the buyer and the seller, etc.

5.1.3 Uploading Islamic LCs/Guarantees

Oracle FLEXCUBE allows you to a facility to automatically upload Islamic LCs and Guarantees.

The MT 700 and MT 701 messages that you receive can be uploaded into Oracle FLEXCUBE as Islamic LC contracts. Depending on whether confirmation is required, the uploaded Islamic LCs will be of type ‘advice’ or ‘advice and ‘confirm’.

Similarly, you can upload MT 760 messages as Guarantee contracts and copy the details of the incoming guarantee from field 77c (and amend these details, if required). You only need to furnish minimal details such as the Currency, the Amount, the Parties, etc.

Upload processing will also upload the document reference of Shipping Guarantee Contracts.

5.2 Islamic LC Contract Details Screen Description

This section consists of the following topics:

- Section 5.2.1, "Description of the Islamic LC Contract Details Screen"

- Section 5.2.2, "Specifying the Main Details of an Islamic LC"

- Section 5.2.3, "Viewing the Media Addresses of a Customer"

- Section 5.2.4, "Capturing Draft Details"

- Section 5.2.5, "Specifying Insurance Details"

- Section 5.2.6, "Specifying Details of the Parties involved in an Islamic LC"

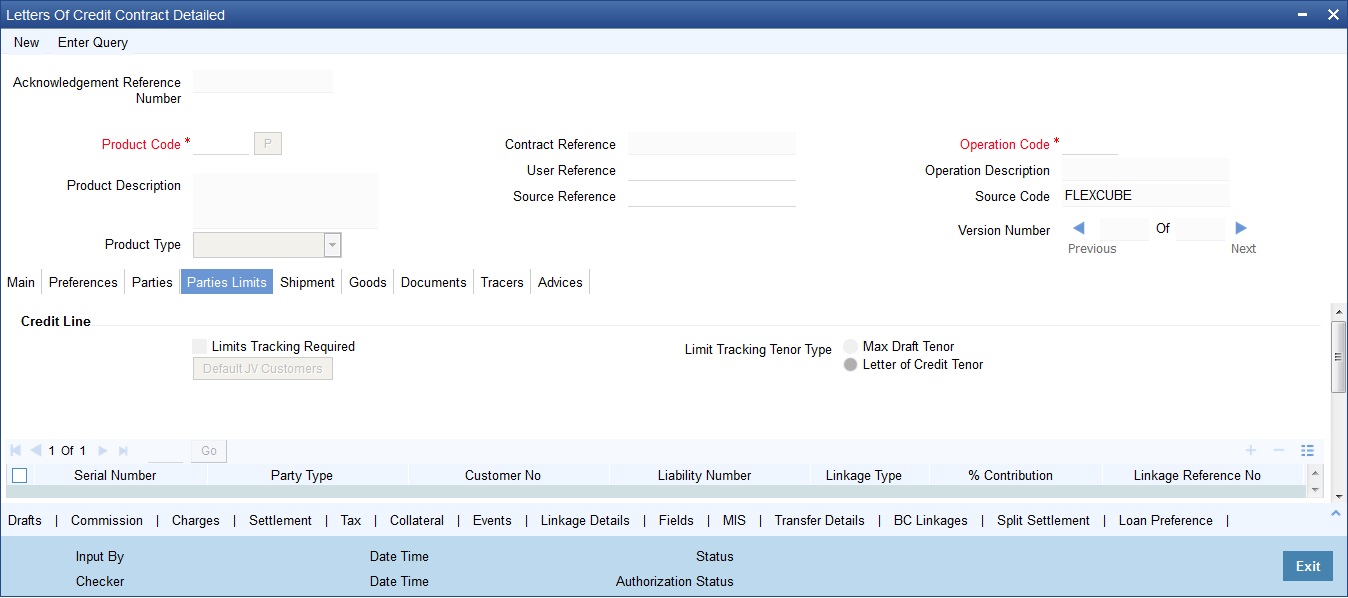

- Section 5.2.7, "Specifying Parties Limits"

- Section 5.2.8, "Updating Parties’ Limits on Amendment of Islamic LC Contract"

- Section 5.2.9, "Updating Parties’ Limits on Islamic LC Availments"

- Section 5.2.10, "Specifying the Media Details for a Party"

- Section 5.2.11, "Specifying Credit Administration Details"

- Section 5.2.12, "Specifying Advices for an Islamic LC"

- Section 5.2.13, "Specifying the Free Format Instructions that should accompany an Advice"

- Section 5.2.14, "Specifying Shipping for an Islamic LC"

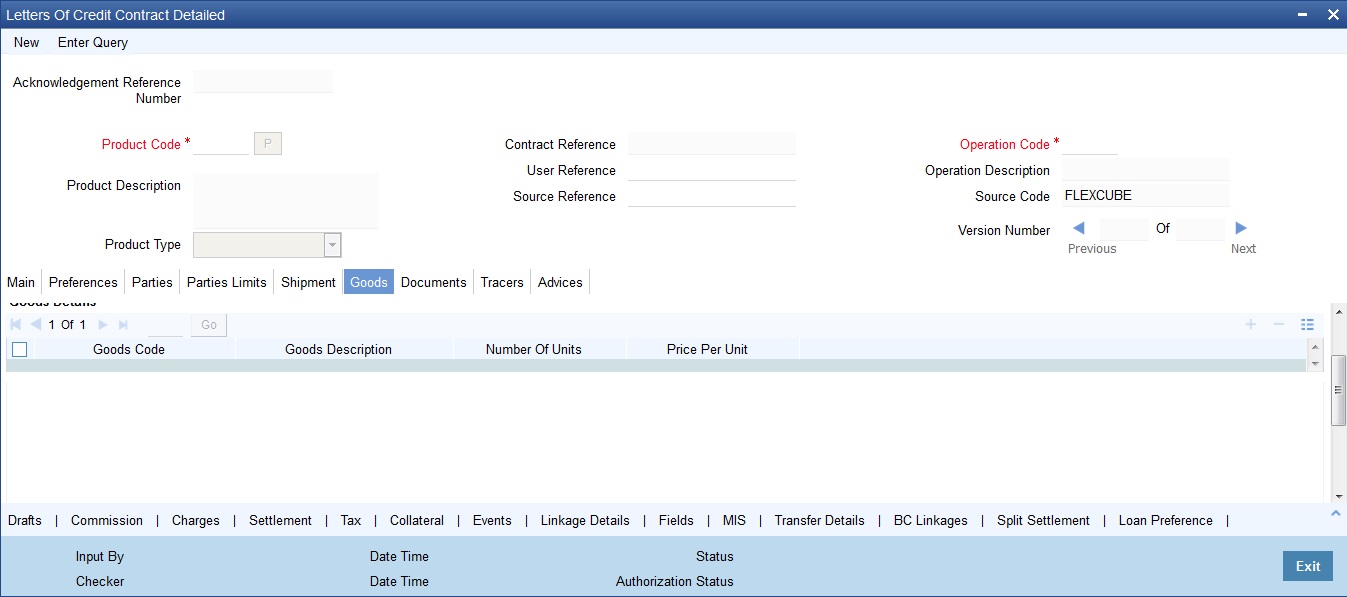

- Section 5.2.15, "Specifying Goods Details"

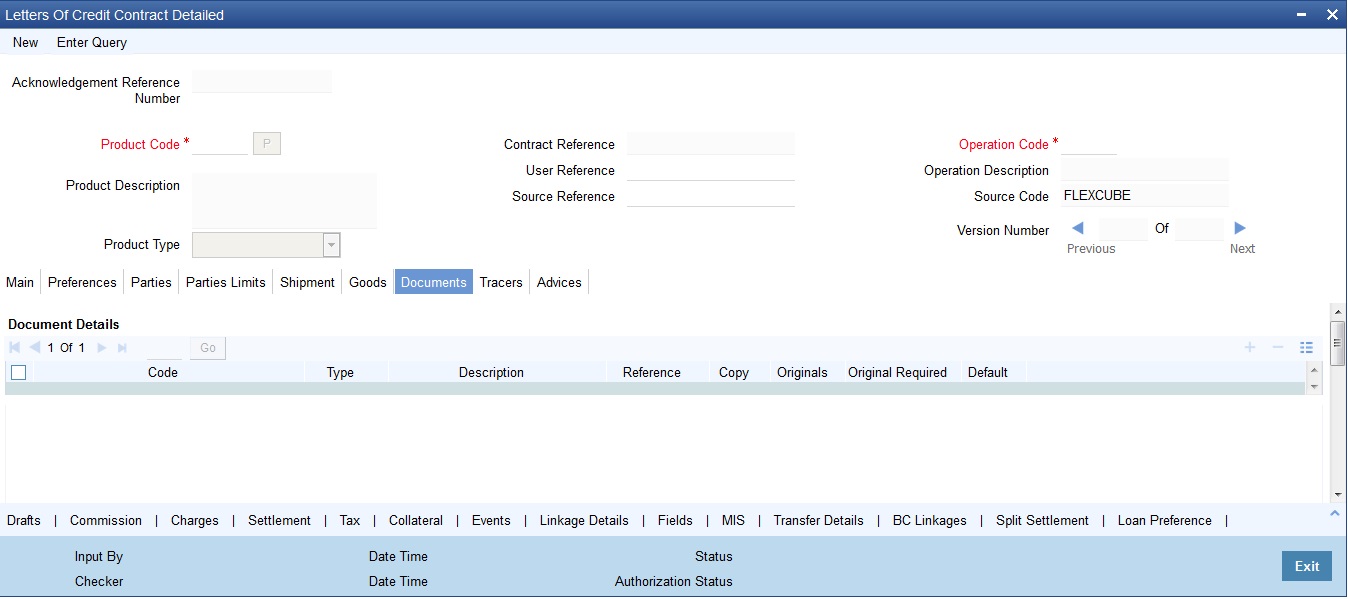

- Section 5.2.16, "Specifying Document Details"

- Section 5.2.17, "Specifying Tracer Details for an Islamic LC"

- Section 5.2.18, "Specifying Settlement Instructions"

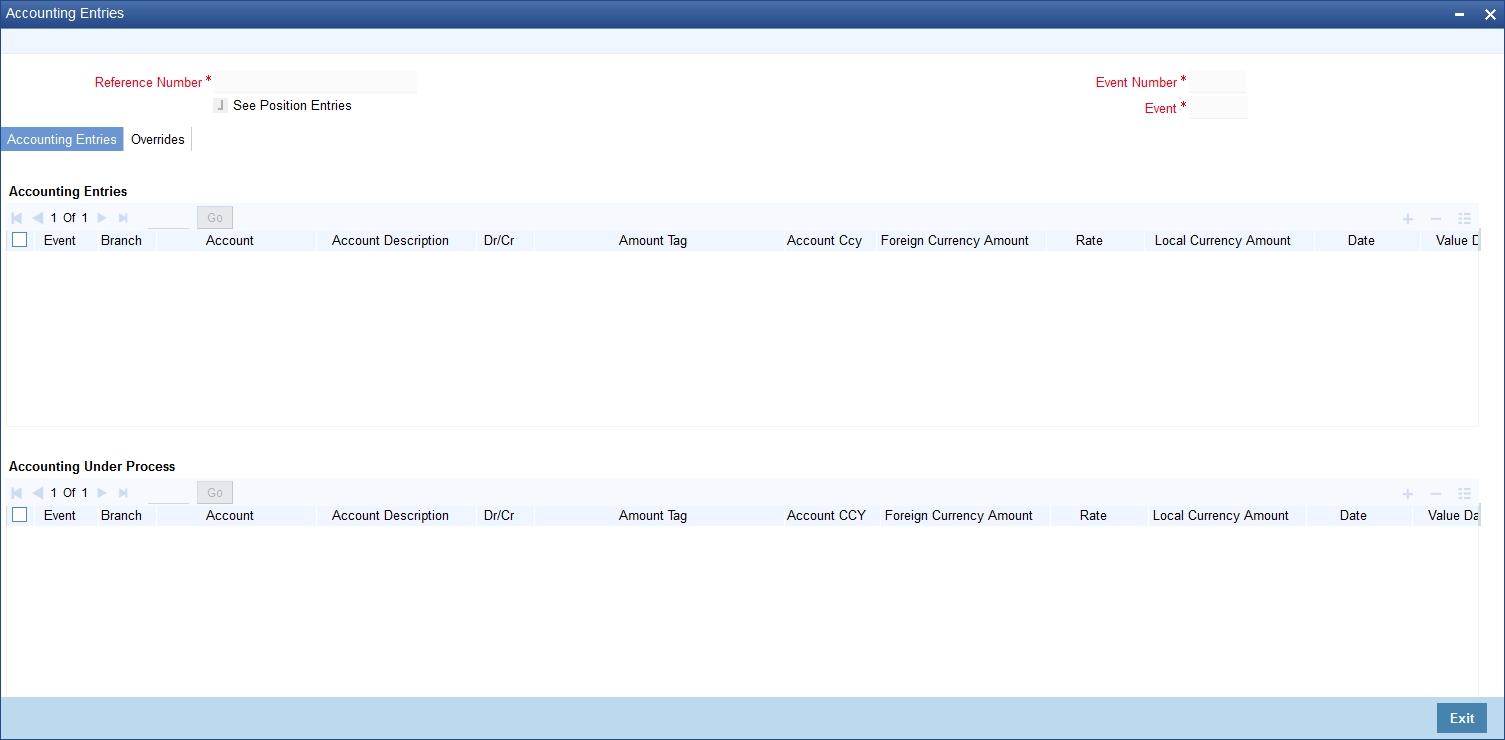

- Section 5.2.19, "Viewing Event Details"

- Section 5.2.20, "Defining Commission and Charge Details for an Islamic LC"

- Section 5.2.21, "Maintaining Collateral Details"

- Section 5.2.22, "Collateral Transfer from Islamic LC to Bills"

5.2.1 Description of the Islamic LC Contract Details Screen

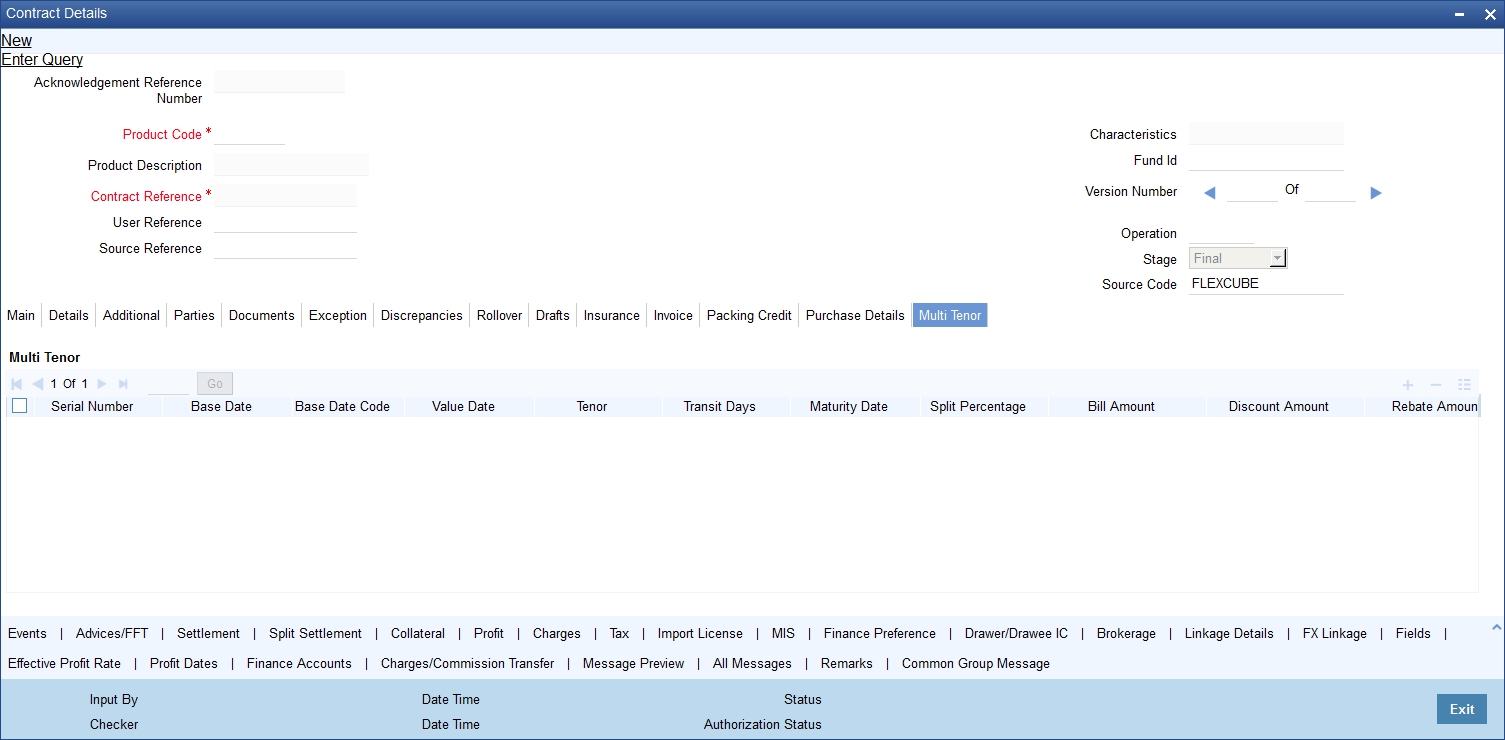

The Islamic LC Contract Details screen consists of a header and footer that contains fields specific to the contract being entered. Besides these, you will also notice six tabs and a horizontal array of icons along the lines of which you can enter details of the contract. Contract details are grouped into the various screens according to the similarities they share.

The Islamic LC Contract Screen contains six tabs along the lines of which you can enter details of the contract. The six tabs are:

Tabs |

Description |

Main |

Click this tab to enter the essential terms of the Islamic LC. This screen along with its fields has been detailed under the head Entering Main Contract Details. |

Preference |

Click this tab to set the preferences |

Parties |

In the screen that corresponds to this tab, you can enter the details of all parties involved in the Islamic LC. This screen along with its fields has been detailed under the head Entering Party Details. |

Parties Limit |

Click this tab to capture parties limit details |

Shipment |

In the screen that corresponds to this tab you can enter details of the documents required under an Islamic LC and the clauses that should accompany the documents. Besides, you can also specify a description of the merchandise traded under the Islamic LC and shipping instructions for the transportation of the merchandise. |

Goods |

Click this tab to capture the goods details |

Documents |

Click this tab to capture the document details |

Tracers |

Click on this tab to enter details of the tracers that should be generated for an Islamic LC. |

Advices |

In the screen corresponding to this tab you can view, suppress and prioritize the advices that are to be generated for a contract. This screen along with its fields has been detailed under the head Specifying Advises for an Islamic LC. |

On the Contract Detailed screen are also displayed a horizontal toolbar. The buttons on this toolbar enable you to invoke a number of functions vital to the processing of an Islamic LC contract. These buttons have been briefly described below.

Buttons |

Description |

Drafts |

Click this button to capture the details of draft drawn for the LC. You can specify the name of the insurance company that is covering the goods traded under the LC. |

Commission |

On invoking this button Commission details of the contract are displayed |

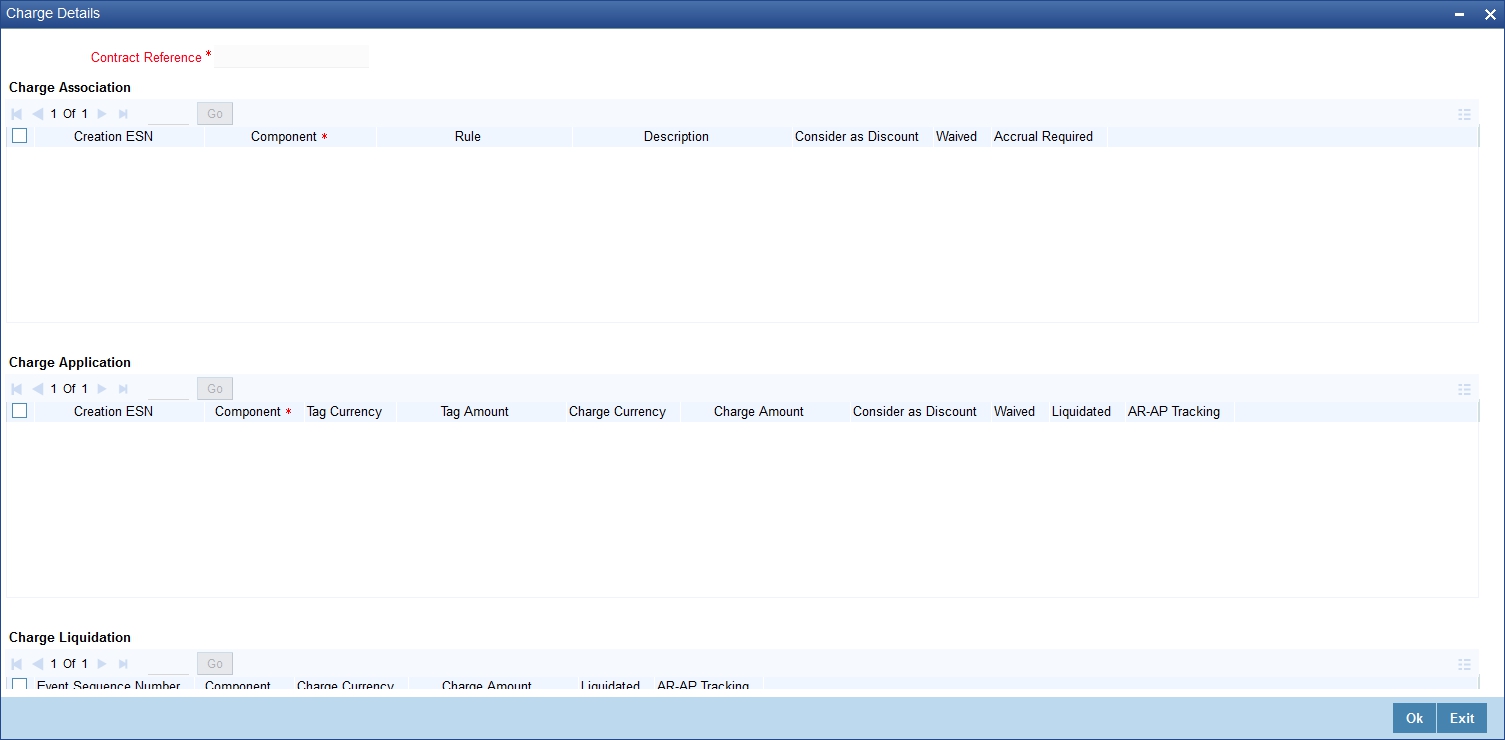

Charges |

This button invokes the Charges and Fees service. On invoking this function you will be presented with a screen where the ICCF rate, amount, currency and the waive charge parameter can be specified. The Processing Charges and Fees manual, details the procedure for maintaining charge rules. It also deals with the linking of a charge rules to a product and the application of the rule on an Islamic LC. The Processing Commissions manual, details the procedure for maintaining commission rules. It also deals with the linking of a commission rule to a product and the application of the rule on an Islamic LC. |

Settlement |

Click this button to invoke the Settlement screens. Based on the details that you enter in the settlement screens the Islamic LC will be settled. The details of these screens have been discussed in the Settlements manual. |

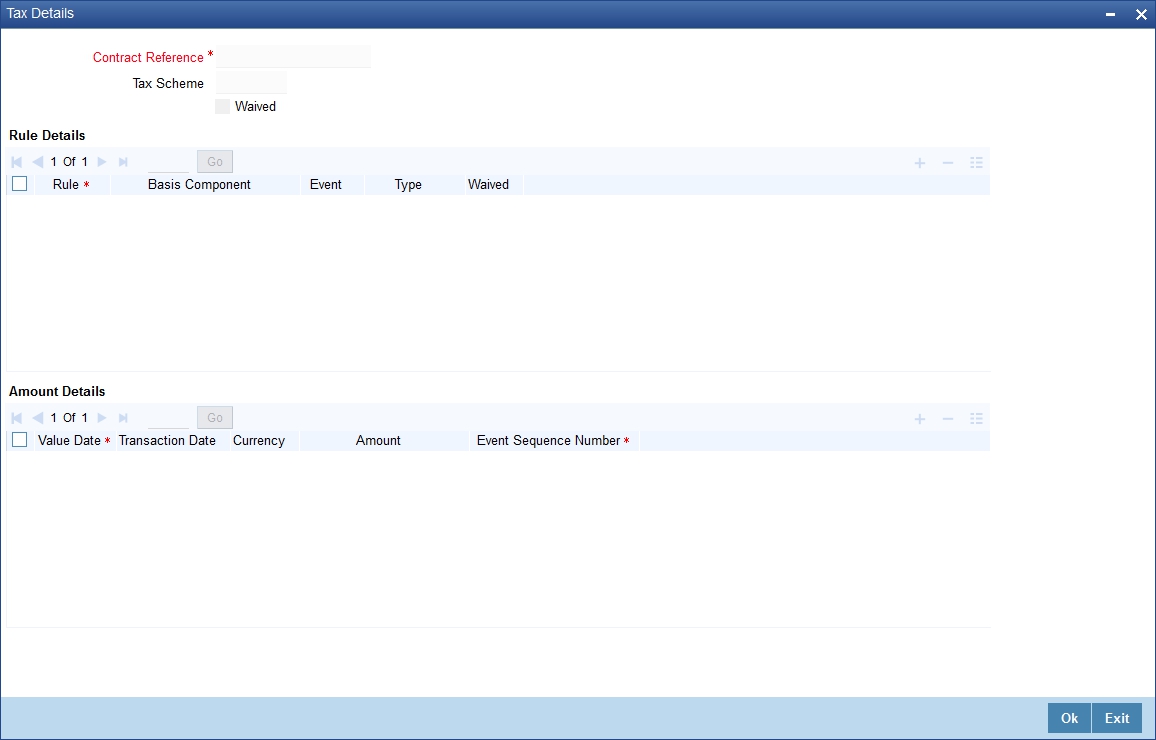

Tax |

This button invokes the Tax services. The Processing Tax manual details the procedure for maintaining tax rules and schemes. It also deals with the linking of a tax scheme to a product and the application of the scheme on an Islamic LC. |

Collateral |

In the screen that corresponds to this icon, you can specify details of the cash that you collect as collateral form a customer for the Islamic LC that you process. The details of this screen are discussed under the head Specifying Collateral details for an Islamic LC. |

Events |

Click this button to view the details of the events and accounting entries that a contract involves. |

Linkage Details |

Clicking this button invokes the Contract Linkages screen. In this screen, you can link an Islamic LC to a deposit or account, and indicate the funds that you would like to block. |

Fields |

Click this button to view the user-defined fields linked to the product. |

MIS |

Click this button to define MIS details for the Islamic LC. |

Transfer Details |

If the LC is transferred to a new party then a transaction will be populated here. You can only view the details. |

IB Linkages |

Click this button to specify IB linkages |

Split Settlement |

Click this button to specify split settlement details |

Finance Preference |

Click this button to invoke the ‘Finance Preference Screen’. You can enter the details of the finance. |

Brokerage |

Use this button to capture brokerage details for the Islamic LC contract and set your preferences for sharing the brokerage amount among multiple brokers. |

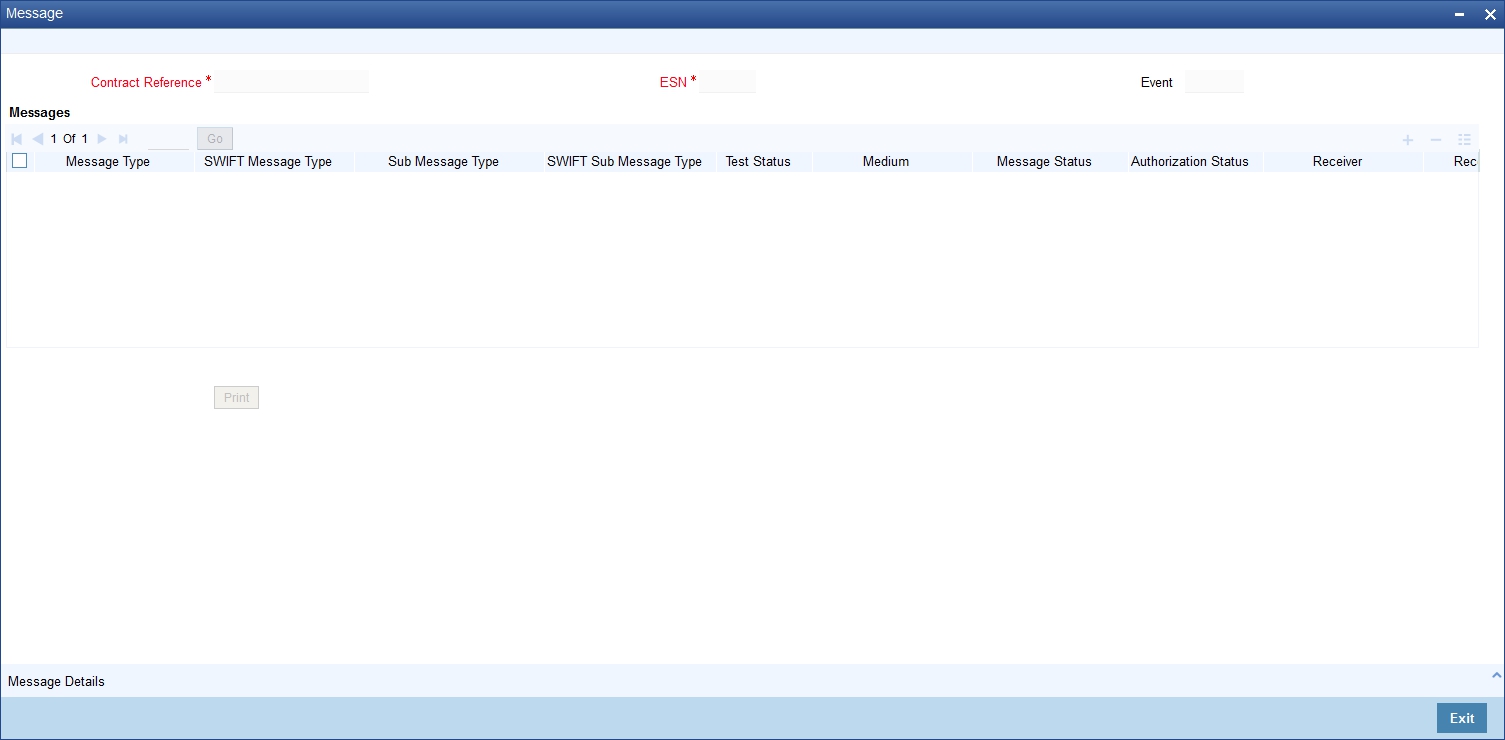

All Messages |

Click this button to view all messages associated to contract. |

Documents |

Click this button to capture the customer related documents in central content management repository. |

Deferred Profit Component |

Click this button view the components which are transferable to BC in Oracle FLEXCUBE |

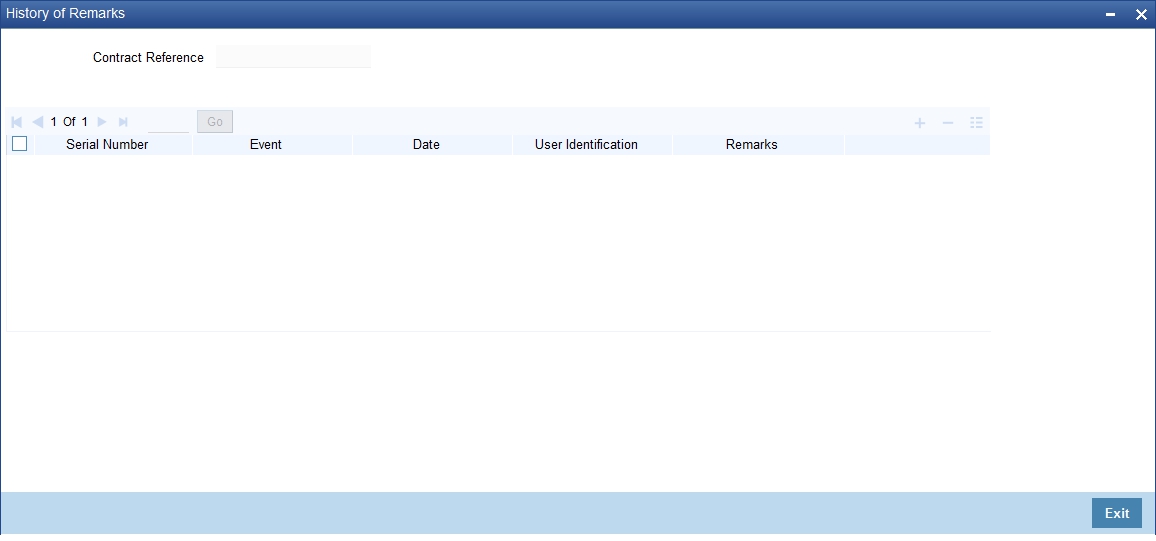

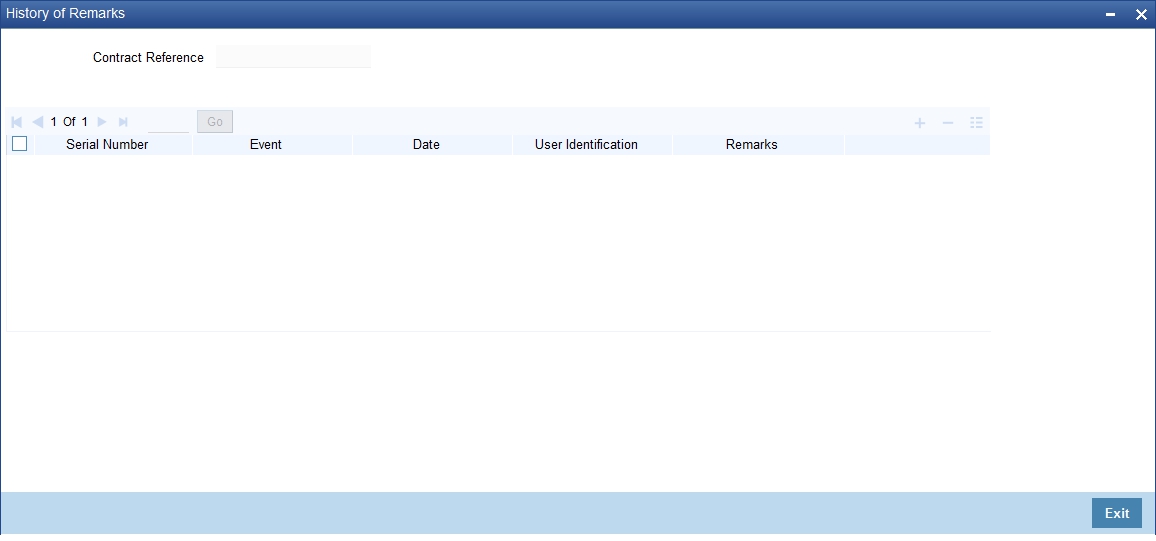

Remarks |

Click this button to view ‘History of Remarks’ screen. |

Change Log |

Click this button to view the changes made to a particular version of an Islamic LC contract. |

Transferred Components |

Click this button to view the deferred components details screen. |

Insurance |

Click this button to capture insurance details for the LC. |

Common Message Group |

Click this button to invoke the common group message screen.

|

Enter valid inputs into all the mandatory fields or you will not be able to save the contract. After making the mandatory entries for the Islamic LC, save the contract by either clicking ‘Save’ icon in the tool bar

A contract that you have entered should be authorized by a user bearing a different Login ID, before the EOD is run.

Note

You have the option to amend all the unauthorized entries made for an Islamic LC. However, after authorization, certain fields cannot be amended.

Click on ‘Exit’ button to go back to the Application Browser.

Hold Support during Islamic LC Issuance [LIDTRONL]

Click HOLD button to support a New operation during Islamic LC Issuance from LIDTRONL. The system is enhanced to support Hold during LC amendment.

- User can unlock contracts put on HOLD, modify details if required and Save. In the existing functionality of amendment, Save would continue ‘Deletion of Hold’ and ‘Hold of Hold’ support.

- 'Similar to Hold of New operation', the system will perform only mandatory validations.

- Validations applicable during amendment, will be processed.

However, authorization is not supported for Contracts put on Hold.

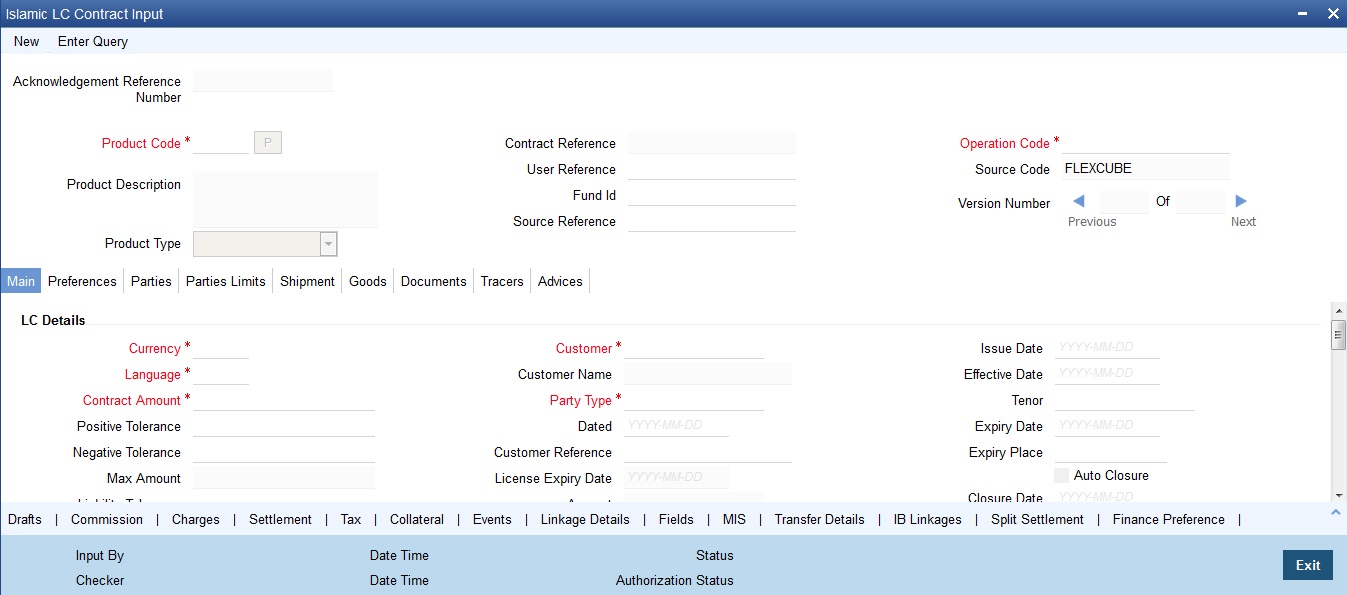

5.2.2 Specifying the Main Details of an Islamic LC

While defining a product, you defined a broad outline that can be applied on Islamic LCs. However, while processing an Islamic LC involving a product, you need to enter information specific to the Islamic LC.

This information is captured through the ‘Islamic LC Contract Details Main’ screen.

The following are the features of the contract details main screen.

LC Details

The terms defined for an Islamic LC form the basis on which the Islamic LC will be processed.

Currency

Specify the currency in which the Islamic LC is drawn.

Contract Amount

Specify the amount for which the Islamic LC is drawn.

Tolerance Text

Select the applicable tolerance text from the adjoining drop-down list. The available options are:

- None

- About

- CIRCA

- Approximately

Customer

If the applicant is a customer of your bank, specify the CIF ID assigned to the customer, the related details of the customer will be automatically picked up.

If you are processing an Export LC, you should typically specify details of the beneficiary.

Specify the ‘Customer’ for which you need to maintain. Alternatively, you can select the ‘Customer’ from the adjoining option list also.

Note

BIC Code appears for a ‘Customer’ only if the BIC Code is mapped with that Customer Number. If the BIC code is not mapped with that Customer Number then the BIC Code will not appear next to the ‘Customer’ in the adjoining list.

Customer Name

The system displays the customer name.

Party Type

Specify a valid party type. The adjoining option list displays all valid party types maintained in the system. You can select the appropriate one.

Dated

Enter the date of the Their Reference. This would normally be the date on which you have a correspondence from the party regarding the LC.

Customer Reference

This is the reference of the party whose CIF ID you have input. This will be picked up appropriately in the correspondence sent for the LC.

License Expiry Date

The system displays the license expiry date.

Amount

The system displays the amount for which the LC is drawn.

Expiry Place

Specify the city, country, or the bank where the LC expires.

Applicable Rule

This is defaulted from the product level. The value displayed here cannot be amended.

Issue Date

Enter the date on which the Islamic LC is issued.

Effective Date

In the Islamic LC Contract Details screen, you can capture the Effective Date of a guarantee. The effective date that you capture for a guarantee will be printed on the instrument.

By default, the system displays the Issue Date, in the Effective Date field. You can change the default value (for a guarantee) to a date in the past or future.

As stated earlier, the Effective Date along with the Tenor of the Islamic LC will be used to calculate the Expiry Date of the Islamic LC.

Note

Please note that commission for a guarantee, will be calculated according to your specifications for the product that the guarantee involves. In the Islamic LC Product Definition screen, you can indicate if commission is to be calculated from:

- The Issue Date

- The Effective Date

- The earlier of the two

Tenor

All Islamic LC contracts will be associated with the standard tenor maintained for the product under which the contract is being processed. The tenor of the Islamic LC will be used in combination with the Effective Date to arrive at the Expiry Date of the Islamic LC, as follows:

Islamic LC Expiry Date = Effective Date + Tenor

However, for a specific Islamic LC contract, you can choose to maintain a different tenor. The tenor of an Islamic LC can be expressed in one of the following units:

- Days (D)

- Months (M)

- Years (Y)

Note

If you do not specify a unit, the system will automatically append ‘D’ with the numeric value (tenor) indicating that the tenor is expressed in Days.

Depending on the tenor that you specify, the system will recalculate the Expiry Date. Consequently, the Closure Date that is dependent on the Expiry Date will also be recalculated by the system.

Expiry Date

Specify the date when the LC expires.

Auto Closure

Check this option to indicate that the Islamic LC should be automatically closed.

Note

This field is not applicable for Islamic LC Module Contracts under Islamic LC Product with Product Type `G’ (Guarantee).

Closure Date

The date of closure is based on the ‘Closure Days’ maintained for the product involved in the Islamic LC. The number of days specified as the Closure Days is calculated from the expiry date of the Islamic LC, to arrive at the Closure Date.

Islamic LC Closure Date = Islamic LC Expiry Date + Closure Days

However, you can change the closure date, thus calculated, to any date after the expiry date.

Note

If the closure date falls on a holiday, the system will prompt you with an override message.

Pre Advice Date

Specify date on which the pre-advice was initiated from the adjoining calendar. The current date is defaulted as pre-advice date, if the operation is Pre-advice Islamic LC; however you can change to an earlier date.

Note

Modifications are not allowed after first authorization.

Reference to Pre-advice

Specify reference to the pre-advice, if any, generated for the Islamic LC contract.

A pre-advice is a brief advice of documentary credit sent by the Issuing Bank to the Advising Bank. This is to be followed by the Islamic LC instrument that contains all the details of the Islamic LC. It notifies the recipient that the named buyer has opened an Islamic LC for a specified amount on a named seller (beneficiary).

Note

Modifications are not allowed after first authorization.

top Date

This date will be defaulted to LC Expiry date. Stop date cannot be earlier than Issue date and later than expiry date.

Credit

You can capture the following details.

Type

Indicate the type of credit for which the LC is being processed.

Mode

Indicate the mode of payment through which the LC will be settled.

If you indicate the LC type as sight in the LC Product Definition screen, then you can select the credit mode as:

- Sight Payment

- Negotiation.

If you indicate the LC type as Usance in the LC Product Definition screen, then you can choose the credit mode as:

- Acceptance

- Deferred Payment

- Mixed Payment

- Negotiation

These validations are applicable only if drafts information is maintained in the Drafts sub-system. These validations are applicable for both Import and Export LC products.

Credit Available With

Specify details of the party with whom the credit will be available.

Details

Specify the details of the credit.

Reimbursement Undertaking

You can capture the following details:

Undertaking Expiry Date

Specify the undertaking expiry date.

You can claim the reimbursement only till the undertaking expiry date, else, the system will display the following error message “The undertaking has been expired”.

Undertaking Amount

Specify the amount that can be reimbursed. It can be less than or equal to contract amount.

The system will default the Undertaking Amount value with the Max LC Amount initially when it is created through the incoming MT740. However you can amend this field by adding the undertaking amount.

Availed Undertaking Amount

The system displays the availed portion of undertaken amount.

Note

- Undertaking Expiry Date and Undertaking Amount fields can be entered for reimbursement contracts only.

- Undertaking Expiry date can be entered only when Undertaking Amount has been specified.

- Undertaking Expiry date cannot be earlier than the issue date or later than the Islamic LC Expiry date.

- In case when Islamic LC Expiry date is not input then Undertaking Expiry date cannot be greater than the Islamic LC closure date.Revolving Details

You can capture the following details.

Revolves In

Islamic LCs can revolve in Time or in Value. Select the appropriate option from the adjoining drop-down list.

Automatic Reinstatement

The mode of reinstatement for a revolving Islamic LC can be either automatic or manual. Check against this field to indicate that the mode of reinstatement is automatic.

This field is applicable only for an Islamic LC revolving in time.

Cumulative

Check this box to indicate that the Islamic LC is cumulative. Leave it unchecked to indicate otherwise.

Frequency

For Islamic LCs that revolve in value, you can specify the maximum number of times the Islamic LC can be reinstated. Based on the value you specify, the Islamic LC Liability Amount will be computed and displayed.

If the number of reinstatements of the Islamic LC exceeds the value you specify, an override message will be displayed when the Islamic LC is saved. This override will have to be ratified at the time of contract authorization.

Units

For Islamic LCs, which revolve in time, the maximum number of reinstatements is calculated based on the Reinstatement Frequency you specify. In the Units field, you can choose one of the following:

- Months

- Days

Next Reinstatement Date

The system computes and displays the date of next reinstatement based on the value in ‘Units’ field.

Remarks

You can specify remarks here if any.

Finance for Collateral

Check this box if finance for collateral is applicable.

Partial Closure

Check this box to perform partial closure of Islamic LC manually.

You can check this box during the following conditions:

- ‘Unlock’ Operation

- If the product is not of Revolving type

- On or before the Expiry date of the Islamic LC

On saving the amendment after checking this option, PCLS event takes place. The Limits, Outstanding Liability and the Cash Collateral are released to the extent of unutilized amount.

Once PCLS event is fired for an Islamic LC contract, system does not allow any operation on the Islamic LC other than LC Closure (CLOS). You can reopen the closed Islamic LC as existing. While reopening the Islamic LCs for which PCLS is fired earlier, the Limits are tracked, OS Liability and Cash collateral is increased to the extent of the amount released as part of PCLS.

After PCLS event takes place on the Islamic LC contract, if the Bill contract to which the Islamic LC is linked is reversed, the corresponding availment of Islamic LC is reversed and the Limits, OS Liability and the Cash Collaterals are updated. The linkages to the Islamic LC are not released automatically as part of PCLS firing during batch. You have to manually release as part of manual partial closure. The above processes are skipped for the Islamic LC contracts under the product for which the ‘Revolving’ option is indicated as ‘Yes’.

The system allows manual partial closure during the partial closure days, until the Islamic LC is closed.

In case of a partially confirmed export Islamic LC contract, the system excludes the bill amount in the initial stage from the confirmed and unconfirmed portions.

Contract Status

Specify the following details:

User Defined Status

Specify the status of the Islamic LC contract. The option list displays all valid statuses that are applicable. Choose the appropriate one.

At the branch level, if you have enabled group level status change for the Islamic LC, the system displays the status of the group with which the Islamic LC is associated. However, you can unlock and modify the statuses of individual contracts. Thus, you can use this field for changing the status of an Islamic LC contract manually.

Derived Status

The system displays the derived status of the Islamic LC contract. You cannot modify this.

Sanction Check Status

The system displays the sanction check status once the sanction check is performed. The system displays any of the following statuses:

- P - Pending

- X - Pending

- A - Approved

- R - Rejected

- N - Not Required

Last Sanction Check Date

The system displays the last sanction check date.

For more information on processing sanction check refer ‘Processing Sanction Check’ section in LC user manual.

Debit Account Branch

The system defaults the details of debit account branch. The values can be modified.

Debit Account Currency

The system defaults the details of debit account currency. The values can be modified.

Debit Account

The system defaults the debit account. The values can be modified.

Charges Debit Account Branch

The system defaults the details of charges debit account branch.The values can be modified.

Charges Debit Account Currency

The system defaults the details of charges debit account currency. The values can be modified.

Charges Debit Account

The system defaults the details of charges debit account. The values can be modified.

5.2.3 Viewing the Media Addresses of a Customer

While capturing the details of the counterparty involved in an Islamic LC or Islamic LC transfer contract, the system displays the Media Address details of the customer once you specify the CIF ID assigned to the party.

Note

When you specify the CIF ID, the system will check to see if you have maintained multiple media addresses for the specific customer. If you have maintained multiple media addresses, a list of all the media addresses will be displayed in a separate window.

Viewing the BIC Details of a Customer

If the media type of the party is SWIFT, and the customer address you have specified is a BIC customer, the system automatically displays the related BIC details in a separate window.

5.2.4 Capturing Draft Details

You can capture the details of the draft that is drawn for the Islamic LC, in the ‘Drafts’ screen. In addition, you can also specify the name of the insurance company that is covering the goods traded under the Islamic LC. Click on ‘Drafts’ button in the ‘Islamic LC Contract’ screen to invoke the screen:

5.2.4.1 Specifying Draft Details

In this section, you can specify the following details:

Draft Serial Number

Specify the serial number of the draft.

Draft Tenor

Specify the tenor of the draft.

Credit Days From

Specify the Date from which the tenor of the draft begins.

Amount/Percentage

Specify whether the draft is a percentage of the Islamic LC amount or a Flat amount. Subsequently, specify the Amount or the Percentage (based on your selection).

5.2.4.2 Specifying the Drawee Details

In this section specify the following details:

Drawee

The ‘Drawee’ is the party on whom the draft is drawn. You can select the drawee’s BIC from the adjoining list. This will contain a list of all the open and authorized BIC maintained in the BIC Directory. Click option list to populate the Drawee field with the drawee’s name and address. This information is captured from the BIC directory.

Address

Specify the addresses of the drawee.

5.2.4.3 Specifying the Insurance Details

The following details are regarding the Insurance Company to be associated with the LC.

Company Code

You can select the appropriate company code from the option list. The list will display all authorized and active company codes. Upon selection of the company code, the following details will be automatically displayed by the system:

- Company Name

- Address of the company

- Telephone Number

- Fax Number

Company Name

Specify the full name of the insurance company.

Address

Specify the mailing address of the insurance company being defined. You can maintain a maximum of four lines of address.

Policy Number

Specify the insurance policy number here.

Telephone Number

You can also capture the telephone number of the insurance company.

Fax Number

Specify the Fax number of the insurance company.

Expiry Date

Enter the expiry date of the policy.

Policy Utilized Amount

Specify the utilized amount of the policy.

Cover Date

Specify the cover date.

Insurance Amount

Specify the insurance amount.

Telex

Specify the telex number.

Warehouse Address

Specify the warehouse address.

5.2.4.4 Specifying the Breakup Details

The breakup details of the draft will be displayed here as follows:

- Amount Name

- Amount

The draft amounts for the different components (Insurance, Profit, Invoice and Freight)

Note

You can also choose to associate an Insurance Company that is not maintained in the system. When you are specifying a company code that does not exist, the system will display an override (based on your requirement, you can configure the override to be a warning or an error message). On confirmation of the override, the company code will be automatically changed to ‘XXXXXXXXX’. Subsequently, you can specify any company name to be associated with the contract. The system will not perform any validations. The remaining fields in the screen will be disabled in this case.

5.2.5 Specifying Insurance Details

You can capture the insurance details for an Islamic LC contract in the ‘Customer Insurance’ screen. To invoke this screen, click ‘Insurance’ button in the ‘Islamic LC Contract’ screen.

Here you can capture details for multiple insurance policies.

Policy No

Specify the insurance policy to be considered for the Islamic LC contract. The adjoining option list displays all the valid insurance policies maintained for the Islamic LC customer. You can select the appropriate one.

Currency

The system displays the currency of the chosen policy. If the currency of the Islamic LC is different from the currency of the insurance, then the system will convert the Islamic LC amount to insurance currency using standard mid rate.

Company Name

The system displays the company to which the insurance policy belongs.

Expiry Date

The system displays the date on which the chosen policy expires. If the expiry date of the insurance is prior to the expiry date of the Islamic LC, the system will display an override.

Insurance Amount

The system displays the available amount for the chosen policy in the contract currency. You can change it to suit the contract’s requirements. However, the amount cannot exceed the per bottom limit defined for the policy in the ‘Customer Insurance’ screen. If the amount exceeds the permissible limit, the system will display an override.

The total insurance amount linked to the Islamic LC should not be greater than the Islamic LC liability amount. If the total exceeds the limit, the system will display an override.

Utilization Lcy Amount

In case the contract currency is different from the insurance currency, the system displays the insurance amount in the insurance currency.

5.2.6 Specifying Details of the Parties involved in an Islamic LC

The Parties screen can be used to record the details related to all the parties involved in the Islamic LC. The documents, tracers and messages that are generated will be sent to the parties concerned, based on the details you specify in this screen.

You can maintain the following details here:

5.2.6.1 Specifying Party Details

You should specify the following for each of the parties involved in the Islamic LC:

Party Type

The party type (beneficiary, accountee, applicant, advising bank, issuing bank, reimbursing bank, advice through bank, confirming bank).

Party Description

You can provide the description for the party type here.

Party ID

Specify a ‘Party ID’ for which you need to maintain. Alternatively, you can select the ‘Customer No’ from the adjoining option list also.

Note

BIC Code appears next to the 'Customer No' only if the BIC code is mapped with that customer number.If the BIC Code is not mapped with that Customer Number, then the BIC Code will not appear next to the ‘Customer No’ in the adjoining option list.

Customer Identification File Identification

The CIF ID assigned to the party, if the party is defined as a customer in Oracle FLEXCUBE. If the applicant (APP) or beneficiary (BEN) is not a customer of your bank, you can use a walk-in customer ID.

Name

Enter the name of the Customer. The party name can be 150 characters in length. However, please note that in the SWIFT messages that you generate only 35 characters will be included.

Country

Enter the country to which the party belongs.

Address 1 to 4

Enter the address of the customer who has initiated the transaction.

Dated

Specify the date of transaction initiation.

Language

Specify the language in which advices should be sent to the customer.

Issuer

The issuer of Islamic LC is a bank or an individual. This is enabled only for the party type ISB (issuing Bank). The party type is defaulted from CIF maintenance. However, you can amend the value before authorizing the contract.

If issuer of Islamic LC is a bank, tags 52A and 52D will be populated. The message Types supported by these tags are MT710/MT720.

If issuer of Islamic LC is not a bank, 52B tag will be populated.

Template ID

Specify the template ID related to MT799 message types from the option list.

Note

You can enter the values only if the ‘Claim Advice in Swift’ field is checked.

5.2.6.2 Specifying the Other Addresses

Following details are displayed here:

- The media type through which the advises should be routed and the respective address(es)

- The party’s mail address

- The account

The parties involved in an Islamic LC depend upon the type of Islamic LC you are processing. The following table indicates the minimum number of parties required for the types of Islamic LC that you can process.

Islamic LC type |

Parties applicable |

Mandatory parties |

Parties not allowed |

Import Islamic LC |

Applicant/Accountee Advising Bank Beneficiary Confirming Bank Reimbursing Bank |

Applicant and Beneficiary

|

Issuing Bank |

Export Islamic LC |

Applicant/Accountee Issuing Bank Advising Bank Beneficiary Confirming Bank Reimbursing Bank |

Beneficiary and Issuing Bank |

Advising Bank |

Shipping Guarantee |

Applicant/Accountee Advising Bank Beneficiary Confirming Bank Advice Through Bank Reimbursing Bank |

Applicant and Beneficiary |

Issuing Bank |

Guarantee |

Applicant and Beneficiary |

Applicant and Beneficiary |

Advising Bank Advise Through Bank Reimbursement Bank Issuing Bank |

Standby |

Applicant/Accountee Advising bank Beneficiary Confirming bank Reimbursing bank |

Applicant and Beneficiary |

Issuing Bank |

Clean Islamic LC |

Applicant/Accountee Advising bank Beneficiary Confirming bank (for confirmed Islamic LCs only; could be more than one bank) |

Applicant and Beneficiary |

Issuing Bank |

Note

While processing Islamic LCs and guarantees, you can use the walk-in customer ID for the applicant (APP) and Beneficiary (BEN) party types. However, note that you can use a particular CIF ID only once in an Islamic LC.

Opting to amend Party Details during System Setup

Oracle FLEXCUBE offers you the facility to edit the party details that you capture in the Islamic LC Contract Online screen. You may exercise this option when setting-up the system at your bank

If you opt for the edit facility, you can change the following party and credit details, captured for an Islamic LC, in the Islamic LC Contract Details screen:

- The Name

- The Mailing Address

- The Credit Details

Click on the adjoining button, adjacent to the name, address and credit details fields, to invoke a popup window. In this screen, you can edit the party and credit details originally captured for the Islamic LC.

Media Type

The system defaults the media type. You can select a different medium from the adjoining option list.

Address

The system defaults the other address of the party. However, you can modify this.

Account

The system defaults the account number. However, you can modify this.

5.2.7 Specifying Parties Limits

Oracle FLEXCUBE allows you to track the credit limits for joint venture customers who are parties to an Islamic LC contract. Using ‘Parties Limits’ tab, you can track the limits of multiple credit lines in an Islamic LC contract. Click ‘Parties Limit’ tab on ‘Islamic LC Contract Details’.

Specify the following details:

Limits Tracking Required

Check this box to indicate that limit tracking is required for the parties to the Islamic LC contract. If you check this box, the system will let you set the limits for multiple credit lines in the contract. If you do not check this box, the system will not track the parties’ limits.

On checking this box, the system enables ‘Default’ button. You can use this button to get the default values for the parties in the credit lines.

Limit Tracking Tenor Type

Choose the limit tracking tenor type from the following options:

- Letter of Credit tenor

- Max Draft Tenor

Party Type

Specify the type of the party whose credit limits need to be tracked.

If you click ‘Default’ button, in the first row, the system defaults the joint venture party type based on the joint venture party selected under ‘Parties’ tab of ‘Islamic LC Contract Details’ screen. However, you need to make sure that the mandatory party details have been maintained under ‘Parties’ tab of the screen.

When you add another row to the list, you can manually select the party type as required. If you leave it blank, the system will automatically update the party type when you save the contract.

Customer No

Specify the customer number of the party whose credit limits need to be tracked. The option list displays the customer numbers of all the parties selected under ‘Parties’ tab..Specify the ‘Customer No’ for which you need to maintain. Alternatively, you can select ‘Customer No’ from the adjoining option list also.

Note

BIC Code appears next to the 'Customer No’ only if the BIC code is mapped with that customer number. If the BIC Code is not mapped with that Customer Number, then the BIC Code will not appear next to the ‘Customer No’ in the adjoining option list.

You need to make sure that the customer number corresponds to the party type selected above. If the customer number and party type do not match, the system displays an error.

JV Parent

When you click ‘Default’ button, the system defaults the joint venture customer number of the party. This customer number is defaulted based on the details maintained in ‘Joint Venture’ sub-screen of ‘Customer Maintenance’ screen.

Liability Number

When you click ‘Default’ button, the system defaults the liability number from ‘Joint Venture’ sub-screen of ’Customer Maintenance’ screen.

Linkage Type

Specify the linkage type. The drop-down list displays the following options:

- Facility (Credit Line)

- Collateral Pool

- Collateral

- Local Collateral

Choose the appropriate one.

Linkage Reference No

Specify the reference number that identifies the facility, collateral pool or collateral. The option list displays all valid facilities and collateral pools specific to the liability. Choose the appropriate one.

In case you choose the same linkage reference for more than one record in the list, the system displays an override message. You may choose to cancel or proceed with the selection.

% Contribution

Specify the proportion of limits to be tracked for the credit line or collateral pool for the joint venture customer. When you click ‘Default’ button, the system defaults the percentage of contribution maintained under ‘Joint Venture’ sub-screen of ‘Customer Maintenance’ screen.

It is mandatory to indicate the percentage of contribution if the party is a customer under joint venture. This is not applicable to customers who are not a part of joint venture.

Note

For one joint venture, the total percentage of contribution in all applicable credit lines together cannot be more than 100%.

Amount Tag

Specify the amount tag. The system tracks the limits for non joint venture customers based on the amount tag. The amount tags applicable to export and import Islamic LC contracts are listed below:

Amount tags applicable to Export Islamic LC:

- Liability Amount

- Confirmed Amount

- Unconfirmed Amount

- Silent Confirmation Amount

Amount tags applicable to Import Islamic LC:

- Liability Amount

- Undertaking Amount

- Non Undertaking Amount

- Liability Minus Margin

Choose the appropriate one based on the type of Islamic LC contract. If you do not specify the amount tag, the system will track the limits based on the liability amount and facility.

In ‘Parties Limit’ tab choose ‘Liability Minus Margin’ from the ‘Amount Tag’ the ‘Limit Amount’is computed as ‘Current Liability Amount’ minus the ‘Margin Amount’

In ‘Parties Limit’ tab choose ‘Silent Confirmation Amount’ from the ‘Amount Tag’ the amount computed will be ‘Silent Confirmation Amount’ which is the Liability Outstanding Amount. For joint venture customers, you need to choose ‘Liability Amount’ as the amount tag. Other amount tags are not applicable to joint venture customers.

The system verifies the amount tag against the product type. If you choose an amount tag, which is not supported by the product type, the system displays an error message.

Amount

When you click ‘Default’ button, the system defaults the amount tracked for each credit line. In case of joint venture customers, the amount is derived on the basis of the percentage of liability amount. In case of other customers, the amount is derived based on the amount tag specified above.

You can add more rows to the list of credit lines using add button. Similarly, you can remove a selected row from the list using delete button.

Once you have specified the details, save the contract. In case the limit for a credit line has been completely exhausted, the system displays a configurable override message. If you have not used ‘Default’ button while specifying the parties’ limit details, the system will automatically default the details and track the limits based on that.

5.2.8 Updating Parties’ Limits on Amendment of Islamic LC Contract

Oracle FLEXCUBE allows you to amend Islamic LC contracts. Such amendments may have direct impact on the parties limits defined in the contracts. This section examines the some amendments that can be made to an Islamic LC contract and their impact on the parties’ limits.

Increase in Islamic LC Amount

If there is an increase in the Islamic LC amount, based on the amount tag, the system updates the parties’ limits as follows:

Amount Tag |

Changes in Parties’ Limits |

Liability Amount |

The liability amount is used to track the delta amount |

Confirmed Amount |

The increased confirmed amount is used to track the parties’ limits |

Unconfirmed Amount |

The increased unconfirmed amount is used to track the limits |

Non-undertaken Amount |

The islamic LC amount is used to track the limits for the line specified under ‘Non-Undertaken Amount’ |

Liability Minus Margin |

The increased islamic LC amount is used to track the limits for the line specified under ‘Liability Minus Margin’ |

After amendment, if there is an increase in the confirmed amount, the parties’ limits are updated as follows:

Amount Tag |

Changes in Parties’ Limits |

Liability Amount |

The system does not track the limits |

Confirmed Amount |

The increased confirmed amount is used to track the limits |

Unconfirmed Amount |

The increased confirmed amount is deducted from the credit line tracked for the unconfirmed portion |

After amendment, if there is an increase in the undertaking amount, the parties’ limits are updated as follows:

Amount Tag |

Changes in Parties’ Limits |

Liability Amount |

The system does not change the parties’ limits |

Undertaken Amount |

The increased undertaken amount is used to track the limits |

Non-undertaken Amount |

The increased undertaken amount is deducted from the credit line tracked for the non-undertaken portion |

After amendment, if there is a decrease in the islamic LC amount, the system updates the parties’ limits as follows:

Amount Tag |

Changes in Parties’ Limits |

Liability Amount |

The decreased amount is deducted from the credit line tracked for the liability amount |

Confirmed Amount |

The decreased confirmed amount is deducted from the credit line tracked for the confirmed amount |

Unconfirmed Amount |

The decreased confirmed amount is deducted from the credit line tracked for the unconfirmed portion |

Liability Minus Margin |

The decreased islamic LC amount is used to track the limits for the line specified under ‘Liability Minus Margin’ |

After amendment, if there is a decrease in the confirmed amount, the system updates the parties’ limits as follows:

Amount Tag |

Changes in Parties’ Limits |

Liability Amount |

The system does not change the parties’ limits |

Confirmed Amount |

The decreased confirmed amount is deducted from the credit line tracked for the confirmed amount |

Unconfirmed Amount |

The decreased confirmed amount is added to the credit line tracked for the unconfirmed portion |

After amendment, if there is a decrease in the undertaking amount, the system updates the parties’ limits as follows:;

Amount Tag |

Changes in Parties’ Limits |

Liability Amount |

The system does not change the parties’ limits |

Non-Undertaken Amount |

The decreased undertaken amount is added to the credit line tracked for the non-undertaken portion |

After amendment, if there is a decrease in the collateral amount, the system updates the parties’ limits as follows:

Amount Tag |

Changes in Parties’ Limits |

Liability Minus Margin |

The decreased collateral amount is used to track the limits for the line specified under ‘Liability Minus Margin’ |

After amendment, if there is a increase in the collateral amount, the system updates the parties’ limits as follows:

Amount Tag |

Changes in Parties’ Limits |

Liability Minus Margin |

The increased collateral amount is used to track the limits for the line specified under ‘Liability Minus Margin’ |

If the percentage of allocation is modified, the system updates the delta amounts accordingly. If the parties in the ‘Parties’ tab are changed and the old party happens to be a joint venture party, the limit tracked against all the joint venture customers will be reduced proportionately.

If the new party is a joint venture, the new JV customers along with the relevant details will be defaulted in the ‘Parties Limits’ tab when you click ‘Default’ button. Please notice that this is applicable only to joint venture customers of the changed parties.

5.2.9 Updating Parties’ Limits on Islamic LC Availments

On receipt of the bills or on notification from the negotiating bank, you can record an availment under an Islamic LC. The system updates the parties’ limits during availment of an Islamic LC contract.

At the time of availment, the system reinstates the limits for the lines under the joint venture customers. This reinstatement takes place proportionately based on the percentage of amount utilized.

In case of non joint venture customers, the reinstatement takes place based on the amount tag selected under ‘Parties Limits’ tab. The method of reinstatement for each amount tag is given below:

Amount Tag |

Changes in Parties’ Limits |

Liability Amount |

The limits are reinstated based on the islamic LC amount availed so far |

Confirmed Amount |

The limits are reinstated based on the confirmed portion of the islamic LC amount availed so far |

Unconfirmed Amount |

The limits are reinstated based on the unconfirmed portion of the islamic LC amount availed so far |

Undertaken Amount |

The limits are reinstated based on the undertaken portion of the islamic LC amount availed so far |

Non-undertaken Amount |

The limits are reinstated based on the non-undertaken portion of the islamic LC amount availed so far |

Liability Minus Margin |

The limits are reinstated based on the LC amount minus collateral amount availed so far. |

5.2.10 Specifying the Media Details for a Party

The advices for a party will be sent to the default media maintained in the Customer Addresses table. If you want to send the advices through another medium, you should indicate it in the Parties screen. The address should be also indicated. The advices will be sent through the new medium, only if you indicate so in the Advices screen of contract processing. If not, the advice will continue to be sent to the default address defined for the party.

You can use this feature to send a one-off advice, through a different medium. For example, for a particular customer, you normally send all advices through mail and hence haven’t defined SWIFT or TELEX advices. For an Islamic LC involving a customer, you want to send the advices through SWIFT. In such a case, you can specify the medium as SWIFT and specify the address only for the Islamic LC you are processing.

5.2.11 Specifying Credit Administration Details

The details on credit lines that feature on this screen have been covered in the chapter titled Specifying Central Liability tracking details.

5.2.12 Specifying Advices for an Islamic LC

An important part of processing an Islamic LC is the generation of various advices applicable for a contract.

The advices that can be generated for the events that occur during the lifecycle of an Islamic LC are defined for the product, to which the Islamic LC is linked. For example, you may have specified the following advices for a product:

- Issue of an import Islamic LC: pre-advice by SWIFT and Islamic LC instrument by mail to the advising bank, the authorization to reimburse to the reimbursing bank

- Advice of an export Islamic LC: the acknowledgement advice to the advising bank

- Issue of a guarantee: the guarantee instrument to the beneficiary

The details of the advices for an event are displayed in the Advices screen. The party type to whom a specific advice should be sent is picked up automatically based on the type of Islamic LC being processed and the parties involved.

From the ‘Islamic LC Contract Details’ screen click on the ‘Advices’ tab. The advices screen is displayed. The advices defined for the event you are processing will be displayed. You can choose to suppress any of them. The address of the party to whom the advice is addressed to will be picked up by default, based on the media and address maintenance for the party.

These can be changed if required. For a payment message by SWIFT, you also have the option to change the priority of the message.

Suppress

By default, all the advices that have been defined for a product will be generated for the Islamic LCs involving it. If any of the advices are not applicable to the Islamic LC you are processing, you can suppress its generation by Checking against the suppress field.

Priority

For a payment message by SWIFT, you also have the option to change the priority of the message. By default, the priority of all advices is marked as Normal.

The priority of a payment message can be changed to one of the following:

- Normal

- Medium

- High

Medium

The medium by which an advice will be transmitted and the corresponding address will be picked up based on the media and address maintenance for a customer.

You can, however, change either of these while processing the Islamic LC. Typically, if changed, both of them will be changed.

After selecting the advices to be generated for the Islamic LC, click on ‘Ok’ button to save it. Click on ‘Delete’ button to reject the inputs you have made. In either case, you will be taken to the Contract Main screen.

5.2.13 Specifying the Free Format Instructions that should accompany an Advice

Free Format Text instructions (FFTs) are a set of instructions or statements that are applicable to the Islamic LC that you process. It can be used to enter additional details related to the Islamic LC you are processing. In the Islamic LC Contract - Advices screen you can specify the FFTs that should accompany an advice, generated for an Islamic LC. When you select an advice code on this screen, the advice code together and the party type, to which it is to be sent, is displayed in the FFT section. This indicates that the FFTs that you specify will appear on the advice, which is displayed and will be sent to the party type that is displayed.

All the FFTs defined for the advice, at the product level will also be displayed. You have the option to add to or delete from the list of FFTs defaulted for an advice.

To add an FFT to the list, click on add button in the screen and then on the option list button. Select an FFT code from the option list that is displayed. After selecting the code that identifies the FFT you wish to attach to the advice, its description is automatically picked up and displayed. The FFT description can be changed to suit the requirements of the Islamic LC you are processing.

To delete an FFT from the list, highlight the code that identifies the FFT and click on the delete button in the screen. The free format codes for the following purposes have the fixed codes:

|

|

SND2RECMTxxx |

Sender to receiver information (Field 72 of SWIFT). |

INSTRUCTION |

Instructions to the Paying/Accepting/Negotiating bank (Field 78 of SWIFT). |

Sender to Receiver Info Tag

FFT codes “SND2RECMTxxx” will be used to pick up the sender to receiver information in various swift messages. In the FFT code “MTxxx” will stand for the SWIFT message type in which the FFT code will be picked up. This facilitates defining a separate FFT code for each of the SWIFT message.

This will be applicable for the following swift messages: MT700, 707, 705, 710, 720, 730, 740, 747, 760, 767, 768, 400, 410, 412, 420,422, 430, 734, 732, 742, 756, 750, 752, 754

The various FFT codes for SND2RECMTxxx are maintained in the Free Format Code maintenance screen. During contract processing, based on the event being processed system defaults the advices maintained for the particular event. For messages of SWIFT type ,you can select the corresponding SND2RECMTxxx FFT code from the list of values

In the SWIFT message generated , the tag 72 will be populated with the text associated with the FFT code SND2RECMTxxx attached for the advice at the contract level.System will not validate the FFT code SND2RECMTxxx being attached with the advice. This has to be operationally controlled.

During advice generation, if the FFT code SND2RECMTxxx corresponding to the advice is not attached or if a different SND2RECMTxxx is attached, system will not populate the tag 72 in the advice generated.

5.2.14 Specifying Shipping for an Islamic LC

An Islamic LC, which is an instrument of trade finance, involves details of merchandise. Hence, you will need to specify the following details for the Islamic LC:

- Details of the merchandise

- Details of the mode of transportation

Click on the tab titled ‘Shipment’ to specify details of the goods and clauses that are part of the Islamic LC instrument.

The following are the features of the Contract Ship screen:

5.2.14.1 Specifying Shipment Details for an Islamic LC

There are certain standard clauses and conditions, associated with the shipment of the merchandise traded under an Islamic LC. You can specify the following shipping details for an Islamic LC that you process.

Partial Shipment Allowed

Check this option if partial shipment of the goods is allowed under the LC.

Trans Shipment Allowed

Check this option if Trans-shipment is allowed under the LC

From

The location from which the goods transacted under the LC should be shipped. In international trading parlance, this is called the Loading on board/Dispatch/Taking in charge at/from.

To

The destination to which the goods transacted under the LC should be sent. In international trading parlance, this is called the ‘For transportation’ to.

‘Shipment From’ and ‘Shipment To’ are linked to the tags 44A and 44 B respectively. These tags are applicable to the following message types:

- MT700

- MT705

- MT707

- MT710

- MT720

Note

Specifying the ‘Shipment From’ and ‘Shipment To’ is optional.

Shipment Days

Specify the number of shipment days.

If you enter the shipment days and leave the field ‘Latest Shipment Date’ blank, on saving the contract, the system calculates the latest shipment date based on the number of shipment days and the effective date.

However, if you specify the latest shipment date, the system ignores the shipment days specified here. Instead, it recalculates the shipment days based on the latest shipment date and the effective date.

Latest Shipment Date

Specify the latest shipment date.

Besides these details, you can also specify shipping preferences like:

- Should Trans-shipment be allowed under the Islamic LC

- Should partial shipment of the goods be allowed under the Islamic LC

- Shipping marks

- Additional shipment details

5.2.14.2 Specifying the Port Details

In this section specify the following details:

Port of Loading

Specify the name of the airport from where the goods transacted under the Islamic LC are loaded for shipping.

Port of Discharge

Specify the name of the destination port to which the goods transacted under Islamic LC should be sent.

Note

Port of Loading and ‘Port of Discharge’ are linked to the 44E and 44F tags respectively. These tags are applicable to the following message types:

- MT700

- MT705

- MT707

- MT710

- MT720

It is not mandatory to specify the Port of Loading or Port of Discharge.

5.2.15 Specifying Goods Details

You can also specify Preferences for the shipment of goods in the ‘Goods ‘tab. Click ‘Goods’ tab to specify details of the goods and captures unit and price of the goods. The ‘Goods’ tab maintains multiple goods details

The fields are maintained as follows:

Goods Code

Select the Goods code from the list provided.

Goods Description

The system displays the description of the Goods.

Number of Units

The system displays the number of units.

Price Per Unit

The system displays the price per unit.

5.2.16 Specifying Document Details

You can specify the documents that should accompany the goods in the ‘Documents’ tab. Click ‘Documents’ tab to specify details documents and clauses that are part of the Islamic LC instrument.

You can specify the following details:

5.2.16.1 Specifying Contract Documents Details

There are some standard documents required under a documentary Islamic LC. In this screen you can specify the documents that are required under the Islamic LC being processed. These details will be a part of the Islamic LC instrument sent to the advising bank, the advice through bank or the beneficiary. All the documents specified for the product to which the Islamic LC is linked will be defaulted to this screen.

Code

Enter the document code.

Type

Enter the document type.

Description

Enter the document description of the document that is defaulted to suit the LC you are processing. This field will be enabled only if the LC type is ‘Shipping Guarantee’, but not mandatory.

During copy operation, the value of this field will not be copied to the new contract.

Reference

Enter the document reference number based on which the Shipping Guarantee issued.

Copy

Enter the number of copies of the document.

Originals

Enter the number of Original documents here.

Original Required

Enter the receipt details here.

You can add to or delete from the list of documents that are defaulted. To add a document for the Islamic LC, click on add button and then on option list positioned next to the Document Code field. Select the code of the appropriate document from the list of document codes maintained in the Documents Maintenance screen. The other details of the document will be defaulted to this screen.

To delete a document that is not required for the Islamic LC, highlight the document code and click on the delete button on the screen.

Specifying the Document Reference

For Shipping Guarantee type of Islamic LCs, you can specify the document reference based on which the Shipping Guarantee is issued in the ‘Doc reference’ field. This field will be enabled only if the Islamic LC type is ‘Shipping Guarantee’. However it is not mandatory to enter the document reference for ‘Shipping Guarantee’ contracts. Documents captured for a shipping guarantee contract, can exist with or without document reference.

During copy operation, the value of this field will not be copied to the new contract.

5.2.16.2 Specifying Clauses for a Document

In addition to the other details, the clauses specified for a document while defining the product, are also defaulted to this screen.

When you highlight a document code, all the clauses defined for the document are displayed in the Clauses window. You can add to or delete from, the list of clauses that are defaulted.

To add a clause to a document for the Islamic LC, click on the add button. Then, click on option list positioned next to the Clause Code field. Select the code of the applicable clause from the list of clause codes maintained, in the ‘Clause Maintenance’ screen. The description of the clause will be defaulted, based on the clause code that you select.

To delete a clause that is not required for the Islamic LC, highlight the Clause code and click on the delete button.

5.2.17 Specifying Tracer Details for an Islamic LC

Tracers are reminders that can be sent to various parties involved in an Islamic LC. The list of tracers that you can send for an Islamic LC is predefined (hard coded in the system) and can be classified into the following types:

- The acknowledgement tracer (sent to the advising bank when an import Islamic LC is issued and an acknowledgement is sought)

- The charge-commission tracer (sent to the party who has to bear the commission or charges for an Islamic LC, pending the payment of the charge or commission)

- The confirmation tracer (sent to the confirming bank, seeking a letter of confirmation).

You can specify the tracers to be sent for an Islamic LC, in the ‘Islamic LC Contract Tracers’ screen. To invoke this screen, click on the tab titled ‘Tracers’ in the ‘Islamic LC Contract Details’ screen. The ‘Islamic LC Product Tracers’ screen is displayed.

The tracers, specified for the product to which you have linked the Islamic LC, will be defaulted to this screen.

5.2.17.1 Specifying Tracer Details

For the tracer code that is highlighted, the details are defaulted from the product and can be changed to suit the Islamic LC you are processing.. Besides the Tracer Code, the following details will be displayed:

- Description of the tracer

- Party to which the tracer is to be sent

- Number of tracers sent thus far, to the party

- Date on which the tracer was last sent to the party

Maximum Tracers

You can specify the maximum number of tracers that should be sent for the Islamic LC. The value is defaulted from the product under which you are processing the Islamic LC.

Start Days

The tracers that you specify for an Islamic LC can be generated only after it has been authorised. Specify the default number of days that should elapse after an Islamic LC has been authorized, on which the first tracer should be sent.

By default, the first tracer for an authorised Islamic LC contract will be sent, after the number of days prescribed for the product under which it is processed.

Frequency

You can specify the frequency (in days) with which the tracer should be re-sent, for the Islamic LC you are processing.

Last Sent On

You can stop the generation of a tracer at any point during the life cycle of an Islamic LC contract.

For instance, you had specified that an acknowledgement tracer is to be generated for a contract. When you receive the acknowledgement from the concerned party, you can disable its generation. At a later stage when you wish to generate the tracer again, you only need to enable it for the Islamic LC by using this facility.

Medium

If you have specified that tracers should be generated for an Islamic LC, you should also specify the medium through which it is to be generated. A tracer for an Islamic LC can be sent through Mail, Telex or other compatible media.

Template ID

Specify the template ID for the SWIFT message type.

If the medium is SWIFT, then the system will generate the tracers in the SWIFT MT799 format based on the template ID mentioned at the Islamic LC Contract level for populating the tag 79.

5.2.18 Specifying Other Details of an LC

The SWIFT messages that are generated require information specific to the Islamic LC you are processing. To specify SWIFT related details invoke the ‘Others’ screen by clicking on the tab titled ‘Preferences’.

The details that you specify in the fields of this screen are picked up for SWIFT messages.

The SWIFT message that utilizes the information that you specify in this screen and the corresponding field of the SWIFT message which carries the input, has been listed below:

Field in Oracle FLEXCUBE |

SWIFT Message |

Field of the SWIFT message |

Charges From Beneficiary |

MT700 |

Field 71B |

Additional Amounts Covered |

MT 700 & MT 740 |

Field 39C |

Period For Presentation |

MT 700 |

Field 48 |

Charges From Issuing Bank |

MT 730 |

Field 71B |

Account For Issuing Bank |

MT 730 |

Field 57A |

Date |

MT 730 |

Field 32D |

The period of presentation defined for the product - or calculated for the Islamic LC, as the case may be - will be displayed in the ‘Period For Presentation’ field. You can change the default to suit the Islamic LC you are processing.

The system uses the Expiry Date and the Last Shipment Date specified for the Islamic LC you are processing, and arrives at the period of presentation.

For details, refer the heading ‘Specifying the Period of Presentation’ in chapter three, ‘Creating Products’, in the Islamic LC user Manual.

Claim Advice in Swift

Check this box to generate the charge claim advice in MT799 SWIFT format.

This field is initially defaulted from product level. However, you can then check or uncheck it at the contract level.

Template ID

Specify the template ID related to MT799 message types from the option list.

Note

You can enter the values only if the ‘Claim Advice in Swift’ field is checked.

User LC Reference Number

System displays the Contract User Reference as the User LC Reference Number. The reimbursement Islamic LC, under which the bill is availed, and the Export Islamic LC linked to the bill, should contain the same ‘User LC Reference Number’.

Unconfirmed Amount

The system displays the current maximum unconfirmed Islamic LC amount. This amount is derived by deducting the confirmed amount from the maximum Islamic LC amount.

Available Confirmed Amount

The system displays the available confirmed portion of the maximum Islamic LC amount.

Available Unconfirmed Amount

The system displays the available unconfirmed portion of the maximum Islamic LC amount.

Beneficiary Confirmation Required

The system checks this box by default for Letters of Credit. This box is unchecked for ‘Guarantees’. You can operationally control the beneficiary confirmation process for an Islamic LC, but you cannot modify it after the first authorization.

Confirmation Instructions

You can also specify the type of the confirmation instruction that should be sent to the advising/confirming bank if you are issuing the Islamic LC (whether Field 49 of MT 700 should be ‘Without’, ‘Confirm’, or ‘May add’).

Auto Status Change

The system defaults the status of the checkbox based on the product maintenance. However, you can modify this. If you check this box, the system picks up the contract during EOD operations for status processing. If you do not check this, the system will not consider the Islamic LC contract for automatic status processing.

Partial Confirmation Allowed

Check this box to confirm the partial amount. The remaining amount can be confirmed after you receive the approval from the external agent.

Note

This field is initially defaulted from product level. However, you can then check or uncheck it at the contract level.

Confirm Percentage

Specify the percentage of Islamic LC Amount to be confirmed. If percentage is not specified, the system will calculate the percentage based on the confirm Amount specified.

Confirmed Amount

Specify the amount to be confirmed. If Confirm Amount is not specified, the system will calculate the confirmed amount based on the Confirm Percentage specified.

Requested Confirmation Party

Select the confirmation party type. You can select one of the following messages:

- Advising Bank

- Advise Through Bank

- Confirming Bank

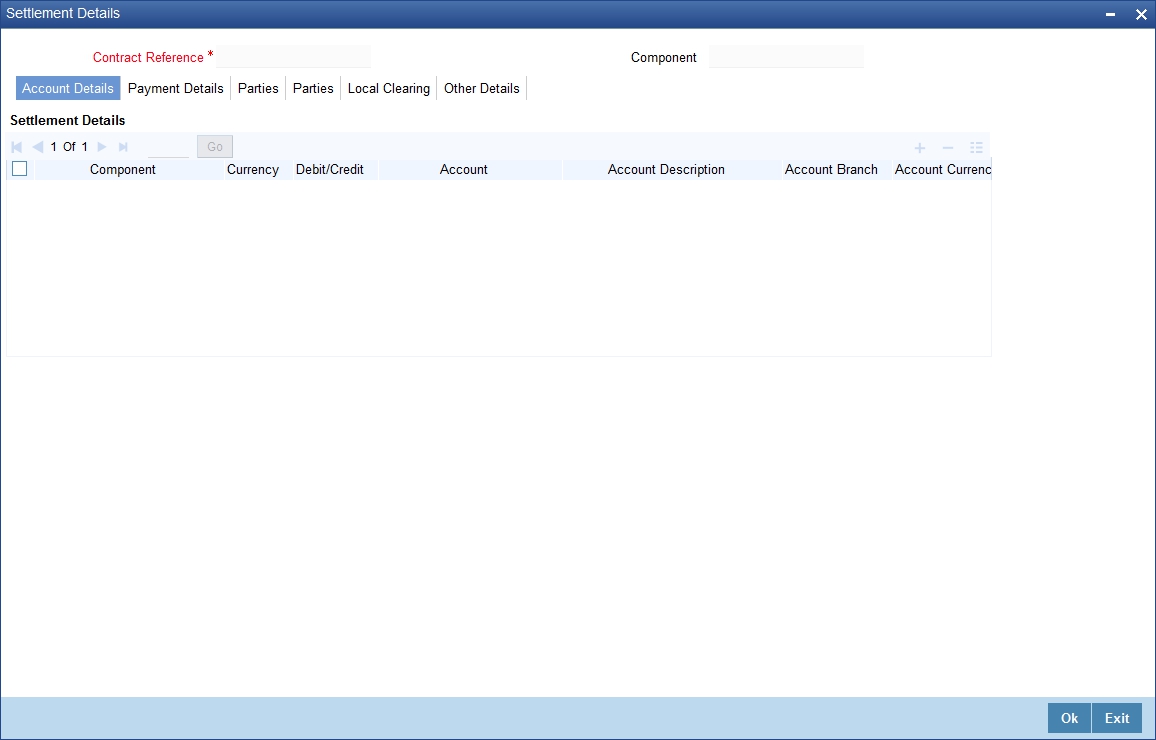

5.2.19 Specifying Settlement Instructions

Through the settlement screens, you should specify the customer accounts to which entries for the commissions, charges, taxes and collateral should be posted.

Click on ‘Settlement’ button in the ‘Contract Main’ screen, for a display of the Settlements screen. Besides the account details, you can specify:

- The currency in which the component is expressed

- The payment account and its currency

Note

If you have specified an account that uses an account class that is restricted for the product, an override is sought.

- The branch of your bank to which the account belongs

- The exchange rate (in the case of the component currency being different from the account currency)

- The ERI Currency

- The ERI Amount

Fund Asset Management

The settlements processing is enabled only if ‘Allow Corporate Access’ has been checked while defining branch parameters in the Branch Parameters – Detail View screen.

- If ‘Allow Corporate Access’ is checked for a fund branch and the fund is Portfolio type, then during settlement processing, the settlement account is chosen based on the settlement instructions maintained for the counterparty.

- If ‘Allow Corporate Access’ is not checked for a fund branch, then the settlement processing is disabled and the settlement account remains as a fund branch account maintained for the fund.