11. Islamic Guarantees and Standby Letter of Credit

A Standby Letter of Credit (SBLC) and Bank Guarantee (BG) is a payment guarantee generally issued by the issuing bank on behalf of an applicant securing payment to the beneficiary, If the buyer fails to fulfil a contractual commitment the issuing bank will release payment to the seller.

This section contains the following section:

- Section 11.1, "Islamic Guarantees and Standby Letters of Credit Contract Input"

- Section 11.2, "Islamic Guarantees and Standby Letters of Credit Amendment"

- Section 11.3, "Islamic Guarantees Transfer Input"

11.1 Islamic Guarantees and Standby Letters of Credit Contract Input

This section contains the following topics:

- Section 11.1.1, "Processing Islamic Guarantees and Standby LC"

- Section 11.1.2, "Main Tab"

- Section 11.1.3, "Preferences Tab"

- Section 11.1.4, "Parties Tab"

- Section 11.1.5, "Parties Limits Tab"

- Section 11.1.6, "Document Tab"

- Section 11.1.7, "Tracers Tab"

- Section 11.1.8, "Terms and Conditions Tab"

- Section 11.1.9, "Advices Tab"

- Section 11.1.10, "Viewing Guarantees and SBLC Contract Details"

11.1.1 Processing Islamic Guarantees and Standby LC

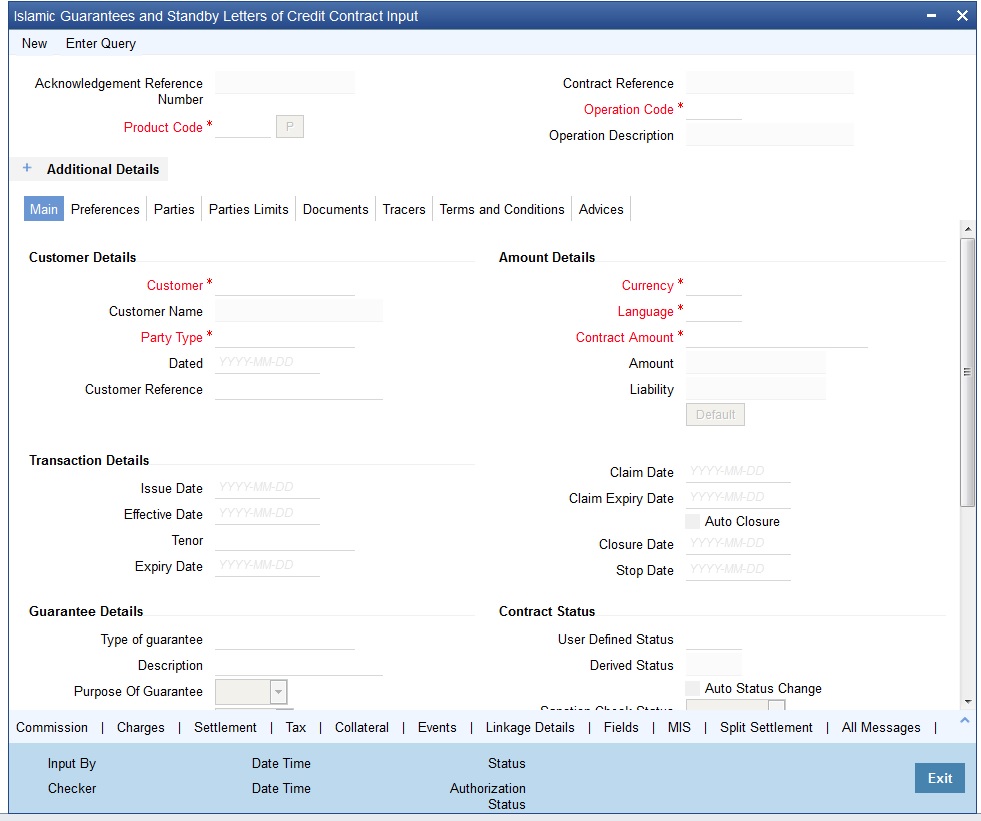

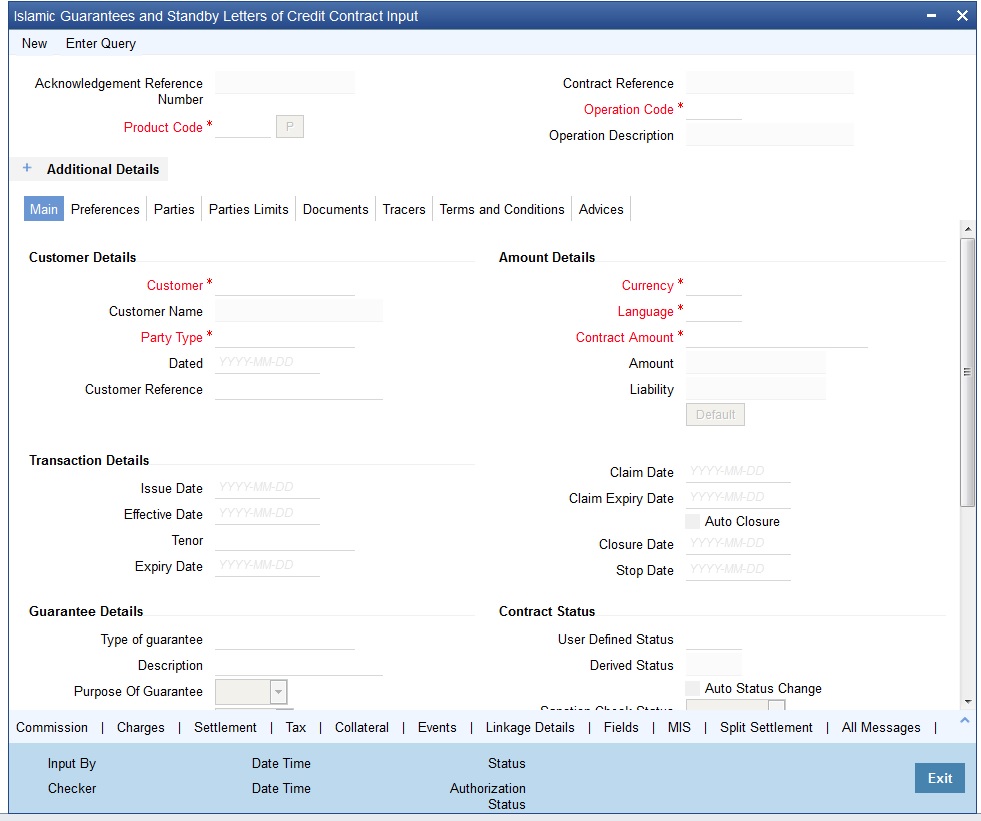

You can process Islamic Guarantees and SBLC contract using ‘Islamic Guarantees and Standby Letters of Credit Contract Input’ screen. You can invoke this screen by typing ‘LIDGUONL’ in the top right corner of the Application toolbar and clicking the adjoining arrow button..

Acknowledgement Reference Number

Specify the acknowledgement reference number. Alternatively, you can select the reference number from the option list. The list displays all the Islamic Guarantees and SBLCs related acknowledgement reference numbers.

Contract Reference

The system displays the contract reference number.

Product Code

Select the product code from the list of products created in the LC. Guarantees, Advice of Guarantees, SBLCs, Advice of SBLC Product codes are displayed in the option list. Click ‘Populate’ button for details of this product to get defaulted from the Product screen.

Operation Code

You can select operation code from the list of valid operation code value based on Product Type. The list displays the following options:

- Advice

- Open

- Open and Confirm

- Advice and Confirm

Advice and Confirm is applicable for Guarantees if SWIFT 2019 is enabled.

Operation Description

The system displays the Operation description.

Additional Details

Product Description

The system displays the product description.

Source Code

The system displays the source code.

Source Reference

The system displays the source reference number.

Product Type

The type of product gets displayed here from the product screen, specifying if the product is of type import/export or revolving or non-revolving.

User Reference

The system displays the contract reference number as user reference number.

Version Number

Specify the version number.

The Islamic Guarantees and SBLC contract processes can be simulated only through gateway. The Islamic Guarantee Issuance Simulation does not have screen, so user cannot invoke Guarantee Issuance Simulation from the application front. All operations are supported for Islamic Guarantee Issuance Simulation same as ‘Islamic Guarantees and Standby Letters of Credit Contract Input’ screen.

11.1.2 Main Tab

Customer Details

Customer

Specify the customer number. Alternatively, you can select the customer number from the option list. The list displays all valid customer numbers.

Specify the ‘Customer’ for which you need to maintain. Alternatively, you can select ‘Customer’ from the adjoining option list also.

Note

BIC Code appears next to the 'Customer' only if the BIC Code is mapped with that customer number If the BIC Code is not mapped with that Customer Number, then the BIC Code will not appear next to the ‘Customer’ in the adjoining option list.

Customer Name

The system displays the customer name.

Party Type

Specify the party type of the customer who is the counter party of the Islamic Guarantee/SBLC. Alternatively, you can select the party type from the option list. The list displays all the valid party types maintained in the system.

Dated

Enter the date of the customer reference. This would normally be the date on which you have a correspondence from the party regarding the Islamic Guarantees/SBLC.

Customer Reference

Specify the customer reference number.

Amount Details

Currency

Specify the currency of the transaction. Alternatively, you can select the currency from the option list. The list displays all valid currencies maintained in the system.

Language

Specify the language to be used for Guarantees/SBLC. Alternatively, you can select the language from the option list. The list displays all valid language codes.

Contract Amount

Specify the amount for which the Islamic Guarantee and SBLC is drawn.

Amount

The balance amount available after the availment of Islamic Guarantee/SBLC is displayed here.

Liability

The system displays the liability amount.

Default

Click the default button for default generation.

Transaction Details

Issue Date

Specify the issue date from the adjoining calendar.

Effective Date

Specify the effective date from the adjoining calendar.

Tenor

Specify the tenor of the contract.

Expiry Date

Specify the date on which the Islamic Guarantee/SBLC contract expires.

Claim Date

Select the claim date from the adjoining calendar. Claim date indicates the date by which all claims needs to be lodged for the guarantee. Claim Date should be on or before Claim Expiry Date.

Claim Expiry Date

Select the claim expiry date from the adjoining calendar. Claim expiry date indicates the date by which all claims lodged need to be settled. Claim Expiry Date = Expiry Date + Claim Days.

System defaults Claim Expiry date as Expiry Date + Claim Days on Product default. If Claim Days is zero, Claim Expiry date will be Expiry Date. Claim Expiry Date can be modified. On Save, system will validate the following:

- Claim Expiry Date cannot be before Claim Date.

- Claim Expiry Date can be on or after Guarantee Expiry Date.

- Claim Expiry Date should not be after Closure Date.

Note

- Commission is computed till Claim Expiry Date.

- During Guarantee Issuance Claim Expiry Date is considered to validate Limit Line expiry date.

- During Guarantee Issuance Claim Expiry Date is considered to validate Collateral expiry date.

Auto Closure

Check this option to indicate that the Islamic Guarantee/SBLC should be automatically closed.

Closure Date

The date of closure is based on the ‘Closure Days’ maintained for the product involved in the Islamic Guarantees/SBLC. The number of days specified as the Closure Days is calculated from the expiry date of the Islamic Guarantee/SBLC, to arrive at the Closure Date.

Closure Date = Expiry Date + Closure Days

Stop Date

This date will be defaulted to LC Expiry date. Stop date cannot be earlier than Issue date and later than expiry date.

Guarantee Details

Type of guarantee

Select the guarantee type from the adjoining list. This is maintained using static type maintenance screen.

Description

Specify the details of guarantee description.

Purpose of Guarantee

If the LC that you are processing is a guarantee you should specify the purpose of guarantee. Click the adjoining drop-down list and select one of the following values:

- Issue

- Request

Validity Type

Select the type of validity from the list provided. The list is as follows:

- Limited

- Unlimited

- Null

Expiry Condition

Specify the details for conditional guarantee.

Remarks

Specify remarks, if any.

Contract Status

User Defined Status

Specify the status of the Islamic Guarantee/SBLC contract. The option list displays all valid statuses that are applicable. Choose the appropriate one.

Derived Status

The system displays the derived status of the Islamic Guarantee/SBLC contract. You cannot modify this.

Auto Status Change

The system defaults the status of the check box based on the product maintenance. However, you can modify this. If you check this box, the system picks up the contract during EOD operations for status processing. If you do not check this, the system will not consider the Islamic Guarantee/SBLC contract for automatic status processing.

Sanction Check Status

The system displays the sanction check status. The statuses can be any of following:

- P - Pending

- X - Pending

- A - Approved

- R - Rejected

- N - Not Required

Last Sanction Check Date

The system displays the last sanction check date.

Settlement Details

Debit Account Branch

Specify the debit account branch. Alternatively, you can select the debit account branch from the option list. The list displays all valid values.

Debit Account Currency

Specify the debit account currency. Alternatively, you can select the currency from the option list. The list displays all valid values.

Debit Account

Specify the debit account. Alternatively, you can select debit account from the option list. The list display all valid values.

Charges Debit Account Branch

Specify the charges debit account branch. Alternatively, you can select the charges debit account branch from the option list. The list displays all valid values.

Charges Debit Account Currency

Specify charges debit account currency. Alternatively, you can select charges debit account currency from the option list. The list displays all valid values.

Charges Debit Account

Specify the charges debit account. Alternatively, you can select charges debit account from the option list. The list displays all valid values.

11.1.3 Preferences Tab

Other Details

Applicable Rule

The system defaults the applicable rule for the product type. However, you can modify this.

Please refer to the section ‘Specifying the Applicable Rules’ under chapter ‘Defining Product Attributes’ in this user manual.

Rule Narrative

This is enabled only if ‘Applicable Rule’ is set to ‘OTHR’. It is mandatory to specify the rule narrative if the applicable rule is ‘OTHR’.

Claim Advice in Swift

Check this box to generate the charge claim advice in MT799 SWIFT format.

Template Id

Specify the template ID related to MT799 message types from the option list.

Ancillary Message

Check this box to generate MT 759 on contract authorization.

Ancillary Message Function

Specify the ancillary message function. Alternatively, you can select the ancillary message from the option list. The list displays all valid options maintained in the system. Ancillary Message Function is mandatory if ‘Ancillary Message’ is checked.

Charges From Beneficiary

Specify the charge amount borne by the beneficiary.

Additional Amounts Covered

Specify the additional amount covered.

Claim Indicator

Select the indicator for claim from the drop-down list. The list displays the following options:

- Multiple demands not permitted

- Multiple and partial demands not permitted

- Partial demands not permitted

Amendment Details

Amendment Number

The system displays the amendment number.

Amendment Date

Specify the amendment date from the adjoining calendar.

Acknowledgement Received

Check this box to indicate that the acknowledgment has received.

Acknowledgement Date

Specify the date on which the acknowledgement is received.

Charges to be Claimed

Currency

Specify the currency in which the charges attributed to the issuing bank is expressed.

Amount

Specify the charge amount.

Charge From Issuing Bank

Give a brief description of the charge.

Issuing Bank Acc

Specify the account from which charge should be collected.

Issuing Bank Date

Specify the date of charge collection.

Preferences

Advice of Reduction

The system displays the value for Advice of Reduction (MT 769) message.

Allow Prepayment

Check this option to indicate that the customer can make a prepayment on the contract.

Transferrable

Check this box to indicate that the Islamic Guarantee/SBLC is transferrable. Islamic Guarantee/SBLC can be transferred only if SWIFT 2019 is enabled.

Transfer Conditions

Specify the transfer conditions for the Guarantee/SBLC transfer.

Confirmation Instruction

Check this option to indicate that the SBLC can have an associated confirmation message. In Islamic Guarantee/SBLC if Confirmation Instruction option is checked cannot be amended to uncheck.

Requested Confirmation Party

Select the confirmation party type. You can select one of the following messages:

- Advising Bank

- Advise Through Bank

- Confirming Bank

Obligor Collateral Percentage

Specify the Obligor collateral percentage. If Obligor Collateral Percentage is provided, then system will collect the collateral partially from applicant and Obligor Party depending on the percentage provided. Else system will collect the entire collateral from Applicant.

Local Guarantee Details

Issue Date

Select the issue date for local guarantee from the adjoining calendar.

Expiry Date

Select the expiry date for local guarantee from the adjoining calendar.

Standard Wording Required

Check this option to indicate that the customer needs standard wording for local guarantee details.

Standard Wording Requested Language

Specify the language in which standard wording requested. Alternatively, you can select the language from the adjoining list.

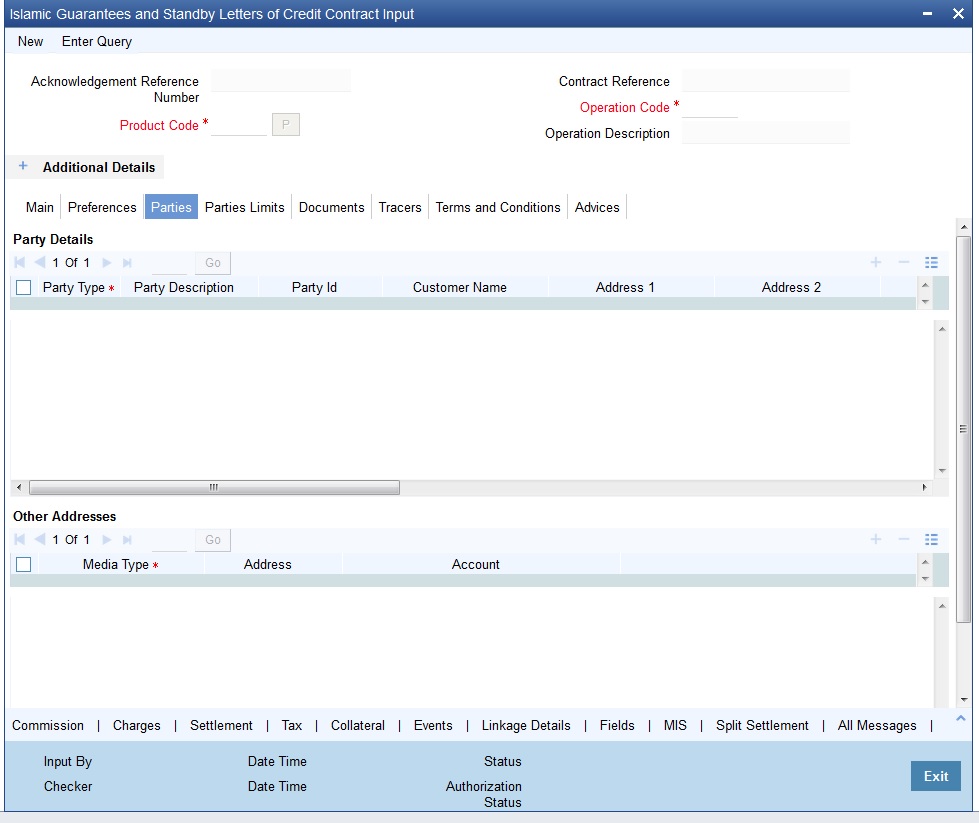

11.1.4 Parties Tab

Party Details

Party Type

Specify the party type. Alternatively, you can select the party type from the option list. The list displays all the valid party types maintained in the system.

Once the record has been saved, you can change party names by amending the record, provided the Islamic Guarantee/SBLC is not linked to a bill. Also, you cannot change party names for a transferred or an availed Islamic Guarantee/SBLC.

Note that, you can change the following party types:

- REB

- ABK

- OBP

The following table gives the details of the messages when there is a change in parties.

Changed Party Name |

Messages |

REB (in case of Guarantees and SGs) |

MT767 will be generated to the Advising bank. |

ABK (in case of Guarantees and SGs) |

MT767 will be generated to the old Advising Bank. In Tag 77C, Code ‘CANCEL’ will be populated indicating that the Guarantee is cancelled. MT760 will be generated to the new Advising Bank. |

OBP (in case of Guarantees and SGs) |

MT767 will be generated to the old Advising Bank. In Tag 77C, Code ‘CANCEL’ will be populated indicating that the Guarantee is cancelled. MT760 will be generated to the new Advising Bank. |

Party Description

The system displays the party description.

Party ID

Specify the ‘Party ID’ for which you need to maintain. Alternatively, you can select the ‘Customer No’ from the adjoining option list also.

Note

BIC Code appears next to the ‘Customer No’ only if the BIC Code is mapped with that customer number. If the BIC Code is not mapped with that customer number then the BIC Code will not appear next to the ‘Customer No’ in the adjoining option list.

Customer Name

Specify the customer name.

Address 1 - 4

Specify the address of the customer.

Country

Specify the country code. Alternatively, you can select country code from the option list. The list displays all valid values.

Customer Reference

Specify the customer reference number.

Dated

Enter the date of the customer reference. This would normally be the date on which you have a correspondence from the party regarding the SBLC.

Language

Specify the language in which advices should be sent to the customer.

Issuer

Check this option to indicate that the issuer is a bank.

Template ID

Specify the template ID. If you change REB party, then a template ID needs to be attached to send MT799 to Advising bank.

Other Addresses

Media Type

Specify the media type. Alternatively, you can select the media type from the option list. The list displays all valid values.

Address

Specify the address of the party.

Account

The system defaults the account number. However, you can edit this field.

The parties involved in a Islamic Guarantee/SBLC depend upon the type of Islamic Guarantee/SBLC you are processing. The following table indicates the minimum number of parties required for the types of Islamic Guarantee/SBLC that you can process.

11.1.5 Parties Limits Tab

|

LC type |

Parties applicable |

Mandatory parties |

Parties not allowed |

Shipping Guarantee |

Applicant/Accountee Advising Bank Beneficiary Confirming Bank Advice Through Bank Reimbursing Bank |

Applicant and Beneficiary |

Issuing Bank |

Guarantee |

Applicant and Beneficiary |

Applicant and Beneficiary |

Advise Through Bank Reimbursement Bank Issuing Bank |

Standby |

Applicant/Accountee Advising bank Beneficiary Confirming bank Reimbursing bank |

Applicant and Beneficiary |

Issuing Bank |

Credit Line

Limits Tracking Required

Specify whether the credit granted under the LC you are processing should be tracked against the credit limit assigned to the customer under a Credit Line.

Check this box to indicate that limit tracking is required for the Islamic Guarantee/SBLC. If left unchecked, the system will display an override message ‘Limit tracking not done for the contract’ while saving the record. In the subsequent fields of this screen, you can specify details of the line under which the credit is to be tracked.

Serial Number

Specify the serial number.

Party Type

Specify the type of party involved in the Islamic Guarantee/SBLC you are processing, whose details you would subsequently enter. The parties involved in the Islamic Guarantee/SBLC can be specified in any sequence. However, a party code can be used only once in each Islamic Guarantee/SBLC.

Customer No

Specify the customer number of the party whose credit limits need to be tracked.

Specify the ‘Customer No’ for which you need to maintain. Alternatively, you can select ‘Customer No’ from the adjoining option list also.

Note

BIC Code appears next to the ‘Customer No’ only if the BIC Code is mapped with that customer number. If the BIC Code is not mapped with that customer number then the BIC Code will not appear next to the ‘Customer No’ in the adjoining option list. Liability Number

When you click ‘Default’ button, the system defaults the liability number from ‘Joint Venture’ sub-screen of ’Customer Maintenance’ screen.

Linkage Type

Specify the linkage type. The drop-down list displays the following options:

- Collateral

- Facility (Credit Line)

- Liability

- Local Collateral

- Pool

Choose the appropriate one.

% Contribution

Specify the proportion of limits to be tracked for the credit line or collateral pool for the joint venture customer. When you click ‘Default’ button, the system defaults the percentage of contribution maintained under ‘Joint Venture’ sub-screen of ‘Customer Maintenance’ screen.

Linkage Reference No

Specify the reference number that identifies the facility or collateral pool. The option list displays all valid facilities and collateral pools specific to the liability. Choose the appropriate one.

Amount Tag

Specify the amount tag. The system tracks the limits for non joint venture customers based on the amount tag.

Limit Amount

When you click ‘Default’ button, the system defaults the amount tracked for each credit line.

JV Parent

When you click ‘Default’ button, the system defaults the joint venture customer number of the party. This customer number is defaulted based on the details maintained in ‘Joint Venture’ sub-screen of ‘Customer Maintenance’ screen.

11.1.6 Document Tab

Document Details

Code

Specify the document code. Alternatively, you can select the document code from the option list. The list displays all valid options.

Type

Select the type of document from the drop-down list.

Description

The system displays the document description.

Reference

Enter the document reference number based on which the Guarantee/SBLC issued.

Copy

Enter the number of copies of the document.

Originals

Enter the number of Original documents here.

Original Required

Check this box if original document is required.

Default

Click the default button for default generation.

11.1.7 Tracers Tab

Tracers are reminders that can be sent to various parties involved in Islamic Guarantees and SBLC.

Tracer Details

The tracers, specified for the product to which you have linked the Islamic Guarantee/SBLC, will be defaulted to this screen. The following details will be displayed:

- Code

- Description

- Party Type

- Required

- Maximum Tracers

- Number Sent

- Start Days

- Last Sent On

- Medium

- Frequency

- Template Id

11.1.8 Terms and Conditions Tab

Terms and Conditions

Serial No

Specify the serial number for terms and conditions.

Type

Select the guarantee type from the drop-down list. Available options are:

- Guarantee

- Local Guarantee

Terms and Conditions

Specify the terms and conditions.

Note

Terms and Conditions for Guarantee are mandatory.

11.1.9 Advices Tab

The details of the advices for an event are displayed in the Advices screen. The party type to whom a specific advice should be sent is picked up automatically based on the type of Islamic Guarantee/SBLC being processed and the parties involved.

Advice Details

Advice Name

Specify the advice name.

Party Type

The system displays the party type for which the message is generated.

Party Id

The system displays the party ID for which the message is generated.

Party Name

The system displays the name of the party for which the advice is generated.

Medium

The medium by which an advice will be transmitted and the corresponding address will be picked up based on the media and address maintenance for a customer.

You can, however, change either of these while processing the LC. Typically, if changed, both of them will be changed.

After selecting the advices to be generated for the LC, click on ‘Ok’ to save it. Click ‘Exit’ or ‘Cancel’ button to reject the inputs you have made. In either case, you will be taken to the Contract Main screen.

Priority

For a payment message by SWIFT, you also have the option to change the priority of the message. By default, the priority of all advices is marked as low. The priority of a payment message can be changed to one of the following:

- Low

- Medium

- High

Suppress

By default, all the advices that have been defined for a product will be generated for the LCs involving it. If any of the advices are not applicable to the LC you are processing, you can suppress its generation by Checking against the suppress field.

Charges

The system displays the charges configured.

A FFT Description field can contain 2000 characters. If the details of the guarantee you specify exceeds 2000 characters, the system will automatically stagger the remaining text into subsequent FFT Description fields.

To delete an FFT from the list, highlight the code that identifies the FFT and click delete icon. The free format codes for the following purposes have the fixed codes:

SND2RECMTxxx |

Sender to receiver information (Field 72 of SWIFT). |

INSTRUCTION |

Instructions to the Paying/Accepting/Negotiating bank (Field 78 of SWIFT). |

Sender to Receiver Info Tag

FFT codes “SND2RECMTxxx” will be used to pick up the sender to receiver information in various swift messages. In the FFT code “MTxxx” will stand for the SWIFT message type in which the FFT code will be picked up. This facilitates defining a separate FFT code for each of the SWIFT message.

This will be applicable for the following swift messages: MT700, 707, 705, 710, 720, 730, 740, 747, 760, 767, 768, 400, 410, 412, 420,422, 430, 734, 732, 742, 756, 750, 752, 754,798, 760 and 762.

The various FFT codes for SND2RECMTxxx are maintained in the Free Format Code maintenance screen. During contract processing, based on the event being processed system defaults the advices maintained for the particular event. For messages of SWIFT type ,you can select the corresponding SND2RECMTxxx FFT code from the list of values

In the SWIFT message generated , the tag 72 will be populated with the text associated with the FFT code SND2RECMTxxx attached for the advice at the contract level.System will not validate the FFT code SND2RECMTxxx being attached with the advice. This has to be operationally controlled.

During advice generation, if the FFT code SND2RECMTxxx corresponding to the advice is not attached or if a different SND2RECMTxxx is attached, system will not populate the tag 72 in the advice generated.

Free Format Text Details

Free Format Text Code

To add an FFT to the list, click add icon. Select an FFT code from the adjoining option list that is displayed.

Text

After selecting the code that identifies the FFT you wish to attach to the advice, its description is automatically picked up and displayed. The FFT description can be changed to suit the requirements of the LC you are processing.

Single

Check this option to indicate that the FFT is a single message.

For more details on the buttons in Islamic Guarantees and SBLC Contract Input screen, refer the chapter titled ‘Capturing Additional Details’ in this user manual.

The following table provides the list of SWIFT messages and the fields of SWIFT messages that utilizes the information provided in this screen:

Field in Oracle FLEXCUBE |

SWIFT Message |

Field of the SWIFT message |

Operation Code |

MT760 |

22A,49 |

Purpose of Guarantee |

MT760 |

22A |

Contract Reference |

MT760,MT761,MT768,MT769 |

20 |

Issue Date |

MT760 |

30 |

Product Type |

MT760 |

22D |

Applicable Rule |

MT760 |

40C |

Validity Type |

MT760 |

23B |

Expiry Date |

MT760 |

31B |

Expiry Condition |

MT760 |

35G |

Party Id – APP |

MT760 |

50 |

Party Id – APB |

MT760 |

51 |

Party Id – ISB |

MT760,MT761 |

52a |

Party Id - BEN |

MT760 |

59 |

Party Id - ABK |

MT760 |

56a |

Party Id - ATB |

MT760 |

57a |

Contract Amount |

MT760 |

32B |

Documents - Description |

MT760 |

45C |

May Confirm |

MT760 |

49 |

Party Id - COB |

MT760 |

49a |

Claim Indicator |

MT760 |

48B |

Transferable |

MT760 |

48D |

Local Guarantee Details - Issue Date |

MT760 |

31C |

Local Guarantee Details - Expiry Date |

MT760 |

31B - Sequence C |

Charges to be Claimed - Amount |

MT768,MT769 |

32a |

Charges to be Claimed - Currency |

MT768,MT769 |

32a |

Issuing Bank Date |

MT768,MT769 |

32a |

Issuing Bank Acc |

MT768,MT769 |

25 |

Charge From Issuing Bank |

MT768 |

71D |

Additional Amounts Covered |

MT769 |

39C |

Charges From Beneficiary |

MT769 |

71D |

The above details are applicable if SWIFT 2019 is enabled.

11.1.10 Viewing Guarantees and SBLC Contract Details

You can view Islamic Guarantees and SBLC contract details through ‘Islamic Guarantees and Standby Letters of Credit Contract Summary’ screen. You can invoke this screen by typing ‘LISGUONL’ in the top right corner of the Application toolbar and clicking the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

Recommended Fields

- Contract Reference

- Currency

- Branch

Optional Fields

- Authorization Status

- Contract Status

- Product Code

- Contract Amount

- Operation Code

Select any or all of the above parameters for a query and click ‘Search’ button. The system displays the following records meeting the selected criteria:

- Authorization Status

- Contract Status

- Contract Reference

- Product Code

- Currency

- Contract Amount

- User Reference

- Source Reference

- Customer Reference

- Dated

- Party Type

- Issue Date

- Expiry Date

- Branch

- Operation Code

- Customer

11.2 Islamic Guarantees and Standby Letters of Credit Amendment

This section contains the following topics:

- Section 11.2.1, "Processing Amendment of Islamic Guarantees and SBLC"

- Section 11.2.2, "Details Tab"

- Section 11.2.3, "Parties Tab"

- Section 11.2.4, "Documents Tab"

- Section 11.2.5, "Terms and Conditions Tab"

- Section 11.2.6, "Advices Tab"

- Section 11.2.7, "Viewing Guarantees and SBLC Amendment Details"

11.2.1 Processing Amendment of Islamic Guarantees and SBLC

You can process amendment of Islamic Guarantees and SBLC using ‘Islamic LC Confirmation Input’ screen. You can invoke this screen by typing ‘LIDGUAMD’ in the top right corner of the Application toolbar and clicking the adjoining arrow button.

Hold button to support financial amendment [LIDGUAMD]

Click Hold button to support financial amendment [LIDGUAMD] from the below given options:

- Amendment without beneficiary confirmation

- Amendment without beneficiary confirmation and with Advice of Reduction

- Amendment with beneficiary confirmation

User can unlock amendments on Hold, modify details if required and save. Processing on Save will continue as existing.

‘Deletion of Hold’ will be supported. ‘Hold of Hold’ will be supported. Contract will be on Hold and in unauthorized status. Authorization is not supported for Contracts put on Hold

Note

Hold will not be supported for amendment with beneficiary confirmation and Advice of reduction, amendment with Cancellation flag or Confirmation / Rejection of amendment

Acknowledgement Reference Number

Specify the acknowledgement reference number. Alternatively, you can select the reference number from the option list. The list displays all the acknowledgement reference numbers for contract amendment registered in the system.

ESN

The system displays the event sequence number.

Product Type

The system displays the product type of Islamic Guarantee/SBLC.

Amendment Status

The system displays the amendment status.

Amendment Initiation Date

The system displays the amendment initiation date.

Contract Reference Number

Select the reference number of the contract to be amended from the option list provided. This option list will display all contracts that are authorized.

Number of Amendment

The system displays the number of amendments based on the contract reference number.You can amend a Islamic Guarantee/SBLC multiple times before the previous amendment is confirmed or rejected.

Financial amendment without Beneficiary Confirmation will not be allowed if there are unauthorized unconfirmed amendments.

Beneficiary Confirmation Required

The system enables ‘Beneficiary Confirmation Required’ flag by default.

When amendment is initiated with Beneficiary confirmation flag checked, then AMNV is triggered and MT767 is generated. When the amendment is confirmed then ACON and AMND is triggered and details are propagated to LIDGUONL.

When amendment is initiated without Beneficiary confirmation flag checked, amendment details are propagated to LIDGUONL. You can modify the and guarantee details. The system triggers AMND event on save and MT767 is generated.

Cancellation Request

Check this box to request cancellation.

If Cancel flag is checked, only cancel information shows a message on authorization of amendment.

If Cancel flag is enabled, other field amendments are not considered and CANCEL event is triggered on amendment confirmation.

The amendment of Islamic Guarantees and SBLC can be simulated only through gateway. The Guarantee Amendment Simulation does not have screen, so user cannot invoke Guarantee Amendment Simulation from the application front. All operations are supported for Guarantee Amendment Simulation is same as Guarantees and Standby Letters of Credit Amendment.

User Reference

The system displays the contract reference number as user reference number.

Amendment Number

The system displays the amendment number.

11.2.2 Details Tab

Currency

The system displays the currency.

Contract Amount

The system displays the contract amount.

Increase Decrease Contract Amount

The system displays the contract amount increased or decreased.

Issue Date

The system displays the issue date.

Expiry Date

Select the date on which the Islamic Guarantee/SBLC is scheduled to expire. On confirmation of guarantee amendment, revised Expiry Date is propagated to ‘LIDGUONL’. System derives Claim Expiry date based on the new Expiry Date.

Closure Date

Specify the date LC is scheduled to be closed. You can modify this.

Other Details

Charges from Beneficiary

Specify the charge amount borne by the beneficiary.

Validity Type

Select the validity type from the drop-down list. the list displays the following options:

- Limited

- Unlimited

Expiry Condition

Specify the details for conditional guarantee.

Transferable

Check this box to indicate that the Islamic Guarantee/SBLC is transferable.

Advice of Reduction

Check this box to send Advice of Reduction (MT 769) message.

Advice of Reduction cannot be enabled if ‘Beneficiary Confirmation Required’ flag is enabled. You can amend ‘Advice of Reduction’ check box, after disabling Beneficiary Confirmation Required flag and choosing Contract Reference number from the option list and clicking ‘P’ (Populate) button.

If ‘Advice of Reduction’ is enabled along with Beneficiary Confirmation flag then the system provides appropriate error message.

Charges to be Claimed

Currency

Specify the currency in which the charges attributed to the issuing bank is expressed.

Amount

Specify the charge amount.

Issuing Bank Date

Specify the date of charge collection.

Issuing Bank Account

Specify the account from which charge should be collected.

Additional Amount Covered

Specify the additional amount covered.

Details applicable to ‘Advice of Reduction’ will be propagated to ‘Islamic Guarantees and Standby Letters of Credit Contract Input’ screen and it can be modified.

STP of MT769 will initiate amendment or cancellation of Islamic Guarantees/Counter Guarantees in LIDGUAMD without Beneficiary Confirmation.

- If value in tag 33B is equal to Guarantee amount cancellation will be initiated.

- If value in tag 33B is lesser than Guarantee amount then amendment will be initiated.

Local Guarantee Details

Expiry Date

Select the expiry date of the local guarantee from the adjoining calendar.

Sanction Check Details

Sanction Check Status

The system displays the sanction check status.

Last Sanction Check Date

The system displays the last sanction check date.

11.2.3 Parties Tab

Parties

Party Type

The system defaults the party type.

Party Description

The system defaults the party description.

Customer

The system defaults the customer number. You can modify the customer number of the beneficiary.

Specify the ‘Customer for which you need to maintain . Alternatively, you can select the ‘Customer No’ from the adjoining option list also.

Note

BIC code appears next to the ‘Customer No’ only if the BIC code is mapped with that customer number. If the BIC code is not mapped with that customer number, then the BIC Code will not appear next to the ‘Customer No’ in the adjoining option list.

Customer Name

The system defaults the customer name.

Country

The system defaults the country of the customer.

Dated

The system defaults the date on which the party joined. However, you can modify it.

Customer Reference

The system defaults the customer reference number. However, you can modify it.

Address 1 to 4

The system defaults the address of the party.

Language

The system defaults the language in which advices are sent to the customer.

Issuer Bank

The system defaults the name of the issuer bank.

Other Addresses

Media Type

The system defaults the media type. You can select a different medium from the adjoining option list.

Address

The system defaults the other address of the party. However, you can edit this field.

Account

The system defaults the account number. However, you can edit this field.

11.2.4 Documents Tab

Document Details

Code

Enter the document code.

Type

Enter the document type.

Description

Enter the document description of the document that is defaulted to suit the Islamic Guarantee/SBLC you are processing.

During copy operation, the value of this field will not be copied to the new contract.

Reference

Enter the document reference number based on which the Islamic Guarantee/SBLC is issued.

Copy

Enter the number of copies of the document.

Originals

Enter the originals details.

Original Required

Check this box to generate the original receipts.

Default

Check the default button for default generation.

11.2.5 Terms and Conditions Tab

Terms and Conditions

Serial No

Specify the serial number for terms and conditions.

Type

Select the guarantee type from the drop-down list. Available options are:

- Guarantee

- Local Guarantee

Terms and Conditions

Specify the terms and conditions.

Note

Terms and Conditions for Guarantee are mandatory.

11.2.6 Advices Tab

Advices Details

Message type

Check the box to view the advice details.

Party type

The system displays the party type for which the advice is generated.

Party Id

The system displays the party id for which the advice is generated.

Party Name

The system displays the name of the party for which the advice is generated.

Medium

The system displays the medium through which the advice is sent. The user can select a different medium from the list. If the medium is modified, the user must provide the new address in the ‘Other Addresses’ section, in the ‘Parties’ tab.

Priority

The system displays the priority of sending the advice. However, you can change the priority.

Suppress

The system displays if the advice is suppressed or not. However, you can edit this field.

Charges

The system displays the charges involved. However, you can edit the charges.

FFT Details

The user can select a message from the ‘Advices Details’ section and associate a code and a description to it.

Code

The user can select the appropriate code from the adjoining option list.

Description

The system displays the description of the selected code. However, you can modify this description.

For more details on the buttons in Islamic Guarantees and SBLC Amendment screen, refer the chapter titled ‘Amending Details of an Islamic LC’ in this user manual.

The following table provides the list of SWIFT messages and the fields of SWIFT messages that utilizes the information provided in this screen:

Field in Oracle FLEXCUBE |

SWIFT Message |

Field of the SWIFT message |

Operation Code |

MT767 |

22A |

Purpose of Guarantee |

MT767 |

22A |

Cancellation Request |

MT767 |

23S |

Contract Reference Number |

MT767,MT775 |

20 |

Number of Amendment |

MT767,MT775,MT787 |

26E |

Amendment Initiation Date |

MT767 |

30 |

Party Id – ISB |

MT767,MT775 |

52a |

Increase Decrease Contract Amount |

MT767 |

32B,33B |

Validity Type |

MT767 |

23B |

Expiry Date |

MT767 |

31E |

Expiry Condition |

MT767 |

35L |

Party Id – BEN |

MT767 |

59 |

Documents – Description |

MT767 |

45C |

Local Guarantee Details- Expiry Date |

MT767 |

31E - Sequence C |

Amendment Status |

MT787 |

23R |

The above details are applicable only if SWIFT 2019 is enabled.

11.2.7 Viewing Guarantees and SBLC Amendment Details

You can view Islamic Guarantees and SBLC amendment details through ‘Islamic Guarantees and Standby Letters of Credit Amendment Summary’ screen. You can invoke this screen by typing ‘LISGUAMD’ in the top right corner of the Application toolbar and clicking the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

Recommended Fields

- Contract Reference Number

- Branch

Optional Fields

- Authorization Status

- Contract Status

- Product Code

- Amendment Status

- Number of Amendment

Select any or all of the above parameters for a query and click ‘Search’ button. The system displays the following records meeting the selected criteria:

- Authorization Status

- Contract Status

- Contract Reference Number

- Product Code

- User Reference

- Customer

- Currency

- Contract Amount

- Issue Date

- Effective Date

- Expiry Date

- Closure Date

- Customer Type

- Customer Reference

- Dated

- Max Amount

- Liability Amount

- Source Reference

- Branch

- Amendment Status

- Number of Amendment

11.3 Islamic Guarantees Transfer Input

This section contains the following topics

- Section 11.3.1, "Islamic Guarantees Transfer Input"

- Section 11.3.2, "Parties Tab"

- Section 11.3.3, "Documents Tab"

- Section 11.3.4, "Parties Limits Tab"

- Section 11.3.5, "Viewing Islamic Guarantees and SBLC Transfer Details"

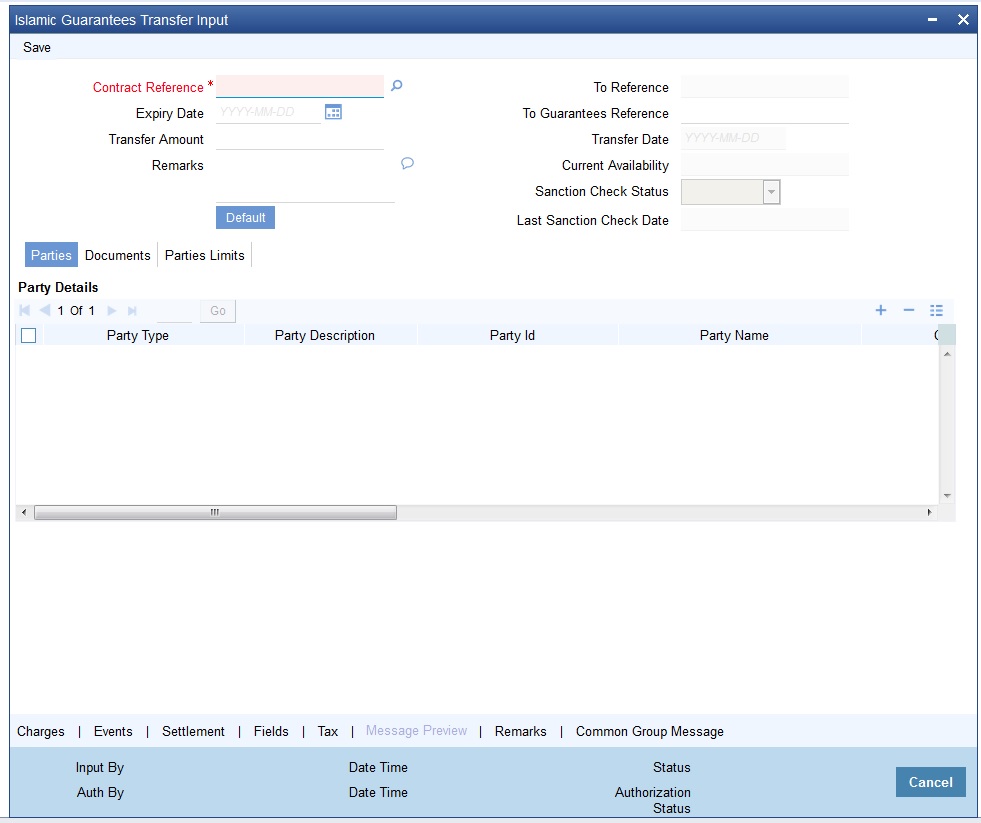

11.3.1 Islamic Guarantees Transfer Input

You can transfer Islamic Guarantees and SBLC using ‘Islamic Guarantees Transfer Input’ screen.You can invoke this screen by typing ‘LIDGUTRF’ in the top right of the Application tool bar and clicking the adjoining arrow button.

You can maintain the following in this screen:

Contract Reference

Indicate the Islamic Guarantee/SB LC from which you want to effect the transfer. Click the adjoining option list and select a valid Contract Reference.

To Reference

Specify the reference number to which the Islamic Guarantee/SB LC should be transferred.

Expiry Date.

The expiry date is the date up to which the transferred Islamic Guarantee/SB LC is valid. The expiry date of the original Guarantee/SB LC is defaulted. You can change the defaulted date. However, the expiry date cannot be earlier than the Islamic Guarantee/SB LC issue date or today's date.

To Guarantees Reference

Specify the reference number to which the islamic guarantees should be transferred.

Transfer Amount

The transfer amount is the amount that should be transferred from the original Islamic Guarantee/SBLC. You can only transfer an amount that is less than or equal to the amount available under the original Islamic Guarantee/SB LC.

Transfer Date

Specify the date of transfer.

Remarks

Specify remarks, if any.

Default

Click the default button for defaulting Islamic Guarantee/SBLC details

Current Availability

The system displays the current outstanding liability amount.

Sanction Check Status

The system displays the sanction check status.

Last Sanction Check Date

The system displays the last sanction check date.

11.3.2 Parties Tab

You can maintain the following details in Parties tab:

Party Details

Party Type

Specify the Party Type by selecting the ‘Party Type’ from the adjoining option list

Party Description

The Party Description appears in the Party Description field once you select the Party Type.

Party ID

Specify the ‘Party ID’ for which you need to maintain. Alternatively, you can select the ‘Customer Id’ from the adjoining option list also.

Note

BIC Code appears next to the ‘Customer Id’ only if the BIC Code is mapped with that customer number. If the BIC code is not mapped with that customer number then the BIC Code will not appear next to the ‘Customer Id’ in the adjoining option list.

The list displays all the valid parties maintained in the system. On selecting the Party ID, the following details are displayed:

- Party Name

- Country

- Language

- Address 1-4

11.3.3 Documents Tab

You can maintain the following details in Documents tab:

- Document Details

- Code

- Document Type

- Document Description

- No of Copies

- No of Original

- Original Required

11.3.4 Parties Limits Tab

You can maintain the following details in Parties Limits tab:

Credit Line

- Serial Number

- Party Type

- Customer No

Specify the ‘Customer No’ for which you need to maintain. Alternatively, you can select ‘Customer Id’ from the adjoining option list also.

Note

BIC Code appears next to the ‘Customer Id’ only if the BIC Code is mapped with that customer number. If the BIC code is not mapped with that customer number then the BIC Code will not appear next to the ‘Customer Id’ in the adjoining option list.

- Liability Number

- Linkage Type

- Linkage Reference No

- % Contribution

- Amount Tag

- Limit Amount

- JV Parent

For more details on the tabs and buttons in Islamic Guarantees and SBLC Transfer Input screen, refer the chapter titled ‘Transferring LI’ in this user manual.

11.3.5 Viewing Islamic Guarantees and SBLC Transfer Details

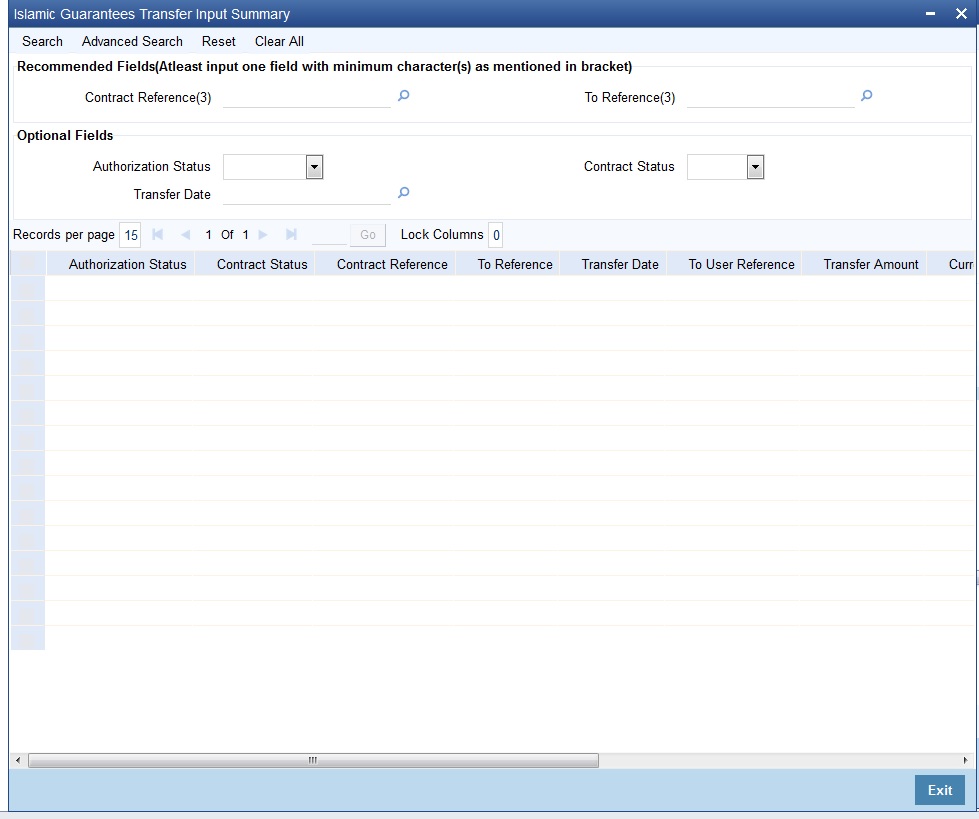

You can view islamic guarantees and SBLC transfer details through ‘Islamic Guarantees Transfer Input Summary’ screen. You can invoke this screen by typing ‘LISGUTRF’ in the top right corner of the Application toolbar and clicking the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

Recommended Fields

- Contract Reference

- To Reference

Optional Fields

- Authorization Status

- Contract Status

- Transfer Date

Select any or all of the above parameters for a query and click ‘Search’ button. The system displays the following records meeting the selected criteria:

- Authorization Status

- Contract Status

- Contract Reference

- To Reference

- Transfer Date

- To User Reference

- Transfer Amount

- Current Availability

- Expiry Date

- Shipment Date

- Period for Presentation