2. Overview of Murabaha Money Market Module

2.1 Introduction

The Murabaha Money Market module of Oracle FLEXCUBE is versatile and efficient. With it, you can handle all kinds of placements and borrowings - whether Call, Notice, or Terms - of varying tenors, profit types, and profit payment methods. The module is efficient in that it automates processing, accounting and messaging of deals captured in your dealing room system.

This chapter contains the following sections:

- Section 2.2, "Product Definition Facility"

- Section 2.3, "Automatic Processing Features"

- Section 2.4, "Settling Murabaha Money Market Deals"

- Section 2.5, "Rolling Over Deals"

- Section 2.6, "Tracking and Retrieval of Information"

2.1.1 Automatic Deal Upload

The corner stone of this module is the Deal Upload facility. With this facility, you can automatically upload the deals captured in your dealing room system. On upload, you can enrich the deals with additional information relating to accounting and messaging (such as profit accrual, brokerage, tax, rollover, customer advice generation details, etc.). This information determines how deals are handled by the automatic processes that you execute. Processing, thus, requires minimal manual intervention, and is efficient.

2.1.2 Architectural Advantages

In architecture, Oracle FLEXCUBE is modular yet integrated. That is, front-end modules such as Murabaha Money Market function around a Core consisting of the Security Management System, the Limits Service, the Management Information System, etc. This architecture eliminates replication of commonly accessed information in every module. Information that is common to several modules is maintained in the Core of the system (for example, currency related information). This is accessed by front-end modules such as MM, MMM, FX, LC, BC, Finances, Deposits, and so on. The architecture, thus, ensures that all front-end modules use reliable and consistent data drawn from the Core.

Oracle FLEXCUBE's architecture also ensures that you can constantly monitor, real-time, your exposure. Crucial services such as Limits reside at the Core of Oracle FLEXCUBE. This means that your liability towards a customer is tracked real-time across front-end modules.

2.1.3 Quick and Easy Retrieval of Information

The facility to retrieve accurate information quickly is a key benefit that Oracle FLEXCUBE offers. Oracle FLEXCUBE supports standard financial reports. In addition, you can customize reports to suit your specific requirement. You can generate these reports at any time during the day.

The powerful query facility that Oracle FLEXCUBE offers is another useful management tool. This facility not only functions as a search tool - you to ‘drill down’ to the very details of a contract or transaction - it retrieves information along the select criteria that you specify.

2.2 Product Definition Facility

A central feature of the front-end modules of Oracle FLEXCUBE is the ‘Product Definition’ facility. This feature drastically reduces marketing time, thus allowing your bank to focus on and take advantage of the opportunities in the market.

This section contains the following topics:

- “Defining Murabaha Money Market Schemes as Products” on page 2

- “Advantage of Defining a Product” on page 2

2.2.1 Defining Murabaha Money Market Schemes as Products

A ‘product’ is a specific type of deal that a bank enters into, or a scheme that a bank offers its customers. An MMM product can imply a specific type of placement/borrow deal that a bank enters into. For example, your bank may offer customers an 'overnight borrow' facility. This facility can be defined as a product in Oracle FLEXCUBE. (If your bank offers several types of overnight borrow schemes, each of these schemes can be defined as a product.)

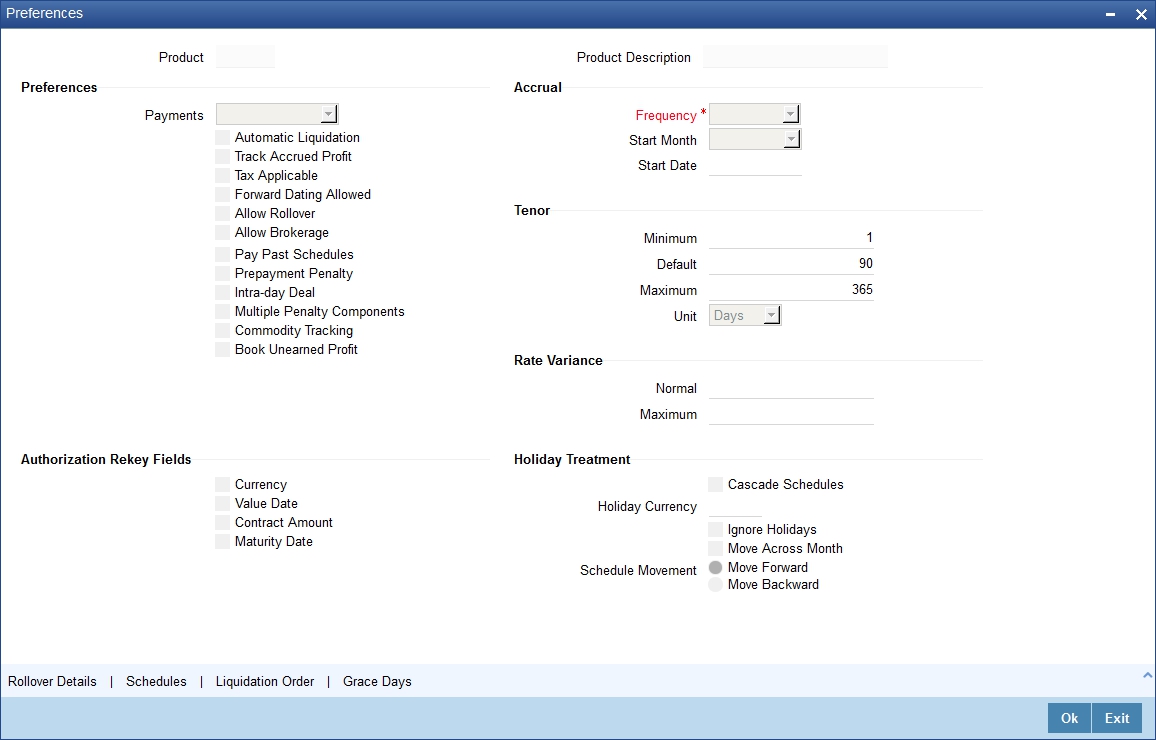

When setting up the module, you can define the various types of deals you enter into as products. For each product, you can define ‘attributes’ such as profit, profit accrual, liquidation, rollover, tax, brokerage details, etc. When you enter into a deal, the deal acquires the attributes defined for the product that it involves.

2.2.2 Advantage of Defining a Product

The product definition facility is a one-time effort. When defining a Murabaha money market deal type or scheme as a product, you can specify (amongst other details):

- the tenor

- the rate of profit

- the repayment schedules

- the tax details

- the accounting entries to be passed

- the advices to be generated

The user does not have to specify these details every time a deal is entered. The product definition facility thus reduces the time required to capture a deal.

The product definition feature also facilitates:

- quick retrieval of information relating to deals of a particular type

- standardization of Murabaha money market schemes across branches

- modification of standard features of a scheme to suit specific requirements

2.3 Automatic Processing Features

Oracle FLEXCUBE completely automates and tracks all the events in the lifecycle of a Murabaha money market deal. It

- Generates deal tickets

- Accrues profit

- Liquidates due schedules

- Matures contracts due for maturity

- Rolls over deals according to your specifications

- Automatically generates the specified messages and advices

Using Oracle FLEXCUBE, you can process Murabaha money market deals with fixed, floating, or period profit rates, and with a variety of profit application methods.

You can also define bullet schedules for all components. Oracle FLEXCUBE allows you to define brokerage on a cumulative or slab basis for each currency or currency pair. You can automate liquidation of brokerage according to the preferences defined for your broker.

The transfer of funds between parties is always confirmed and corroborated with the exchange of messages, advices or receipts. When defining a product in the MMM module, you can specify the advices and messages that should be generated at different 'events' (such as profit liquidation and rollover) in the life cycle of deals involving it. Once an event defined for message generation occurs in a deal, the system automatically generates the advices or notices in the media that you specified.

You can configure the format and the contents of the advices to suit you requirement.

2.4 Settling Murabaha Money Market Deals

All scheduled component and maturity settlements are handled automatically in Oracle FLEXCUBE by calling the Settlement and Messaging sub-systems. Further, you can generate, online, all payment transfer messages to correspondent banks together with related settlement accounting entries.

In keeping with its flexible design, Oracle FLEXCUBE offers you the option to process maturities manually.

2.5 Rolling Over Deals

The Murabaha Money Market module provides an extensive feature for rollover of contracts on maturity. The rollovers could be with or without profit, with the option to net withholding tax on rollover.

2.6 Tracking and Retrieval of Information

The interface with the Limits module ensures online counter-party exposure tracking. The module gives you a better handle over your Murabaha Money Markets portfolio by constantly providing you with real-time and relevant information for efficient asset-liability and maturity management.

During the day or end of the day you may want to retrieve information on any one of the several operations that were performed at your bank. This information can be generated in the form of reports. The following are some of the reports that you can generate for the Murabaha Money Markets module:

- Contract schedules and maturities report

- Forward contracts report

- Value dated amendments report

- Contract events report

- Contract retrieval report

- Memo accrual control journal

- Accrual control journal

- Accrual control journal summary

- Activity journal