3. Defining Attributes of a Murabaha Money Market Product

In this chapter, we shall discuss the manner in which you can define attributes specific to a Murabaha Money Market product.

This chapter contains the following sections:

3.1 Islamic Money Market - Product Definition

You can create an Islamic Money Market (IMM) product in the ‘Islamic Money Market - Product Definition’ screen. You can invoke this screen by typing ‘MCDPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. In this screen, you can enter basic information relating to a Islamic Money Market product such as the Product Code, the Description, and so on.

For a Murabaha Money Market product, you can define other generic attributes, such as branch, currency, and customer restrictions, and so on by clicking on the appropriate icon in the horizontal array of icons in this screen. In addition to these generic attributes, you can define attributes specifically for a money market product. These attributes are discussed in detail in this chapter.

For further information on these generic product attributes, please refer the following Oracle FLEXCUBE User Manuals under Modularity.

- Product Definition

- Profit

- Charges and Fees

- Tax

- User Defined Fields

- Settlements

You can define User Defined Fields in ‘Product UDF Mapping’ screen (CSDPDUDF).

For details on User Defined Fields screen refer Other Maintenances chapter in Core Service User Manual.

You can define product restrictions for branch, currency, customer category and customer in Product Restrictions (CSDPRDRS) screen.

For details on product restrictions refer Product Restriction Maintenance chapter in Core Service User Manual.

This section contains the following topics:

3.1.1 Defining a Money Market Product

A product is defined by setting the following attributes:

Product Code

Enter a unique code to identify the product throughout the module. This code should have four characters. You can follow your own conventions for devising this code.

While defining a new product, you should enter a code, which is unique across the different modules of Oracle FLEXCUBE. For instance, if you have used MM01 for the Money Market module, you cannot use it as a code in any other module.

Product Description

Enter a unique code and a brief description for the product that you want to set up. Enter a brief description of the product. The description will be associated with the product for information retrieval purposes.

Slogan

Enter the marketing punch line to be associated with the product. This slogan will be printed on all the advices that are sent to the customer for a deal involving this product.

For example, if you have a borrowings product called Money Multiplier you could enter the slogan “Watch your money grow with Money Multiplier”.

Product Type

A product that you are defining can belong to any of the following categories:

- Placement

- Borrowing

These product categories are referred to as ‘product types’. When you create a product, you must specify the ‘type’ to which it belongs. For example, you should specify the product type as ‘Placement’ if you are defining a placement product and ‘Borrowing’ if you are defining a borrowing product.

Description

A brief description of the product type is displayed here.

Product Group

Each product is classified under a specific group. The different groups are defined in the Product Group Definition table. Select a Group ID from the option list. The product will belong to this group.

Product Group Description

A brief description of the product group is displayed here.

Start Date

A product is set up to be used over a particular period. The Start Date for this product is specified in this field. The Value Date (initiation date) of a deal involving this product should be:

- The same as or later than this date and

- The same as or earlier than the End Date

End Date

Specify the End Date for the product. The Value Date (initiation date) of a deal involving this product should be the same as or earlier than the End Date. If you do not specify an End Date, the product can be used till it is closed.

The start and end dates of a product come in handy when you are defining a product for a scheme, which is open for a specific period.

Remarks

Click ‘Free Format Text’ button. Provide information about the product intended for your bank’s internal reference. This information will not be printed on any correspondence with the customer. Click ‘OK’ after you enter the information.

The remarks are displayed when the details of the deal are displayed or printed.

3.1.2 Specifying the Product Type

A product that you are defining can belong to any of the following categories:

- Placement

- Borrowing

These product categories are referred to as ‘product types.’ When you create a product, you must specify the type to which it belongs. For example, you should specify the product type as ‘Placement’ if you are defining a placement product and ‘Borrowing’ if you are defining a borrowing product.

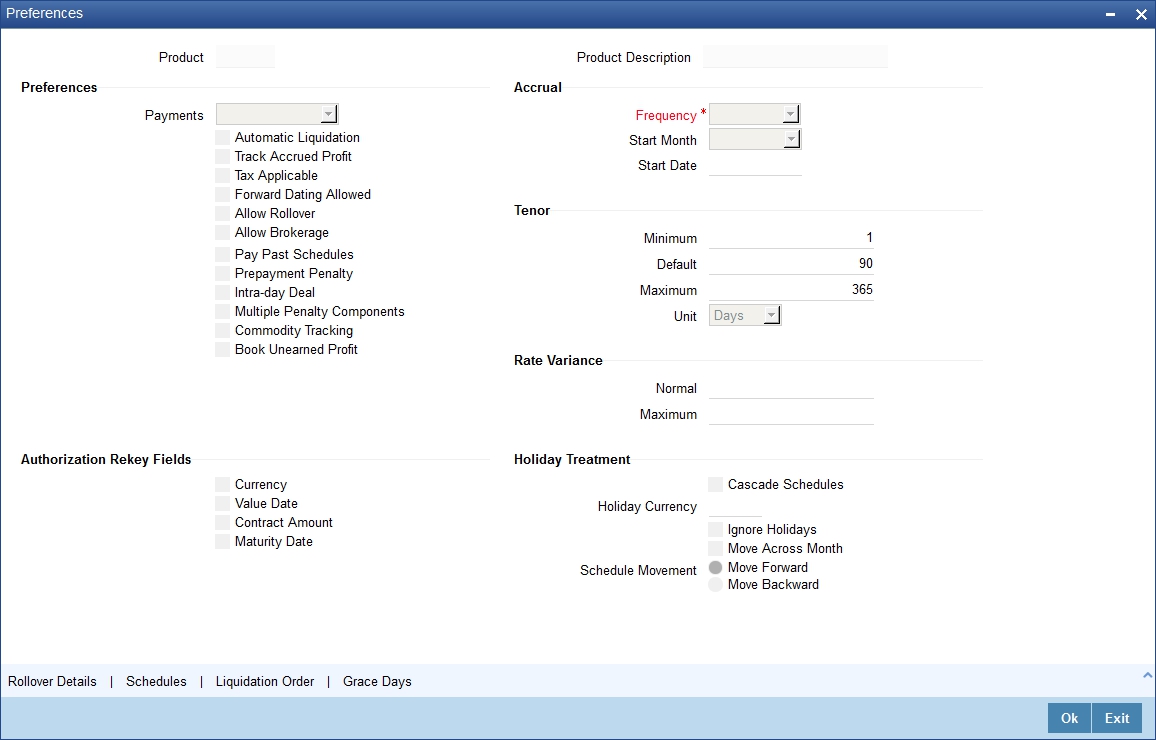

3.2 Setting Product Preferences

Preferences are the options that are available to you for setting the attributes of a product. The options you choose ultimately shape the product.

For example, you have the option of applying tax on a product. If you specify that tax is applicable for a product, the deal involving the product will inherit the attribute. However, you can waive tax (if it has been defined for the product the deal involves) at the time of deal processing.

Similarly, you choose between the automatic liquidation of schedules and manual liquidation; you can choose to allow rollover of deals involving the product, or deny it, and so on.

You should specify whether the payment method for the ‘main’ profit (specified while defining attributes for the profit, commission, charge or fee) components is to be bearing, discounted or true discounted. This cannot be changed at the time of processing a deal.

If you select ‘Bearing’, then the profit is liquidated on scheduled payment date(s).

If you select ‘Discounted’, then the profit is deducted from the principal at the time of initiating the deal.

If you select ‘True Discounted’, then the profit is calculated on the principal in a manner differing slightly from the ‘Discounted’ method. The profit rate is applied on the Principal instead of the Nominal, as it is done in the ‘Discounted’ method.

Components of a deal can be liquidated automatically or manually. In the ‘Islamic Money Market - Preferences’ screen, you have to indicate whether the mode of liquidation of repayment schedules is to be automatic.

Specify ‘Automatic Liquidation’ if you want the components of a deal involving this product to be liquidated automatically.

If you opt for automatic liquidation, a schedule will be automatically liquidated on the day it falls due, during beginning-of-day processing (by the Automatic Contract Update function).

The manner in which the automatic schedule liquidation date falling on a holiday will be handled is based on your holiday handling specifications in the Branch Parameters table:

- If a schedule falls on a holiday it will be processed on the last working day before the holiday − during end of day processing − if you specified that processing (of such schedules) has to be done on the last working day before the holiday.

- If you have specified that processing has to be done only up to the System Date, then the events scheduled for the holiday will be processed only on the next working day after the holiday, during beginning-of-day processing.

If you have defined verification of funds for the product, it will have an impact on the automatic liquidation.

If specify manual liquidation, you should give specific instructions for liquidation through the ‘Manual Liquidation’ screen on the day you want to liquidate the schedule.

You have to specify whether the accrued profit of earlier placements (that has not been paid) should also be considered as the ‘utilized amount’ for the purpose of credit administration. (You could have more than one profit type of component applicable on a product. In such a case, you should designate one as the ‘main’ profit.)

If you opt to ‘Track Accrued Profit’, then the profit accrued on deals will be added on to the amount utilized by the customer, for credit administration.

The utilization will be shown as the sum of the principal and the accrued profit in the reports generated by the credit administration (Limits) sub-system. Outstanding profit, if any, will also be shown in these reports.

As part of the preferences that you define for a product, you can specify whether any tax is applicable for the MMM product that you are creating.

If tax is specified for a product, you can waive it for specific deals. However, if you specify that tax is not applicable to a product, you cannot levy tax on any deal involving the product.

The Value Date (That is the date on which it is initiated) for a deal can be:

- the date on which it is input

- a date in the past

- a date in the future

You should indicate whether a deal involving a product could have a value date in the future. A deal can have a value date in the future only if you have allowed it for the product that it involves. An initiation date in the past, or today, can be indicated for any deal.

When a deal with a Value Date in the future is stored, no accounting entries will be passed on the date of input. The deal will be initiated by the Automatic Contract Update function during the Beginning-of-Day (BOD) processes on the Value Date (initiation date). All the necessary accounting entries will be passed on this date.

However, if the Value Date falls on a holiday, the deal will be initiated as per your holiday handling specifications in the Branch Parameters screen:

- If you have specified that automatic processes are to be carried out for holidays, the deal slated for initiation on the holiday will be initiated during end-of-day processing on the last working day before the holiday.

- If you have specified that the automatic processes are to be carried out only till System Date (today’s date), the deal slated for initiation on the holiday will be initiated on the next working day immediately after the holiday, during beginning-of-day processing.

You should specify whether a deal, involving the product you are defining, can be rolled over into a new deal if it is not liquidated on its Maturity Date.

If you specify that rollover is allowed for the product, it will be applicable to all the deals involving the product. However, at the time of processing a specific deal involving this product, you can indicate that rollover is not allowed.

However, if you specify that rollover is not allowed for a product, you cannot rollover deals involving the product.

The terms of the rolled over deal can be the same as those of the original deal or they can be different If the terms should be different, they should be specified during deal processing.

You can specify whether brokerage should be applied on deals involving this product. If brokerage is specified for the product, you can waive it for specific deals, but if you have specified that brokerage is not applicable to the product; you will not be able to levy brokerage on a specific deal involving the product.

Prepayment Compensation

You can indicate whether compensation is to be applied on a contract involving the product if a withdrawal is made before it is due.

Discount Accrual Applicable

You can check this option if the component is to be considered for discount accrual on a constant yield basis.

Note

This option will be enabled only if brokerage applicable is ‘Yes’.

Intra-day Deals

Deals having the same Maturity and Value Date are known as Intra-day deals.

You will be able to capture intra-day deals only if you have indicated that the product for which you are specifying preferences is meant for intra-day deals.

Pay Past Schedules

A backdated deal may have schedules prior to today’s date. If so, you have to indicate whether those schedules have to be liquidated when the deal is initiated. A back dated deal is one, which has a Value Date (initiation date) falling before the date on which it is booked.

For example, a money market deal can be initiated as of today, a date in the future, or as of a date in the past. Today’s date is October 15. Suppose you initiate a deal of 15,000 USD today, with the Value Date (date on which the deal comes into effect) as September 15, the system will pass accounting entries for initiation as of September 15.

But if there had been a profit payment schedule for September 30 for 500 USD, then if you specify that back values schedules should be liquidated, you can make the system pass accounting entries to liquidate this schedule also when the deal is initiated.

If you specify that back dated schedules are not to be liquidated; only accrual entries will be passed till today.

Note that the entries associated with each event (initiation and liquidation in this case) will be passed only if they have been defined for the product. Further, the accounts used will be the ones defined for each entry.

Commodity Tracking

You can also opt to track commodity for contracts processed under the product. If selected, commodity tracking becomes mandatory for activating the contracts. For such contracts, the ‘Commodity Tracking Status’ will identify the different stages in the contract life cycle. This status value will vary for ‘Borrowing’ and ‘Placement’ contracts.

The status value for Placement contracts is as given below.

Events |

Commodity Tracking Status |

BOOK (Booking a contract) |

Waiting for offer |

OFFR (Offer received and accepted) |

Offer Received and Accepted |

GRNT (Receipt of the letter of the guarantee) |

Closed |

The status value for Borrowing contracts is as given below.

Events |

Commodity Tracking Status |

BOOK (Booking a contract) |

Offer to be sent |

OFFR (Offer is sent) |

Offer Sent |

GRNT (Guarantee is sent) |

Closed |

Contracts that require commodity tracking will be initiated or activated only when the status is ‘Closed’.

Note

If you do not select this option for a product, the ‘Commodity Tracking Status’ will be ‘Not Applicable’.

You can view the commodity details in the ‘Commodity Tracking’ screen invoked from the ‘Contract Online’ screen.

For more details, refer the ‘Processing a Murabaha MM Deal’ chapter of this User Manual.

Book Unearned Profit

You can opt to do an upfront booking of the unearned profit, if required. However, this is applicable only for the ‘Main’ profit component. If you select this option, the system will trigger the ‘UIDB’ event (Upfront Profit Booking) along with the INIT event. The computation of upfront profit is done differently depending on the profit rate type, whether fixed or floating, as follows:

- For ‘fixed’ profit types, the upfront profit is computed as the total of the profit to be collected over the contract tenor.

- For ‘floating’ rate types with ‘periodic’ rate revision, profit is computed as the profit collected till the next revision date.

- For different rate revision and payment frequency, profit is calculated upto the next revision date only.

Note

If you select this option, the system will validate to ensure that the main profit component is not defined with the following parameters:

- Rate Type as ‘Floating’

- Code Usage as ‘Automatic’

The system will post adjustment entries if any of the following operations affects the unearned profit amount:

- Revision of profit rates

- Value Dated amendment to contracts

- Changing the schedules for a contract

- Rollover of a contract

For details on the various events and event-wise accounting entries and advices applicable during an MM contract life cycle, refer ‘Annexure A’ of this User Manual.

This section contains the following topics:

- Section 3.2.1, "Prioritizing the Liquidation of Components"

- Section 3.2.2, "Defining other Preferences"

Accrual

Apart from the principal, you can have other components for a deal. The other components of a deal could be the profit, charge or fees and they can be accrued over the tenor of the deal before being realized into the income or expense account.

You can define the frequency at which you would like to accrue these components, as part of the preferences that you specify.

The attributes of these other components are defined in the ICCF sub-system of Oracle FLEXCUBE. For components that have been marked for accrual, the frequency is specified in this screen (Product Preferences screen).

When you run the Automatic Contract Update function at the end of day, the system carries out the accruals according to the frequency that you specified.

However, if the accrual date falls on a holiday, then the accruals will be done as per your holiday handling specifications in the Branch parameters screen. That is

- If you have specified that automatic events are to be processed for a holiday(s) on the working day before the holiday, the accruals falling due on a holiday(s) will be processed during end-of-day processing on the last working day before the holiday.

- If you have specified that the automatic events are to be processed for a holiday(s) on the working day following the holiday, the automatic events falling due on a holiday(s) will be processed on the next working day, during the beginning of day processing.

The frequency can be one of the following:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

In the case of monthly, quarterly, half yearly or yearly accruals, you should specify the date on which the accruals have to be done. For example, if you specify the date as ‘30’, accruals will be carried out on the 30th of the month, according to the frequency that you have defined.

If you want to fix the accrual date for the last working day of the month, you should specify the date as ‘31’ and indicate the frequency. If you indicate the frequency as monthly, the accruals will be done at the end of every month -- that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February.

If you specify the frequency as quarterly and fix the accrual date as the last day of the month, then the accruals will be done on the last day of the month at the end of every quarter. It works in a similar fashion for half-yearly accrual frequency. If you set the accrual frequency as quarterly, half yearly or yearly, you have to specify the month in which the first accrual has to begin, besides the date.

For example, If you specify the frequency as half yearly, the start date as 31, and the start month as June, the system will accrue profit for the first time on June 30, for the period from January 1 to June 30, and for the second time on December 31, for the period from July 1, to December 31.

Tenor

You can set the minimum and maximum tenor limits for a product that you are creating. You can also set a default tenor. This is the tenor that is normally associated with a deal involving the product.

However, the default tenor applied on a deal can be changed during its processing.

For example, assume that you have a Weekly Borrowing product. This product is for borrowings from customers for a maximum duration of one week. For such a product you can set a minimum tenor of one day and a maximum tenor of one week. You can also define a default tenor for the product, of, say, one week. This tenor will be applicable to all the deals involving the product, if you do not specify any tenor at the time of its processing.

Rate Variance

When a deal involves a currency conversion, the standard rates defined for the currency will be picked up, by default. This default can be changed for specific deals. You can impose some restrictions on the changed rate, as follows:

Normal

If the exchange rate variance exceeds the standard exchange rate specified for the currency, the system will ask you for an override before proceeding to apply the exchange rate.

Maximum

You cannot apply an exchange rate on a deal, involving the product that you are creating, that is greater than the value that you specify as the Maximum Variance. If the exchange rate variance exceeds the standard rate by the value that you specify as the ‘maximum variance’; the system will not allow you to store the contract.

For example, you have specified the normal variance as 3% and the maximum variance as 6% for Product MM01. Now, if you apply an exchange rate on a contract involving MM01 that varies from the applicable rate maintained for the day by less than 3%, the system will not display an override message.

If you apply an exchange rate on a contract involving MM01 that varies from the Standard Rate by between 3% and 6%, the system will display an override message. If you apply an exchange rate on a contract involving MM01 that varies from the day's rate by more than 6%, the system will not store the contract.

Note

The exchange rate variance is a percentage.

Authorization Rekey Fields

You can specify the values that the authorizer of an MMM deal has to rekey at the time of authorization.

All operations on a deal (input, modification, reversal, manual liquidation or manual rollover) have to be authorized:

- by a user other than the one who carried out the operation

- before you can begin the end-of-day operations

When you invoke a deal for authorization - as a cross-checking mechanism to ensure that you are calling the right deal - you can specify that the values of certain fields should be entered before the other details are to be displayed. The complete details of the deal will be displayed only after the values to these fields are entered. This is called the ‘rekey’ option.

If no re-key fields have been defined, the details of the deal will be displayed immediately once the authorizer calls the deal for authorization.

The re-key option also serves as a means of ensuring the accuracy of inputs.

You can specify any or all of the following as re-key fields:

- Currency

- Value Date

- Contract Amount

- Maturity Date

Product Restriction

Branch List

Indicate whether you want to create a list of allowed branches or disallowed branches by selecting one of the following options:

- Allowed

- Disallowed

Currency Restrictions

Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options:

- Allowed

- Disallowed

Categories List

Indicate whether you want to create a list of allowed customers or disallowed customers by choosing one of the following options:

- Allowed

- Disallowed

3.2.1 Prioritizing the Liquidation of Components

If you have defined automatic liquidation for the product, you can specify the order of liquidation of the various components, which have:

- schedules that fall due on the same day and

- the same repayment account

You can specify the order in which you would like to liquidate components in the ‘Component Liquidation Order’ screen.

For a contract defined with manual liquidation of components, the liquidation order will be considered when a payment has to be automatically distributed among the various outstanding components.

For a contract with automatic liquidation, the order of liquidation becomes important when funds are insufficient in the repayment account on the day of liquidation and more than one component has a schedule falling due on that day.

Under such circumstances, you may want to allot priority to the recovery of certain components. For example, you may want to recover the profit (or profit type of components) first and then the principal. The aging analysis function takes over once a component is overdue and an appropriate compensation is applied. For a component on which compensation profit has been applied, you may wish to recover compensation profit first, the profit next and finally the principal.

Note

You can specify the liquidation order for all the profit type of components and the principal.

3.2.2 Defining other Preferences

From the ‘Murabaha Money Market - Preferences’ screen, you can invoke other screens in which you can specify:

- the rollover details (in the Rollover Details screen)

- the default schedules (in the Product Default Schedules screen)

- the order in which you would like to liquidate the various deal components (in the Component Liquidation Order screen)