4. Processing a Murabaha MM Deal

A product is a specific service that you offer your customers.

For example, amongst other financial services, you may offer an overnight borrowing facility to your customers. By defining the overnight borrowing facility as a product − with certain attributes − you can categorize all overnight borrowings, which share the attributes, defined for the product.

The other advantage of defining a product is that you can define certain general attributes for a product that will default to all contracts (placements or borrowings) involving it.

Note

When you enter into a deal with a customer, you enter into a contract. Contracts are customer specific.

Deals (contracts) inherit the attributes of the product by default. This means you will not have to define these general attributes each time you input a deal involving the product. These general attributes, however, can be changed at the time of processing a deal.

Besides, these general attributes which a deal inherits from a product - and which can be changed for it − there are the specific attributes which you have to define for the deal:

- the counterparty (customer) details

- the deal amount

- the deal currency

- the repayment account for the deal, and so on

This chapter contains the following sections:

- “Invoking the Deal Input Screen” on page 2

- “Features of the Contract Details Screen” on page 3

- “Preferences for a Deal” on page 10

- “Modifying a Placement or a Borrowing” on page 14

- “Financial Details that can be Changed” on page 15

- “Reversing and Rebooking Contracts” on page 15

- “Viewing the other Details of a Deal” on page 15

- “Advices for deal initiation” on page 16

- “Viewing Event Details” on page 17

- “Viewing Accounting Entries for Deal Initiation” on page 18

- “Viewing the Different Versions of a Deal” on page 18

- “Initiating a Future Value Dated Deal” on page 18

- “Maintaining the Commodity Details for a Contract” on page 19

- “Viewing Islamic Money Market Contracts Details” on page 21

- “Bulk MM Contracts Details” on page 22

- “Reassigning the Murabaha MM Contract to another User” on page 25

4.1 Invoking the Deal Input Screen

The capture of disbursement details of an MM deal involves inputs to the following screens:

- Contract Details screen

- Contract Preferences screen

- Contract Schedule Definition screen

- Contract Rollover screen

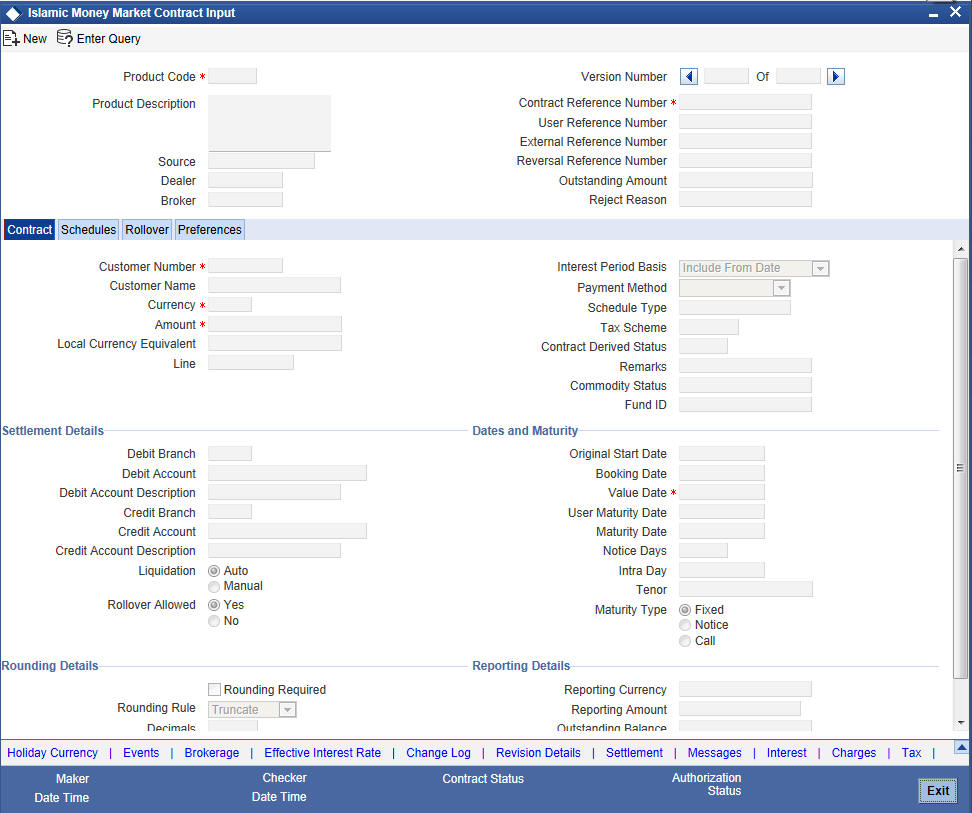

You can invoke ‘Islamic Money Market Contract Input’ screen by typing ‘MCDTRONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The screen is displayed below:

Once in the Contract Details screen, you will see four other sections, each representing a screen:

Section |

Screen |

Preferences |

Contract Preferences screen |

Schedules |

Contract Schedule Definition screen |

Rollover |

Contract Rollover screen |

Linkages |

Contract Linkages screen |

4.2 Features of the Contract Details Screen

Every product that is created in your bank is endowed with certain general attributes. A deal that you enter into acquires the general attributes defined for the product it involves. To recall, a product is endowed with the following general attributes:

- The product code, description, slogan, start and end date for the product and remarks

- The frequency of profit accrual

- The tenor limits for the product

- The liquidation mode: manual or automatic

- Whether a deal involving the product can be rolled over into a new deal if it is not liquidated on its Maturity Date

- Whether the accrued profit of earlier placement(s) should be considered as part of the utilized amount while tracking credit utilization for a customer

- Whether tax has to be applied

- Whether brokerage has to be applied

- The exchange rate variance (For a special customer, you can choose to apply a rate that is greater than the standard exchange rate defined for the currency. You can impose some restrictions on the special rate by way of specifying a variance.), whether a compensation is to be imposed if there is an advance repayment

- Whether profit schedule amounts have to be recomputed in case of an advance payment

- Whether a deal involving a product can be booked to be initiated on a date in the future

- Whether for a backdated deal that has schedules prior to today’s date, the schedules have to be liquidated when the deal is initiated. A back dated deal is one, which has an initiation date, which falls before the date on which it is booked.

- The payment type for main profit - bearing, discounted or true discounted

- The values to be rekeyed, by the authorizer of a contract, at the time of authorization

- The liquidation order of various components in case of auto liquidation

- Repayment schedules

- Aging analysis details such as the movement of deals from one status to another; the mode of status change - whether forward and reverse movements should be automatic or manual; reversal or stoppage of accruals upon change of status; the transfer GL upon status change; the messages to be generated; and the transfer days for interim schedules and maturity schedules

- Specifying rollover details like updating credit limit utilization on rollover (for a placement), tax on rollover, rolling over with profit or without, deduction of tax on rollover

- Details of profit, charge and fee

- Other tax details like the component being taxed, the type of tax and the event (booking, liquidation, and so on.) upon which it is applied

- The accounting roles and the General Ledgers for accounting purposes when an event (initiation, liquidation, and so on.) takes place, and the advices or messages to be generated

- The customer categories and customers who can be counterparty to a deal involving the product

- The branch and currency restrictions

A deal that you enter into acquires the details specified for the product. However, you also need to enter information that is specific to the contract. You can enter details specific to a contract in the ‘Murabaha Money Market Contract Online’ screen.

You need to enter the following information:

- The template ID if you are using one

- The base number of the counterparty (customer)

- The currency of the contract

- The principal amount (for a deal with True Discounted profit, you should enter the nominal)

- The credit line under which the placement has to be tracked

- The tenor related details for the deal

- The code of the broker involved

- The dealer involved

- The default settlement account

- The maturity details

- The related reference number, if any

- The profit details

- Whether the deal can be rolled over

- The status of the placement if it is to be changed manually

The following details are displayed. They cannot be changed:

- Product type

- Default tax scheme

- Schedule payment method

- Profit type

- Rollover count

Reference Number

The contract reference number identifies the deal. It is automatically generated by the system for each deal. It is a combination of the branch code, the product code, the date on which the deal is booked (in Julian format) and a running serial number for the booking date.

The reference number consists of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number.

The Julian Date has the following format:

‘YYDDD’

Here, YY stands for the last two digits of the year and DDD for the number of day(s) that has/have elapsed in the year.

For example, January 31, 1998 translates into the Julian Date: 98031. Similarly, February 5, 1998 becomes 98036 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those that elapsed in February (31+5=36).

User Reference

You can enter any reference number for a deal that you enter into. The deal will be identified through this number in addition to the contract reference number generated by the system. No two deals can have the same user reference number. By default, the contract reference number generated by the system will be taken as the user reference number. You can use this number, besides the deal reference number, to retrieve information relating to a deal.

Source

You have to indicate the source from which contracts have to be uploaded.

If this value is left null, then you will not be able to amend the contract. Amendment for the contract can be uploaded only through the same source as that used for creation.

Product Code

Every deal that you enter into would involve a specific service that you offer (which you have defined as a product). When processing a deal that you enter into, you should specify the product that it involves. The option list provides all the valid products maintained through the ‘Murabaha Money Market – Product Definition’ screen.

All the attributes of the product that you specify will apply to the deal. However, you can change some of these attributes while entering the details of the contract. When you specify the product, the product type - placement or borrowing - will be displayed.

Customer

When entering the details of a deal, you should specify the customer (counterparty) involved in the deal. The category of customers (or the customers themselves) who can be counterparty to a deal is defined for the product. Specify the code of an authorized customer who falls into a category allowed for the product.

Currency

When processing a deal, you should specify the currency of the deal. You can select any currency that is allowed for the product, which the deal involves. Amendment to this field will be considered a financial amendment.

Amount

If a product has bearing or discounted type of profit, you should enter the principal of the deal in this screen. For a deal involving a true discounted product, you should enter the face value (nominal) of the deal. You can enter “T” or “M” to indicate thousands or millions, respectively. For example, 10T means 10,000 and 10M means 10 million. Amendment to this field will be considered a financial amendment.

Note that the amount, which you enter, would be taken to be in the currency that you specify as the deal currency.

Ext Ref No

If the transaction is being uploaded from an external source, you can specify the identification for the transaction in the external source, as the external reference number. You cannot amend this value post contact save.

Line

By default, you will view the placement credit line defined for the customer. You can change over to another authorized credit line if you want to track the placement under a different line.

During an upload, the credit lines for the given counterparty, product, branch, currency combination are fetched by the system. If there is only one credit line available, the system will display it here. If there are multiple lines found, the field will be left blank.

Reversed Reference

The reference number of the contract that is being reversed and rebooked is displayed here. To enable amendment of MMM Contract details Oracle FLEXCUBE will reverse the old contract and rebook a new contract with the old user reference number and external reference number. The old contract is reversed and a new contract is booked with Reversed Oracle FLEXCUBE ref as the parent contract.

For further details on reversing and rebooking of a contract, refer the section titled ‘Reversing and Rebooking a Contract’ of this user manual.

Dealer

When processing a deal, you must specify the code of the dealer.

In the ‘Dealer Code – Details’ screen you maintain a list of the dealers in your bank. That is, those who have the requisite rights to enter into an MMM deal on behalf of your bank.

Fund Id

Select the fund id from the adjoining option list. The system defaults the value of Default Mudarabah Fund as fund id.

This field will be enabled only for fund branch.

The system populates the fund MIS details for a contract which is linked to the Fund ID.

4.2.1 Specifying Settlement Details

You have to specify the settlement account if settlement instructions have not been defined for the customer.

The settlement account that you specify is the account through which:

- The placement amount would be drawn down

- The repayment for ALL the components would be done

- For a borrowing all repayments be made to this account

If settlement instructions have been defined for the customer, the settlement accounts will be picked up from those instructions. While entering the deal details, you can change the settlement instructions for the deal.

Note

If a settlement account has been specified in the settlement instructions for the customer, and a different account has been specified for the deal, the account specified for the deal will take precedence.

The settlements processing is enabled only if ‘Allow Corporate Access’ has been checked while defining branch parameters in the ‘Branch Parameters – Detail View’ screen.

- If ‘Allow Corporate Access’ is checked for a fund branch and the fund is Portfolio type, then during settlement processing, the settlement account is chosen based on the settlement instructions maintained for the counterparty.

- If ‘Allow Corporate Access’ is not checked for a fund branch, settlement processing is disabled and the settlement account remains as a fund branch account maintained for the fund.

- If the corporate account exists in a different branch, the Inter branch account/GL maintenance is used for resolving the bridge account.

Booking Date

The date on which the deal details are entered would be displayed in this screen. This defaults to the system date (today’s date). This date is for information purposes only. The accounting entries are passed as of the value date of the deal (initiation date of the deal). Amendment to this field will be considered a financial amendment.

Value Date

This is the date on which a deal takes effect. The accounting entries for the initiation of the deal will be passed as of this date. The tenor of the deal will begin from this date and all calculations for profit and all the other components based on tenor will be made from this date onwards.

The system defaults to today’s date. You can enter a Value Date of your choice here. The date that you enter can be any one of the following:

- Today’s date

- A date in the past

- A date in the future (you can enter a date in the future only if Future Dating has been allowed for the product)

The Value Date should not be earlier than the Start Date or later than the End Date defined for the product involved in the deal. In case of a child rolled over contract, this value will be the same as the maturity date of the parent contract.

If the liquidation date for any component falls before today’s date, the liquidation entries (as defined by you for the product) will be passed if you have so specified for the product. If the Maturity Date of a deal is earlier than today, maturity entries will also be passed.

Once the deal details have been stored and authorized, this date can be amended only if the deposit has bearing type of profit and NO schedule has been liquidated. Modification to this field will be considered as a financial amendment.

An override will be sought if the Value Date falls on a holiday, in the country of the deal currency.

Original Start Date

For a deal that has been rolled over, this is the date on which the deal was originally initiated. If a deal has been rolled over more than once, this will be the date on which the first deal was initiated.

If you are entering a deal that has already been initiated, you should enter the date on which the deal began. In this case, the date will be for information purposes only and for all accounting purposes the Value Date will be considered as the date on which the deal was initiated.

Status Control

The status of a placement is indicative of the status of repayments on it. If you have specified automatic status movement for the placement, it will be moved automatically to the status, as per your definition. However, if you indicated that the status change will be made manually on the placement, you can change the status manually in this screen. Even if you have defined a placement with automatic status movement, you can still change the status manually before the automatic status change is due.

There is yet another scenario, where you have defined a placement with automatic status movement forward, but manual status movement in the reverse direction. That is, when the conditions for a placement being in a particular status no longer exist, if you have specified manual reverse movement, then you will have to manually move the placement to the appropriate status.

A placement on which the latest repayment has been made will be in the Active status. If a payment is outstanding on a placement, its status can be changed, based on your requirements of reporting placements with outstanding payments.

The different status codes applicable for a placement are defined for a product and it applies to the placement, by default. However, you can change the status for the contract through this screen.

When you are capturing placement details, the system allots the status of ‘Active’ by default. You may change it to any of the status codes as per your requirement.

While doing manual status changes, ensure that you change the status in the order they are defined. For example, the status codes are defined as follows, in that order:

- Active

- Past Due

- Non-accrual

- Write-off

You cannot change the status of a placement from ‘Active’ to ‘Non-accrual’, by passing Past Due. If the requirement is that the placement has to be put in the Non-accrual status from the Active status, you should first change the status to Past Due, store and authorize this status change and then change it to the Non-accrual status.

If a status change has been defined with a change in the GL, the entries will be passed for the GL movement.

Payment method

The payment method defined for the main profit for the product (whether bearing, discounted or true discounted) applies to the contract as well. The method defined for the product is displayed here.

If the payment method defined is ‘Bearing’, then the profit is liquidated on schedule payment date(s).

If the payment method defined is ‘Discounted’, then the profit is deducted at the time of initiating the deal.

If the payment method defined is ‘True Discounted’, then the profit is calculated on the principal of the deal and not on the nominal. All the same, like the discounted method, here too, it is deducted from the principal at the time of initiation of the deal.

Maturity Type

The Maturity Type you have specified for the product is displayed by default, in the screen. However, you can change it to one of the following:

Maturity Type |

|

Fixed |

The deal has a fixed Maturity Date. This date should be specified in the screen. |

Call |

The Maturity Date is not fixed. The deal can be liquidated any time. |

Notice |

The deal will be liquidated at a certain period of notice. The number of days of notice should be specified in the screen. |

For a deal with a Fixed Maturity, this date can either be postponed or advanced through the Value Dated Changes function, once the deal has been initiated. Amendment to this field will be considered a financial amendment.

Maturity Date

If the Maturity Type is fixed (that is, the Maturity Date of the deal is known when the deal is initiated) specify the Maturity Date in this screen. This date should be later than the Start Date of the product. If the product has a Default Tenor, this date will be defaulted based on the tenor and the From Date of the contract. If you change this date, you should give an override when you store the deal.

For a deal with Call or Notice type of maturity, the Maturity Date should be entered in the screen when it is known. This date should be later than the Start Date of the product. You can unlock the record and add the date.

If the product has a Default Tenor, this date will be defaulted based on the tenor and the From Date of the contract. If you change this date, you will have to give an override when you store the deal.

If you have specified auto liquidation for the deal, liquidation will be done automatically on that date. If manual liquidation has been specified, you will have to manually liquidate the deal through the Manual Liquidation function.

For a deal with Fixed Maturity Type, this date can either be extended or brought backward through the Value Dated Changes function, once the deal has been initiated.

Notice Days

For a contract maturing at notice, you should enter the notice period (in days). This is for information purposes only. When the notice to repay is issued to the counterparty, you should indicate the Maturity Date of the deal in this screen. You can Unlock the record and add the date.

Component

Any number of profit rates, charges and fees can be defined for a product through the ICCF (Profit, Commission, Charge or Fee) screens. By default, all these will be applied on the deal involving the product.

The component defined as the Main Profit (by checking the ’Main Component’ in the ‘ICCF Product Details’ screen) will be displayed here. If you want to make changes to the main profit component only, you can do so through this screen without having to invoke the ‘Contract ICCF’ screen. If you change the main profit details, the changed values will be applied on the deal, along with the specifications for the other components (fee, charge and so on.,) defined for the product. If you want to change the details for any other ICCF component, you have to invoke the Contract ICCF screen by clicking on the ICCF button and make the changes there.

Rate Type

The rate type applicable for the product involved in the deal will be displayed. It can be one of the following:

- Fixed: a fixed profit rate

- Floating rate: an profit rate that changes periodically or automatically as per your specifications in the Floating Rate Table

- Special: an amount instead of a rate

Floating Rate Code

If a Floating Rate Code has been specified for the product involving this deal, it will be displayed in the screen. You can change it to suit the needs of this specific deal.

Spread

For a deal with a floating profit rate, you can specify the Spread that you want to apply over the rate maintained in the Floating Rates table.

This Spread should be greater than or equal to the Minimum Spread and less than or equal to the Maximum Spread defined for the product involved in the deal. If the spread you apply happens to be greater than the Maximum Spread, then the Maximum Spread will be applied on the rate. On the other hand, if it is less than the Minimum Spread defined for the product, the Minimum Spread will be picked up.

For a floating rate, the spread will be applied over the market rate applicable for the day.

Fixed Profit Rate

If the deal involves a fixed profit rate product, the default rate defined in the Product ICCF screen will be displayed here. This rate can be changed through this screen, only for the main profit component.

This changed rate should be greater than or equal to the Minimum Rate and less than or equal to the Maximum Rate defined in the Product ICCF screen.

The rate specified for the deal, along with the spread, can exceed the profit rate specified for the product only within the variance rate specified for the product.

Special Profit Amount

If the product involved in the deal has been defined with a special profit, the profit amount applicable for the deal will be displayed in this screen. You can change it.

While setting up a product, if you specified that deals involving the product should be automatically rolled over, all deals involving the product will be rolled over on their respective Maturity Dates, if they are not liquidated. This feature is called auto rollover. If auto rollover is specified for the product the deal involves, it will be indicated on this screen.

However, if you do not want the deal (whose details are being captured) to be rolled over, you can disallow rollover for the deal. If rollover has been disallowed for a product, you cannot rollover deals involving the product.

Note

For rollover to be applicable for the deal, it has to be defined for the product.

Count

You will see the rollover count in this screen. For a deal that has been rolled over, this count indicates the number of times it has been rolled over.

Tax Scheme

The tax scheme, which has been specified for the product, will be displayed in this screen. The tax scheme cannot be changed at the time of deal processing.

Internal Remarks

You can enter information describing the deal that you are processing. This will be available when you retrieve information on the deal. However, this information will not be printed on any advice printed for the customer’s benefit. This information will be displayed whenever you retrieve information on the deal either as a display or in print.

4.3 Preferences for a Deal

This section contains the following topics:

- “Stating Preferences for a Deal” on page 11

- “Handling a Repayment Schedule Date that Falls Due on a Holiday” on page 12

- “Amortization Type” on page 13

- “Ascertaining Availability of Funds before an Automatic Liquidation” on page 13

4.3.1 Stating Preferences for a Deal

Preferences are options. For instance, for a product, you have the option of:

- Making liquidation automatic or manual

- Allowing or disallowing rollover

- Applying tax or waiving it

- Applying prepayment compensation or waiving it

For a contract, you have the option (preference) of:

- Liquidating automatically or manually, the principal of the deal being input. (This defaults from the product but you can change it for a specific deal)

- Verifying of funds in case of automatic liquidation of repayment schedules. If you indicate that funds have to be verified, the components that will leave the repayment account with a debit balance will not be liquidated. If not, all the components will be liquidated leaving the repayment account with a debit balance (if a debit balance has been allowed for the repayment account). The payment schedule will be marked as liquidated. If a debit balance has not been allowed, the schedules will not be liquidated and aging analysis will take over.

- Ignoring holidays. If you choose this preference, the schedule dates will be calculated ignoring the holiday. The automatic processing of the schedule that falls due on a holiday, however, will be determined by your holiday specifications for the product. If you indicated, for example, that the processing should be done till the day before the next working day, the schedule will be liquidated during the end-of-day run of the Automatic Contract Update function. If you specified, though, that processing should be done only till the System Date, then the schedule falling on the holiday will be processed during the beginning-of-day run of the Automatic Contract Update function on the next working day.

- Choosing to ignore holidays. If you choose not to ignore holidays, you can move a repayment schedule forward or backward to the next or previous working day. You can also specify whether the schedule is allowed to move across the month in case of a holiday.

- Cascading schedules. This means that if one schedule has been moved backward or forward in view of a holiday, the other schedules will be accordingly shifted. If you do not want to cascade schedules, then, only the schedule, which falls on a holiday, will be shifted as specified and the others will remain as they were.

- Specifying the holiday currency

- Liquidating back valued schedules

A deal inherits the attributes defined for the product it involves. However, for a specific deal you can change these inherited attributes, to suit your requirements and those of your customer. The attributes that you can change are:

- The liquidation of schedules that fall due before the day on which the deal is booked

- The liquidation mode (auto to manual)

- The change of status for a placement (auto to manual or vice versa)

There are also some parameters you have to set for the repayment schedules for the deal. They determine whether a schedule date falling on a holiday should be retained or moved and how it is to be moved if you opt for the latter. They also determine whether funds have to be verified if a placement is marked with automatic liquidation.

The attributes that have been listed are discussed in detail.

4.3.2 Handling a Repayment Schedule Date that Falls Due on a Holiday

You have specified that repayment schedules should be generated automatically once you indicate the frequency, number and the date of first repayment. When the system computes the repayment dates based on these values, there is a chance that one or more schedules fall due on a holiday. In such a case, you have two choices:

- Ignore the holiday and retain the due date

- Move it either backward or forward

If you specify that holidays are to be ignored, the schedule dates will be fixed without taking the holidays into account. In such a case, if a schedule date falls on a holiday, the automatic processing of such a schedule is determined by your holiday handling specifications for automatic processes, in the Branch Parameters screen.

In this screen if you have specified:

- That processing has to be done on the previous working day for automatic events right up to the day before the next working day, the schedule falling on the holiday will be liquidated during end-of-day processing on the previous working day

- That processing has to be done only up to the System Date, then only the events scheduled for today will be processed. The events of the holiday are processed on the next working day during beginning - of-day processing

Move Schedule Dates Forward or Backward

If a schedule date falls on a holiday and you have not specified that holidays are to be ignored at the time schedule definition, then you have to indicate the movement of the schedule date either forward to the next working day or backward to the previous working day. In such a case, since the schedule date itself is moved to a working day, the payment will be processed on the day it falls due, as of that day.

Move Across Months

If you have chosen to move a schedule falling due on a holiday either forward or backward, such that it falls due on a working day, and it crosses over into another month, the schedule date will be moved into the next month only if you so indicate. If not, the schedule date will be kept in the same month.

If you have not allowed movement across months but have indicated backward movement for this schedule, the schedule date will be automatically moved (forward in this case), to the next working day of the same month, that is, to May 2, despite your having indicated a backward movement into the previous working day.

Holiday Ccy

You can indicate here the country of the deal currency for which the holiday table should be checked before drawing the payment schedules related to the deal.

By default, the currency to be checked is the deal currency. If a currency other than this is specified, the holiday table is checked for both the currencies. Amendment to this field will be considered as a financial amendment.

Cascade Schedules

The question of cascading schedules arises only if:

- You have specified that a schedule falling due on a holiday has to be moved forward or backward

- The schedule has been defined with a definite frequency

If you have indicated that schedules should be cascaded, the schedule date for the next payable schedule will depend on how the schedule date was moved for a holiday.

The following example illustrates how this concept of cascading schedules functions:

When you cascade schedules, the last schedule (at maturity), however, will be kept for the Maturity Date and will not be changed like the interim schedules. Hence for this particular schedule, the profit days may vary from that of the previous schedules.

Liquidation

When setting up a product you specify the mode of liquidation - whether automatic or manual - for the different components of a deal. By default, all deals involving the product will inherit this definition. However, you can change the mode of liquidation, from automatic to manual, or vice-versa, while processing a deal.

Status control

While defining the product, you indicate the various status codes for the product - for example, active, past due obligation, non-accrual basis, write-off, and so on. For the product, you can specify either manual or automatic change of status.

When processing a deal, you can change the mode of status change from automatic to manual or vice-versa.

4.3.3 Amortization Type

You need to specify the amortization applicable to the contract only if the schedule type is amortization. The following are the amortization types you can specify for a contract:

- Reducing balance

- Rule 78

4.3.4 Ascertaining Availability of Funds before an Automatic Liquidation

When the customer’s repayment account is debited automatically by the system, you can specify that the availability of funds for liquidation of the various components of the placement has to be ascertained before the liquidation is done.

This feature is of significance when:

- The components have the same schedule dates, and are serviced by a single repayment account

- The funds in the repayment account are insufficient

If the availability of funds has to be ascertained:

- All the components which are due will be liquidated only if funds are available in the repayment account

- In case of insufficient funds, a partial liquidation is done to the

extent of availability of funds. If this is so:

- The payment schedules for those components, which have not been liquidated or have been partly liquidated, will be left as outstanding. Aging analysis on such placements will be carried out as specified for the product and an appropriate compensation applied, if it has been defined for the product.

- The component(s) for which funds are available will be liquidated in the order that you have specified in the ‘Liquidation Order’ screen. This can be done if you want to allot priority to the recovery of certain components. (For example, you may want to recover the profit type of components first and then the principal). If the liquidation order is not specified for the components, then, it will be liquidated in the following order:

- Compensation Profit (if one has been applied)

- Profit

- Principal

If availability of funds need not be ascertained and the liquidation results in the account going into a debit balance:

- All the components will be liquidated only if the repayment account has been defined for overdraft. The schedules for the components will be liquidated to the extent of the debit balance allowed. If it crosses the extent of debit balance allowed (the extent of overdraft limit); the liquidation will be done with an overdraft override, which will be automatically recorded.

On the repayment account that has a debit balance, the debit profit as specified for the type of accounts (current or savings), through the Profit and Charges sub-system, will be applied.

- If overdraft is not allowed for the account, the components will be liquidated to the extent of availability of funds.

Placements with payments, which have not been processed due to non-availability of funds, will appear in the Exception Report generated by the Automatic Contract Update function for the day.

Note

For the final principal payment on maturity, the availability of funds in the payment account will always be verified.

The system will not allow any value dated amendment if the value for this field is ‘Complete’.

Rollover Indicator

This option is updated by the system. You cannot change it. If checked, it indicates that the contract has been rolled over.

4.4 Modifying a Placement or a Borrowing

There are two types of modifications that you can make on a contract:

- Those that affect the financial details of the contract

- Those that do not affect the financial details of the contract

(‘Financial details’ include the accounting entries that have already been passed or the advices that have already been generated).

For example, the changes made to the user reference number, auto rollover and auto liquidation fields; do not result in changes to the accounting entries that have been passed.

However, the inputs to some fields that contain financial information can be changed only under specific circumstances. This is done through the Value Dated Changes function. For example, the changes in the profit rate, increase in the principal and so on, can be made only through the Value Dated Changes function.

A deal on which the previous activity has been saved but not been authorized, can be modified. For example, you have captured the details of a deal. The details have been saved but not yet authorized when you realize that some of the details have been wrongly entered. You can unlock the contract make the modifications and Save it.

The uploaded contracts can be amended by any valid user – the contract maker or others.

Note

Any type of change, however, has to be authorized, before it takes effect.

4.5 Financial Details that can be Changed

Inputs to the following fields can be changed through the contract processing function:

- Takedown Account if the placement has not yet been initiated and Customer Account if a borrowing has not been initiated

- Maturity Account if the deal is yet to mature

- Profit Payment Account if the entire profit on the deal has not yet been liquidated. The new account will be used for future profit payments.

- Contract End Date for a notice or call type of deal

- Tax details if tax has not yet been liquidated

Note

The changes listed do not trigger any accounting entries or the generation of any advices.

4.6 Reversing and Rebooking Contracts

While reversing and rebooking the parent contract details including the subsystems will be copied to a new contract and the parent will be reversed and the screen will be in new mode so that any details of the contract can be changed. It will be validated that no payment messages have been sent for the ‘Reversed FCC ref no’. A configurable override will be displayed. If the payment messages have been generated then the Cancellation request messages (REVSWIFT) will be generated. At the branch parameters maintenance, the check box ‘User Ref No in Messages’ should be selected.

The user reference number and the external reference number of the parent contract number will be copied to the new contract. Deletion of the new contract will delete the reversal of the parent contract and set the value of user ref number and external ref number in the parent contract from the child contract. Authorization of the new contract will authorize the parent contract. It will not be possible to delete or authorize the reversal of the parent contract reference number without deleting or authorizing the child.

The Confirmation message of the parent message will be suppressed if the counterparty of the parent contract and the current contract are the same. In case the counterparty of the parent and child are the same then in case the parent contract is confirmed then the child will also be marked as confirmed. If the parent is not confirmed then it will be marked as confirmed and the incoming confirmation will be matched with the child contract.

4.7 Viewing the other Details of a Deal

Using the buttons that are displayed in the ‘Contract On-line’ screens you can view the following details of a deal:

- The settlement details

- The tax details

- The advices that you can suppress or prioritize

- The MIS details

- The ICCF details

- The events for the deal

- The accounting entries for the deal

- The brokerage details

- The commodity details

4.8 Advices for deal initiation

The advices that have to be generated for any event during the life cycle of a deal are specified for the product involved in the deal. For example, you may have specified the following advices for the product:

- When a deal is initiated, an advice, addressed to the customer

- If any components (like discounted profit, tax on principal and so on) are liquidated on takedown, an advice for each of them

While processing the deal initiation, you can do the following:

- Suppress the generation of any of these advices

- Specify the priority of generation

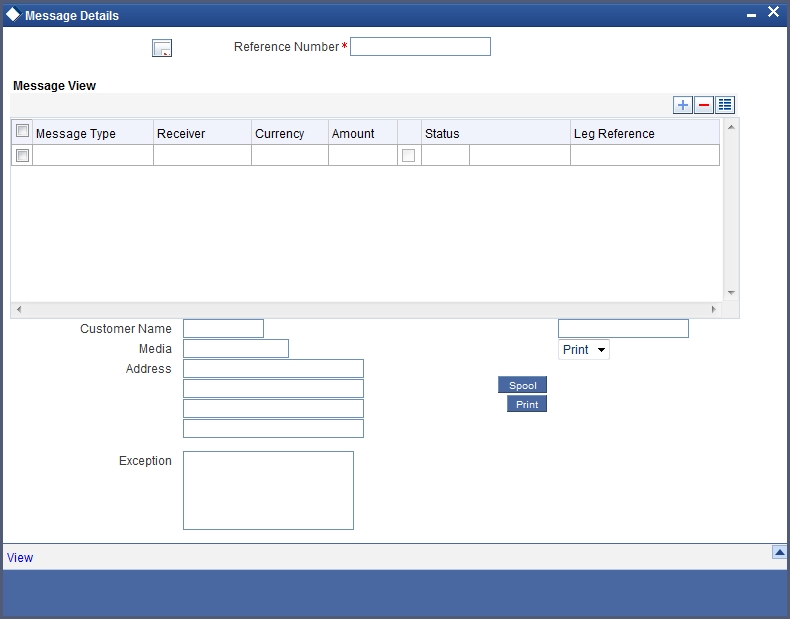

In the Message Details screen you can make these changes.

Suppress

By default, all the advices that have been defined for a product will be generated for a deal. However, you can suppress the generation of an advice for a deal by specifying so in this screen.

Priority

Priority applies to payment messages that have to be sent over S.W.I.F.T. By default, such advices will be sent on a Normal priority. You can change it to Urgent.

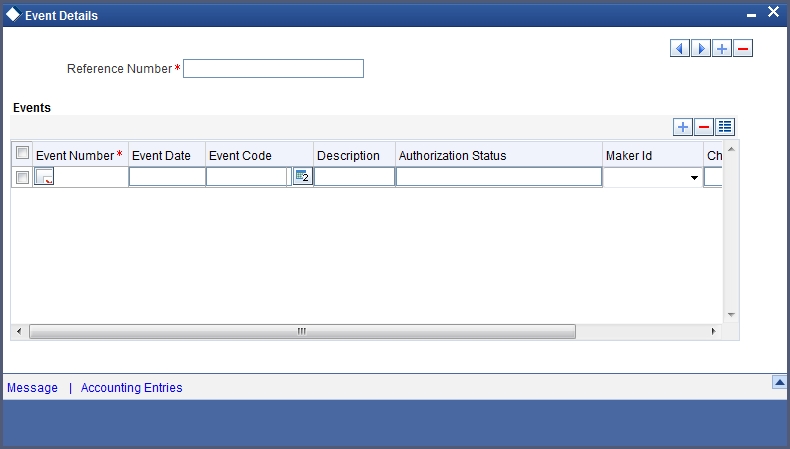

4.9 Viewing Event Details

You can view all the events that have take place on a finance through the ‘View Events’ screen. You can access this screen by clicking on the view events button in any of the Contract On-line screens.

All the events that have taken place on the deal so far will be listed in this screen according to the sequence in which they have taken place. The Date on which the event took place will also be displayed.

For example, this list contains events like Booking, Initiation, Profit Accrual, and so on.

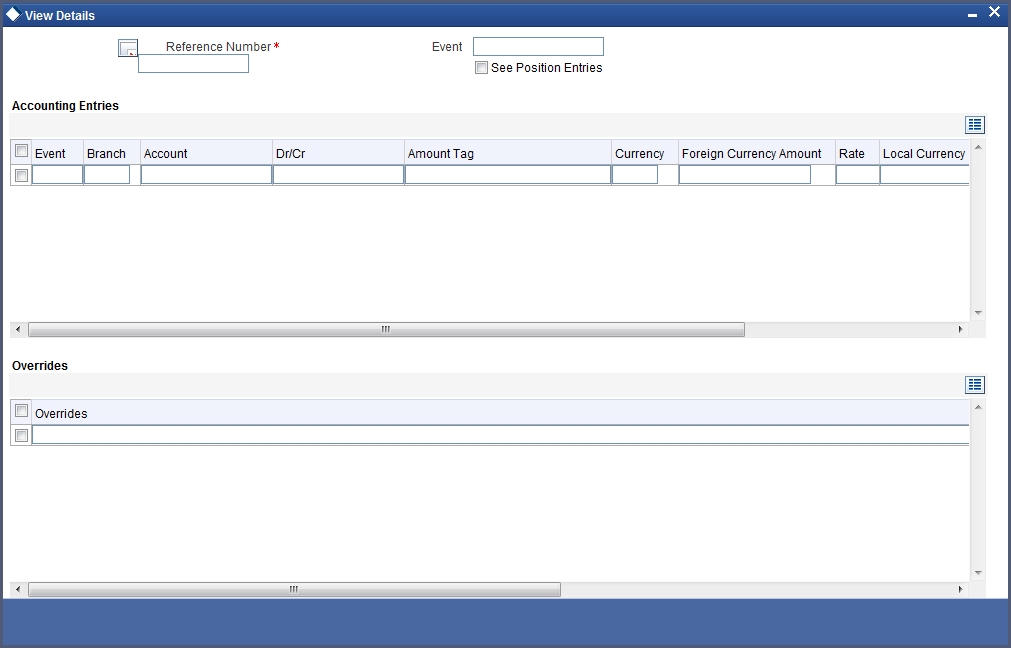

4.10 Viewing Accounting Entries for Deal Initiation

To view the accounting entries passed for a specific event, double click on the event in the ‘View Events’ screen. The accounting entries and overrides for that event will be displayed.

4.11 Viewing the Different Versions of a Deal

When a deal is input, it is assigned a version number of 1. From then on, each amendment of the deal results in its next version. When you come to the ‘Detailed View Screen’ for a deal, the latest version will be displayed.

To see the previous version, click backward button from a previous version clicking forward button displays the next version.

4.12 Initiating a Future Value Dated Deal

A future-dated deal is one that has a Value Date that is later than the date on which it is booked. The automatic contract update function will initiate the deal on the Value Date of the deal.

A future Value Date falling on a holiday will be initiated either on the previous working day or the next, depending on your definition for automatic processing at your branch.

All the initiation related entries specified for the product involved in the deal will be passed automatically. If currency conversions are involved, the conversion rates as of the date on which the deal is initiated will be picked up from the currency table. To recall, the rates that are applicable for a deal are defined for the product involved in the deal.

If there is a rate revision applicable for the future dated deal on the day it is initiated (that is, on the future Value Date), the rate revision will also be applied on the deal. This rate revision could either be due a Floating Rate change or a Value Dated Change.

4.12.1 Initiating Future Dated Murabaha MM Deals Manually

In a situation where the initiation event for MMM deal has not been triggered during the BOD processes, you can choose to trigger it manually using the Reopen option in the Toolbar or from the Actions Menu. A typical instance when the system does not trigger the initiation event is due to insufficient funds.

You can manually trigger the initiation event for all uninitiated MMM deals with value date less than or equal to the system date.

Note

If your user profile has been granted the Auto-Auth privilege, such a deal gets authorized automatically after initiation. Otherwise it has to be authorized by a different user from the MMM contract online screen.

4.13 Maintaining the Commodity Details for a Contract

Murabaha MM contracts that require commodity tracking are processed under products for which you have selected the ‘Commodity Tracking’ option as a preference in the ‘Murabaha Money Market - Preferences’ screen. For such contracts, commodity tracking becomes mandatory to activate the contract.

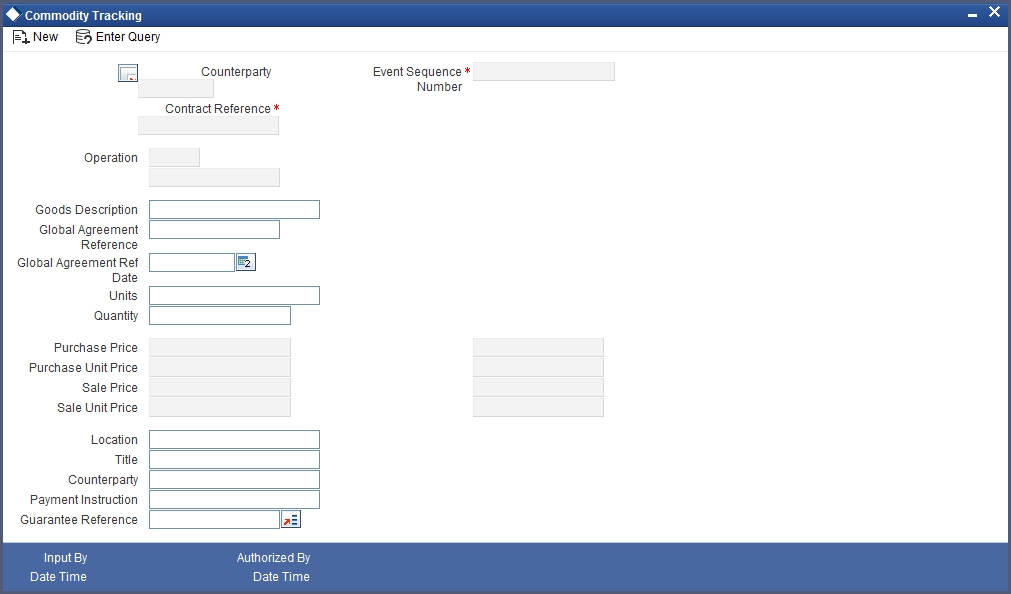

You can capture the commodity details for a contract using ‘MC Commodity Tracking’ screen. You can invoke this screen by typing ‘MCDCOTRK’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The screen is displayed below.

In this screen, by default the following fields are displayed:

- Contract reference number - the contract for which you have to specify the commodity details

- Counterparty

- Event sequence number

- Operation - When you unlock a contract, this field is populated based on the contract type and the commodity tracking status. For instance, for the contract type ‘Placement’, if the commodity tracking status is ‘Waiting for Offer’, then this field is populated as ‘Offer Acceptance’ and if the commodity tracking status is ‘Offer Received and Accepted’, then it is populated as ‘Closure’. Similarly for the contract type ‘Borrow’, if the commodity tracking status is ‘Offer to be sent’, this field is populated as ‘Sending Offer’ and if the commodity tracking status is ‘Offer Sent’, this will be populated as ‘Closure’.

Note

You will not be allowed to change the above details.

Goods Description

You can describe the goods/commodity being bought. You cannot modify this information if the ‘Commodity Tracking Status’ is ‘Closure’.

Global Agreement Reference

Specify the agreement reference number associated with the transaction.

Global Agreement Date

Specify the date of the agreement that you associate with the contract.

Quantity Units

Specify the unit in which the commodity is measured. You cannot modify this information if the ‘Commodity Tracking Status’ is ‘Closure’.

Quantity

Specify the quantity to be purchased. You cannot modify this information if the ‘Commodity Tracking Status’ is ‘Closure’.

Purchase Price

By default, the principal amount of the transaction is displayed as the purchase price of the commodity. You will not be able to change this value. The currency of the purchase amount is also displayed.

Purchase Unit Price

Based on the quantity of the commodity purchased and the purchase price, the system arrives at the unit price (Purchase Price/Quantity). The currency of the amount is also displayed.

Sale Price

By default the system displays the sum of principal amount and profit of the transaction. You will not be able to change this value. The currency of the amount is also displayed.

Sale Unit Price

Based on the quantity of the commodity sold and the sale price, the system arrives at the unit price (Sale Price/Quantity).

Location

Specify the place of the trade, that is, the place where the sales and purchases of the commodity occurs.

Counter Party

Specify the name of the counterparty associated with the trade.

Payment Instructions

Here, you can capture payment instructions for the trade. You cannot modify this information if the ‘Commodity Tracking Status’ is ‘Closure’.

Title Documents

Specify the documents that should be submitted as part of commodity trading.

Guarantee Ref

Specify the reference number of the guarantee linked to the contract. The option list will display all valid guarantee contracts (advice of guarantee for placement contracts) that have not already been linked to an MMM contract. You can associate a guarantee only if the Commodity Tracking Status’ is ‘Closure’.

Note

The ‘Commodity Tracking Status’ in the status bar of the Contract Online screen displays the current tracking status of the contract and this varies depending on the contract type, whether ‘Placement’ or ‘Borrowing’, as follows:

For Placements

Events |

Commodity Tracking Status |

BOOK (Booking a contract) |

Waiting for Offer |

OFFR (Offer received and accepted) |

Offer Received and Accepted |

GRNT (Receipt of the letter of the guarantee) |

Closed |

For Borrowings

Events |

Commodity Tracking Status |

BOOK (Booking a contract) |

Offer to be sent |

OFFR (Offer is sent) |

Offer Sent |

GRNT (Guarantee is sent) |

Closed |

Contracts that require commodity tracking will be initiated or activated only when the status is ‘Closed’. For contracts involving normal products, ‘Commodity Tracking Status’ will be displayed as ‘Not Applicable’.

You cannot perform any operation in the ‘Commodity Tracking’ screen when the ‘Commodity Tracking Status’ is ‘Closed’.

You can also view the commodity details for a contract by clicking ‘Commodity Tracking’ button in the ‘Contract Online’ screen.

4.14 Viewing Islamic Money Market Contracts Details

You can view the summary of all the Islamic Money Market contracts using ‘Islamic Money Market – Contract Input’ screen. You can invoke this screen by typing ‘MCSCONON’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The screen giving all the details of the contracts is displayed.

4.15 Bulk MM Contracts Details

This section contains the following topics:

- “Authorizing Bulk MM Contracts” on page 22

- “Authorizing the Deals” on page 24

- “Viewing the Errors” on page 24

- “Viewing the Settlement Details” on page 24

- “Viewing the Details of the Deal” on page 25

4.15.1 Authorizing Bulk MM Contracts

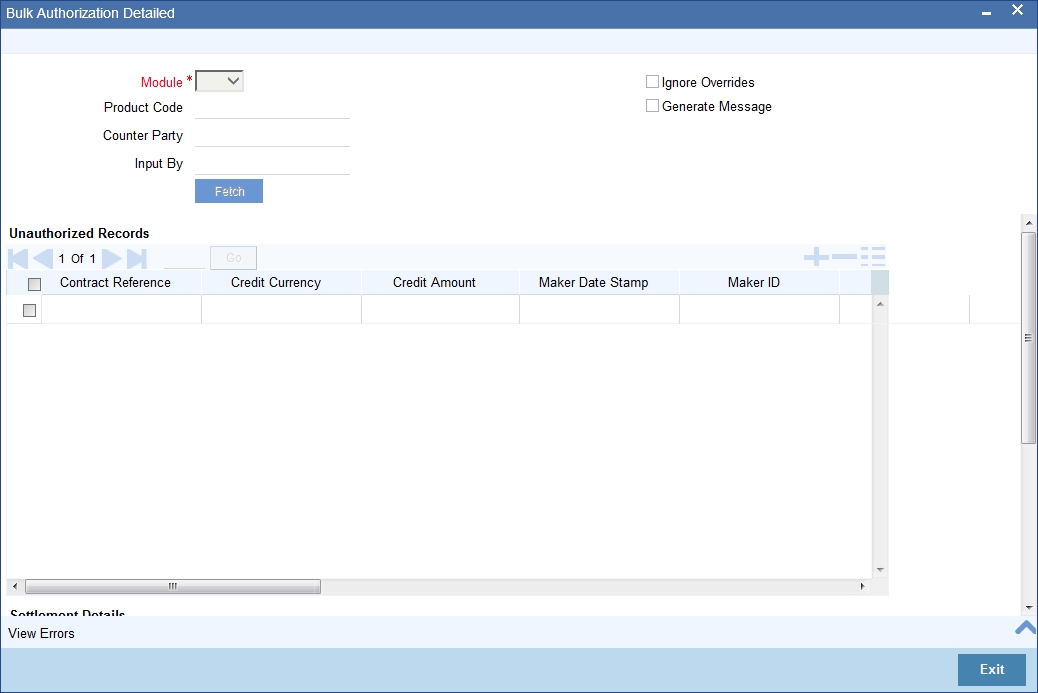

Murabaha Money Market deals must be authorized in the respective Contract Online screens. This method of authorizing the deals can be quite cumbersome, especially if the volume of transactions is large. In view of that, Oracle FLEXCUBE allows bulk authorization of all unauthorized money market deals from the ‘Unauthorized Contracts’ screen. Invoke this screen from the Application Browser by typing ‘CSDUAUTH’ in the field at the top right corner of the Application Browser and click the adjoining arrow button.

In the ‘Unauthorized Contracts’ screen, you can indicate the following parameters:

- The module (Finances, MMM or FX) whose deals or contracts have to be authorized

On selection of the module, all unauthorized deals or contracts pertaining to that module will be displayed in the grid.

- Whether the system should ignore the overrides generated at the time of authorization

If the overrides of the deals are not authorized, system displays an error message. Check against ‘Ignore Overrides’ to ignore the overrides associated with the contracts.

For example, if the maturity date of a contract is December 30 2001 and is a holiday for your bank, system will display an override:

30-DEC-2001 is a holiday

However, you can opt to ignore such overrides by checking against ‘Ignore Overrides’.

- Whether the messages associated with authorization should be generated

On authorization of a contract, the messages associated with the deal will be generated. To generate the messages, check against ‘Generate Messages’.

4.15.2 Authorizing the Deals

You can either opt to authorize all the deal that are displayed or choose only certain contracts for authorization.

- To authorize only specific deals, check against the boxes positioned before each deal reference number.

- If all the deals that are displayed have to be authorized, check against the box positioned before ‘Contract Ref No’.

After selecting the deals, click ’Authorize’ button to authorize the deals.

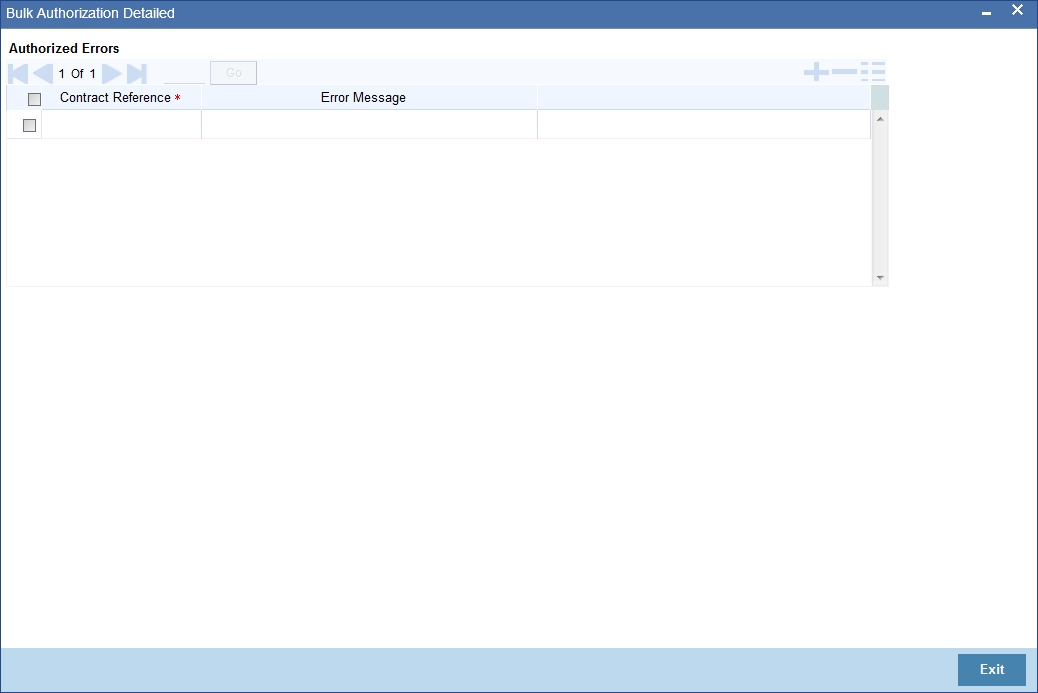

4.15.3 Viewing the Errors

If the system encounters any errors during the authorization of a particular deal, it will record the error and move on to the next contract.

Among the deals selected for authorization, there may be certain deals, which are created by the user who is authorizing. As the maker and checker cannot be same, system will record an error, as it cannot authorize the deal.

Click on ‘View Error’ button to view the details of the errors recorded. In this screen, system will display the reference number of the deals, which could not be authorized and the reason for the failure of deal authorization.

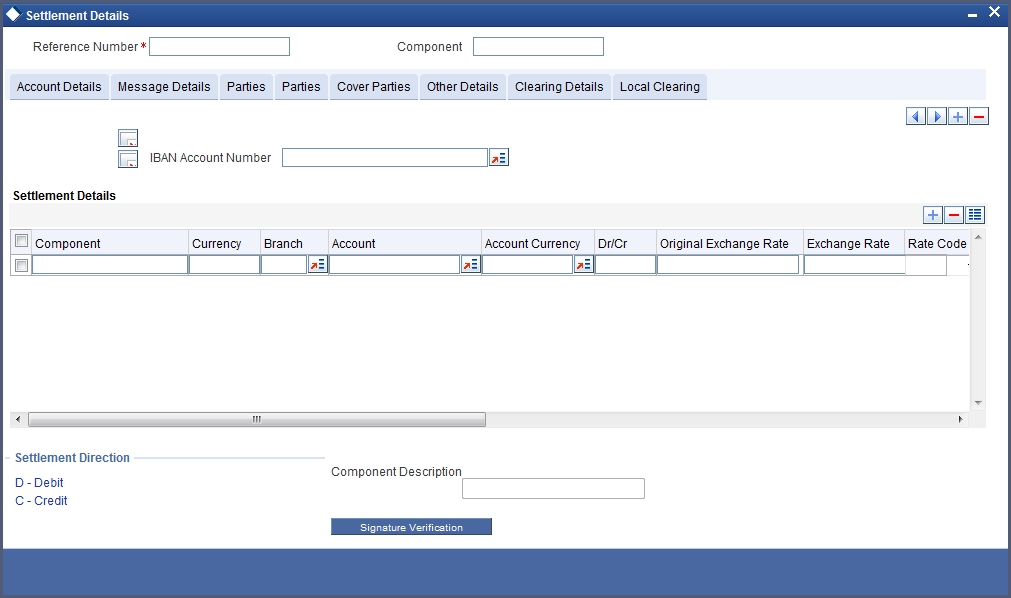

4.15.4 Viewing the Settlement Details

The settlement account details of each deal will be displayed in the ‘Settlement Instructions’ screen. Click on the contract for which you want to view the settlement details and it will be displayed in the ‘Settlement Instructions’ section. For each amount tag, the following settlement details are displayed:

- Settlement account

- Currency of the settlement account

- Settlement account branch

- Payable or Receivable

- Ordering Institution

- Ordering Customer

- Beneficiary Institution

- Ultimate Beneficiary

The settlement details for the latest event of the deal will be displayed.I

4.15.5 Viewing the Details of the Deal

The details of the unauthorized deals can be viewed by double clicking on the deal reference number in this screen.

In case of money market deals, the screen that is displayed on double clicking a deal depends on the stage of the deal that is unauthorized.

- If booking, initiation or deal amendment is not authorized, the Contract Online screen is displayed.

- If a payment of a deal is unauthorized, the Payment screen is displayed.

- If a value-dated amendment is unauthorized, the Value Dated Amendment screen is displayed.

4.16 Reassigning the Murabaha MM Contract to another User

A contract can be deleted only by the user who entered it. If a contract has to be deleted and the user who input it is not around to do it, you can reassign the contract to another user so that the other user can delete it. Typically, this situation may arise during End of Day operations when a contract that is not authorized has to be deleted and the user who input it has left office for the day. The access rights to reassign a contract are usually allotted to a senior user in the department.

You can perform the reassigning operation through the ‘Islamic Reassign User – Prior to Authorization’ screen. You can invoke this screen by typing ‘MCDREAS’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The screen is displayed below.

Product Code

Specify the product for which you want to reassign the user. The adjoining option list displays all the products maintained for Islamic fixed assets through the ‘Islamic Fixed Assets Product Definition’ screen.

Contract Reference Number

Specify the contract reference number for which you wan to reassign the user. The adjoining option list displays all the contracts maintained for the product selected.

Current User

Current user ID is displayed in this field.

New User Id

Specify the new user to whom you want to reassign the contract.

Click ‘Ok’ button to save the details you entered. Click ’Exit’ button if you do not want to save the details.