4. Defining MIS Heads

Each accounting entry that is generated can be linked to an MIS Head. An MIS Head indicates the manner in which the type of entry should be considered for profitability reporting purposes.

This chapter contains the following section:

4.1 MIS Head Maintenance

This section contains the following topics:

- Section 4.1.1, "Invoking the MIS Heads Screen"

- Section 4.1.2, "Linking an MIS Head to an Accounting Entry"

- Section 4.1.3, "Operations on the MIS Head Record"

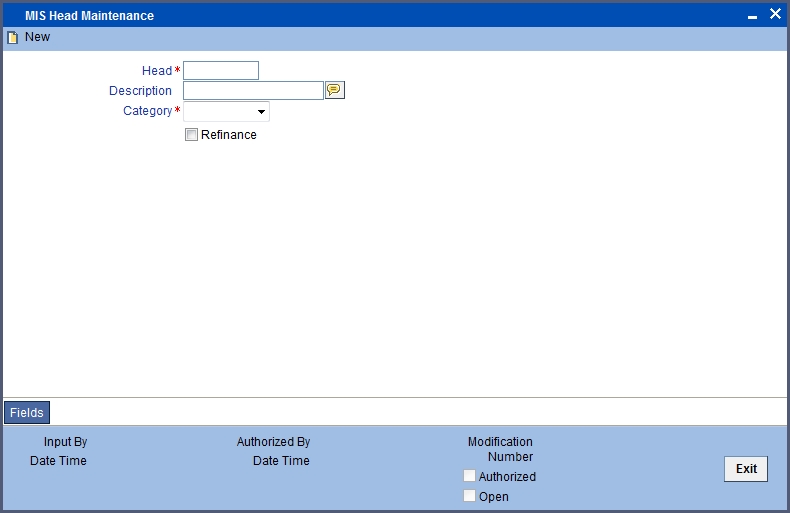

4.1.1 Invoking the MIS Heads Screen

You can invoke the ‘MIS Head Maintenance’ screen by typing ‘MIDHEAD’ in the field at the top right corner of the Application toolbar and clicking the adjoining arrow button.

If you are creating a new MIS Head, select ‘New’ from the Actions Menu in the Application toolbar or click new icon. The ‘MIS Head’ screen is displayed without any details.

If you are calling an MIS Head that has already been defined, double-click an MIS Head from the summary screen.

Category

The MIS Head Category classification indicates the method in which the accounting entry will be reported in the profitability report. It could be one of the following:

Balance

Indicates that the accounting entry should be considered for calculating the Cumulative Average Balance. Typically, an asset entry would be classified under the balance type MIS Head. The GL entry leg of a loan disbursement transaction, would typically be classified under a Balance type of MIS Head.

Income

Indicates that the accounting entry should be considered as an income for the purpose of profitability reporting. Clearly, any interest or charge income would be classified under an Income type of MIS Head.

Expense

Indicates that the accounting entry should be considered as an expense for the purpose of profitability reporting. Any interest, postage, or tax expense would be classified under an expense type of MIS Head.

Contingent

Indicates that the accounting entry should be considered as a contingent entry for the purpose of profitability reporting. A forward FX deal, the issue of an import Letter of Credit, etc., are examples of contingent type of entries. You can generate a report that gives the balances due to such contingent type of entries.

Under each type of MIS Head, you may define additional MIS Heads, as per your reporting requirement. For example, you can have an MIS Head for each loan product, so that you can have the cumulative average balance due to all the loans disbursed under the product.

Refinance

The ‘Refinance’ option is provided for marking MIS Heads for refinancing. For MIS Heads that are marked for refinancing, the refinancing income or expense would be calculated, on the cumulative average balance, for the reporting period. You would typically mark a balance type of MIS Head for refinancing.

This option is provided because not all the balance type of entries would come under the umbrella of refinancing. To enable this option select the check box beside ‘Refinance’.

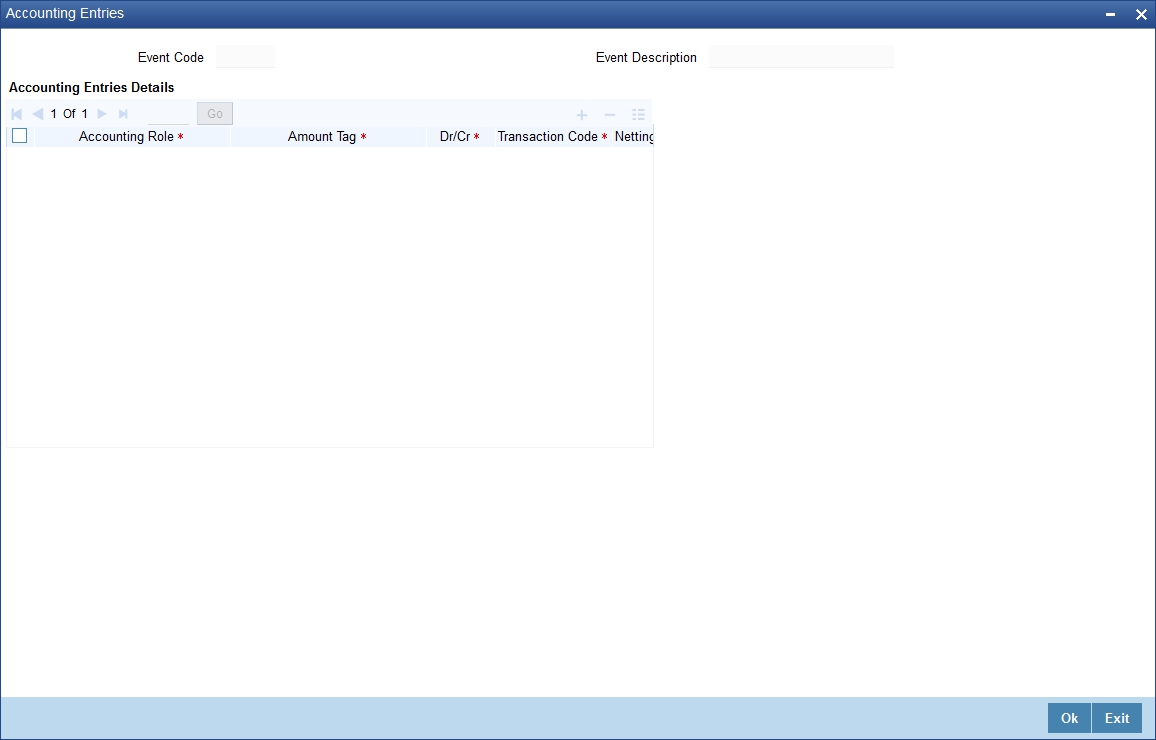

4.1.2 Linking an MIS Head to an Accounting Entry

Each accounting entry generated in Oracle FLEXCUBE will have a transaction code that describes the nature of the entry. These transaction codes are defined by you, depending on your requirements.

An MIS Head can be attached to a transaction code. A transaction code is attached to an accounting entry when an event is defined for a product, through the ‘Product Event Accounting Entries Maintenance’ screen. Thus, whenever a transaction with an MIS Head attached is entered for an entry, the MIS Head will automatically be linked to it. You can change this while defining the product.

Alternatively, you can link an MIS Head to an accounting entry directly while defining the product.

You should link the appropriate leg of the accounting entry to the MIS Head to which it belongs. Ensure that you link only one leg of the entry to an MIS Head.

To add a record to the list of ‘Accounting Entries’ click add icon. Choose values for each field of a record using the adjoining option list.

4.1.3 Operations on the MIS Head Record

On an existing MIS Head record, you can perform the following operations (if any function under the Actions Menu is disabled, it means that the function is not allowed for the record):

- Amend the details of an MIS Head

- Authorize an MIS Head

- Copy the details an MIS Head on to a new one

- Print the details of an MIS Head

- Delete an MIS Head

Please refer to the manual on common procedures for details of these operations.