5. Defining External Accounts

5.1 Introduction

Nostro reconciliation deals with the matching and reconciliation of external accounts with the internal ones of your bank. Therefore it is necessary for you to:

- Define an external entity.

- Indicate the accounts that the external entity maintains with your bank.

- Indicate the internal accounts to which the external account can be matched.

- Indicate the reconciliation class that should be used whenever the external account is involved in a transaction.

You can define these details in the External Account Definition screen.

This chapter contains the following sections:

- Section 5.2, "Reconciliation External Account Definition Screen"

- Section 5.3, "Features of the External Account Definition Screen"

5.2 Reconciliation External Account Definition Screen

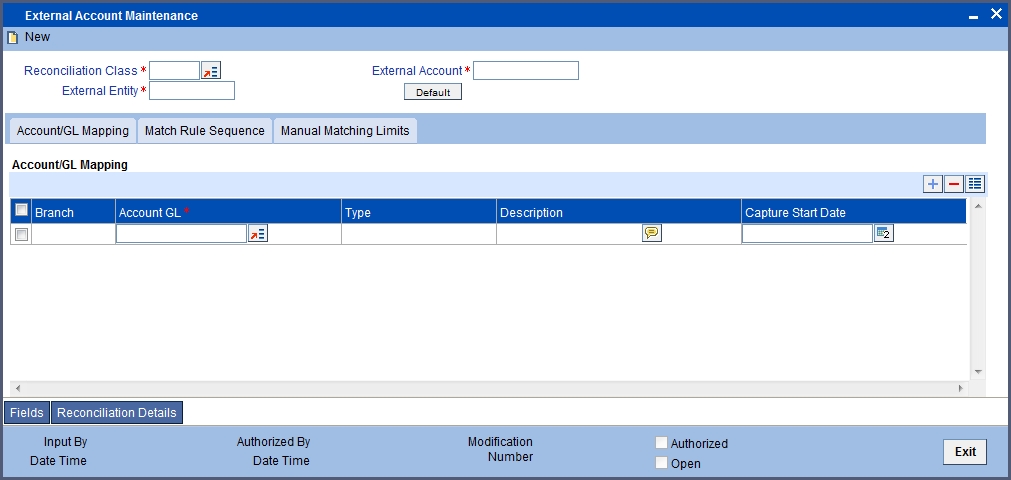

You can invoke the ‘Reconciliation External Account Maintenance’ screen by typing ‘REDXTACC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

If you are maintaining details for a new account, click the new button on the Application toolbar. The ‘Reconciliation External Account Maintenance’ screen is displayed without any details.

If you are calling a Reconciliation Class Definition record that has already been defined, double-click a class record of your choice from the summary screen.

5.3 Features of the External Account Definition Screen

Defining an External Entity

In Oracle FLEXCUBE, a bank that is external to your bank is called an external entity. Each external entity that you define is identified by an eight character code called an External Entity Code. You can follow your own convention for devising this code.

Note

The code that you assign to an external entity should be unique as it is used to identify the entity across the branches of your bank.

Indicating the External Account

An external entity can have several accounts under it. You should specify details for each of the accounts that the external entity maintains with your bank.

Consider the following example.

Kuber s Saving Bank has the following accounts with your bank:

- Kuber1USD.

- Kuber2AUD.

- Kuber3INR.

- Kuber4GBP.

- Kuber5YEN.

This leads to a two level hierarchy, wherein Kuber’s bank is the External Entity and the accounts that Kuber’s bank has with you are the external accounts under it.

Note

If the external entity has several accounts with your bank, you will have to maintain a new external account record for each of the accounts, under the same external entity.

Indicating the Reconciliation Class to be Used

Having defined an external account, you should map the external account to a reconciliation class. The Reconciliation Class and External Account combination should be unique across the branches of your bank. You can choose a Reconciliation Class Code from the option list available.

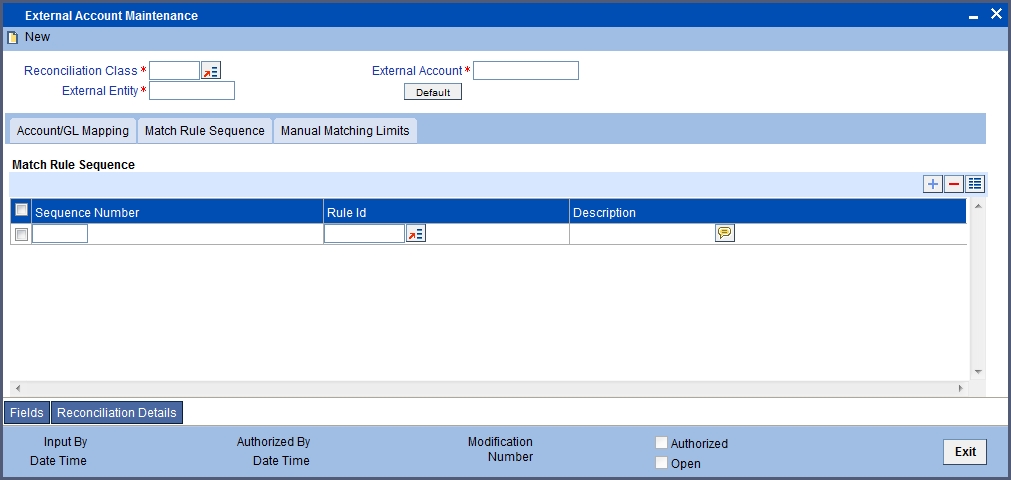

The attributes that you have defined for the reconciliation class are displayed in the match rule sequence section of the screen.

The following details of the reconciliation class are displayed:

- The match rules that constitute the reconciliation class.

- The sequence in which the rules that constitute the class will be applied to the class.

Subsequently, you can rearrange the sequence in which the matching rules defined for the class should be used while matching transactions belonging to the external entity. You also have the option to delete from or add to the list of rules defined for the reconciliation class. To add a rule to a reconciliation class, select the code that identifies the rule and click add icon. If you do not want to make one or more rules defined for the reconciliation class applicable to the external entity, select the rule and click delete icon.

Note

The reconciliation class + External account combination should be unique across the branches of your bank.

Mapping an External Account to an Internal GL or Account(s)

Having mapped an external entity with a reconciliation class, you should map the reconciliation class + external account combination to one or many internal GLs or accounts (belonging to your branch) with which the external account should be matched and reconciled.

When an external transaction involving the external account that you have defined comes into your branch, it would be reconciled with the transactions posted internally to the corresponding GL or Account(s) in your branch.

Note

The mapping is a one-time maintenance. Once you save the mapping, you will not have an option to change it.

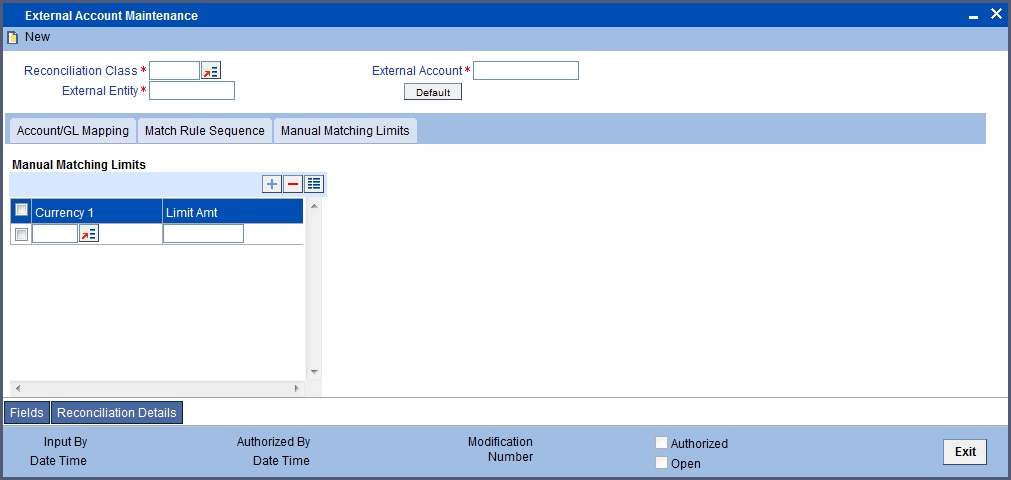

Setting up Manual Matching Limits

Click ‘Manual Matching Limits’ tab to invoke the following screen.

The manual-matching limit associated with a reconciliation class will be made applicable on the external account as well. Click ‘Default’ button to pick up the manual matching limit of reconciliation class. However, you have the option of specifying separate manual matching limits for a specific external account. You can do this while maintaining the details of an external account through the External Account Definition screen.

You can specify manual limits for individual currencies in order to be able to manually match amount differences up to the limit. As a result of maintaining these limits you will be allowed to match reconciled entries manually only when there is no difference between the net amount of the external and internal entries.

Setting up Match Rules

Click ‘Match Rule Sequence’ tab to invoke the following screen.

You can indicate the rules and sequence in which they need to be applied while reconciling account balances.