8. Overseas Cheques Payable Abroad under Collection

This chapter contains the following sections:

- Section 8.1, "Overseas Cheques Payable Abroad under Collection"

- Section 8.2, "Amend Overseas Checks Payable Abroad under Collection"

- Section 8.3, "Reversing Overseas Cheques Payable Abroad under Collection"

- Section 8.4, "Finance Overseas Cheques Payable Abroad under Collection"

- Section 8.5, "Realize Overseas Cheques Payable Abroad under Collection"

- Section 8.6, "Dishonouring/Protesting/Returning Overseas Cheques Payable Abroad under Collection"

- Section 8.7, "Book Overseas Cheques Payable Abroad under Collection in Bulk"

- Section 8.8, "Realize Overseas Cheques Payable Abroad under Collection in Bulk"

8.1 Overseas Cheques Payable Abroad under Collection

This section contains the following topics:

- Section 8.1.1, "Creating Overseas Cheques Payable Abroad under Collection"

- Section 8.1.2, "Main Tab"

- Section 8.1.3, "Other Details Tab"

- Section 8.1.4, "Capturing Additional Details for Overseas Cheques Payable Abroad under Collection"

- Section 8.1.5, "Viewing Summary of Overseas Cheques Payable Abroad under Collection"

8.1.1 Creating Overseas Cheques Payable Abroad under Collection

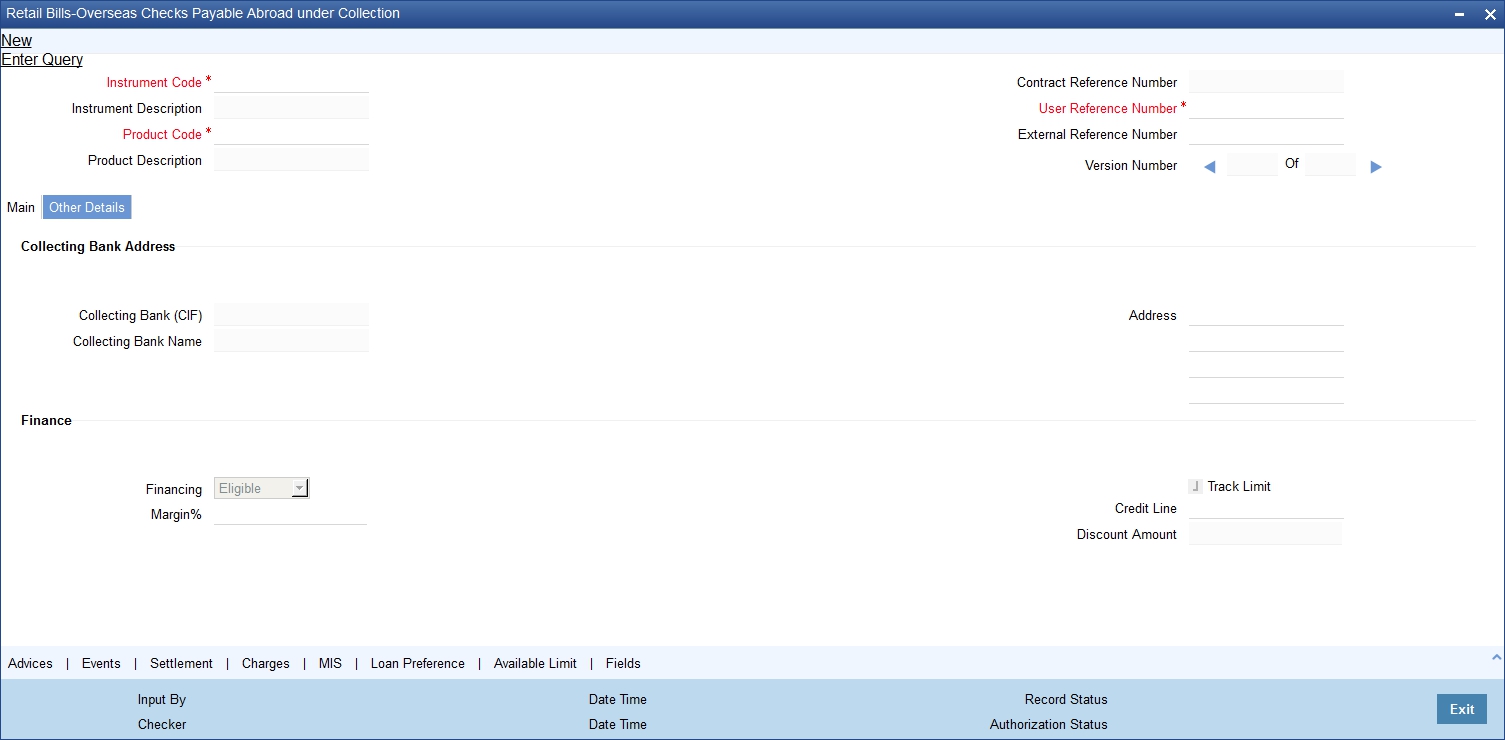

You can capture the details of the overseas cheques payable abroad on collection basis using ‘Retail Bills - Overseas Cheques Payable Abroad under Collection’ screen. To invoke this screen, type ‘RBDOCPAY’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Instrument Code

Select the instrument code from the adjoining option list.This list displays the instrument codes associated with the Product type ‘Overseas Cheques Payable Abroad under Collection’.

Instrument Description

System displays the description of the instrument code selected.

Product Code

Select the product code from the adjoining option list. The option list displays all valid product codes that are of type ‘Overseas Cheques Payable Abroad under Collection’.

Product Description

System displays the description for the product code selected above.

Contract Reference Number

System displays a unique reference for the contract which is being booked.

User Reference Number

By default, the system displays the contract reference number in this field. However you can modify this and specify a different user reference number.

External Reference Number

The External Reference Number is used when the contract is being uploaded from an external system. During Manual booking, system will default the contract reference number In this field.However,you can edit this value when required.

8.1.2 Main Tab

Click ‘Main’ tab to capture the details under this tab

Specify the following details:

Counterparty Details

Counterparty Identification

Select the customer number of the person who has submitted the instrument for collection. If you do not select the counter party id, then the system will display the counterparty ID when you specify the ‘Counterparty Account number’.

Counterparty Name

Based on the counterparty identification, the system displays the name of the customer.

Counterparty Account Number

Select the account number of the counterparty from the adjoining option list.

If you have already specified the counterparty identification, then the option list will display all valid accounts of that counterparty. If you have not specified the counterparty identification, then the option list will display all valid account numbers maintained in the system.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Counterparty Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

The branch to which the customer belongs is defaulted by the system.

Instrument Details

Instrument Number

Specify the cheque number here.

Instrument Date

Specify the date of the cheque. You may specify a past date in case of a backdated instrument. But the instrument date should not be earlier than the date arrived at by considering the stale days specified in ‘Instruments Maintenance’ screen.

Currency

Select the cheque currency from the adjoining option list.

Amount

Specify the cheque amount.

LCY Amount

The system displays the amount converted into Local Currency Amount on save or subsystem visit.

Collecting Bank Details

Collecting Bank (CIF)

Specify the bank to which the FCY cheques can be sent under collection. You can select the appropriate one from the option list.

You can also select the walk-in customer id maintained in the ‘Branch Parameter Maintenance’ screen.

Collecting Bank Name

The system displays the name of the collecting bank.

Debit Account for Realization

Select the debit account for realization from the option list. This is the account debited at the time of realization of proceeds. The option list displays all Nostro accounts applicable. Select the appropriate one.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Debit Account for Realization field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

The system displays the debit account branch.

Additional Details

Booking Date

System displays the application date as the booking date. This is the date on which the instrument is being booked.

Due Date for Payment

System displays a date on which the proceeds are expected from the collecting bank.

Transit Days

The system displays the number of transit days.

If country of the collecting bank is the same as the country of the Nostro account, then the system displays the direct transit days maintained for the currency - Nostro account combination in ‘Float Days’ tab of ‘Retail Bills Branch Parameters Maintenance’ screen.

If country of the collecting bank and country of Nostro account are different, then the system displays the indirect transit days maintained for the currency - Nostro account combination in ‘Float Days’ tab of ‘Retail Bills Branch Parameters Maintenance’ screen.

Auto Liquidation

Check this box to indicate that the instrument should be liquidated automatically on due date.

Other Party Name

Specify the name of the other party.

Drawee Bank Name

Specify the name of the bank on which the cheque is drawn.

Internal Remarks

Specify your remarks on the transaction.

8.1.3 Other Details Tab

Click ‘Other Details’ tab to capture the additional details.

Specify the following details:

Collecting Bank Address

Collecting Bank (CIF)

Select the Collecting Bank CIF from the adjoining option list.

Collecting Bank Name

System displays the name of the collecting bank.

Address

Based on the collecting bank (CIF) or walk-in customer id, the system displays the address of the collecting bank/walk-in customer. However, you can modify this address if the collecting bank (CIF) id is selected as walk-in customer.

Finance

Financing

If the contract is eligible for financing, then the system defaults the value as 'Eligible'.You can change the value to 'Financed'.If the system defaults the value as 'Not eligible’, then you cannot change the contract value to 'Financed'.

Margin%

System defaults the margin% from instrument maintained. You can edit this value if needed.

Track Limit

Check this box to indicate that the counterparty limits should be tracked when the instrument is financed.

Credit Line

Select the facility Id of the customer from the adjoining option list. It is used for limit validation.

‘Credit line’ field is Mandatory if the instrument is considered for financing.

Note

If you select ‘Eligible’ or ‘Not Eligible’ in the field ‘Financing’, then the system will nullify the values in fields ‘Credit Line’ and ‘Track Limit’. Appropriate override messages will be displayed.

Discount Amount

System computes and displays the amount being financed as the discount amount. Here, Discount amount = Instrument amount - Margin.

8.1.4 Capturing Additional Details for Overseas Cheques Payable Abroad under Collection

For capturing additional details, an array of buttons are provided at the bottom of ‘Retail Bills - Overseas Cheques Payable Abroad under Collection’ screen. You can capture the following additional details for a cash letter contract:

- Advices

- Events

- Settlements

- Charges

- MIS

- Loan Preference

- Available Limit

- Fields

For further details on these sub-systems, refer to the section 'Capturing Additional Details for FCY Cheques under Cash Letter' in this user manual.

Once you have captured the details, click ‘Save’ button.

8.1.5 Viewing Summary of Overseas Cheques Payable Abroad under Collection

You can view a summary of overseas cheques payable abroad under collection using ‘Overseas Cheques Payable Abroad under Collection Summary’ screen. To invoke this screen, type ‘RBSOCPAY’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the records based on one or more of the following parameters:

- Authorization Status

- Contract Reference Number

- Counterparty Identification

- Product Code

- Record Status

- Instrument Code

- Collecting Bank (CIF)

Once you have specified the search parameters, click ‘Search’ button. The system displays the following details of the records that match the search criteria.

- Authorization Status

- Record Status

- Contract Reference Number

- Instrument Code

- Counterparty Identification

- Counterparty Name

- Instrument Number

- Instrument Date

- Instrument Currency

- Instrument Amount

- Booking Date

- Collecting Bank (CIF)

- Collecting Bank Name

- Due Date for Payment

- Transit Days

- Product Code

8.2 Amend Overseas Checks Payable Abroad under Collection

This section contains the following topics:

- Section 8.2.1, "Amending Overseas Checks Payable Abroad under Collection"

- Section 8.2.2, "Main tab"

- Section 8.2.3, "Other Details Tab"

8.2.1 Amending Overseas Checks Payable Abroad under Collection

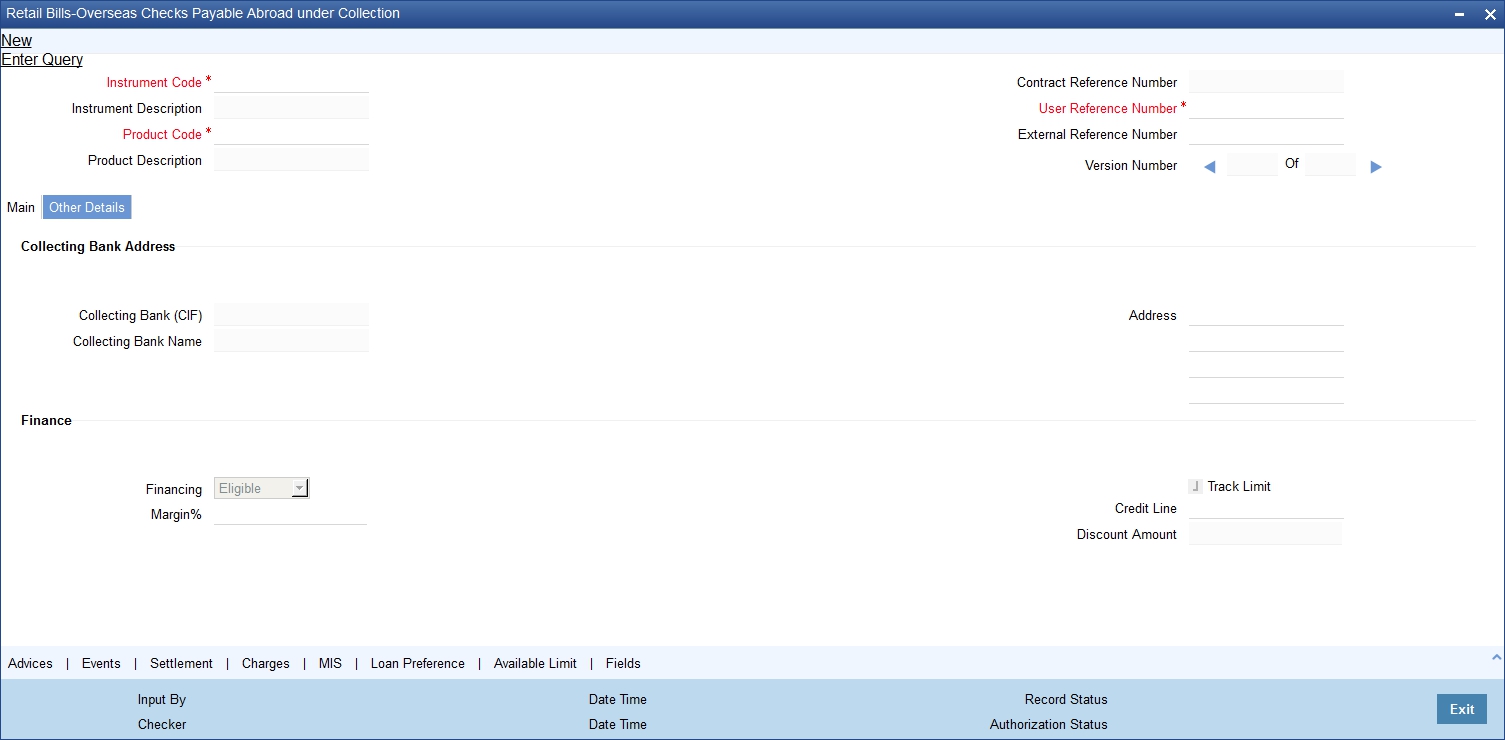

You can amend certain details of an existing overseas cheques payable abroad on collection.The amendment process is initiated for an existing contract from the 'Retail Bills - Overseas Cheques Payable Abroad under Collection' screen by using 'unlock' option.

You can invoke ‘Retail Bills - Overseas Cheques Payable Abroad under Collection’ screen by typing ‘RBDOCPAY’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

8.2.2 Main tab

Once you have specified the 'Contract Reference Number', click ‘Execute Query’ button. The system displays the details of the contract and makes available different action buttons including unlock button. You can view the details of the following fields captured during booking:

- Counterparty Account Number

- Account Branch

- Instrument Number

- Instrument Date

- Currency

- Collecting Bank CIF and Name

- Due Date for Payment

- Other Party Name

- Drawee Bank Name

You can amend the following fields:

- Instrument Number

- Instrument Date (If instrument date is greater than the current system date, then the system displays an error message)

- Other Party Name

- Drawee Bank Name

- Amount (The field cannot be amended if the instrument is already financed)

- Auto Liquidation

- Remarks

8.2.3 Other Details Tab

You can view the details of the following fields captured during booking:

- Collecting Bank (CIF)

- Collecting Bank Name

- Address

The following fields can be amended:

- Financing

- Margin %

- Track Limit

- Credit Line

Once you have edited the fields, click on ‘Save’ button to save the amendment details.

You can also amend the details for the following subsystems:

- Settlements

- Charges

- MIS

- Fields

For detailed information on Settlements, Charges, MIS and Fields, refer to the section ‘Capturing Additional Details for FCY Cheques under Cash Letter’ of chapter ‘FCY Cheques under Cash Letter Arrangement’ in this User Manual.

8.3 Reversing Overseas Cheques Payable Abroad under Collection

Using ‘Retail Bills - Overseas Cheques Payable Abroad under Collection’ screen, you may reverse an overseas cheque payable abroad under collection created in the system. A contract may be reversed in the following instances:

- Errors or mistakes occurred during contract input

- After authorization, the contract was identified as invalid

Reversal can be performed only on the same day of contract booking, before the instrument is dispatched. You need to manually ensure that the instrument has not been dispatched.

To invoke ‘Retail Bills- Cash Letter Contract Details’ screen, type ‘RBDOCPAY’ in the field at the top right corner of the application toolbar and click the adjoining arrow button. You may also invoke the summary screen and search for the contract that you need to reverse.

Once you have opened the contract, click ‘Reverse’ button to reverse it.

Note

In case of financed instrument, before reversing the contract, you need to ensure that the loan account associated with the instrument is reversed.

Once you click ‘Reverse’ button, the system validates the following parameters:

- Booking date of the contract earlier than the current system date or not - If the booking date is a previous date and not the current date, then the system will display an error message.

- Contract is already reversed/realized/dishonoured/protested/returned or not - If the contract is already reversed, realized, dishonoured, protested or returned, then the system will display an error message.

- For financed instruments, if the corresponding loan account in the CL module is reversed or not - If the loan account is not reversed, then the system will display an error message.

If the validations are successful, then the system reverses the contract updates the status of the contract as ‘Reversed’ and triggers the event ‘REVR’. The system will also reverse all the entries generated during the earlier events on the contract.

8.4 Finance Overseas Cheques Payable Abroad under Collection

This section contains the following topics:

- Section 8.4.1, "Financing Overseas Cheques Payable Abroad under Collection"

- Section 8.4.2, "Capturing Additional Details for Financing Overseas Cheques Payable Abroad under Collection"

- Section 8.4.3, "Viewing Summary of Overseas Cheques Financing"

8.4.1 Financing Overseas Cheques Payable Abroad under Collection

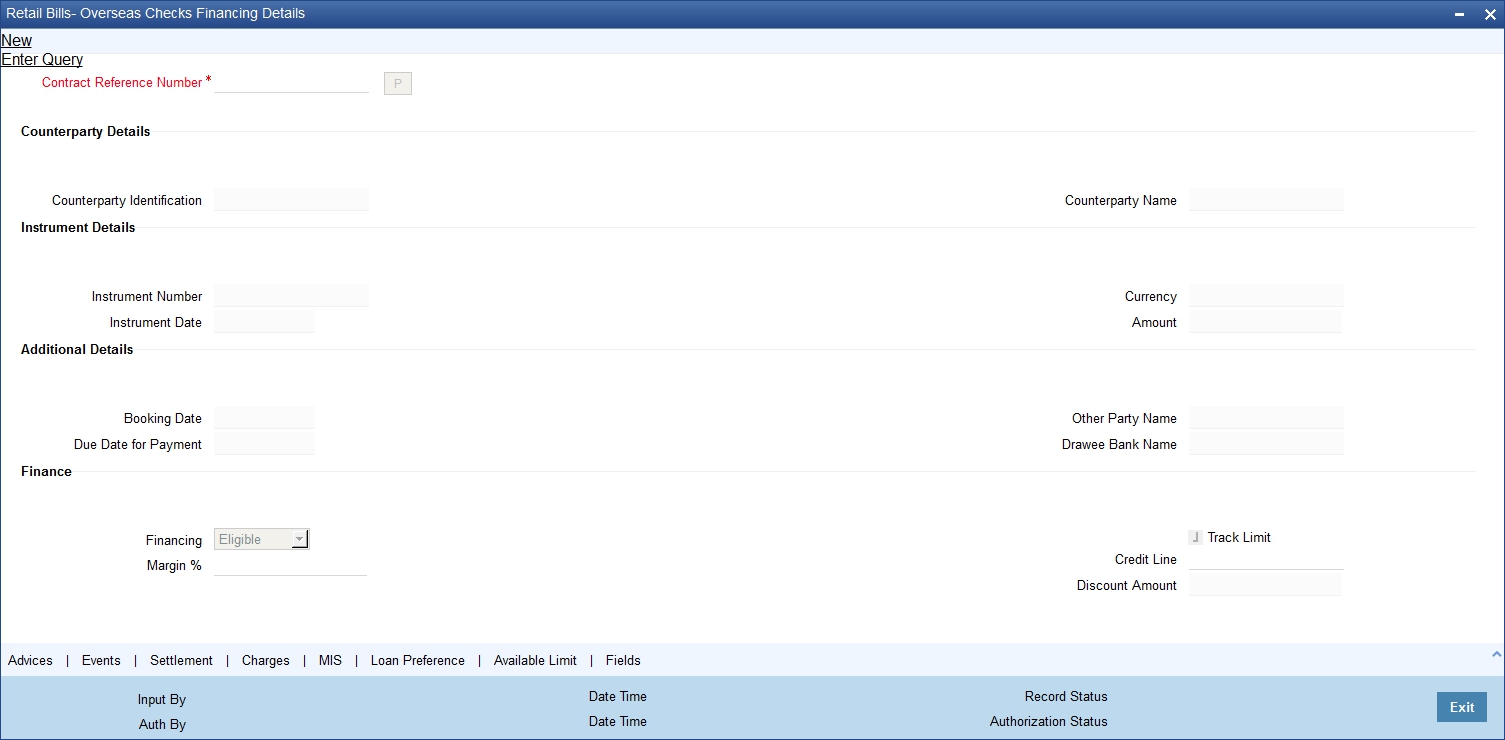

You can finance an overseas cheque using ‘Retail Bills - Overseas Cheques Financing Details’ screen. To invoke this screen, type ‘RBDOCFIN’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Contract Reference Number

Specify the contract reference number of the cheque for which financing is required. You can select the contract reference number from the option list. The option list displays all valid contracts which are eligible for financing.

Once you have specified the contract reference number, click 'P’ button to populate the details of the contract.

Counterparty Details

Counterparty Identification

System displays the customer id based on the contract reference number selected.

Counterparty Name

System displays the name of the customer here.

Instrument Details

Instrument Number

The system displays the cheque number based on the contract reference number selected.

Instrument Date

System displays the date of the cheque based on the contract reference number selected.

Currency

The system displays the cheque currency.

Amount

The system displays the cheque amount.

Additional Details

Booking Date

System displays a date on which the instrument is being booked.

Due Date for Payment

System displays the due date for payment based on the contract reference number selected.

Other Party Name

System displays the name of the other party.

Drawee Bank Name

System displays the name of the bank on which the cheque is drawn.

Finance

Financing

The system displays whether the instrument is eligible for financing or not, based on the instrument selected. If the financing status is ‘Eligible’, then you can change it to ‘Financed’.

- Eligible - if the instrument is eligible for financing, then the system allows you to finance the contract through ‘Overseas Checks Financing’ screen.

- Not Eligible - if the instrument is not eligible for financing, then the system will not allow you to finance the instrument

- Financed - if the instrument is financed, then the system allows you to finance the contract through contract booking screen itself.'

Margin %

System defaults the margin% from instrument maintained. You can edit this value if needed.

Track Limit

Check this box to indicate that the counterparty limits should be tracked.

The value is defaulted by the system as 'Yes'. However, the value can be changed later from 'Yes' To 'No', the system displays an override at the time of saving a record

Credit Line

Select the facility id of the customer from the adjoining option list.The list contains only those lines that belong to the counterparty. It is applicable only if the track limit is set to YES.

Discount Amount

System computes and displays the amount being financed as the discount amount. Here, Discount amount = Instrument amount - margin.

8.4.2 Capturing Additional Details for Financing Overseas Cheques Payable Abroad under Collection

For capturing additional details, an array of buttons are provided at the bottom of ‘Retail Bills - Overseas Cheques Financing Details’ screen. You can capture the following additional details for a cash letter contract:

- Advices

- Events

- Settlements

- Charges

- MIS

- Loan Preference

- Available Limit

- Fields

For further information on the above buttons, refer to the section ‘Capturing Additional Details for Cash Letter Contracts’ in this user manual.

Once you have captured the details, click ‘Save’ button. The system will create a loan account for the discounted amount in Retail Lending module.

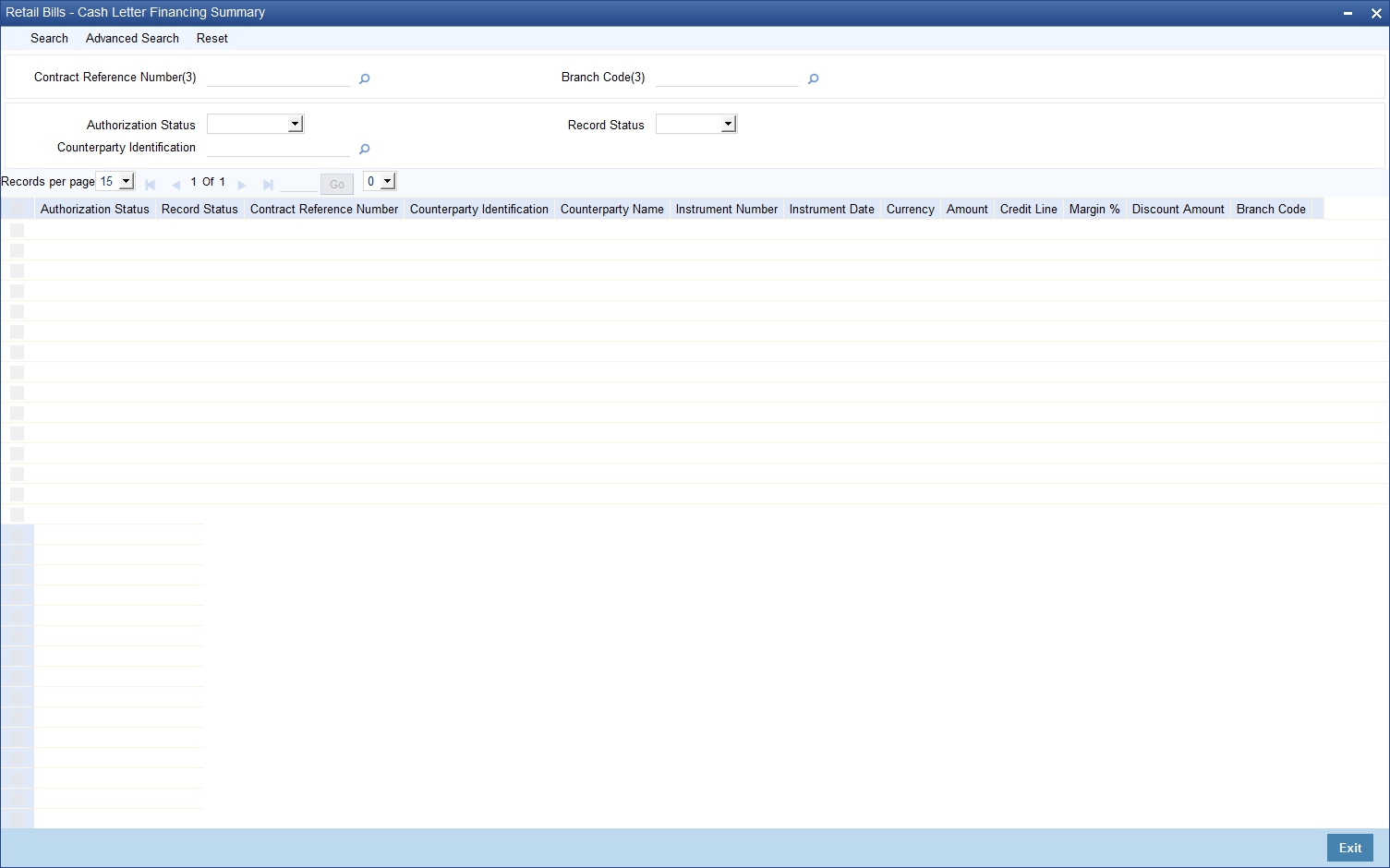

8.4.3 Viewing Summary of Overseas Cheques Financing

You can view a summary of financing of overseas cheques payable abroad under collection using ‘Overseas Checks Financing Summary’ screen. To invoke this screen, type ‘RBSOCFIN’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the records based on one or more of the following parameters:

- Authorization Status

- Contract Reference Number

- Record Status

- Counterparty Identification

Once you have specified the search parameters, click ‘Search’ button. The system displays the following details of the records that match the search criteria.

- Authorization Status

- Record Status

- Contract Reference Number

- Counterparty Identification

- Counterparty Name

- Instrument Number

- Instrument Date

- Currency

- Amount

- Credit Line

- Margin %

- Discount Amount

8.5 Realize Overseas Cheques Payable Abroad under Collection

This section contains the following topics:

- Section 8.5.1, "Realizing Overseas Cheques Payable Abroad under Collection"

- Section 8.5.2, "Capturing Additional Details for Realizing Overseas Cheques Payable Abroad under Collection"

- Section 8.5.3, "Viewing Summary of Overseas Cheques Realization"

8.5.1 Realizing Overseas Cheques Payable Abroad under Collection

You can realize the individual overseas cheques that were sent for collection using ‘Retail Bills’ Overseas Cheques Collection Details’ screen. To invoke this screen, type ‘RBDOCREA’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Contract Reference Number

Specify the contract reference number that you need to realize. You can select the contract reference number from the option list. The option list displays all valid and active contracts.

Once you have specified the contract reference number, click ‘P' button to populate the details of the contract.

Counterparty Details

Counterparty Identification

System displays the customer id based on the contract reference number selected.

Counterparty Name

System displays the customer name based on the contract reference number selected.

Counterparty Account Number

The system displays the account number of the counterparty.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Counterparty Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

The system displays the branch to which the customer belongs.

Instrument Details

Instrument Number

The system displays the cheque number as the instrument number.

Instrument Date

The system displays the date of the cheque.

Currency

The system displays the cheque currency.

Amount

The system displays the cheque amount.

Collecting Bank Address

Collecting Bank (CIF)

System displays the collecting bank code based on the contract reference number selected.

Collecting Bank Name

System displays the name of the collecting bank.

Debit Account for Realization

Select the account from the option list. It is the account debited at the time of realization of proceeds.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Debit Account for Realization field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

The system displays the debit account branch.

Collecting Bank Reference Number

Specify the reference number of the collecting bank if the value is not available in the contract details.

Additional Details

Net Realized Amount

Specify the net realized amount here.

Other Bank Charges

The system displays the other bank charges. This is calculated by deducting the net realized amount from instrument amount.

If the other bank charges exceeds the tolerance limit specified in ‘Branch Parameters Maintenance’, then the system displays an override message.

Value Date

System defaults the Current system date as the value date and you can edit this value.

Remarks

Specify your remarks on the transaction.

8.5.2 Capturing Additional Details for Realizing Overseas Cheques Payable Abroad under Collection

For capturing additional details, an array of buttons are provided at the bottom of ‘Retail Bills - Overseas Cheques Realization Details’ screen. You can capture the following additional details for a cash letter contract:

- Advices

- Events

- Settlements

- Charges

- MIS

- Fields

For further information on the above buttons, refer to the section ‘Capturing Additional Details for Cash Letter Contracts’ in this user manual.

Once you have specified the above details, click ‘Save’ button. The system triggers LIQD event.

In case of financed instruments, the system initiates liquidation of the loan account in CL module.

8.5.3 Viewing Summary of Overseas Cheques Realization

You can view a summary of realization of overseas cheques payable abroad under collection using ‘Overseas Checks Realization Summary’ screen. To invoke this screen, type ‘RBSOCREA’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the records based on one or more of the following parameters:

- Authorization Status

- Contract Reference Number

- Record Status

- Counterparty Identification

Once you have specified the search parameters, click ‘Search’ button. The system displays the following details of the records that match the search criteria.

- Authorization Status

- Record Status

- Contract Reference Number

- Counterparty Identification

- Counterparty Name

- Instrument Number

- Instrument Date

- Currency

- Amount

- Net Realized Amount

- Other Bank Charges

8.6 Dishonouring/Protesting/Returning Overseas Cheques Payable Abroad under Collection

This section contains the following topics:

- Section 8.6.1, "Invoke Retail Bills-Overseas Cheques Dishonour-Protest-Return Details screen"

- Section 8.6.2, "Capturing Additional Details for Dishonour/Protest/Return of Overseas Cheques Payable Abroad under Collection"

- Section 8.6.3, "Viewing Summary of Dishonour of Overseas Cheques"

8.6.1 Invoke Retail Bills-Overseas Cheques Dishonour-Protest-Return Details screen

In the event of non payment of a cheque, you can capture the dishonour, protest or return details using ‘Retail Bills - Overseas Cheques Dishonour - Protest - Return Details’ screen. To invoke this screen, type ‘RBDOCDPR’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

The 'Retail Bills-Overseas Cheques Dishonour-Protest-Return Details' screen is used for handling the dishonour, protest and return of retail instruments.

Specify the following details:

Contract Reference Number

Specify the contract reference number of the instrument which needs to be dishonoured/protested/returned. You can select the appropriate contract from the option list. The option list displays all valid and active contract reference numbers.

Once you have specified the contract reference number, click ‘P’ button to populate the contract details.

Counterparty Details

Counterparty Identification

System displays the Customer Id based on the contract reference number selected.

Counterparty Name

System displays the counterparty Name based on the contract reference number selected.

Instrument Details

Instrument Number

The system displays the cheque number here.

Instrument Date

The system displays the date of the cheque.

Currency

The system displays the cheque currency.

Amount

The system displays the cheque amount.

Collecting Bank Details

Bank code

The system displays the collecting bank code based on the contract reference number selected.

Bank Name

The system displays the collecting bank name associated with the bank code.

Additional Details

Booking Date

System displays the booking date based on the contract reference number selected.

Other Party Name

System displays the name of the other party.

Drawee Bank Name

System displays the name of the bank on which the cheque is drawn.

Dishonour / Protest / Return Reason

Reason Code

Select a reason code from the adjoining option list.

Reason

System displays a reason description based on the reason code selected.

Dishonour Details

Dishonour Date

Specify a date of dishonour and it should not be earlier than the booking date or later than the system date.

Protest Details

Protest Date

Specify the date of protest.

The protest date should not be -

- Earlier than the booking date

- Later than the system date

Notary Description

Specify the notary description.

Return Details

Return Date

Specify the date of return of the instrument. The return date should not be -

- Earlier than the booking date

- Later than the system date

Other Details

Discount Amount

System displays the financed amount as the discount amount, if the instrument is financed.

Other Bank Charges

Specify the Charges that are claimed by the other bank.

Remarks

Specify your remarks on the transaction.

8.6.2 Capturing Additional Details for Dishonour/Protest/Return of Overseas Cheques Payable Abroad under Collection

For capturing additional details, an array of buttons are provided at the bottom of ‘Retail Bills - Overseas Cheques Dishonour - Protest - Return Details’ screen. You can capture the following additional details for a cash letter contract:

- Advices

- Events

- Settlements

- Charges

- MIS

- Fields

For further information on the above buttons, refer to the section ‘Capturing Additional Details for Cash Letter Contracts’ in this user manual.

Once you have captured the details, click ‘Save’ button.

Based on the details that you have captured, the system will perform one of the following actions when you save the record:

- If you specify only dishonour details, then the system will pass only DISH event by reversing the contingent entry which is passed during BOOK event. The system will not reverse the same in the events PROT and RETN.

- If you specify both dishonour and protest details, then the system will pass only PROT event by reversing the contingent entry which is passed during BOOK event. The system will not reverse the same in the event RETN.

- If you specify dishonour, protest and return details, then the system will pass only RETN event by reversing the contingent entry which is passed during BOOK event.

8.6.3 Viewing Summary of Dishonour of Overseas Cheques

You can view a summary of dishonour, return or protest of overseas cheques payable abroad under collection using ‘Overseas Checks Dishonor-Protest-Return Summary’ screen. To invoke this screen, type ‘RBSOCDPR’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the records based on one or more of the following parameters:

- Authorization Status

- Contract Reference Number

- Instrument Status

- Reason Code

- Record Status

- Counterparty Identification

- Collecting Bank CIF

Once you have specified the search parameters, click ‘Search’ button. The system displays the following details of the records that match the search criteria.

- Authorization Status

- Record Status

- Contract Reference Number

- Counterparty Identification

- Counterparty Name

- Instrument Number

- Instrument Date

- Instrument Status

- Collecting Bank CIF

- Collecting Bank Name

- Booking Date

- Date of Dishonour

- Date of Protest

- Date of Return

- Reason Code

- Reason

8.7 Book Overseas Cheques Payable Abroad under Collection in Bulk

This section contains the following topics:

- Section 8.7.1, "Booking Overseas Cheques Payable Abroad under Collection in Bulk"

- Section 8.7.2, "Viewing Errors"

- Section 8.7.3, "Viewing Summary of Bulk Booking of Overseas Cheque"

8.7.1 Booking Overseas Cheques Payable Abroad under Collection in Bulk

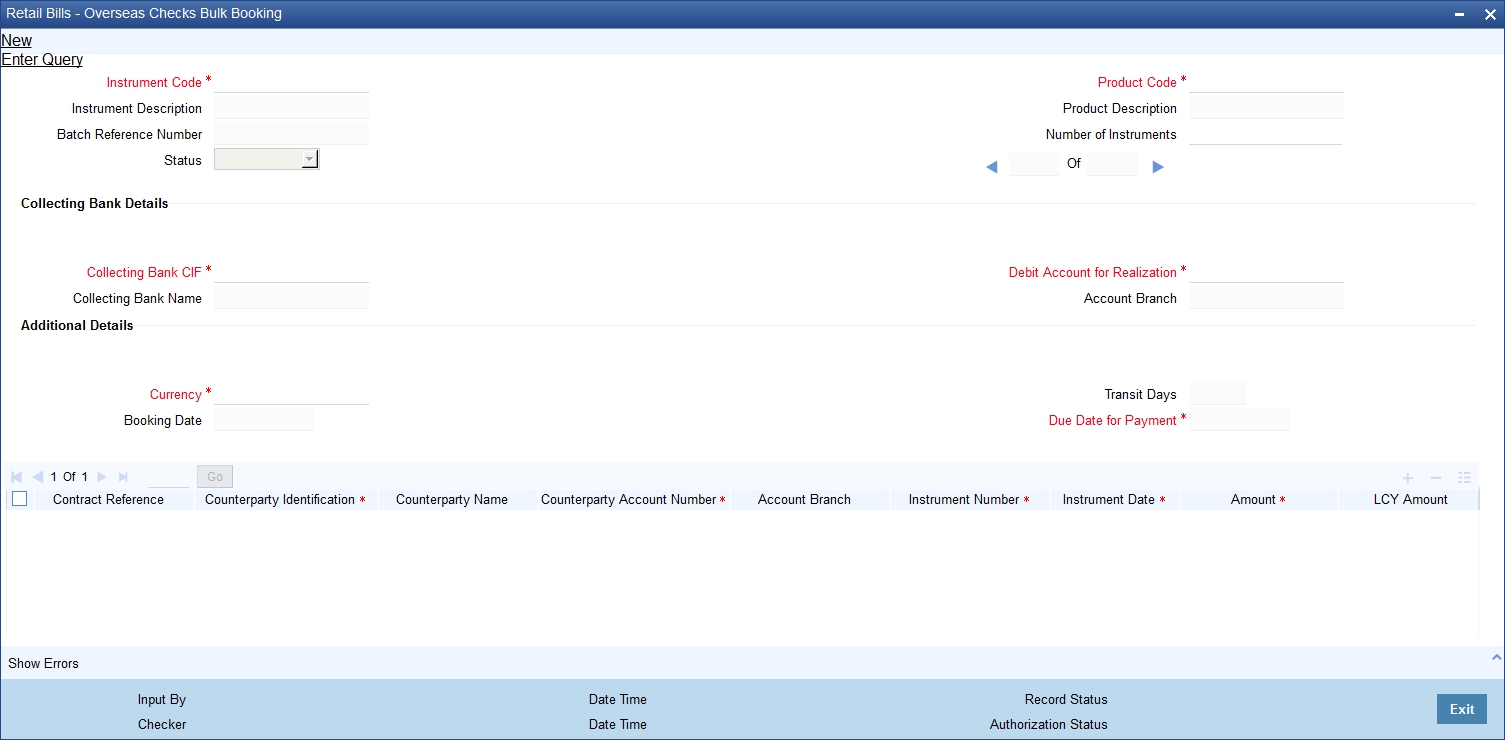

You can capture multiple overseas cheques payable abroad under collection using a single screen- 'Retail Bills-Overseas Cheques Bulk Booking'. You can invoke this screen by typing ‘RBDBOCPA’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details:

Instrument Code

Select the instrument code from the adjoining option list. The list contains only those instruments which are linked to product of type’ Overseas Cheques payable abroad for collection’.

Instrument Description

System displays instrument description for the instrument code selected in the above case.

Batch Reference Number

System generates and displays a unique reference number for the batch of instruments being booked.

Status

System displays the status of the booking here. This record can have one of the following statuses:

- Unprocessed - this indicates that the record is saved but not authorized

- Processed - this indicates that the record is saved and authorized

Product Code

Select a product code under which the contract is booked from the adjoining option list.

Product Description

System displays the description of the Product code selected.

Number of Instruments

Specify the number of instruments that are being booked in the batch. When you save the record, the system verifies whether this number equals the number of entries in the grid. If the number of entries in the grid and the number of instruments specified here do not match, then the system displays an error message.

Collecting Bank Details

Collecting Bank CIF

Select the CIF of the collecting bank/walk-in customer from the adjoining option list.

Collecting Bank Name

System displays the name of the collecting bank.

Debit Account for Realization

Select the account number which needs to be debited during realization from the adjoining option list. The list contains the Nostro accounts of the cheque currency.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Debit Account for Realization field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

System displays the debit account branch.

Additional Details

Currency

Select the currency of the cheque from the adjoining option list.

Booking Date

System displays the date on which the batch is booked.

Transit Days

The system displays the number of transit days.

If country of the collecting bank is the same as the country of the Nostro account, then the system displays the direct transit days maintained for the currency - Nostro account combination in ‘Float Days’ tab of ‘Retail Bills Branch Parameters Maintenance’ screen.

If country of the collecting bank and country of Nostro account are different, then the system displays the indirect transit days maintained for the currency - Nostro account combination in ‘Float Days’ tab of ‘Retail Bills Branch Parameters Maintenance’ screen.

Due Date for Payment

The system displays the due date for payment. This date is calculated by adding the number of transit days for the currency to the booking date.

Contract Reference

The system generates and displays a unique reference number for the contract on authorization. This reference is used in all accounting entries and transactions related to this contract.

Counterparty Identification

Specify the customer id of the counterparty. The counterparty is the party who has submitted the instrument. If you do not specify the counterparty id, then the system will display it when you specify the counterparty account number.

Counterparty Name

System displays the name of the customer here.

Counterparty Account Number

Specify the account number of the counterparty.

If you have selected the counterparty identification, then the option list displays only the valid account numbers of the selected counterparty. If you have not specified the counterparty identification, then the system will display all the valid account numbers maintained in the system.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Counterparty Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

System displays the account branch here.

Instrument Number

Specify the cheque number here.

Instrument Date

Specify date of cheque.

Amount

Specify a cheque amount.

LCY Amount

The system defaults the base amount as the Local Currency Amount on save or subsystem visit.

Other Party Name

Specify the name of the other party here.

Drawee Bank Name

Specify the name of the bank on which the cheque is drawn.

Auto Liquidation

Check this box to indicate that an instrument should be liquidated automatically on due date. The value is defaulted from the product and can be modified by the user.

Financing

If the contract is eligible for financing, then the system displays the value as ‘Eligible’. You can change the value to ‘Financed’. If the value defaulted by system is 'Not Eligible', then the contract cannot be financed and you cannot change the value to ‘Financed'.

Margin%

System defaults the margin% from instrument maintained. You can edit this value if needed.

Track Limit

Check this box to indicate that the counterparty limits should be tracked.

Credit Line

Select the facility Id of the customer from the adjoining option list. The list contains only those lines that belong to the counterparty. It is applicable only if the track limit is set to ‘Yes’.

Discount Amount

System computes and displays the amount being financed as the discount amount. Here, Discount amount = Instrument amount - margin.

It depends on the contract amount captured and margin% for the batches, where the financing value is ‘Financed’.

Internal Remarks

Specify your remarks on the transaction.

Status

System displays the status value here.

8.7.2 Viewing Errors

You can view the errors and overrides that took place in the bulk overseas cheque booking process using ‘Overrides’ screen. Click ‘Show Errors’ button to invoke this screen.

You can view the following details of errors/overrides in the process:

- Batch sequence number

- Error code

- Error description

- Error type

Once you have captured the details, click ‘Save’ button. On authorization, the system triggers BOOK event for all the contracts that you have requested to create as part of this batch.

In case you have opted for financing of any contract, the system creates the corresponding loan account as well.

8.7.3 Viewing Summary of Bulk Booking of Overseas Cheque

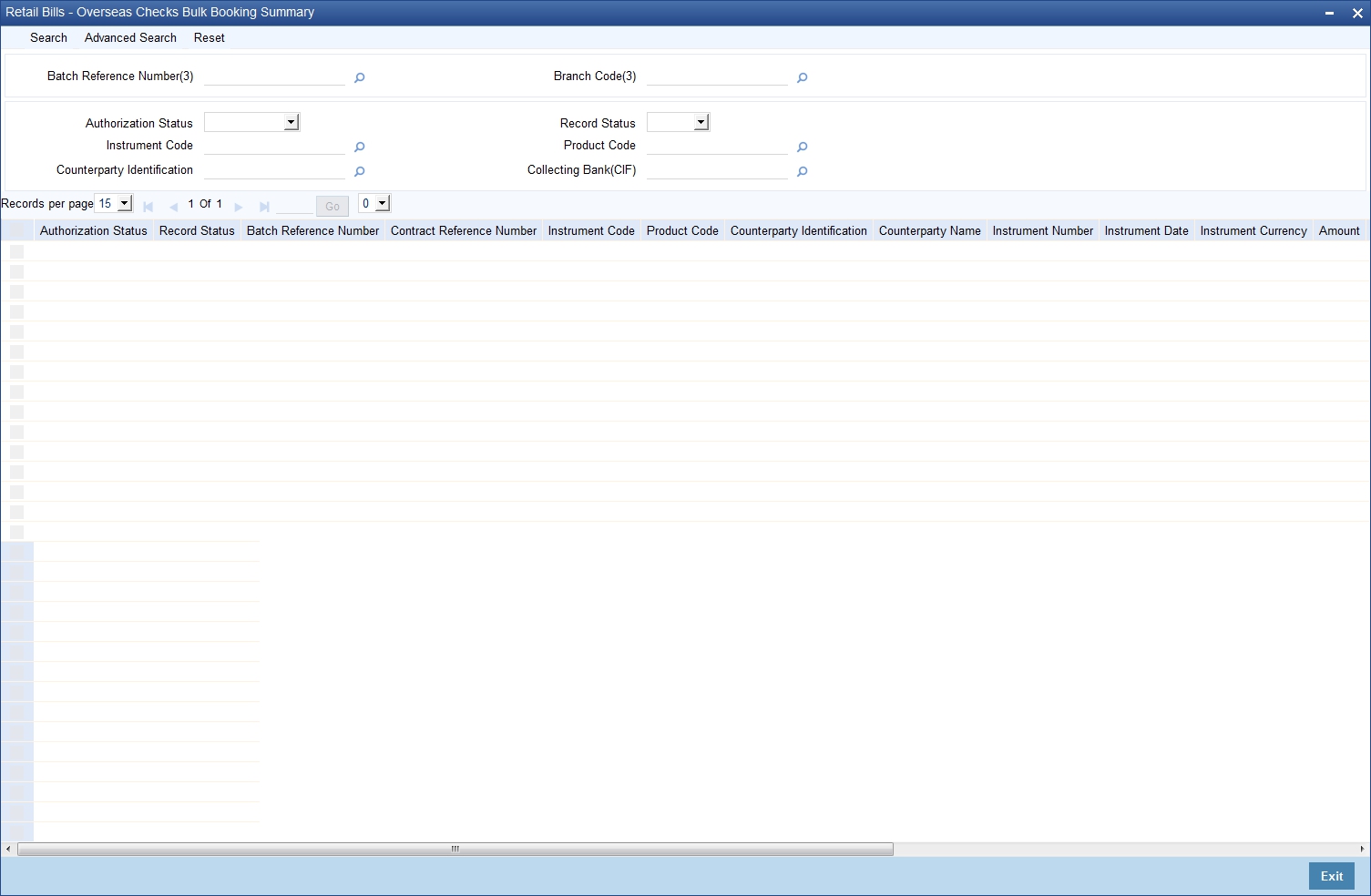

You can view a summary of bulk booking of overseas cheques payable abroad under collection using ‘Retail Bills - Overseas Checks Bulk Booking Summary’ screen. To invoke this screen, type ‘RBSBOCPA’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the records based on one or more of the following parameters:

- Authorization Status

- Instrument Code

- Batch Reference Number

- Collecting Bank (CIF)

- Record Status

- Product Code

- Counterparty Identification

Once you have specified the search parameters, click ‘Search’ button. The system displays the following details of the records that match the search criteria.

- Authorization Status

- Record Status

- Instrument Code

- Product Code

- Batch Reference Number

- Counterparty Identification

- Counterparty Name

- Collecting Bank (CIF)

- Collecting Bank Name

- Contract Reference Number

- Booking Date

- Instrument Number

- Instrument Date

- Instrument Currency

- Amount

- Due Date for Payment

- Transit Days

8.8 Realize Overseas Cheques Payable Abroad under Collection in Bulk

This section contains the following topics:

- Section 8.8.1, "Realizing Overseas Cheques Payable Abroad under Collection in Bulk"

- Section 8.8.2, "Viewing Errors"

- Section 8.8.3, "Viewing Summary of Bulk Realization of Overseas Cheques"

8.8.1 Realizing Overseas Cheques Payable Abroad under Collection in Bulk

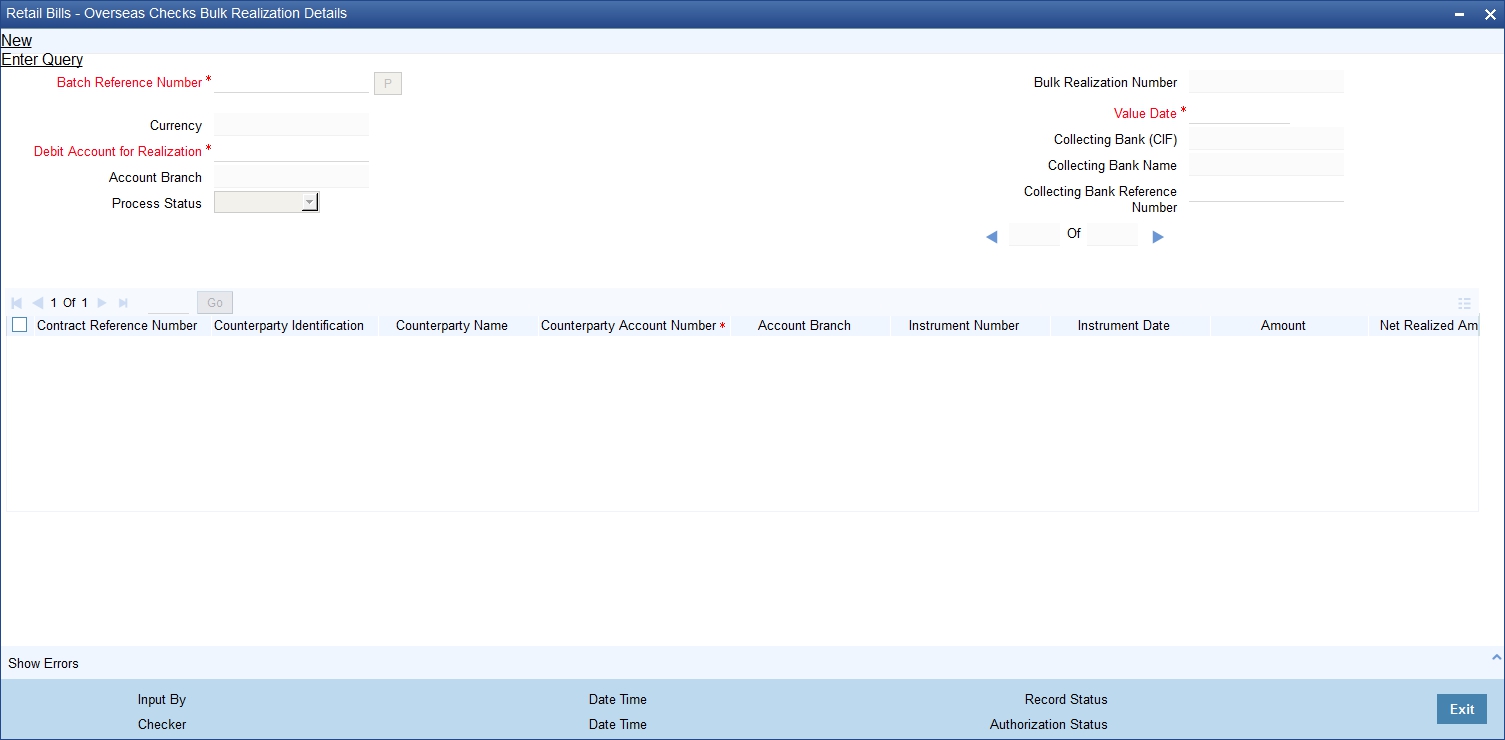

You can realize all overseas cheques sent under a batch using 'Retail Bills-Overseas Cheques Bulk Realization Details' screen. This screen allows you to identify a batch under which the selected set of instruments will be realized.

You can invoke this screen by typing ‘RBDBOCRE’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details:

Batch Reference Number

Select the Batch Reference number from the adjoining option list for which the bulk realization has to be done.

Once you have specified the above details, click 'P' button to populate the details of the instruments in a batch.

Currency

System displays the currency based on the batch reference number selected.

Debit Account for Realization

System displays the Debit Account for Realization based on the Batch Reference Number selected. You can edit the same.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Debit Account for Realization field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

System displays the debit account branch.

Process Status

Based on the batch reference number, the system displays the process status. The process status can be one of the following:

- Processed

- Un-processed

Bulk Realization Number

System generates and displays a unique bulk realization number.

Value Date

The system displays an application date as a value date. You can edit this value.

Collecting Bank (CIF)

System displays the collecting bank code based on the batch reference number selected.

Collecting Bank Name

System displays the collecting bank name based on the batch reference number selected.

Collecting Bank Reference Number

Specify a reference number provided by the collecting bank for payment.

Contract Reference Number

System displays the contract reference number of the contracts which are due for realization.

Counterparty Identification

System displays the counterparty ID of the contracts which are due for realization.

Counterparty Name

System displays the name of the counter party.

Counterparty Account Number

System defaults counterparty account number based on contract input.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Counterparty Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Account Branch

System displays the branch associated with the account number mentioned above.

Instrument Number

System displays the instrument number of the contracts which are due for realization

Instrument Date

System displays the instrument date of the contracts which are due for realization

Amount

System displays the amount for the selected contract.

Net Realized Amount

Specify the net realized amount here. If no value is captured for this field, then the system considers the instrument amount as net realized amount.

Other Bank Charges

System computes and displays the Instrument amount minus Net realized amount as other bank charges.

Internal Remarks

Specify your remarks on the transaction.

Process Status

System displays the status of the contract available for bulk realization as part of this batch.

8.8.2 Viewing Errors

You can view the errors and overrides that took place in the bulk overseas cheque realization process using ‘Overrides’ screen. Click ‘Show Errors’ button to invoke this screen.

You can view the following details of errors/overrides in the process:

- Batch sequence number

- Error code

- Error description

- Error type

Once you have specified the above details, click ‘Save’ button to save the contract. The system triggers LIQD event for all instruments selected for realization. In case of financed instruments, the system initiates liquidation of the loan account as well.

8.8.3 Viewing Summary of Bulk Realization of Overseas Cheques

You can view a summary of bulk realization of overseas cheques payable abroad under collection using ‘Retail Bills - Overseas Checks Bulk Realization Summary’ screen. To invoke this screen, type ‘RBSBOCRE’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the records based on one or more of the following parameters:

- Authorization Status

- Batch Reference Number

- Record Status

- Currency

Once you have specified the search parameters, click ‘Search’ button. The system displays the following details of the records that match the search criteria.

- Authorization Status

- Record Status

- Batch Reference Number

- Currency

- Contract Reference Number

- Counterparty Identification

- Counterparty Name

- Instrument Number

- Instrument Amount

- Instrument Date

- Other Bank Charges

- Net Amount Realized

- Bulk Realization Number