3. Securities - an Overview

3.1 Introduction

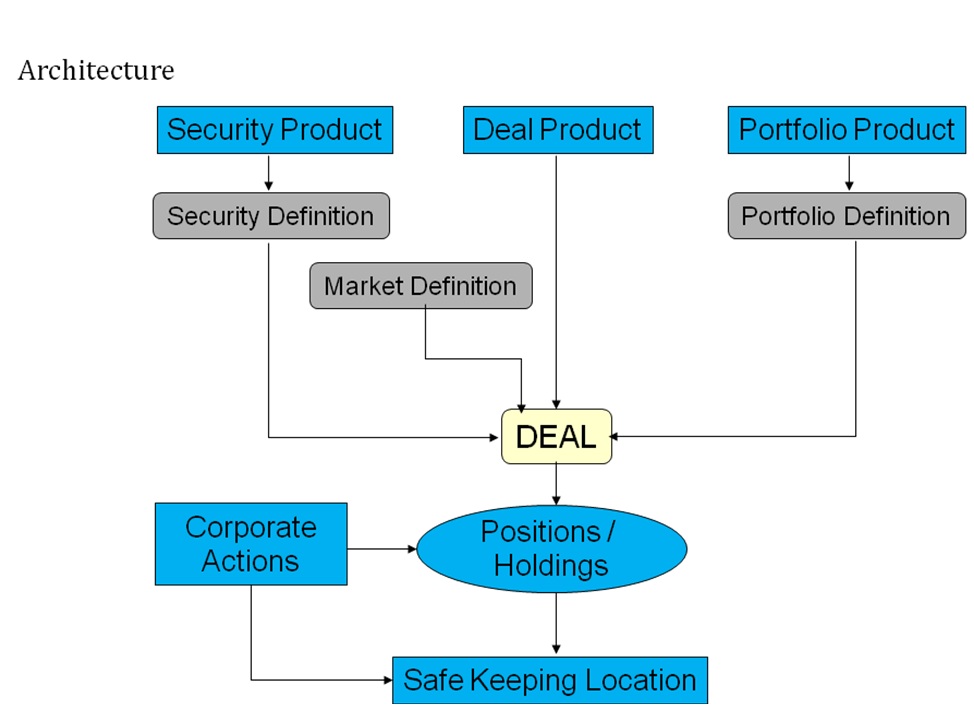

The Securities module of Oracle FLEXCUBE is a comprehensive, automated, and flexible back-office deal processing, and security lifecycle processing system. With this module, you can capture details of the security deals entered at your front office, process deals, and track the life cycle events of holdings in your own, or your customer’s portfolios.

The module is comprehensive in its ability to process different types of securities (fixed and flexible interest bonds, bonds with staggered and bullet redemptions, series type bonds, equities, warrants, rights, and discounted instruments) and portfolios (bank type, customer type, and issuer type). It is comprehensive in its ability to capture a host of relevant information for a variety of deal types (buy/sell; spot/forward; block; lodge/withdraw; repo/reverse repo; safe keeping location transfers, etc.).

The Securities module automates the entire processing-cycle of holdings in a portfolio (asset, liability, profit and loss bookings, accrual processing, and revaluation), and the processing of corporate actions (coupons, dividends, bonus, rights, warrants, and redemptions) defined for an instrument. The module automatically generates the SWIFT, Telex, and mail messages specified for the ‘events’ linked to deals or portfolios. It helps you automatically track your positions and holdings across various safe keeping locations, and automatically track, online, your exposure to a customer at the deal level for total or pre-settlement risks. At the end of day, you can also track your exposure to selected issuers and safe keeping locations.

Defining ‘Products’, in Oracle FLEXCUBE, helps you streamline your operations based on the various types or categories of business segments you operate in. For example, if you are an issuer of securities, you can define the different types of issuer portfolios as products. If you offer customer portfolio maintenance schemes, you can define each type of scheme as a product. Similarly, if you maintain short term zero coupon bonds, you can define it as a product. You can, likewise, define different deal types into products.

The Securities module gives you the flexibility to define, upfront, components (such as interest, charge, and tax), restrictions (such as branch, currency, customer, security, and portfolio), preferences, and events and accounting entries into ‘Classes’. When defining a product, you merely need to associate it with the different classes that you have built. You can change the attributes of classes, on association with a product, to suit a specific security, portfolio, or deal.

The module also offers you the flexibility to define portfolios based on your requirements. If you are an issuer of securities, you can maintain issuer portfolios for the coupon and discounted instruments you issue. On these instruments, you can automatically track coupon events, accruals, and redemption till maturity. You can define your trading and investment portfolios, and choose the costing method (LIFO, FIFO, WAC, etc.), the interest and discount/premium accrual frequencies, and the revaluation method that you would like to adopt. If you offer customer portfolio management facilities, you can define customer portfolios, and track all life cycle events from inception to maturity. You can levy charges on a variety of bases, at deal or portfolio level, for your services.

This chapter contains the following sections

- Section 3.2, "A Snapshot of the Module"

- Section 3.3, "Processing at the Portfolio Level - at the Beginning or End of Day"

- Section 3.4, "Getting Started with the Module"

3.2 A Snapshot of the Module

The instruments supported

- Fixed interest bonds with quantity (staggered), bullet, or series type redemptions, and user-defined coupon schedules supporting different interest methods for accrual and liquidation.

- Flexible interest bonds with quantity, bullet, or series type redemptions, and user-defined coupons with synchronous or asynchronous rate revision schedules supporting different interest methods for accrual and liquidation.

- Discounted instruments (Treasury Bills, Zero Coupon Bonds and Commercial Papers)

- Equities

- Rights

- Warrants

Corporate Actions processing supported

Bonds:

- Collection and disbursement of coupons for long and short holdings — collected/disbursed, by batch, from safe keeping location of holding for each portfolio.

- Redemption: processed, by batch, as an auto sell-type deal. The types

of redemption supported are:

- Bullet (at premium or face value)

- Quantity (percent of original face value) at a user-defined redemption price for each intermediate redemption

- Series (with user defined series and redemption date and price)

- Warrant events are processed as appropriate auto buy or sell deals between the portfolio and the SK location of the holding.

Equities:

- Cash Dividend (as rate per face value, or value per unit) collected and disbursed, by batch, from the safe keeping location of the holding, for each portfolio.

- Stock Dividend (Bonus) with user-defined resultant security processed, by batch, as a ‘buy’ deal from the location of holding of the parent security, for each portfolio.

- Partial or full cash conversion, at user-defined encashment price, collected by batch from the safe keeping location of the holding, for each portfolio.

- Rights events are processed as appropriate auto buy or sell deals between the portfolio and the SK location of the holding.

Rights and Warrants:

- Tear -off from the parent security at a user-specified ratio

- Exercise giving a user-defined resultant security at a user-defined ratio and exercise price.

- Automatic expiry on the date specified.

Portfolio features supported:

Bank Portfolio

- Costing basis: Deal Matching, LIFO, FIFO, and Weighted Average Costing

- Independent accrual option at flexible frequencies

- Flexible accrual options for forward profit or loss

- Revaluation using MTM or LOCOM for Settled or Total positions

- Option to restrict the portfolio from taking a short position

- Flexible, user-defined accounting entries and advices for each event

- Facility to specify, upfront, the GLs to which accounting entries for a portfolio product would be posted. You can change the default to suit a specific portfolio maintained under a product.

Issuer Portfolio

- Costing basis is always WAC and the portfolio is always short in the issued security.

- Independent option for accruing interest and discount on zero coupon bonds, issued by the portfolio, at a user-defined frequency.

- Flexible user-defined accounting entries and advices for each event.

Customer Portfolio

- Can attach pre-defined charge components (built with different charge bases, such as the coupon liquidation amount, stock to cash liquidation amount, etc.) to a customer portfolio.

- Can specify the notices to be generated for the various corporate actions due on a security in the portfolio.

Deal Product Types

The following deal types are supported:

- Buy and sell deals of type bank-to-customer, bank-to-bank, and customer-to-customer

- Rights and warrants ‘exercise’ type deals for bank and customer portfolios

- Lodge and withdraw type deals for customer portfolios

- Block and Release Block type deals for bank and customer portfolios

- Transfer from one SK location to another

Activities Supported through Deal Online

- Purchase and sale of securities between bank and customer portfolios, bank and standalone customers, bank and bank, and customer and customer.

- Spot and forward deals can be processed using user specified market details, rates, trade and settlement dates, bought or sold interest, and deal currency. Most likely values available as defaults for aiding faster inputs.

- Money settlement, on auto or manual basis, according to pre-defined settlement instructions.

- Deal level messaging based on the parties specified

- Customer portfolio deals, with accompany withdraw/lodge options, to capture deals by customer portfolio outside bank’s custodial interest.

- Standalone Withdraw/Lodge for customer to handle customer deals struck independently from holdings managed by the bank.

- Repo by bank portfolio/Reverse Repo by bank to customer with portfolio (auto blocking in portfolio of securities and with tracking of the market value of the blocked securities vis-à-vis the contract amount outstanding).

- Block Release Block

- Transfer across Safe Keeping Locations

- Facility to change the format of the security

3.3 Processing at the Portfolio Level - at the Beginning or End of Day

- Corporate Actions of coupons, dividends, and stock to cash (for bank

and customer portfolios).

- Manual and auto initiation at the security level

- Manual and auto collection from the SK location by the bank

- Liquidation and disbursement of the corporate action to the portfolio

- Deal Settlement and updating of holdings. Profit and loss booking for user-entered and auto deals.

- Accrual entries passed — Accrual of Interest, Discount, Premium, Redemption Premium, Forward Profit and Loss accruals.

- Revaluation entries posted

3.4 Getting Started with the Module

Oracle FLEXCUBE’s Securities module helps you streamline your operations to a remarkable degree. This is borne out by the following maintenance features.

The maintenance functions can be broken into the following categories:

- Maintaining commonly accessed data - such as market, SK locations, Interest, Charge and Tax components, and so on - required to simulate the specific business related environment that you desire.

- Building classes.

- Defining products.

This section contains the following topics

- Section 3.4.1, "Building Classes"

- Section 3.4.2, "Defining Products"

- Section 3.4.3, "Handling Interest, Charge and Tax Components"

- Section 3.4.4, "Building a Transaction Tax Scheme"

- Section 3.4.5, "Building an Issuer Tax Scheme"

- Section 3.4.6, "Handling Brokerage"

- Section 3.4.7, "Tracking Limits"

- Section 3.4.8, "Settling Deals"

- Section 3.4.9, "Querying the System for Details"

3.4.1 Building Classes

In Oracle FLEXCUBE, a ‘Class’ embodies a generic set of attributes. A class could represent:

- A set of restrictions (branch, currency, customer, security restrictions, or portfolio restrictions),

- A set of ‘preferences’ (security preferences, portfolio preferences, or deal preferences),

- A set of events and the corresponding accounting roles and heads (account types and the GLs involved), or

- A component (tax, interest, or charge).

As part of your one-time set up, you can define several sets of classes of a particular type. For instance, you may want to disallow banks and financial institutions from availing a customer portfolio service that you offer. You can maintain a Restrictions Class with a ‘Disallowed List’ of customers, and include Banks and Financial Institutions in this list. When defining the Customer Portfolio Service as a product, you merely need to associate this Restrictions Class to it. The same principle applies to all classes that you build.

In Oracle FLEXCUBE, therefore, you do not have to specify restrictions, preferences, and components every time you create a product. You only need to associate the different sets of classes that you have already maintained.

This feature eliminates redundancy, and saves processing time.

3.4.2 Defining Products

You can use the Product Definition facility in Oracle FLEXCUBE to streamline your operations based on the types or categories of business segments you operate in.

A 'Portfolio Product' is a category or a type of portfolio. For instance, you can define your investment portfolio of zero coupon bonds as a product in Oracle FLEXCUBE. A portfolio product can, thus, serve to classify the portfolios that you maintain in your bank, and to reflect either the security level, or the investment philosophy of your operations.

A portfolio product can also represent a specific service that you offer. You can define a customer portfolio maintenance service, ‘Clean, Safe and Fast Buck’, for example, as a product.

Similarly, you can define a category of securities (such as the t-bills issued by your government) as a product, and a category of security deals as a product.

When building a product, you assign it a set of attributes. (You can define these attributes by associating the appropriate classes to the product.) The securities, portfolios, and security deals that you maintain under a product, respectively, acquire the attributes defined for the corresponding product.

The Advantage of Defining a Portfolio Product

The advantage of defining products is illustrated by the following example. Assume this scenario: Mr. Silas Marner, your customer, would like you to maintain his portfolio, worth USD 100,000, under the customer portfolio maintenance scheme, ‘Clean, Safe, and Fast Buck’. The highlights of this scheme are:

- You would not deal in long-term Zero Coupon Bonds.

- You would not deal in securities issued by alcoholic beverage companies.

- You would not deal in securities issued by industries blacklisted by Greenpeace.

Let us consider the different operations that you would perform in setting up this portfolio. You would specify, amongst other details:

- The securities that you are not allowed to deal in (long term zero coupon bonds, securities issued by alcoholic beverage companies and companies blacklisted by Greenpeace).

- If you would like to provide Transaction, Corporate Action, and Holdings Statements (and if so, the frequency, the start date and the start month)

- The GLs that would be impacted.

- The advices that need to be generated.

- The charges that you would levy.

- The taxes that would apply.

- If you would like to auto liquidate for Corporate Actions.

- The MIS Heads under which you would like to report the portfolio.

If you maintain a hundred such customer portfolios under the same scheme, you will repeat the above operations as many times.

By defining portfolios with similar attributes as a product, you can standardise these operations. For example, for a portfolio product, you can define:

- The GLs that would be impacted (by associating an appropriate ‘Events, Accounting Entries and Advices Class)

- The advices that need to be generated

- The charges that you would levy (by associating a Charge Class)

- The taxes that would apply (by associating a Tax Class)

- The MIS Heads under which you would like to report the portfolios

Portfolios maintained under the product will acquire these attributes defined for the product.

Defining a customer portfolio scheme as a product reduces the effort involved in maintaining a portfolio.

By classifying your securities, portfolios, and security deals into products, you not only save time, you can easily retrieve information relating to securities, portfolios, or deals of a particular type.

3.4.3 Handling Interest, Charge and Tax Components

In Oracle FLEXCUBE, you can build interest, charge and tax components, upfront. When defining a product, you merely have to attach the required components. Thus, a security, maintained under a security product, acquires the components associated with the security product. Similarly, portfolios and deals acquire the components associated with the respective products they involve.

The following example illustrates the advantage of defining a component upfront.

The following transaction taxes apply on all the securities deals that you enter into:

A Stock Exchange tax

Local tax 1 - applicable on the deal amount

Local tax 2 – an additional tax

In Oracle FLEXCUBE, each of these taxes is referred to as a ‘component’ of the deals that you enter into.

In Oracle FLEXCUBE, you can build each of these components upfront. Since these taxes apply on all deals, you can associate the tax components to all the deal products that you maintain at your bank. Deals involving a product acquire the components defined for the product.

The advantage is clear: you do not have to define these taxes every time you enter into a securities deal.

Building Interest and Charge Classes

A class is a specific type of Interest or Charge component. A ‘quarterly coupon paid on the current face value’ is an example of an interest component. A charge levied on every extra ‘Statement of Holdings provided’ is an example of a charge component. When building a class, you can identify:

- The Charge Rule (in case of a charge class)

- The event at which you would like to associate the component to a security

- The application event (for a charge class)

- The liquidation event (for a charge class)

- The basis amount on which the coupon is paid. Typically, this is on the current face value of a security (for an interest class)

- The rate type (for an interest class)

- The default rate code (for an interest class)

- The default tenor (for an interest class)

These details default to the products with which you associate the class. For instance, a security maintained under a product acquires the interest components associated with the product. By building classes, and associating them to products, you remarkably save time and effort.

Building Tax Classes

With the Securities module of Oracle FLEXCUBE, you can process two kinds of tax:

- Issuer tax (charged on the coupon or cash dividend paid by the issuer)

- Transaction tax (local taxes, for example)

Issuer tax for a security is calculated on the basis of the Issuer Tax Scheme associated with the product that the security involves. Transaction tax for a securities deal is calculated on the basis of the Transaction Tax Scheme associated with the product that the deal involves. (A tax class is a specific type of Issuer or Transaction tax. A tax scheme is a set of Issuer or Transaction tax classes.)

3.4.4 Building a Transaction Tax Scheme

When building a transaction tax class, you associate it with a tax ‘rule’. A rule identifies the logic required to compute tax. The logic built into a tax rule defaults to the tax class with which you associate the rule. For a tax rule you can define the following:

- The tax currency

- The minimum tax amount

- The maximum tax amount

- The floor amount

- The floor charge

- The ceiling amount

- If you would like to apply a rate or a flat amount

- The basis amount, etc

You can group any number of transaction tax classes into a tax scheme. When defining a security deal product, you can associate it with a transaction tax scheme that you have built. Transaction taxes for all deals associated with the deal product will be calculated, by default, according to the components built into the scheme.

3.4.5 Building an Issuer Tax Scheme

When building an Issuer tax class, you associate it with a Rate Code, and not a Tax Rule. (A code uniquely identifies a rate value.) You can group the Issuer tax classes that you have built into an issuer tax scheme. When maintaining a security product, you can associate it with an issuer tax scheme that you have built. Issuer taxes for securities associated with the product will be calculated, by default, according to the issuer tax components built into the scheme.

3.4.6 Handling Brokerage

In Oracle FLEXCUBE, you can maintain a list of all the brokers with whom you deal with in the Broker Master Maintenance table. In this table, for each broker, you can specify brokerage details such as the broker’s name and address; a unique code for the broker; the brokerage payable currency; whether you would like to book brokerage in advance or in arrears, etc.

A centralized brokerage set up means that you do not have to specify brokerage details every time you enter into a deal. When processing a security deal, the details maintained for the specified broker are automatically picked up. You can change the default brokerage details.

3.4.7 Tracking Limits

The liability details for a customer, customer account, and product are maintained in the Central Liability module, which is at the core of Oracle FLEXCUBE. Other modules, such as the Securities module, access these details online. This allows you to constantly track you exposure to:

- A counterparty in a securities deal

- An Issuer

Oracle FLEXCUBE also provides you the facility to track your exposure in an SK Location.

For details relating to limits tracking and monitoring, please refer the Central Liability user manual.

3.4.8 Settling Deals

For a customer, you can maintain settlement preferences, centrally, in the Settlements sub-system of Oracle FLEXCUBE. Defining preferences centrally means you do not have to specify settlement details every time you enter into a deal. Security deals are settled, by default, according to the preferences specified for the counterparty. When entering into a deal, however, you can change the default settlement details.

3.4.9 Querying the System for Details

Oracle FLEXCUBE offers you an invaluable tool - the ‘Online Query’ facility. Using this facility, you can sieve data to locate the precise information that you require. Here is how the facility works: in the midst of your operations, you would frequently want to retrieve very specific information relating to:

- SK security movements

- SK location balances

- Portfolio security movement

- Portfolio balances

The Securities module offers you a Query screen to locate each of the above types of information. In the query screen, specific to the type of information you are looking for, you can enter the criteria by which you would like to filter data. Only data that satisfies the criteria that you specify will be displayed for your reference.

The chapter ‘Querying the System for details’ discusses this feature elaborately.