5. Maintaining Price Details

5.1 Introduction

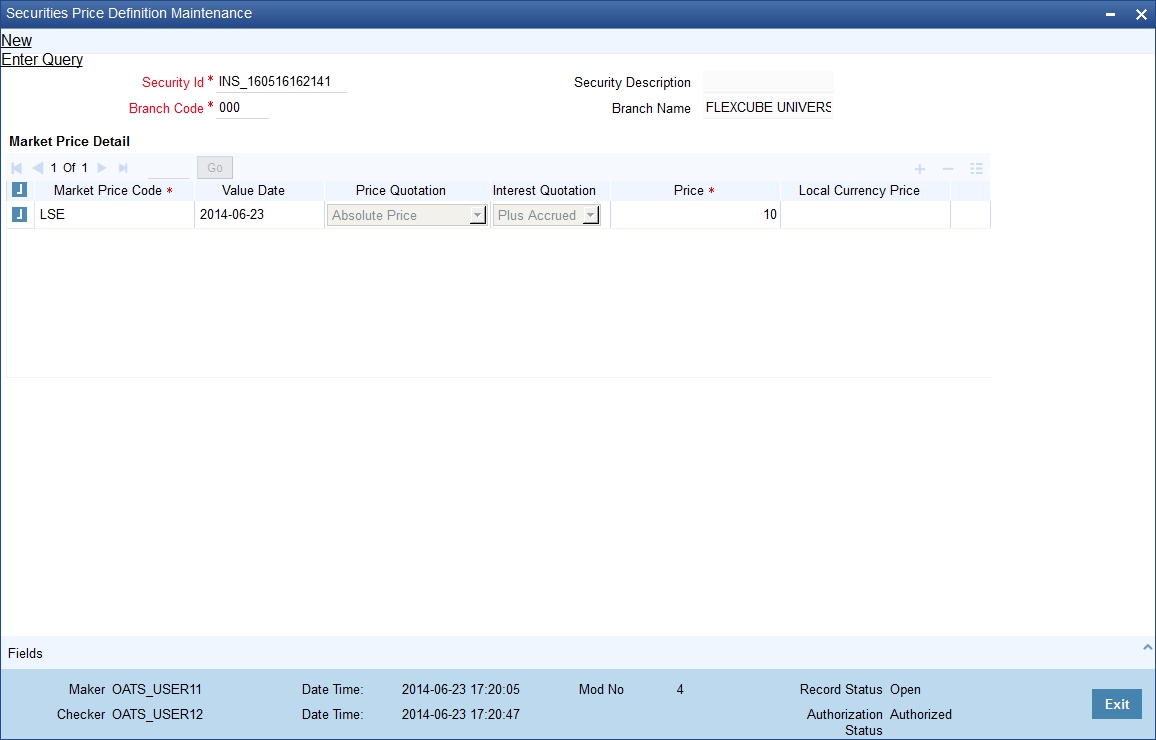

From time to time, you need to update the current market price of various securities maintained in the system. Through the Market Price Definition screen, you can update the market price of the securities that you maintain.

On selecting a market code for the security being defined, the price code details maintained in this screen, will be picked up and defaulted to the Security Definition screen. You have the option of changing these details at the security definition level.

Thus, at the time of entering a deal, all you need to do is select the code assigned to the security. All other details such as the market to which it belongs, the interest quotation method and the price quote, will be automatically picked up from the Security Definition screen.

You can invoke the ‘Securities Price Definition Maintenance’ screen by typing ‘SEDXMRAT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

If you are maintaining details of the market price for a new security, click on new from the tool bar. The Market Definition detailed screen will be displayed without any details. To modify or update the existing prices as of different Value dates, click on the unlock button. Enter the value date and the new price in the respective fields and save the record.

If you are calling a market price maintenance record that has already been defined, choose the Summary option under Market Price. From the Summary screen, double click on a record to open it.

Price Code

The price code indicates the price of a market place. Each price code you define is unique. If the security is quoted in different markets, its value would be different in each market. You can capture these prices using different price codes.

The price code assigned to each security, is used to identify the particular market price of the security for the purpose of revaluation. All the price codes defined in this screen are picked up and displayed in the picklist available for Revaluation Price Code field, of the Security Definition screen. You can specify the revaluation price code for each security while defining it.

For example, the following security has been quoted in four different markets at varying prices:

Security ID |

Market Place |

Price |

Price Codes |

Reliance |

NSE - Delhi |

3000 Rs. |

SERL01 |

Reliance |

BSE - Bombay |

3020 Rs. |

SERL02 |

Reliance |

OTC- Bombay |

3010 Rs. |

SERL03 |

Reliance |

CSE - Calcutta |

3025 Rs. |

SERL04 |

If you are defining the revaluation price for the security, you can choose any one of the price codes as the revaluation code. Let’s assume you choose SERL03. This code will be picked up exclusively for the purpose of revaluation.

Each security code is associated with a market code. At the time of entering a deal, specify the security code and the price code linked to the market will be picked up and defaulted.

5.1.1 Price Quotation Method

You can specify the price quotation method to be used, for the security for which you are defining the price. The details that you maintain here are specific to the price quotation method used for the particular security.

You can choose any of the following methods for calculating the price:

Absolute price |

Here the market value of the security is quoted as the actual price of the security. |

%Price |

Here the security price is quoted as, % Price = (Market price / Face value) x 100 |

For example, the Face value of security A is USD1000. The market value of the same security is USD900. If the price quotation method specified is Absolute Price then the price of the security will be quoted as USD900.

For the same security, if you choose to apply the % Price method, then the price of the security will be:

900 / 1000) x 100 =90%

You will quote the %price of the security as 90.

Premium/Discount is the differential between the face value of the bond and the price at which it is sold.

If you were to specify the Discount/Premium method then the security would be quoted at a discount of USD100 (USD1000 – USD900 = USD100). If the market price of the security were to be USD1100 then the security would be quoting at a premium of USD100.

In the %Discount/% Premium method the percentage of the discounted price is quoted. In the case of the above example it would be a 10% discount or a 10% premium.

The YTM price is quoted on the basis of its yield to maturity. This price quotation method is applicable only for Zero coupon bonds.

The yield on discounted instruments is measured by the yield to maturity (YTM) which is the return on a security bought at current market price for the remaining time to maturity of the security. The YTM would keep changing with the market price, in case the market price increases above the straight discounted price YTM would decrease and vice versa.

In the Yield to Maturity quotation method the price is calculated as follows:

Interest Quotation Method

For interest bearing instruments, the price at which the instrument is quoted can include the accrued interest or can be calculated separately. Indicate the interest quotation method for the security price code you are defining.

The interest quotation method could be either:

- Flat or

- Plus accrued

In the former method the price is quoted inclusive of the interest. This is also called the Dirty price. In the latter method the accrued interest is quoted separately; i.e., the price quoted is exclusive of the interest component. This is also referred to as the clean price.

Price

This is the price at which the security is to be traded. The price of the security keeps on fluctuating depending on the market rates. Hence, the updating of the price of the security at regular intervals is necessary.

To define a new price for an existing security, click add button and enter the new price. This price will be associated with the particular security when it is traded. To delete an existing price, highlight the old price and click on the delete button.

Each time you change the price details of an existing security, the old details will automatically get stored into a history file maintained internally.