4. General Maintenance

4.1 Introduction

Before beginning operations on the Securities module, you need to maintain certain basic information. The information that needs to be maintained includes:

- Bank and Branch parameter details

- Floating interest rate details

- Market definition details

- Safe Keeping location details

- Tax details

The procedure for maintaining these details is discussed in the following sections.

Note

The basic information, necessary for the successful operation of the securities module, should be periodically reviewed and updated to reflect the latest changes.

4.2 Bank Parameters

This section contains the following topics

- Section 4.2.1, "Maintaining Bank Parameters"

- Section 4.2.2, "Maintaining Deal Products"

- Section 4.2.3, "Maintaining Nominal Based Yield Computation"

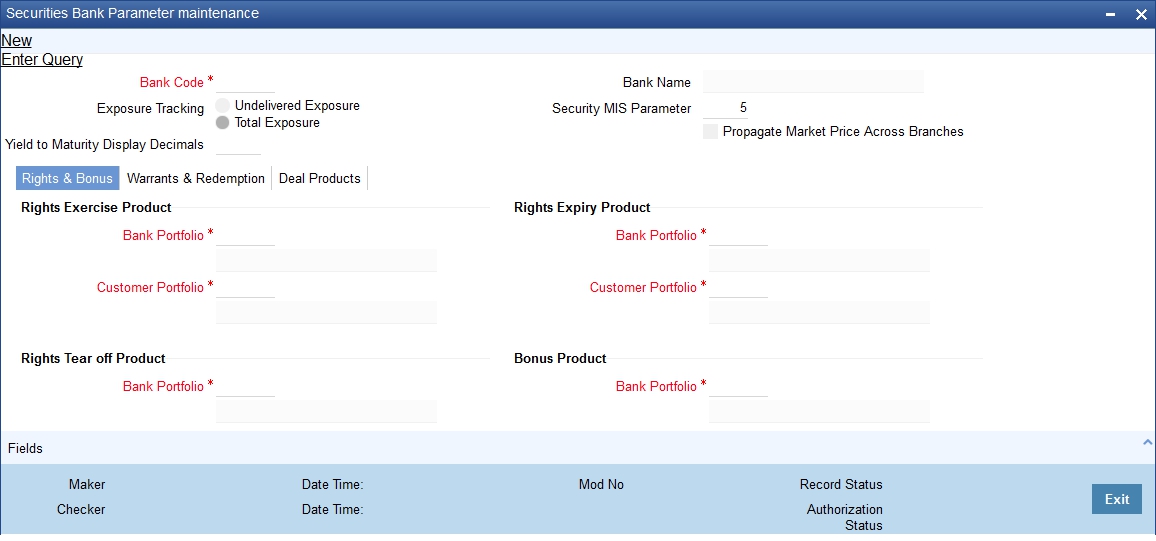

4.2.1 Maintaining Bank Parameters

In the Securities Bank Parameters screen, you maintain certain basic information regarding the processing of Auto Deals.

You can invoke the ‘Securities Bank Parameters Maintenance’ screen by typing ‘SEDXBNPM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

If you are calling a record that has already been created, click on Summary view. From the Summary screen you can open an existing record. Highlight the record you wish to view and double click on it. The details of the bank parameter record will be displayed in a tabular form.

Security MIS parameter

In Oracle FLEXCUBE, a maximum of 10 transaction classes can be maintained for a security and portfolio.

By specifying the security MIS parameter, you can indicate how the MIS transaction classes for a security position (Portfolio plus Security combination), is built from the respective transaction classes of the security and portfolio.

The number that you enter in this field denotes the number of MIS transaction classes of the security that should be picked up, to determine the MIS transaction of the security position.

Year to Month Display Decimals

The YTM values, which you can view through the Yield to Maturity details sub-screen of the Deal Online screen, are rounded off to the number of decimal places that you specify in this screen.

You can indicate the deal combination product code, which should be picked up, in case of declaration of one of the following:

- Rights

- Tear-off

- Exercise

- Expiry

- Bonus

- Warrants

- Tear-off

- Exercise

- Expiry

- Redemption

Deal combination product codes are maintained in the Deal Combination Product definition screen. All the product codes defined in that screen will be reflected in the picklist available. The attributes defined for a particular deal combination product, will be inherited by the auto deal to which it is linked. The parameters maintained in this screen are applicable across the bank.

4.2.2 Maintaining Deal Products

Specifying Banker’s Acceptance for a Placement/Loan Product

If you wish to process Banker’s Acceptances in your bank, then you must indicate the Loan/MM product, under which loan contracts or money market placements are to be created whenever you process a Banker’s Acceptance deal.

In a Banker’s Acceptance deal, you fund the issuer of a security by creating a loan or a money market placement.

Select from the list of values containing all open and authorized Loan / MM products, which satisfy the following conditions:

- In case of an LD product, the product type should be: ‘Loans’

- In case of an MM product, the type should be: ‘Placement’

- The rate type should be: ‘Special’

- The payment type should be: ‘Discounted’

- The Loan / MM product can have only one interest component attached.

Refer to the Deal Online chapter of this User Manual for details on processing Banker’s Acceptances.

4.2.3 Maintaining Nominal Based Yield Computation

For your bank you can specify whether the yield computation for securities should be based on Nominal Cash Flows or Face value (per unit). You can maintain this parameter in the CSTB_PARAM (Bank Level Parameters) table. Maintain the parameter COMMON_YLD_ACCR as ‘Y’.

Once this parameter is maintained as Y, the system will compute the yield and NPV for Bonds and T Bills using Nominal based cash flows.

Subsequently, the system triggers the Yield accrual event YACR. The value passed for the event YACR is inclusive of the discount/premium accrual for the deal and the events ACRD and ACRP will not be passed separately.

To compute yield using nominal based cash flows, the following validations are performed in the system:

- Coupon Rate Revision – If you have specified the bank parameter

‘COMMON_YLD_ACCR’ as ‘Y’, then

- The system does not allow a coupon rate revision prior to an existing IRR effective date. The IRR record can be a result of a sell deal or an earlier coupon rate change.

- If the revision date is less than the application date, the coupon rate revision is populated with the future revision details on confirmation of the coupon rate revision.

- Buy Deal – In case the Security is a Bond and you have specified

the bank parameter ‘COMMON_YLD_ACCR’ as ‘Y’ then

- The initial cash flow for yield computation is taken from the net considerations of the deal.

- Yield is computed based on actual cash flows instead of the face value.

- Securities Batch -

- Coupon rate revision – during EOD processing, IRVN process initiates the coupon rate revision activity on the effective date of coupon rate revision. This is triggered before the YTMCALC – YTM Recalculation & ALPL processes. The system triggers the IRR re-computation prior to ALPL (profit/loss realization) processing. As a result of the revision, the ‘CRVN’ event for the deal is passed based on the new coupon rate.

- Sell deal – the system triggers an IRR effective on the sale date during processing of a sell deal. In this case the Yield value does not change but the cash flows are recomputed based on the current outstanding amount. Yield is recomputed only if the sell deal is back dated and a rate change has happened subsequent to the DSTL date of the sale deal. System throws up an override is a back dated sell or buy deal is input for a security for which rate revision has already occurred.

- Reversal of Sell Deal – in case of reversal of a sell deal, the IRR record as of the DSTL date of the sale deal is deleted and a new IRR record is created as of the earliest IRR re-computation date. The re-computed date can be the date of the coupon rate revision date or the DSTL date of the re-computed sell deal.

4.3 Branch Parameters

This section contains the following topics

- Section 4.3.1, "Defining Branch Parameters"

- Section 4.3.2, "Specifying the Batch Processing Parameter"

- Section 4.3.3, "Specifying Revaluation Level"

- Section 4.3.4, "Specifying whether Coupon Dates can Move across Months"

- Section 4.3.5, "Specifying whether Accounting Value Date can Move across Months"

- Section 4.3.6, "Specifying Interest Accrual level"

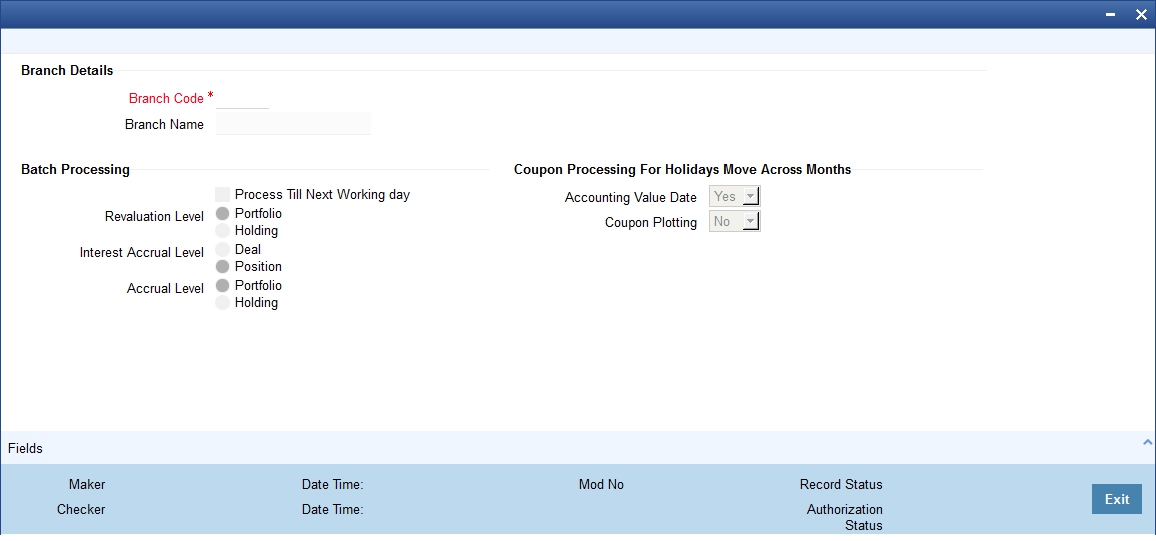

4.3.1 Defining Branch Parameters

A set of rules that governs the processing of securities in a particular branch of your bank, is defined in the Branch Parameters screen.

You can invoke the ‘Securities Branch Parameters’ screen by typing ‘SEDXBRPM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The events, for which you had indicated automatic processing, are triggered off during the Batch Process. You can specify preferences for the automatic events that fall on a holiday, in the Branch Parameters screen.

4.3.2 Specifying the Batch Processing Parameter

You have the option to specify when the batch process, should process automatic events falling due on a holiday. It could be either:

- As part of the EOD on the last working date before the holiday

- As part of the BOD process on the next working day after the holiday

4.3.3 Specifying Revaluation Level

Revaluation entries can be passed at the portfolio level or at the holding level.

- Portfolio: At the portfolio level, revaluation entries will be passed for the portfolio and currency combination.

- Holding: At the holdings level entries will be passed for the net holdings for a portfolio and security across SK locations and SK location accounts.

For example, consider the following securities held in a portfolio at your bank:

Portfolio |

Security ID |

PF1 |

SE01 |

PF1 |

SE02 |

PF1 |

SE03 |

PF1 |

SE04 |

The security currency for SE01, SE02 and SE03 is USD. The security currency for SE04 is GBP.

If you indicate that revaluation should be passed at the holdings level, entries will be passes exclusively for the following combinations:

- PF1 + SE01

- PF1 + SE02

- PF1 + SE03

- PF1 + SE04

If you specify that entries should be passed at the portfolio level, then the revaluation entries will be made in the following manner:

PF1 + SE01 + SE02 + SE03

PF1 + SE04

Note

If you indicate that revaluation should be performed at the Holdings level, you have the option of selecting between Deal level revaluation and Position level revaluation while defining a portfolio.

See the ‘Maintaining a Portfolio Preference class’ chapter of this User Manual for more details.

Specifying the Accrual level

- Portfolio: At the portfolio level accruals will be passed for the portfolio and currency combination.

- Holding: At the holdings level entries will be passed for net holdings of a portfolio and for security across SK locations and SK location accounts.

4.3.4 Specifying whether Coupon Dates can Move across Months

In the Security Definition screen, you can define whether a coupon payment falling due on a holiday should be shifted backward or forward. In the Securities Branch Parameters screen, you can specify if such a forward/backward shift shall be allowed when it involves a movement across months. In the Coupon Plotting field in the Holiday Treatment – Move Across Months area, you have to select either ‘Yes’ or ‘No’ accordingly.

4.3.5 Specifying whether Accounting Value Date can Move across Months

Interest calculations and accruals are done till the coupon event date. However, if the coupon event date is a holiday, the accounting entries are processed as part of the batch process on the next working day or the previous working day, depending upon your specification. Select ‘Yes’ or ‘No’ in the Accounting field in the Holiday Treatment – Move Across Months area.

If the coupon plotting date itself has moved to a working day, then this field becomes irrelevant.

Note

For both Coupon Details and Accounting Value Date, if movement across months is allowed, then such movement takes place (subject to necessity and as per other preferences maintained) even if this entails a movement across accounting periods or across financial years.

4.3.6 Specifying Interest Accrual level

You can opt to accrue interest at a position level or at a deal level.

- Position: At the position level, accrual happens for a combination of security and portfolio

- Deal Matching: Deal level interest accrual is done for every individual buy deal for the same combination of security and portfolio

Interest accrual at deal level is for Bank Portfolios only.

Deal Level Interest Accrual

The interest accrual process pickups all the settled buy deals and pass accrual entries for each of them.

The deal level interest accrual will be done only for portfolios with the following costing methods:

- Deal Matching (DM)

- First in First Out (FIFO)

- Last in First Out (LIFO)

Deal level interest accrual cannot be done for portfolios with Weighted Average Costing (WAC) method since it would not be possible to determine the deals for which interest accrual should be stopped.

Consider the following example.

The following buy deals for ’1year EURODOLLAR Bonds’ (S1) have been struck for the Trading Portfolio (P1):

Leg Ref. No |

Purchase date |

Deal |

No of units |

Deal 1 (D1) Deal 2 (D2) Deal 3 (D3) |

1st January 2nd January 5th January |

Buy Buy Sell |

10 15 12 |

If P1 were maintained as a WAC portfolio, it would not be known from which deal the 12 units of ‘10-Year RBI Bond’ are being sold. It could be 6 units each from D1 and D2 or 12 units entirely from D2. Therefore, for WAC portfolios, interest accrual will be done at the position level rather than at individual deal level.

However, if P1 were of type FIFO, it would be easy to determine that the 12 units that are sold comprise of 10 units from D1 and 2 from D2. Therefore, once the sell deal, D3 is settled, interest accrual will be stopped for D1 as all the 10 units are sold. For D2, interest accrual will happen for the remaining units (i.e. 15 – 2 = 13).

Revaluation

Though interest accrual occurs at deal level, the revaluation (REVL) entries will continue to be posted at the position level. The revaluation process will compare the current book value (cost of assets in your books) with the book value at the market place.

The price quote at the market place can be:

- Plus Accrued, in which case the value will be devoid of interest, which will be subsequently accrued.

- Flat Value, where the interest is built into the value. In this case, the system will arrive at the clean price of the asset.

Capitalization

Capitalization or compounding of interest (interest on interest) will result in a new deal and the face value would be considered as the coupon amount for the previous coupon period. Therefore, IACR for the new deal would be done with the new face value.

For Back Dated Deals

In the case of back dated deals, adjusted entries will be posted. As the IACR will be at a deal level, for a back dated buy deal, a consolidated IACR entry will be posted. For a back dated sell deal, an adjustment IACR entry will be posted for the matched buy deals(s).

On reversal of a sell deal, the interest accrual process will pass an adjustment entry for the relevant matched buy deals. This is illustrated in the example below.

Let us continue with the example discussed above. You have struck 3 deals (2 buy + 1 sell) for ’10-year RBI Bonds’ (S1) for the Trading Portfolio (P1). Further, the 12 units sold comprise of 10 units from D1 and 2 units from D2. The other details of the deal are as follows:

- Coupon Period – 1st Jan to 30th Jan

- Coupon Amt – 1 USD per day per unit

- Interest Accrual Frequency - Daily

Coupon Accrued on D1 till 4th Jan = 40 USD (10 units* 1 USD* 4 days)

Accrual will not happen for D1 after 4th January as all the 10 units are sold out on 5th January.

Coupon Accrued on D2 till 4th January = 45 USD (15 units * 1 USD * 3 days)

After 4th January, for D2, accrual will happen only for the remaining 13 units (15 – 2 units sold = 13).

Now, on 10th January, the sell deal, D3 is reversed.

Between, 5th and 10th Jan, coupon accrued on D2 = 65 USD (13 units * 1 USD * 5 days)

Due to the reversal of the sell deal, the interest accrual process will pass accrual entries for the period 5th Jan to 10th Jan for the buy deals (D1 and D2):

D1 = 60 USD (10 units * 1 USD * 6 days)

D2 = 12 USD (2 units * 1 USD * 6 days)

Subsequently, interest accrual will continue for deals D1 and D2 till redemption/CPLQ.

The accrual process will be zero based i.e. at deal level, the accrual process will do the following:

- Identify all the BUY deals

- Determine the current quantity (buy quantity – the sold quantity)

- Find the amount to be accrued from the Previous Coupon Date (PCD) to the accrual date i.e. if the PCD is 1st Jan and the accrual date is 10th Jan, it will calculate interest to be accrued for the period 1st Jan to 10th Jan. This amount is, say A1.

- Find the amount already accrued for the deal i.e. interest accrued for the period 1st Jan to 9th Jan i.e. before the actual accrual date, 10th Jan. The interest accrued is say, A2.

- Pass the accrual entry for A1-A2.

Note

For a deal level interest accrual, the accrual of the Withholding Tax will also happen at the deal level. However, interest accrual will not happen for unsettled deals. For deal level interest accrual, the IACR (Interest Accrual) event and the associated accounting entries will continue to be maintained at the portfolio product level.

You have to maintain the accounting entries as shown below:

For the Events SPLP & SPSP

Accounting Roles |

Amount Tags |

Debit/Credit Indicator |

iccfcomp01_RCPY |

iccfcomp01_PUCM |

Dr |

SEC BRIDGE GL |

iccfcomp01_PUCM |

Cr |

SEC BRIDGE GL |

iccfcomp01_PUEX |

Dr |

iccfcomp01_RCPY |

iccfcomp01_PUEX |

Cr |

For the Events SSLP & SSSP

Accounting Roles |

Amount Tags |

Debit/Credit Indicator |

SEC BRIDGE GL |

iccfcomp01_SOCM |

Dr |

iccfcomp01_RCPY |

iccfcomp01_SOCM |

Cr |

iccfcomp01_RCPY |

iccfcomp01_SOEX |

Dr |

SEC BRIDGE GL |

iccfcomp01_SOEX |

Cr |

For the Event IACR

Accounting Roles |

Amount Tags |

Debit/Credit Indicator |

iccfcomp01_RCPY |

iccfcomp01_IA |

Dr |

Iccfcomp01_I |

iccfcomp01_IA |

Cr |

For the Event CPLQ

Accounting Roles |

Amount Tags |

Debit/Credit Indicator |

PAYABLE |

iccfcomp01_ILIQ |

Dr |

iccfcomp01_RCPY |

iccfcomp01_ILIQ |

Cr |

At the end of the coupon liquidation event, CPLQ, the balance in the interest receivable head (iccfcomp01_RCPY) would be zero. The following example will illustrate this.

The following deal details are available:

- Coupon Period – 1st January 2003 to 30-Jan-2003

- Previous Coupon Date (PCD) – 1st January 2003

- Next Coupon Date (NCD) – 30th January 2003

- Ex Date – 26th January 2000 (the issuer will pay interest to the holders of the securities as on the Ex. Date or the Record Date).

- Interest amount – 1$ per day per unit

- Accrual Frequency – Daily

Now, on 10th Jan, you buy 20 units of a bond, S1 at PUCM amt of 200$ i.e. the interest accrued for the period 1st Jan (PCD) to 10th Jan will be tracked as a receivable from the issuer of the units (200 $ = 20 * 1*10)

The following entries would be passed as part of event SPLP (amount tag IntComp_PUCM):

Dr |

IntComp_Rcpy (Interest Receivable) |

200 $ |

Cr |

Sec Bridge GL |

200 $ |

Interest accrued on EOD of 26th Jan (for the period from 11th Jan to 26th Jan) = 320 USD (16 days * 20 units * 1 USD).

The following entries will be passed for this amount as part of event IACR (amount tag IntComp_IA):

Dr |

IntComp_Rcpy (Interest Receivable) |

320 $ |

Cr |

IntComp_IA (Accrued Interest) |

320 $ |

On 27th Jan, you decide to sell 15 units at SOEX amount of 60 $. This is the sold interest after the Ex. Date/Record Date i.e. the interest on 15 units for the period from 27th Jan to 30th Jan.

The following entries will be passed for this amount as part of event SSLP (amount tag IntComp_SOEX):

Dr |

IntComp_Rcpy (Interest Receivable) |

60 $ |

Cr |

Sec Bridge GL (Intcomp_SOEX) |

60 $ |

Interest accrued on the remaining 5 units for the same period i.e. from 27th Jan to 30 Jan = 20 USD (5 units * 1 USD * 4 days)

Therefore, Interest accrued on EOD of 30th Jan = 320 + 20 = 340 USD

The following entries are passed for the 5 units at a daily frequency for 4 days:

Dr |

IntComp_Rcpy (Interest Receivable) |

5 $ |

Cr |

IntComp_Rcpy |

5 $ |

The total interest receivable = 200 + 320 + 60 + 20 = 600 USD

The Coupon Liquidation event will pass an entry of 600 USD (20 units * 1 USD * 30 days)

Dr |

Payable |

600 $ |

Cr |

IntComp_Rcpy |

600 $ |

Therefore, at the end of the Coupon Liquidation, the net balance in the IntComp_Rcpy head will become zero.

4.4 Floating Rate Codes

This section contains the following topics

- Section 4.4.1, "Defining Floating Rate Codes"

- Section 4.4.2, "Defining Rate Sources"

- Section 4.4.3, "Defining Rate Type"

- Section 4.4.4, "Defining Floating Rates"

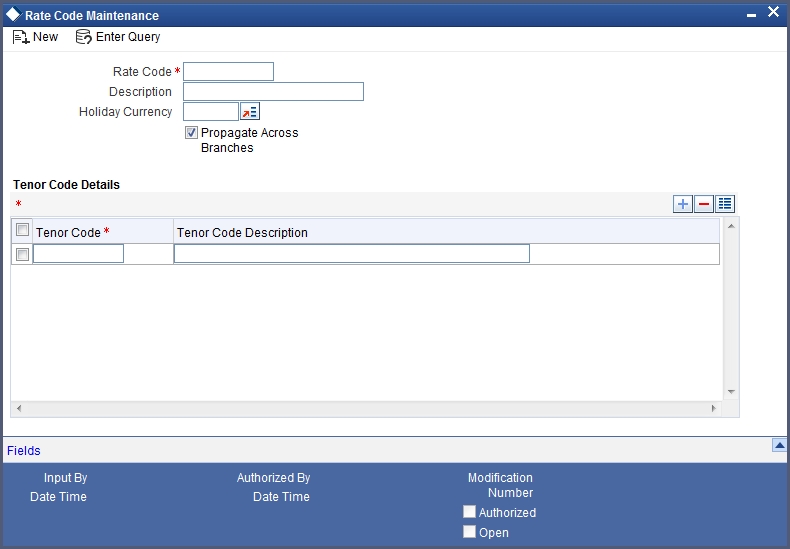

4.4.1 Defining Floating Rate Codes

You can define rate codes using the ‘Rate Code Maintenance’ screen. You can invoke this screen by typing ‘CFDRTCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can enter the following details:

Rate Code

Enter a code to identify the rate you are defining. You can associate several currencies to the rate code and specify rates for each currency. While processing a contract, you need to indicate this code to make the rate applicable to the contract. The code cannot exceed 10 characters.

Description

Enter a brief description to identify the rate code being defined.

Holiday Currency

Specify the holiday currency for this rate code. You can choose the appropriate one from the adjoining option list that displays all valid currency codes maintained in the system.

Propagate Across Branches

Check this option to indicate that the rate code should be available across all branches.

Indicating Tenor Code Details

Here you need to indicate the following:

Tenor Code

Specify a unique code to identify the tenor for which this rate code should be applicable.

Tenor Code Description

Enter a brief description for the tenor code.

You can add multiple tenor codes for the rate code by clicking the add row button. Similarly, you can delete a tenor code by selecting the desired row and then clicking delete row button.

In order to process MT340, MT360 and MT361 you need to maintain the following rate codes:

- AONIA

- BBR-AUBBSW

- BBR-BBSW

- SWAPRATE

- BA-CDOR

- BA

- CORRA

- TBILL

- ISDAFIX

- CLICP

- CIBOR

- DKKOIS

- ANNSR

- ANNUALSR

- EONIA

- EURIBOR

- TEC10-CNO

- HIBOR

- HONIX

- ISDA

- IDMA

- IDREFIX

- SBI

- SOR

- TELBOR01

- TELBOR

- BMK

- CMT

- INBMK

- MIBOR

- MIFOR

- MIOIS

- MITOR

- RFRCBANKS

- BBSF

- LIBOR

- MUTANCALL

- TIBOR

- TONA

- TSR

- CD3220

- CD-KSDA

- TIIE-BANXICO

- NIBOR-NIBR

- BBR

- NZIONA

- WIBOR

- WIBOR

- ANNUAL

- STIBOR

- SIBOR

- SONAR

- SOR

- BRIBOR

- SOR

- THBFIX

- CMS

- COF11

- FEDFUND

- FEDFUND

- ISDAFIX3

- SANDPINDEX

- SIFMA

- TREASURYRATE

- TRSYRATE

- TRSYRATE

- BBR

- BA

- BA

- TBILL

- TBILL

- LIBOR

- EURIBOR

- TAM

- TMM

- LIBOR

- HIBOR

- SOR

- LIBOR

- TSR

- BBR

- WIBOR

- SIBOR

- SOR

- BRIBOR

- SOR

- CMS

- COF11

- ISDA

- LIBOR

- TIBOR

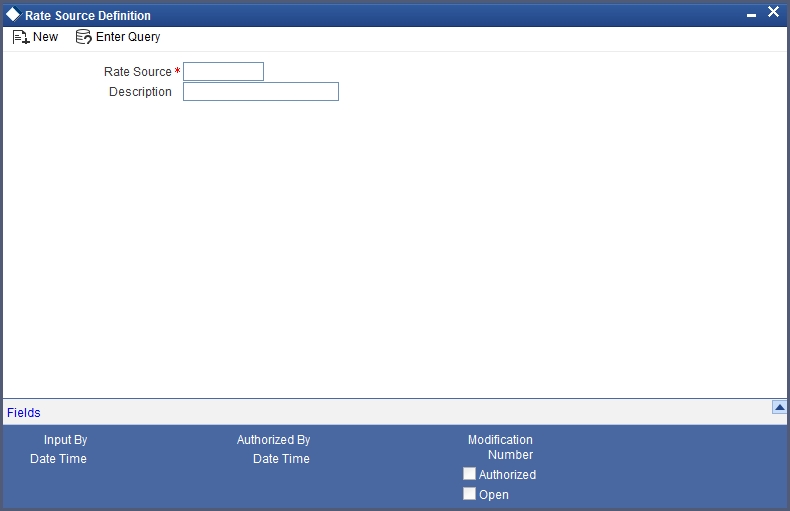

4.4.2 Defining Rate Sources

You can maintain rate sources using the ‘Rate Source Definition’ screen. You can invoke this screen by typing ‘CFDRTSRC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can capture the following details:

Rate Source

Specify a unique code to identify the rate source you wish to maintain. The code cannot exceed 10 characters.

Description

Enter a brief description for the rate source.

In order to process MT340, MT 360 and MT361you need to maintain the following rate sources:

- SWPMKR

- AUBBSW

- BLBG

- 10:00-SWPMKR

- 11:00-BLBG

- 11:00-SWPMKR

- 3M-SWPMKR

- COMP-BLBG

- 365-BLBG

- BLBG

- SWAPRATE-11:00

- SWAPRATE-4:00

- RFRCBANKS

- BLOOMBERG-10:00

- BLOOMBERG-15:00

- FRASETT

- TONAR

- 17096

- 17097

- BLBG

- REUTERS-10:00

- REUTERS-15:00

- CD3220

- BLBG

- BID

- RFRCBANKS

- WIBO

- COMPOUND

- BLOOMBERG

- OIS-COMPOUND

- NBSK07

- ICAPSP

- REUTERS

- H.15-BLBG

- H.15-OIS-CPD

- FIX3SR-3:00

- SWAPRATE

- SWAPRATE-3:00

- BBA-BLOOMBERG

- HIGHGRADE

- MCPLSWAPINDEX

- ICAPBKT

- SWPMKR100

- SWPMKR99

- ISDC

- ISDD

- TELERATE

- ISDD

- TELERATE

- ISDA

- TELERATE

- CDC

- CDC-COMPOUND

- ISDA

- ISDC

- TELERATE

- ISDA

- TELERATE-10:00

- TELERATE-15:00

- TELERATE

- RFRCBANKS

- WIBO

- TELERATE

- TELERATE

- BRBO

- TELERATE

- TELERATE

- TELERATE

- SWAP RATE

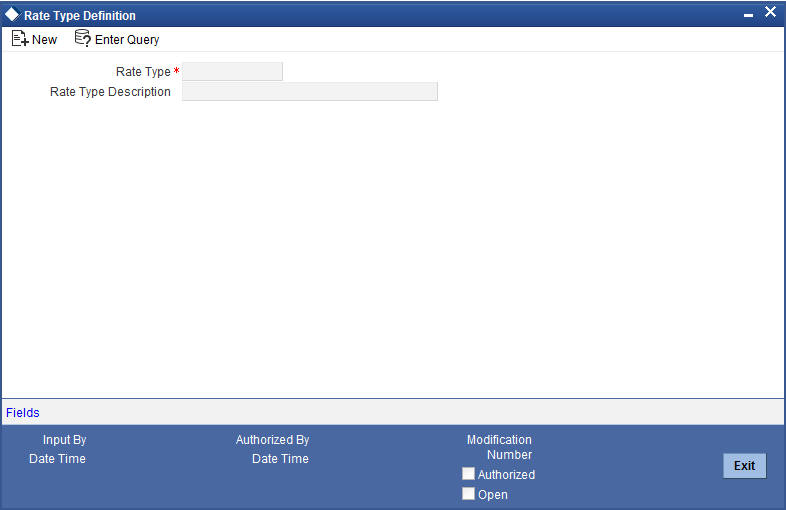

4.4.3 Defining Rate Type

You can maintain rate types using the ‘Rate Type Definition’ screen. You can invoke this screen by typing ‘CFDRTTYP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can capture the following details:

Rate Type

Specify a unique code to identify the rate type you wish to maintain. The code cannot exceed 10 characters.

Description

Enter a brief description for the rate type.

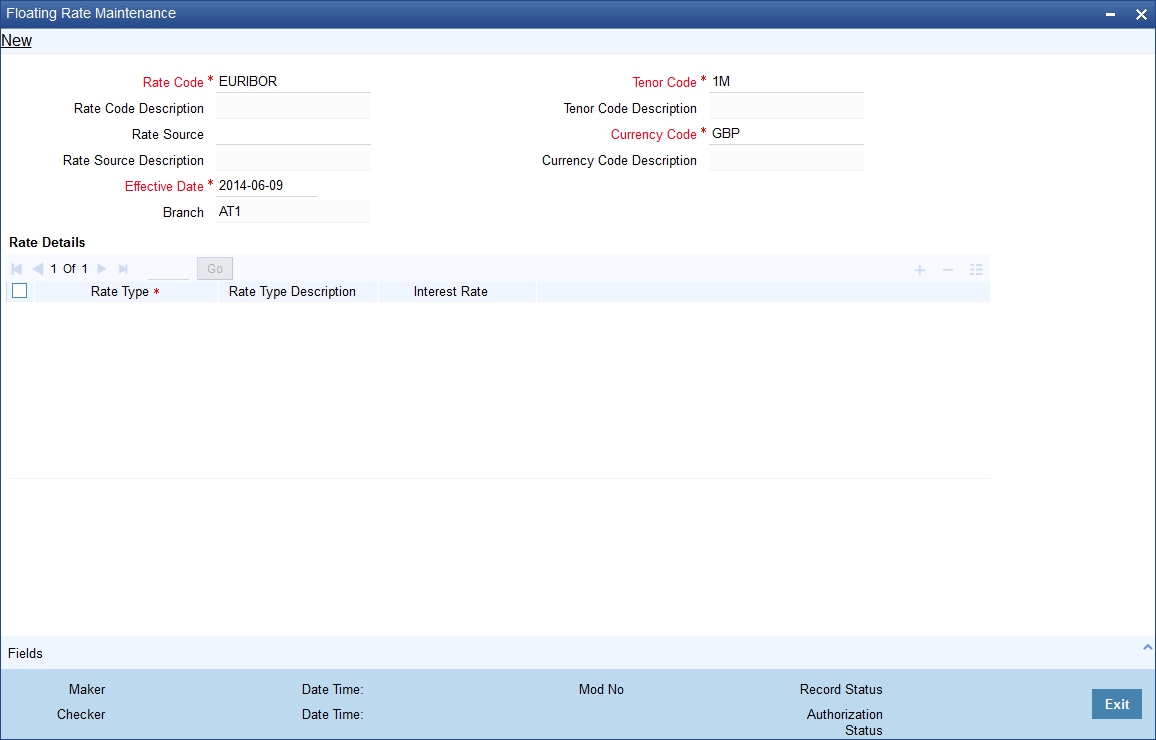

4.4.4 Defining Floating Rates

You can maintain floating rates using the ‘Floating Rate Maintenance’ screen. You can invoke this screen by typing ‘CFDFLRAT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can capture the following details:

Rate Code

Select the Appropriate Rate Code from the List of Values Available.

Rate Source

Select the Appropriate Rate Source from the List of Values Available.

Tenor Code

Select the Tenor Code created as part of Rate Code Maintenance from the List of Values Available.

Currency Code

Select the Currency Code from the List of Values Available for which the Interest Rates are to be maintained.

Rate Details

Update the Interest Rate by adding the required rate types maintained and providing the Interest rates pertaining to the particular rate type selected.

4.5 Market Details

This section contains the following topics

- Section 4.5.1, "Maintaining Market Details"

- Section 4.5.2, "Specifying ‘Main’ details"

- Section 4.5.3, "EIM for Treasury Bills and Security Bonds"

- Section 4.5.4, "Specifying Interest Details"

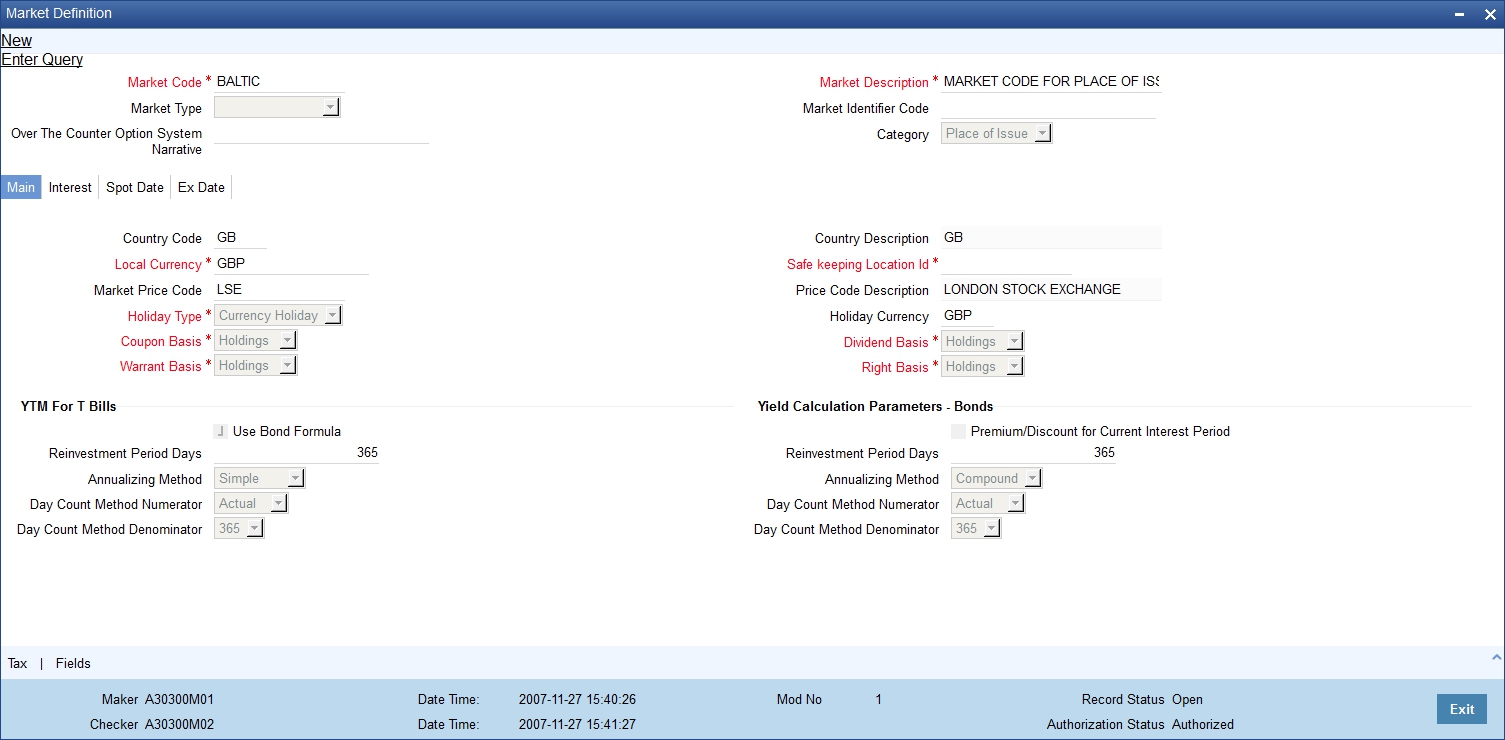

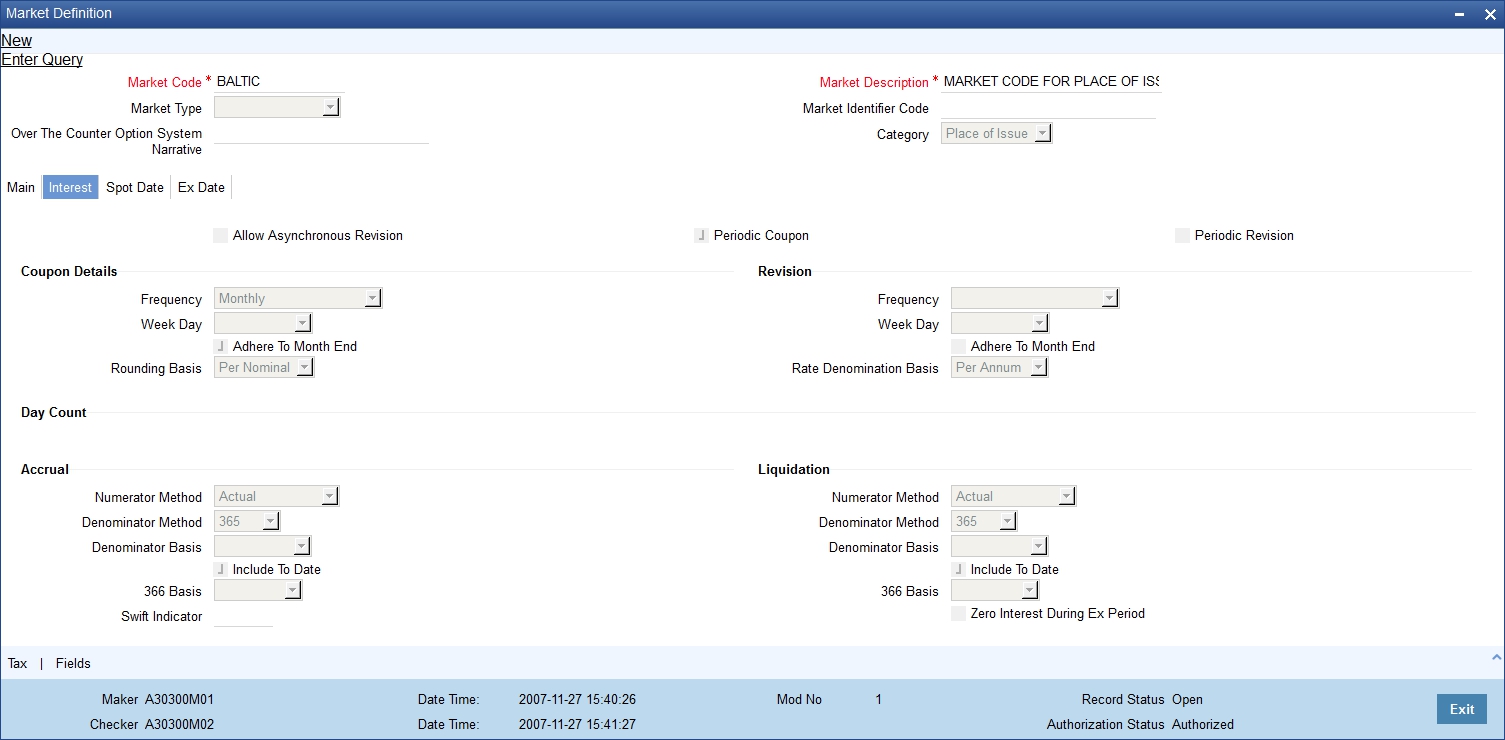

4.5.1 Maintaining Market Details

It is necessary to maintain certain standard details, relating to the markets where securities are traded. The information relates to issues such as the interest calculation method, the relevant spot and ex-dates and the default safe keeping location.

Only the Head Office of your bank can define and maintain market place related details. The other branches of your bank can refer to these details, every time a security is processed.

The advantage of defining market place details is that at the time of defining a security, you only need to specify the code assigned to the market. All the details maintained for the particular market will be automatically picked up.

You can invoke the ‘Market Definition’ screen by typing ‘SEDXMTCD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

If you are maintaining details of a new market place choose New from the Actions Menu or click on new icon from the tool bar. The Market Definition detailed screen will be displayed.

If you are calling a market place maintenance record that has already been defined, choose the Summary option under Market Codes. From the Summary screen double click a record of your choice to open it.

4.5.2 Specifying ‘Main’ details

Prior to maintaining, the interest calculation method and the relevant spot and ex dates etc., certain basic details about the market place need to be maintained.

Country Code

You need to specify the country to which the market belongs.

Local Currency

You need to specify the local currency of the country in which the market is situated.

Safe Keeping Location Id

The Safe Keeping location to and from which the securities will be delivered.

Price Code

You need to specify the price code from which the security price is to be picked up for this market.

All the details maintained here are picked up and defaulted to the Securities Definition screen. You are allowed to change the information, at the time of defining securities.

4.5.2.1 Specifying Yield Calculation Parameters

Apart from the other ‘main’ details you can specify the Yield Calculation Parameters for Bonds and T-bills for each market definition record that you maintain.

YTM method for T-Bills

The basis for YTM calculation for T-Bills can either be:

- Simple interest

- Effective (Compound) interest

Use Bond Formula

If you enable the Use Bond Formula option, YTM is calculated using the effective interest formula (typically used for bonds).

For Bonds and for T-Bills with the effective interest method of YTM calculation you need to specify the following details:

Reinvestment Period

The effective interest formula assumes that payments are reinvested at the same rate as the yield of the T-Bill/Bond (coupon schedules) till the maturity of the security. You have to specify this period in terms of days.

Annualizing Method

For Bonds and for T-Bills, with effective interest you need to specify the annualizing method. This is the method by which the System computes the periodic YTM.

The options available are:

- Simple

- Compound

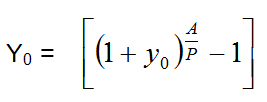

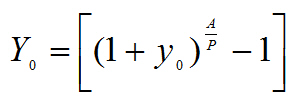

If the Annualizing method is Compound, the Annual YTM is computed as follows:

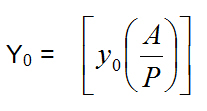

If the Annualizing method is Simple, the annual YTM is computed as follows:

Where

- y0 is the Periodic YTM

- Y0 is the Annual Deal YTM

- A is the Day Count Method – Denominator (this is picked up from your maintenance in the Security Definition screen).

- P is the Period of Reinvestment. If Null, defaulted to A/n

Apart from these details you need to specify the Day Count Denominator and Numerator methods for all Bonds and T-Bills.

4.5.3 EIM for Treasury Bills and Security Bonds

Oracle FLEXCUBE also supports yield computation using nominal based cash flows. This is applicable for bonds and treasury bills for both WAC and non-WAC based portfolio cash flows.

4.5.3.1 Processing for Bonds

If the parameter ‘COMMON_YLD_ACCR’ is set to ‘Y’, the initial cash flow for yield computation will be based on the net considerations of the deal. Yield will be calculated based on the actual cash flows instead of the face value.

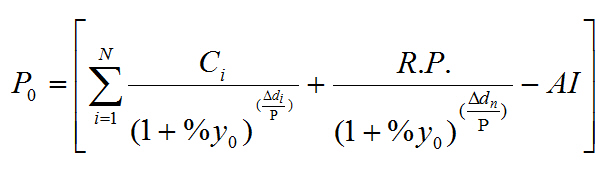

The formula used for computation of YTM for Bonds is the same.

Where,

(‘Annualizing Method’ is COMPOUND in this case)

Notation:

Value |

Description |

P0 |

Purchase price of the Bond |

N |

Total number of coupons |

Ci |

Coupon payment for coupon i |

y0 |

Periodic YTM |

Y0 |

Annualized Deal YTM |

A |

Day Count Method – Denominator |

n |

Number of coupons in a year |

P |

Period of Reinvestment (Defaulted to A/n if null) |

R.P. |

Redemption Price |

Ai |

Accrued Interest |

Adi |

Coupon date – Value date |

Adn |

Redemption date – Value date |

4.5.3.2 Processing for Treasury Bills

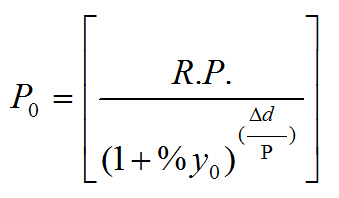

The YTM is computed using O/S Deal Nominal if ‘COMMON_YLD_ACCR’ is set to ‘Y’. During Revaluation of T-Bills and Accrual of Discount for T-Bills, the O/S Deal Nominal is also used to compute the Net Present Value (NPV).

The formula used for computation of YTM for T-Bills is the same.

Where,,

(‘Annualizing Method’ is SIMPLE in this case)

Notation:

Value |

Description |

P0 |

Purchase price of the T-Bill |

R.P. |

Redemption Price |

y0 |

Periodic YTM |

pd |

Redemption Date – Value Date |

P |

Period of Reinvestment |

Y0 |

Deal YTM |

A |

Day Count Method – Denominator |

Note

If the parameter ‘COMMON_YLD_ACCR’ is set to ‘Y’, discount accrual is calculated at nominal value and no scale up would be done during the discount accrual process. This is applicable to both, T Bills and Bonds.

Day Count Method Numerator

Indicate the day count numerator, which is to be used to arrive at the number of days for yield calculation. The options available are:

- 30 Euro

- 30 US

- Actual

Day Count Method Denominator

Select the day count method to be used for calculating yield from the adjoining drop-down list. This list displays the following values:

- 360

- 365

- 364

Yield Calculation Parameters for T-Bills

In case of T-Bills, you have to select the numerator and denominator methods, which will be used to arrive at the day, count method for calculating yield for T-Bills.

The options available for calculating the Numerator are:

- 30 Euro

- 30 US

- Actual

The options available for calculating the Denominator are:

- 360

- 365

- 364

You can select the appropriate.

Note

For each Security, the Yield Calculation Parameters are defaulted from the market of issue depending on whether it is a Bond or a T-Bill. You will be allowed to modify these details.

Consider the following example for 364 Days Interest Method:

For a given bond security (SEC364M2) schedules are generated as shown below:

Security Instrument : SEC364M2

Quantity : 100

Security Face Value : 100

Interest Rate : 2%

Denom Method : Actual/364

Deal Value Date : 2-Sep-2008

Deal Maturity : 23-Nov-2008

Coupon Schedule : Weekly

No |

Coupon Due Date |

Days |

Interest Amount |

1 |

9-Sep-2008 |

7 |

3.89 |

2 |

16-Sep-2008 |

7 |

3.89 |

3 |

23-Sep-2008 |

7 |

3.89 |

4 |

30-Sep-2008 |

7 |

3.89 |

5 |

7-Oct-2008 |

7 |

3.89 |

6 |

14-Oct-2008 |

7 |

3.89 |

7 |

21-Oct-2008 |

7 |

3.89 |

8 |

28-Oct-2008 |

7 |

3.89 |

9 |

4-Nov-2008 |

7 |

3.89 |

10 |

11-Nov-2008 |

7 |

3.89 |

11 |

18-Nov-2008 |

7 |

3.89 |

12 |

23-Nov-2008 |

5 |

2.74 |

Consider the following example for Yield (T-Bills/Bonds)

Security Instrument: SEC364M2

Deal Input Price: 100

Redemption Price: 120

Denom Method: 364

DSTL Date: 2-Sep-2008

Deal Maturity: 23-Nov-2008

Formula used for Yield Calculation:

Discounted:

Yield = ((Redemption Value – Input Price) /( Redemption Value)) * (Denom Method/ No of days);

True discount (Return):

Yield = ((Redemption Value – Input Price) /( Input Price)) * (Denom Method/ No of days);

Days between DSTL and Maturity Date = 81

For Discounted:

Yield = ((120-100)/120)*(364/81) = 0.748971193415638

True discount (Return):

Yield = ((120-100)/100)*(364/81) = 0.898765432098765

Premium/Discount for Current Interest Period

Check this option to specify that the premium or discount should be accrued only for the current period. This option will be applicable only if the security is a Floating Rate Bond. If you check this option, all the securities whose market code is identical to the one specified in the Market Definition screen will inherit this feature, provided the interest rate type of the specified security product is ‘Floating’.

4.5.4 Specifying Interest Details

The interest details that you define here will be picked up and defaulted, in the interest section of the Securities Definition screen. However, while defining security details you have the option of changing these details.

Click on the Interest tab to maintain interest related details.

The details maintained here are specific to the interest calculation methods, applied during accruals and liquidation.

It is not necessary to specify, the same day count method for calculating interest on accruals as well as on liquidation. The system allows you to specify two different day count methods for calculating interest, one for accruals and the other for liquidation.

The following combinations are allowed for calculating interest:

Actual / Actual |

The Actual number of days in the period/ The Actual number of days in that year. Click on Actuals in Numerator Method field, click on Actuals in ‘Denominator Method’ field. |

Actual / 365 |

The number of actual calendar days for which calculation is done / 365 days in a year. Click on Actuals in Numerator Method field; click on 365 days in Denominator Method field. |

Actual / 365 – Japanese |

This is similar to the Actual/365 method except that leap days are always ignored, in the numerator day count calculation. Click on Actual Japanese in Numerator Method field; click on 365 in Denominator Method field. |

Actual / 365 – ISDA |

Sum of (A) and (B) where: A = Interest accrual days falling within the leap year / 366 B = Interest accrual Days not falling within the leap year/ 365 The denominator is the actual number of days in a year. Click on 365 ISDA in Numerator Method field; click on Actual in Denominator Method field. |

Actual / 360 |

The actual number of calendar days for which calculation is done / 360 days. Click on Actual in Numerator Method field; click on 360 in ‘Denominator Method’ field. |

Denominator Method

Select the denominator method from the adjoining drop-down list. This list displays the following values:

- 360

- 365

- 364

4.6 Computing Coupon Interest

This section contains the following topics

- Section 4.6.1, "Interest Method for Computing Coupon Interest"

- Section 4.6.2, "Exempting Interest for the Ex Period"

- Section 4.6.3, "Specifying Spot Date"

- Section 4.6.4, "Specifying Ex date"

4.6.1 Interest Method for Computing Coupon Interest

Apart from the above-mentioned method for calculating the interest, you can also use the ACT/ACT–ISMA Interest Method and ACT/ACT–FRF Interest Method.

ACT/ACT–ISMA Interest Method

The ACT/ACT–FRF Interest Method is applied for periodic coupons using the following coupon:

Coupon Interest = Nominal x (Coupon Rate/Number of Coupons) x (Number of elapsed Days/ Number of days in coupon period)

For ACT/ACT–ISMA, you need to maintain the following parameters:

- Numerator Method – Any of the option in the list

- Denominator Method – Actual

- Denominator Basis – Per Annum

- Rate Denomination Basis – Per Coupon Period

Let us understand the above with the following example:

Consider the following facts:

A security purchased for 10 million at a rate of 5% p.a with the coupon date of 15th Jan.

In case the frequency of the coupon is Yearly:

The ACT/ACT–ISMA method for a non leap year is

Amount x 5/100 x 365/365 x 1

And for a leap year the ACT/ACT–ISMA method is

Amount x 5/100 x 366/366 x 1

In case the frequency of the coupon is Half yearly:

Then, for coupon on 15/01 the formula used in ACT/ACT–ISMA method is

Amount x 5/100 x 184/184 x 2

And for coupon on 15/07, the formula used in this method is

For a non leap year:

Amount x 5/100 x 181/181 x 2

For a leap year the formula is:

Amount x 5/100 x 182/182 x 2

In case the frequency of the coupon is Quarterly:

Then, for coupon on 15/01 the formula used in ACT/ACT–ISMA method is

Amount x 5/100 x 92/92 x 4

For coupon on 15/07, the formula used in this method is

For a non leap year:

Amount x 5/100 x 90/90 x 4

For a leap year the formula is:

Amount x 5/100 x 91/91 x 4

For coupon on 15/10, the formula used in this method is

Amount x 5/100 x 92/92 x 4

366 Basis

You need to specify the whether the system should use leap year or leap date for calculating the interest.

- Leap Year (Y) – Indicates that the system will compute the interest based on the number of calendar days in the year.

- Leap Date (D) – Indicates that the system will use the ACT/ACT–FRF Interest Method to compute the interest.

Note

This field is enabled only if the Denominator Basis value is Per Annum and the Denominator Method is ACTUAL.

ACT/ACT–FRF Interest Method

In ACT/ACT–FRF Interest Method, the Numerator will be the actual number of days between two coupon dates and the denominator will be 366 under the following cases:

- If 29th February falls between the duration of two coupon dates (i.e. previous coupon date and next coupon date)

- If the previous coupon date and the next coupon date fall in different years (annual frequency, next coupon dates in immediate subsequent year of previous coupon date)

- If the coupon schedule is not periodic and spreads across multiple years. The system will apply 366 as the denominator for all the years for computing the day count even if one instance of 29th February falls in between the coupon dates.

Let us understand the formula applied for calculating the interest in ACT/ACT–FRF method with an example:

Consider the following facts:

A security purchased for 10 million at a rate of 5% p.a with the coupon date of 15th January.

Case 1:

Assume the following parameters are maintained for a yearly coupon:

- Nominal - 10,000,000

- Interest Rate – 5% per Annum

- Coupon Frequency – Annual

- Previous Coupon Date – 15/01/1999

- Next Coupon Date – 15/01/2000

- Numerator Method – ACTUAL

- Denominator Method – ACTUAL

- Denominator Basis – Per Annum

In case 366 basis is Leap Year:

The interest is calculated based on the day count derived for each of the two years in which the coupon date fall and the formula applied is:

10,000,000 x 5/100 x 350/365 + 10,000,000 x 5/100 x 15/366

In case 366 basis is Leap Date:

Here the system will apply ACT/ACT–FRF interest method to compute the coupon interest. Since this period does not include 29th February, the denominator for interest calculation will be 365 and the formula will be:

10,000,000 x 5/100 x 365/365

Case 2:

Assume the following parameters are maintained for a half yearly coupon:

- Nominal - 10,000,000

- Interest Rate – 5% per Annum

- Coupon Frequency – Half yearly

- Previous Coupon Date – 15/01/2000 (PCD 15/07/1999)

- Next Coupon Date – 15/07/2000 (PCD 15/01/2000)

- Numerator Method – ACTUAL

- Denominator Method – ACTUAL

- Denominator Basis – Per Annum

In case 366 basis is Leap Year:

The interest is calculated based on the day count derived for each of the two years in which the coupon dates fall (if the previous and the next coupon dates fall in different years). If both coupon dates fall in the same year, the denominator will be 365 or 366 respectively depending on whether the current year is a leap year or a non leap year.

For coupon on 15/01/2000, the formula used is

10,000,000 x 5/100 x 169/ 365 + 10,000,000 x 5/100 x 15/366

And for coupon on 15/07/2000, the formula used in this method is

10,000,000 x 5/100 x 182/366

In case 366 basis is Leap Date:

For coupon on 15/01/2000, the formula used in ACT/ACT– FRF method is

10,000,000 x 5/100 x 184/ 365

This period does not include 29th February.

And for coupon on 15/07/2000, the formula used in ACT/ACT– FRF method is

10,000,000 x 5/100 x 182/366

29th February falls in this period.

Case 2:

Assume the following parameters are maintained for a Quarterly coupon:

- Nominal - 10,000,000

- Interest Rate – 5% per Annum

- Coupon Frequency – Quarterly

- Coupon Date 1– 15/01/2000 (PCD 15/10/1999)

- Coupon Date 2– 15/04/2000 (PCD 15/01/2000)

- Coupon Date 3– 15/07/2000 (PCD 15/04/2000)

- Coupon Date 4– 15/10/2000 (PCD 15/07/2000)

- Numerator Method – ACTUAL

- Denominator Method – ACTUAL

- Denominator Basis – Per Annum

In case 366 basis is Leap Year:

The interest is calculated based on the day count derived for each of the two years in which the coupon dates fall (if the previous and next coupon dates fall in different years). If both coupon dates fall in the same year, the denominator will be 365 or 366 respectively depending on whether the current year is a leap year or non leap year.

For coupon on 15/01/2000 the formula used in is

10,000,000 x 5/100 x 77/ 365 + 10,000,000 x 5/100 x 15/366

For coupon on 15/04/2000, the formula applied is

10,000,000 x 5/100 x 91/366

For coupon on 15/07/2000, the formula applied is

10,000,000 x 5/100 x 91/366

For coupon on 15/10/2000, the formula applied is

10,000,000 x 5/100 x 92/366

In case 366 basis is Leap Date:

For coupon on 15/01/2000, the formula used in ACT/ACT– FRF method is

10,000,000 x 5/100 x 92/ 365

This period does not include 29th February.

For coupon on 15/04/2000, the formula used in this method is

10,000,000 x 5/100 x 91/365

29th February falls in this period.

For coupon on 15/07/2000, the formula used in this method is

10,000,000 x 5/100 x 91/365

This period does not include 29th February.

For coupon on 15/10/2000, the formula used in this method is

10,000,000 x 5/100 x 92/365

This period does not include 29th February.

4.6.2 Exempting Interest for the Ex Period

For Purchase Deals and Sell Deals booked in the Ex Period, you can specify whether you want to calculate the interest for that period. If you check this box, the system will not apply interest for such deals. In addition, the system accrues the holdings as of the ex date and will not pass any interest related accounting entries related to the deals booked in the Ex period.

In case you do not opt for zero interest facility, the system accrues the actual holdings during the accrual period including the buy/sell deals booked in the Ex period.

Consider the following example.

Let us consider a security with:

Coupon Start Date – 01 Aug

Next Coupon Date – 08 Aug

Record Date –05 Aug

Coupon Interest – 3.65 % (Per Annum)

Interest Accrual Frequency – Daily

Now let us assume that on 06 Aug 5000 Units are sold -

Case 1: If you do not opt for Zero interest

Accounting entries are passed for event SSLP (Interest Only)

Dr IntComp_RCPY- 100 (IntComp_SOEX)

Dr Sec Bridge GL - 100 (IntComp_SOEX)

Case 2: If you opt for Zero interest

For interest, the system does not pass any accounting entries

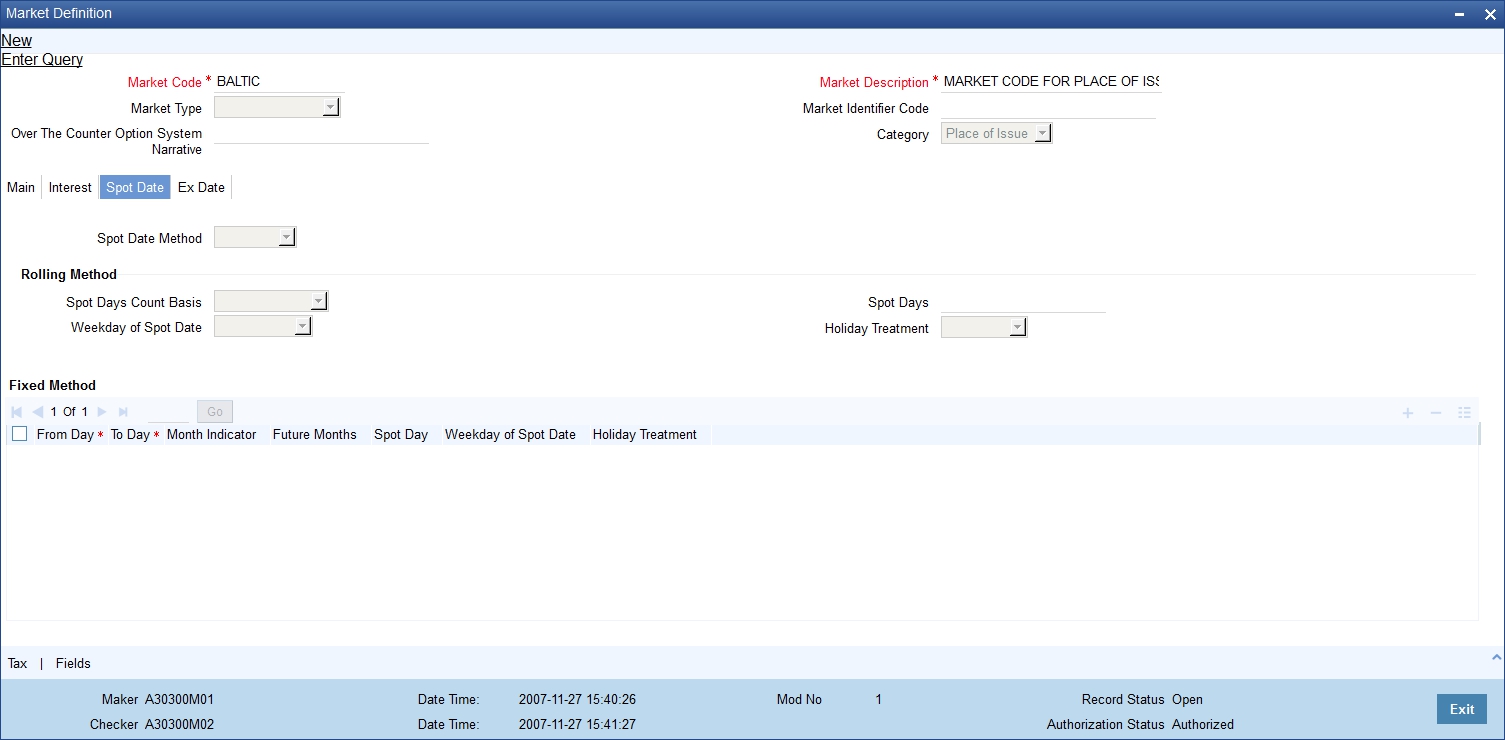

4.6.3 Specifying Spot Date

In this section, you have to indicate the method by which Spot Date is calculated. Spot date is calculated to keep a track of deal settlements. You can click on the respective tab to go to this section of the screen.

There are two methods for calculating the spot-date. It can be calculated as a certain number of days from the trade date of the security. It can also be fixed for a market place for a specific range of trade dates.

Rolling

If the spot date calculation method indicated is rolling, then you can specify the spot day count basis.

Spot Day Count Basis

There are two options available for this field:

- Calendar days – spot days will be expressed as calendar days

- Working days - spot days will be expressed as working days

Weekday of Spot Date

You can indicate your preference of weekday for the spot date if you have specified the calculation method as rolling.

If the weekday of the spot date computed, is different from the preferred weekday then, the spot date computed will be moved forward to the preferred weekday.

Holiday Treatment

Once you indicate a preferred weekday for the spot date, you are required to specify the holiday treatment for the preferred weekday. If you choose to ignore this option, the spot date will be retained on the holiday. If not, as specified by you, it will be moved forward to the next working day or moved backward to the previous working day.

When the spot day method specified is Fixed, indicate the details relating to the range of trade dates and the corresponding spot date for each slab. You also have to specify whether the spot date lies in the current month or in a future month. You can select the relevant option from the picklist available for the month indicator.

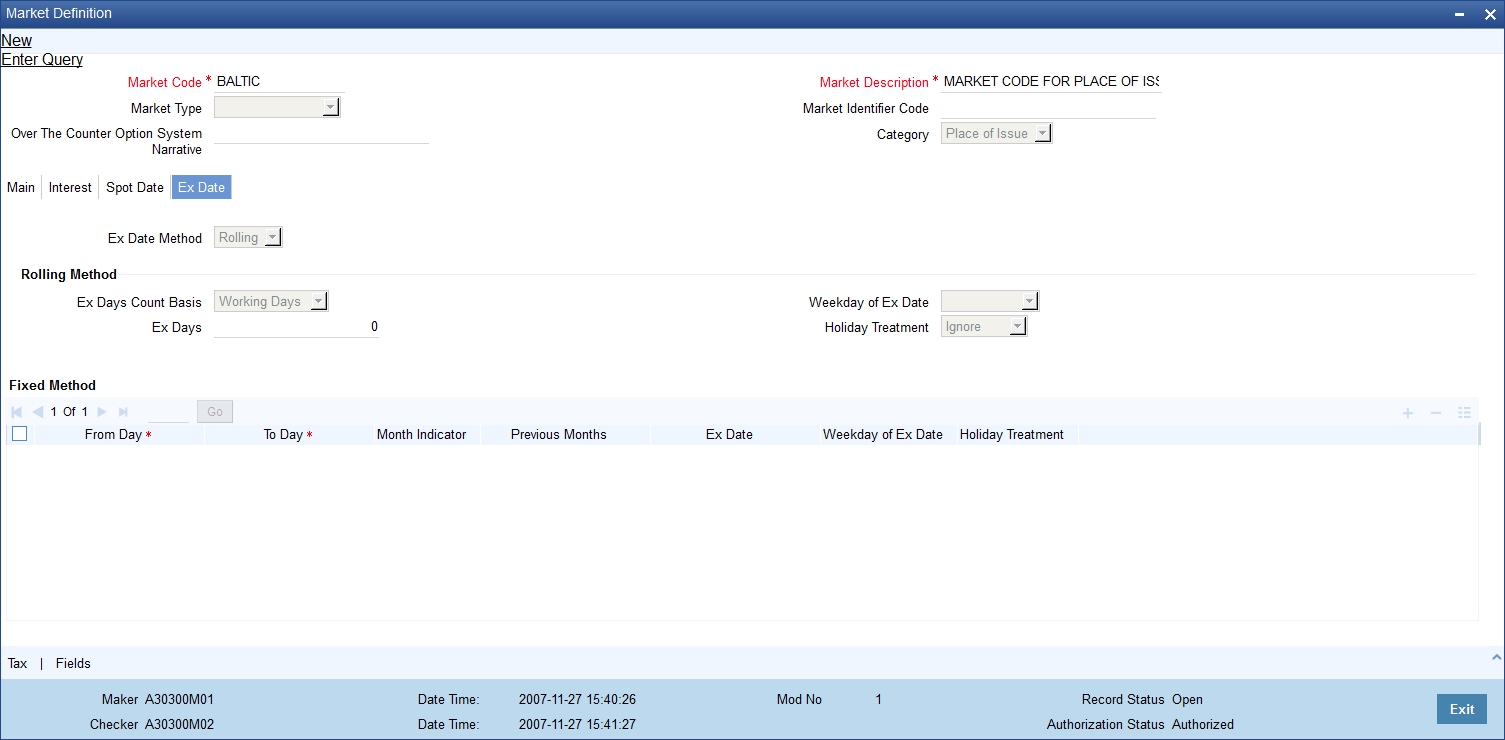

4.6.4 Specifying Ex date

The Ex date referred to here, is the same as the Record date. You need to specify the ex date to keep a track of corporate events for securities that are using this market place as the default market. Click on the Ex Date tab, to go to this section of the screen.

There are different methods for calculating the ex date. It can be calculated as a certain number of ex days, prior to the next coupon date of the security or it can be fixed for a market place for a specific period.

4.6.4.1 Rolling Method

Expiry Date Method

If the expiry date calculation method indicated, is rolling then you can specify the expiry date count basis.

Expiry Days Count Basis

You can express the expiry days as calendar days or as weekdays.

Weekday of Expiry Date

You can also specify your preference of the weekday for the ex date. The concept of weekday, of the ex date and of the holiday treatment, is the same as that of Spot date.

4.6.4.2 Fixed Method

If the ex date specified is fixed then you need to maintain certain mandatory details such as the From and To dates, the month indicator and the holiday treatment. The information that you maintain here, is similar to the information entered for the spot date. This is so only if the spot date method specified, is fixed. However in such a case, the ex date will be prior to the event date.

4.7 Tax Details

This section contains the following topics

- Section 4.7.1, "Specifying Tax Details"

- Section 4.7.2, "Associating Scheme with Issuer Tax"

- Section 4.7.3, "Indicating Stop Association"

4.7.1 Specifying Tax Details

With every market place that you define you can associate a Tax scheme. When you specify the market code, at the time of defining a security, the details of the tax scheme associated with the market code are automatically associated with the security.

Note

At the market definition level you can only maintain the Issuer tax details. You can however change these details at the security definition level.

To invoke this screen, click ‘Tax’ button in the Market Definition screen. The Tax Definition screen will be displayed.

4.7.2 Associating Scheme with Issuer Tax

To associate a tax scheme with an issuer class, click ‘Default From Class’ button. The Default from Class screen will be displayed. In it are available a list of tax classes specific to the Securities module. Select the tax scheme to be associated with the issuer tax. All the components linked to the particular scheme, will be associated with the market code you are defining.

To change the tax scheme which has already been linked to a market code, in the Market Definition screen, click on the unlock button in the toolbar.

4.7.3 Indicating Stop Association

The tax components linked to a tax scheme will be automatically applied to all deals involving the security associated with the particular market code. However if you want to stop applying one or more of these components to new contracts that are initiated, you can do so by checking the Stop Association field.

Stopping the application, of a tax component for a market code would be equivalent to deleting the component for all deals involving the security. However you have the option of using the definition made for the component, once again. To do so, uncheck this field. Deals that are subsequently input, will pick up the components.

Note

Entry to certain fields in the Market Definition screen is mandatory. If you try to save the record without inputs to all these fields, the record will not be saved. You will be prompted to give all the mandatory inputs before attempting to save it again.