21. Defining Portfolios

21.1 Introduction

After creating Portfolio Products, you can proceed to set up a securities portfolio. In Oracle FLEXCUBE securities portfolios can be defined for the following:

- The Bank

- The Bank's Customers

- An Issuer of securities

The portfolios that you set up should necessarily be associated with a portfolio product. All portfolios associated with a portfolio product will inherit the attributes defined for it. Certain attributes can be changed to suit the portfolio you are defining.

While setting up a portfolio you can indicate details such as:

- The currency of the portfolio

- The revaluation method and frequency

- Inventory management preferences (valuation) method (LIFO, FIFO, deal matching, WAC)

- The basis for asset accounting (in case of a bank portfolio)

You can also specify restrictions on the securities that the portfolio can trade in. The preferences (that involve accounting entries) specified for a product is defaulted. These preferences cannot be changed.

Note

In Oracle FLEXCUBE, portfolio products and securities portfolios are defined at the bank level. They will be available to the branches of your bank, based on the restrictions that you set up.

This chapter contains the following sections:

- Section 21.2, "Specifying Portfolio Definition Details"

- Section 21.4, "Entering the Details of a Portfolio"

- Section 21.5, "Defining Preferences for a Portfolio"

- Section 21.3, "Viewing Details of a Portfolio"

- Section 21.6, "Specifying the Advices to be Generated"

- Section 21.7, "Viewing Event Details"

- Section 21.8, "Maintaining Security Restrictions for a Portfolio"

- Section 21.9, "Mapping Accounts to a Safe Keeping Location"

- Section 21.10, "Specifying Accounting Role to Head Mapping Preferences"

- Section 21.11, "Maintaining Security Revaluation Prices for a Portfolio"

- Section 21.12, "Maintaining Risk Profile"

- Section 21.13, "Viewing Safe Keeping Location Portfolio Balances"

21.2 Specifying Portfolio Definition Details

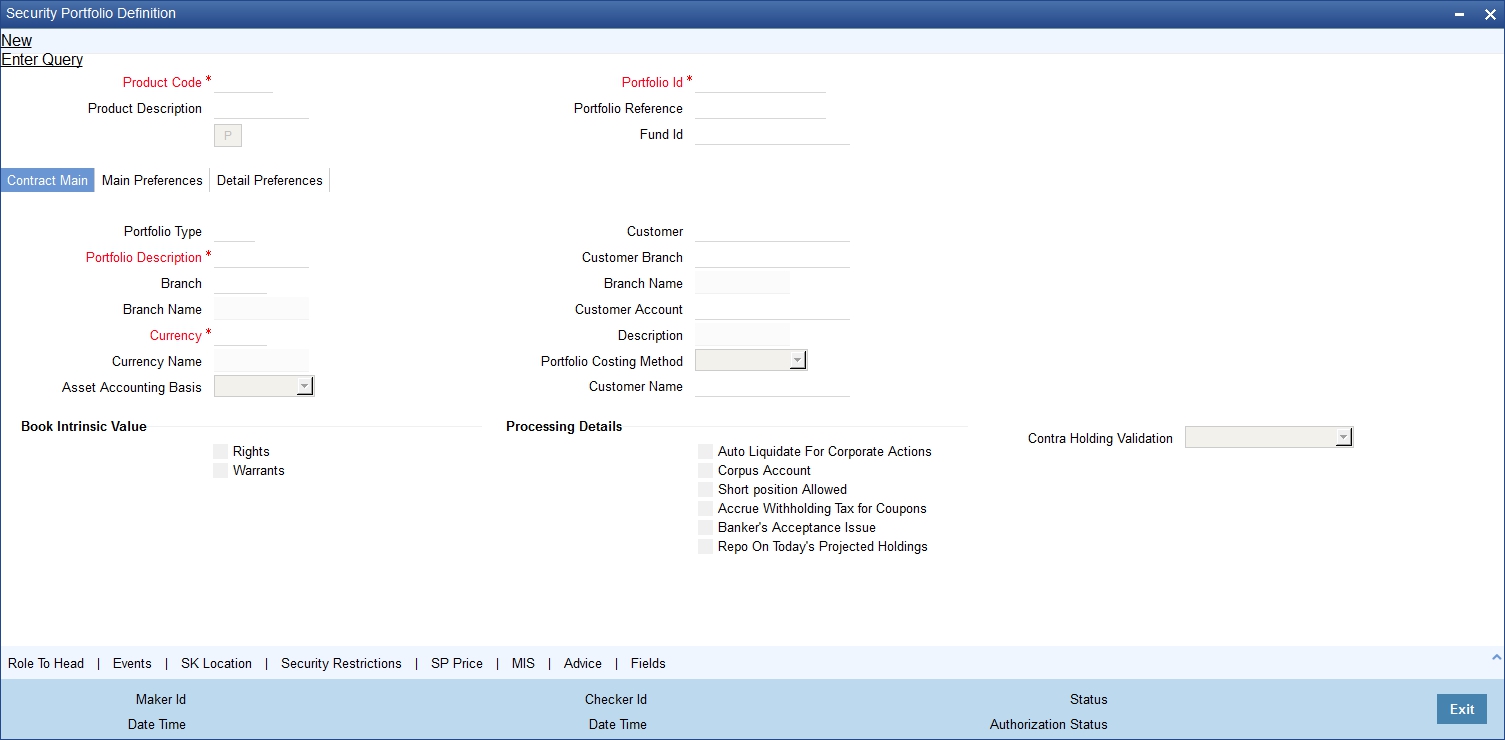

You can invoke the Portfolio Maintenance screen, from the Application Browser. If you are setting up a new portfolio, click new icon on the tool bar. The Portfolio Definition screen is displayed without any details.

You can invoke the ‘Security Portfolio Definition’ screen by typing ‘SEDXPFNL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

If you are calling a Portfolio Definition record that has already been defined, choose the Portfolio Definition Summary screen.

From the Summary screen double-click a portfolio to open it.

The Securities Portfolio Definition screen consists of a header, a footer containing fields that are specific to the portfolio you are defining and three tabs (Contract main, Main preferences and the Detail preference).

Also displayed is a vertical array of six icons, along the lines of which you can enter details of a portfolio. Portfolio details are grouped into screens according to the similarities they share.

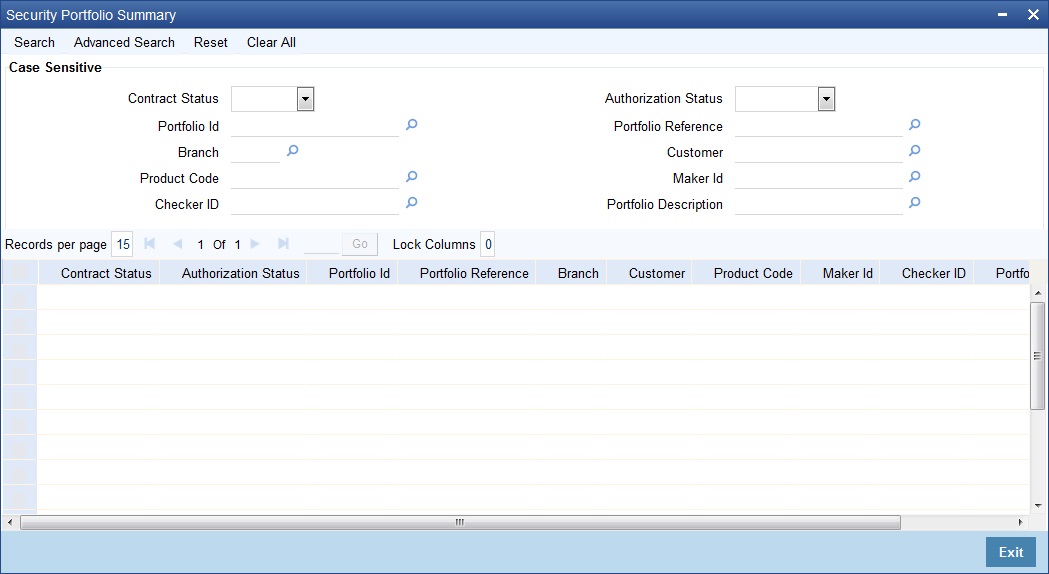

21.3 Viewing Details of a Portfolio

You can view the portfolio details in the ‘Security portfolio Summary’ screen. To invoke this screen, type ‘SESXPFNL’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can click ‘Search’ button to view all the pending functions. However, you can to filter your search based on any of the following criteria:

- Contract Status

- Authorization Status

- Portfolio Id

- Portfolio Reference

- Branch

- Customer

- Product Code

- Maker Id

- Checker ID

- Portfolio Description

When you click ‘Search’ button the records matching the specified search criteria are displayed. For each record fetched by the system based on your query criteria, the following details are displayed:

- Contract Status

- Authorization Status

- Portfolio Id

- Portfolio Reference

- Branch

- Customer

- Product Code

- Maker Id

- Checker ID

- Portfolio Description

21.4 Entering the Details of a Portfolio

Product Code

You should use a product that has already been created, to enter the details of a portfolio. Depending on the type of portfolio you are creating, you can select an appropriate product code from the picklist available.

A portfolio will inherit all the attributes, defined for the product associated with it. You can also add details that are specific to the portfolio, like the deal amount and details of the buyer and the seller. Some of the defaulted attributes if necessary can be changed.

This feature simplified the procedure of setting up of a portfolio.

21.4.1 Identifying a Portfolio

Portfolio Reference Number

In Oracle FLEXCUBE, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the portfolio being defined. The system generates a unique number for each portfolio.

The portfolio reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date, and a four-digit serial number. The Julian Date has the following format:

YYDDD

Here, YY stands for the last two digits of the year and DDD for the number of day(s) that have elapsed in the year.

For example, January 31, 1998 translates into the Julian date: 98031. Similarly, February 5, 1998 becomes 98036 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those elapsed in February (31+5 = 36).

User portfolio reference number

In addition to the reference number generated by the system, you can enter a reference number for the portfolio. This number, in addition to the Portfolio reference number generated by the system, will be used to identify the portfolio. This number should be unique. By default, the Portfolio reference number generated by the system is taken as the User PortfolioID.

Portfolio Identification

Enter a unique reference number to identify the portfolio. The portfolio will be identified by this reference in addition to the portfolio reference generated by Oracle FLEXCUBE.

The portfolio reference generated by Oracle FLEXCUBE is defaulted to this field. You can choose to change it and indicate a reference of your own.

You can query information on the portfolio by using any of the reference IDs.

Fund ID

You can indicate as to which fund the aggregate account balance of all the customers under this account class will report for the depositor contribution from the option list.

Portfolio Type

This field is defaulted from the product code that you have selected earlier. The values are:

- Bank (B)

- Customer (C)

- Issuer (I)

Portfolio Description

Enter a brief description of the portfolio you are defining. This description will be associated with the portfolio for information retrieval purposes.

You can change or modify the description of a class. All subsequent retrieval of information on the portfolio will contain the modified description.

Branch

In this field when the new button is clicked, the current branch is displayed.

Branch Name

This field is automatically generated. This gives a brief description of the branch.

Currency and Currency Name

Here you can choose the currency applicable for the portfolio from the available pick list. The currency name will default based on this selection and it is as per the description given in the Core Module.

Asset Accounting Basis

This indicates how the assets of the portfolio should be accounted for and is applicable only for Bank Portfolios.

Note

This field is defaulted based on the portfolio product selected and cannot be changed during portfolio definition.

Accrual basis:

If you select the accrual basis for asset accounting, then on 1 January you would:

Dr. Premium to be accrued USD 5

Dr. Asset USD 10

Cr. Customer USD 15

On 30 January the amount to be accrued is USD 1. The following entries will need to be passed:

Cr. Premium to be accrued USD 1

Dr. Expense USD 1

When you sell the bond at $20

Dr. Customer USD 20

Cr. Asset USD 10

Cr. Premium to be accrued USD 4

Cr. Profit and Loss USD 6

Customer

If you are setting up a Customer portfolio, you should indicate the customer for whom you are setting it up. Select a customer code from the picklist available.

For a customer portfolio, indicate the default branch of the customer. Also indicate default account that should be either debited or credited when an accounting entry involving the portfolio is passed.

Note

You can set up several portfolios for a customer of your bank.

Customer Name

The customer name is automatically generated based on the customer code selected.

Customer Branch

Indicate the default branch in which the customer or issuer maintains accounts with your bank. Select a branch code from the option list. This field is applicable only for customer portfolios.

Customer Account

Indicate the default account that should be used for deals involving the portfolio. This field is applicable only for customer portfolios.

Select an account from the option list. The option list will contain a list of all the valid accounts that the customer maintains with your bank.

Description

A brief description about the customer account will be displayed.

Portfolio Costing Method

Indicate the method in which the Holding cost of the portfolio should be calculated. These preferences are defaulted from the Portfolio product and cannot be changed during Portfolio definition.

Currency

For all types of portfolios indicate the currency of the portfolio. You can select a currency code from the available option list.

The securities that constitute a portfolio can be in currencies other than the portfolio currency. When entering a deal involving the securities of the portfolio, the currency conversion, would be done using the standard rate maintained in the Exchange Rate screen. The same will be done when income is earned by the securities that are part of a portfolio.

21.4.1.1 Specifying Book Intrinsic Value

A warrant or right attached to a security entitles the holder to convert it into common stock at a set price during a specified period. Thus rights and warrants have a hidden or intrinsic value. The intrinsic value of a right or warrant is the difference between the exercise price of the unit and the market price of the resulting security.

For asset accounting purposes, you can choose to book or ignore the intrinsic value of rights and warrants.

Check against the field Rights to indicate that the intrinsic value of the rights attached to securities in the portfolio should be included for asset accounting.

Check against the field Warrants to indicate that the intrinsic value of the warrants attached to securities in the portfolio should be included for asset accounting.

Leave the fields unchecked to indicate that intrinsic value should be ignored.

21.4.1.2 Specifying Processing Details

Auto Liquidate for Corporate Actions

The corporate actions that are applicable for securities in the portfolio can be automatically liquidated on the Event date (the date on which the corporate action is due).

Check against this option to indicate the corporate actions applicable to securities in the portfolio should be automatically liquidated on the due date. Leave it unchecked to indicate that it should be manually liquidated.

If you select the automatic option, the corporate action will be automatically liquidated on the liquidation date as part of the automatic processes run as part of beginning of day (BOD) or End of day (EOD).

Corpus Account

This field is meant for future use.

Short Positions Allowed

If you check this box, you can select whether system should do contra holdings validation during save (Online) or at the end of the day (EOTI). If you do not want any validation on contra holdings, then you can select ‘No Check - Unlimited’.

If you do no check this box, then contra holding validation has to be null.

If you check this box and ‘Contra Holding Validation’ is set to 'No Check - Unlimited' or 'EOTI', then the system will display an override message when you save/modify the contract and the sell quantity is greater than the value dated holdings for a particular security code.

If there is an active Repo deal in the portfolio, the system will not allow you to check this box.

Accrue Withholding Tax

The withholding tax levied on transactions involving a portfolio can be accrued over the tenure of the security that is traded.

Check against this field to indicate that withholding tax should be accrued. Leave it unchecked to indicate otherwise.

Bankers Acceptance

Check this box if you intend the portfolio to be used for a Banker’s Acceptance deal. The value for this field defaults based on your specification in the Portfolio Product Preference screen. If the default value is ‘Yes’, you can change it to ‘No’, but not the other way round.

Only those SK locations can be chosen for this portfolio, which have the Banker’s Acceptance option enabled.

Repo on Today’s Projected Holdings

Check this box to enable Repo on projected holdings for the day. If you check this, the system will allow you to create a Repo deal based on the projected holdings for the day.

This option does not allow you to create a Repo deal based on future dated projected holdings.

If you check this box, then 'Short Positions allowed' cannot be checked.

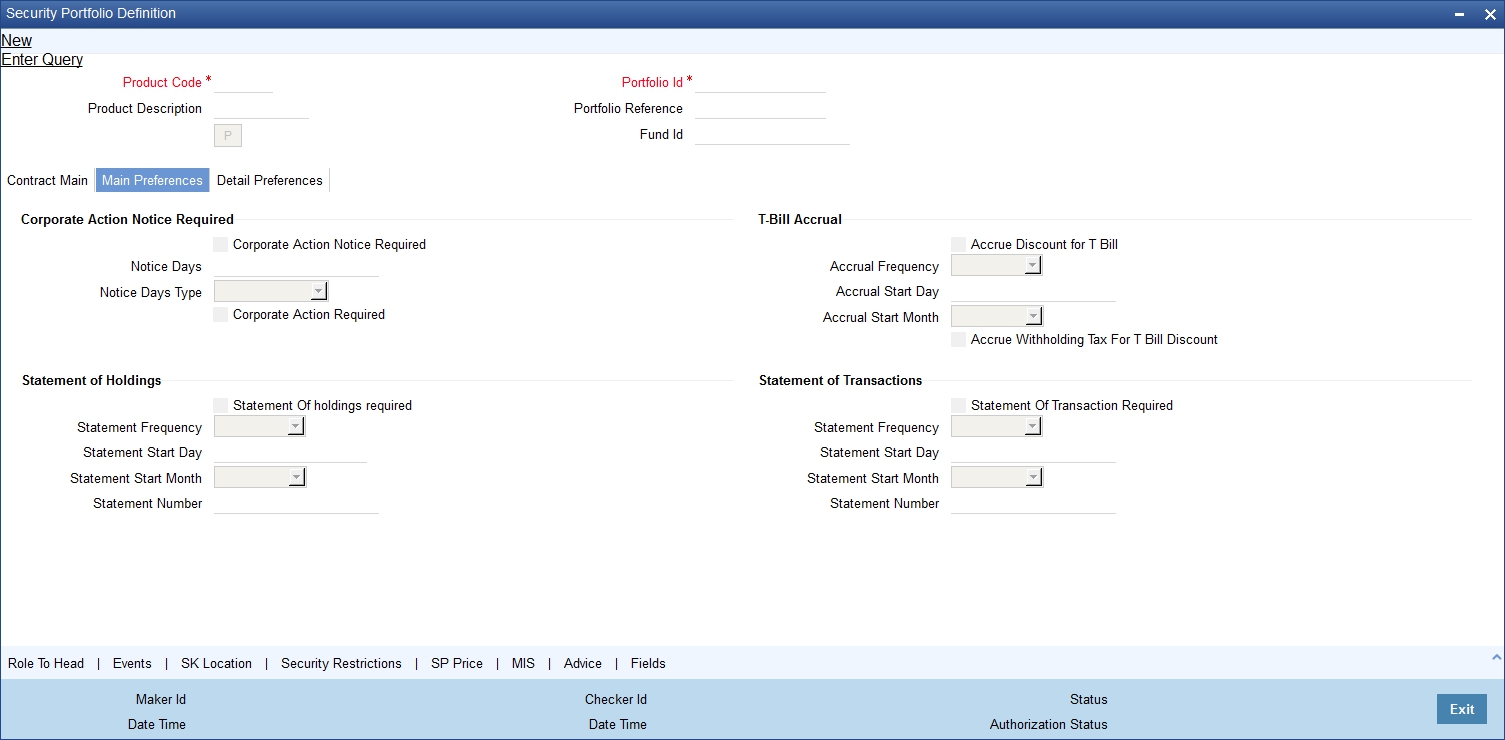

21.5 Defining Preferences for a Portfolio

While defining a portfolio, you can indicate preferences for the portfolio. The preferences defined for the portfolio product to which the portfolio is associated is defaulted. You have the option to change some of the defaults, but certain details that are characteristic of the product type to which the portfolio belongs cannot be changed.

The preferences that you can specify are spread over two screens:

- The Main preference screen

- The Detail preferences screen

The Portfolio Main Preferences screen:

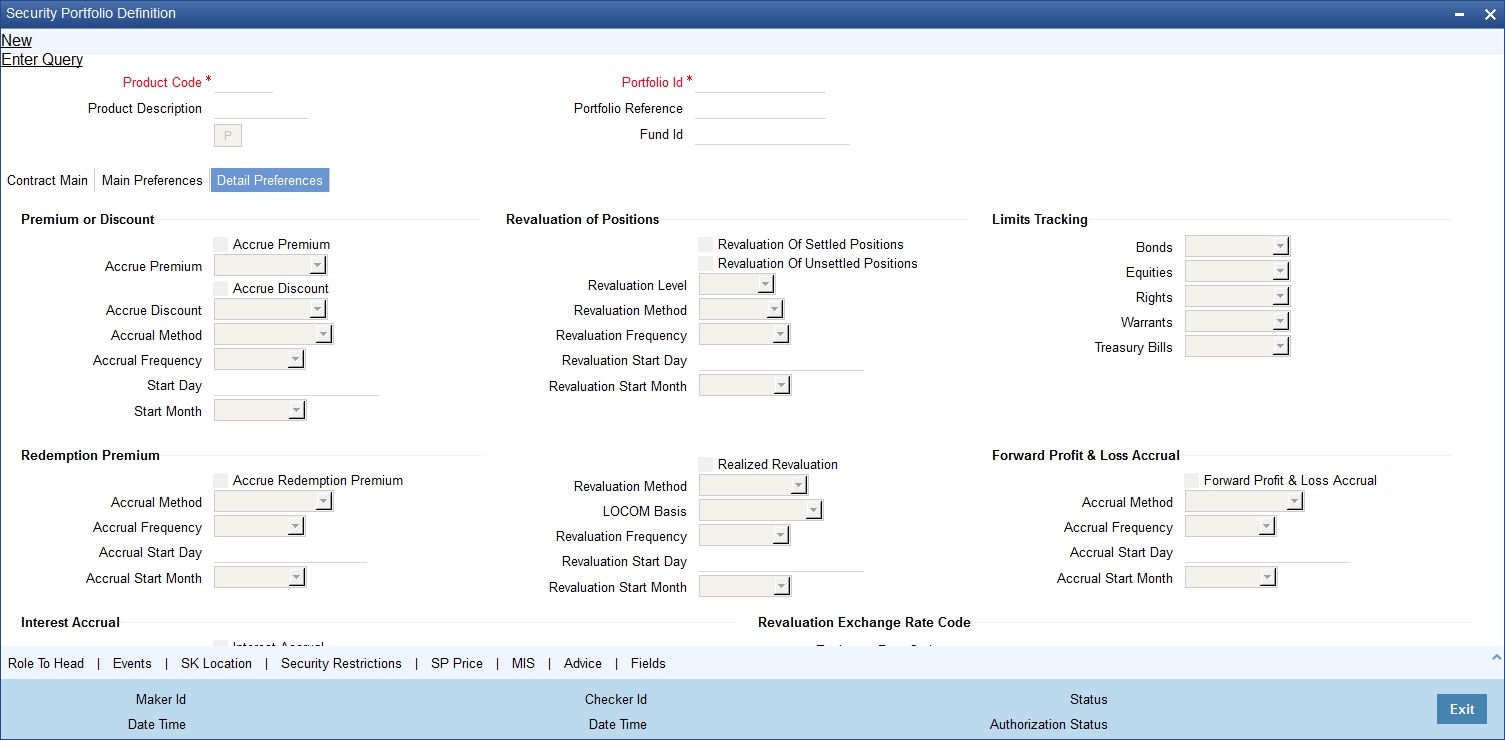

The Portfolio Detail preferences screen

Preferences (that involve accounting entries) defined for the product cannot be changed while creating a Securities Portfolio that involves it. These include:

- The asset accounting basis

- The portfolio costing method

- Whether the intrinsic value of rights and warrants needs to be booked

- Accrual preferences like

- Whether withholding tax should be accrued

- Whether the discount for T-Bills should be accrued

- Whether withholding tax for discounted T-Bills should be accrued

- Whether premium or discount should be accrued

- Whether redemption premium should be accrued

- Whether interest should be accrued

- Whether forward profit or loss should be accrued

- Revaluation preferences, such as the revaluation basis, LOCOM basis, method, frequency, and start date)

The LOCOM basis is defaulted from the Portfolio Product, and can be changed. Subsequently, amendment of the LOCOM basis specified in the Portfolio Definition screen is not possible.

For details about the LOCOM basis, refer the chapter ‘Maintaining a Portfolio Preference Class’ of this User Manual.

Further, you can specify the following preferences, for the components that can be accrued:

- The accrual method

- Accrual frequency

- Start days

- Start month

Premium Discount

Specify the following details:

Accrual Method

The accrual method refers to the method to be used to calculate the amount of premium or discount to be accrued. You can select one of the following options from the drop-down list:

- 30 (Euro) / 360

- 30 (US) / 360

- Actual / 360

- 30 (Euro) / 365

- 30 (US) / 365

- Actual / 365

- 30 (Euro) / Actual

- 30 (US) / Actual

- Actual / Actual

- 30 (Euro) / 364

- 30 (US) / 364

- Actual / 364

Forward PL Accrual

Specify the following details:

Accrual Method

The accrual method refers to the method to be used to calculate the amount of forward profit or loss that is to be accrued. You can select one of the following options from the drop-down list:

- 30 (Euro) / 360

- 30 (US) / 360

- Actual / 360

- 30 (Euro) / 365

- 30 (US) / 365

- Actual / 365

- 30 (Euro) / Actual

- 30 (US) / Actual

- Actual / Actual

- 30 (Euro) / 364

- 30 (US) / 364

- Actual / 364

Redemption Premium

Specify the following details:

Accrual Method

The accrual method refers to the method to be used to calculate the amount of premium that is due to you for holding the bond. You can select one of the following options from the drop-down list:

- 30 (Euro) / 360

- 30 (US) / 360

- Actual / 360

- 30 (Euro) / 365

- 30 (US) / 365

- Actual / 365

- 30 (Euro) / Actual

- 30 (US) / Actual

- Actual / Actual

- 30 (Euro) / 364

- 30 (US) / 364

- Actual / 364

Note

The value of the accrual method maintained in the ‘Security Portfolio Definition’ screen is used for calculating the accrual interest for a given portfolio.

Indicating the Revaluation Level

As a branch parameter, if you have indicated that revaluation should be performed at the Holdings level, you have the option of selecting between Deal level revaluation and Position level revaluation for a specific portfolio. This option will not be made available if, as a branch parameter, you have indicated that the revaluation should be performed at the Portfolio level.

You will not be allowed to revalue a portfolio at the deal level if the Costing Method for the portfolio is WAC. The default level is positions and that cannot be changed.

The entries passed for deal level revaluation at the event BRVL (Securities Revaluation of Positions/Deals) are:

Debit/ Credit |

Accounting Role and Description |

Amount Tag and Description |

Debit |

MTM_EXP - Expense GL for Revaluation (MTM Method) |

MTM_EXP - Revaluation Expense (MTM Method) |

Credit |

MTM_LBY - Liability GL for Revaluation (MTM Method). |

MTM_EXP - Revaluation Expense (MTM Method) |

Debit |

MTM_ASS - Asset GL for Revaluation (MTM Method). |

MTM_INC - Revaluation Income (MTM Method) |

Credit |

MTM_INC - Income GL for Revaluation (MTM Method). |

MTM_INC - Revaluation Income (MTM Method) |

Debit |

LOCOM_REVAL_EXP - Expense GL for Revaluation (LOCOM Method). |

LOCOM_REVAL_EXP - Revaluation Expense (LOCOM Method) |

Credit |

LOCOM_REVAL_LBY - Liability GL for Revaluation (LOCOM Method). |

LOCOM_REVAL_EXP - Revaluation Expense (LOCOM Method) |

A note on Processing Bonds and T-bill based on the YTM parameters

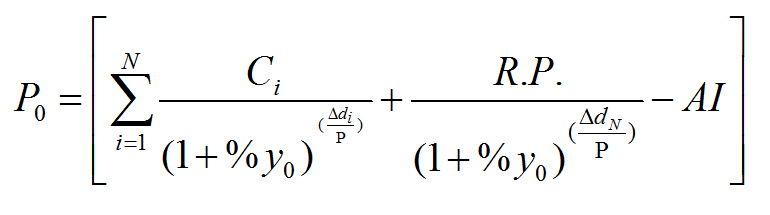

While processing a Bond or a T-Bills, if the Price quote is not by ‘Yield to Maturity’, the YTM is computed based on the formula given below:

Where:

- P0 is the Purchase price of the Bond

- N is the Total number of coupons

- Ci is the Coupon payment for coupon i

- y0 is the Deal YTM ( Periodic )

- Y0 is the Deal YTM

- A is the Day Count Method – Denominator

- n is the Coupons in a Year

- P is the Period of Reinvestment. If Null, defaulted to A/n

- R.P. is the Redemption Price

- AI is the Accrued Interest

- pdi is the Coupon Date – Value Date

- pdN is the Redemption Date – Value Date

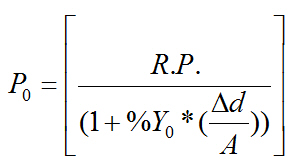

The formula used to calculate the yield given price – for T-Bills, will be

Where:

- P0 is the Purchase price of the T-Bill

- R.P. is the Redemption Price

- Y0 is the Deal YTM

- pd is the Redemption Date – Value Date

- A is the Day Count Method - Denominator

End-of-Day processing – accrual by the straight line method

During EOD processing on each day, the system picks up all deals in Bonds and T-Bills marked for DPRP accrual – based on Constant Yield Basis.

‘DPRP’ stands for Discount, Premium and Redemption Premium.

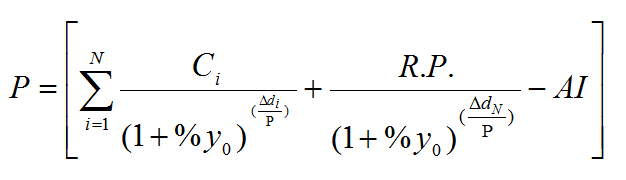

In case of Bonds, from the formula mentioned below, the YTM computed and stored at the time of saving the deal, is used to arrive at the price of the deal for the current working day (P2).

If the Annualizing method is Compound, the deal YTM is computed as follows:

If the Annualizing method is Simple, the deal YTM is computed as follows:

If case of EX Deal, first coupon amount will be 0 (C1 = 0 ).

Where:

- P is the Price of the Bond.

- N is the Total number of coupons.

- Ci is the Coupon payment for coupon i

- y0 is the Deal YTM (Periodic).

- Y0 is the Deal YTM.

- A is the Day Count Method – Denominator.

- n is the Coupons in a Year.

- P is the Period of Reinvestment. If Null, defaulted to A/n.

- R.P. is the Redemption Price

- AI is the Accrued Interest

- pdi is the Coupon Date – Application Date

- pdN is the Redemption Date – Application Date

The price obtained for the current working day is then compared with the price obtained during the previous day’s EOD processing (P1). The difference between the price of the deal on the current working day and the previous day (P2 – P1) is the amount for which accrual entries will be passed, on the current working day.

In case of T-Bills, from the formula mentioned below, the YTM computed and stored at the time of saving the deal, is used to arrive at the price of the deal for the current working day (P2).

Where:

- P is the Price of the T-Bill

- R.P. is the Redemption Price

- Y0 is the Deal YTM

- pd is the Redemption Date – Application Date

- A is the Day Count Method - Denominator

The price obtained for the current day is compared with the price obtained during the previous day’s EOD processing (P1). The difference between the price of the deal on the current day and the previous day (P2 – P1) is the amount for which accrual entries will be passed, on the current working day.

For example, let us assume, in your country all Securities (Bonds, Tbills, CPs ) are quoted in the market on a yield basis. Additionally, no tax is levied on any capital gains (to encourage trading) but 35 % tax is charged on the Discount Amount. Accrual in a straight line method would divide the discount amount equally to the number of days to mature. But your bank would like to calculate the present value on the Security on a daily basis and difference will be booked as Discount Earned. In this method the present holding cost will be always lesser than the straight line revaluation (if it is bought in discount) and hence capital gain will be higher during the sell.

A T Bill worth 50,000,000.00 (FV) is Bought on 1-Sep-2002 Maturing on 08-Aug-2003 at Annual Yield rate of 13%.

On Buy:

Buy Date |

01-SEP-2002 |

|

Redemption Date |

08-Aug-2003 |

|

YTM Price |

13% |

B3 |

Quantity (Nominal) |

50,000,000.00 |

B4 |

Days to Mature |

341 |

B5 |

Price |

89.1701 |

B6 = ROUND(100/(1+(B3*B5)/365),4)) |

Net Consideration |

44,585,050.00 |

|

Discount |

5,414,950.00 |

B14 |

On A later date (10-Sep-02)

Yield |

13% |

D3 |

Holding Quantity |

50,000,000.00 |

|

Days to Mature |

332 |

D5 |

Present Cost |

89.4257 |

D6 = ROUND(100/(1+(D3*D5)/365),4) |

Present Value |

44,712,85000 D7 =D4*D6/100 |

|

Present Discount |

5,287,150.00 D14 |

|

Discount to Be Amortized |

127,800 |

D15 = B14- D14 |

DPRP Accrual for Bonds with quantity redemption schedules

For securities which are redeemable on call and with redemption type Quantity, you can choose to redeem a specific amount of the face value by entering the requisite percentage in the Redemption Percent field in the Securities Corporate Action Maintenance – Redemption screen.

Refer to the chapter on Maintaining and Processing Corporate Actions in this manual.

For such securities, the DPRP accrual takes into account the weighted average of the days to redemption.

Accrual by the exponential method

In the exponential method of DPRP accrual, the amount accrued is not the same each day, but rises exponentially with each passing day of the accrual period. The amount accrued at the end of each day is given by the following formula:

Wb = PP * (FV/PP)(n1/n2)

Where:

Wb = Value of the Bond on accrual date;

PP = Purchase Price of the Bond;

FV = Face Value of the Bond;

n1 = Number of days from purchase till the date of accrual;

n2 = Number of days from purchase till maturity.

For example, consider a Bond with the following basic details:

- Purchase Price = PP = 80 USD

- Face Value (Nominal) = FV = 100 USD

- n2 = 10

The value of the bond and the amount accrued each day till maturity is given in the table below. For comparison, the accrued amount each day, as obtained by the straight line method of accrual, is given in the last column. All figures are in USD:

n1 |

Value of Bond |

Value of Bond in excess of Purchase Price |

Discount Accrual by exponential method |

Discount Accrual by straight line method |

1 |

81.805 |

1.805 |

1.805 |

2.000 |

2 |

83.651 |

3.651 |

1.846 |

2.000 |

3 |

85.539 |

5.539 |

1.888 |

2.000 |

n1 |

Value of Bond |

Value of Bond in excess of Purchase Price |

Discount Accrual by exponential method |

Discount Accrual by straight line method |

4 |

87.469 |

7.469 |

1.930 |

2.000 |

5 |

89.443 |

9.443 |

1.974 |

2.000 |

6 |

91.461 |

11.461 |

2.018 |

2.000 |

7 |

93.525 |

13.525 |

2.064 |

2.000 |

8 |

95.635 |

15.635 |

2.110 |

2.000 |

9 |

97.793 |

17.793 |

2.158 |

2.000 |

10 |

100.000 |

20.000 |

2.207 |

2.000 |

|

|

|

20.000 |

20.000 |

In case the redemption date is extended, the system recomputes the DPRP amounts irrespective of the accrual method maintained for DPRP. Discount/Premium accrual will be completed till the extension date (using the old redemption date). However, all the unaccrued Discount/Premium will be accrued from the transaction date of the redemption date extension. Subsequently, YTM for all the deals will also be recomputed.

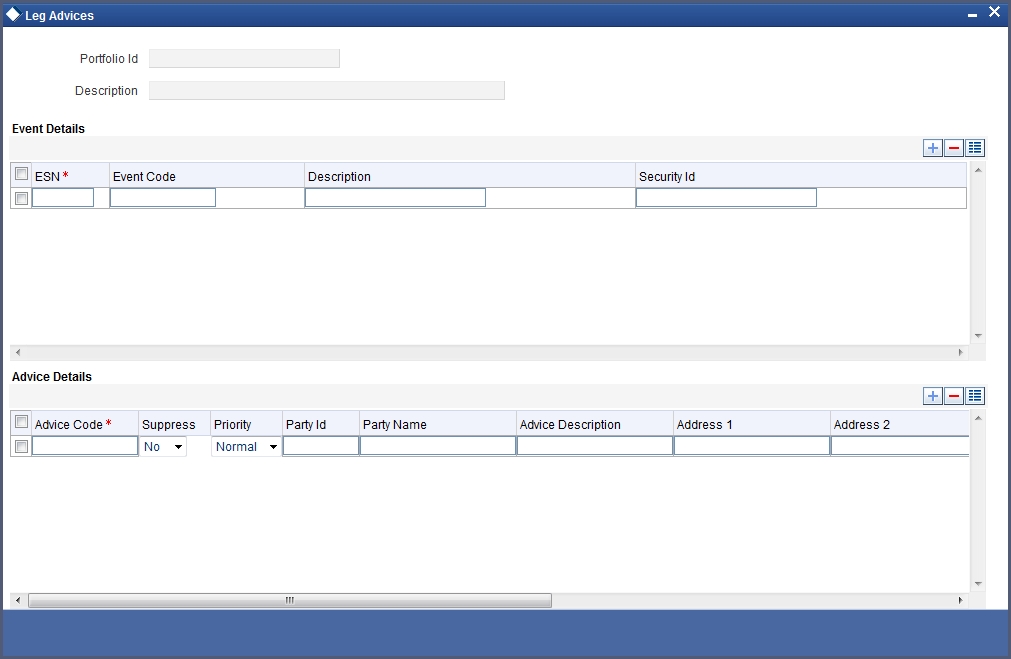

21.6 Specifying the Advices to be Generated

The advices that can be generated, for the events that occur during the life cycle of securities in a portfolio, are defined for the product to which the portfolio is associated.

From the Portfolio definition screen, click ‘Advices’ button. The advices screen is displayed.

Highlight an event, to view the advices associated with it. The address, to which an advice should be delivered, is picked up by default, based on the media and address maintained for the party.

The party type to whom an advice should be sent is also picked up automatically, based on the type of portfolio you are entering and the parties involved.

Suppressing the generation of an advice

By default, all advices defined for a product will be generated for the portfolios to which it is associated. If any of the advices are not applicable to the portfolio being created you can suppress its generation.

Priority

For a payment message by SWIFT, you have the option to change the priority with which a message should be delivered. By default, the priority of an advice is marked as Normal. You have the option to prioritise a payment message to one of the following options:

- Normal

- Medium

- High

After selecting the advices to be generated for the portfolio, click add icon to save the entries that you made. Click delete icon to reject the entries that you have made. In either case, you will be returned to the Portfolio Definition screen.

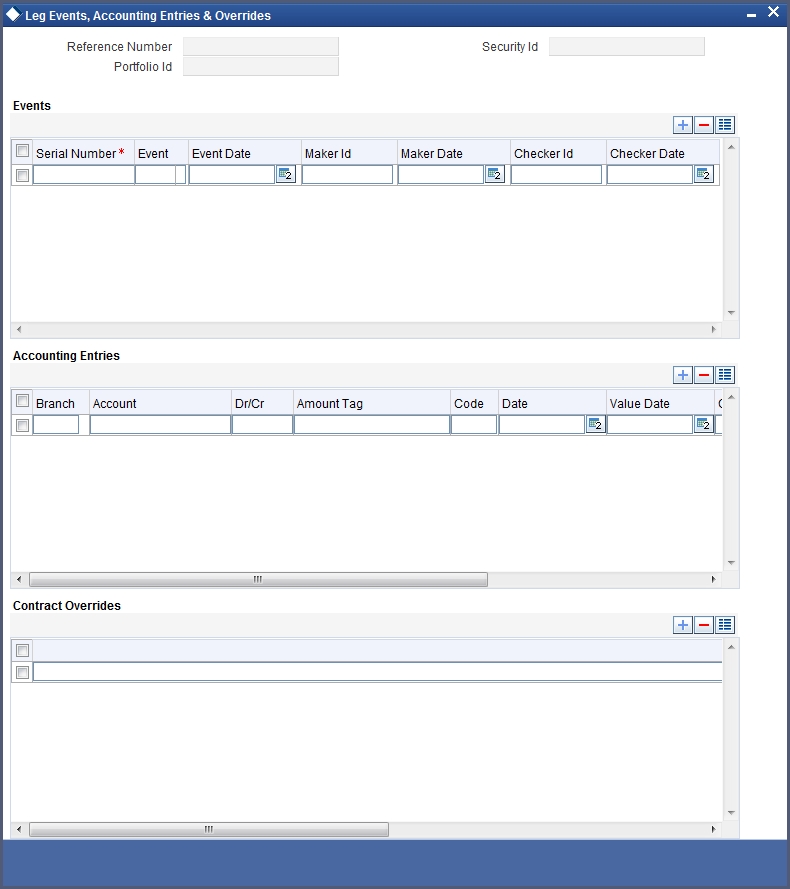

21.7 Viewing Event Details

Click ‘Events’ from the Portfolio definition screen, to view the accounting entries that were passed and the overrides that were encountered, for each event in the lifecycle of a portfolio.

Accounting entry details

Highlight the event to view its accounting entries. All the accounting entries that were passed and the overrides that were encountered for the event will be displayed.

The following information is displayed for each accounting entry:

- Branch

- Account

- Dr/Cr indicator

- The amount tag

- The date on which the entry was booked

- Value Date

- The deal currency

- Amount in deal currency

- The foreign currency equivalent (if applicable)

- The exchange rate that was used for the conversion

- Amount in local currency

- All the overrides that were encountered for the event will also be displayed

Click ‘Exit’ button to exit the screen. You will be returned to the Application Browser.

21.8 Maintaining Security Restrictions for a Portfolio

From the head office of your bank, you can establish certain controls over the securities that a portfolio can trade in. These controls are achieved by specifying restrictions.

The security restrictions maintained for the portfolio product associated with a portfolio will by default apply. You can use the defaulted restrictions or define security restrictions for a portfolio.

Click ‘Security Restrictions’ button from the Portfolio Definition screen, to invoke the Security Restrictions screen.

21.8.1 Features of the screen

Restriction Type

You can specify security restrictions in the form of an allowed or disallowed list. You can indicate whether you are maintaining an allowed or a disallowed list type by choosing the appropriate option under the field Restriction type.

When you set up security restrictions, the securities that do not figure in the allowed list cannot be traded with. If you have maintained a disallowed list, securities that do not figure in it can be involved in deals linked to the product.

Allowed/Disallowed

Under Security Restriction, you will see a column displayed.

- An Allowed or Disallowed list (depending on the restriction type you are maintaining).

For example, if you have chosen to maintain an Allowed list, the column will display the list of categories that you allow.

Exempting specific securities from an allowed or disallowed list

You can exempt specific securities, from the restriction specified for the product to which they belong. Click add icon and select a security code from the picklist.

You can choose to Allow or Disallow the security that you have selected by choosing the appropriate option under Restriction Type. Click delete icon to remove a security from the list.

For example, suppose that you have maintained the following security products in Oracle FLEXCUBE:

Product Code |

Products linked to it |

SECA |

EQ 1 EQ 2 EQ 3 |

SECB |

BD1 BD2 BD3 |

You are maintaining security restrictions for a portfolio. You have indicated the restriction type as Allowed. For this portfolio, you have moved the Security product SECA to the allowed list. This in effect means that you have,

Allowed SECA for the portfolio.

Disallowed SECB for the portfolio.

You want disallow security EQ 3 and allow security BD 1. In Oracle FLEXCUBE this is achieved thus:

Follow the same procedure for the security ID, BD1 and indicate that it is allowed for the portfolio.

Thus you have allowed the securities EQ 1, EQ 2, and BD 1 for the portfolio.

Confirming your specifications

After you have defined restrictions, click ‘Exit’ to delete your specifications. You will be returned to the Portfolio Definition screen.

21.9 Mapping Accounts to a Safe Keeping Location

While setting up a portfolio, you can indicate the default account at a safe keeping location (SKL) that should be used when deals involving securities lodged at the SKL are traded.

Click ‘SK Location’ from the Portfolio Definition screen to invoke the Safe Keeping Location screen. In this screen you can indicate the default account to be used for each SK location.

The procedure for mapping accounts

Indicate the ID of the safe keeping location at the Safe Keeping Location field. Alternatively, select a safe keeping location from the picklist. The picklist will contain details of all valid safe keeping locations, maintained in the SKL Maintenance screen.

Thereafter, indicate the default account at the SKL account field. Select an account from the picklist. The picklist will contain the accounts that the holder of the portfolio maintains, with the SK location.

To add another SK location and account combination for a portfolio, click add icon and follow the procedure listed above. To delete a mapping that you have made, highlight the mapping and click delete icon.

Click ‘Exit’ to cancel the entries. You will return to the Portfolio Definition screen.

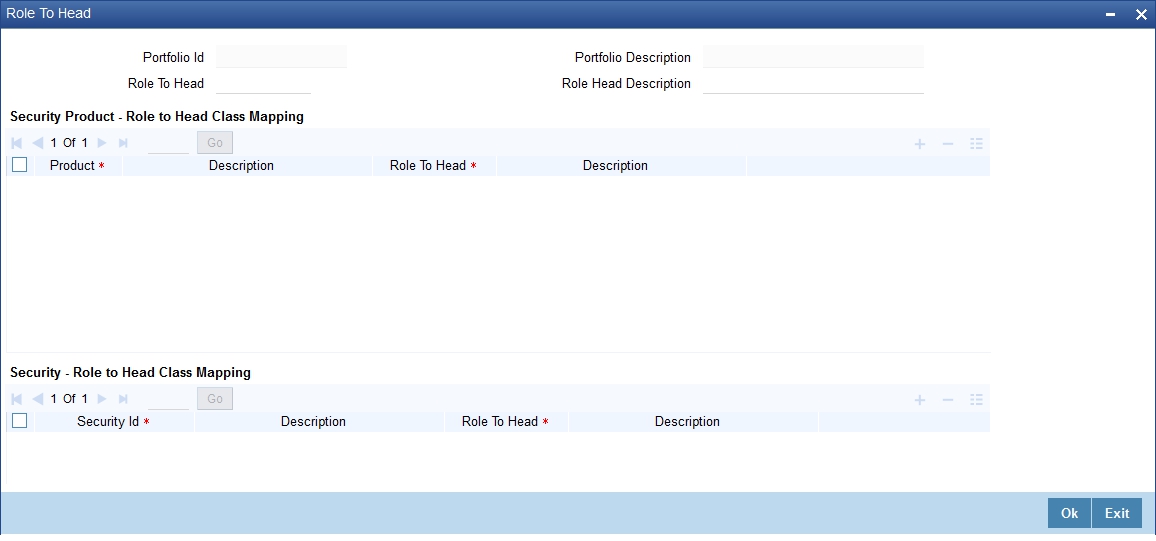

21.10 Specifying Accounting Role to Head Mapping Preferences

While creating a product, you have specified Role to Head Mapping preferences. The preferences specified for the product associated with the portfolio is defaulted. Click ‘Role to Head’ from the Securities Portfolio Definition screen.

While defining a portfolio you can change the role to head mapping class that is defaulted from the portfolio product. You can select a new Role to Head Mapping class and make it applicable to a portfolio.

Oracle FLEXCUBE provides complete flexibility in mapping accounting roles to heads. The levels to which, accounting entries can be defined are follow:

Level one:

You accept the role to head mapping class defaulted from the product associated with the portfolio. In this case, the role to head mapping class will be made applicable across all securities in the portfolio.

Level two:

The Role to Head Mapping Class that is defaulted from the product is not applicable to the portfolio being defined. You can specify another role to head mapping class and make it applicable to the portfolio.

In this case, the new class that you specified will become applicable to all securities in the portfolio.

Level three:

You have either accepted the default role to head mapping from the product or have associated a new role to head mapping class for the portfolio.

However, for a specific security product you want to use a different role to head mapping class.

Indicate the role to head mapping that is applicable to the portfolio and specify a Role to Head Mapping Class that is to be applied to specific securities products.

Level four:

Besides the Accounting Role To Head Mapping class defined for the portfolio, you can also define an accounting role to head mapping class for a particular security, within a security product.

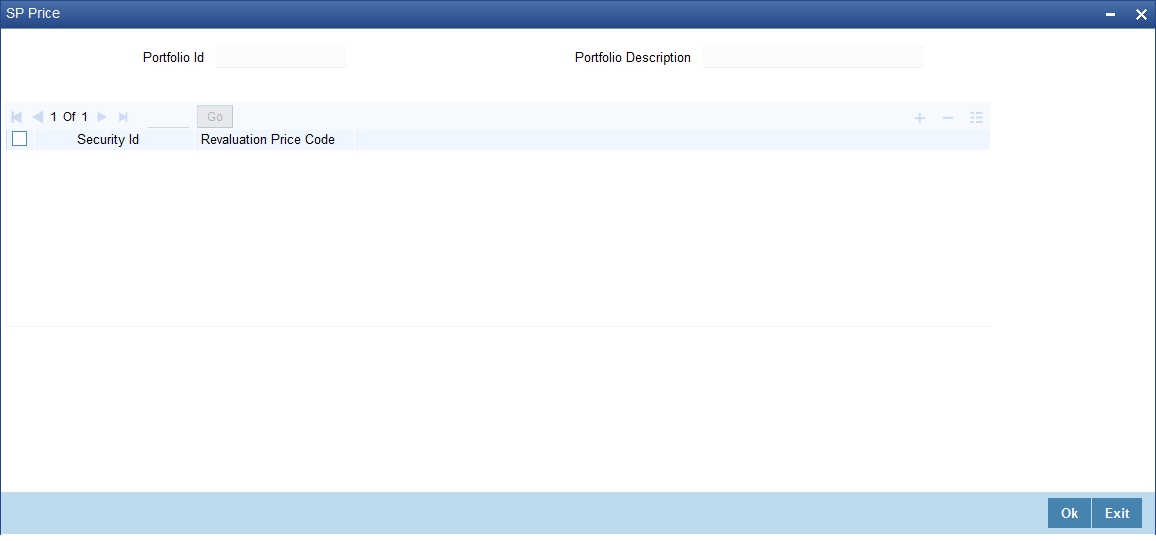

21.11 Maintaining Security Revaluation Prices for a Portfolio

You can choose to maintain different price codes for each security within the portfolio. The prices associated with these price codes will be used to revalue the portfolio. Thus for the same security you could specify different revaluation price codes in different portfolios. To maintain price codes for each security within the portfolio click ‘SP Price’ button in the Securities Portfolio Definition screen.

In this screen, you can maintain set of securities and associate appropriate price codes with each of them. While revaluing the portfolio the system first checks for the price code associated with the security at the portfolio level. Else, the default price code maintained for the security will be used for revaluation.

Note

You can link only one price code for a given security in a given portfolio.

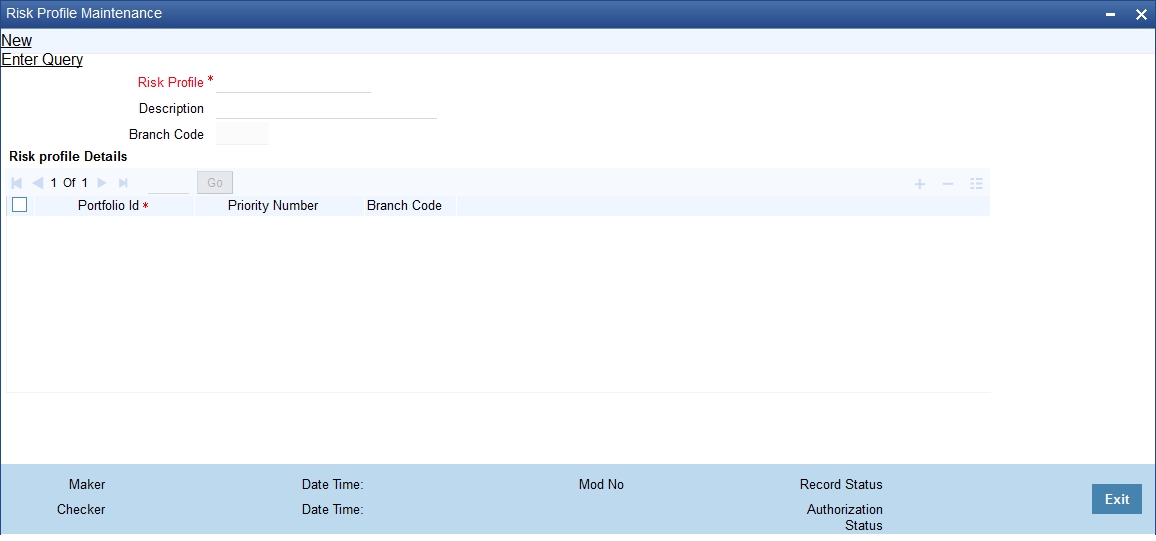

21.12 Maintaining Risk Profile

You can maintain risk profiles in the Risk Profile Maintenance screen. To invoke this screen To invoke the screen, type 'SEDXRMNT' in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Risk Profile

Specify the risk profile.

Description

Enter a description for the risk profile.

Branch Code

Specify the branch code.

Risk Profile Details

Portfolio Id

Select the portfolio ID from the adjoining list of values provided.

Priority Number

Specify the priority number to be associated with the benefit plan for the selected module.

Note

The priority number specified should be unique across all benefit plans for a given module.

Branch Code

Specify the branch code.

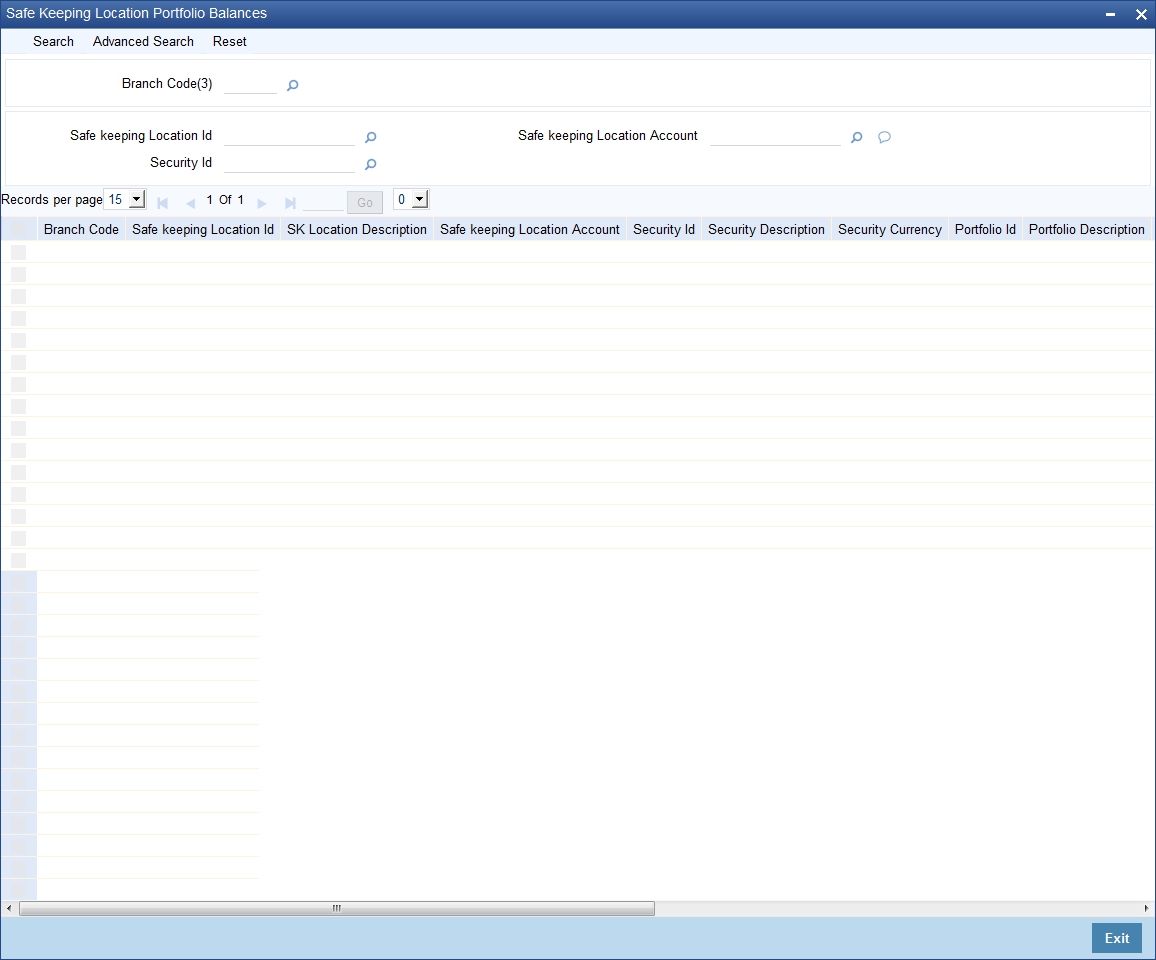

21.13 Viewing Safe Keeping Location Portfolio Balances

You can view the safe keeping location portfolio balances in the 'Safe Keeping Location Portfolio Balances Summary' screen. You can invoke this screen by typing 'SESXSKPB' in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Branch Code

- Safe Keeping Location Id

- Safe Keeping Location Account

- Security Id

Select any or all of the above parameters for a query and click 'Search' button. The records meeting the selected criteria are displayed.

If you are allowed to query, then system displays the following details pertaining to the fetched records:

- Branch Code

- Safe Keeping Location Id

- SK Location Description

- Safe Keeping Location Account

- Security Id

- Security Description

- Security Currency

- Portfolio Id

- Portfolio Description

- Portfolio Type

- Portfolio Reference

- Security Form

- Current Position

- Current Holdings

- Opening Position

- Opening Holdings