22. Processing a Securities Deal

22.1 Introduction

Using the securities module of Oracle FLEXCUBE, you can process the following deal types:

- Bank portfolio buys and sells

- Customer buys and sells

- Standalone lodge and withdraw

- Accompany lodge and withdraw

- Safe keeping location (SKL) to SKL transfer

- Block securities

These could be spot, forward or back value dated deals. Moreover, these deals could be directly captured in Oracle FLEXCUBE or uploaded from an external system. You can nevertheless amend an uploaded deal in Oracle FLEXCUBE.

Each deal that you enter in Oracle FLEXCUBE should necessarily be associated with a deal product or combination product. To recall, you have already defined deal products to group together or categorise deals that share broad similarities. Deal products provide a general framework and serve to classify or categorise deals.

Under each Product that you have defined, you can enter specific deals based on your requirement. By default, a deal inherits all the attributes of the product or combination product, which is associated with it.

This means that you will not have to define these general attributes each time you enter a deal, rendering the entry of a deal in Oracle FLEXCUBE quick and simple.

Note

While defining a combination product you have indicated the 'preferred leg' of the combination. The preferences specified for the preferred leg will be defaulted to a deal involving a product combination.

The sequence of events involved in processing a securities deal, right from the trade date to the settlement date can be entered in Oracle FLEXCUBE. A deal would therefore require information on:

- The securities that are traded

- The number of securities that are traded

- The counterparties involved in the deal

- The price at which the securities are traded

- The portfolio to which the securities belong

- The dealer involved in the deal

- Details of the broker involved in the deal (if applicable)

These details, and several others, required to process a deal in Oracle FLEXCUBE have been discussed in the course of this chapter.

This chapter contains the following sections:

- Section 22.2, "Securities Deal Input Screen"

- Section 22.3, "Entering the Details of a Deal"

- Section 22.4, "Deal Net Consideration"

- Section 22.5, "Specifying Details of the Parties Involved in a Deal"

- Section 22.6, "Settlement Instructions for a Deal Leg"

- Section 22.7, "Levying Tax on a Deal"

- Section 22.8, "Processing Brokerage on a Deal"

- Section 22.9, "Uploading the Deals for Amendment"

- Section 22.10, "Liquidating a Deal"

- Section 22.11, "Reassigning a Deal to another User"

22.2 Securities Deal Input Screen

This section contains the following topics:

- Section 22.2.1, "Invoking the Securities Deal Input Screen"

- Section 22.2.2, "A Description of the Securities Deal Input Screen"

- Section 22.2.3, "Viewing Securities Deals"

22.2.1 Invoking the Securities Deal Input Screen

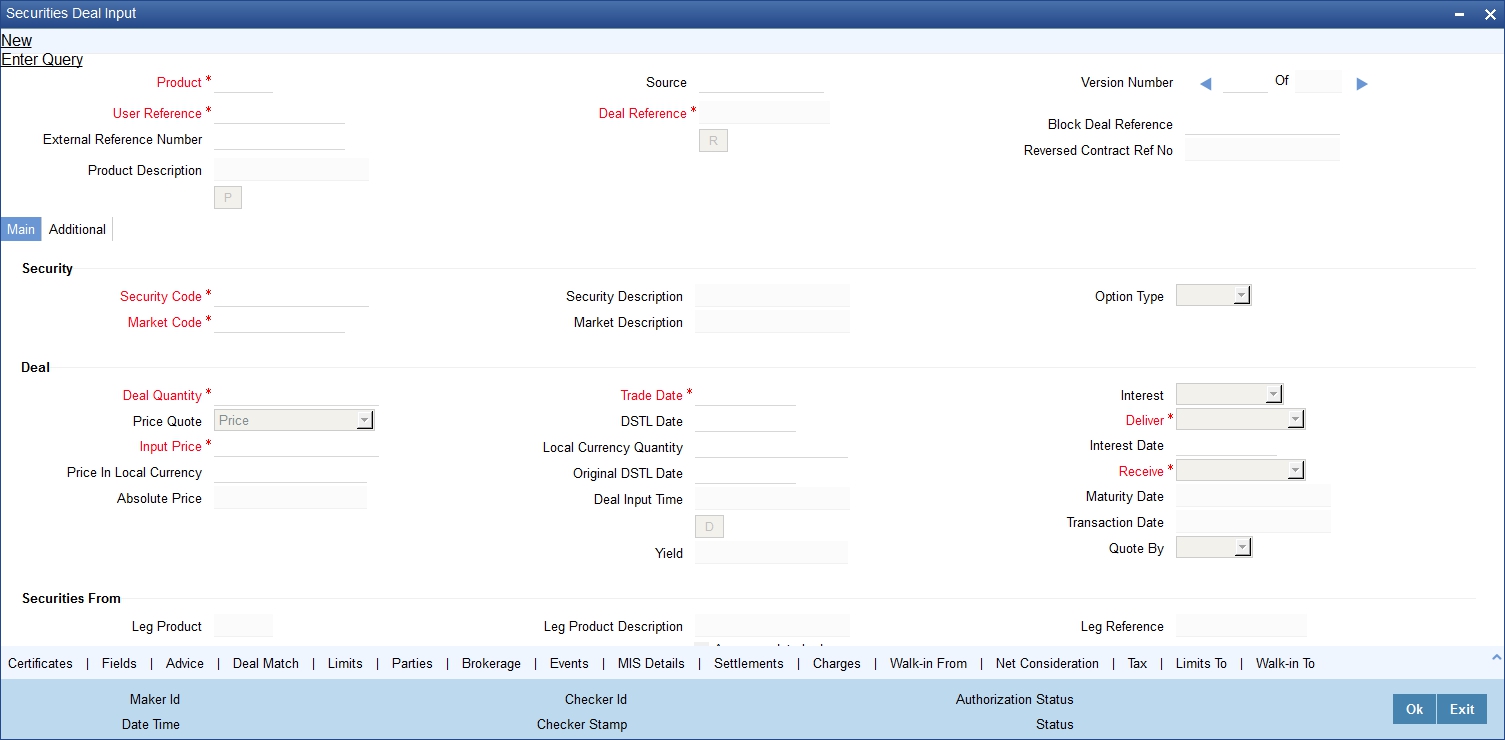

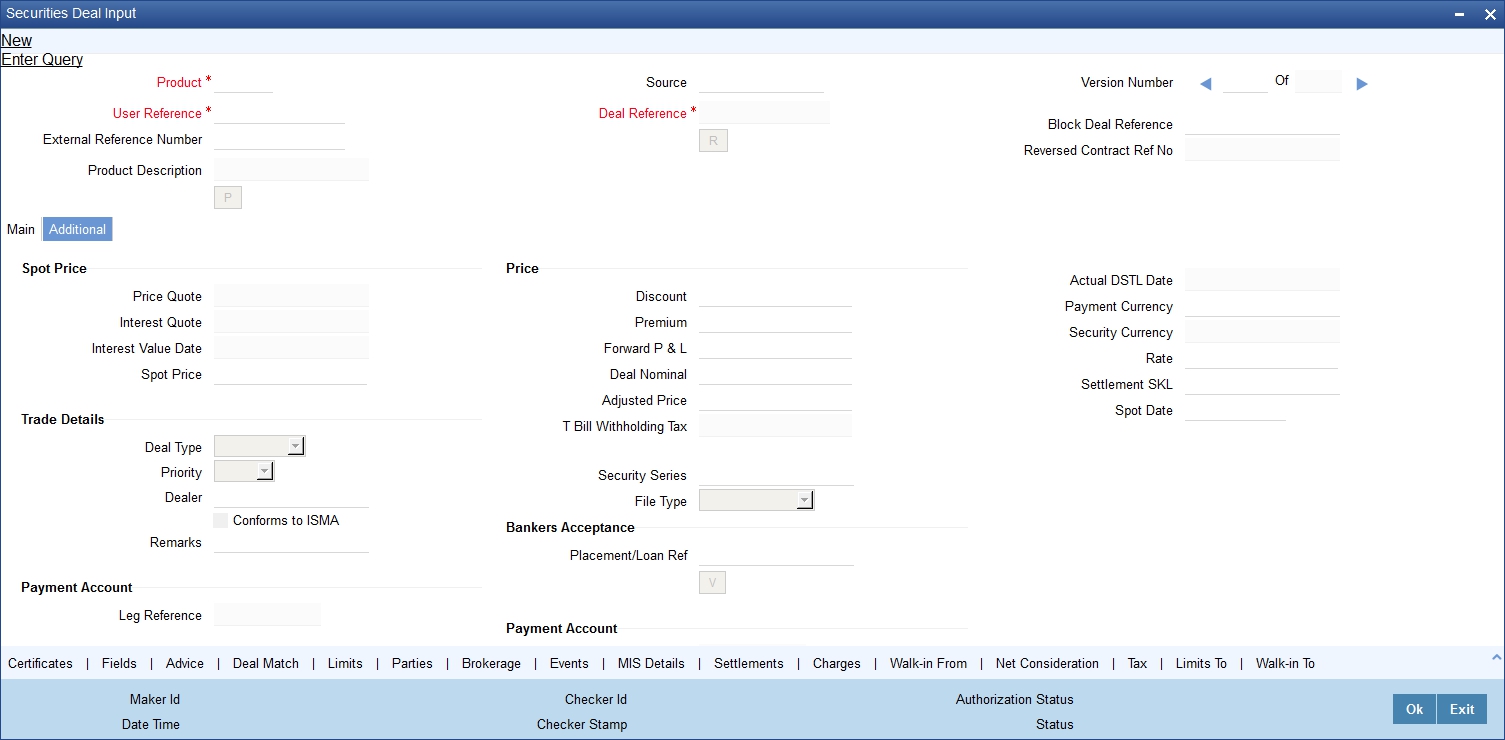

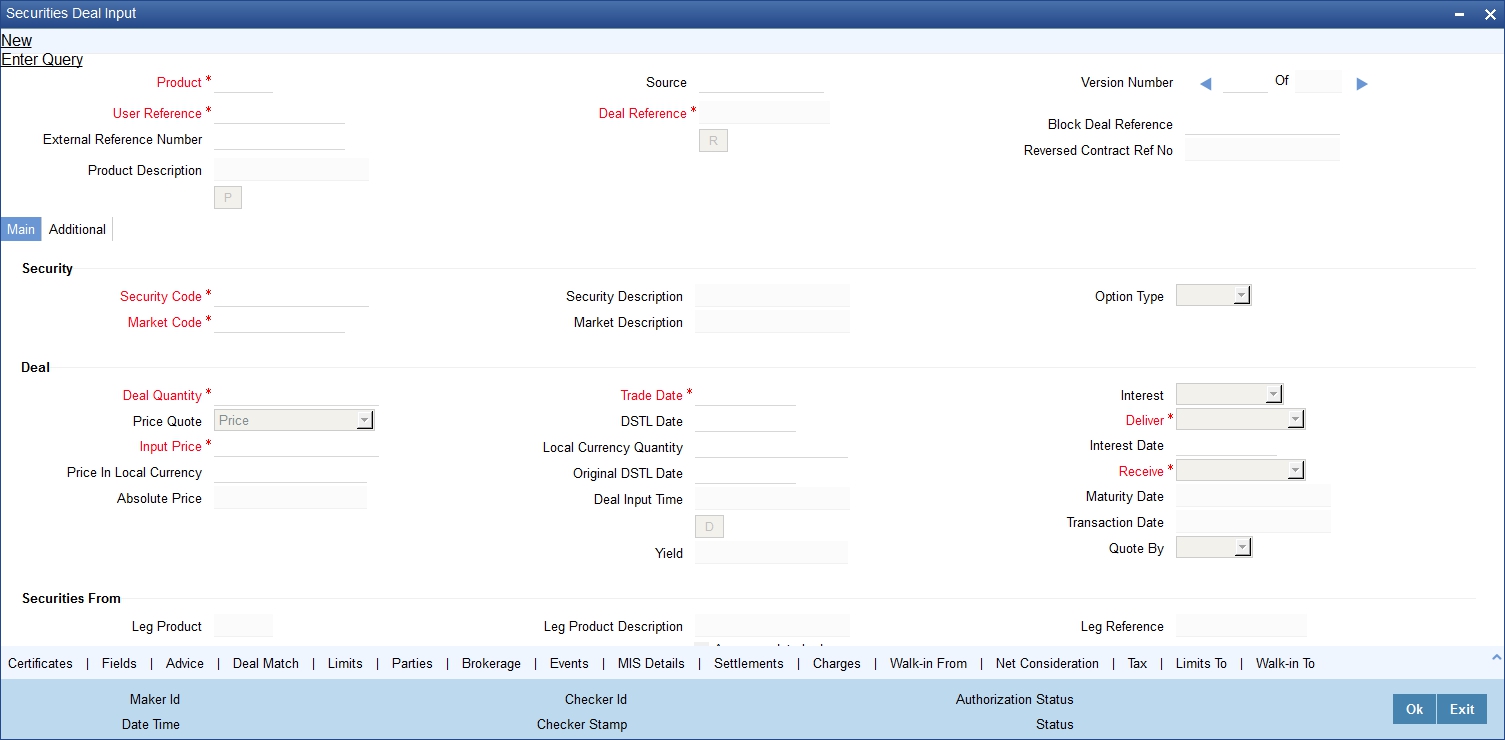

You can invoke the Securities Deal Input screen from the Application Browser. To enter the details of a new deal click new icon from the tool bar.

You can invoke the ‘Securities Deal Input’ screen by typing ‘SEDXDLNL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

If you are calling a deal that has already been created, choose the Deal Input Summary option. The details of all the deals that you entered earlier will be displayed in a tabular form. From the summary screen, you can open an existing deal by double clicking it.

22.2.2 A Description of the Securities Deal Input Screen

The securities deal input screen, as it appears contains a header and a footer containing fields that are specific to the deal you are entering. Besides these, you will also notice two tabs and an array of icons along the lines of which you can enter details of a securities deal.

The two tabs are:

‘Main’ |

Click this tab to enter the essential terms of a deal. This screen, along with its fields has been detailed under the head ‘Entering the details of a deal’. |

‘Additional’ |

In the screen that corresponds to this tab, you can enter additional details that are required to process the deal. The screen also displays price-related details, calculated on the basis of the amounts that you specified in the Main screen. The features of this screen have been detailed under the head ‘Entering additional details of a deal’. |

On the Securities Deal Input screen you will also notice a toolbar with icons. The same set of icons is available for each leg of a deal. The buttons on this toolbar enable you to invoke a number of functions that are vital to processing a deal. These buttons have been briefly described below:

Advices |

Click this icon to invoke the advices screen. In the screen corresponding to this icon you can view, suppress and prioritize the advices that are to be generated for each leg of the deal. This screen along with its fields has been detailed under the head ‘Specifying Advices for a deal'. |

Brokerage |

Click this icon to indicate brokerage details applicable to the deal leg. |

Charges |

This button invokes the Charge service of Oracle FLEXCUBE. On invoking this function you will be presented with a screen where the charge rate, amount, currency, and the waive charge parameter can be specified. The procedure for making charge components applicable to a deal leg is discussed under the head 'Levying charges on a deal'. |

Deal Match |

If you are trading in a portfolio that involves deal matching, you can indicate deal-matching preferences. Click this button to match earlier buys in a portfolio, to the deal you are processing. |

Events |

Click this icon to view details of the events and accounting entries that the deal involves. The screen also displays the overrides that were encountered for the deal. |

Limits |

Click this icon to view the forward profit that you have made or the loss that you have incurred on account of the deal. |

WalkIn |

In the screen that corresponds to this button, you can indicate the credit lines under which your liability to the deal should be tracked. The details of this screen are discussed under the head ‘Specifying credit administration details’. |

MIS Details |

Click this icon to define MIS details for the deal. |

Netcons |

Click this icon to view your net consideration in the deal. |

Parties |

In the screen that corresponds to this button, you can indicate the parties involved in the deal. |

Settlements |

Click this icon to invoke the settlement screens. Based on the details that you enter in the settlement screens, the deal will be settled. The details of these screens have been discussed in the section titled ‘Maintaining Settlement Instructions’. |

Tax |

This icon invokes the Tax services. The application of tax on a deal is discussed under the head 'Levying tax on a deal'. |

22.2.3 Viewing Securities Deals

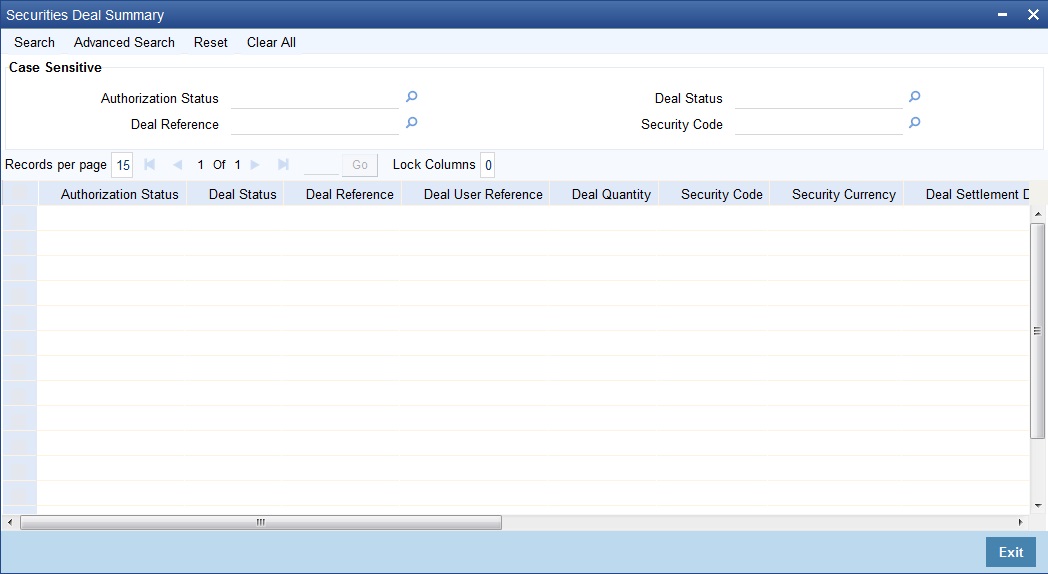

You can view the security details in the ‘Security Deal Summary’ screen. To invoke this screen, type ‘SESXDLNL’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can click ‘Search’ button to view all the pending functions. However, you can to filter your search based on any of the following criteria:

Authorization Status

Specify the authorization status. Alternatively you can select the authorization status of the contract from the drop-down list.

Deal Status

Specify the deal status. Alternatively you can select the deal status of the contract from the drop-down list.

Deal Reference

Specify the deal reference number. Alternatively you can select the deal reference number of the contract from the drop-down list.

Security Code

Select the security code Alternatively you can select the security code from the drop-down list.

Select the sold currency from the option list.

When you click ‘Search’ button the records matching the specified search criteria are displayed. For each record fetched by the system based on your query criteria, the following details are displayed:

- Authorization Status

- Deal Status

- Deal Reference

- Deal User Reference

- Deal Quantity

- Security Code

- Security Currency

- Deal Settlement Date

- Booking Date

- Trade Date

- Checker ID

- Maker Id

- Portfolio Id

- Transaction Date

- Block Reference

22.3 Entering the Details of a Deal

Through the Securities Deal input screen, you can process all type of deals (Bank portfolio buys and sells, Customer buys and sells, Accompany lodge and withdraw, SKL to SKL transfer and Block securities).

You can enter the details of a deal by using a deal product / product combination.

This section contains the following topics:

- Section 22.3.1, "Product"

- Section 22.3.2, "Indicating details of the security that is traded"

- Section 22.3.3, "Indicating Deal Details"

- Section 22.3.4, "Entering 'Additional Details' of a Deal"

- Section 22.3.5, "Price Details of the Deal"

- Section 22.3.6, "Viewing Safe Keeping Location Balances"

22.3.1 Product

You should necessarily use a product or a product combination that has already been created to enter the details of a deal. Based on the type of deal you are entering, you can select a product or a product combination from the picklist available at the 'Product' field.

It is mandatory that you use a product combination to process the following deal types that involve two legs (a buy and a sell):

- Bank portfolio buys and sells

- Customer buys and sells

- Accompany lodge and withdraw

You can use a deal product to process a:

- Deal that involves only one leg (either a buy or sell)

- Safe keeping location (SKL) to SKL transfer and

- To Block securities

A deal will inherit all the attributes defined for the product to which it is associated. For deals that are associated with a product combination, the preferences specified for the preferred leg of the product combination will be applied. You can further add details that are specific to the deal like the deal amount, details of the buyer, the seller, etc. and process the deal.

Block Deal Reference

This is a system generated deal reference for the sub-deals, created by way of a block deal product.

Reversed Contract Reference Number

The reference number of the contract that is being reversed and rebooked is displayed here.

User Reference

You can enter a reference number for the deal. A deal will be identified by this number in addition to the ‘Deal Reference No’ generated by the system. This number should be unique and cannot be used to identify any other deal. By default, the Deal Reference Number generated by the system will be taken as the User Reference No.

While reversing a deal the tag 23Gis populated as CANC. In this case tag 20C:: INGENL should be populated with the value DCN. For the subsequent A1 (Linkages) block, the value for the tag 20 C will be populated as '20C::PREV//' followed by the reference number.

Deal Reference

In Oracle FLEXCUBE, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the deal you are entering, it is also used in all the accounting entries and transactions related to this deal. Hence the system generates a unique number for each deal.

The deal reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number. The Julian Date has the following format:

“YYDDD”

Here, YY stands for the last two digits of the year and DDD for the number of day (s) that has/have elapsed in the year.

For example, January 31, 1998 translates into the Julian date: 98031. Similarly, February 5, 1998 becomes 98136 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those elapsed in February (31+5 = 36).

External Reference

If the transaction is being uploaded from an external source, you can specify the identification for the transaction in the external source, as the external reference number.

Source

You have to indicate the source from which contracts have to be uploaded.

22.3.2 Indicating details of the security that is traded

Security Code

While entering the details of a deal, you should indicate the security that the deal involves and the market in which it is traded.

You can select a security code from the picklist. The picklist will contain a list of all the securities that you maintained in the Securities Definition screen. The trading in the security should be allowed for the portfolios involved in the deal.

As you have already maintained details of the security, all the features of the security like its price, the quotation method, the corporate actions that it involves and several other details of the security will be processed based on these details.

After you indicate the securities that are being traded in the deal, you can indicate the market in which they are traded.

The market in which the security is traded is defaulted from the Security Definition screen. You can change the default and select a market code from the picklist available. The picklist will contain valid market codes maintained in the Market Definition screen.

Market Code

Indicate the market in which the security involved in the deal is traded. Select a market code from the option list. The option list will contain valid market codes maintained in the Market Definition screen.

The market in which the security is traded is defaulted from the Security Definition screen. You can change the default.

Rules for amendment

The entries made in this field can be amended before the deal is authorized. However, if amendment is required after authorization, you should reverse the deal and enter it again.

Deal Type

Indicate the type of deal you are processing. Using the Securities module of Oracle FLEXCUBE, you can enter spot or forward deals. You can choose the appropriate option from the option list.

A spot deal is one that settles on or before the spot date of the deal. A forward deal is one that settles on a date after the spot date of the deal.

Deal Quantity

Securities that are traded can be quoted in terms of:

- Units (100 units of a security), or

- As a Nominal (securities worth USD 5000).

The price quotation method defined for the security in the security definition screen is defaulted. You can change the quotation method that is defaulted.

The deal quantity that you specify should be expressed in the security quotation method.

22.3.3 Indicating Deal Details

After you have indicated the securities that are traded and the market in which they are traded, you can indicate details of the security that are specific to the deal you are processing.

Deal Quantity

Indicate the quantity of the security that is traded. The quantity that you specify depends on the method in which the security is quoted (units or nominal).

If the security is quoted in units, you should indicate the number of units of the security that was traded. If it is quoted as Nominal, indicate the sum of the face value for which it is purchased.

For example, suppose that you have bought 100 units of a security of face value USD 100.

If the security quotation method is units, then, while indicating the deal quantity you should indicate 100.

If the quotation method is nominal, you should indicate USD 10000 (USD 100 x 100 Units) at the deal quantity prompt.

Trade Date

The trade date is the date on which the deal is transacted. It is also referred to as the deal date. The date that you enter can be either today's date or a date earlier than today.

The trade date should be earlier than the maturity date of the security as specified in the Securities Definition screen.

For a series with a redemption record, the trade date should be earlier than the redemption date.

Interest

The Interest Quotation Method for interest bearing instruments can be:

- Flat

- Plus Accrued

You can indicate whether the deal price that you specified includes the purchased interest or the same has to be accrued separately.

Indicate flat if the price at which the security is quoted includes accrued interest. The flat price is also called the 'Dirty Price'. Indicate plus accrued to indicate that the price at which the security is quoted excludes accrued interest. This quotation method is also referred to as the 'Clean Price'.

Note

You can specify an interest quotation method only if the deal involves the buying or selling of interest bearing bonds.

For indexed securities

In the case of indexed securities, you can specify the number of units that are traded, expressed either in the index or the local currency.

If you express the deal quantity in the local currency, the equivalent in the index currency is displayed in the field titled Deal Quantity. Similarly, if you indicate the deal quantity in the index currency, it’s equivalent in the local currency is displayed in the filed titled LCY Qty.

Price Quote

The method in which price is quoted is a feature of the market where the security is traded. Each market may use a particular price quotation method. The price of a security can be quoted as:

Price - in this case the security is quoted on the basis of the price at which it is traded. You have already maintained the face value of the security in the Security Definition screen. The premium that you paid or discount at which you purchased the security is calculated against the face value of the traded security.

The price can be expressed as:

(Face Value ± Premium or Discount) + Accrued Interest (if the interest quotation method is ‘Flat’)

% Price — the price is quoted on the basis of the percentage of the price.

% Price = (Market price / Face value) x 100

% Discount - in this case, the price is quoted on the basis of the discount percentage at which the deal was bought or sold.

% Premium - in this case, the price is quoted on the basis of the premium percentage at which the deal was bought or sold.

Premium - here the price is quoted on the basis of the premium at which the security was bought or sold. That is, the differential between the face value of the bond and the price at which it is bought or sold.

Discount - the price is quoted on the basis of the discount at which the security is bought or sold. That is, the differential between the face value of the bond and the price at which it is bought or sold

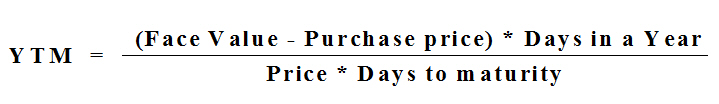

YTM - the price is quoted on the basis of its yield to maturity. This price quotation method is applicable only for Zero coupon bonds.

The yield on discounted instruments is measured by the yield to maturity (YTM) which is the return on a security bought at current market price for the remaining time to maturity of the security. The YTM would keep changing with the market price, in case the market price increases above the straight discounted price YTM would decrease and vice versa. The price using this quotation method is calculated thus:

Based on the deal quantity and the price quotation method, the deal amount is determined. Irrespective of the price quotation method that is used, the net result is the same.

For example, take a USD 100 bond, maturing 20 months from the settlement date, which you have purchased at a premium of USD 20. We will examine the entry that you will have to make at the input price field while entering the details of the deal.

Price — USD 120

% Premium —20%

Premium — USD 20

Percentage price — 120%

YTM — 12%

Using any of the above price quotation methods, the price of the security amounts to USD 120.

Delivery Settlement date (DSTL date)

The delivery settlement date is the date on which settlement of the traded securities should take place. Depending on the type of deal (spot or forward) you are processing, you can indicate the security settlement date.

In the subsequent fields you can indicate the locations from which and to which the security should be delivered.

Deliver

Specify instructions to the safe keeping location as to when the traded securities should be released to the buyer. The options available are:

- Deliver against payment

- Deliver free

The deliver against payment option has no risk involved, as securities will be handed to the buyer only on payment. Choose the deliver free option to indicate that the delivery of securities is to be independent of payment.

As there is a risk involved in choosing the deliver free option, while specifying limit details for the deal, you can also indicate the undelivered credit line under which your liability to the deal should be tracked.

Input Price

The deal price is the price at which the deal is transacted. You can enter the price of the security as a price or a percentage of the price depending on the price quotation method specified for the security that is traded. You can enter “T” or “M” to indicate thousands or millions, respectively. For example, 10T means 10,000 and 10M means 10 million.

The deal price would include or exclude the purchased or sold interest depending on whether the security being dealt in is quoted flat or plus accrued.

For a spot deal, if the deal price varies from the market price by more that the sensitivity range specified for the security you will be prompted for an override or will not be allowed to process the deal.

The price that you enter is taken to be in the currency of the security that is traded.

Yield

This field is applicable only for deals that involve bonds. Enter the equivalent yield of the bond for the price that you input.

It is important to note that no processing is done based on the yield that you enter. It is only for reporting purposes.

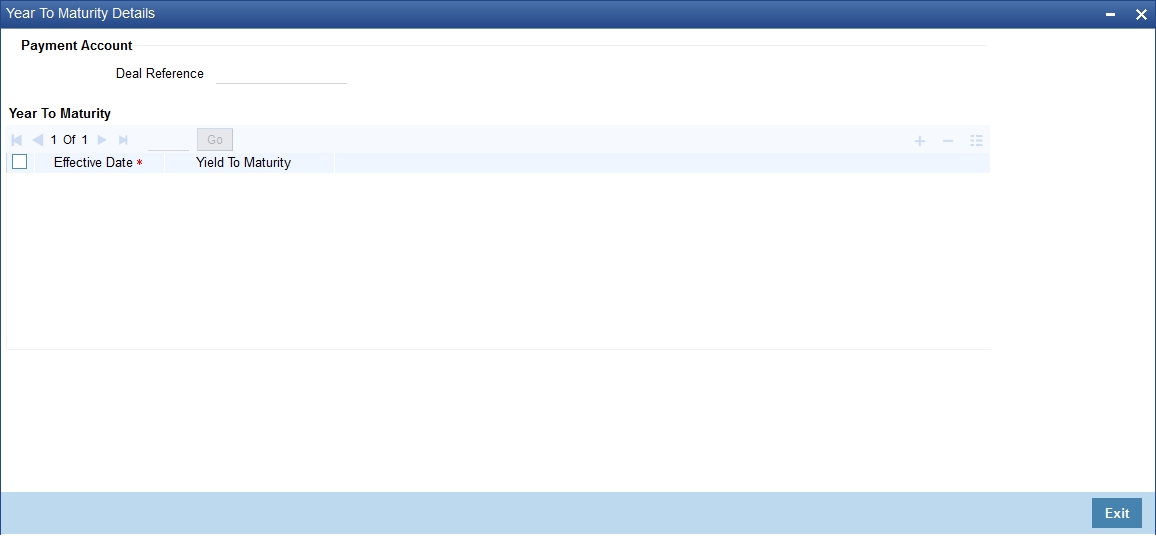

Viewing revised YTMs

Deal YTMs are computed for a security on the following occasions:

Event |

YTM is computed Effective from |

When you enter the deal |

Deal Settlement Date |

When coupon rates are revised for securities with periodic rate revision |

Rate Effective Date |

When the redemption definition is changed |

Event Date |

To view details of changes in YTM, click ‘D’ button . The Yield to Maturity details screen is displayed.

YTM values can change due to Coupon Rate Revision, Redemption redefinition or extension of a security.

The YTM values are rounded off to the number of decimal places specified in the Securities Bank Parameters screen.

Interest Date

If you are entering the details of a buy or sell deal, you can indicate the date from which purchased or sold interest for interest bearing bonds should be calculated.

For securities whose issue market has trade based accounting:

Interest value date = Trade date

For securities whose issue market has settlement date based accounting, the settlement date is defaulted to the settlement date. You have the option to change the defaulted date. However, the interest value date that you enter in this case should be in the same coupon period as the settlement date.

Interest computations will be performed on-line from the last coupon date (including) to interest value date (excluding) in the case of deals where settlement date is before ex-date. In case the settlement date is past the ex-date the computation will be from interest value date (including) to the next coupon date (excluding). The interest might need to be received or paid depending on whether the deal is a buy or a sell.

Price in Local Currency

Enter the price at which the deal was transacted expressed in the local currency. This field is applicable only for nominal quoted index securities. If you specify the deal price in the index currency, the local currency equivalent is displayed in this field.

You can enter the price of the security as a price or a percentage of the price depending on the price quotation method that you specified earlier. You can enter "T" or "M" to indicate thousands or millions, respectively. For example, 10T means 10,000 and 10M means 10 million.

The deal price would include or exclude the purchased or sold interest depending on whether the security being dealt in is quoted flat or plus accrued. For a spot deal, if the deal price varies from the market price by more that the sensitivity range specified for the security you will be prompted for an override or will not be allowed to process the deal.

Receive

The receive instructions that you can specify to the SKL involved in a deal are:

- Receive against payment

- Receive free

Absolute price

Incase the price quote is Premium, %Premium, % Price etc, the Absolute Price is the actual price (i.e. Premium + FV) of the security. This is a system generated field.

Local Currency Quantity

Enter the number of units traded in the deal expressed in the local currency. This field is applicable only for units quoted index securities.

For indexed securities, you can specify the number of units that are traded either in the index or local currency. If you express the deal quantity in the local currency, the equivalent in the index currency is displayed in the field titled Deal Quantity. Similarly, if you indicate the deal quantity in the index currency, it’s equivalent in the local currency is displayed in this field.

Maturity Date

This field is applicable only in case of Bonds or securities with a redemption date. This is automatically generated to reflect the maturity date of the security being traded.

Original DSTL Date

This is automatically generated by the system to reflect the original delivery settlement date as per the market code maintenance for Spot days. You can change the date by using the calendar menu.

Transaction Date

The transaction date is the date on which you entered the deal into Oracle FLEXCUBE. The system defaults the transaction date to today's date. Normally, the transaction date would be the same as the trade date of the deal. It would differ from the trade date if you enter a back valued deal.

Deal Input Time

This is system updated date and time stamp.

Quote By

This is the Quantity quotation method. Here you specify whether the Security quantity quoted above is in Units or in Nominal.

22.3.3.1 Specifying details for the buy and sell leg of a deal

In this section we will discuss the details that you should specify for the buy and sell legs of a deal. The preferences specified for the buy and sell products defined for the product combination will be made applicable to the respective legs of the deal.

For each leg of the deal, you have been provided a toolbar using which you can capture details specific to the deal leg.

These icons together with the functions they invoke have been dealt with in the subsequent paragraphs.

Identifying each leg of a deal

Oracle FLEXCUBE assigns a unique reference number to identify both the buy and sell legs of a deal. Besides helping to identify the leg of the deal, this number tag is used in all the accounting entries and transactions related to the leg that it represents.

The deal leg reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number. The Julian Date has the following format:

“YYDDD”

Here, YY stands for the last two digits of the year and DDD for the number of day (s) that has/have elapsed in the year.

User Reference

You can enter a unique reference number for the sell and the buy legs of a deal. The leg will be identified by this number in addition to the ‘Leg Reference’ generated by the system. By default, the Leg Reference generated by the system will be taken as the User Reference.

Indicating the broker

If you are processing a bank buy or bank sell deal that involves brokerage, you can indicate the ID of the broker through whom the deal was brokered. You can select a Broker ID from the picklist available. The picklist will contain a list of valid brokers with whom you can enter deals. On indicating the broker code, the name of the broker is also displayed.

You will be allowed to enter details of a broker only if brokerage was allowed for the product to which the deal is associated.

Indicating whether your liability to the deal should be tracked

You can indicate whether your liability to the deal should be tracked. If you indicate positively you can indicate the credit lines against which the buy and sell leg of the deal should be tracked.

Click ‘WalkIn’ button from the relevant leg of the deal to specify the credit line against which the deal should be tracked. The screen that corresponds to this button is discussed under the head 'Specifying credit administration details'.

22.3.3.2 Specifying Details of the Sell Leg

You can specify the following details for the sell leg of a deal:

- The Portfolio from which you are selling securities

- The counterparty (the holder of the portfolio from which you are selling securities)

- The safe keeping location from which securities need to be collected

- The account at the sake keeping location, from which the traded securities need to be transferred

- Details of the securities dealer at your bank who sold securities from the portfolio

- The money settlement date

A note on the settlement date

The money settlement indicates the date by which the buyer should pay for the securities bought. The settlement date should be later than or the same as the Trade date and earlier than the maturity date of the security.

For forward deals, the settlement date should be later than the default Spot date.

For spot deals in the primary or secondary market, the settlement date should not be a holiday in any of the payment currencies. An override will be sought if the money settlement date is a holiday in any of the currencies involved in the deal.

22.3.3.3 Specifying Details of the Buy Leg of a Deal

In this section we will discuss the details that you should specify for the buy leg of the deal. You can specify the following details for the buy leg of a deal:

- The Portfolio into which you are buying securities

- The counterparty (the holder of the portfolio into which you are buying securities)

- The safe keeping location to which securities need to be delivered

- The account at the sake keeping location, to which the traded securities are being transferred

- Details of the securities dealer at your bank who bought securities into the portfolio

- The date by which the seller should receive the amount for which securities were sold

Besides these, you can specify details for the buy leg by invoking the buttons on the Securities Deal details 'Main' screen.

22.3.3.4 Trading in securities that do not belong to a portfolio

You may encounter a situation where your customer requests you to sell securities that are not held in any of the portfolios that the customer maintains with the bank.

When entering the details of this deal in Oracle FLEXCUBE, you can indicate this situation by checking against the option 'Accompany Lodge'. By checking this option, you indicate that the holding of the customer in any of the portfolios maintained with the bank should not be reduced on account of the deal.

For example, your customer requests you to sell 100 units of a security. But these securities do not belong to any portfolio that the customer maintains with the bank.

Another such situation is when a customer requests you to buy securities but does not want them to be held in any portfolio that the customer maintains with the bank. When entering the details of such a deal, check against the option 'Accompany Withdraw'. By checking this option you indicate that the holding of the customer in any of the portfolios maintained with the bank should not increase on account of the deal.

Note

This situation will arise only when the bank is trading securities on behalf of a customer or while processing a deal for a walk-in-customer.

22.3.4 Entering 'Additional Details' of a Deal

To recall in the Main details screen you have captured details regarding the deal. In the Additional Details screen you can define details like the spot price details, the settlement currency, the settlement SKL, exchange rates for deals in a foreign currency and other such details.

22.3.4.1 Specifying Spot Price Details for the Deal

For forward deals you should also indicate spot price details. The spot price details that you specify will determine the calculation of forward profit that you have made or the loss that you have incurred in a forward deal.

Spot Price and Spot Date

The spot price refers to the price at which the security is currently quoted in the market. This price is compared with the deal price to determine the forward profit or loss. The market price of the security as maintained in the price code maintenance screen is defaulted. You have an option to change the default.

The forward profit or loss is the difference between the deal price and the spot price and is calculated from the spot date of the deal to its settlement date.

The spot date is calculated by adding the spot days specified for the market in which the security is traded to the trade date.

Spot date = Trade date + spot days

The forward profit or loss would be accrued from the spot date to the settlement date of the deal. The accrual of the forward profit and loss will be done on the basis of the accrual preferences specified for the portfolio to which the security belongs.

Even if you have indicated that no accrual should be done, on the settlement of the deal the accrual will be done automatically.

Note

In case of forward deals Spot Price is defaulted from the market price maintenance and the spot price cannot be changed.

Payment Currency

If the currency of the security is different from the settlement currency, you should indicate the currency in which payment is made. All the components of the deal like the deal amount, the charges and tax that is levied will be settled in this currency.

By default the security currency is taken to be the payment currency.

If you indicate the settlement currency to be different from the security currency you should also indicate the exchange rate to be used for the conversion.

22.3.5 Price Details of the Deal

The following information of the price of the deal is displayed:

Interest Value Date

This is the number of days for which accrued interest has been calculated. The interest value date that you specified earlier is used in the calculation. For cum-coupon deals, this is the difference between the last coupon date and the interest date. For ex-coupon deals the interest days is the difference between the settlement date and the ex-coupon date.

Discount

This is the amount of rebate in the purchase or sale price of the deal, as compared to the nominal price of the security.

Premium

This is the price or amount paid by the buyer in addition to the nominal amount.

Forward P & L

The forward profit or loss is the amount of profit made or the loss incurred in the deal. It is the variance between the deal price and the spot price of the security.

Deal Nominal

The deal nominal refers to the net consideration of the deal. The sum of all the components of a deal is the net value of the deal.

Adjusted Price

This is the price of interest bearing instruments exclusive of the interest component. Interest bearing instruments can be quoted as flat or plus accrued. The adjusted price is applicable only for flat quoted instruments. The price of such instruments tends increases during the period nearing the interest payment date and subsequently falls after the interest payment date. The adjusted price is thus the deal price stripped of the interest component.

22.3.5.1 Specifying Trade Details

Deal Type

You can select the Deal type from the drop down list. The Deal Type can be

- Primary

- Secondary

Priority

Indicate the priority of the deal you are processing. Select one of the following options from the option list:

- High

- Normal

- Low

The priority that you specify is picked up and used by S.W.I.F.T.

Dealer

Indicate the dealer at your bank who bought securities from the portfolio. Select a dealer code from the option list.

Conforms to ISMA

This is an indicator to denote whether the deal has been made as per ISMA (International Securities Market Association) requirements. This indicator is displayed during deal confirmation. Indicating the security series

Security Series

Here you can specify the format of the security. You can select a format from the list:

- Dematerialized

- Immobilized

- Combination

22.3.5.2 Marking a Securities deal for Banker’s Acceptance

A Banker’s Acceptance (BA) is a facility, by which you guarantee the redemption of a security. This facility is processed in Oracle FLEXCUBE by the creation of a loan or a money market placement deal, with the issuer of the security as the beneficiary of the loan or the placement.

Placement Loan Reference

If the security that you have chosen for the deal, as well as the Sell leg deal product, is enabled for BA processing, then, on authorization of the deal, a loan or an MM placement is created with the issuer of the security as the counterparty. The loan / MM placement is created under the Loan / MM product that you have maintained as part of Securities Bank Parameters. The System performs the following validations while saving the deal:

- The Quote By field should have the value ‘Nominal’

- A Loan/MM product should have been maintained for Banker’s Acceptance as part of Securities Bank Parameters

- In case of a Customer Buy/ Bank Sell deal, money and deal settlements should take place on the same day

- The deal should always be at a discount, as BAs are always traded at a discount in the secondary market

Note

For such a deal, the portfolios available to you for selection for the Sell leg will be those, which you have enabled for Banker’s Acceptance.

The loan / MM placement that is created has the following attributes defaulted from the specifications of the concerned security / deal:

- The Booking Date: This defaults to the Trade Date of the deal

- The Value Date: This defaults to the deal settlement date

- The Maturity Date: This defaults to the Redemption Date of the security

- The Amount: This defaults to the Nominal Amount of the sell transaction

- The Interest Amount: This defaults to the Discount Amount of the securities deal

The Interest Rate Type: This defaults to the value – ‘Special’.

The other attributes of the loan / MM contract are determined by the product under which it originates.

Note

After authorization of the securities deal, the loan / MM contract and the securities contract follows their respective life cycles.

The Reference Number of the Loan / MM contract created due to the processing of a BA deal is displayed in the Securities Deal Input screen. You can click ‘V’ icon next to the display field to call up the Loan / MM contract screen corresponding to this Reference Number.

Setting up a BA deal

The steps involved in setting up a BA deal are listed below.

- Define a security product, with the Banker’s Acceptance option enabled and with the product type as Zero Coupon Bond

- Define a security under the above product. Keep the Banker’s Acceptance option enabled and quantity quotation as ‘Nominal’

- Define an SK Location with the Banker’s Acceptance option enabled

- Specify a GL as the settlement destination for the above SK location customer

- Define a portfolio product of type ‘Issuer’ with the Banker’s Acceptance option enabled

- Define a bank portfolio. Map this portfolio to the same SK location as mentioned above

- Define a portfolio under the above portfolio product and keep the Banker’s Acceptance option enabled. Map this portfolio to an SK location, for which you have allowed Banker’s Acceptance

- Define a Loan/MM placement product in the Securities Bank Parameters maintenance

- Define a ‘Bank Sell’ type of deal product with the Banker’s Acceptance option enabled

- Define a combination Bank Sell – Bank Buy or Bank Sell – Customer Buy product, using the above Bank Sell product

- Enter a Securities deal using the above combination product and security. The portfolio that you specify for the Sell leg will need to be enabled for BA.

- On authorization of the securities deal, a loan / MM contract is created with the issuer of the security as the counterparty.

Refer to the other relevant chapters in this User Manual for details of relevant data inputs.

22.3.5.3 Specifying Advices for the Deal

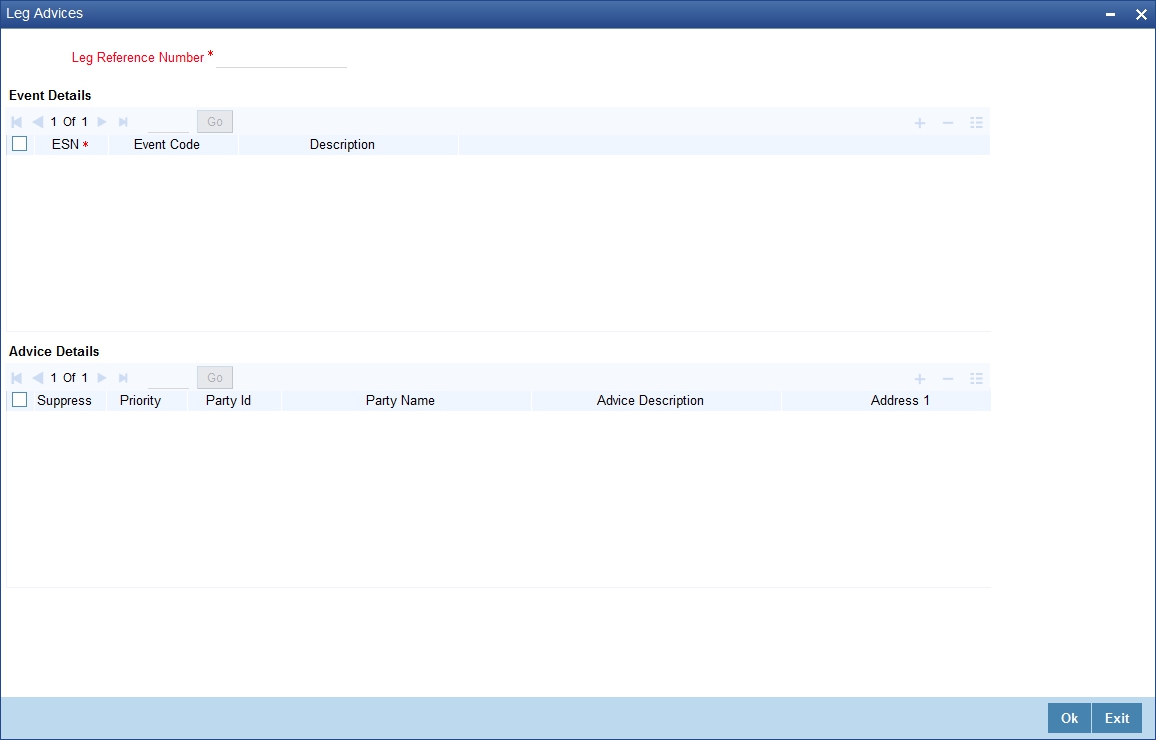

From the Securities Deal Input screen, click ‘Advices’ button. The advices screen is displayed. To recall, the advices that can be generated for the events that occur during the life-cycle of a deal are defined for the product to which the deal is associated.

The details of the advices applicable for an event are displayed in the Advices screen. The party type to whom a specific advice should be sent is picked up automatically based on the type of deal you are entering and the parties involved in the deal.

Choose the event for which you want to view advice details. .The address of the party who is the recipient of the message, will be picked up by default, based on the media and address maintenance for the party. You can change either of them.

For a payment message by SWIFT, you also have the option to change the priority of the message.

Suppressing the generation of an advice

By default, all the advices defined for a product will be generated for the deals involving it. If any of the advices are not applicable to the deal you are processing, you can suppress its generation.

Indicating the generation priority

For a payment message by SWIFT, you also have the option to change the priority with which the message should be generated. By default, the priority of all advices is marked as 'Normal'.

You have the option to prioritise a payment message to one of the following options:

- Normal

- Medium

- High

Indicating the medium of generation

The medium through which an advice is transmitted and the corresponding address will be picked up based on the address and media maintained for the customer who is the recipient of the message.

You can, however, change either of these while processing a deal. Typically, if changed, both of them will be changed.

Click ‘Exit’ button to reject the entries you have made or to exit form the screen. In either case, you will be taken back to the Securities Deal Input screen.

22.3.5.4 Levying Transaction Charges on a Deal

For each leg of the deal you can specify the charges that you levy. Charges are applicable only for customer legs of a deal (customer buys, customer sells, lodge, withdraw and block securities).

The characteristic feature of a charge is that it is always booked in advance and is not accrued, as a charge is collected only when it is due.

To recall, you have defined the attributes of a charge by defining a ‘Rule’. A rule identifies the basic nature of the charge. You have further defined a Charge class where you have enriched the attributes of a rule. We shall refer to these classes as 'components'.

Each charge component in turn is linked to a deal product. All the charge components linked to a product are defaulted to the deals associated with it. Thus each time you enter a deal, you need not specify when and how charges should be collected.

However, while capturing the details of a deal, you can choose to associate a component to the deal. Further, you can modify some of the attributes defined for the applicable component.

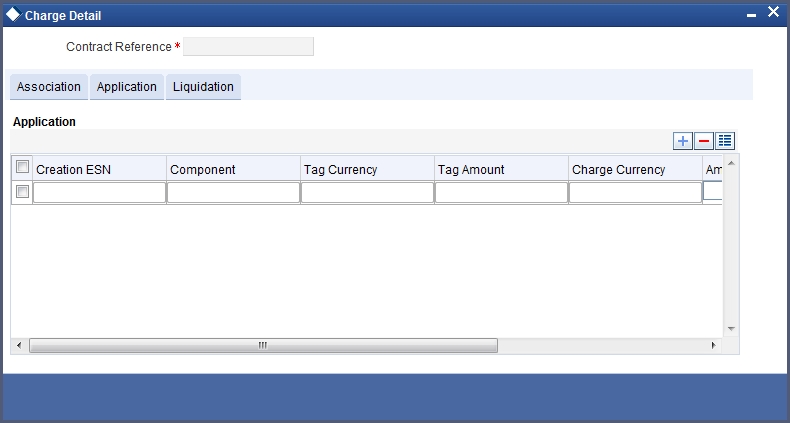

From the Securities Deal Input screen, click ‘Charges’ button - The Contract Charge Details screen is displayed.

The reference number of the deal leg for which you are defining charge details is displayed. The screen will contain a list of all the charge components applicable to the deal leg.

Associating a charge component to a deal leg

All the charge components applicable to the deal leg you are processing will be displayed together with the rule that is linked to the component.

In this section of the screen you can:

- Change the charge rule linked to the component

- Disassociate a charge component from the deal leg

Changing the charge rule linked to a component

The rule that is linked to a charge component is displayed next to the component. To link a new rule to the component. A list of all the charge rules maintained will be displayed. Select the appropriate rule from the picklist. The new rule will be made applicable to the charge component.

Disassociating a charge component from the deal leg

You can disassociate a charge component from the deal leg. In the 'Association' section of the Contract Charge screen, click against the waive option positioned next to the component.

In this case, the charge component is attached to the deal leg but is not calculated.

Indicating the charge components to be applied to a deal leg

In the application section of the screen, you can indicate the charge components that should be applied to the deal leg. The list of components that is displayed depends on the charge components that you have associated to the deal leg.

The following details of the component are also displayed:

- The basis component on which the charge is levied

- The currency of the basis amount

- The basis amount

- The charge amount and the

- The currency in which the charge amount is defined.

You can change the charge amount that is calculated using the class applicable to the component.

Waiving a charge on a deal leg

You also have the option to waive the component for the deal leg that you are processing. If, for some reason you want to waive the charge on the deal you are processing, you can do so by checking against the 'waiver' option in the application section of the screen. The charge will be calculated but not applied.

You can waive a charge only if it is yet to be liquidated.

Consider as Discount

If the charge component is to be considered for discount accrual on a constant yield basis, ‘Consider as Discount’ option will be checked. You cannot modify this value.

In case the charge currency is not equal to the contract currency and the contract currency is equal to the settlement account currency, the exchange rate as specified in the Settlements Screen will be used to convert Charge Amount to Contract Currency.

Charge liquidation

When a charge component that is applied to a deal is liquidated, the relevant accounting entries are passed. The contract charge screen displays:

- The charge components that have already been liquidated

- The amount that was liquidated

- The currency in which it was liquidated

22.3.5.5 Specifying Deal Matching Preferences

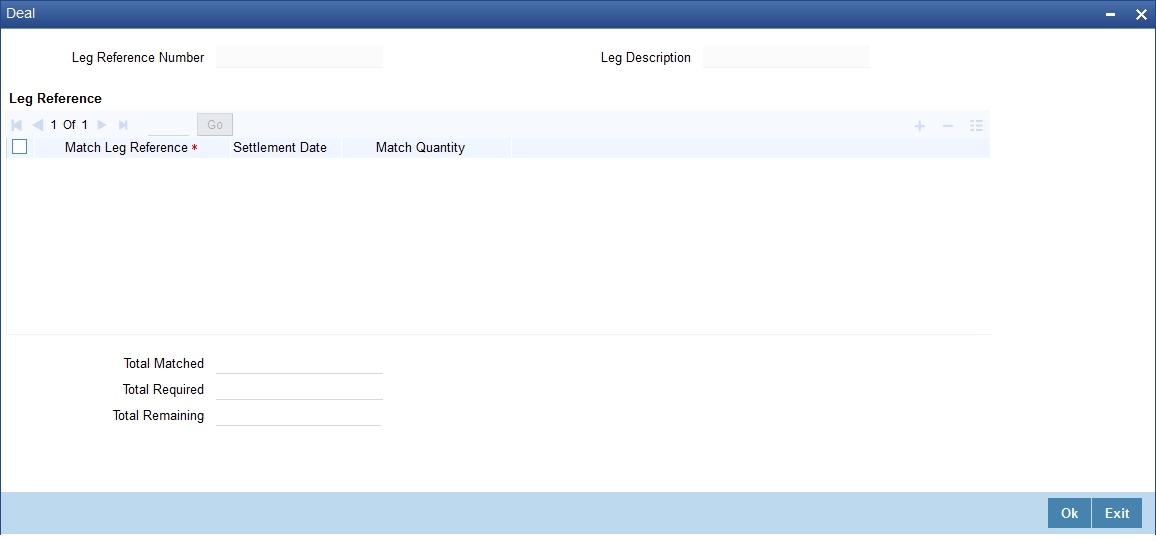

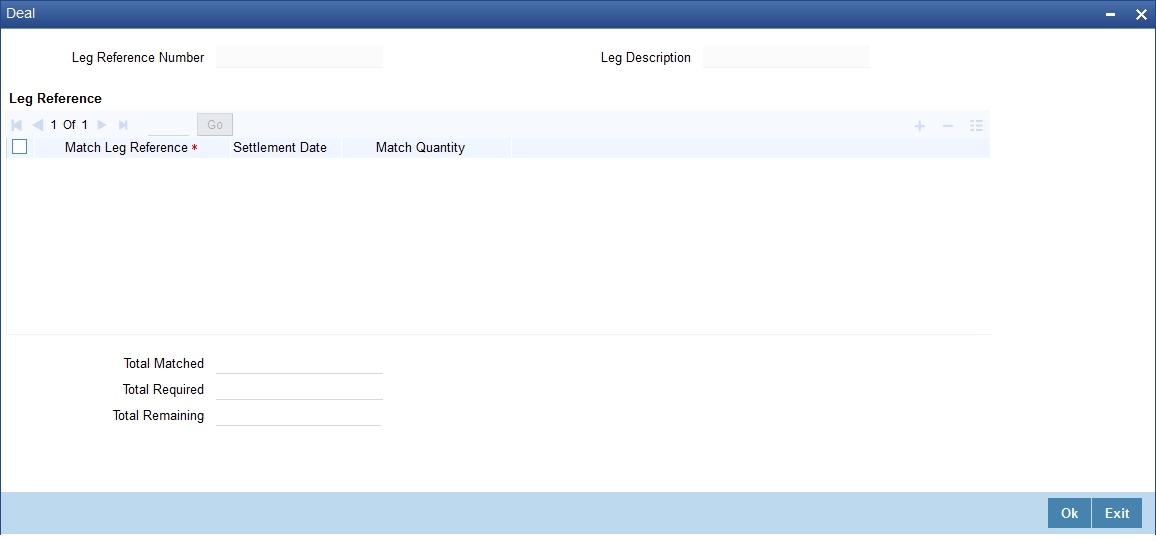

If the portfolio from which you are buying or selling involves deal matching, you should indicate against which of the earlier buy deals the sell deal is to be matched. Click ‘Deal Match’ button from the Securities Deal Input screen to match the sell leg of a deal to the buy leg. Click this button from the buy leg section of the screen to indicate the matching preferences and from the sell leg section to view the matched details.

For the sell leg

If you are processing the sell leg of securities deal, and if the portfolio from which you are selling involves the deal matching costing method, you should also match the sell leg to previous buys in the portfolio.

Procedure

Indicate the reference number of the buy deal, which you have selected for deal matching. In other words, indicate the buy deals done in the same security and portfolio to be matched with the sell leg of the deal. You can select a leg reference number from the picklist available.

On indicating the match leg reference, you should also indicate the number of units or nominal that should be matched. Click add icon to add the details of another buy leg to which you want to match the sell leg. Click delete icon to cancel a buy leg that you have mapped to the sell leg.

The summation displayed at the bottom of the screen contains the following information:

- The total quantity of securities that have been matched

- The number required to be matched

- The number yet to be to be matched

For the sell leg

While processing the sell leg of the deal, you can view details of the buy deals that have been matched to the sell leg. The reference number of the buy deal from which securities have been matched is displayed together with the number of units or nominal for which matching is done.

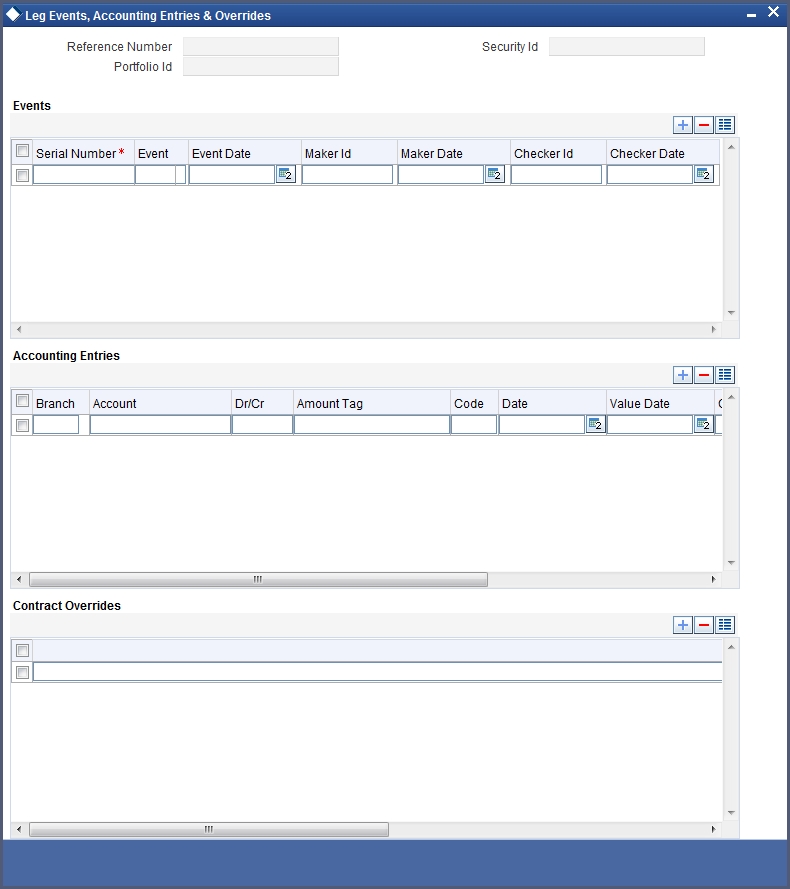

22.3.5.6 Viewing Event Details

Click ‘Events’ button from the Securities Deal Input screen, to view the accounting entries and overrides for an event. The details of events that have already taken place for the deal leg will be displayed, along with the date on which the event took place.

22.3.5.7 Accounting Entry Details

Highlight the event for which you want to view accounting entries. All the accounting entries that were passed and the overrides that were encountered for the event will be displayed.

The following information is provided for each event:

- Branch

- Account

- Dr/Cr indicator

- Code

- The date on which the entry was booked

- Value Date

- The deal currency

- Amount in deal CCY

- The foreign currency equivalent (if applicable)

- The exchange rate that was used for the conversion

- Amount in local currency

- All the overrides that were encountered for the event will also be displayed.

Click ‘Exit’ button to exit this screen. You will be returned to the Securities Deal Input screen.

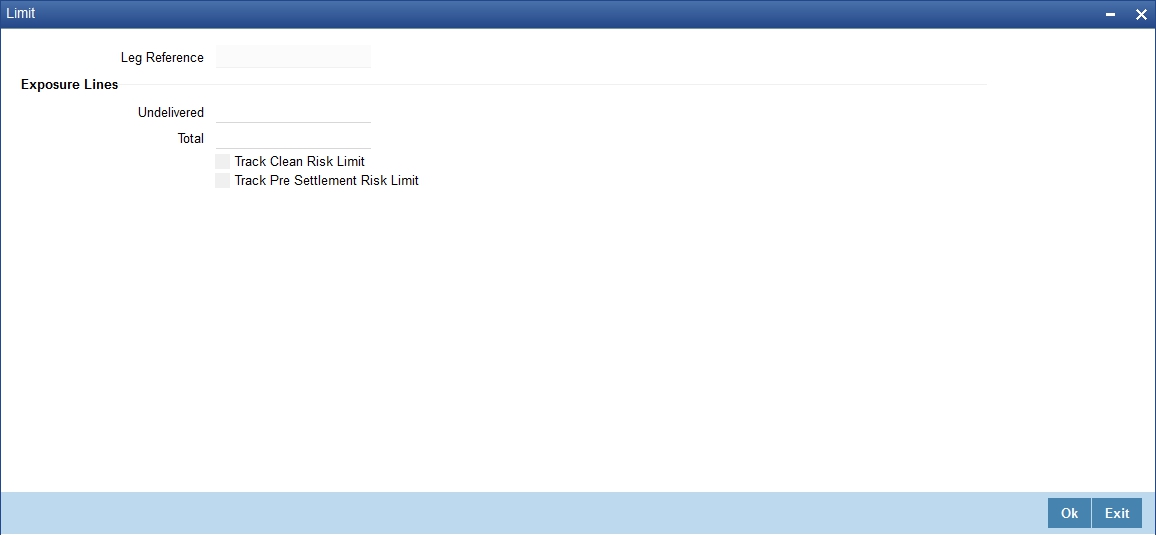

22.3.5.8 Specifying Credit Administration Details

In Oracle FLEXCUBE, liability tracking is done using credit lines allotted to a customer. If you indicated that your exposure to the deal should be tracked, you can indicate the credit lines under which it should be tracked.

Click ‘Limits’ button from the Securities Deal Input screen, the Limits screen is displayed.

In this screen you can indicate the credit lines under which you want to track your:

- Undelivered risk exposure

- Total exposure to the deal leg

Your undelivered risk arises only if you specified that the mode of security settlement for the deal is 'deliver free'. You can choose a credit line from the picklist available in this screen.

Click ‘Exit’ button to delete the entries. In either case you will be returned to the Securities Deal Input screen.

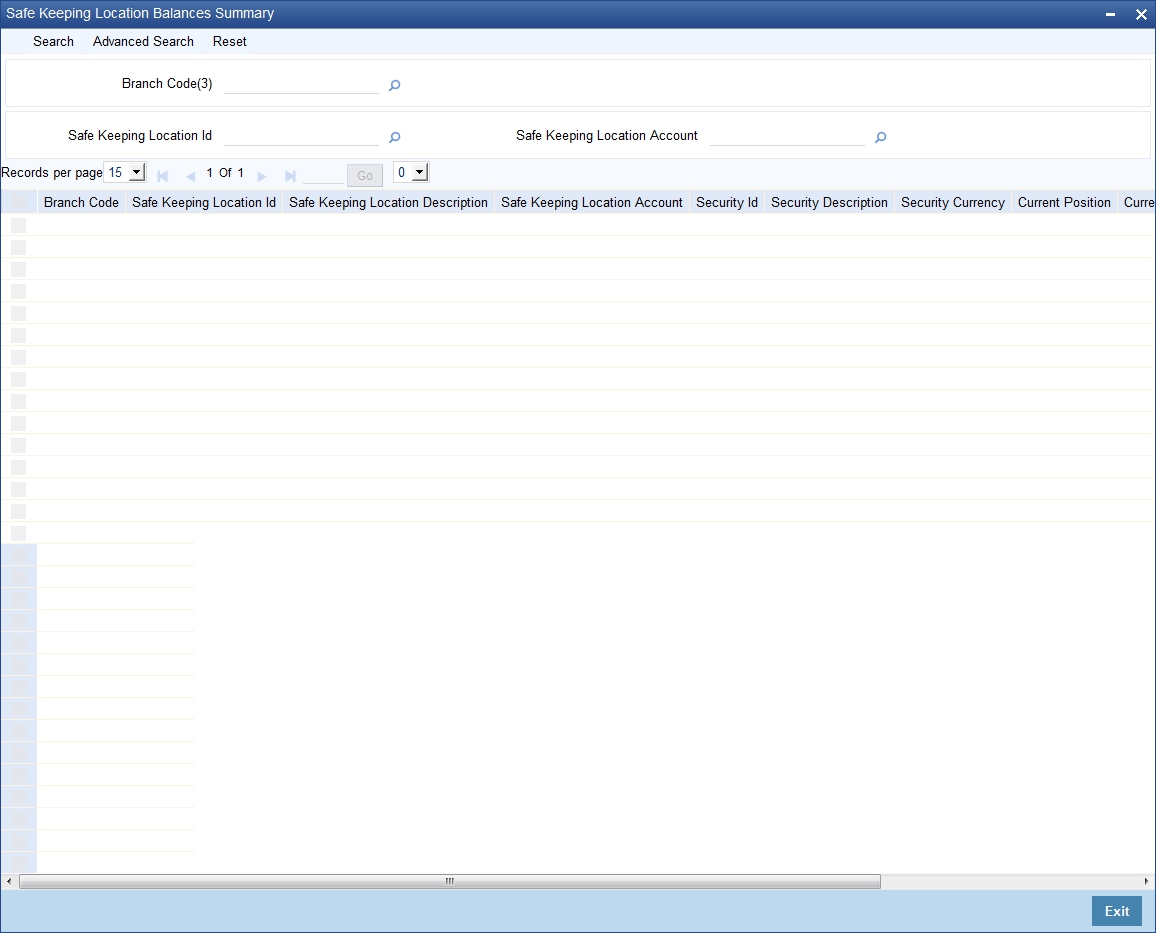

22.3.6 Viewing Safe Keeping Location Balances

You can view the safe keeping location balances in the 'Safe Keeping Location Balances Summary' screen. You can invoke this screen by typing 'SESXSKBL' in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Branch Code

- Safe Keeping Location Id

- Safe Keeping Location Account

Select any or all of the above parameters for a query and click 'Search' button. The records meeting the selected criteria are displayed.

If you are allowed to query, then system displays the following details pertaining to the fetched records:

- Branch Code

- Safe Keeping Location Id

- Safe Keeping Location Description

- Safe Keeping Location Account

- Security Id

- Security Description

- Security Currency

- Current Position

- Current Holding

- Opening Position

- Opening Holding

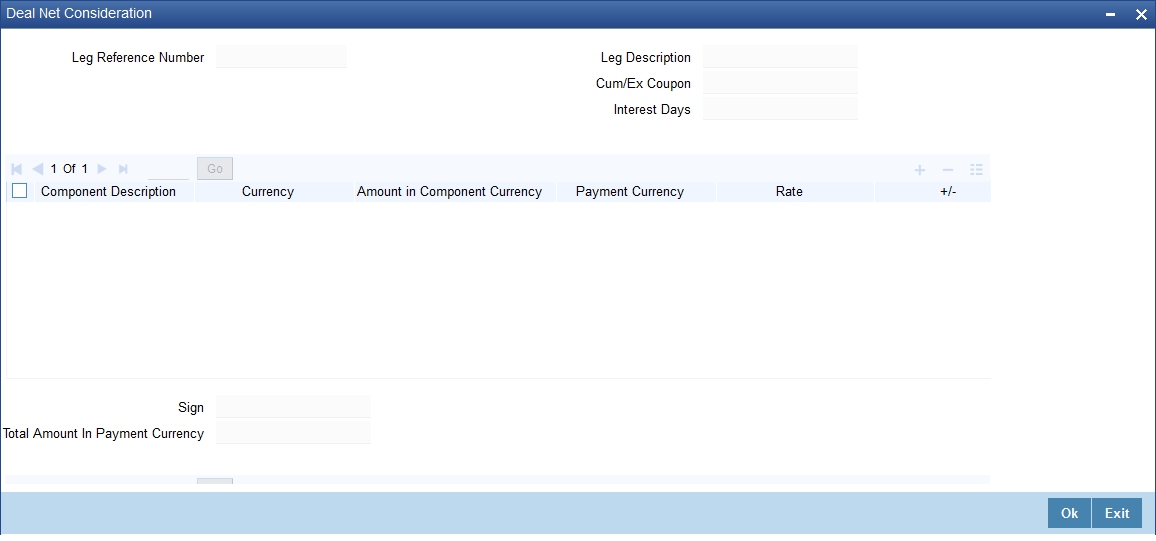

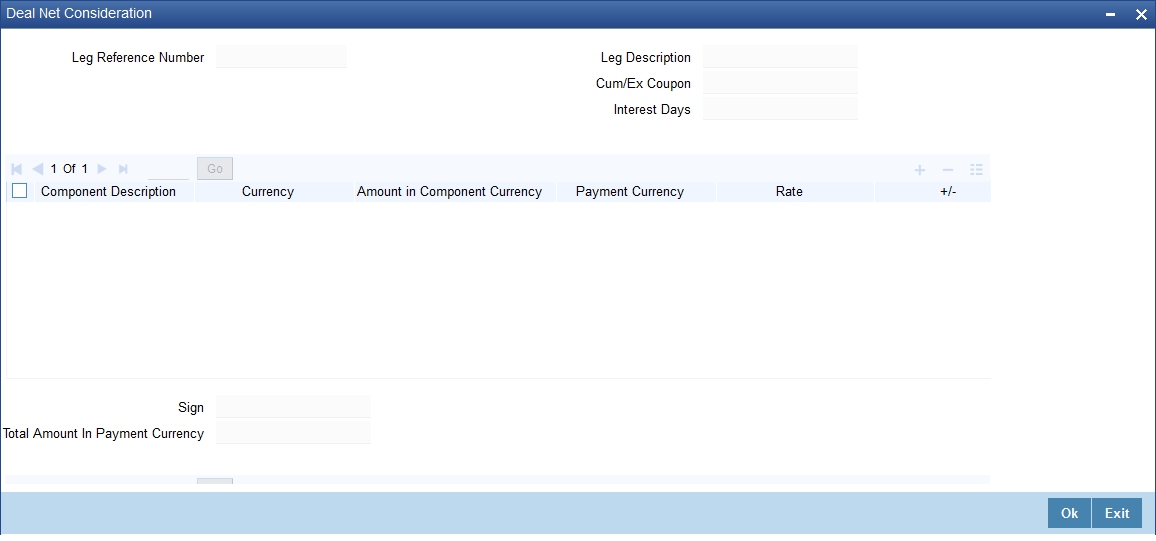

22.4 Deal Net Consideration

The sum of all the components of a deal is the net value of the deal. While processing a leg of a securities deal, you can view the net consideration of the deal.

Click ‘Netcons’ button from the Securities Deal Input screen. The deal net consideration screen is displayed.

From this screen, you can choose to view either the:

- Interest

- Net consideration of the deal

Viewing the Net consideration

The sum of the different components of a deal determines the net value of the deal. To recall while defining a charge or tax (transaction and issuer) component, you can indicate whether the charge or tax component should be taken into account, when determining the net value of a deal.

All other components of the deal like the interest, premium, discount, forward profit or loss etc will be included in the net consideration of the deal.

The screen displays in tabular columns the following details:

- The component in consideration

- The currency in which the component is defined

- The component amount (in the component currency)

- The payment currency of the component

- The payment amount derived using the exchange rate that you specify

- The direction in which money flows. A (+) sign next to a component indicates that the buyer pays the component amount to the seller and a (-) sign indicates that the seller pays the component amount to the buyer.

If the component and payment currencies are different, the default exchange rate used for the conversion is displayed. You have the option to change the exchange rate to be used in the conversion. However, the rate that you specify should be within the exchange rate variance specified for the product to which the deal is associated.

The net consideration for the deal expressed in the payment currency is displayed at the bottom of the screen.

Viewing details of the bought or sold interest

Along with other interest details, the interest amount is displayed. This is the amount of accrued interest to be paid or received on the settlement date. The interest is calculated by the system depending on whether the deal is an ex coupon or cum-coupon deal. You have the option to change the amount calculated for the interest and issuer tax components.

Interest is applicable only if:

- It is an interest bearing security

- It is a secondary deal

- Buy or sell type of deal

- Deal type is spot or forward

22.4.0.1 Viewing the KEST amount during deal processing

At the time of processing a security deal for a customer, the system will pick up the KEST rate from the market price maintenance (maintained for the various security codes) based on the KEST type specified for the customer.

If the KEST rate is non-zero, the system will calculate the KEST amount for the above-mentioned amount tags. It is displayed in the ‘Deal Net Consideration’ screen.

Click on ‘Netcons’ in the ‘Securities Deal Input’ screen to invoke the ‘Net Consideration’ screen.

If the picked-up KEST rate is zero, the amounts will not be displayed in the ‘Net Consideration’ screen, as the amount will also be zero.

The system will not calculate the KEST amount on the Bank leg of the security deals. Therefore, for Bank Buy Customer Sell or Bank Sell Customer Buy type of deals, the system will calculate the KEST for the relevant Customer leg. This is displayed as part of Net Consideration.

Note

If the deal has customer buy and sell legs, then, both the customers involved in the deal should necessarily have the same KEST type. If the KEST types are different, you cannot save the deal. This restriction is to have same net consideration amount for both the legs.

22.4.0.2 Viewing the forward profit or Loss in a Deal

If you are processing a forward deal, you can view the forward profit that you have made or the loss that you have incurred in the deal.

The following forward profit or loss details are displayed:

- The deal price

- The spot price

- The deal spot date

The Forward profit or loss amount and the frequency in which it is accrued is determined by the forward profit or loss preferences specified for the portfolio for which the deal is done.

Click ‘Exit’ button to exit the screen, you will be returned to the Securities Deal Input screen

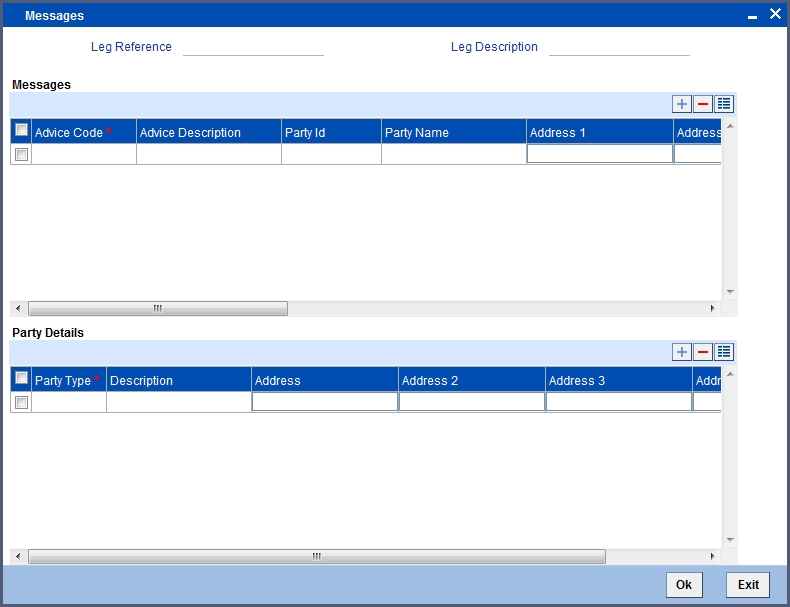

22.5 Specifying Details of the Parties Involved in a Deal

The Parties screen can be used to record details related to all the parties involved in the deal. The advices and messages that are generated for a deal will be sent to the concerned parties based on the details you specify in this screen. Click ‘Parties’ button from the ‘Securities Deal Input’ screen to indicate the parties involved in the deal leg.

You can specify the following for each of the parties involved in a leg of the deal:

- The party type (beneficiary, advising bank, issuing bank, reimbursing bank, etc)

- The CIF ID assigned to the party, if the party is defined as a customer in Oracle FLEXCUBE

- The country to which the party belongs

- The party’s mail address

- The media type through which the advises should be routed and the respective address (es)

The parties involved in a leg of a deal depend on the type of deal you are processing.

The party details for the party type ‘PSET’ will be populated in the following SWIFT messages:

- MT 540

- MT 541

- MT 542

- MT 543

Note

- If you have specified the party type ‘DEAG’ in the ‘Party and Party Narratives’ screen, it is mandatory to specify PSET.

- The party details should not begin or end with ‘/’ and should not have two consecutive slashes such as ‘//’.

Specifying media details for a party

The advices for a party will be sent to the default media maintained in the Customer Addresses table for the party. If you want to send the advices through another medium, you should indicate it in the Parties screen for the party. The address for this medium should also be indicated. The advices will be sent through the new medium only if you indicate so in the Advices screen of Securities Deal Input screen. If not, the advice will still be sent to the default address defined for the party, even if a different medium has been input.

You can use this feature to send a one-off advice through a different medium. For example, for a particular customer, you would normally send all advices through mail and hence haven’t defined SWIFT or TELEX advices at all. But for a particular deal, you want to send the advices through SWIFT. In such a case, you can specify the medium as SWIFT and specify the address only for the deal you are processing.

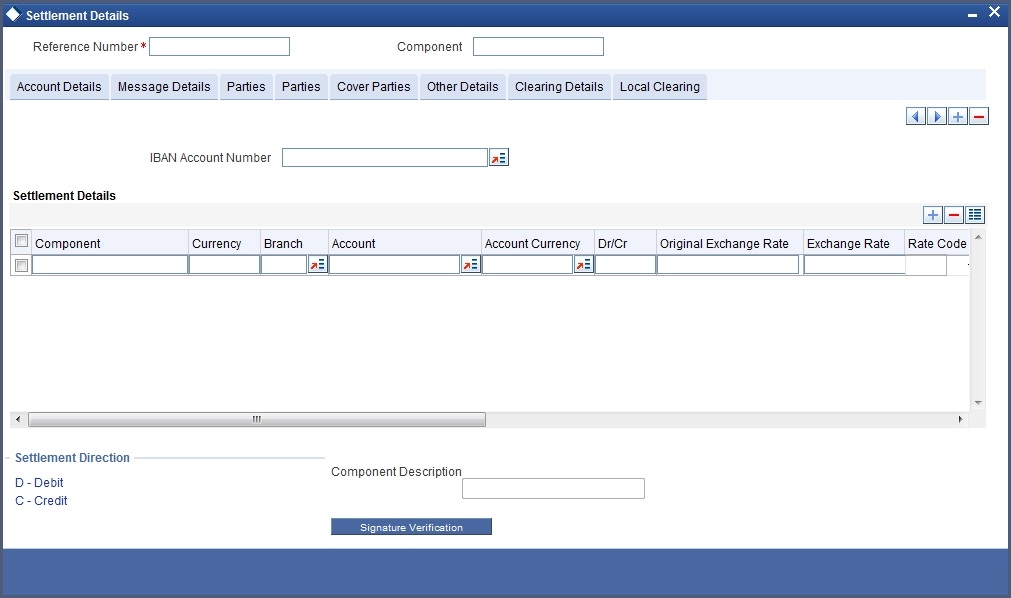

22.6 Settlement Instructions for a Deal Leg

This section contains the following topics:

- Section 22.6.1, "Maintaining Settlement Instructions for a Deal Leg"

- Section 22.6.2, "Capturing Settlement Instructions"

- Section 22.6.3, "Capturing Account Details"

- Section 22.6.4, "Capturing Details of the Deal Output"

- Section 22.6.5, "Capturing Party Details"

22.6.1 Maintaining Settlement Instructions for a Deal Leg

So far, we have discussed the basic information that is captured through the Securities Deal Input screen. To recall, along with other details of a deal, you have also specified the buy or sell amounts and the accounts to be debited or credited. The Debit and Credit amounts (and accounts) indicate the accounting entry that has to be passed at your bank to effect the deal. This entry is for the deal amount only.

Apart from the details of these two accounts, you may have to capture the following details to effect a deal successfully:

- The accounts to be debited for charges, if there are any

- The accounts to be debited for interest that the deal involves

- The method in which the deal is to be settled -- whether it is an instrument or a Message (as in a SWIFT or TELEX message) and

- Details about the rout through which the money settlement should take place

The information that is related to the settlement method and route applicable for a transfer is referred to as “Settlement Instructions”.

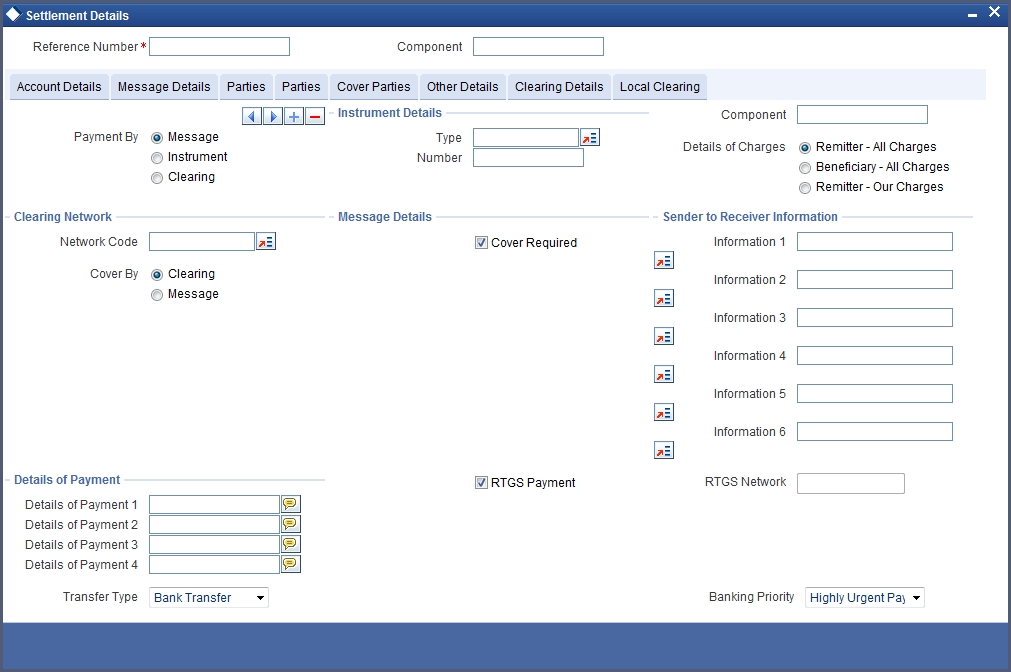

22.6.2 Capturing Settlement Instructions

The Settlement Instructions are captured through four different screens. Click ‘Settlements’ button on the Deal Input screen, to invoke the Settlement Instructions screen. Through the four screens you can capture the following information:

- Account details (details about the accounts involved in the deal that have to be either debited or credited in your branch)

- Message details

- Party details (details about the various parties involved in the deal)

Fund Asset Management

The settlements processing is enabled only if ‘Allow Corporate Access’ has been checked while defining branch parameters in the Branch Parameters – Detail View screen.

If ‘Allow Corporate Access’ is checked for a fund branch and the fund is Portfolio type, then during settlement processing, the settlement account is chosen based on the settlement instructions maintained for the counterparty.

If ‘Allow Corporate Access’ is not checked for a fund branch, then the settlement processing is disabled and the settlement account remains as a fund branch account maintained for the fund.

If the corporate account exists in different branch then the Inter branch account/GL maintenance is used for resolving the bridge account.

22.6.3 Capturing Account Details

As mentioned earlier, you have specified the accounts to be debited and credited for the deal amount in the Securities Deal Input screen. For deals that settle in a currency other than the security currency, the local currency equivalent of the Deal Amount is called the ‘Amount Equivalent’. Amount Equivalent is also the term used for the amount involved in the second leg of the accounting entry for the deal.I

The accounts and amount involved in the Debit and Credit legs of the accounting entry for the deal amount will be displayed, as you have already entered them in the Securities Deal Input screen. These details cannot be changed here. If a change is necessary, you have to go back to the Deal Input screen and specify the change.

For the other components involved in a deal, like charges, etc, you have to specify the account details in this screen. These details include the component, the currency in which it is paid, the payment account and its currency, the branch of your bank to which the account belongs, the exchange rate (in the case of the component currency being different from the account currency).

Depending on the component, the system will also display whether the account involved in an entry has to be debited or credited:

- P indicates you credit (Pay to) the account involved

- R indicates you debit (Receive from) the account involved

22.6.4 Capturing Details of the Deal Output

A deal can be settled either in the form of an instrument (a Demand Draft, a Manager’s Check or a Check) or a Message (a S.W.I.F.T, TELEX or Mail message to be sent to the receiver). The details regarding the instrument or message have to be specified in the Message Details screen.

The message details that you specify here are applicable only for S.W.I.F.T. The type of S.W.I.F.T. message that is generated depends on the parties involved in the deal.I

Depending on the method in which you want to settle the deal, you should input either Instrument or Message details.

Specifying instrument details

For a deal that is being settled through an instrument, you should specify the type of instrument being used. It could be Manager’s Check, Check or a Demand Draft. You should also specify the number that will identify the instrument. This number will be printed on the instrument.

If the settlement is through an instrument, you cannot specify party details for the deal.

Specifying message details

For a SWIFT message, you have to specify:

- Whether a Cover has to be sent to the Reimbursement Bank, along with the payment message to the receiver

- Bank to bank payment details, (these can be in the form of instructions or additional information to any of the parties involved in the deal)

- Information from the sender to the receiver

22.6.5 Capturing Party Details

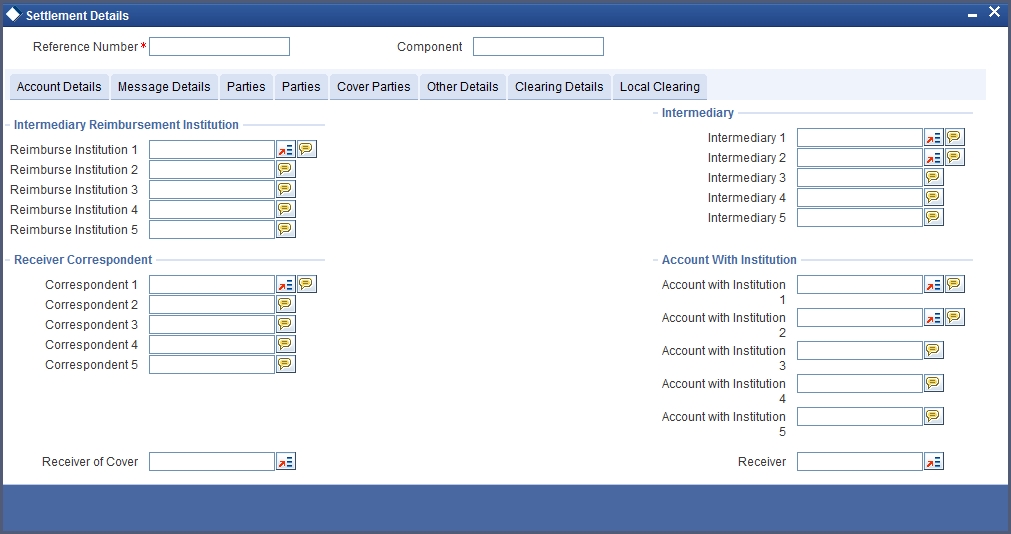

To effect a securities deal, you may have to pass on funds through a series of banks before it actually reaches the ultimate beneficiary. Through the two ‘Parties’ screens you can capture details of all the parties that will be involved in settlement of the deal.I

These screens contain fields that explore the possible routes in which the deal components can be transferred.

Intermediary Reimbursement Institution

An ‘Intermediary Reimbursement Institution’ is the financial institution between the Sender’s Correspondent and the Receiver’s Correspondent, through which the reimbursement of the deal will take place.

Intermediary

The ‘Intermediary’ in a deal, refers to the financial institution, between the ‘Receiver’ and the ‘Account With Institution’, through which the deal component must pass.

The Intermediary may be a branch or affiliate of the Receiver or the account with Institution, or an entirely different financial institution. This field corresponds to field 56a of S.W.I.F.T.

Here you can enter either the:

- ISO Bank Identifier Code of the bank or the

- Name and address of the Bank.

Receiver’s Correspondent

The ‘Receiver’s Correspondent’ is the branch of the Receiver or another financial institution at which the funds will be made available to the Receiver. This field corresponds to field 54a of S.W.I.F.T. You can enter one of the following:

- ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent.

Account With Institution

An ‘Account With Institution’ refers to the financial institution, at which the ordering party requests the Beneficiary to be paid. The Account With Institution may be a branch or affiliate of the Receiver, or of the Intermediary, or of the Beneficiary Institution, or an entirely different financial institution.

This field corresponds to field 57a of S.W.I.F.T. You can enter one of the following:

- ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

- Other identification codes (for example, account number)I

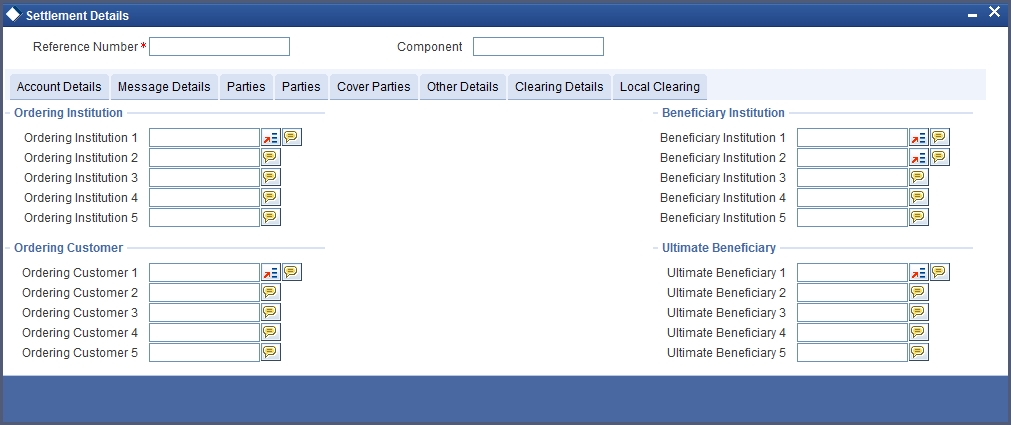

Ordering Institution

The ‘Ordering Institution’ is the financial institution, which is acting on behalf of itself, or a customer, to initiate the transaction. This field corresponds to 52a of S.W.I.F.T.

In this field you can enter one of the following:

- The ISO Bank Identifier Code of the Ordering Institution

- The branch or city of the Ordering Institution

- The Name and address of the Bank

Ordering Customer

The ‘Ordering Customer’ refers to the ordering customer of the deal. Here you can enter the name and address or the account number of the Customer, ordering the transaction. This field corresponds to field 50 of S.W.I.F.T. You will be allowed to enter details in this field only if you have initiated a customer transfer (MT 100 and MT 202).

Beneficiary Institution

Here, you can enter details of the institution in favour of which the payment is made. It is in reality the bank that services the account of the Ultimate Beneficiary. This field corresponds to field 58a of S.W.I.F.T.

You will be allowed to make entries into this field only for Bank Transfers (when the remitter and beneficiary of the transfer are financial institutions -- MT 100 or MT 202). Here you can enter either:

- The ISO Bank Identifier Code of the Beneficiary Institution

- The Name and Address of the Beneficiary Institution

Ultimate Beneficiary

The Ultimate Beneficiary refers to the Customer to whom the deal amount is to be paid. This field refers to field 59 of S.W.I.F.T. You can make entries into this field only for a customer transfer (MT 100 and MT 202).

The number of banks involved in the transfer would depend on the:

- Relationships and arrangements between the sending and receiving banks

- Customer instructions

- Location of parties

- The banking regulations of a country

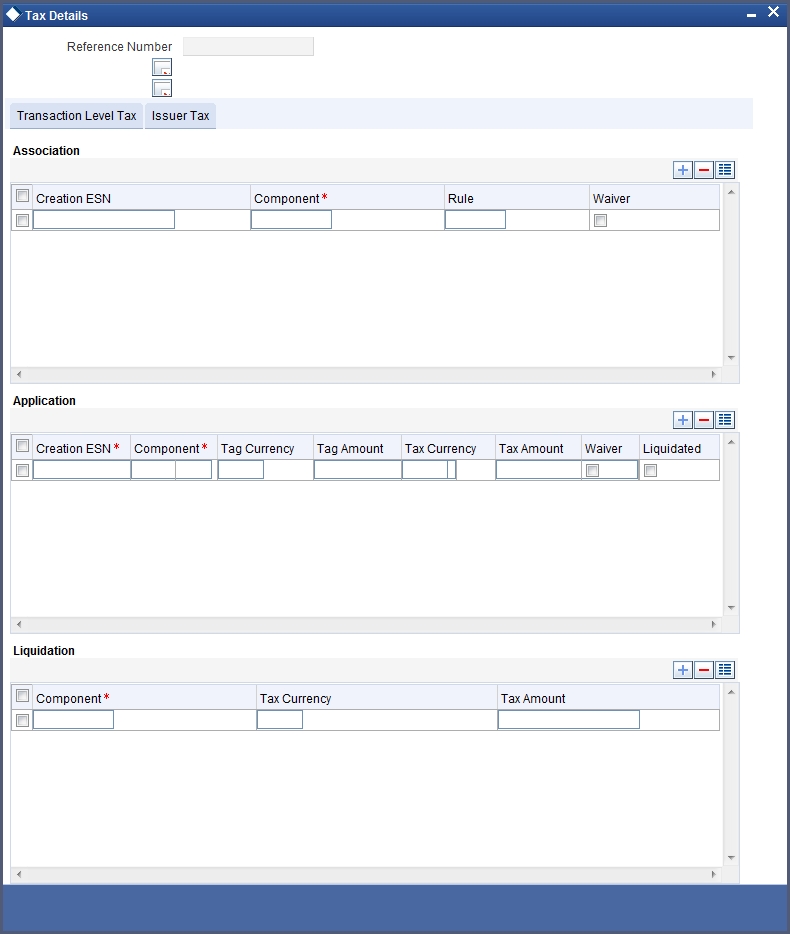

22.7 Levying Tax on a Deal

The tax details specified for the product to which the deal is associated will be automatically applied to the deal. However, while processing a deal, you can waive the application of tax.

You can invoke the Contract Tax Details screen by clicking ‘Tax’ button from the applicable leg of the deal.

22.7.1 Features of the Tax Details Screemn

The reference number of the deal leg for which you are defining transaction tax details are displayed. The screen will contain a list of all the tax components applicable to the deal leg.

Associating a tax component to a deal leg

All the transaction tax components applicable to the deal leg you are processing will be displayed together with the rule that was linked to the component.

In this section of the screen you can:

- Change the tax rule linked to the component

- Disassociate a tax component from the deal leg

Changing the tax rule linked to a component

The rule that is linked to a tax component is displayed next to the component. To link a new rule to the component. A list of all the tax rules maintained will be displayed. Select the appropriate rule from the picklist. The new rule will be made applicable to the component.

Disassociating a tax component from the deal leg

You can disassociate a tax component from the deal leg. In the 'Association' section of the Transaction tax screen, click against the waive option positioned next to the component.

In this case, the tax component is attached to the deal leg but is not calculated.

Indicating the tax components to be applied to a deal leg

In the application section of the screen, you can indicate the tax components that should be applied to the deal leg. The list of components that is displayed depends on the tax components that you have associated to the deal leg.

The following details of the component are also displayed:

- The basis component on which the tax is levied

- The currency of the basis amount

- The basis amount

- The tax amount and the

- The currency in which the tax amount is defined.

You can change the tax amount that is calculated using the class applicable to the component.

Waiving tax on a deal leg

You also have the option to waive the component for the deal leg that you are processing. If, for some reason you want to waive tax on the deal you are processing, you can do so by checking against the 'waiver' option in the application section of the screen. The tax will be calculated but not applied.

Note

You can waive tax only if it is yet to be liquidated.

Tax liquidation

When a tax component that is applied to a deal is liquidated, the relevant accounting entries are passed. The contract tax screen displays:

- The tax components that have already been liquidated

- The amount that was liquidated

- The currency in which it was liquidated

22.8 Processing Brokerage on a Deal

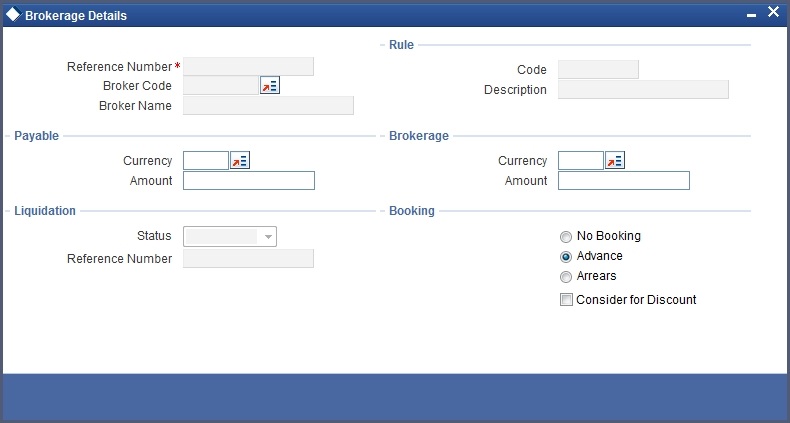

When capturing the details of a deal that involves brokerage, you will have to specify the brokerage details applicable to the deal. To recall, you have already specified the name of the broker through whom the deal was brokered in the Securities Deal screen. The details specified for the broker including the brokerage rule linked to the broker, is defaulted. However, you can change some details, like — whether brokerage should be booked in advance, in arrears or whether it should be waived altogether.

Click ‘Brokerage’ button to define the brokerage details that are applicable to the deal leg you are processing. You will be allowed to enter details of a broker only if brokerage was allowed for the product to which the deal is associated.

22.8.1 Features of the Contract Brokerage Details Screen

The code assigned to the broker through whom the deal was brokered is displayed along with the broker’s name.

If the brokerage payable currency is the same as the brokerage paid currency, then the same amounts (brokerage paid and brokerage payable) are displayed against the currencies. You have the option to change these currencies.

While you cannot input the brokerage payable amount, the brokerage paid amount can be changed.

The following brokerage details are displayed:

- The brokerage liquidation status. If it has been liquidated, the liquidation reference number is also displayed.

- The rule code and description that has been linked to the broker

22.8.1.1 Indicating when brokerage should be booked

Booking

You can indicate preferences as to when the brokerage applicable to the deal should be linked. The options available are:

- Advance

- Arrears

The preference specified for the broker will be displayed. You can change it in this screen, say from advance to arrears or vice-versa.

You have a third option. That is, of waiving brokerage. If you opt for no booking, no accounting entries will be passed for brokerage for this deal.

Consider As Discount

This option is defaulted from the deal product level. However, the following validations are carried out:

- The checkbox is unchecked if the booking method is other than ‘Advance’.

- If the ‘Capitalize’ option is not checked for the broker, deal, product and currency combination in the ‘Charge Class Maintenance’ screen, then this option will be left unchecked.

Note

If you invoke the Contract Brokerage Details screen for operations like delete, change, authorise, liquidate and detailed view, this screen will only display brokerage details. You can change brokerage details for a deal only if you have clicked the Modify option from the Actions Menu.

Click ‘Exit’ button to delete the details and return to the Securities Deal details screen.

22.9 Uploading the Deals for Amendment

From an external system, you can upload Securities Deals that require amendment in Oracle FLEXCUBE. The system will distinguish between the new and the deals that require amendment based on the action code of the uploaded record. For a contract requiring amendment, the action code will be ‘AMND’. If the action code is ‘AMND’, Oracle FLEXCUBE will first check whether the deal exists in the system or not. If it does not exist in the system, an error message will be displayed to notify that the deal cannot be amended.

The Reference Number provided by the external system has to same if it is a new deal or if it is an amendment to an existing deal.

When you upload a new deal, the Reference Number will be displayed in the User Reference Number field for that deal. The User Reference Number will be the basis for checking whether the deal exists or not.

The upload for contract amendment will trigger the ‘AMND’ event. The same event is triggered even when the amendment is done in the ‘Securities Deal Input’ screen.

The fields that can be amended for a Securities Deal are as follows:

- Deliver Free Pay

- Original DSTL Date

- Receive Free Pay

You can upload a securities deal using Gateway. A Module upload procedure is introduced to validate the following data at the time of creating a deal:

- Product Code

- Security Code

- Deal Quantity

It is mandatory to specify a value for the above fields. If the value for any of the above fields is missing, system will stop any further processing of the message. Subsequently, system will send an appropriate error message.

Once the validation is complete for all fields, the errors/overrides generated will be scanned to identify the type of error.

Using the Module upload process, you can also amend financial details for a Securities deal. This upload process will accept 2 sets of upload record type variables. They are:

Set 1 – Combination of base data and request message data

Set 2 – Base data of the deal to be modified

Each field value that needs to be changed will be compared to Set 1 and Set2. Any difference in the field value will trigger a business logic validation. If the validation fails, system will return a fault message.

When a financial amendment is done, the existing contract is reversed and a new contract with the modified value is created. The new contract will contain the reference number of the reversed contract against the field ‘Reversed Contract ref no’.

For cancellations of securities deal on existing transactions, a new upload process is created in Oracle FLEXCUBE. This upload process will trigger reversal of an existing deal.

22.10 Liquidating a Deal

Details about liquidating a deal are explained below.

22.10.1 Money settlement

Money settlement for security deals can be either automatic or manual. While processing a deal you can indicate the manner in which the deal should be settled. Check against the option 'automatic money settlement' from the Securities Deal Main screen to indicate the automatic mode of settlement. Leave it unchecked to indicate manual settlement.

If you specify the automatic mode of money settlement, the deal will be automatically settled on the settlement date that you specify when the beginning of day operations are run.