23. Processing a Block Securities Deal

23.1 Introduction

A block deal is one in which either the buy or the sell legs of the deal are associated with more than one portfolio. For example, in a block securities deal, securities can be bought from portfolios PF01, PF02, PF03 and sold to Portfolio PF04.

To recall, in the Securities Deal Details screen you can enter deals that involve only two parties, the selling, and the buying party. The Block Securities Deal screen allows you to execute a securities deal in the market and allocate the same to several portfolios.

Block deals are processed differently for fund and non-fund branches. In the case of a fund branch you can trade only with bank portfolios. For non-fund branches, block deals can involve customer portfolios.

This chapter contains the following sections:

- Section 23.2, "Block Deal"

- Section 23.3, "Details of a Block Deal"

- Section 23.4, "Entering 'Additional Details' of a Deal"

- Section 23.5, "Uploading the Details of a Block Deal"

23.2 Block Deal

This section contains the following topics:

- Section 23.2.1, "Features of a Block Deal in Oracle FLEXCUBE"

- Section 23.2.2, "Invoking the Block Securities Deal Screen"

- Section 23.2.3, "A Description of the Block Securities Deal Screen"

23.2.1 Features of a Block Deal in Oracle FLEXCUBE

The following are the features of a Block deal:

- A block deal can have multiple parties associated with either the buy or sell leg

- Portfolios of different costing methods can be involved in the multi-leg of the block deal

- Details that you specify for a Block Deal will need to be uploaded. The Upload process will automatically create individual sub deals for each of the portfolios involved in the multiple leg of the deal.

- You can specify details like the certificate numbers, details of the brokerage, tax, charge etc, applicable to the sub deals in the Securities Deal Online screen.

- You will not be allowed to perform any operation on a sub deal directly.

It will have to be done only through the Block deal. Should you need

to amend the main details of a sub deal (details that affect accounting

entries), you will have to delete the block deal, which eventually deletes

all the sub deals. To amend other details of a sub deal like the certificate

numbers, you should:

- Unlock the block deal

- Go to the relevant sub deal

- Unlock the sub deal

- Make the required changes

- Save both the sub deal and the block deal

23.2.2 Invoking the Block Securities Deal Screen

You can invoke the Block Securities Deal Input screen from the Application Browser. To enter the details of a new deal, click new icon from the tool bar.

If you are calling a block deal that has already been created, choose the Block Deal Summary option. The details of all the block deals that you entered earlier will be displayed in a tabular form. From the summary screen, you can open an existing deal by double clicking it.

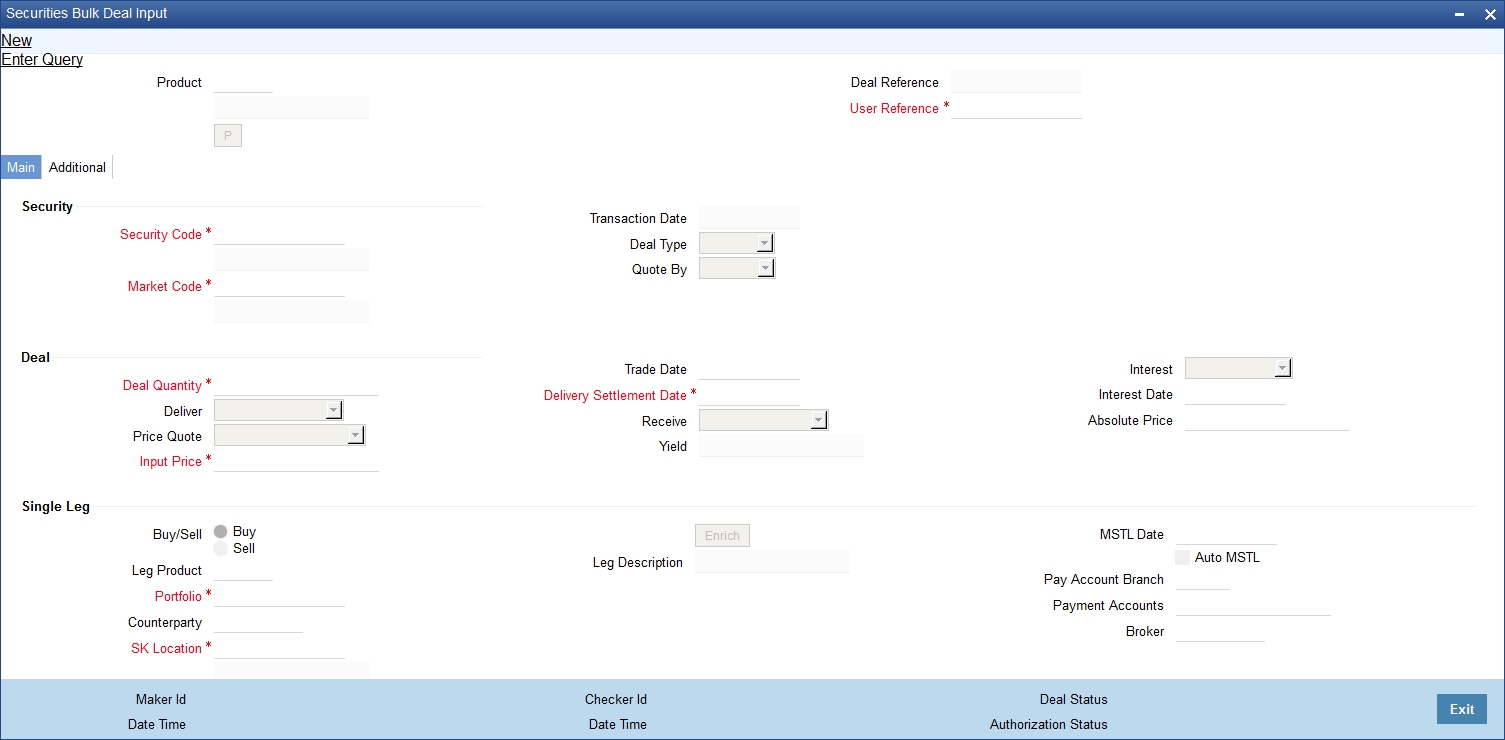

You can invoke the ‘Securities Bulk Deal Input’ screen, by typing ‘SEDXBLDL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the Securities Block Deal screen you can enter details of the multiple parties (portfolios or customers) involved in a deal. Oracle FLEXCUBE will automatically create separate deals for each portfolio involved in the deal. These individual deals are in turn linked to the Block deal. You can view or edit the details of a sub deal by double clicking the party concerned in the Securities Block Deal Detail screen.

23.2.3 A Description of the Block Securities Deal Screen

The securities deal input screen as it appears contains a header and a footer containing fields that are specific to the deal you are entering. Besides these, you will also notice two tabs along the lines of which you can enter the details of a block securities deal.

The two tabs are:

‘Main’ |

Click this tab to enter the essential terms of a block deal. This screen, along with its fields has been detailed under the head ‘Entering the details of a block deal’. |

‘Additional’ |

In the screen that corresponds to this tab, you can specify price, currency, and trade details that are required to process the deal. The features of this screen have been detailed under the head ‘Entering additional details of a block deal’. |

23.3 Details of a Block Deal

This section contains the following topics:

- Section 23.3.1, "Entering the Details of a Block Deal"

- Section 23.3.2, "Indicating Details of the Security that is Traded"

- Section 23.3.3, "Indicating Deal Details"

- Section 23.3.4, "Specifying Details of the Single and Multiple Legs of a Deal"

- Section 23.3.5, "Specifying Details of the Multiple Leg of the Deal"

23.3.1 Entering the Details of a Block Deal

Through the Securities Block Deal input screen, you can process deals that involve multiple parties either in the buy or sell legs. You should compulsorily use a securities combination product to process a block deal.

After you have specified all the details of the buy ands sell legs; you should upload the block deal. The upload function will automatically create sub deals for each of the parties involved in the multi party leg of the transaction.

Refer to the title ‘Uploading the details of a block deal’ in this chapter for more details.

Product

You should necessarily use a product or a product combination that has already been created to enter the details of a block deal. Based on the nature of the deal you are entering, you can select a product combination from the picklist available at the ‘Product’ field.

A block deal will inherit all the attributes defined for the preferred leg of the product combination to which it is associated. You can further add to or change the details that are defaulted from the product to suit the deal you are processing.

Deal Reference No

In Oracle FLEXCUBE, identification references are generated automatically and sequentially. This unique number tag is used to identify the block deal you are entering, it is also used in all the accounting entries, and transactions related to the deal.

The deal reference is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date, and a four-digit serial number.

The Julian Date has the following format:

“YYDDD”

Here, YY stands for the last two digits of the year and DDD for the number of day (s) that has/have elapsed in the year.

For example, January 31, 1998 translates into the Julian date: 98031. Similarly, February 5, 1998 becomes 98136 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those elapsed in February (31+5 = 36).

User Reference

You can enter an identification reference number for the deal. A deal will be identified by this reference in addition to the ‘Deal Reference’ generated by Oracle FLEXCUBE. This reference should be unique and cannot be used to identify any other deal. By default, the Deal Reference generated by Oracle FLEXCUBE is taken as the User Reference No.

23.3.2 Indicating Details of the Security that is Traded

Indicating the security that is traded

While entering the details of a deal, you should indicate the securities that are traded in the deal and the market in which it is traded.

Security Code

You can select a security code from the picklist. The picklist will contain a list of all the securities that you maintained in the Securities Definition screen. As you have already maintained details of the security, all the features of the security like its price, the quotation method, the corporate actions that it involves and several other details of the security will be processed based on these details.

Note

Trading in the security should be allowed for the portfolios involved in the block deal.

Market Code

After you indicate the securities that are being traded in the deal, you should indicate the market in which they are traded. The market in which a security is traded is defaulted from the Security Definition screen. You can change the default and select a market code from the picklist available. The list will contain valid market codes maintained in the Market Definition screen.

Txn Date

The transaction date is the date on which you entered the deal into Oracle FLEXCUBE. The system defaults the transaction date to today's date. Normally, the transaction date would be the same as the trade date of the deal. It would differ from the trade date if you enter a back valued deal.

Deal Type

Securities that are traded can be quoted in terms of:

- Units (100 units of a security)

- As a Nominal (securities worth USD 5000)

The price quotation method defined for the security in the Security Definition screen is defaulted. You can change the quotation method that is defaulted.

Note

The block deal quantity that you specify should be expressed in the security quotation method.

Quote By

The Interest Quotation Method for interest bearing instruments can be:

- Flat

- Plus Accrued

You can indicate whether the deal price that you specified includes the purchased interest or the same has to be accrued separately.

Indicate flat if the price at which the security is quoted includes accrued interest. The flat price is also called the 'Dirty Price'. Indicate plus accrued to indicate that the price at which the security is quoted excludes accrued interest. This price is also referred to as the 'Clean Price'.

Note

You can specify an interest quotation method only if the deal involves the buying or selling of interest bearing bonds.

23.3.3 Indicating Deal Details

After you have indicated the securities that are traded and the market in which they are traded, you can indicate details of the security that are specific to the deal you are processing.

Indicating the deal type

Using the Securities module of Oracle FLEXCUBE, you can enter spot or forward deals. A spot deal is one that settles on the spot date of the market. A forward deal is one that settles on a date after the spot date of the deal. You have the option to change the settlement date even for spot deals.

It is mandatory for you to specify the spot price for forward deals. The deal will settle at spot price and the difference between the deal price and the spot price is take to be the forward profit or loss.

Deal Quantity

Indicate the quantity of the security that is traded. The quantity that you specify depends on the method in which the security is quoted (units or nominal).

If the security is quoted in units, you should indicate the number of units of the security that was traded. If it is quoted as Nominal, indicate the sum of the face value for which it is purchased.

For example, suppose that you have bought 100 units of a security of face value USD 100.

If the security quotation method is units, then, while indicating the deal quantity you should indicate 100.

If the quotation method is nominal, you should indicate USD 10000 (USD 100 x 100 Units) at the deal quantity prompt.

Trade Date

The trade date is the date on which the deal is transacted. It is also referred to as the deal date. The date that you enter can be either today's date or a date earlier than today.

The trade date should be earlier than the maturity date of the security as specified in the Securities Definition screen.

For a series with a redemption record, the trade date should be earlier than the redemption date.

Price Quote

The method in which price is quoted is a feature of the market where the security is traded. Each market may use a particular price quotation method. The price of a security can be quoted as:

Price - in this case the security is quoted on the basis of the price at which it is traded. You have already maintained the face value of the security in the Security Definition screen. The premium that you paid or discount at which you purchased the security is calculated against the face value of the traded security.

The price can be expressed as:

(Face Value ± Premium or Discount) + Accrued Interest (if the interest quotation method is ‘Flat’)

% Price — the price is quoted on the basis of the percentage of the price.

% Price = (Market price / Face value) x 100

% Discount - in this case, the price is quoted based on the discount percentage at which the deal was bought or sold.

% Premium - in this case, the price is quoted based on the premium percentage at which the deal was bought or sold.

Premium - here the price is quoted based on the premium at which the security was bought or sold. That is, the differential between the face value of the bond and the price at which it is bought or sold.

Discount - the price is quoted based on the discount at which the security is bought or sold. That is, the differential between the face value of the bond and the price at which it is bought or sold

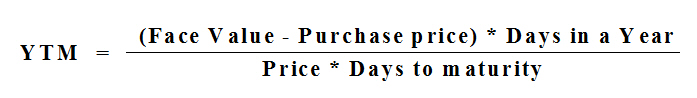

YTM - the price is quoted based on its yield to maturity. This price quotation method is applicable only for Zero coupon bonds.

The yield on discounted instruments is measured by the yield to maturity (YTM), which is the return on a security bought at current market price for the remaining time to maturity of the security. The YTM would keep changing with the market price, in case the market price increases above the straight discounted price YTM would decrease and vice versa.

The price using this quotation method is calculated thus:

Based on the deal quantity and the price quotation method, the deal amount is determined. Irrespective of the price quotation method that is used, the net result is the same.

Absolute Price - This is the price at which the block deal is transacted. You can enter the price of the security as a price or a percentage of the price depending on the price quotation method specified for the security that is traded.

You can enter “T” or “M” to indicate thousands or millions, respectively. For example, 10T means 10,000 and 10M means 10 million.

The deal price would include or exclude the purchased or sold interest depending on whether the security being dealt in is quoted flat or plus accrued.

For a spot deal, if the deal price varies from the market price by more that the sensitivity range specified for the security you will be prompted for an override or will not be allowed to process the deal.

Note

The price that you enter is taken to be in the currency of the security that is traded.

Delivery Settlement date (DSTL date)

The delivery settlement date is the date on which settlement of the traded securities should take place. Depending on the type of deal (spot or forward) you are processing, you can indicate the security settlement date.

In the subsequent fields you can indicate the locations from which and to which the security should be delivered.

23.3.3.1 Indicating the Mode of Settlement

You can specify instructions to the safe keeping location as to when the traded securities should be delivered or released.

Delivery

The options available for the delivery of the traded securities:

- Deliver against payment

- Deliver free

The deliver against payment option has no risk involved, as securities will be handed to the buyer only on payment. Choose the deliver free option to indicate that the delivery of securities is to be independent of payment.

As there is a risk involved in choosing the deliver free option, while specifying limit details for the deal, you can also indicate the undelivered credit line under which your liability to the deal should be tracked.

Receive

The receive instructions that you can specify to the SKL are:

- Receive against payment

- Receive free

Int Date

If you are entering the details of a buy or sell deal, you can indicate the date from which purchased or sold interest for interest bearing bonds should be calculated.

For securities whose issue market has trade based accounting:

Interest value date = Trade date

For securities whose issue market has settlement date based accounting, the settlement date is defaulted to the settlement date. You have the option to change the defaulted date. However, the interest value date that you enter in this case should be in the same coupon period as the settlement date.

Interest computations will be performed on-line from the last coupon date (including) to interest value date (excluding) in the case of deals where settlement date is before ex-date. In case the settlement date is past the ex-date the computation will be from interest value date (including) to the next coupon date (excluding). The interest might need to be received or paid depending on whether the deal is a buy or a sell.

Yield

You can enter the equivalent yield of the bond for the price that you input.

It is important to note that no processing is done based on the yield that you enter. It is only for reporting purposes.

Input Price

Enter the price at which the deal is transacted. You can enter the price of the security as a price or a percentage of the price depending on the price quotation method that you specified earlier. You can enter "T" or "M" to indicate thousands or millions, respectively. For example, 10T means 10,000 and 10M means 10 million.

The deal price would include or exclude the purchased or sold interest depending on whether the security being dealt in is quoted flat or plus accrued.

For a spot deal, if the deal price varies from the market price by more that the sensitivity range specified for the security you will be prompted for an override or will not be allowed to process the deal.

Note

- The price that you enter is taken to be in the currency of the security that is traded.

- The entries made in this field can be amended before the deal is authorised. However, if amendment is required after authorisation, you should reverse the deal and enter it again.

Interest

Indicate whether the price at which the security is quoted includes accrued interest. You can specify an interest quotation method only if the deal you are processing involves the buying or selling of interest bearing bonds.

Select an interest quotation method from the option list. It could be:

- Flat

- Plus accrued

Indicate 'flat' if the price at which the security is quoted includes accrued interest. The flat price is also called the 'Dirty Price'.

Indicate 'plus accrued' to indicate that the price at which the security is quoted excludes accrued interest. This price is also referred to as the 'Clean Price'.

23.3.4 Specifying Details of the Single and Multiple Legs of a Deal

While entering the details of a block deal, you can indicate which leg (buy or sell) of the deal involves multiple parties. Depending on this, products associated with the combination product will be made applicable to the appropriate legs of the deal.

If your branch is a fund branch, then customer portfolios cannot be involved in either the buy or sell legs of the Block deal.

23.3.4.1 Specifying Details of the Single Leg of the Deal

You can specify the following details for the single leg of the deal:

- The Portfolio involved with the leg of the transaction

- The counterparty (the holder of the portfolio from which you are buying/selling securities)

- The safe keeping location and account from or to which securities need to be collected or lodged

- The broker that brokered the deal

- The money settlement date

A note on the settlement date

The money settlement indicates the date by which the buyer should pay for the securities bought. The settlement date should be later than or the same as the Trade date and earlier than the maturity date of the security.

For forward deals, the settlement date should be later than the default Spot date.

For spot deals in the primary or secondary market, the settlement date should not be a holiday in any of the payment currencies. An override will be sought if the money settlement date is a holiday in any of the currencies involved in the deal.

23.3.5 Specifying Details of the Multiple Leg of the Deal

In this section we will discuss the details that you should specify for the leg that involves multiple parties. For each portfolio involved in the multiple leg of the deal, you can specify the following details:

- The Portfolio from which you are buying/selling securities

- The counterparty (the holder of the portfolios into which you are buying/selling securities)

- The safe keeping location to which securities need to be delivered

- The account at the sake keeping location, to which the traded securities are to be transferred

- The quantity of securities that has been bought or sold from the portfolio

- Pay account branch

- Pay account

- The Broker involved in the deal

- Yield

- MSTL Date

23.4 Entering 'Additional Details' of a Deal

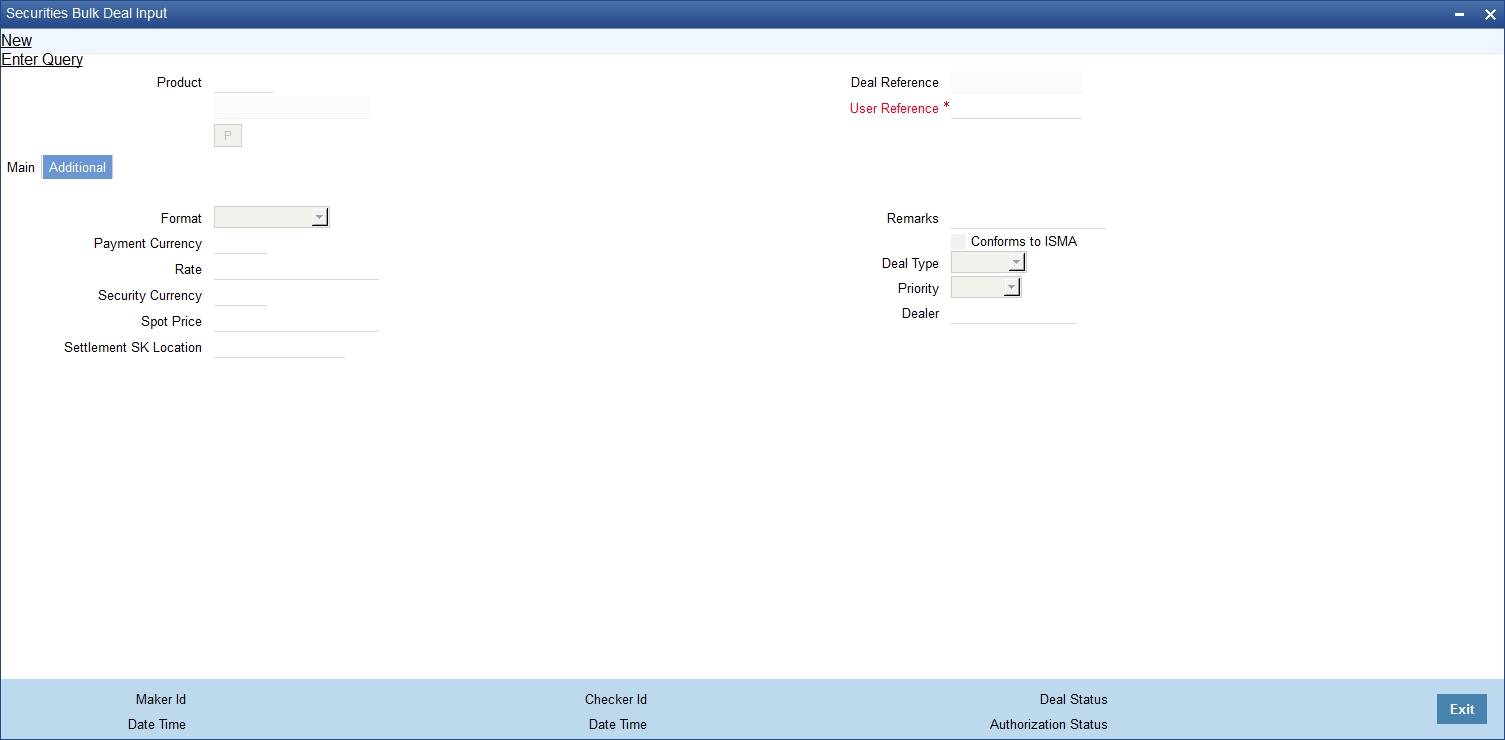

In the Additional Details screen you can define details like the spot price, currency, the trade details. Click on the tab titled Additional to invoke this screen.

23.4.1 Specifying Additional Details for the Deal

For forward deals you should also indicate spot price details. The spot price details that you specify will determine the calculation of forward profit that you have made or the loss that you have incurred in a forward deal.

Spot Price

The spot price refers to the price at which the security is currently quoted in the market. This price is compared with the deal price to determine the forward profit or loss. The market price of the security as maintained in the price code maintenance screen is defaulted. You have an option to change the default.

The forward profit or loss is the difference between the deal price and the spot price and is calculated from the spot date of the deal to its settlement date.

Note

In case of forward deals the spot price is defaulted from the market price maintenance and the price cannot be changed.

Payment CCY

If the currency of the security is different from the settlement currency, you should indicate the currency in which payment is made. All the components of the deal like the deal amount, the charges and tax that is levied will be settled in this currency.

By default the security currency is taken to be the payment currency. If you indicate the settlement currency to be different from the security currency you should also indicate the exchange rate to be used for the conversion.

SCY You can indicate the format of the securities that are traded. It could be:

Option |

Description |

Scrip-based |

Issued in a paper format |

Dematerialized |

In an electronic format |

Immobilized |

Securities in lieu of which proxies are traded |

Combination |

Issued in one or more of the above formats |

Rate

This is the exchange rate applicable incase the Payment Currency and Security Currency are different. This rate is defaulted from the deal product type.

Settlement SKL

Indicate the SK location in which the deal settlement takes place.

Format

You can select whether the security format is

- Scrip Based

- Dematerialized

- Immobilized

- Combination

Deal Type

You can select the Deal type from the drop down list. The Deal Type can be

- Primary

- Secondary

Priority

Indicate the priority of the deal you are processing. You can select a value from the drop down list:

- High

- Normal

- Low

Conforms to ISMA

This is an indicator to denote whether the deal has been made as per ISMA (International Securities Market Association) requirements. This indicator is displayed during deal confirmation.

Dealer

You can also capture details of the dealer at your bank that handled the leg of the deal.

Remarks

Enter additional information about the product.

23.5 Uploading the Details of a Block Deal

After you have specified all the details of the buy and sell legs; you should upload the block deal. Click on ‘Upload’ from the Securities Block Deal Main screen to upload the details of a deal.

The upload session will automatically create sub deals for each of the parties involved in the multi party leg of the transaction of the block deal.

You can navigate to the individual sub deals by double clicking the party concerned on the block deal screen. You can specify details like the certificate numbers, details of the brokerage, tax, charge etc applicable to the sub deals in the Securities Deal Online screen.