29. Handling Repos

29.1 Introduction

Securities repurchase agreements (referred to as repos) are entered into to raise money, or meet your Central Bank statutes. To invest short-term surplus funds, at minimal risk, reverse repo transactions are entered into.

The repo and reverse repo transactions are similar to money market transactions. In Oracle FLEXCUBE, they are handled in the same manner as the money market placement and borrow transactions.

The set up, maintenance, and processing functions discussed in the Money Market user manual also apply to repos. However, you would have to maintain a few additional details in Oracle FLEXCUBE to handle repo transactions. In this chapter, we shall discuss only those additional details that need to be maintained.

Refer to the Money Market user manual for a detailed discussion of the other set up, maintenance, and processing functions.

This chapter contains the following sections:

- Section 29.2, "Products"

- Section 29.3, "Capturing Details of Repo Contract"

- Section 29.4, "Uploading Deals for Amendment"

- Section 29.5, "Maintaining Asset –Liability Linkage"

29.2 Products

This section contains the following topics:

- Section 29.2.1, "Maintaining Products"

- Section 29.2.2, "Specifying Securities Repo Product Definition Details"

- Section 29.2.3, "Setting Product Preferences"

- Section 29.2.4, "Specifying Interest Details for Product"

- Section 29.2.5, "Associating Discount Accrual Components to Products"

29.2.1 Maintaining Products

A Repo Product is a category or a type of repo transaction. For instance, you can classify repo transactions involving short-term zero coupon bonds, as a repo product in Oracle FLEXCUBE. Similarly, you can classify reverse repo transactions, involving customer portfolios at your bank, as a reverse repo product. A product, thus, serves to classify the repo transactions that you enter into.

You can define certain attributes for a product that you create. Attributes are qualities that you define for a product.

The following are some of the attributes that can be defined for a product:

- The product type (whether a Repo or a Reverse Repo product)

- The interest and charges that you would like to levy on repo deals involving the product

- The tax (es) that apply on the deals involving the product

- The type of accounts and the GL/SLs to which the accounting entries have to be posted

- The advices to be generated at different points in the life cycle of deals involving the product

- The Management Information System (MIS) details

The attributes that you define for a repo product, will be inherited by all repo transactions involving the product. However, when entering a specific transaction, you can change its attributes.

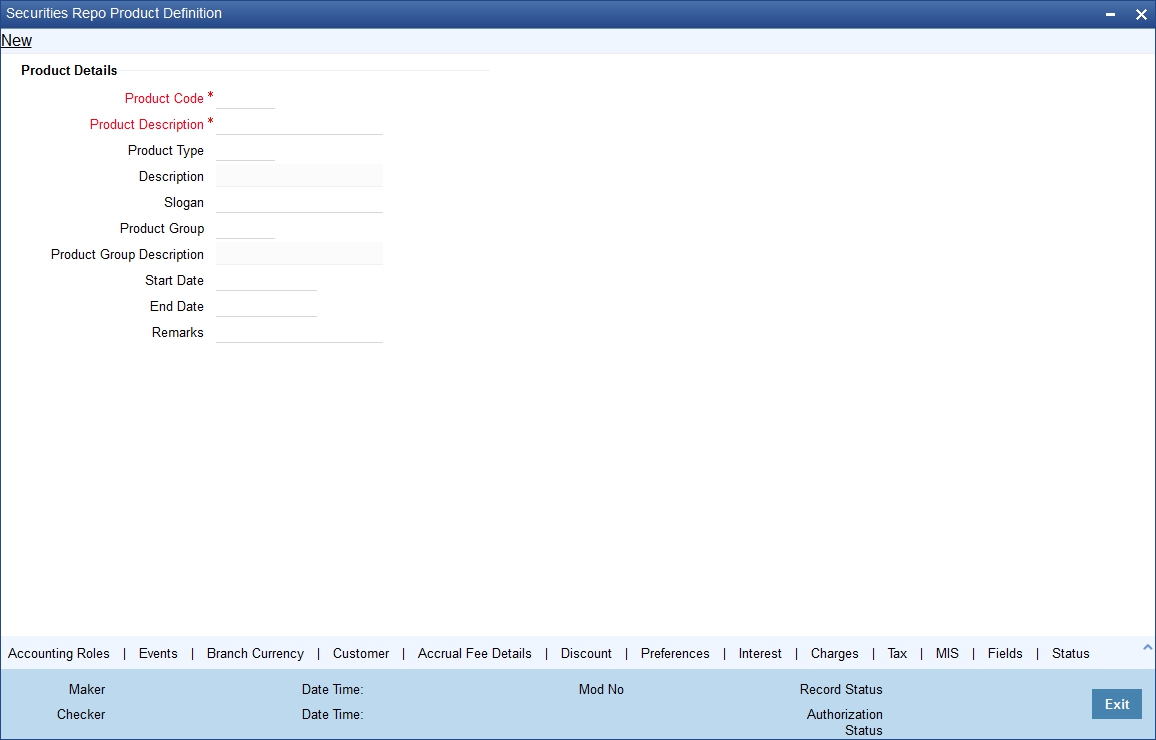

29.2.2 Specifying Securities Repo Product Definition Details

You can create a product in the Securities Repo Product Definition screen, invoked from the Application Browser.

You can invoke the ‘Securities Repo Product Definition’ screen by typing ‘SRDPRMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the Product Definition screen, enter the basic information about a product like the Product Code, the Description, etc. Information relating to specific attributes of a product can be defined in subsequent screens.

For further information on the generic attributes that you can define for a product, please refer the following Oracle FLEXCUBE User Manuals under Modularity:

- Product Definition

- Tax

Product Type

A product that you are defining can belong to either of the following types:

- Repo

- Reverse Repo

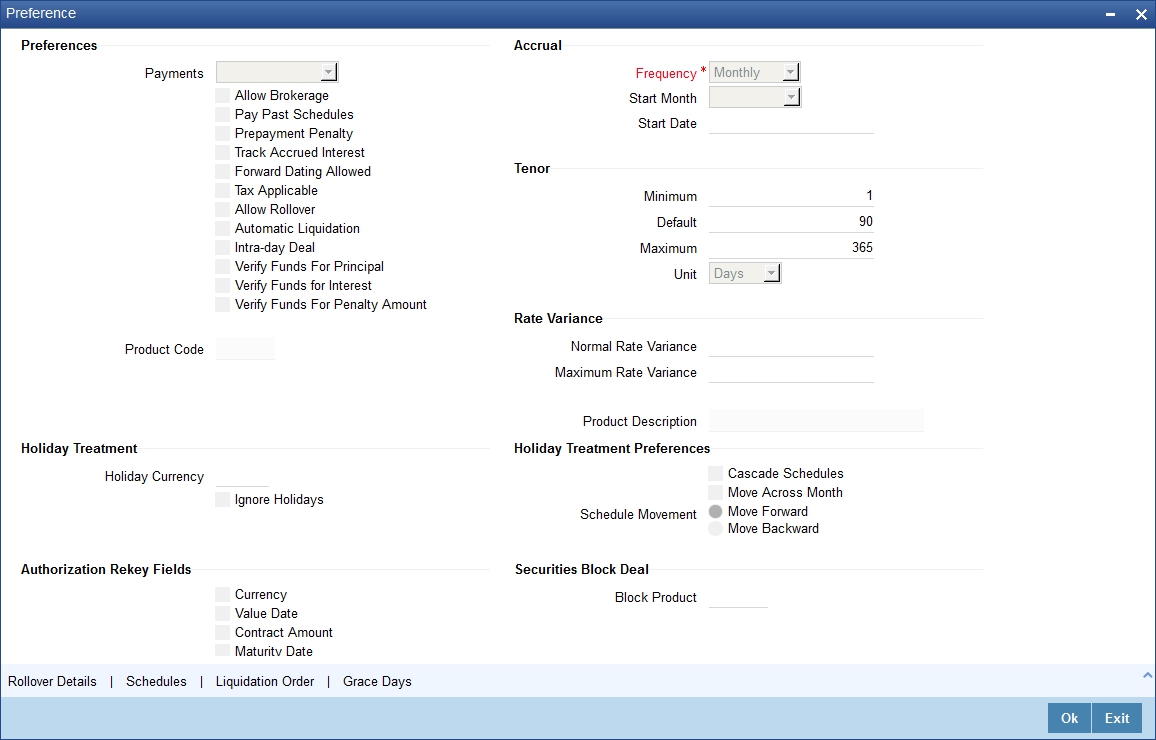

29.2.3 Setting Product Preferences

Preferences are the options available for setting the attributes of a product. The options you choose ultimately shape the product.

For example, you have the option of applying tax on a product. If you specify that tax is applicable for a product, deals involving the product will inherit the attribute. However, you can waive this tax (if it has been defined for the product the deal involves) at the time of deal processing.

Click ‘Preferences’ button to invoke the preferences screen.

Choosing a deal product

When defining the preferences for a repo product that you are creating, you have to indicate a Block Security deal product that you would like to use to process repo deals (involving the product). You can choose from a list of Block Security products that maintained at your bank, in the Block Product field.

When you associate a deal with a repo product, the Block Security Deal product will be picked up. This product will be used to block the underlying securities in the repo deal.

Note

EIM features are also supported in Repo and Reverse Repo products.

For a detailed discussion of products please refer the Money Market user manual.

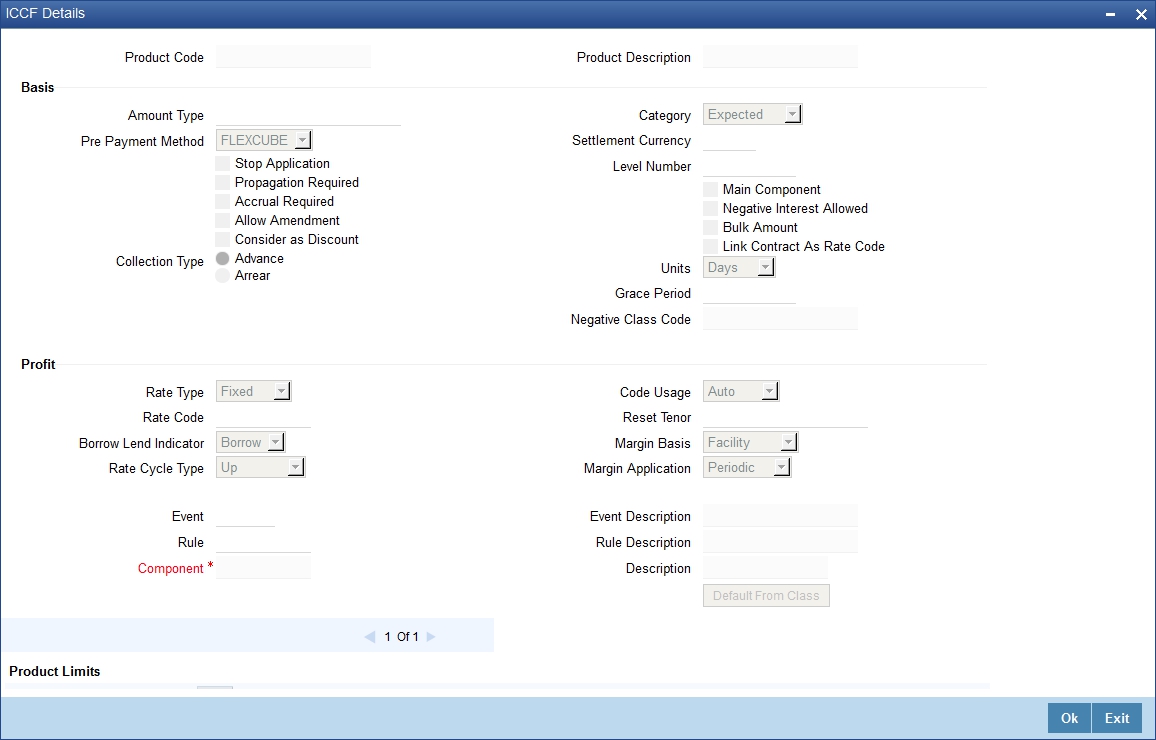

29.2.4 Specifying Interest Details for Product

You can link an interest rule to a product in the ‘ICCF Details’ screen. When a contract involving the product is processed, the interest attributes defined for the product will be applied on the contract. Some of these attributes can be changed during contract processing. To invoke the ‘ICCF Details’ screen, click ‘Interest’ button in the ‘Securities Repo Product Definition’ screen.

Specify the following details:

Interest Basis

The method in which the number of days are to be calculated for interest, charge, commission or fee components and whether their application is tenor based is displayed here based on the specification you made at the product level. You can choose to change it. The following are the options available:

- 30(Euro)/360

- 30(US)/ 360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/ 364

- Actual/364

For further information refer the section ‘Specifying the Interest Details for the Product’ in the ‘Interest’ chapter in the ‘Interest’ User Manual.

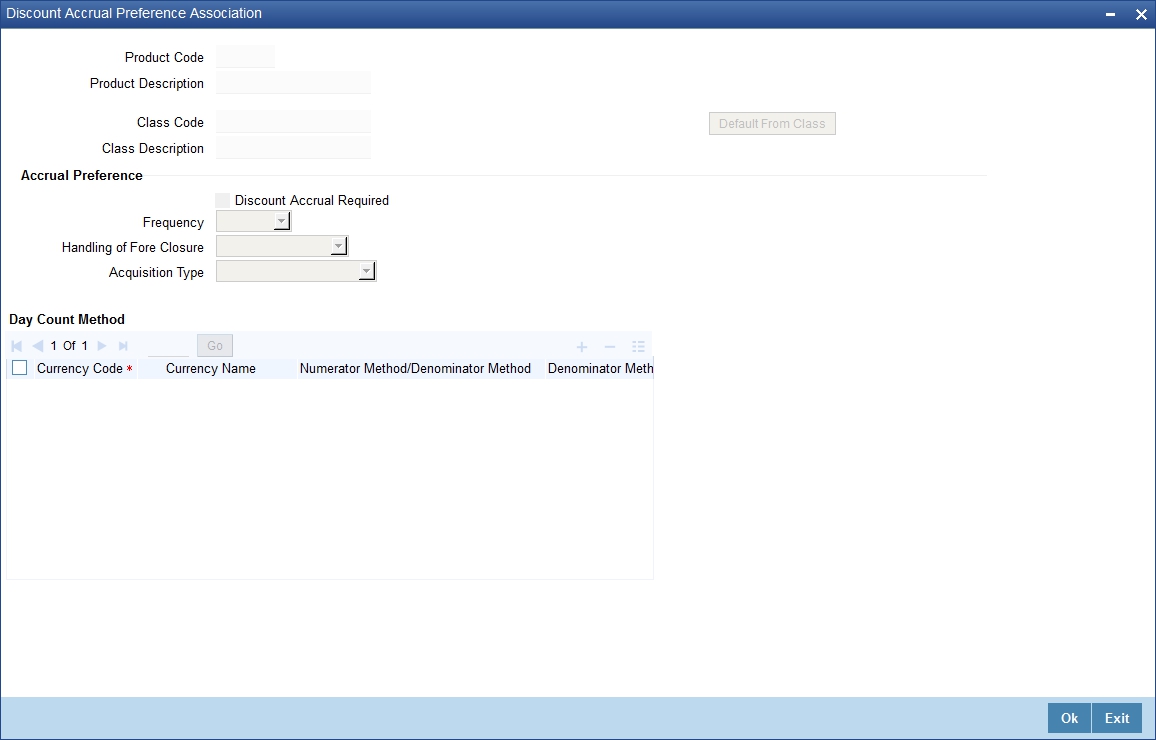

29.2.5 Associating Discount Accrual Components to Products

After building discount accrual fee classes you can associate the class with product in the ‘Discount Accrual Preference Association’ screen is invoked. To invoke the ‘Discount Accrual Preference association’ screen, click ‘Discount’ button in the ‘Securities Repo Product Definition’ screen.

Specify the following details:

Denominator Method

Select the denominator method from the adjoining drop-down list. This list displays the following values:

- 360

- 365

- 364

For further information refer the section ‘Associating Discount Accrual Components to Products’ in the ‘Defining Discount Accrual Fee Classes’ chapter in the ‘Bills and Collections’ User Manual.

29.3 Capturing Details of Repo Contract

When you enter into a repo (or reverse repo) deal, you must associate it with a product that you have maintained. By default, a deal inherits all the attributes of the product with which it is associated.

Most deal details are captured for the product the deal involves. These details default to the deal.

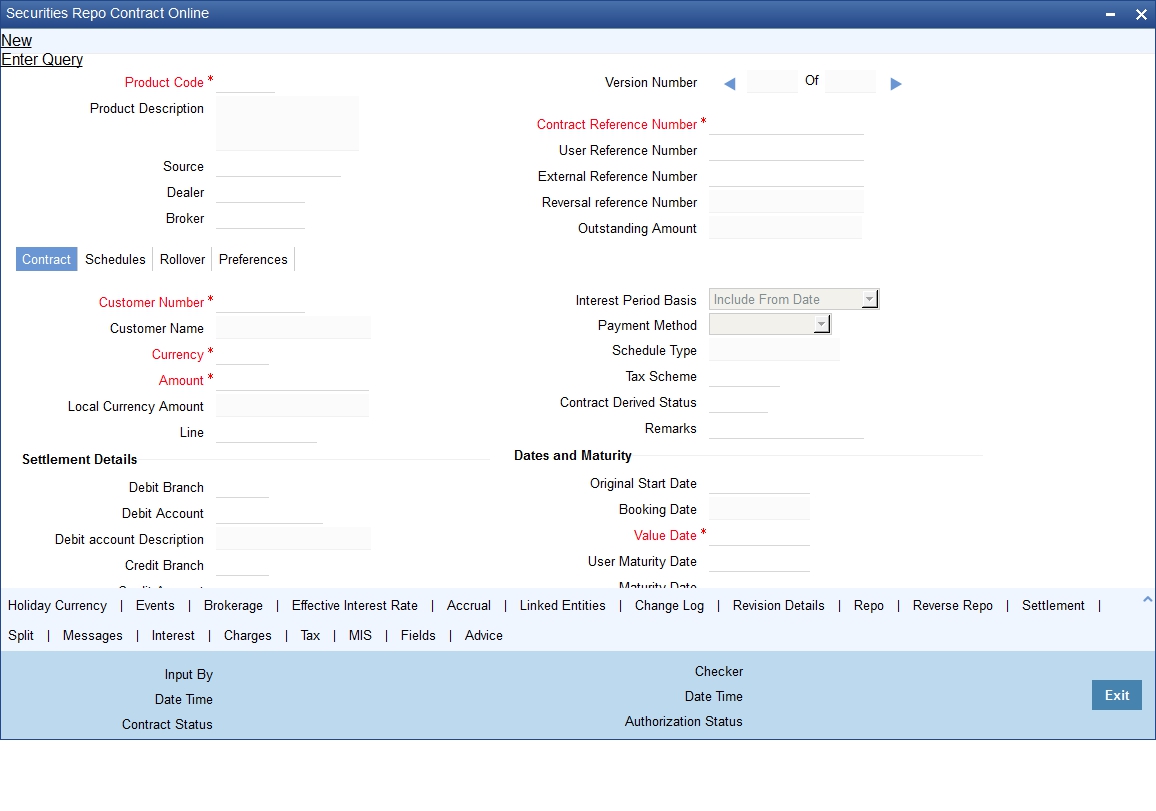

You can capture the details of repo deals in the Securities Repo – Online screen.

You can invoke the ‘Securities Repo Contract Online’ screen by typing ‘SRDTRONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

At the time of saving a Securities Repo contract, the system will pass certain information about the Securities Repo contract to the FATCA accounts and obligations maintenance for the customer. This will be done if the beneficiary account’s customer has a reportable FATCA classification and if the Securities Repo product used to book the contract is present in the FATCA Products, account class and Instruments maintenance.

If the SR contract is closed or liquidated completely, then the corresponding row in FATCA accounts and obligations maintenance will be archived. If you delete the SR contract before authorization, then you should also delete corresponding entry in FATCA accounts and obligations maintenance.

In this screen, you should specify the following details:

- The Portfolio ID in which you would like to block securities (this specification is not mandatory for a reverse repo deal that involves a walk-in customer)

- The Security ID(s) that you would like to block

- The SK Location and the SK Account where the security to be blocked is held

- The format of each security (scrip-based, dematerialized, immobilized, etc.)

- The Number of Units of each security that you are blocking

- If the underlying security is defined with a series redemption, the series

- Settlement details like the credit/debit branch, booking date, value date, original start date, user input maturity date and liquidation mode. In an outgoing MT518 message, this maturity date is captured in field 98a. Field 98a is sequence B is generated with only option A.

Source

You have to indicate the source from which contracts have to be uploaded.

If this value is left null, then you will not be able to amend the contract. Amendment for the contract can be uploaded only through the same source as that used for creation.

Ext Ref No

If the transaction is being uploaded from an external source, you can specify the identification for the transaction in the external source, as the external reference number. You cannot amend this value post contact save.

Reversed FCC Ref

The reference number of the contract that is being reversed and rebooked is displayed here. To enable amendment of SR Contract details Oracle FLEXCUBE will reverse the old contract and rebook a new contract with the old user reference number and external reference number. The old contract is reversed and a new contract is booked with Reversed FCC ref as the parent contract.

Interest Basis

The method in which the number of days are to be calculated for interest, charge, commission or fee components and whether their application is tenor based is displayed here based on the specification you made at the product level. You can choose to change it. The following are the options available:

- 30(Euro)/360

- 30(US)/ 360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/ 364

- Actual/364

The value of interest basis maintained here is used for calculating interest for repo contract.

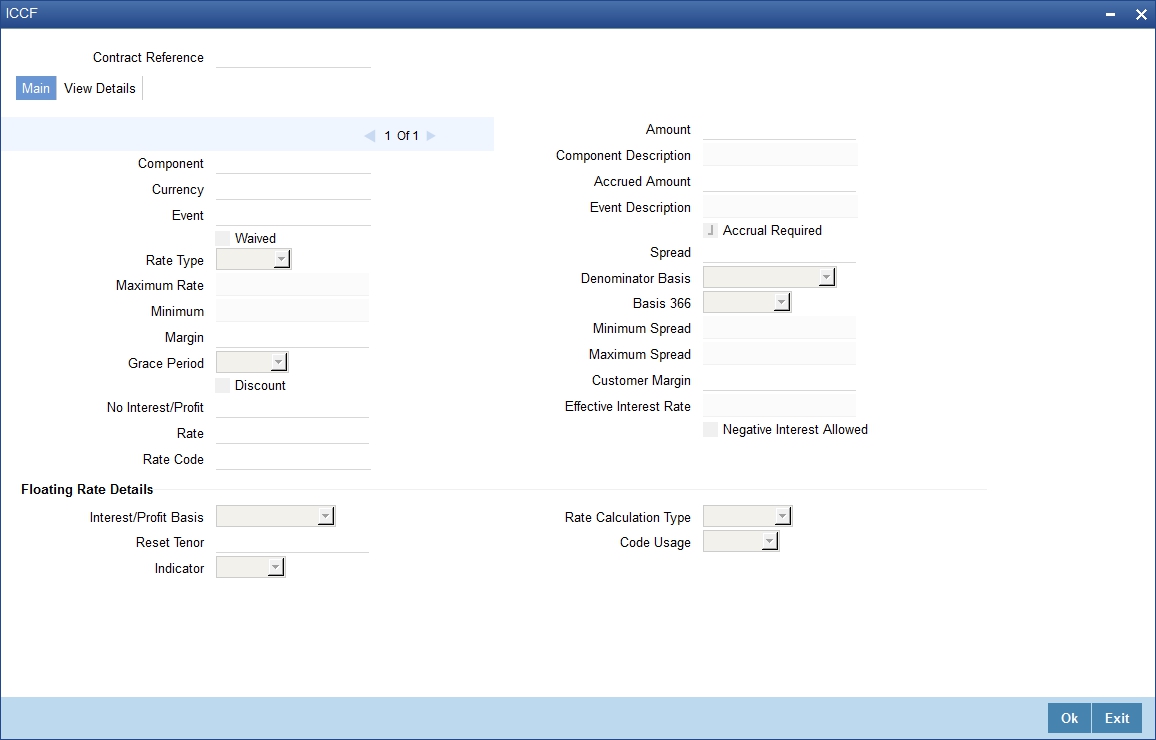

29.3.1 Specifying Interest Details

Numerous interest rates and fees can be defined through the ICCF (Interest, Commission, or Fee) screen. To invoke this screen, click ‘Interest’ button in the ‘Security Repo Contract Online’ screen.

Specify the following details:

Interest Basis

The method in which the number of days are to be calculated for interest, charge, commission or fee components and whether their application is tenor based is displayed here based on the specification you made at the product level. You can choose to change it. The following are the options available:

- 30(Euro)/360

- 30(US)/ 360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/ 364

- Actual/364

For further information refer the section ‘Specifying Interest Details’ in the ‘Capturing Details of Deposit’ chapter in the ‘Deposits’ User Manual.

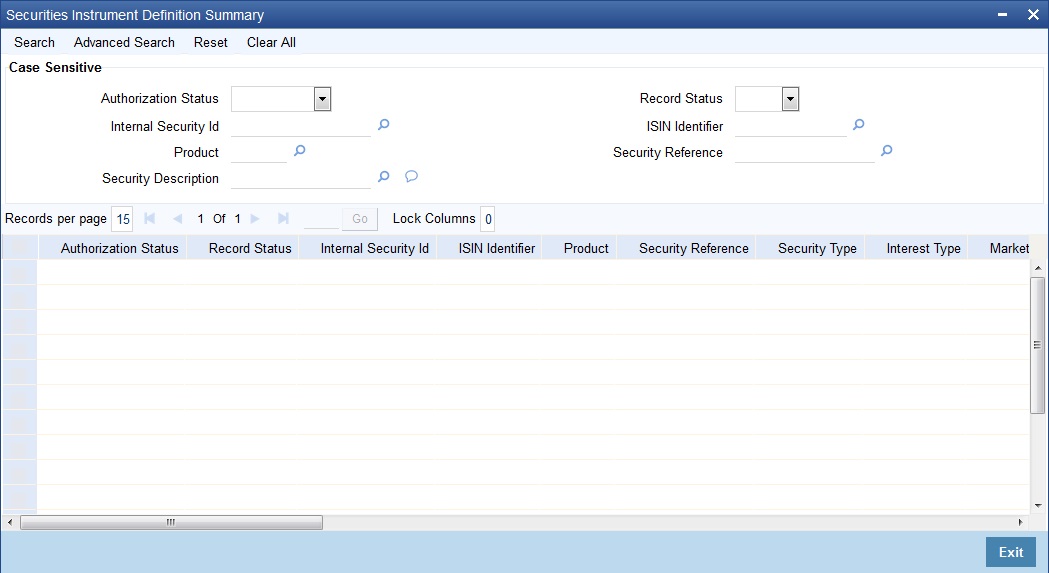

29.3.2 Viewing Details of Repo Contract

You can view the security instrument details in the ‘Security pInstrument Definition Summary’ screen. To invoke this screen, type ‘SESTRONL’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can click ‘Search’ button to view all the pending functions. However, you can to filter your search based on any of the following criteria:

Recommended Fields

- Reference Number

Optional Fields

- Authorization Status

- Status

- User Reference

- Product

- Customer

- Currency

- Booking Date

- Maturity Date

- Related Reference

When you click ‘Search’ button the records matching the specified search criteria are displayed. For each record fetched by the system based on your query criteria, the following details are displayed:

- Authorization Status

- Status

- Reference Number

- User Reference

- Product

- Customer

- Currency

- Booking Date

- Value Date

- Maturity Date

- Related Reference

- Account Branch

- Module

- Status

- Payment Method

- Rate Code

- Rate

- Spread

- Profit Amount

- Product Description

- Outstanding Principal

- Related Reference

- Maker Id

- Checker Id

29.4 Uploading Deals for Amendment

From an external system, you can upload Securities Deals that require amendment in Oracle FLEXCUBE. The system will distinguish between the new and the deals that require amendment based on the action code of the uploaded record. For a contract requiring amendment, the action code will be ‘AMND’. If the action code is ‘AMND’, Oracle FLEXCUBE will first check whether the deal exists in the system or not. If it does not exist in the system, an error message will be displayed to notify that the deal cannot be amended.

The Reference Number provided by the external system has to same if it is a new deal or if it is an amendment to an existing deal.

When you upload a new deal, the Reference Number will be displayed in the User Reference Number field for that deal. The User Reference Number will be the basis for checking whether the deal exists or not.

The upload for contract amendment will trigger the ‘AMND’ event. The same event is triggered even when the amendment is done in the ‘Contract Online’ screen.

The fields that can be amended for a Securities Repo Deal are as follows:

- Verify Funds For Principal

- Verify Funds For Interest

- Verify Funds For Penalty Amount

- Verify Funds

- Holiday Currency

- Holiday Months

- Move Forward

- Move Payment Schedules

- Move Revision Schedules

- Move Disbursement Schedules

- Receivable tracking Parameters

- Liquidation – Auto/Manual

- Status Control – Auto/Manual

- Exposure Category

- Risk Free Exposure Amount.

- Internal Remarks

- Demand Basis

- Schedule Details

- Settlement Details

- The amendments through upload of the following fields are considered as financial amendment:

- Currency

- Counterparty

- Amount

- Booking Date

- Value Date

- Cr/Dr Branch Code

- Cr/Dr Account Number

- Holiday Currency

- Commitment (Revolving/ Non- revolving)

- Maturity Type

- User Input Maturity Date

Note

- If the request received has settlement details, then the values sent as part of the upload should be uploaded.

- If Settlement Details are not sent and are maintained in the list of amendable fields, then the details corresponding to the parent contract is copied to the child contract.

- In case the request is a financial amendment, then the contract is reversed and rebooked. If it is non-financial amendment, then the normal amendment procedure is followed.

- In case of financial amendment, Settlement Instructions requires a special handling.

- The financial amendment can be done only through upload and not through front-end.

However, if the SGEN message is already generated then financial amendment upload is not allowed.

For amending a contract, if the source is null, it indicates that the contract is created in Oracle FLEXCUBE and you are not allowed to amend. If the value is not null, then you are allowed to amend a contract.

29.4.1 Specifying Interest Details

Numerous interest rates and fees can be defined through the ICCF (Interest, Commission, or Fee) screen. To invoke this screen, click ‘ICCF’ button in the SRDXVMND’ screen.

Specify the following details:

Interest Basis

The method in which the number of days are to be calculated for interest, charge, commission or fee components and whether their application is tenor based is displayed here based on the specification you made at the product level. You can choose to change it. The following are the options available:

- 30(Euro)/360

- 30(US)/ 360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/ 364

- Actual/364

For further information refer the section ‘Specifying Interest Details’ in the ‘Capturing Details of Deposit’ chapter in the ‘Deposits’ User Manual.

29.5 Maintaining Asset –Liability Linkage

You can carry out an asset liability matching also through the repo block screen. Click ‘Repo’ button to access the screen.

You can also click on the P button positioned next to the Deal Reference Number to view details of messages (MKTTRADECONF / DLVRSECFREE / RECVSECFREE) that have been associated with the Block Security product.

Note

These messages will not be sent if the security block contract is amended and the quantity or price changed.

Oracle FLEXCUBE handles a repo contract in much the same manner as a Money Market deal. Please refer the Money Market user manual for details.