30. Printing Subsidiary General Ledger Form- Repo and Reverse Repo Deals

30.1 Introduction

At the time of defining a security, you can specify a form type for the security.

If the form is of type SGL, the system automatically generates a corresponding SGL advice.

An SGL advice is generated for security, repo and reverse repo deals when the following events occur:

- On authorization of a securities deal

- On initiation of a repo deal

- On liquidation of a reverse repo deal

This chapter contains the following sections:

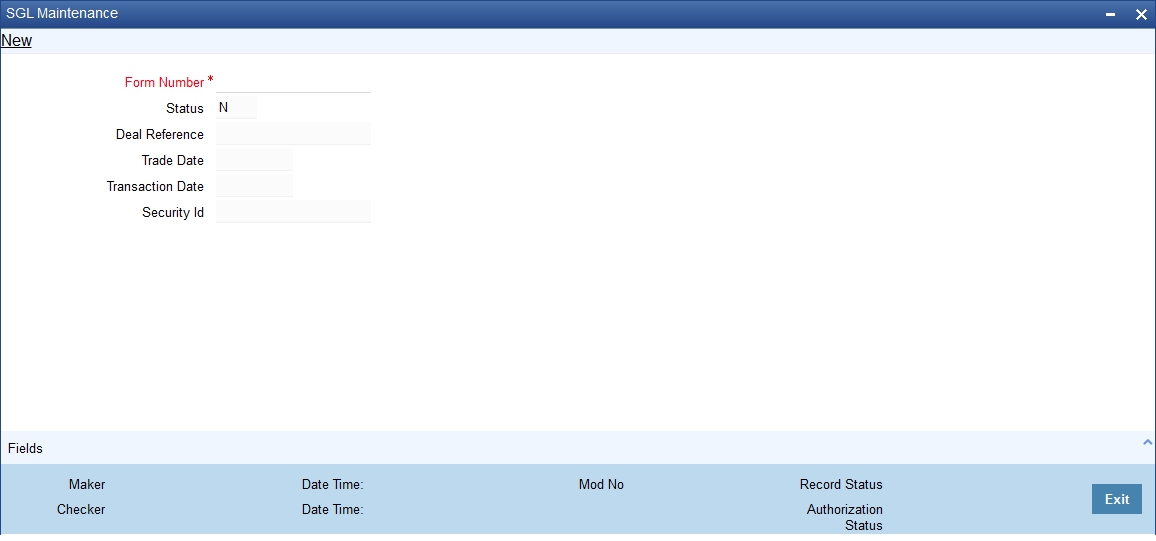

30.2 SGL Form Maintenance

An SGL advice is printed on formatted stationery. Every SGL advice triggered by the system is tracked by a unique form number (serial number). You can maintain the form numbers in the ‘SGL Maintenance’ screen.

You can invoke the ‘SGL Maintenance’ screen by typing ‘SEDXGLMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, you can specify the form numbers either as a range or choose to enter the numbers manually.

Click on new icon in the tool bar to specify a new form number.

At any point of time the status of a form number will either be:

- U (Used)

- N (Not Used)

- Cancelled (C)

Note

- By default, the status of a form number is ‘N’ (Not Used).

- The form numbers will be available for use only after you save and authorize the record.

Assigning a form number to an SGL advice

Whenever a deal involving a security with form type SGL is being processed, the system automatically assigns the next available unused form number to the deal.

After a number is assigned to a deal, the system displays the following information corresponding to the form number, in the SGL Maintenance screen:

Status

The status will be updated to U (Used).

Deal Reference No

The reference number of the deal to which the form number is linked.

Trade Date

The Value Date of the deal.

Transaction Date

The actual date when the deal was captured in the system.

Security Id

The security (the Security Code specified at the time of capturing a deal) involved in the deal.

Note

You are not allowed to close or delete a record with status ‘Used’ or ‘Cancelled’. However, you can to delete an unused form number before authorization.

If you reverse a deal for which an SGL advice has been generated, the system displays an over-ride saying that the SGL advice for the deal has already been generated. If you say ‘Yes’ to the over-ride, the system updates the status of the form number to C (Cancelled) in the SGL Maintenance screen.

Note

After a form number is assigned to a deal, you cannot reuse the number even on reversal of the deal associated with it.

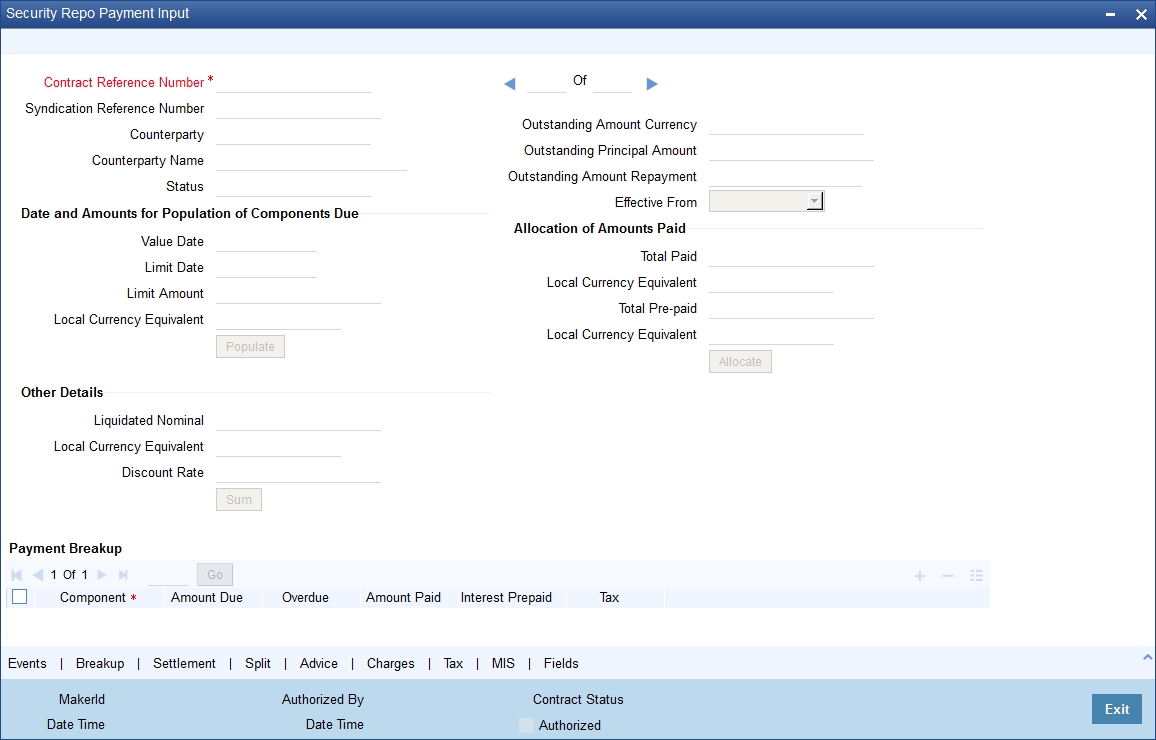

30.3 Maintaining Security Repo Payment

You can maintain the details for security repo payment in the 'Security Repo Payment Input' screen. To invoke the screen, type 'SRDPAMIN' in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can capture the following in this screen:

Contract Reference

Specify the contract reference number.

Outstanding Amount

Specify the outstanding balance amount.

Outstanding Amount Repayment

Specify the outstanding amount repayment.

Counterparty

Specify the counterparty details.

Currency

Specify the currency.

Syndication Ref No

Specify the syndication reference number.

Status

Specify the status of payment.

Effective from

Enter the date for which the rate should become applicable. Each rate that is defined for a Rate Code and Currency combination should have an Effective Date associated with it. This is the date on which the rate comes into effect. Once a rate comes into effect, it will be applicable till a rate with another Effective Date is given for the same Rate Code and Currency combination

Counterparty Name

Specify the name of the counterparty.

Prepayment of Amortized Loans

Recomputation Basis

Choose the recomputation basis for prepayment of amortized loan. The options available are Recalculated Tenor or Change EMI. Choose the relevant basis from the list for recomputation basis.

Old Maturity Date

If you opt for a prepayment with a change in the loan tenor, the system will display the maturity date of the loan prior to the prepayment.

New Maturity Date

Specify the new maturity date.

Prepayment Effective from

You can choose the date on which the prepayment becomes effective. You can start the prepayment on the Value Date or Next Installment.

Value Date

Specify the value date.

Limit Date

Enter here the Limit Date for prepayments. If you have given a payment limit date, the system shows all the components, which are due till the limit date. If you have given the amount limit in the Amount field, it shows all the schedules for the limit amount.

Discount Rate

Enter the discount rate.

If the discount rate basis is Direct Input then you have to enter the rate at which interest is to be discounted in this field.

Amount Paid

Enter the amount being paid for a particular component. This must be less than or equal to the total amount due for the component.

LCY Equivalent

Specify the local currency equivalent for the total paid amount. The local currency equivalent is calculated using the standard rate in case of cross currency transactions.

Amount Prepaid

Specify the prepaid amount.

LCY Equivalent

Specify the local currency equivalent for the total prepaid amount. The local currency equivalent is calculated using the standard rate in case of cross currency transactions.

Limit Amount

For a liability code and revolving credit line combination, you can define limit schedules and indicate the limit that is applicable for the period. You can enter a negative limit amount.

The limits maintained for a tenor are for information purposes. The limit does not become automatically effective to the line - liability combination when the tenor begins.

LCY Equivalent

Specify the local currency equivalent for the limit amount. The local currency equivalent is calculated using the standard rate in case of cross currency transactions.

Liquidated Nominal

Specify the Liquidated Nominal amount which is the amount that you would receive when you redeem a T-Bill on the maturity date.

This is also known as the face value of the T-Bill. The discount rate is used to calculate the Net Present Value (NPV) of a T-Bill when it is liquidated before the liquidation date i.e. the actual value obtained on the T-Bill when you redeem it prior to the maturity date.

LCY Equivalent

Specify the local currency equivalent for the liquidated nominal value of the amount. The local currency equivalent is calculated using the standard rate in case of cross currency transactions.

Payment Breakup

Component

Specify the component that has to be maintained.

Amount Due

Enter the details of the amount due for repayment in this field.

Overdue

Specify the balance that is overdue.

Amount Paid

Specify the paid amount.

Interest Prepaid

Specify the profit prepaid for the component.

Tax

Specify the amount paid in tax.